Build A Tips About Revenue Account Normal Balance Income Statement Of A Company

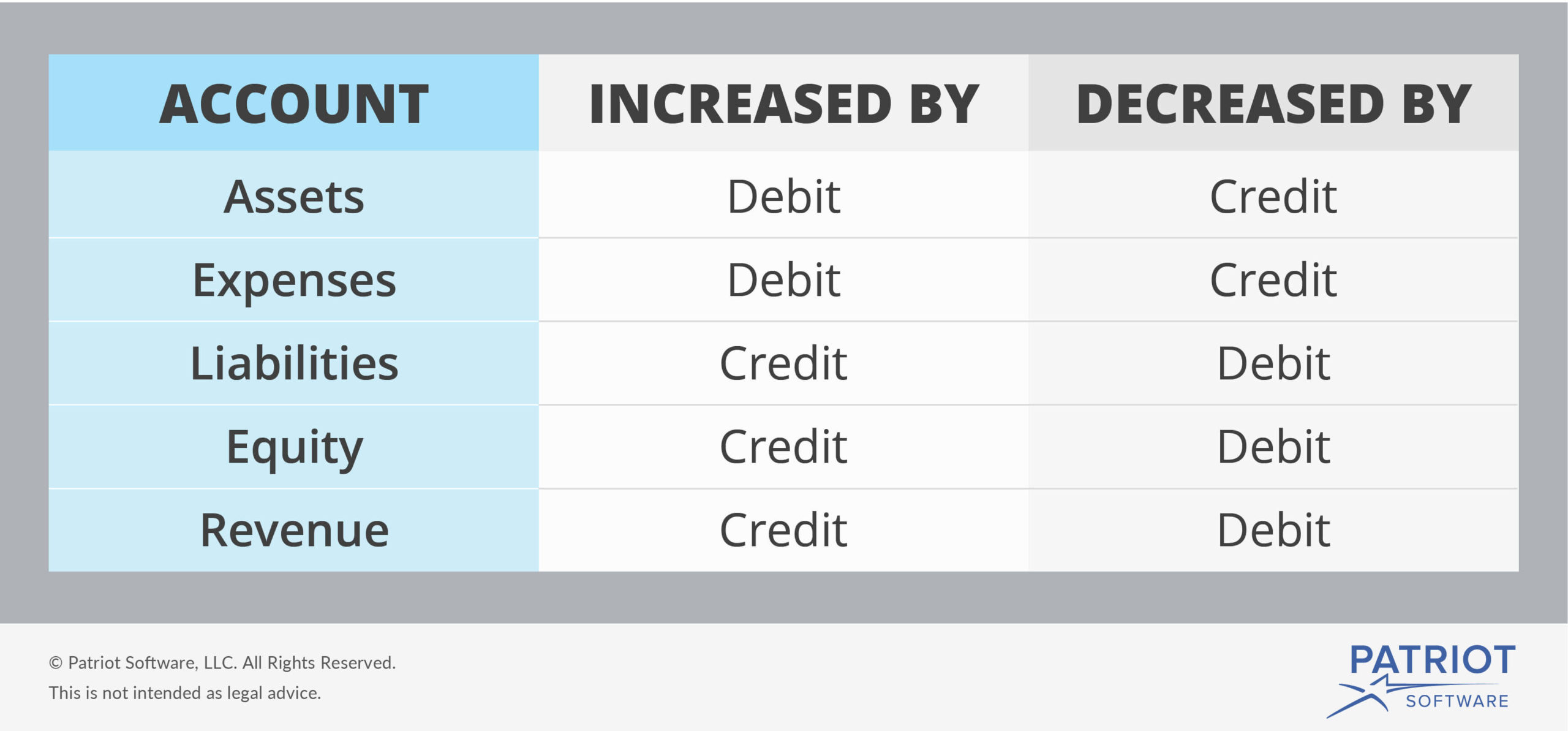

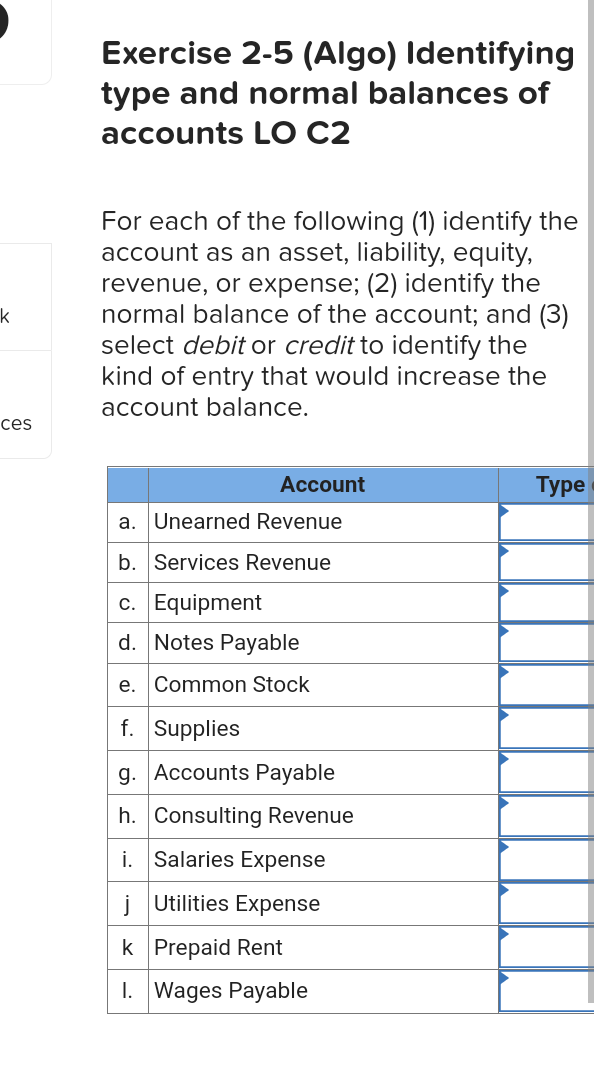

