Favorite Tips About Prepaid Balance Sheet International Accounting Standard

A “prepaid asset” is the result of a prepaid expense being recorded on the balance sheet.

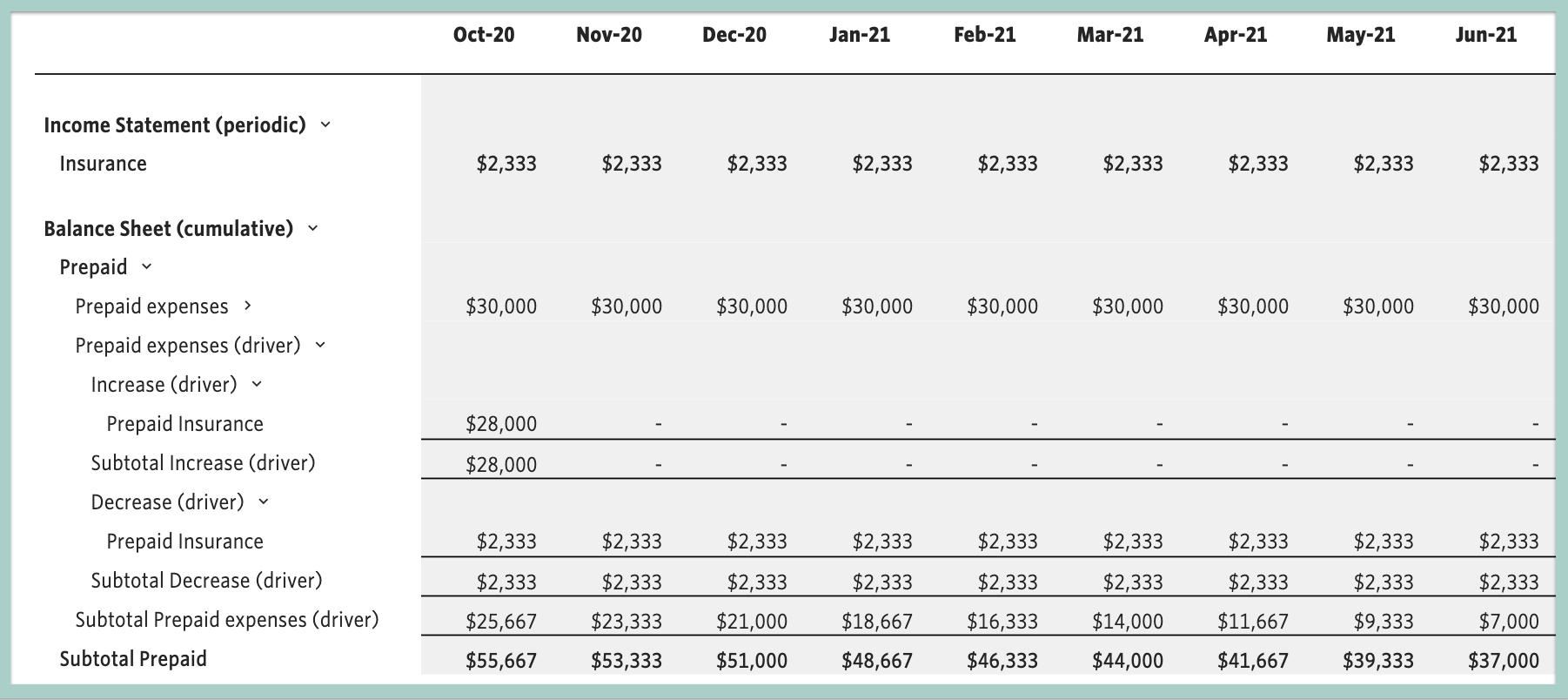

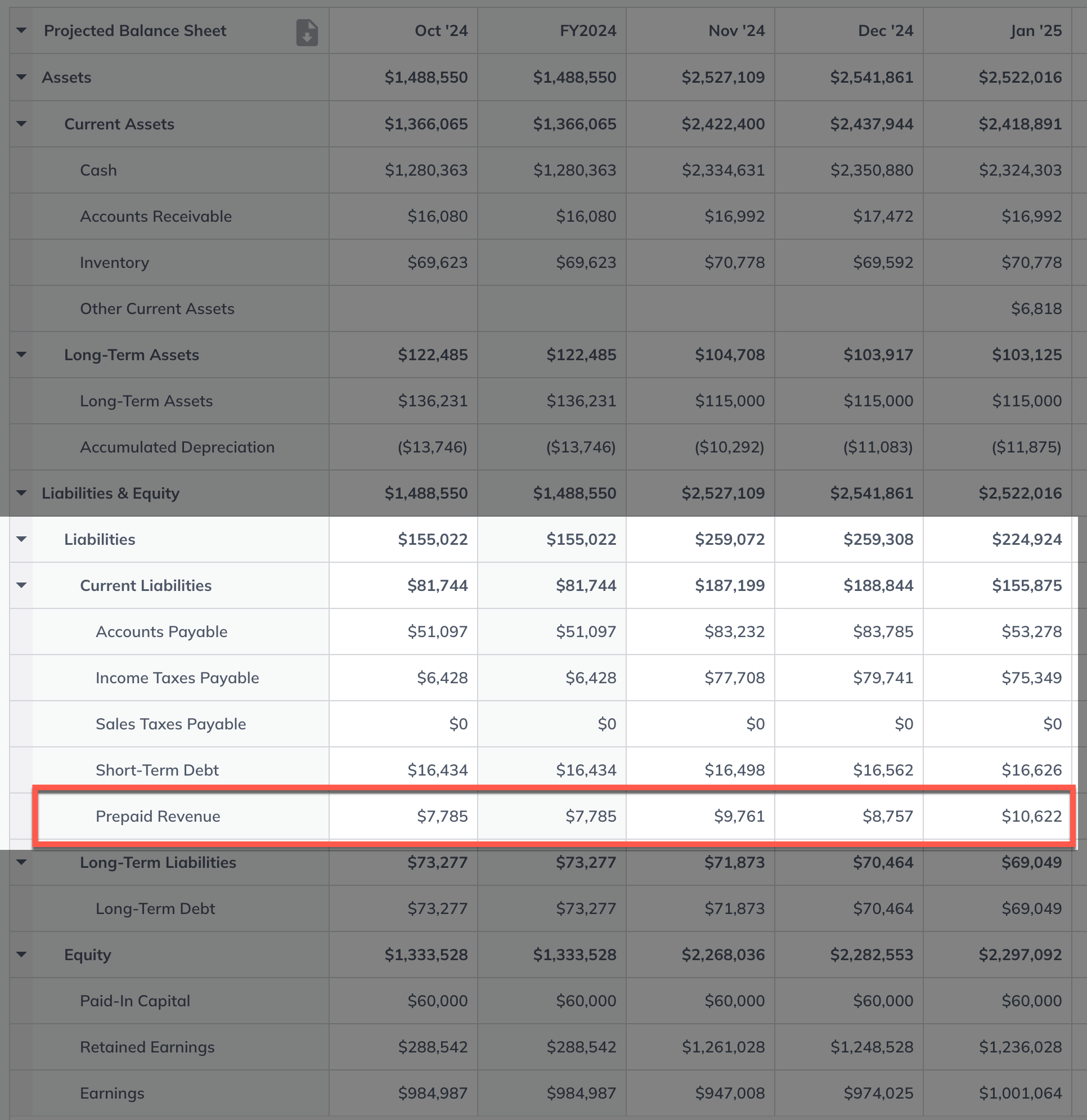

Prepaid balance sheet. A concern when recording prepaid rent in this manner is that one might forget to shift the asset into an expense account in the month when rent is consumed. Some of these examples are given below: Utility bill paid in advance for coming months that are still unaccounted for.

Rent for future months that are paid in advance) prepaid utility bill: Prepaid expenses, or prepaid assets as they are commonly referred to in general accounting, are recognized on the balance sheet as an asset. Prepaid insurance is the insurance premium paid by a company in an accounting period that didn’t expire in the same accounting period.

