Nice Info About Debit Side Of Trial Balance Samsung Sheet 2018

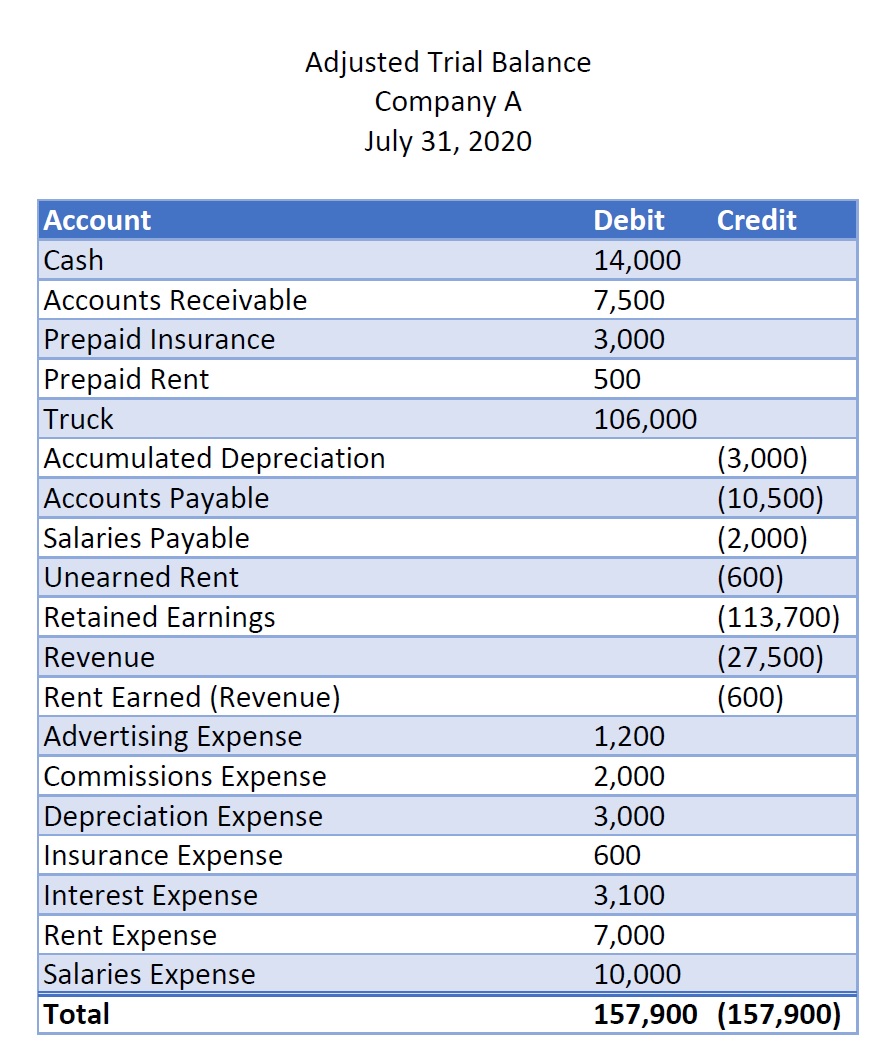

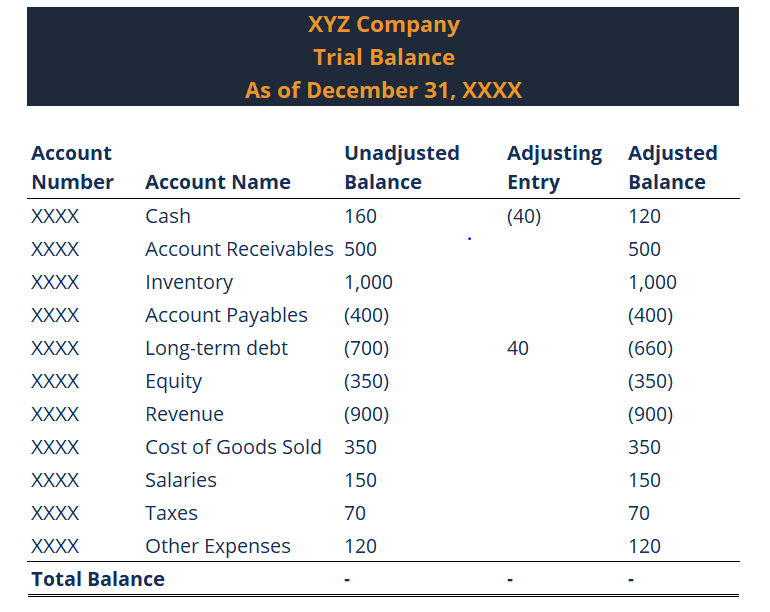

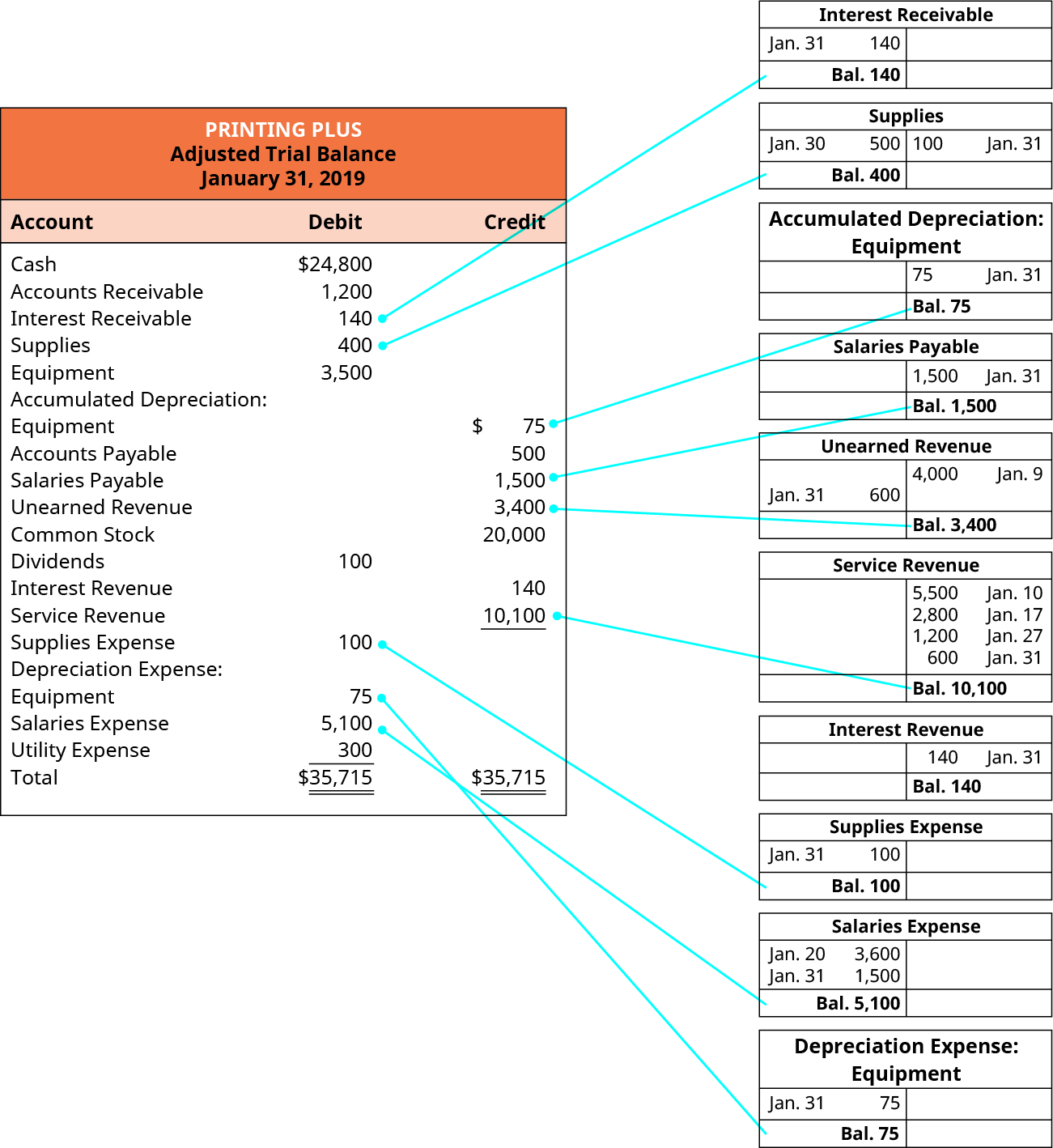

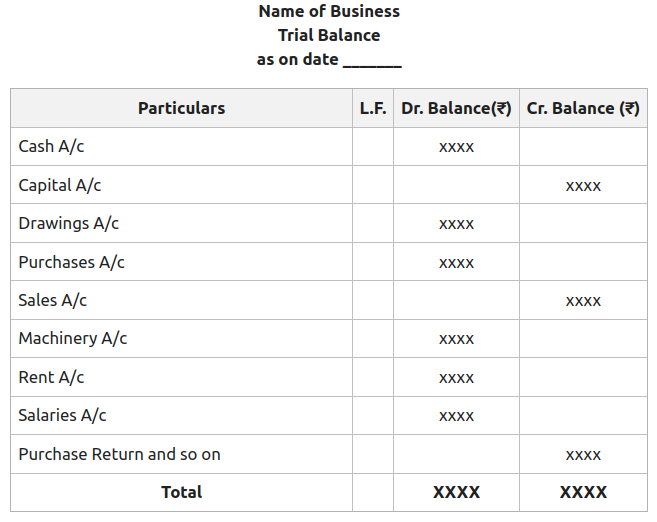

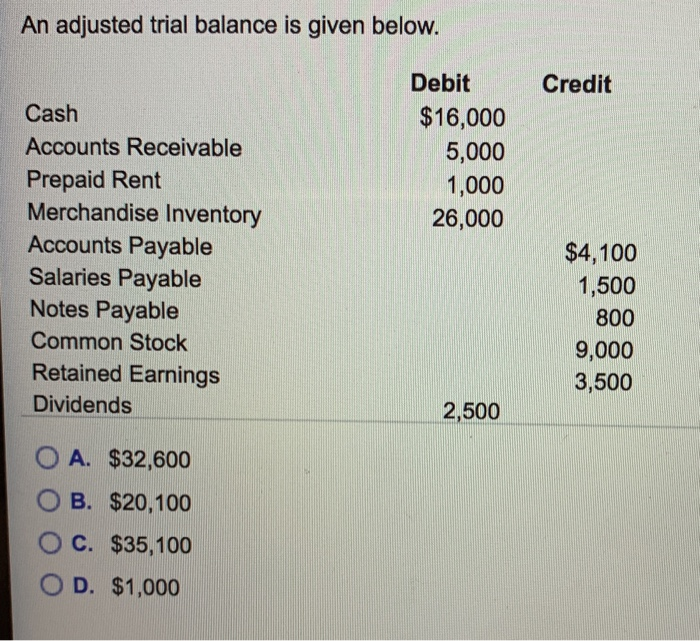

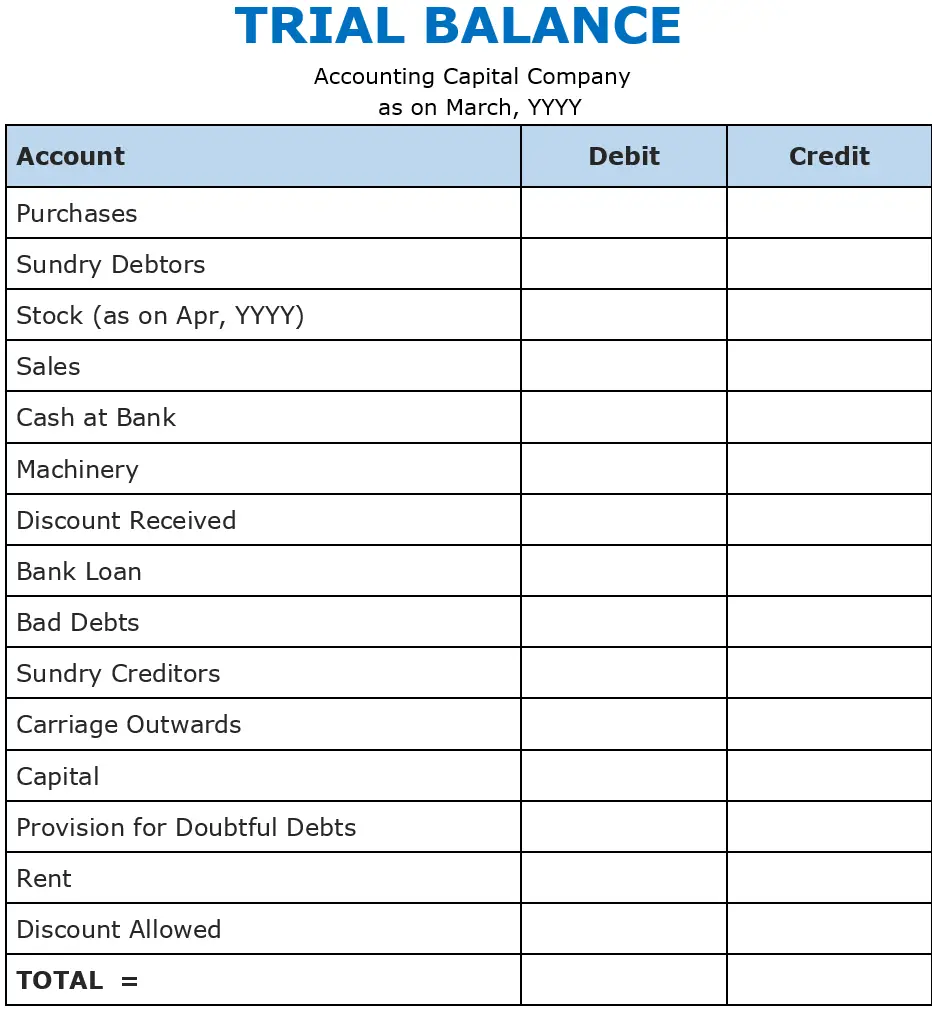

Balances relating to assets and expenses are presented in the left column (debit side) whereas those relating to liabilities, income and equity are shown on the.

Debit side of trial balance. The unadjusted trial balance is the preliminary trial balance report or document that lists all ending balances or totals of accounts to determine if total debits