Best Of The Best Tips About Balance Sheet Items In Detail Amazon Profit And Loss Statement

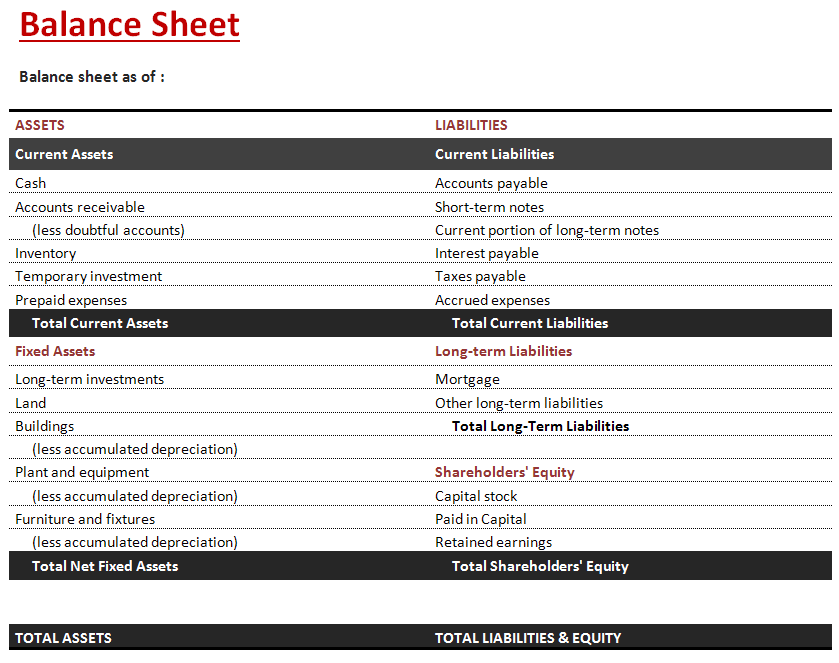

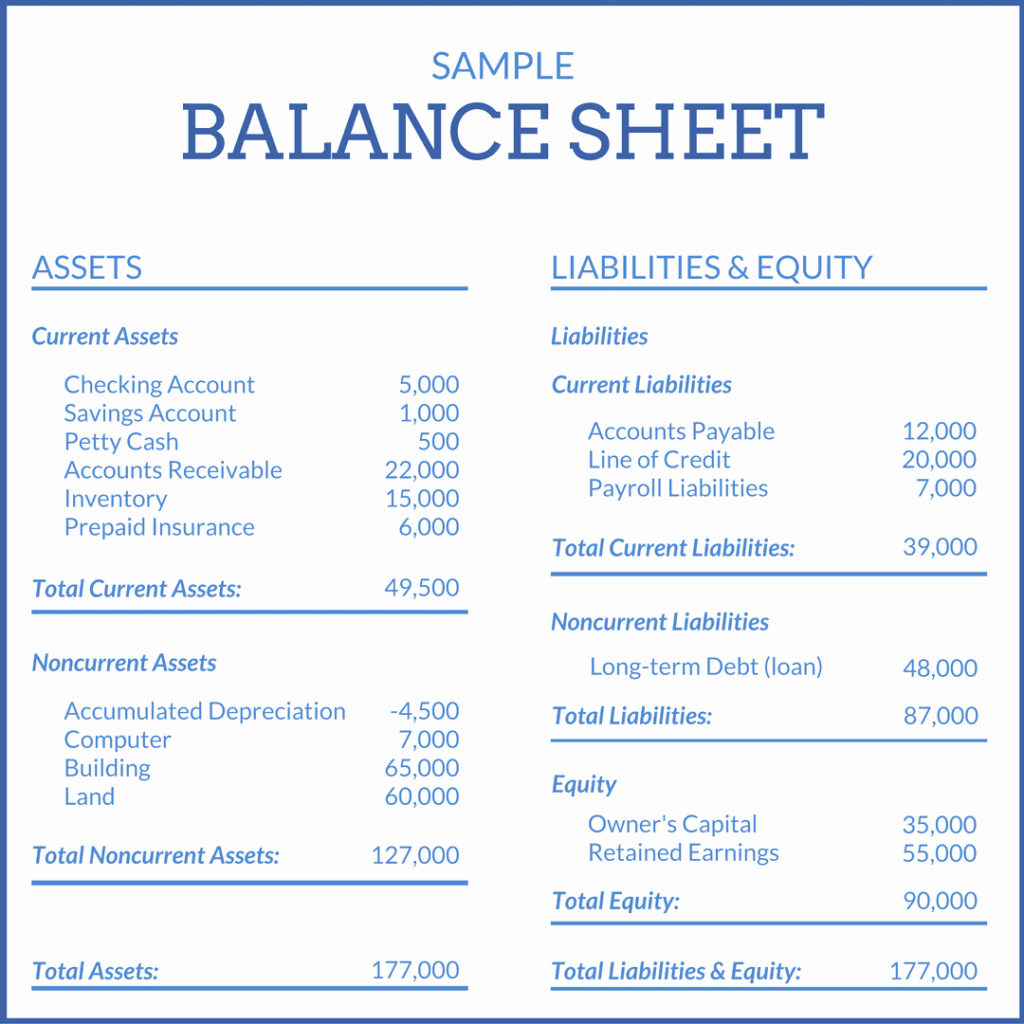

