Glory Info About Pro Forma Income Statement And Balance Sheet Preparation Of A Trial Is The First Step

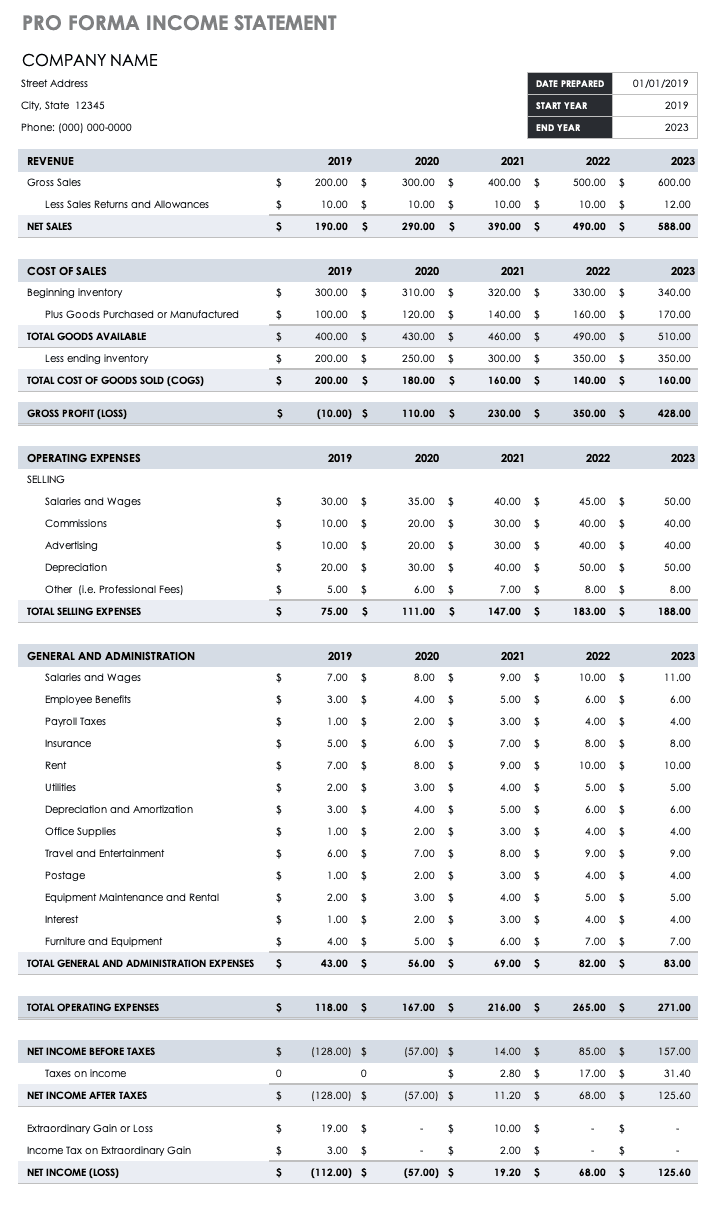

