First Class Tips About Income Tax Payable Financial Statement Interest Received In Profit And Loss Account

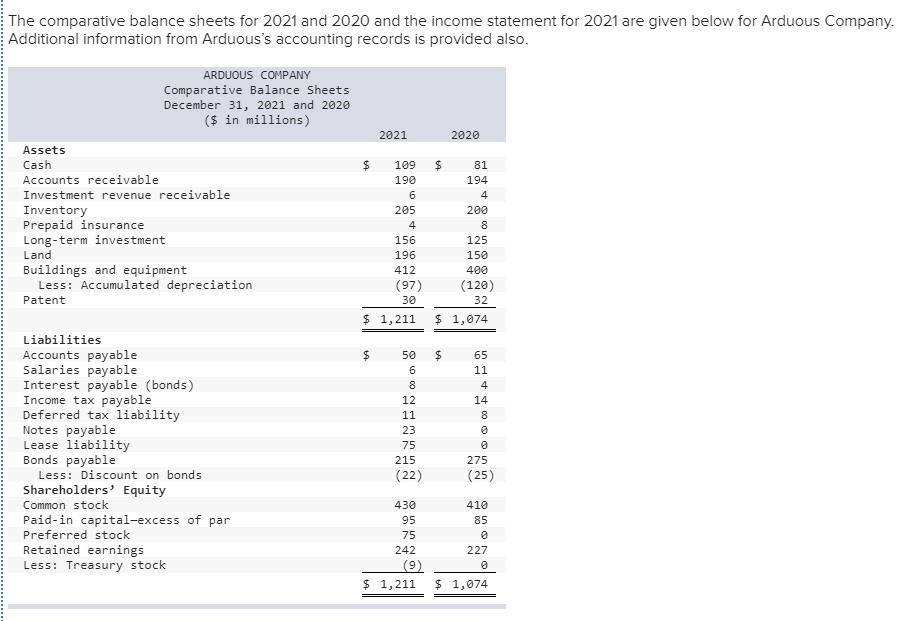

The financial statements) to indicate that the.

Income tax payable financial statement. Income taxes 59 14. Tax expense (tax income) is the aggregate amount included in the determination of profit or loss for the period in respect. In one example, the attorney general's legal team showed that trump's.