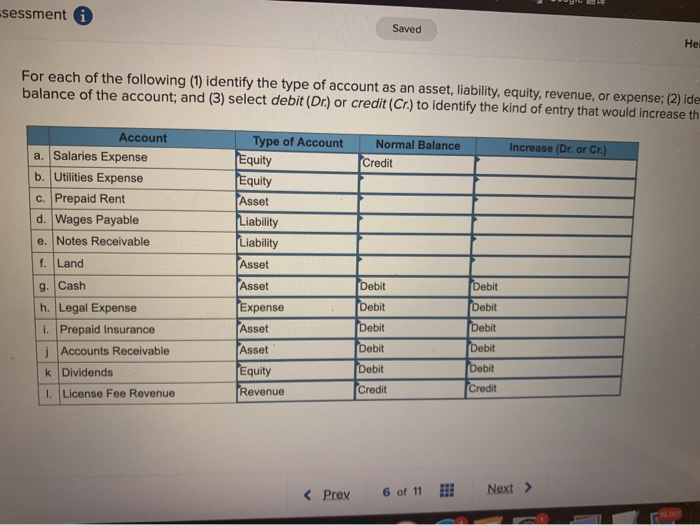

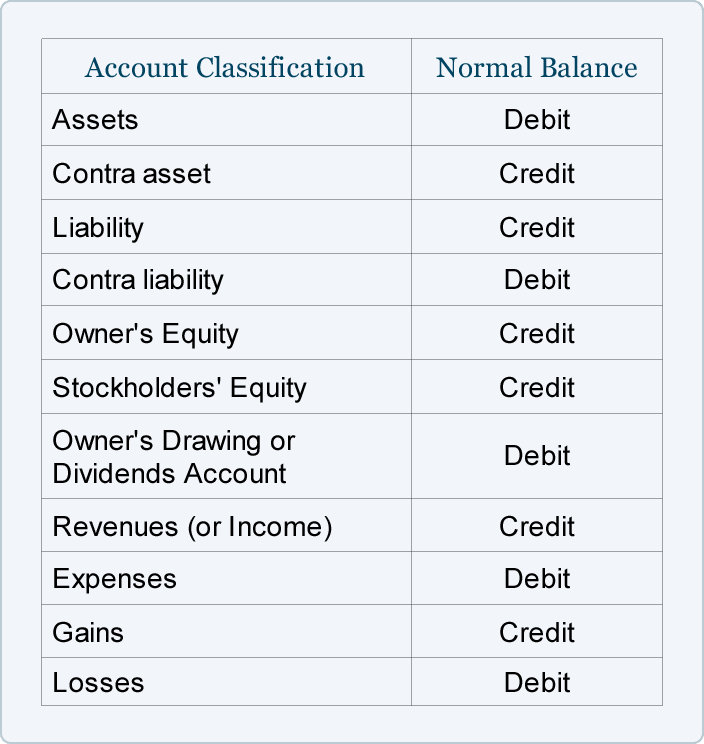

The following general ledger account classifications normally have debit balances:

