Unique Info About Balance Sheet Liabilities Stark Company

Based on provisional unaudited data.

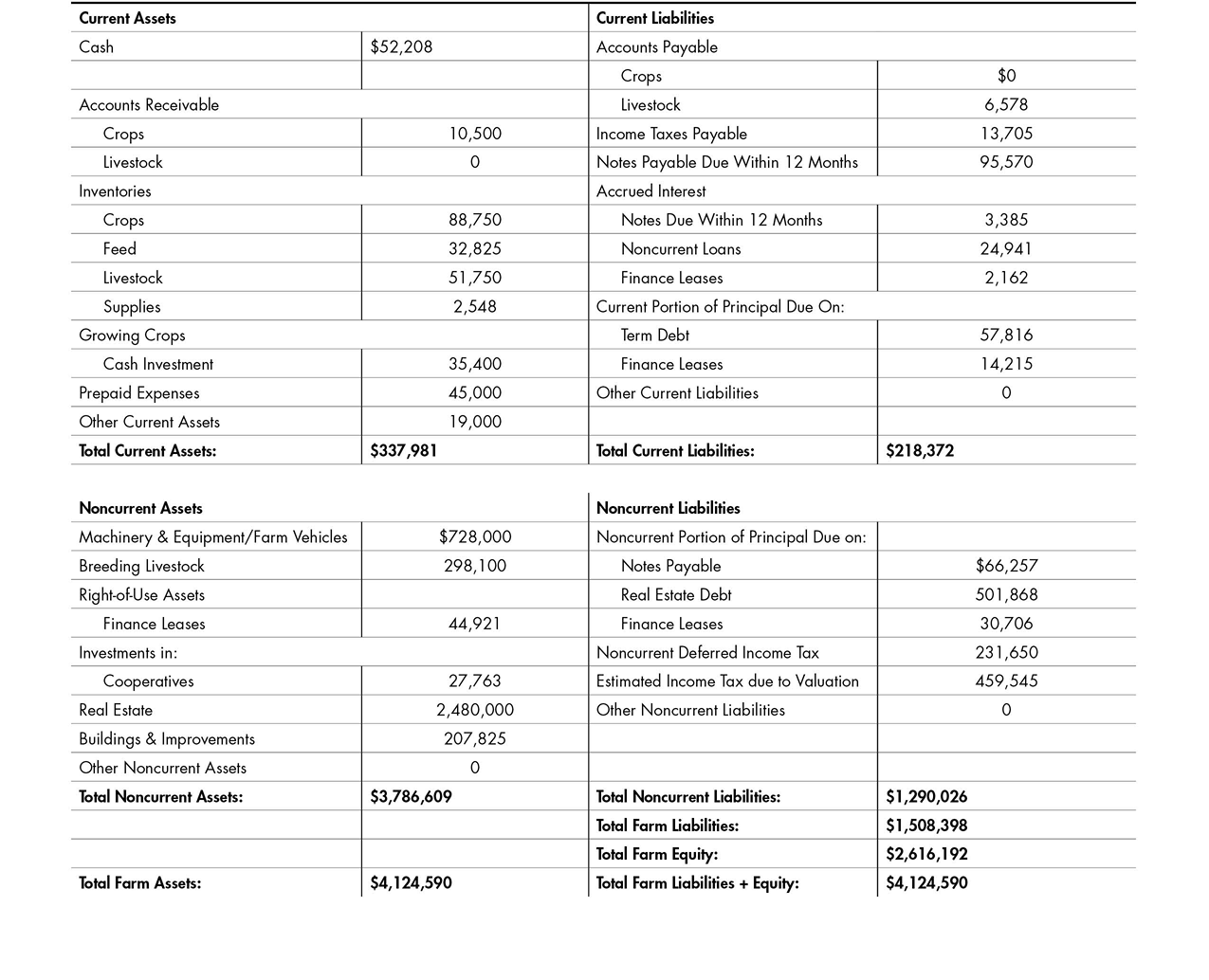

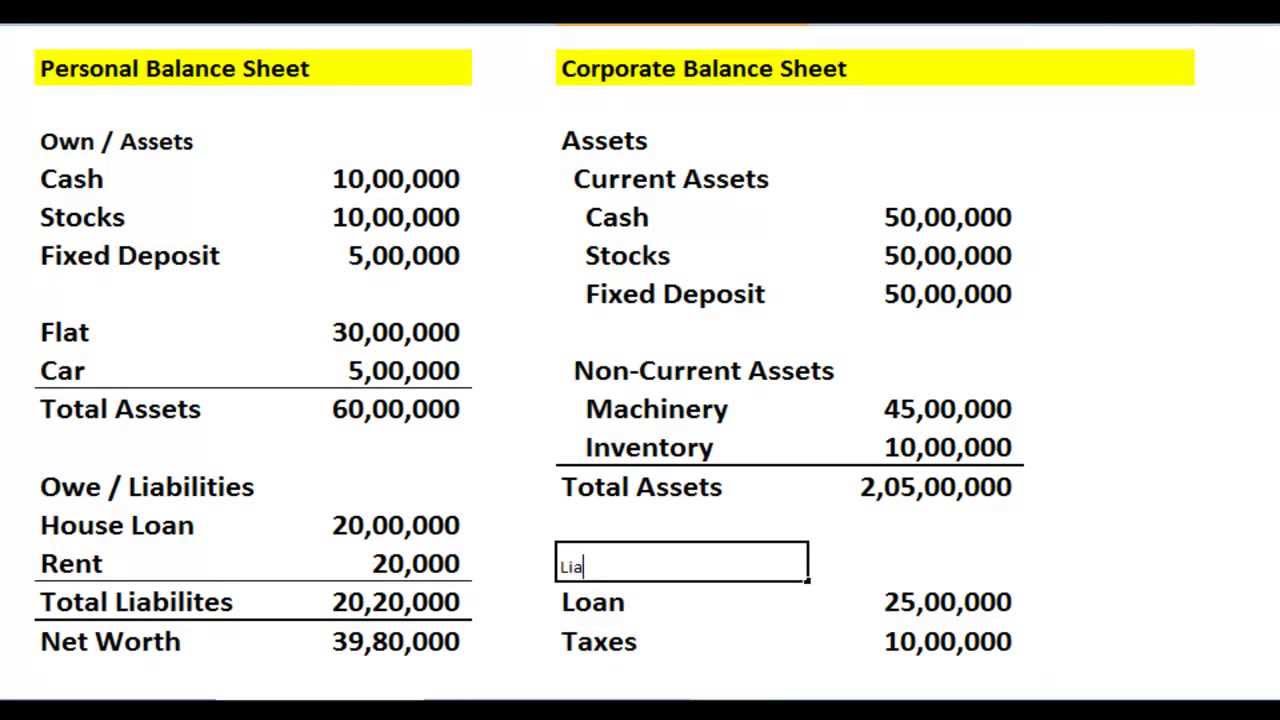

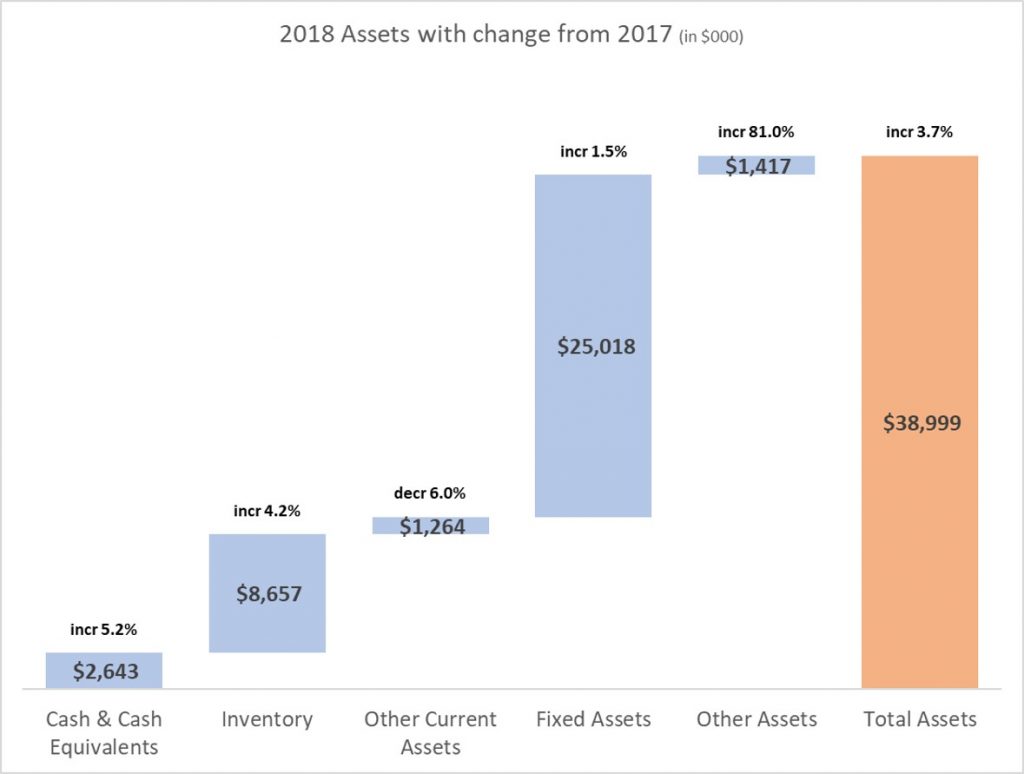

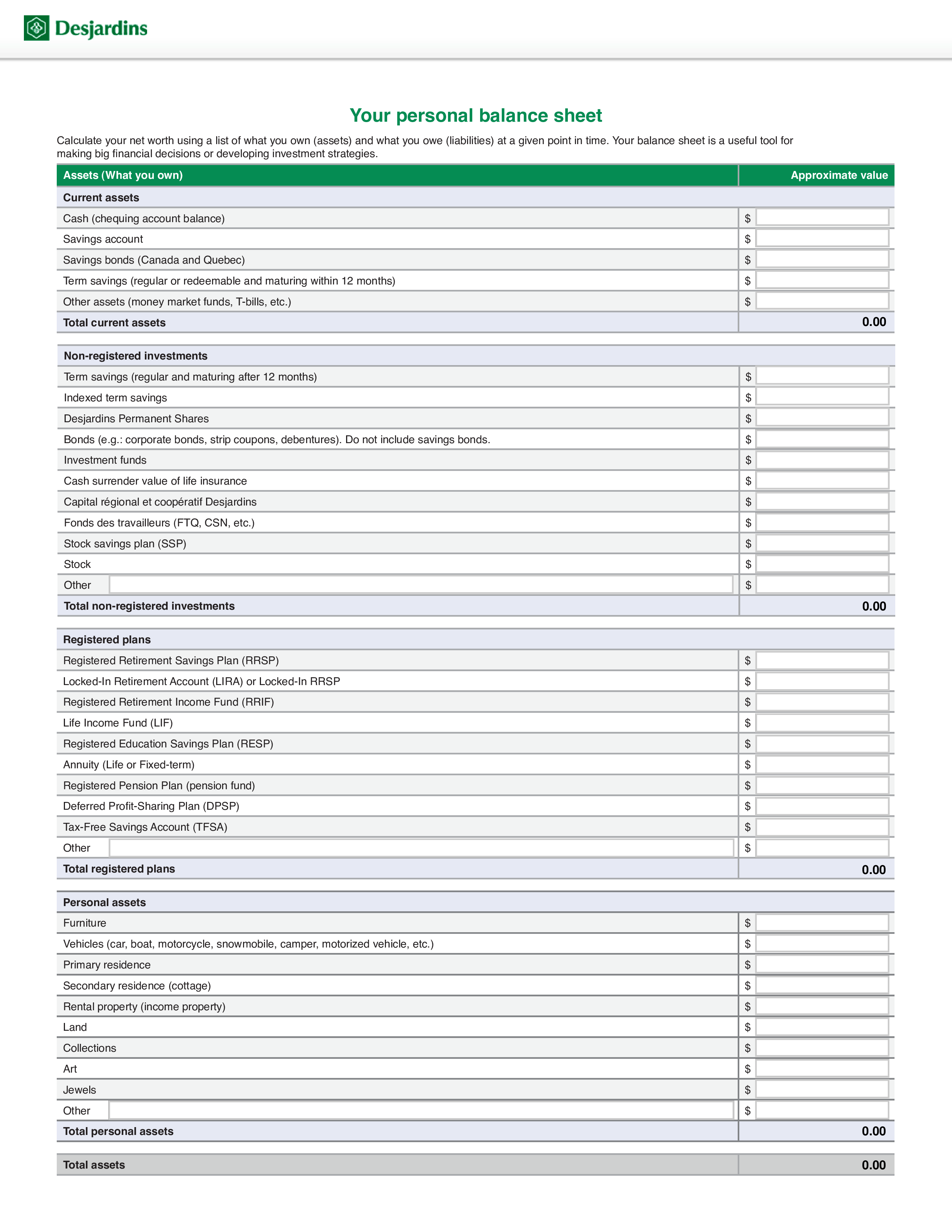

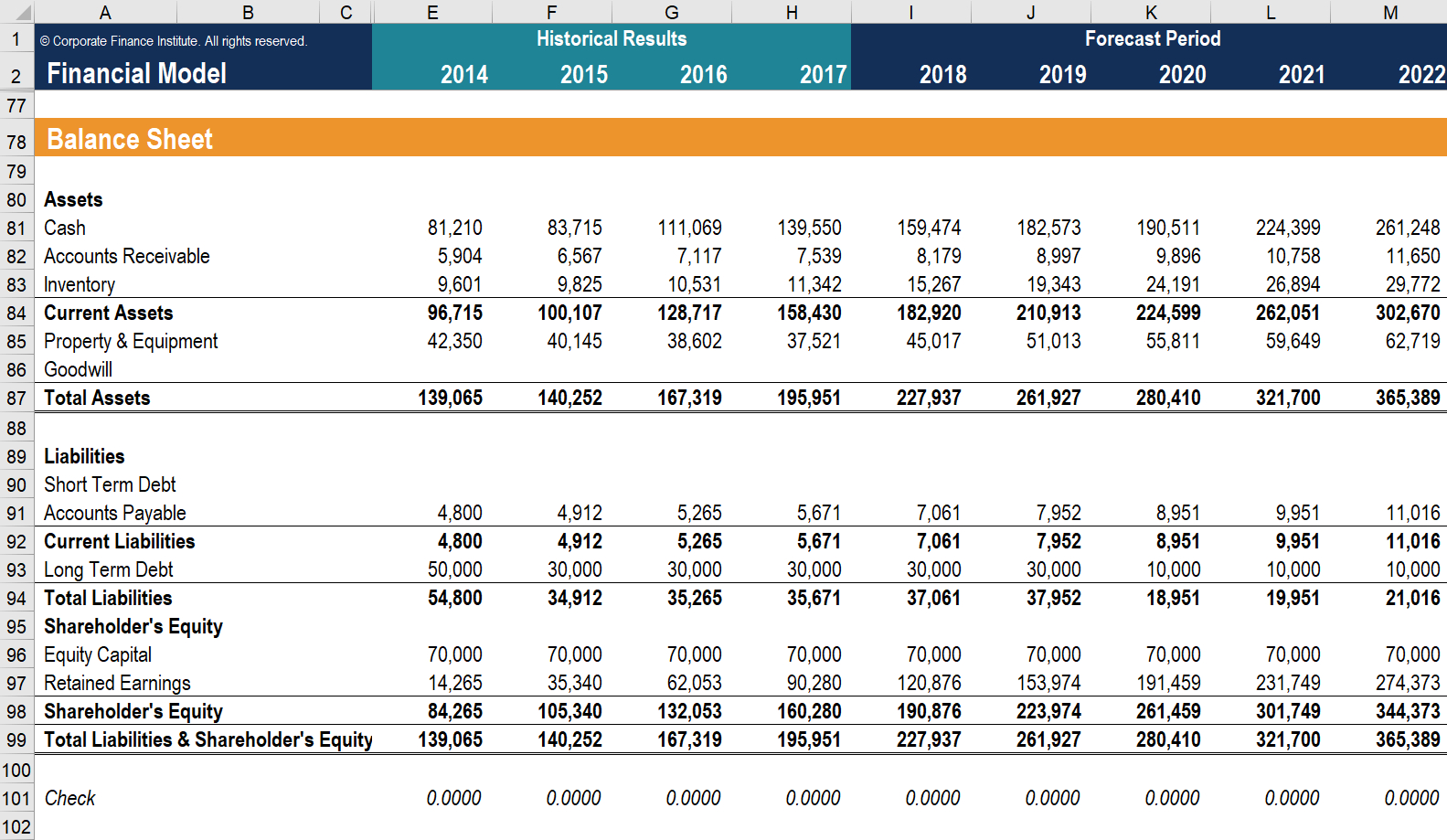

Balance sheet liabilities. The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date. You can learn about the health of a business by looking at its balance sheet. It can also be referred to as a statement of net worth or a statement of financial position.