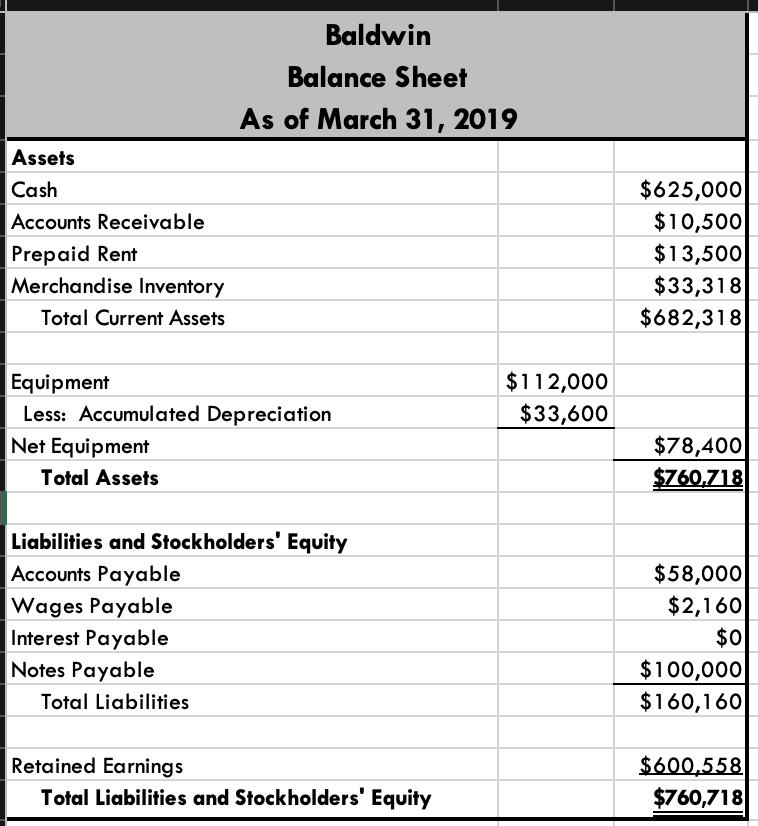

Prepaid expense prepaid income is revenue received in advance but which is not yet earned.income must be recorded in the accounting period in which it is earned. A “prepaid asset” is the result of a prepaid expense being recorded on the balance sheet. Conceptually, working capital is a measure of a company’s short.

What type of account is prepaid expense? Broadly speaking, working capital items are driven by the company’s revenue and operating forecasts. Prepaid expenses refer to expenses that a company pays in advance for goods or services that it will receive in the future.

