Neat Tips About Bonds Payable Cash Flow Operating Activities Include

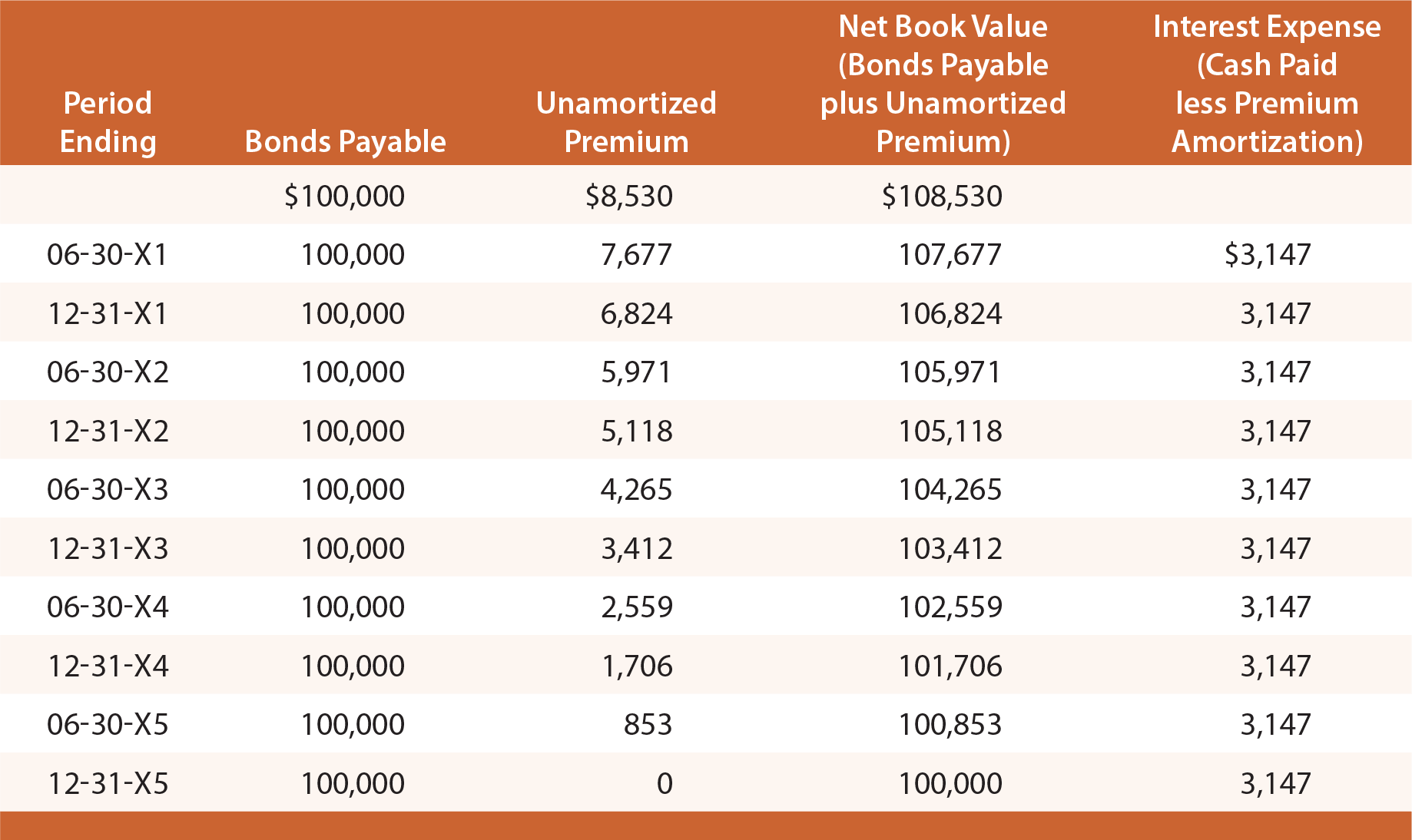

The interest expense and principal repayment — bonds payable are.