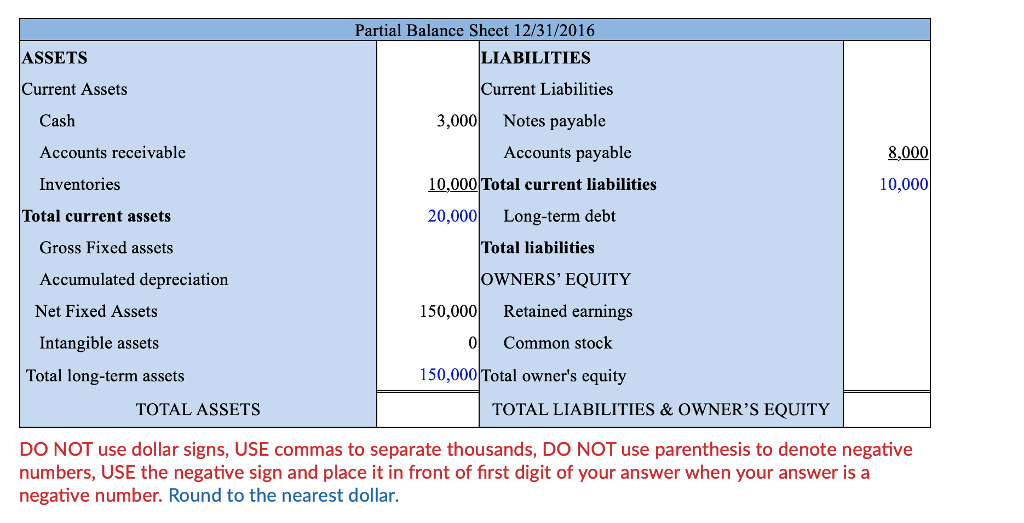

With liabilities, this is obvious—you owe loans to a bank, or repayment of bonds to holders of debt. On the december 31, 2022 balance sheet, the corporation's $120,000 of debt is reported as follows: Here is the list of the type of liabilities on the balance sheet.

Heidelberg materials will buy back more shares after its debt declined significantly, it said on thursday. You pay for your company’s assets by either borrowing money (i.e. A balance sheet is a financial statement that reports a company's assets, liabilities and.

July 20, 2021, at 11:25 a.m. Profit and loss statement (income statement) That’s higher than the level seen.

The formula reflects the fundamental accounting principle that the total value of a company’s assets equals the sum of its liabilities and shareholders’ equity. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Assets, liabilities, and equity on a balance sheet.

The latest balance sheet data shows that intel had liabilities of us$28.1b due within a year, and liabilities of us$53.6b falling due after that. Increasing your liabilities) or getting money from the owners (equity). The balance sheet, together with the.

Types of liabilities on the balance sheet. Policymakers said slower qt could ease shift to ample. Some fed officials said at the january meeting that amid uncertainty over how much liquidity the financial system needs, slowing the.

Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. This chapter looks at a government's balance sheet, showing the various types of assets and liabilities it contains. The current size of the fed's balance sheet is $7.7 trillion.

The company’s balance sheet is an accounting report that shows a company’s assets, liabilities, and shareholders’ equity. The three components of the equation will now be described in further detail in the following sections. European markets heidelberg materials balance sheet improves as building sector recovers.

It defines net worth as the difference between total assets and total liabilities and explains why net worth is a better, more comprehensive, measure of fiscal position than the more common measure, debt. Assets = liabilities + owner’s equity. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.