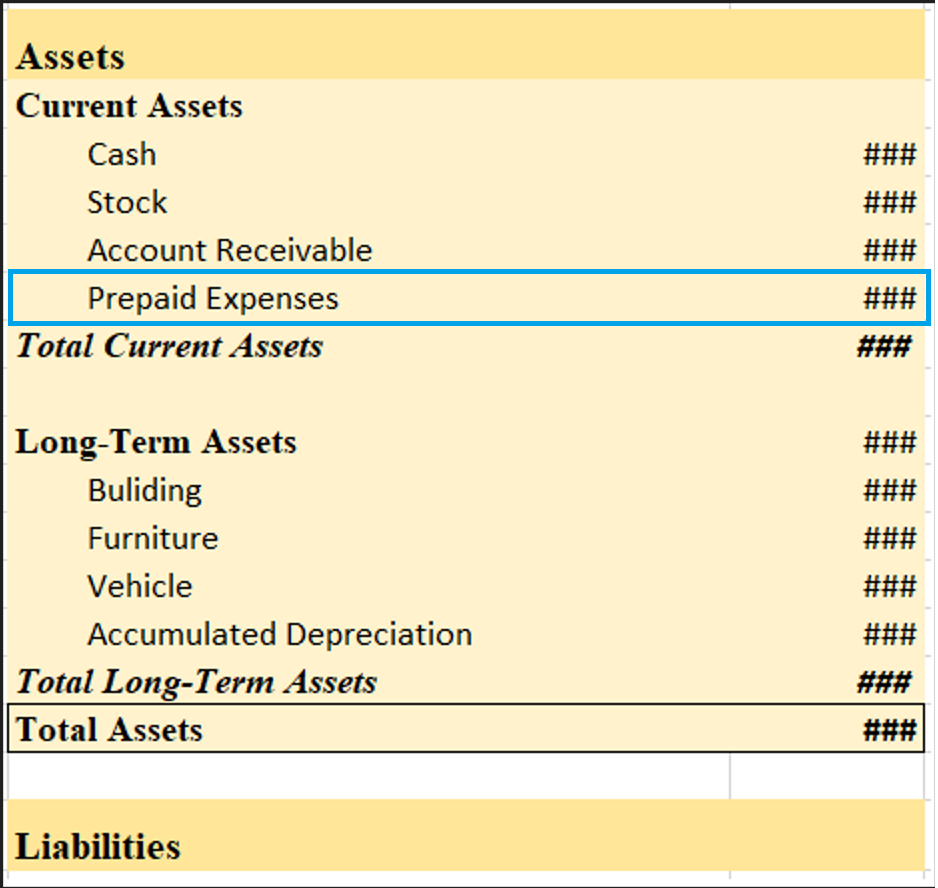

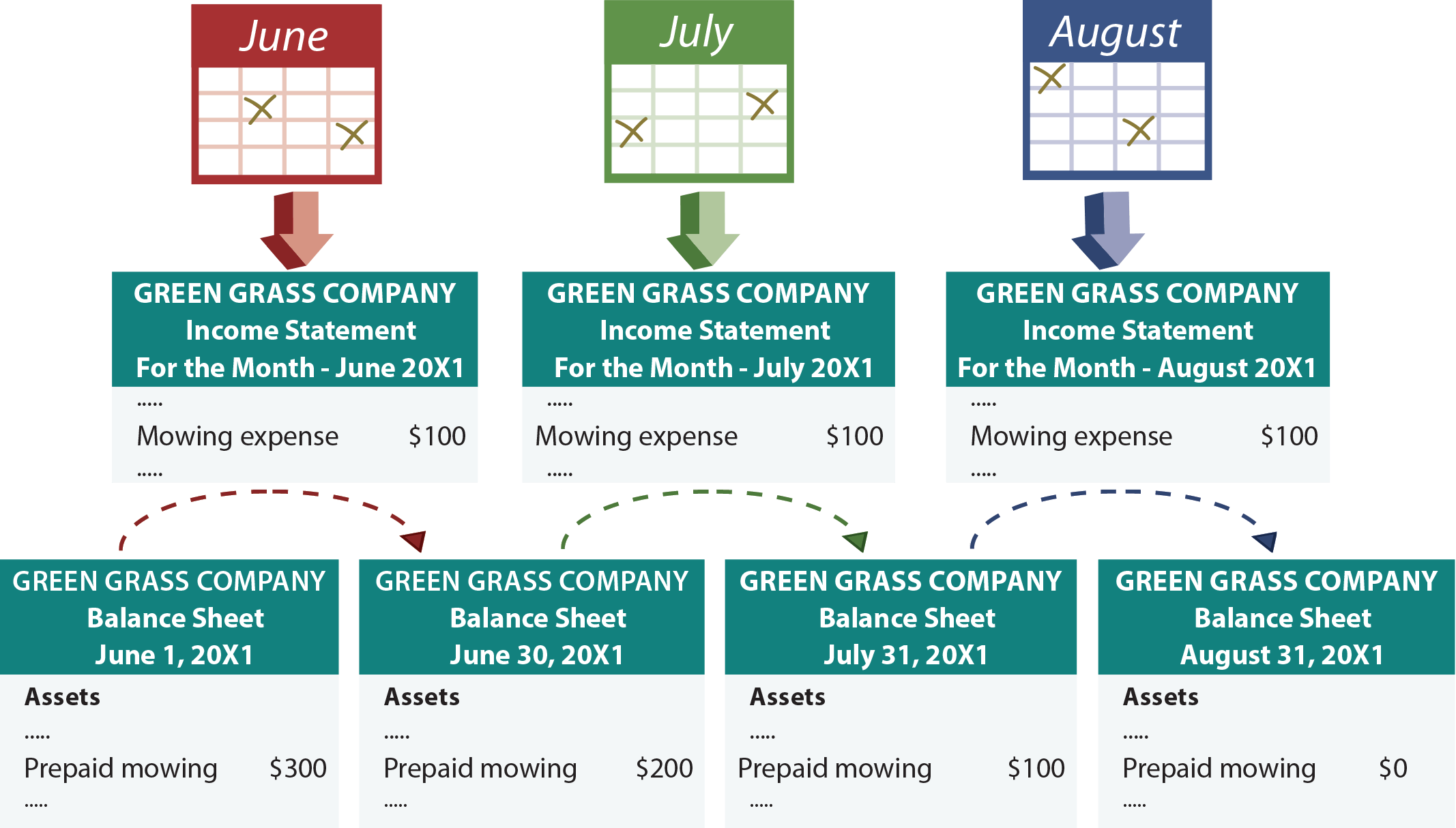

Prepaid expenses are a crucial aspect of a company's balance sheet, representing payments made in advance for goods or services that will be received in the future. Following accounting entry is required to account for the prepaid income: When a company prepays for an expense, it is recognized as a prepaid asset on the balance sheet, with a simultaneous entry being recorded that reduces the company's cash (or payment account).