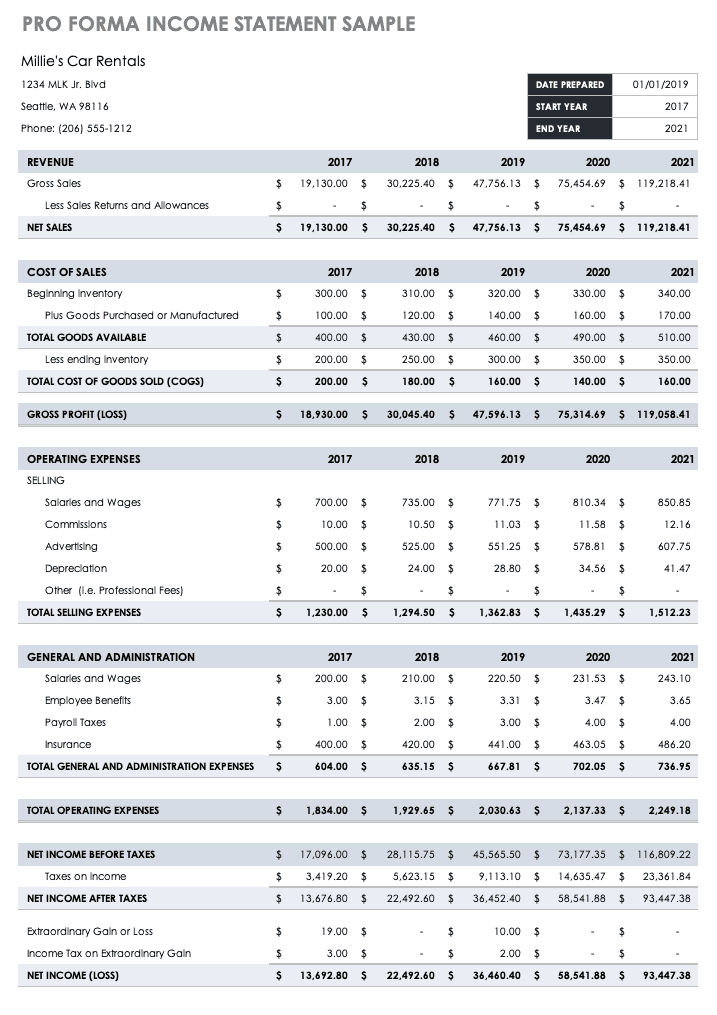

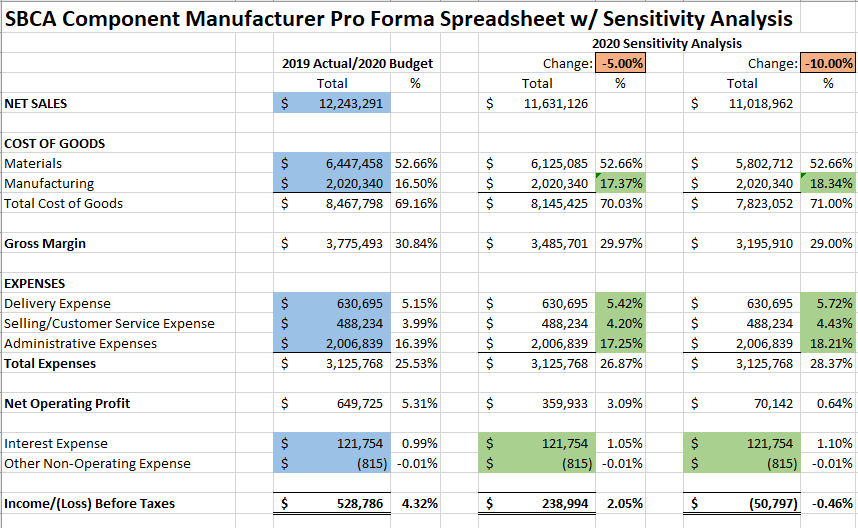

Pro forma financial statements present the complete future economic projection of a company or person.

