Ideal Info About Preparation Of Capital Account And Balance Sheet Retained Earnings Current Liabilities

Gather the needed information like in any other financial statement, we need to gather information to be used in preparing a balance sheet.

Preparation of capital account and balance sheet. It was created to fill in some informational gaps that existed in the other three statements (income statement, owner’s equity/retained earnings statement, and the balance sheet). Rent paid of $30,000 is the amount for the nine months to 31 december 20x2. Both the profit and loss account and the balance sheet are drawn from the trial balance.

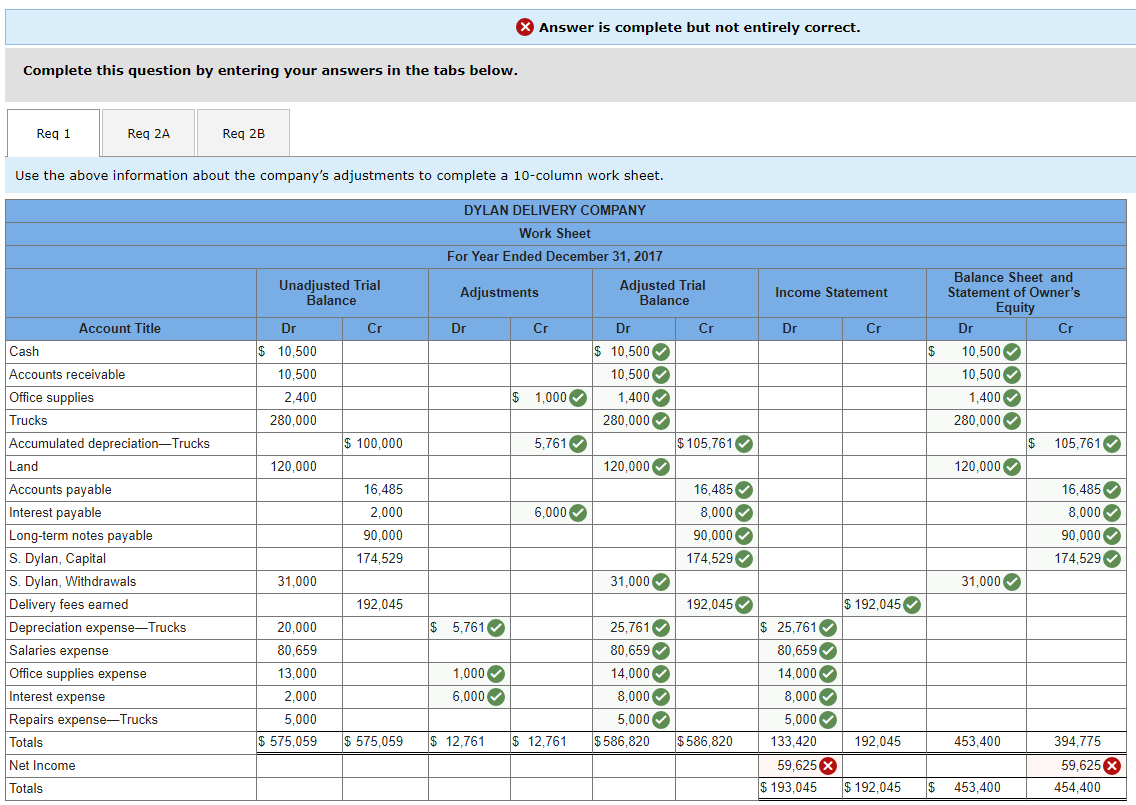

Understanding the different types of capital and how to calculate them can help you properly manage your company's finances. Debts of $2,400 are to be written off, and the allowance for receivables is to be adjusted to 5% of trade receivables. Using the trial balance below, sohaib wants to prepare the.

Balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure. Preparing financial statements is the seventh step in the accounting cycle. Provision for doubtful debts given = ₹ 1,000 provision for doubtful debts to be created =

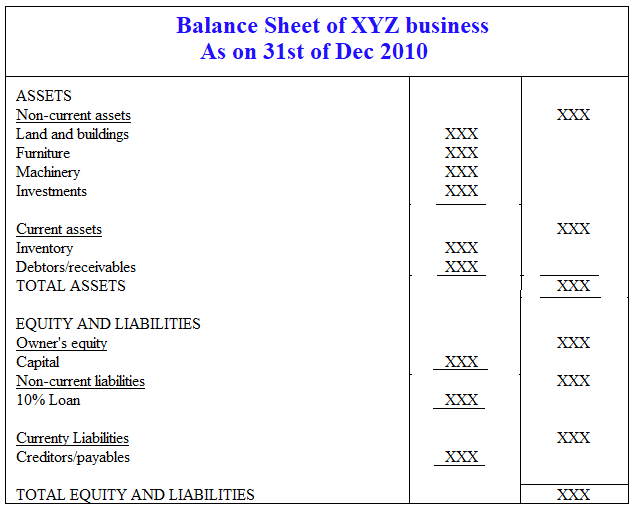

For example, personal assets introduced or business assets withdrawn from the business to become the owner’s personal property. The balance sheet is based on the fundamental equation: A full demonstration of the creation of the statement of cash flows is.

The two sides must always be equal. Remember that we have four financial statements to prepare: Use the financial information from the previous financial statements to create the statement of owner's equity (also known as a statement of retained earnings).

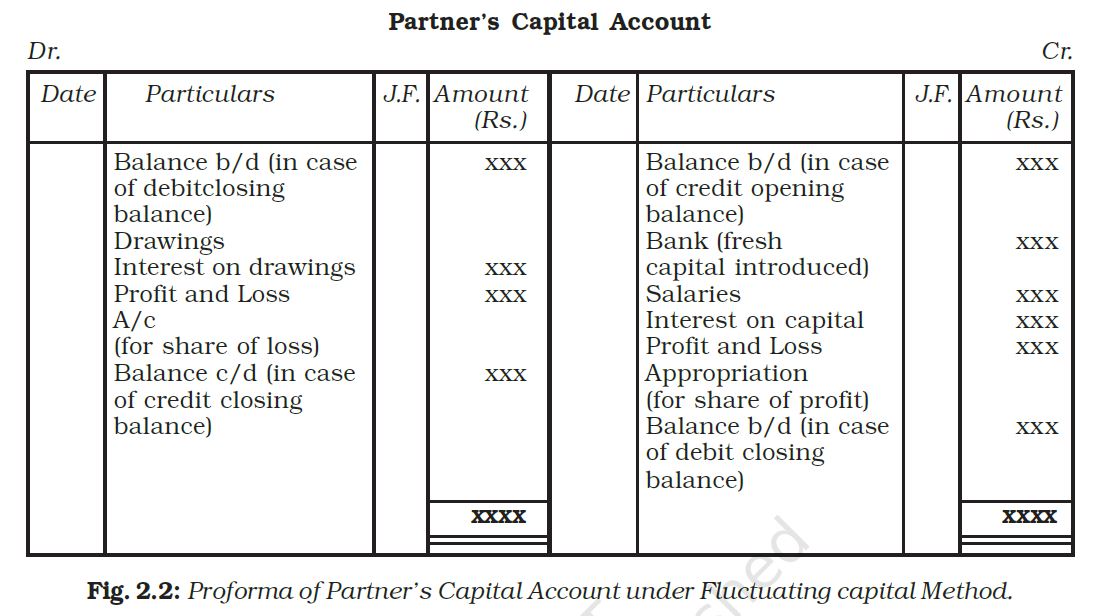

An income statement, a statement of retained earnings, a balance sheet, and the statement of cash flows. It maintains all the transactions of capital reinvestment, the balance of money, and any withdrawal or adjustment. Show how the following items will appear in the capital accounts of the partners, anbu and balu.

Complete a comprehensive accounting cycle for a business; From that date the rent was increased by 10%. Some businesses also produce final accounts half yearly, quarterly or.

In short, the balance sheet is a financial statement that. Assets = liabilities + equity. In order to prepare the profit and loss account and the balance sheet, a business owner needs to set out the closing balances from the trial balance in the formats shown above in figs 7.1 and 7.2.