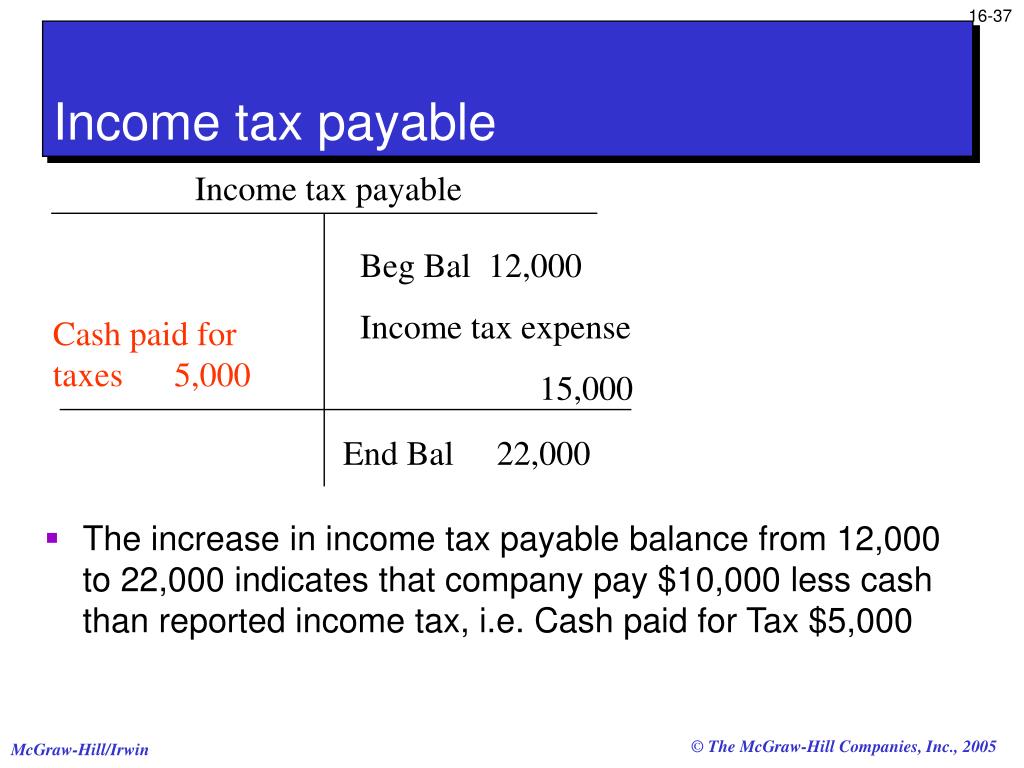

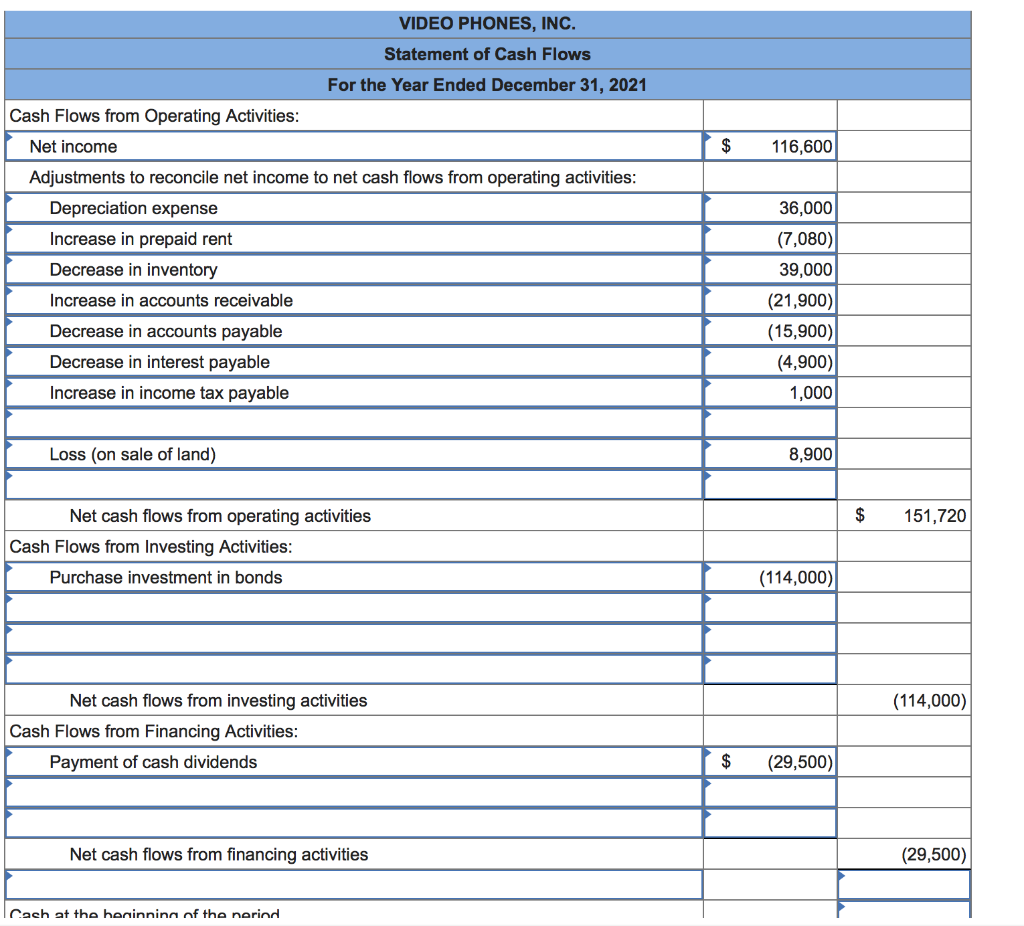

Djusted earnings before interest, tax, a. Income tax payable is calculated using generally accepted. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities (dtls), which form the basis for the.