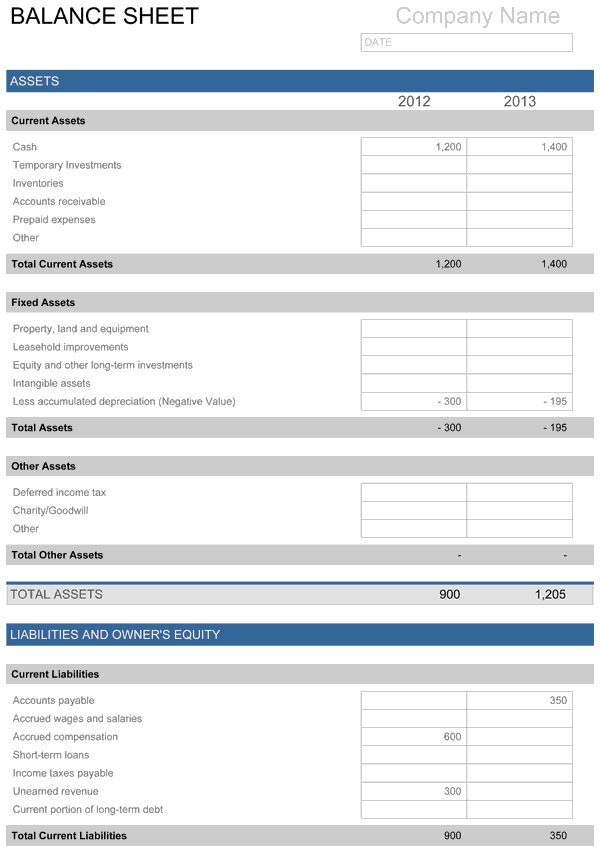

Assets like cash, inventory, accounts receivable, investments, prepaid expenses, and fixed assets.