and credit balances. One, there was an error in either recording the account balance. Items that appear on the debit side of the trial balance generally, assets and expenses have a positive balance so they are placed on the debit side of the trial.

Salaries expenses are initially recorded on the debit side in the t account, and the balancing amount would be on the credit side. Once all ledger accounts and their balances are recorded, the debit and credit columns on the trial balance are totaled to see if the figures in each column match each other. A trial balance is a conglomerate of or list of debit and credit balances extracted from various accounts in the ledger including cash and bank balances from.

One for debit balances, and one for credit. Additionally, it ensures that there are no errors in the ledger. The primary purpose of a trial balance is to identify errors and ensure the equality of debits and credits.

Trial balance is the report of accounting in which ending balances of a different general ledger of the company are and is presented into the debit/credit column as per their. Carriage inwards in trial balance and. This statement comprises two columns:.

When the debit and credit sides of a trial balance do not match, it means one of two things. The trial balance is a summation of or list of credit and debit balances drawn from the many ledger accounts like the bank balance, cash book etc. All debit balance accounts are recorded on the debit side and all the credit balance.

It consists of two columns: This is used as a first check by auditors to ensure there. A trial balance is used in bookkeeping to list all the balances in your business’s general ledger accounts.

Now it’s time to learn about the various items which are placed on either side of the trial balance. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. It is prepared to prove that the total of accounts with a debit balance is equal to the total of accounts with a credit balance in the company.