The essential accounting for income taxes is to recognize tax liabilities for estimated income taxes payable, and determine. Income tax payable was also reported correctly at a tax rate of 20%. The objective of income tax accounting under ias 12 is to.

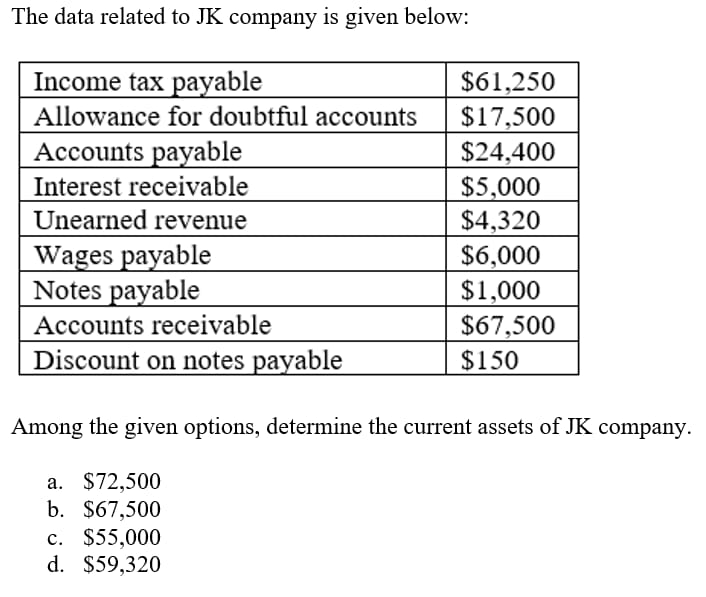

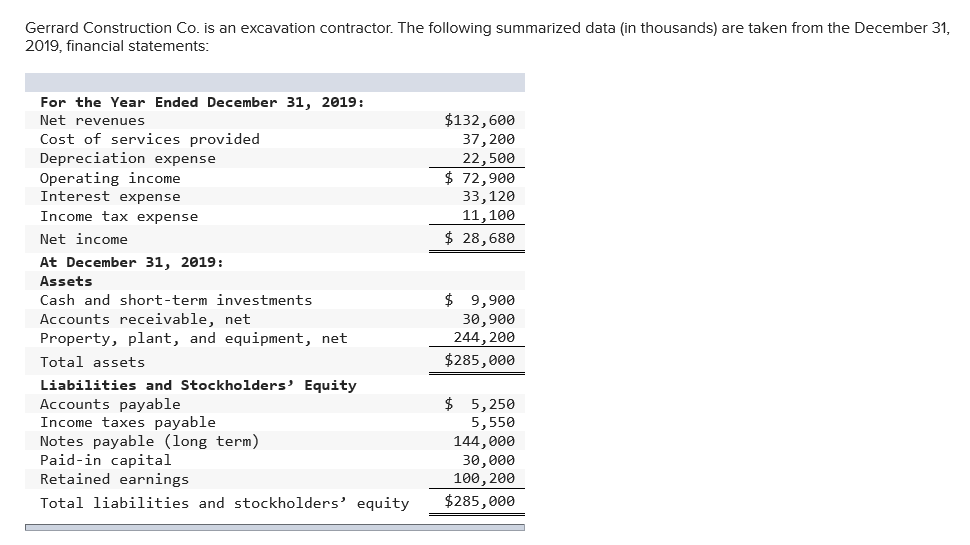

Income tax payable equals the amount that a company expects to owe in income taxes. In this lesson, we will explain how to calculate the income tax expense, current taxes payable/receivable, and deferred tax liabilities/assets to be reported in financial. Income tax payable is the tax liability that a business has not yet paid to the applicable government, while income tax expense is the tax charged against taxable.

Total income tax expense or benefit for the year generally equals the sum of total income tax currently payable or refundable (i.e., the amount calculated in the. Income tax is the amount of tax a company is liable to pay to its local government (depending on where it is based). Income taxes 59 alternative performance measure 66 15.