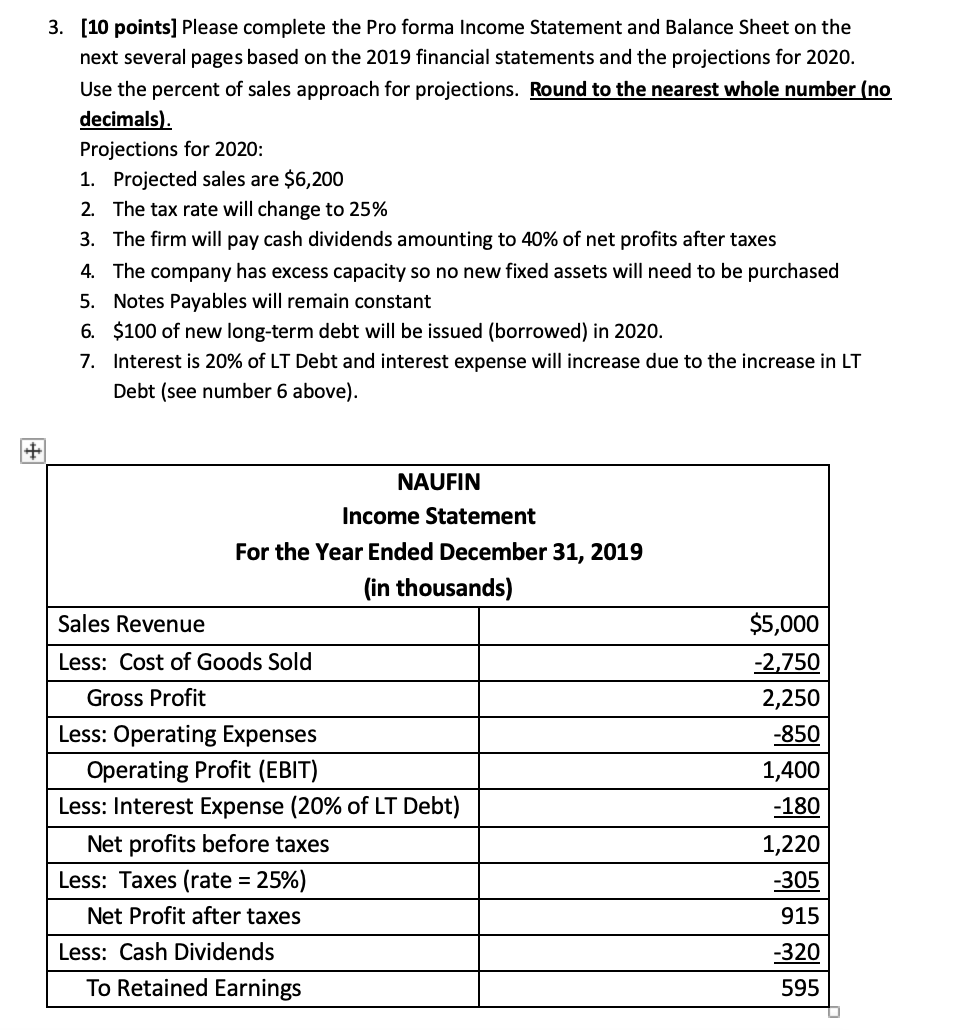

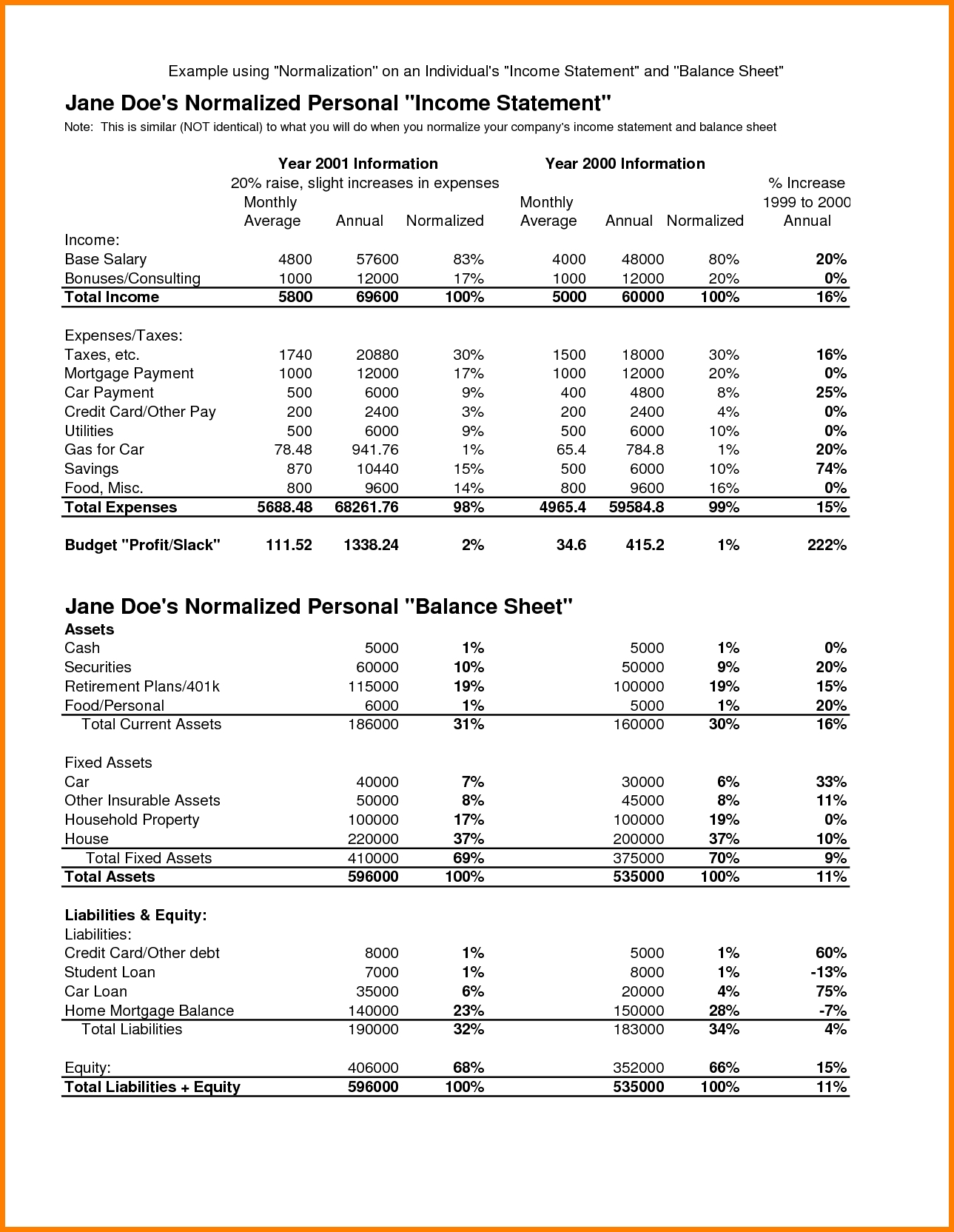

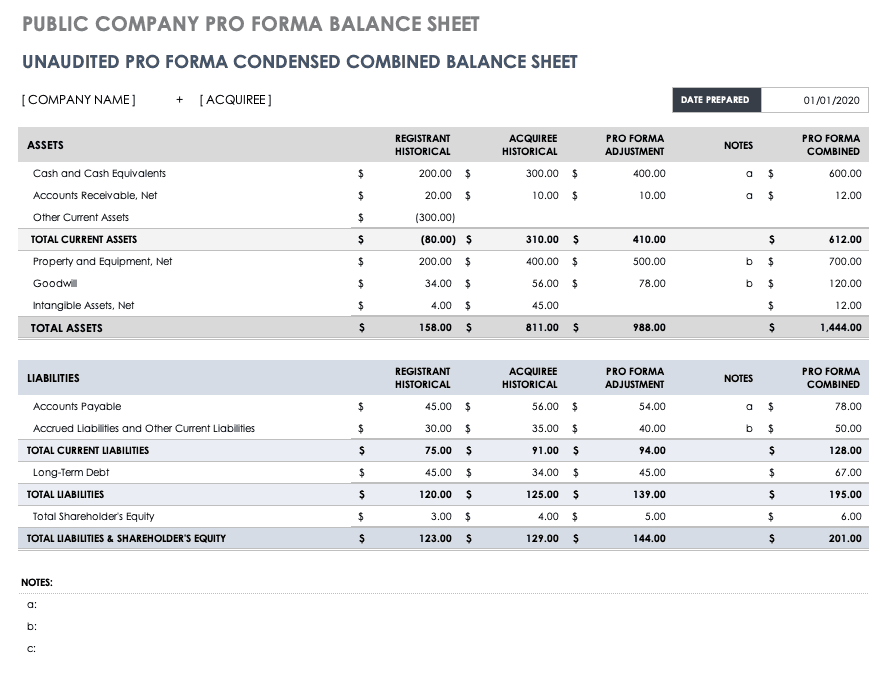

Pro forma income statement and balance sheet. It is used to produce the cash flow statements and balance sheets balance sheets a balance sheet is one of the financial statements of a company that presents the shareholders' equity, liabilities, and assets of the. There are three general types of pro forma financial statements and a variety of other types used in specific circumstances. Pro forma financial information (pro formas) presents historical balance sheet and income statement information adjusted as if a transaction had occurred at an earlier time.

