Beautiful Work Info About Income Statement Same As P&l Difference Between Direct Cash Flow And Indirect

The p&l statement is one of three.

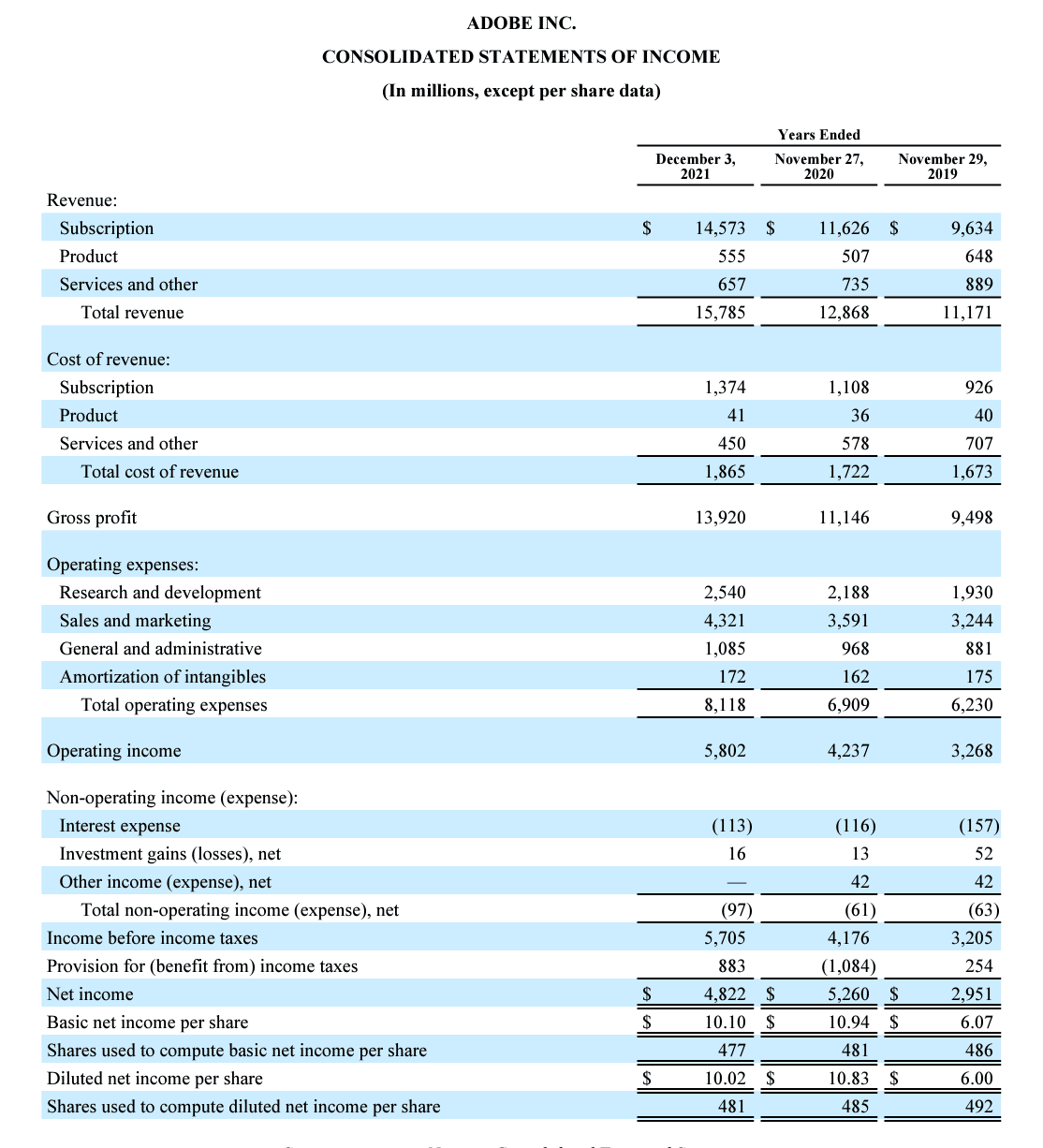

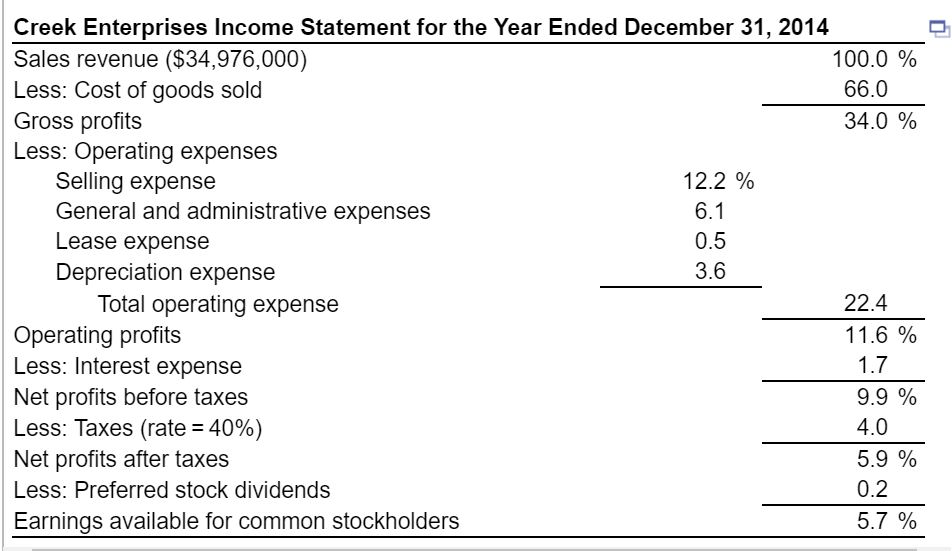

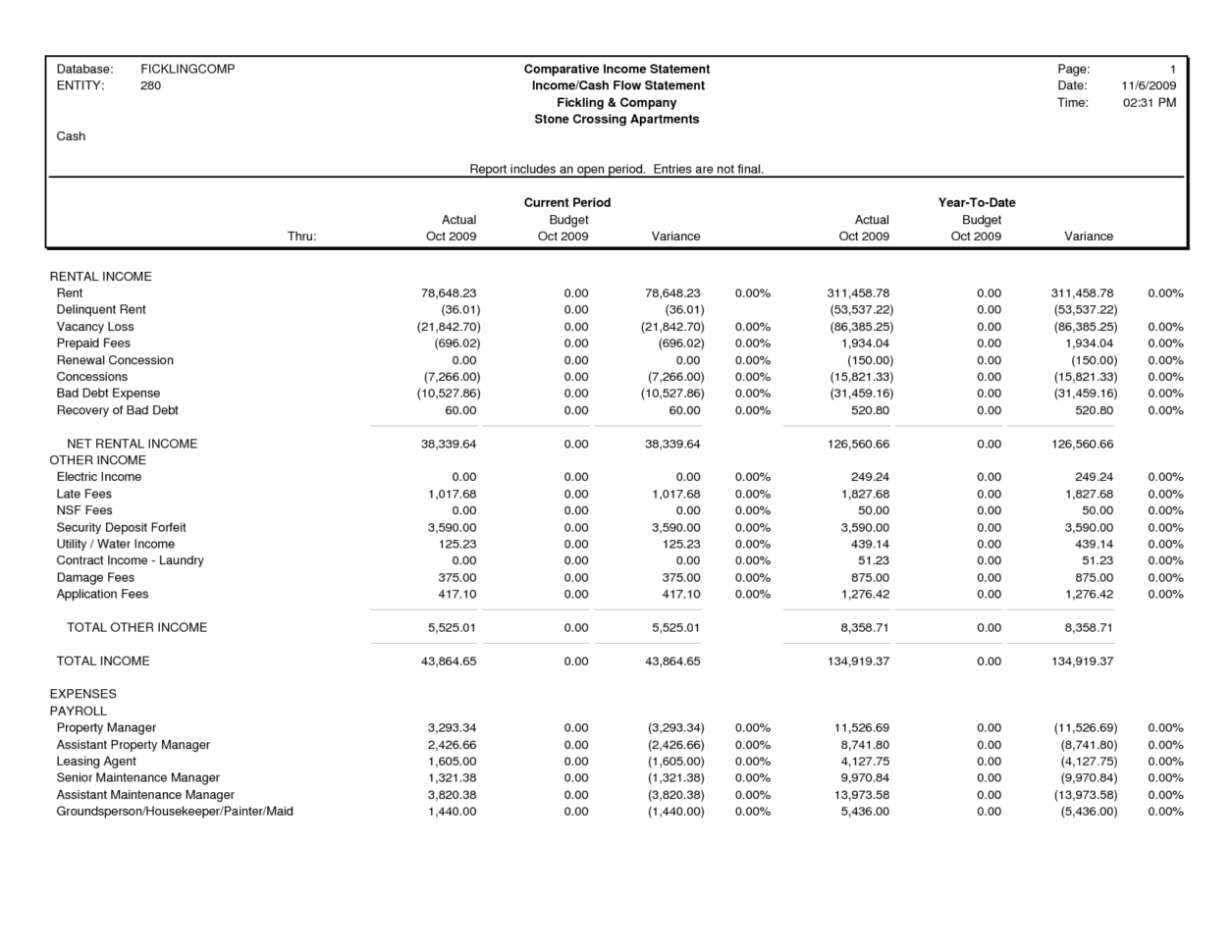

Income statement same as p&l. Written by tim vipond what is the profit and loss statement (p&l)? A p&l is typically broken into several sections. The income statement might be the same as the p&l, but it is different from the other financial statements.