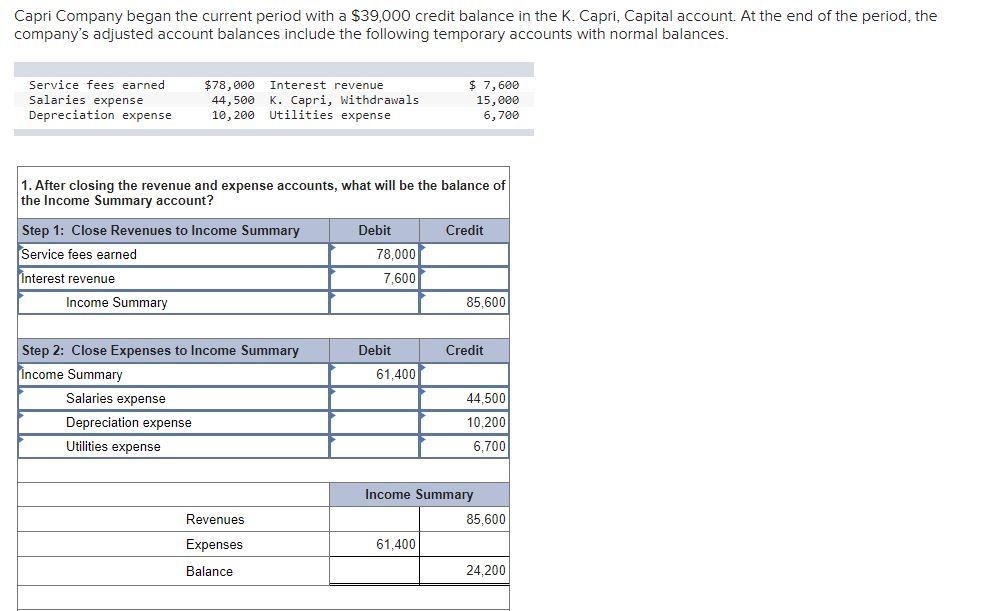

Revenue account normal balance. It is possible for an account expected to have a normal balance as a debit to actually have a credit balance, and vice versa, but these. To better understand this concept, let’s break it down further: Since the service was performed at the same time as the cash was received, the revenue account service revenues is credited, thus increasing its account balance.