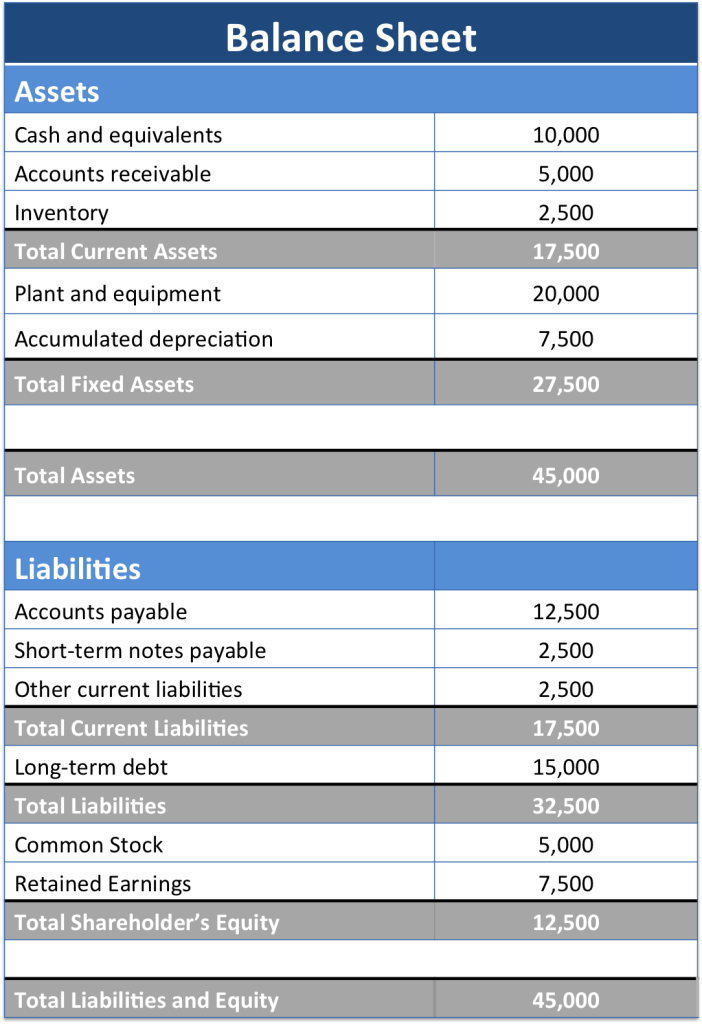

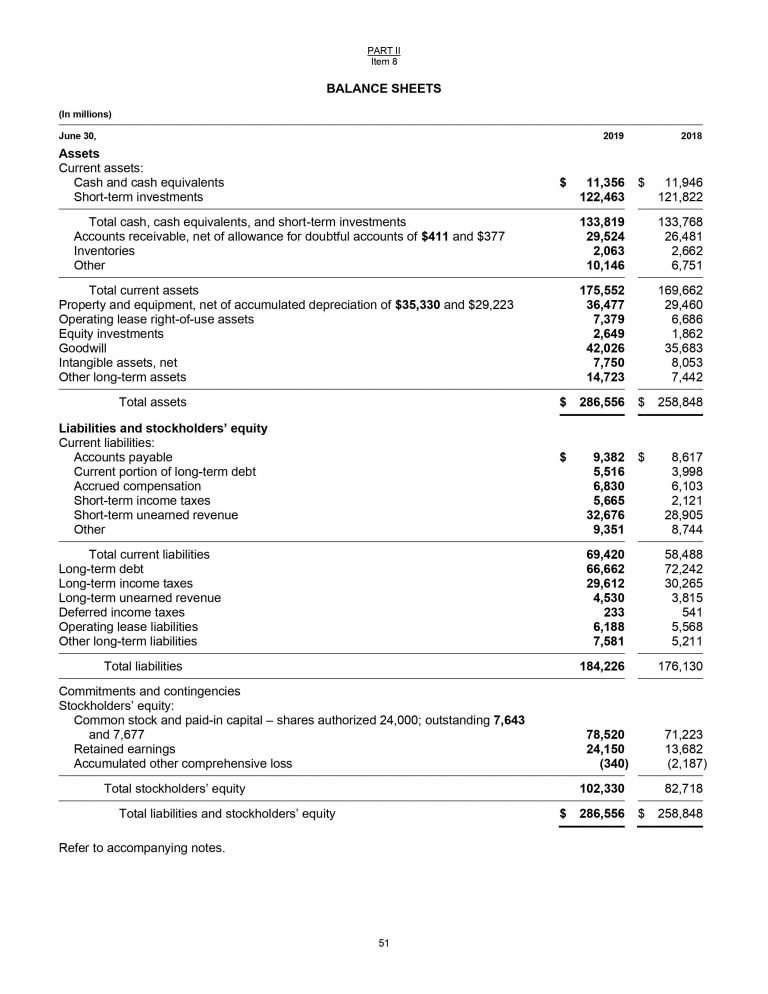

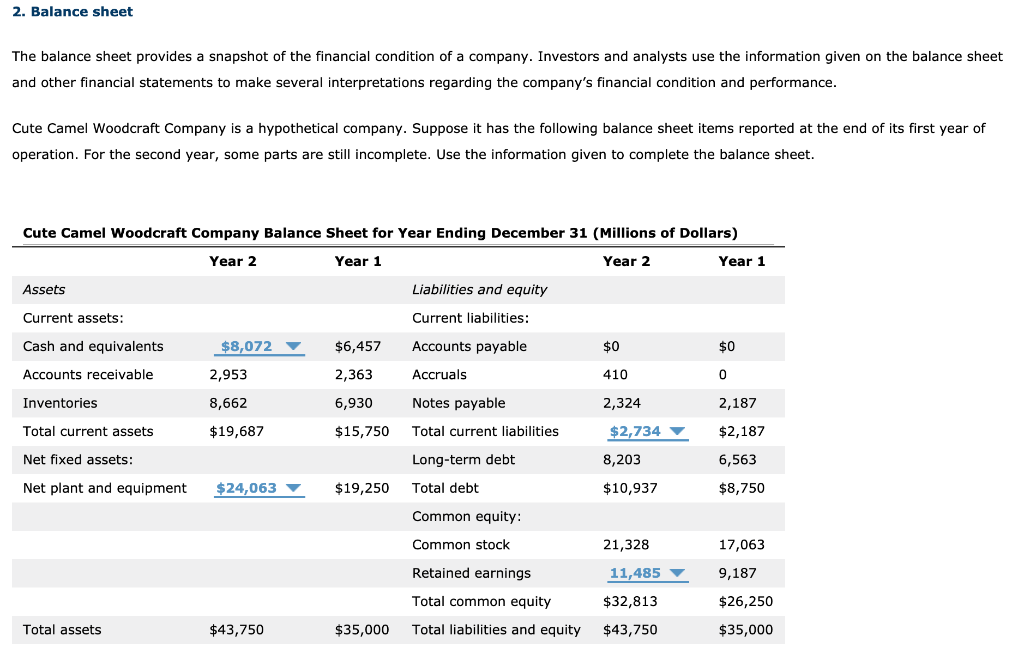

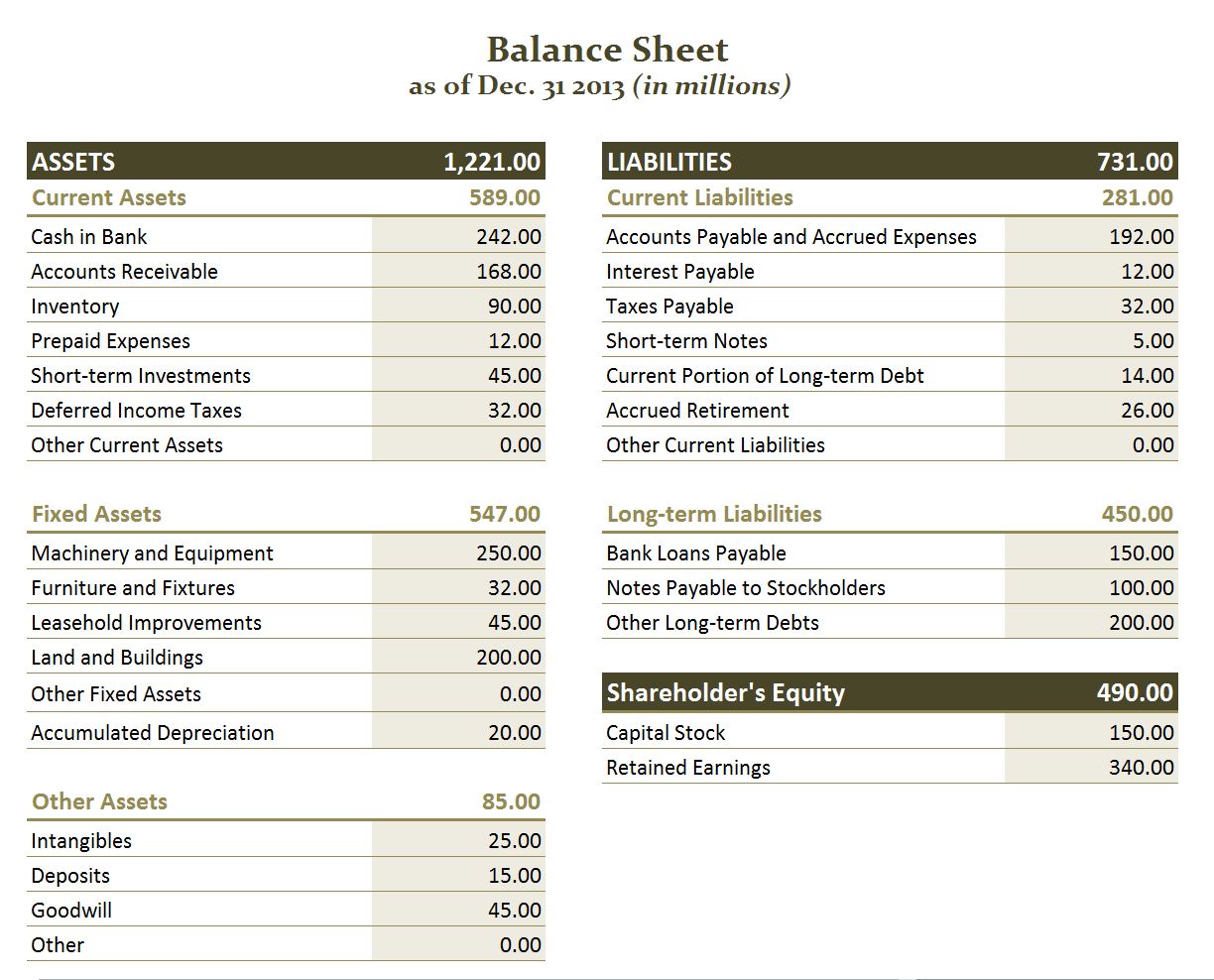

Balance sheet items in detail. The term “balance sheet items” refers to all the records captured in the balance sheet in the form of assets and liabilities as of a certain reporting date. Assets, liabilities, and shareholders’ equity. A quick glance at the balance sheet of a small business or large corporation can give investors clues about the company's financial health and net worth at a specific point in time.

The balance sheet displays the company’s assets, liabilities, and shareholders’ equity at a point in time. Assets an asset is something that the company owns and that is beneficial for the growth of the business. Its purpose is to verify that the.

