Painstaking Lessons Of Info About Contribution Margin Income Statement Example Template Xls

Variable costs are direct and indirect expenses incurred by a business from producing and selling goods or services.

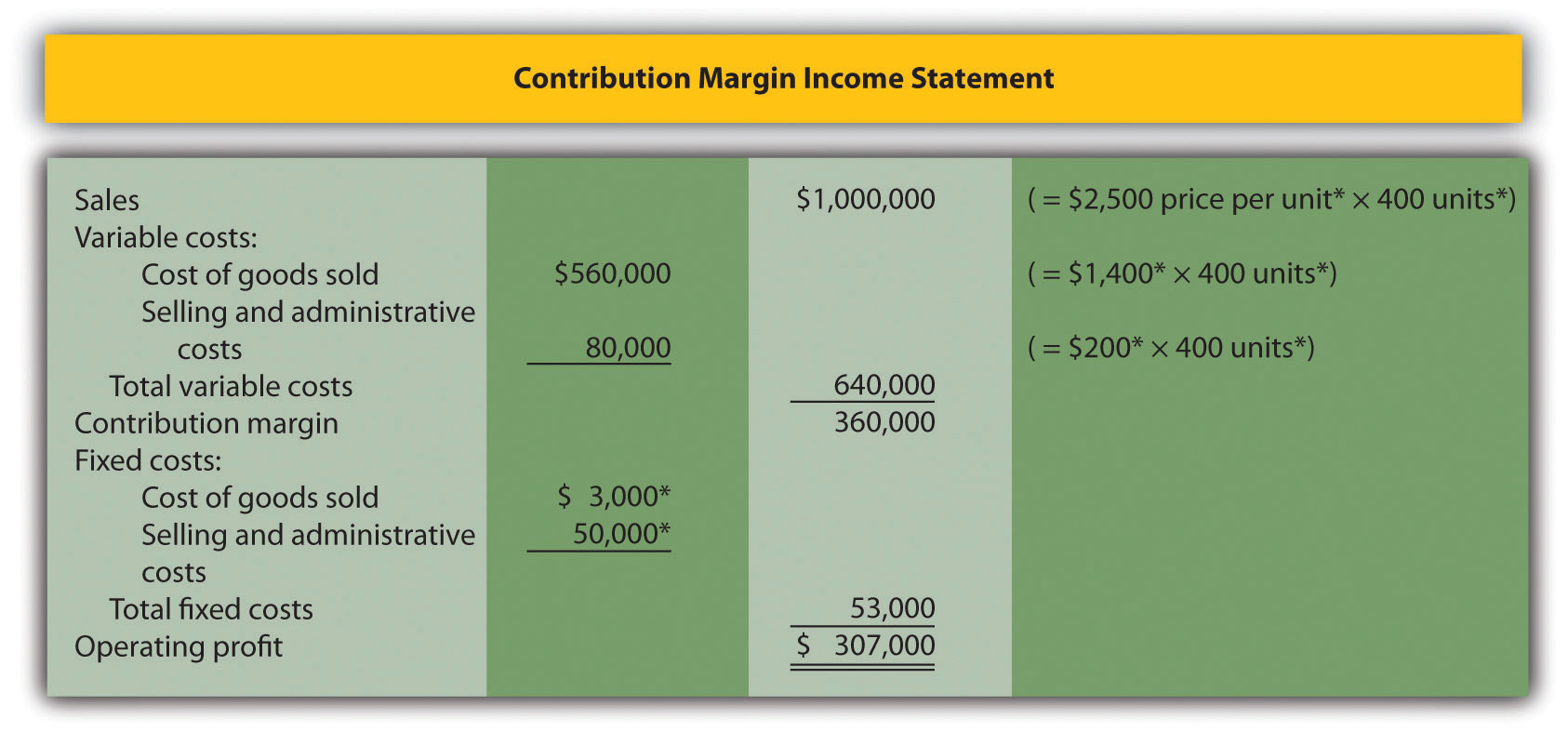

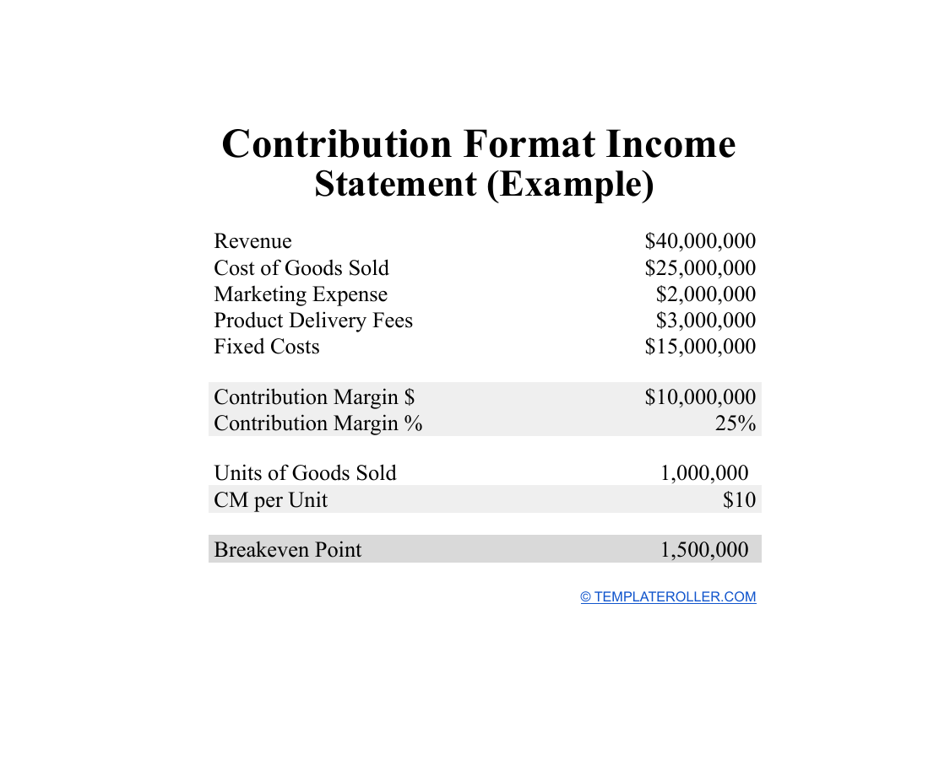

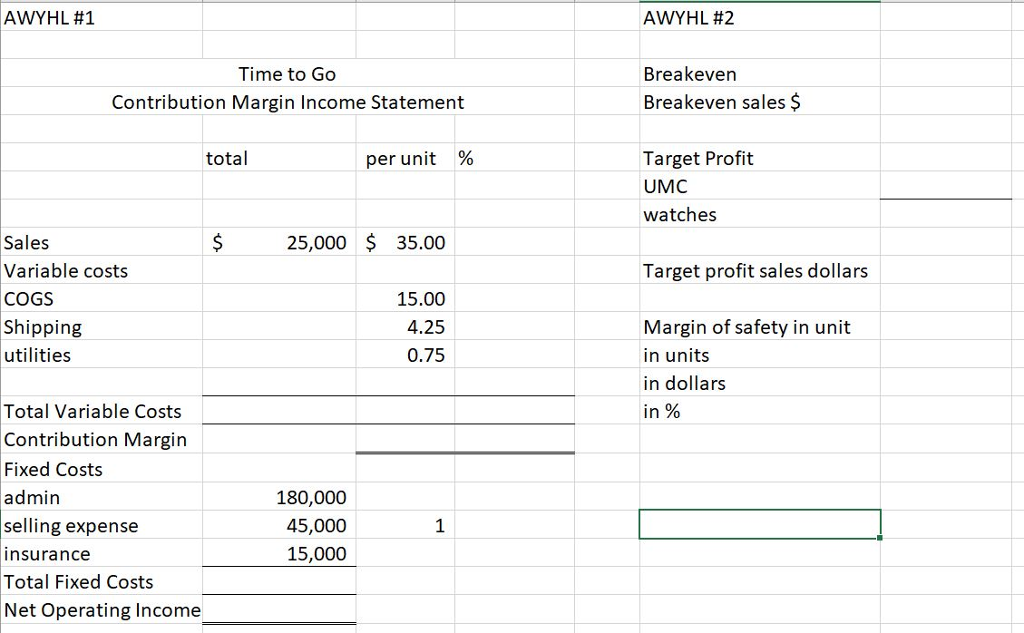

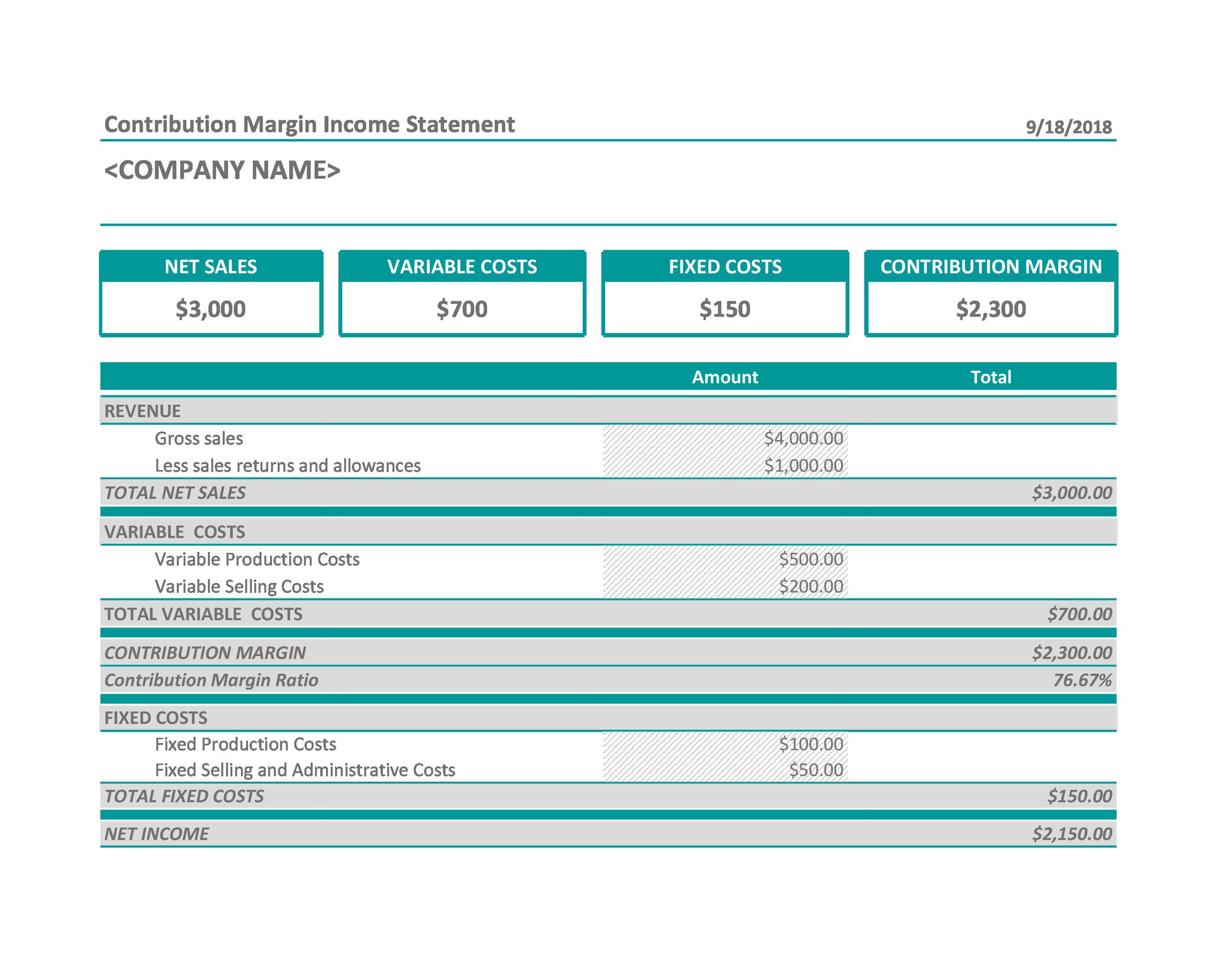

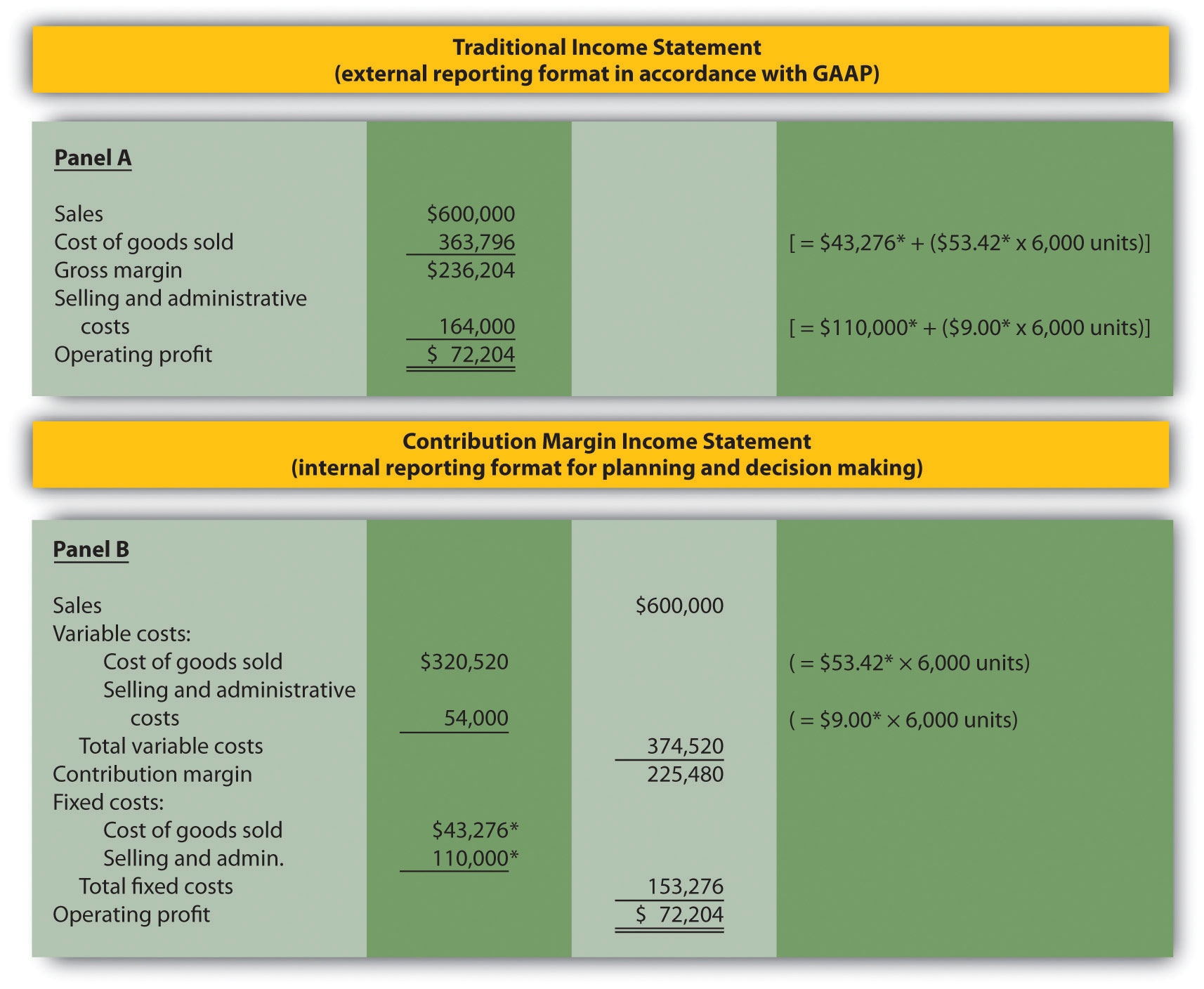

Contribution margin income statement example. To calculate this figure, you start by looking at a traditional income statement and recategorizing all costs as fixed or variable. A contribution income statement shows what revenue is left after you’ve subtracted the. Using total contribution margin we would divide the $500,000 total contribution margin by the total sales of $1.5 million for $500,000 / $1.5 million =.33 or 33%.