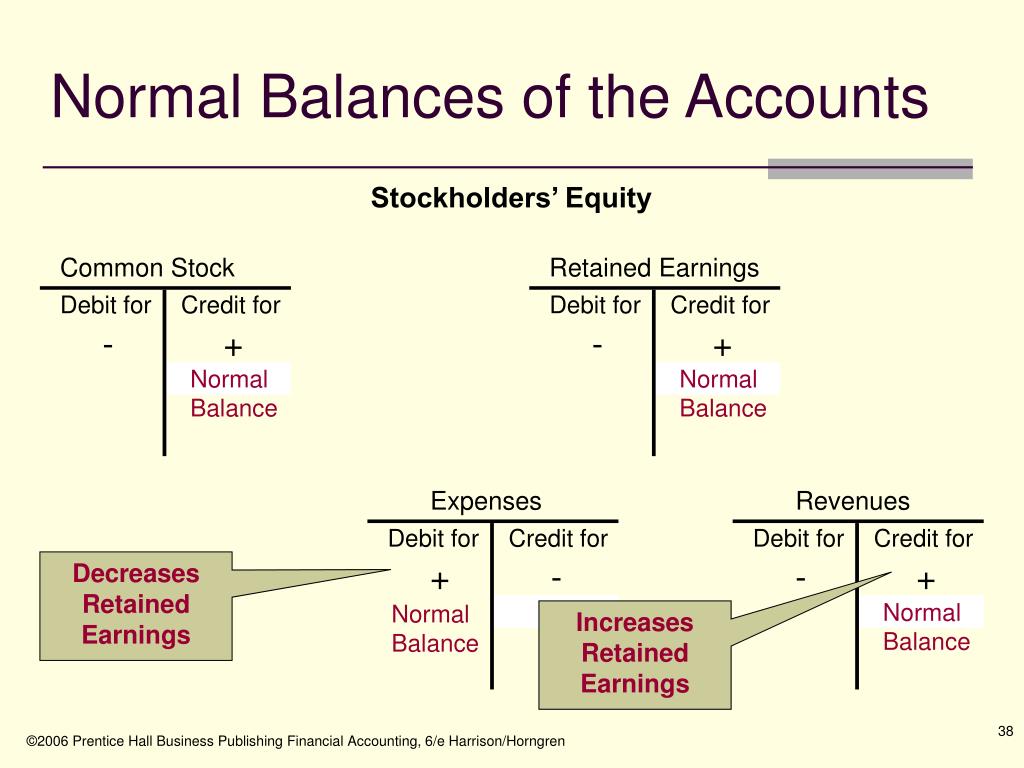

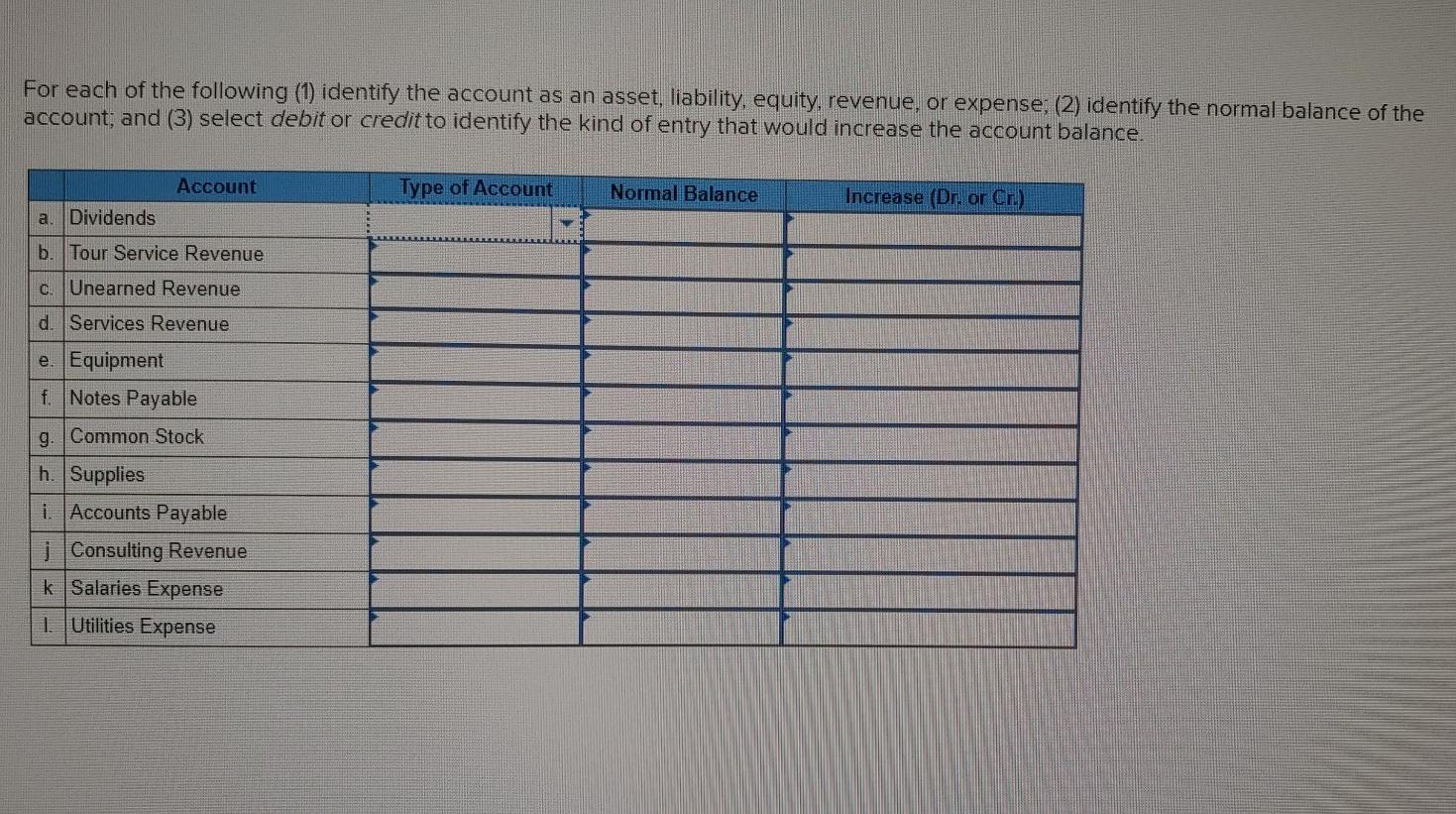

Revenue accounts typically have a credit normal balance, reflecting the inflow of economic benefits during a period. Because of the impact on equity (it increases), we assign a normal credit balance. The normal balance for a revenue or gain account is a credit.

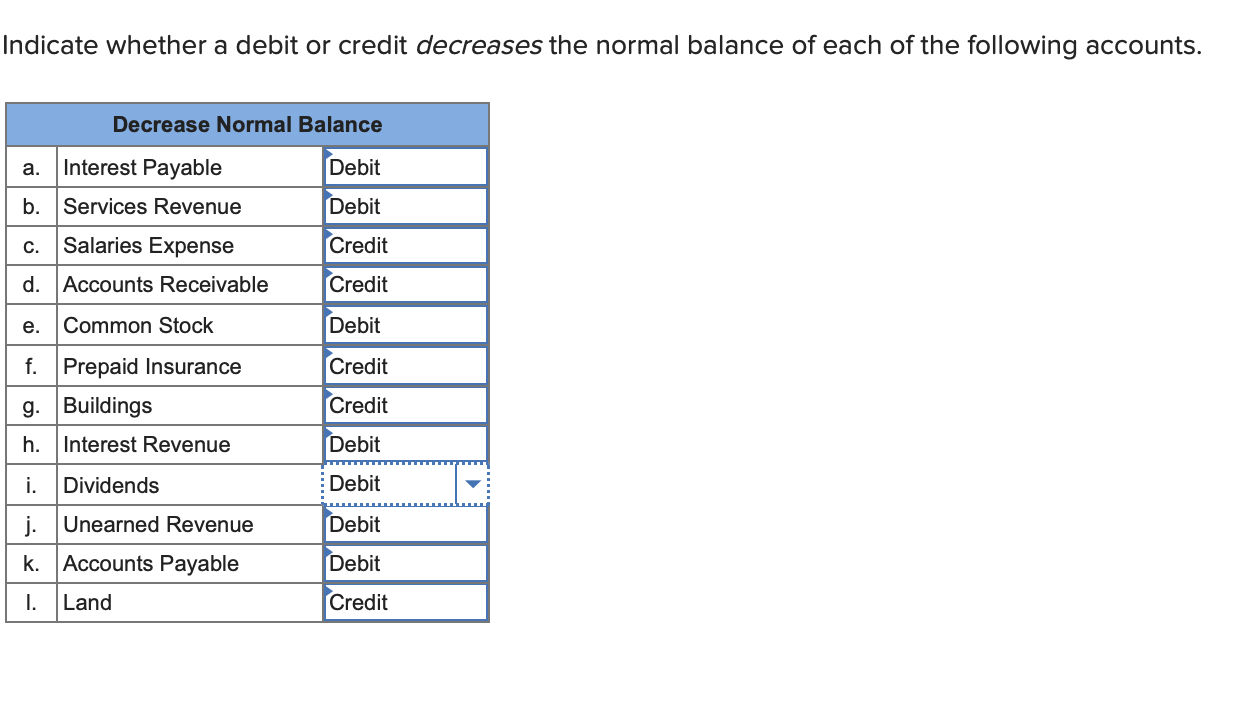

The short answer to the question is the unearned revenue’s normal balance is a credit; We can explain normal balance using an example. A contra revenue account is a revenue account that is expected to have a debit balance (instead of the usual credit balance ).

Recall that credit means right side. Any particular account contains debit and credit entries. A contra revenue account allows a company to see the original amount sold and to also see the items.

List of normal balances example 1: What is the normal balance for. Expenses are costs incurred by a company in the course of its operations.

For sales returns and allowances, the normal balance is on the credit side. This might seem counterintuitive at first, as one would expect returns to be a negative aspect of revenue. Because it is a liability account.