Each of the first three sections contains the balances of the various accounts under each heading. This typically means they can either be sold or used by the company to make products or provide services that can be sold. Assets = liabilities + owners’ equity

A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity. The balance sheet represents the financial position of a business at any given point in time. It records the closing balances of all the general ledgers of accounts.

A balance sheet keeps the details of the assets and liabilities and presents the company’s financial details in a proper format. Add total liabilities to total shareholders’ equity and compare to assets. Vertical representation or horizontal representation.

Because it summarizes a business’s finances, the balance sheet is also sometimes called the. Financial statements can be presented in two ways; The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date.

The balance sheet is a statement that shows the financial position of the business. To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity. These can include cash, investments, and tangible objects.

It shows the company’s assets along with how they are financed, which may be by debt, equity, or a combination of both. All its accounts are divided into equity, liabilities and assets. The structure of a balance sheet a company's balance sheet is comprised of assets, liabilities, and equity.assets represent things of value that a company owns and has in its possession, or.

Assets must equal liabilities plus equity. It is important to note that the balance sheet is one of the three fundamental financial statements (the other two being the income statement and cash flow statement ). The balance sheet is one of the three core financial statements that are used to.

It records a company’s equity, liabilities and assets. This describes whether the asset can be easily converted to cash. Assets = liabilities + equity.