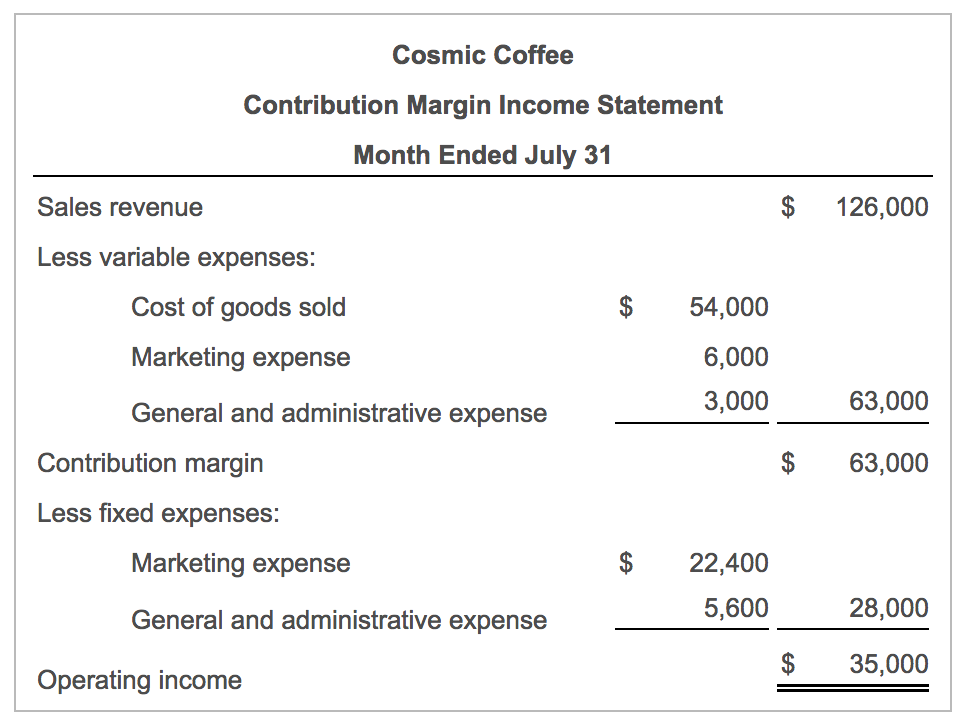

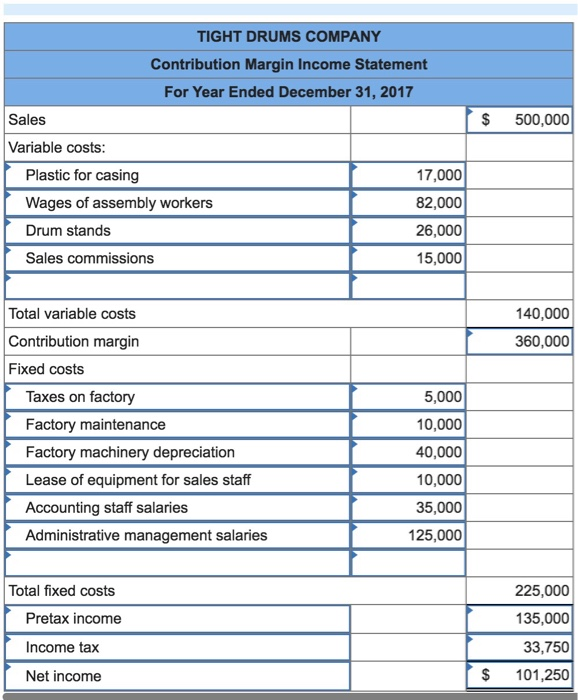

A contribution margin income statement separates fixed and variable business expenses and shows the revenue generated after those two categories of expenses have been paid. This $5 $ 5 contribution margin is assumed to first cover fixed costs first and then realized as profit. Key highlights contribution margin is a business’s sales revenue less its variable costs.