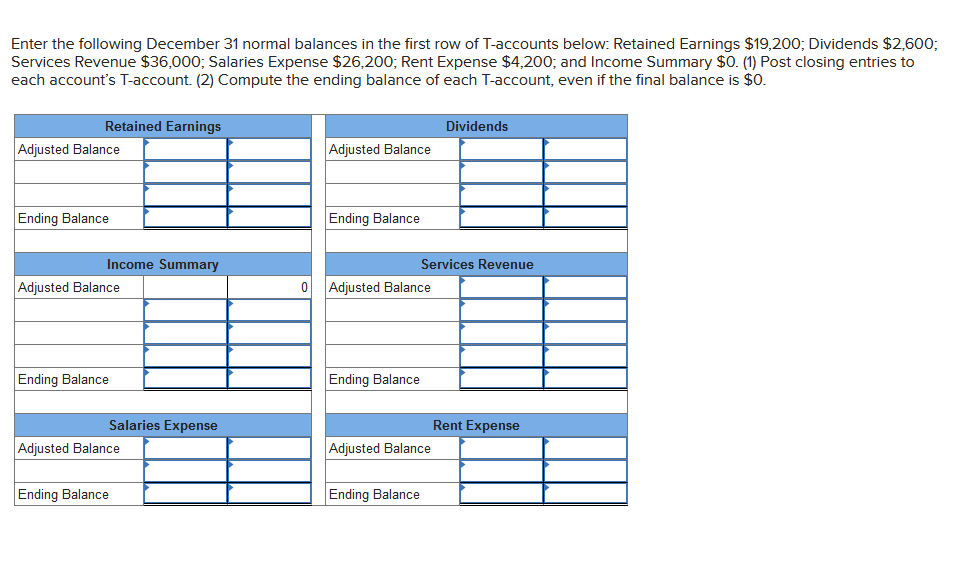

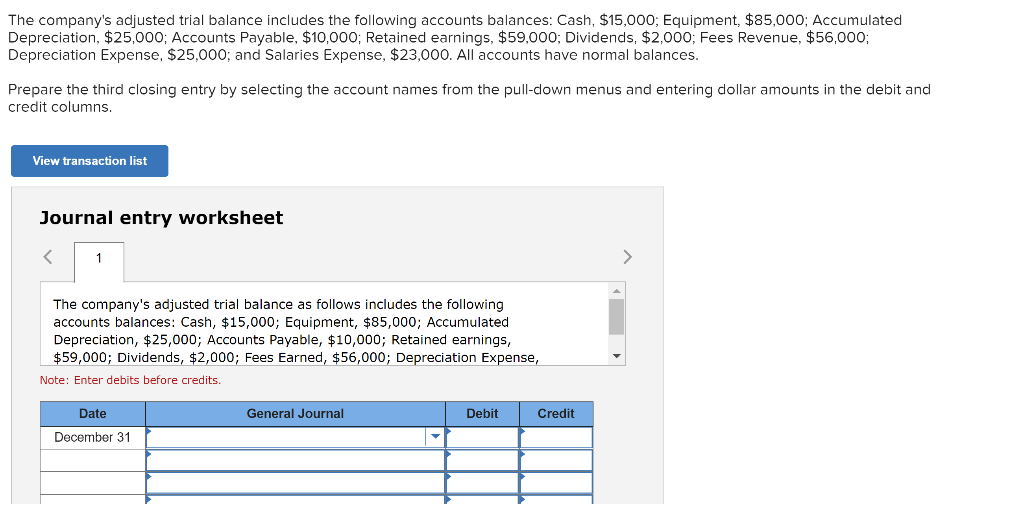

In accounting, a normal balance refers to the debit or credit balance that’s normally expected from a certain account. The account's net balance is the difference between the total of the debits and the total of the credits. All revenue accounts increased by credits normal balance is a credit all dividend accounts increased by debits normal balance is a debit look at the following account.

It has this because it is a liability account. It contains the fee revenue earned during a reporting period. Revenue is normally a credit balance so a contra revenue account such as sales returns is normally a debit balance.

While the normal balance for an expense or loss account is a debit. Normal balance of different types of accounts are mentioned below: If you would like a fuller explanation, please read on.

Expenses, on the other hand, usually bear a debit balance, indicating the cost incurred in the process of generating revenue. Liability accounts will normally have credit balances and the credit balances are increased with a credit entry. What is a revenue account?