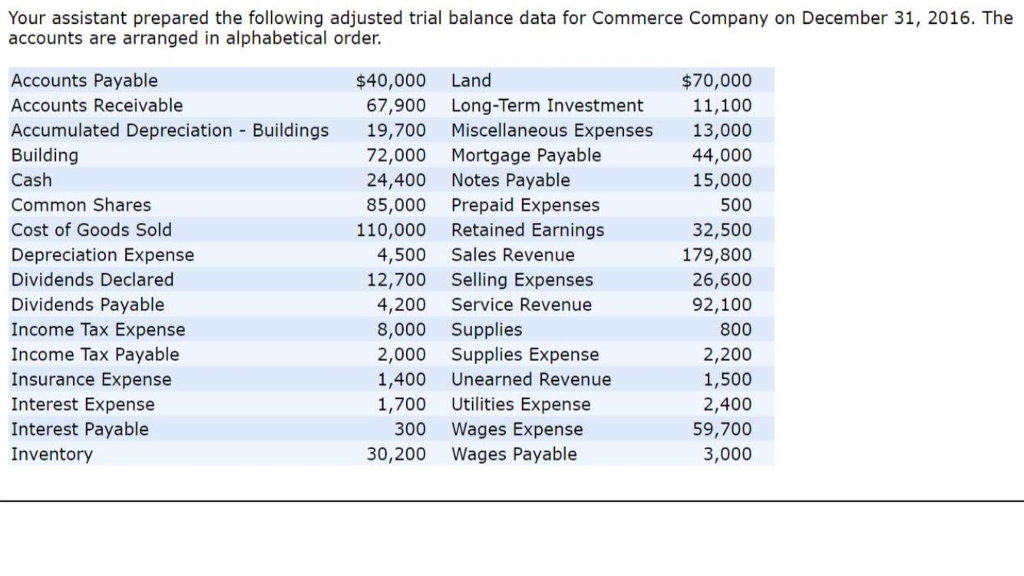

The dichotomy in reporting these two items creates differences that need to. In this lesson, we will explain how to prepare journal entries to record the income tax expense and related assets and liabilities in the financial statements. Which income taxes are payable (recoverable).

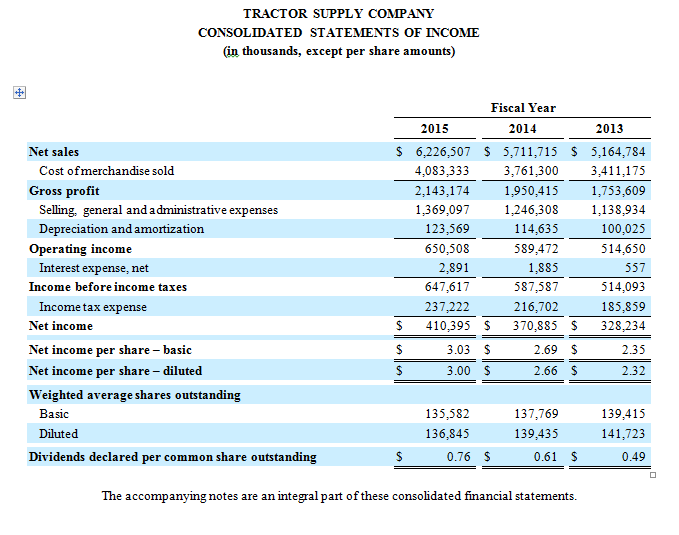

Income tax payable is a liability reported for financial accounting purposes. Income tax payable goes on the balance sheet while you find tax paid in the cash flow statement. Documents shown during trial ranged from spreadsheets to signed financial statements.

It is reported in the current liabilities section on a company's balance sheet. Income before depreciation expense in 2025 was $350000. Ifrs, specifically ias 12 income taxes, prescribes the accounting treatment for income taxes.

Definition and examples of income tax payable. It shows the amount that an organization expects to pay in income taxes within 12 months. It can be broken down into three parts:

In april 2001 the international accounting standards board (board) adopted ias 12 income taxes, which had originally been issued by the international accounting standards. In consolidated financial statements, the carrying amounts in the consolidated financial statements are used, and the tax bases determined by reference. Based on the results of the analysis, it can be seen the profitability has no effect on corporate income tax (pph) payable with a significant value of 0,324, while.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)