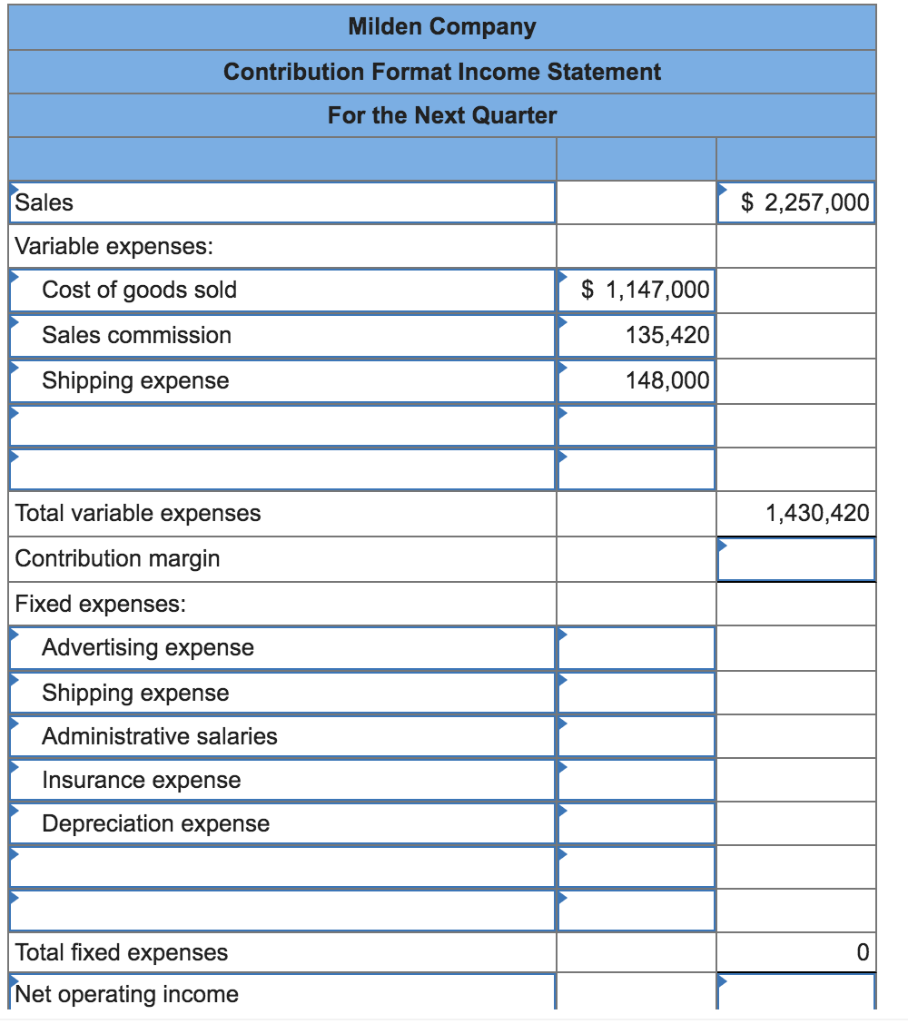

The contribution margin income statement organizes the data in a way that makes it easier for management to assess how changes in production and sales will affect operating profit. The contribution margin income statement separates variable and fixed costs in an effect to show external users the amount of revenues left over after variable costs are paid. The formula for your contribution margin is:

This is expressed through the following formula: With the rising demand in customers asking for workshops for baking their cakes, you started weekend workshops for the same. In our example, the sales revenue from one shirt is $15 $ 15 and the variable cost of one shirt is $10 $ 10, so the individual contribution margin is $5 $ 5.

Some other helpful tools for business From our bottled drink example we can calculate it as 50 cents / $1.50 =.33 or 33%. How to calculate the contribution margin and the contribution margin ratio?

Cite table of contents: Examples of contribution margin income statement example #1 ‘my cake shop’ is a cake and pastry business that you run. For example, if your product revenue was $500,000 and total variable expenses were $250,000, your contribution margin would be $250,000 ÷ $500,000, or 50%.