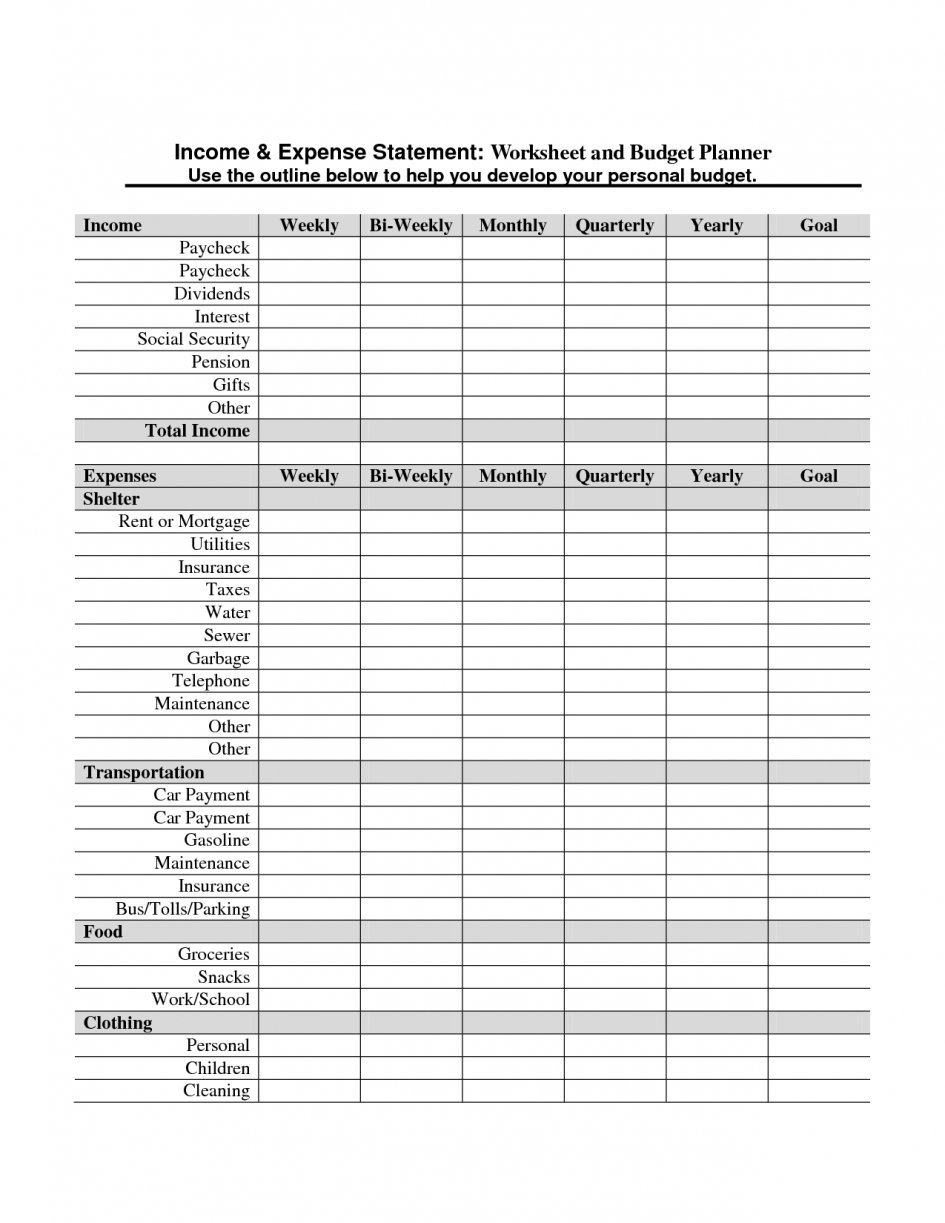

But, in my opinion, one of the most important documents is the income statement. The differences are typically to do with time or in some cases, accounting standards. The profit and loss statement summarizes all revenues and expenses a company has generated in a given timeframe.

These statements are the balance sheet,. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. The profit and loss statement, or “p&l statement”, is interchangeable with the income statement, one of the three core financial statements that all publicly traded companies are obligated to file with the sec.

Using the p&l formula, net income can be calculated like this: While both statements provide insight into a company’s financial performance, they differ in the way that information is presented. Mahbub mmhem the income statement shows the profit/loss for any date/day of the year while a profit & loss statement reports profit/loss for the whole accounting period.

P&l and income statement may sound like similar terms, but they are different in many ways. There are three main financial statements, including the income statement, balance sheet, and cash flow statement. It’s no surprise that many people still wonder “is p&l the same as income statement?”.

A profit and loss (p&l) statement is the same as an income statement. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time. The income statement summarizes income and expenses.

An income statement is primarily used by external stakeholders such as investors or creditors to evaluate the profitability of a. While p&l and income statement may sound interchangeable, they are actually two different financial statements. Profit and loss (p&l) statements are one of the three financial statements used to assess a company’s performance and financial position.

While the p&l is a financial statement that summarizes a company’s revenues, costs, expenses during a specific period of time (usually monthly or quarterly) to calculate its net profit or loss, the income statement is broader. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. The statement is called a p&l when it’s for internal use only.

However, an income statement is more comprehensive than a p&l statement. Profit and loss statement sample The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period.

Knowing how to read a profit and loss statement is key to making informed. This statement is sometimes alternatively referred to as the statement of revenue and expense, or the statement of operations, but. Business owners use the p&l to assess the company's profitability—how much money a company makes.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-021-eb8d8819386649a898bb94fd7ca3abf8.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)