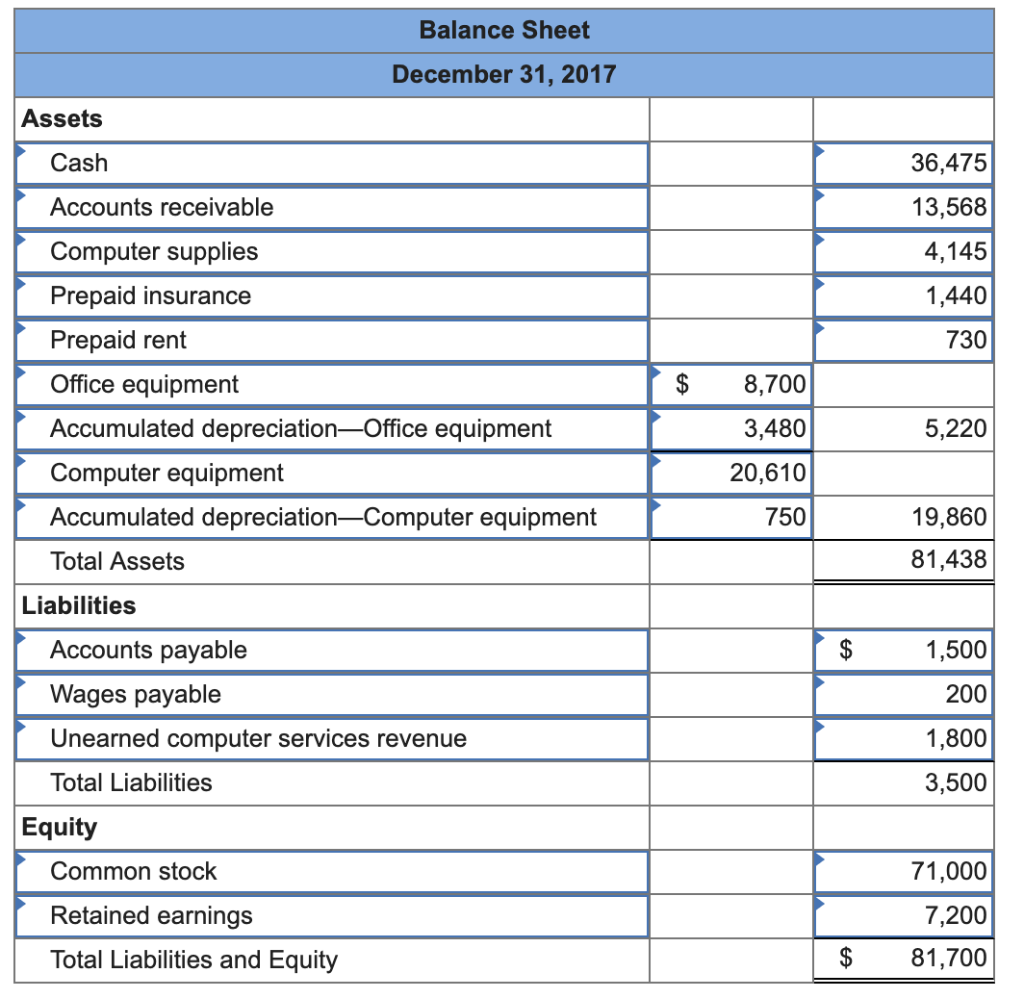

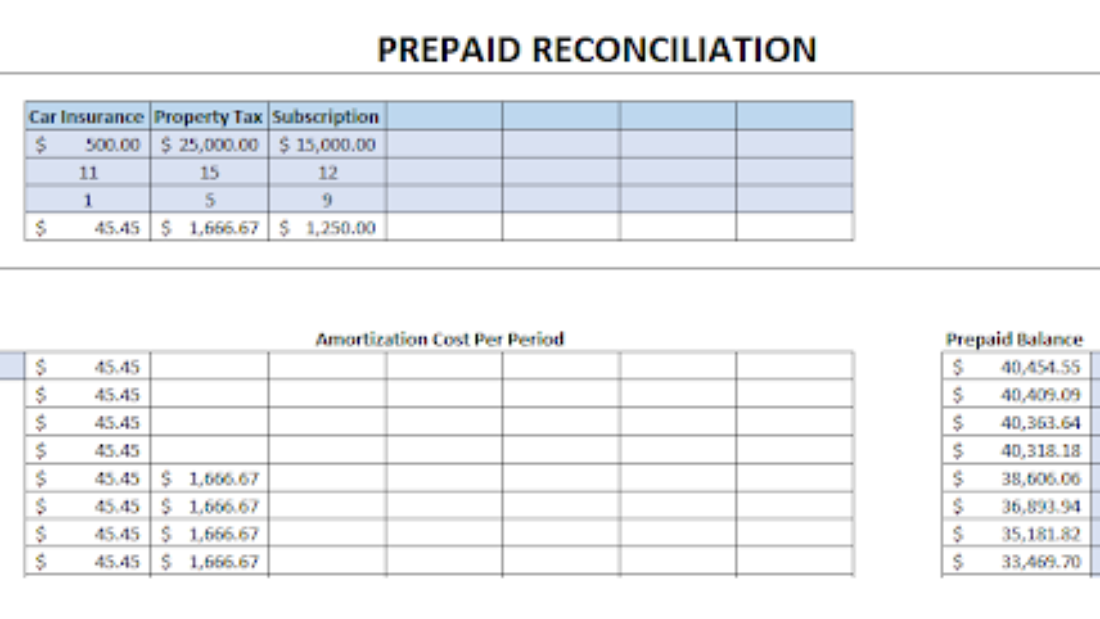

Therefore, the unexpired portion of this insurance will be shown as an asset on the company’s balance sheet. Every month, when you get the work you paid for, you reduce the prepaid expense entry by. To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity.

To record a prepaid expense, create a new asset account with an appropriate title to distinguish it from other assets. These expenses are considered assets because they provide future economic benefits to the company. Before answering the question “where do prepaid expenses appear on balance sheets?”, you first need to understand what is meant by a prepaid expense.

These expenses are considered assets on the company's balance sheet, as they represent an amount that the company has already paid, but for which it has not yet received the corresponding benefit. For accounting purposes, both prepaid expense and deferred expense amounts are recorded on a company's balance sheet and will also affect the company’s income statement when adjusted. The balance sheet lists prepaid expenses under current assets, which are expected to be consumed or utilized within a year.

Prepaid expenses are recorded on the balance sheet as an asset, most often as a current asset. Prepaid expenses example we will look at two examples of prepaid expenses: There can be several different examples of prepaid expenses commonly found on the company’s balance sheet.

Prepaid expenses are the money set aside for goods or services before you receive delivery. Some utility bills interest expenses again, anything that you pay for before using is considered a prepaid expense. In short, these expenses are considered assets because they represent future economic benefits for a business.