February 4, 2021 14 min read in this article, you will learn: Using the above example, the contribution margin ratio (cmr) is calculated as: Calculate the company’s contribution margin for the period and calculate its breakeven point in both units and dollars.

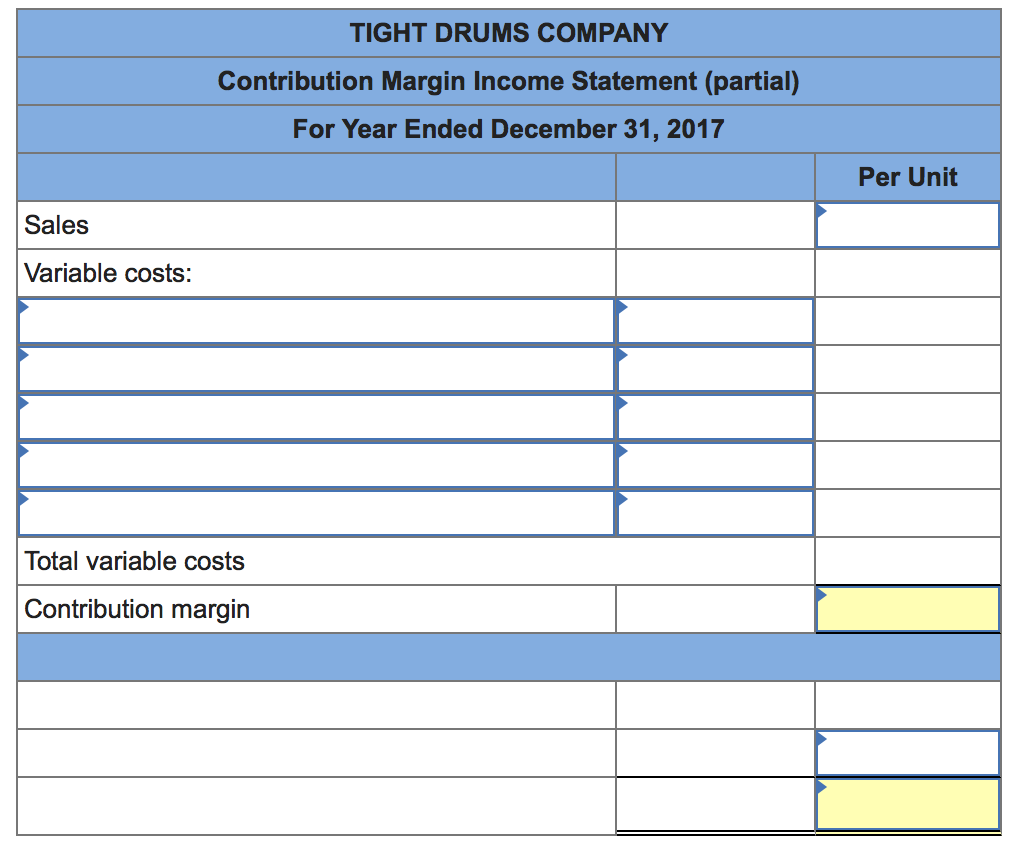

Contribution margin ratio will be the same when computed using total dollars, as follows: Example of contribution margin income statement for example, there is a company a ltd which is manufacturing and selling the different products in the market. A contribution margin income statement is an income statement in which all variable expenses are deducted from sales to arrive at a contribution margin.

Marginal analysis marginal revenue marginal cost marginal profit average cost (per unit cost) what is contribution margin? This is useful because you can assess a particular period in your sales cycle to see if you were profitable or if your expenses were unusually high. Contribution margin definition contribution margin formula contribution margin formula components contribution margin per unit contribution margin ratio how to calculate contribution margin?

An income and expenditure statement first gives us the gross profit figure by deducting the cost of goods sold from. Figure 3.1.1 3.1. Example limitations of the contribution margin income statement limited use difference between fixed and variable costs frequently asked questions how do we make the contribution margin income statement?