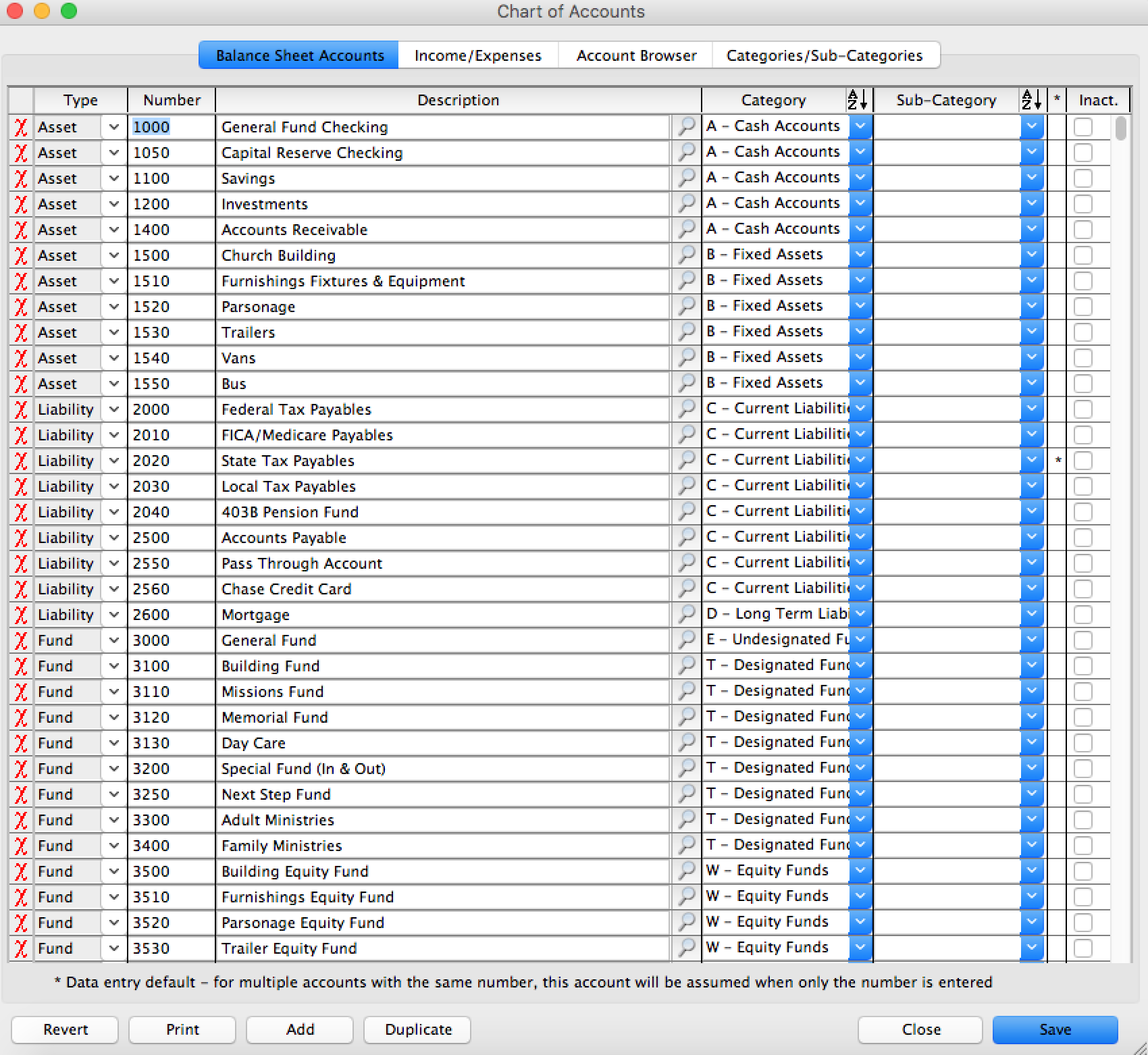

Determine the reporting date and period. Once all ledger accounts and their balances are recorded, the debit and credit columns on the trial balance are totaled to see if the figures in each column match each other. Partnership accounting, class 12th, chapter change in profit sharing ratio, accountancy, class 12, accountsrevaluation a/c, capital a/c & balance sheet | com.

It can also be referred to as a statement of net worth or a statement of financial position. 5.1 describe and prepare closing entries for a business; In practice, however, it is convenient to separate the amount invested by the partner (the capital account) from the amount they have earned through the trading activities of the partnership (the current account).

:max_bytes(150000):strip_icc()/CapitalAccount_color_v3_recirc-6de0a7d9191b4239af9147806b077d02.png)