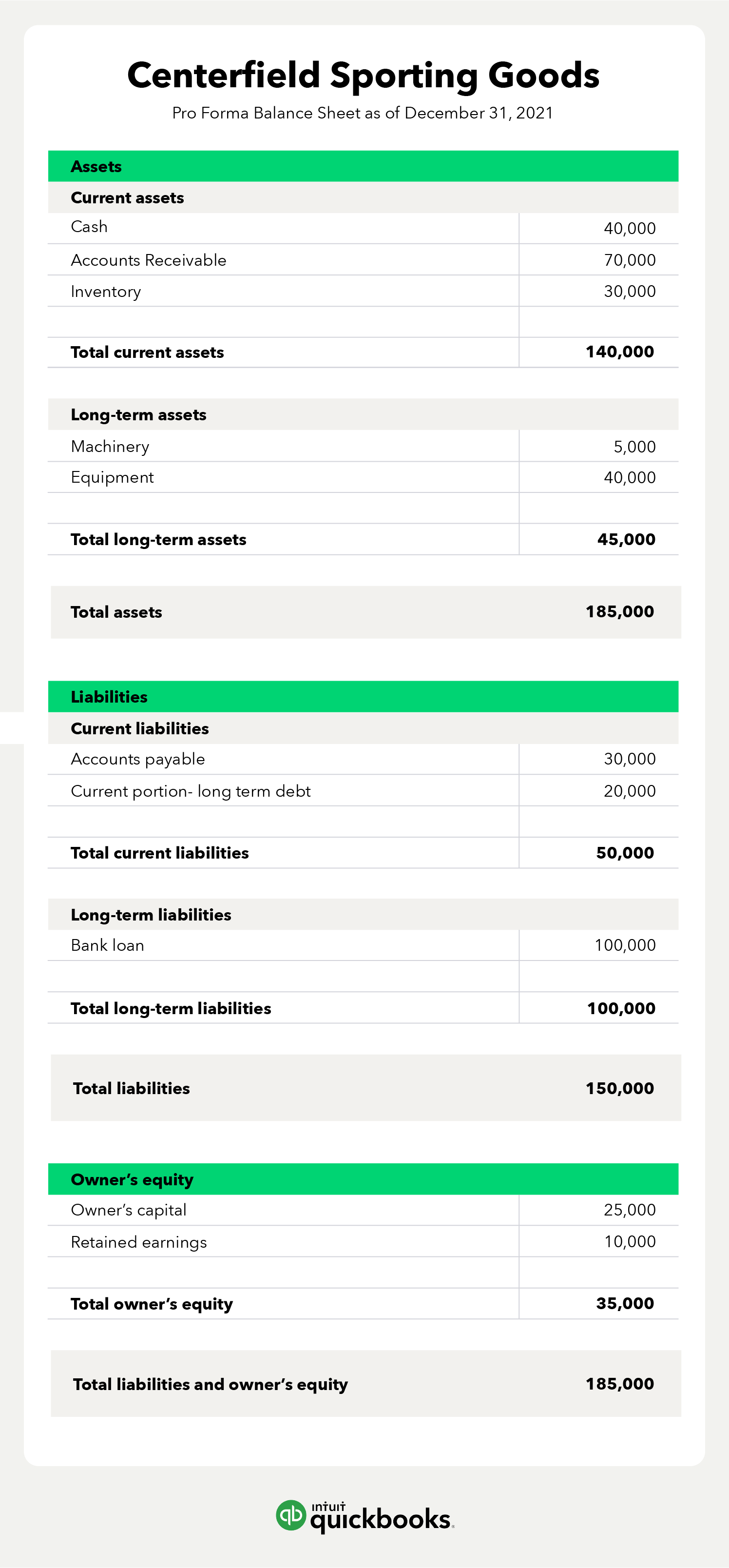

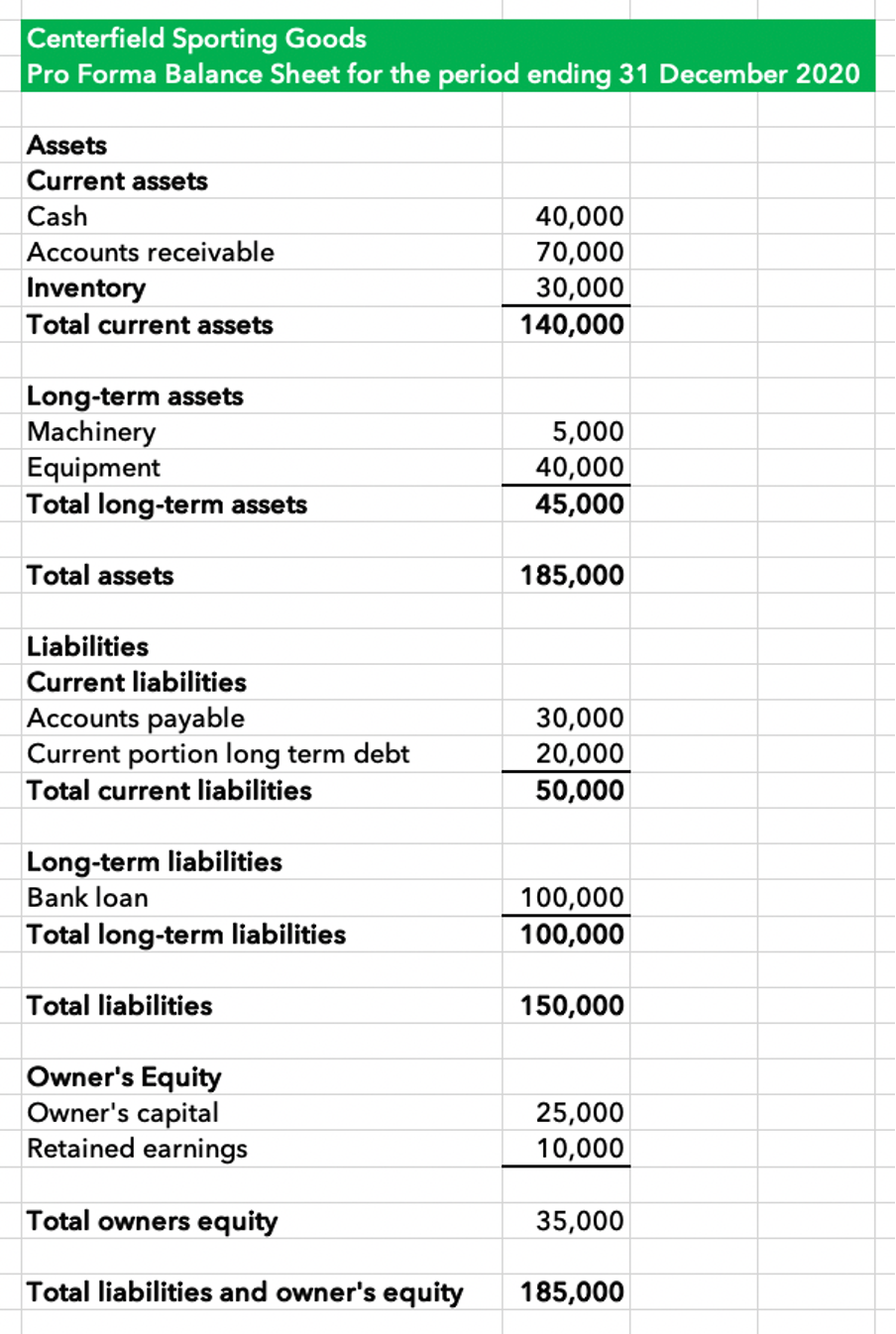

Since the term “pro forma” refers to projections or forecasts, it can apply to a variety of financial statements, including: Whether you’re trying to interpret pro forma financial statements or prepare them, these projections can be useful in guiding important business decisions. Similar to a pro forma income statement, the pro forma balance sheet is a projection of a balance sheet.

A pro forma statement is an important tool for planning future operations Using the assumptions provided, create the 2020 pro forma income accounts receivable ed, and common stock will not change. While they all fall into the same categories—income statement, balance sheet, and cash flow statement—they differ based on the purpose of the financial forecast.

Here are the most commonly implemented types of pro forma statements: There are four main types of pro forma statements. The balance sheet that was discussed earlier in this lesson provides a snapshot in time of the financial health of a firm or the valuation (again, at a snapshot in time) of a specific investment project.

Based on the adjustments in the pro forma income statement, other balances in the pro forma balance sheet should. The pro forma income statement is used to create cash flow statements and balance sheets, which are an important part of the business plan; They should also be included with in the financial of a business plan.

The claimed rationale should include the current income and. Often used to back up a lending or investment proposal, they are issued in a standardized format that includes balance sheets, income statements, and statements of cash flow. The step by step method to prepare a pro forma balance sheet is as follows:

It lists out your future assets, liabilities, and stockholders’ equity in the same format as your historical balance sheet. Pro forma income statement can be used to analyze and predict transactions and is a great tool to predict the future growth, sales, and even expenses of the organization. Given the relationship between your income statement and balance sheet, you'll want to create the pro formas for each in conjunction with one another, using the following steps to generate your pro forma balance sheet:

Let’s go through a pro forma balance sheet using an example of a company called bright lawn. The budget makes assumptions about sales, production, and pricing. Proforma balance sheet for year ended december 31st 2020 2020 current assets cash & securities $ 703.07 accounts receivable $ 1,924.65 inventory $ 1,052.14.

The pro forma balance sheet will show a projected version of the company’s actual balance sheet, like: Sales and balance sheet update, further trading statement, strategic response and cautionary announcement pick n pay stores limited incorporated in the republic of south africa registration number: The net profit after tax figure should be transferred from the pro forma income statement and adjusted in the retained earnings balance on the balance sheet.

This is similar to a traditional balance sheet as it shows the accounts receivable, your cash flow statements, and other pertinent. Types of pro forma statement. A balance sheet shows a company's financial position by estimating assets.