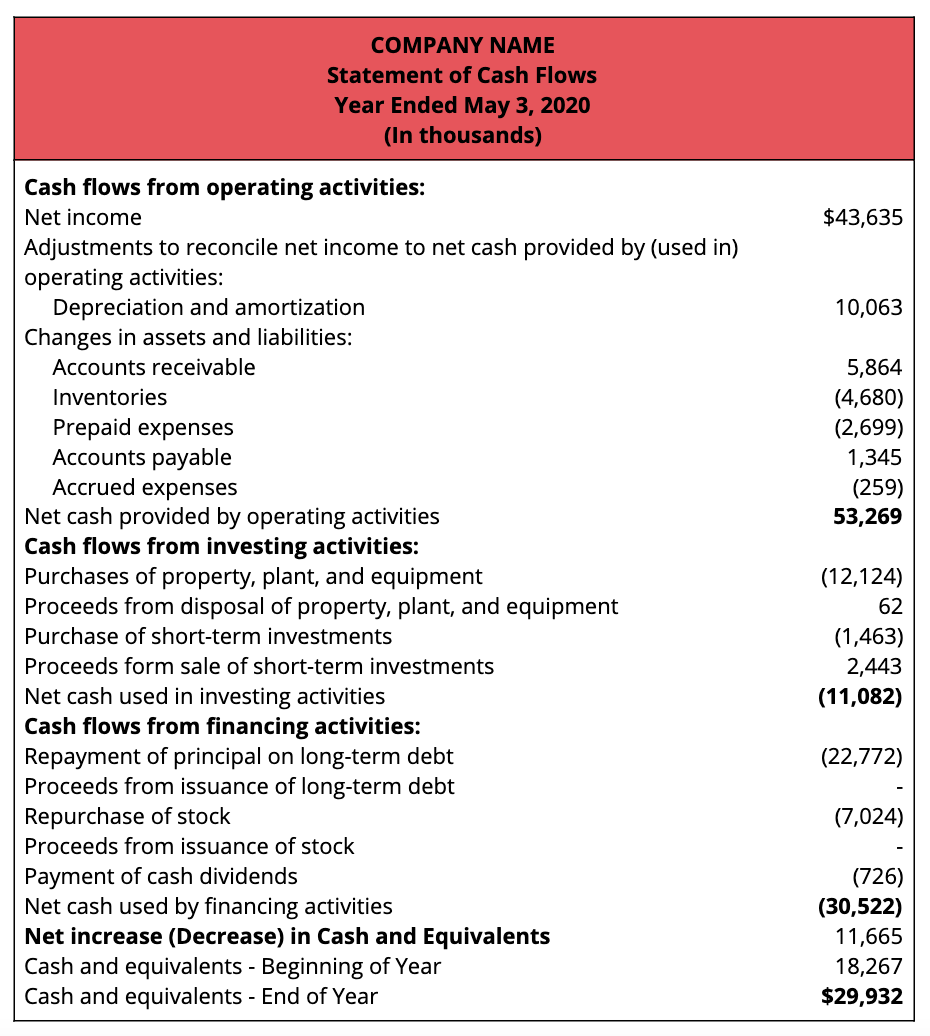

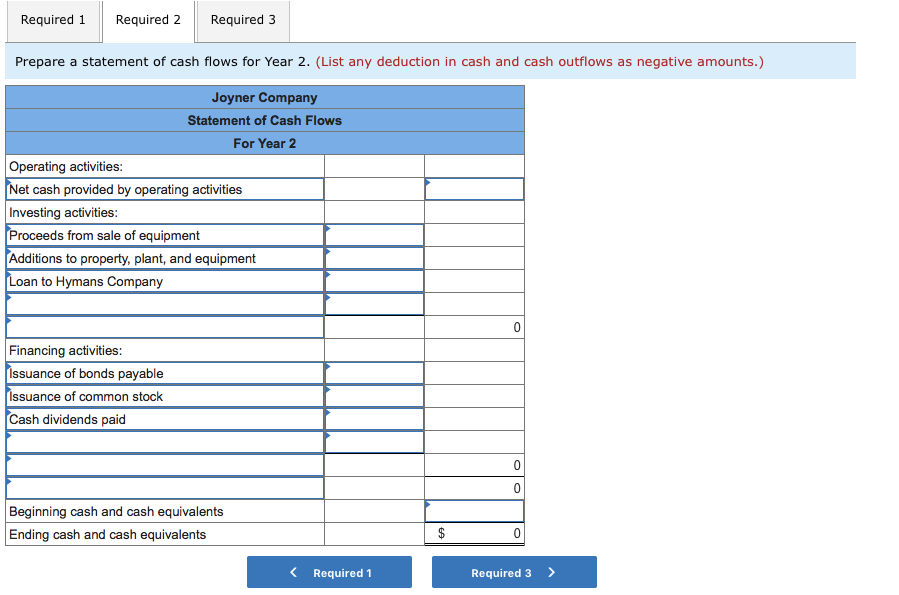

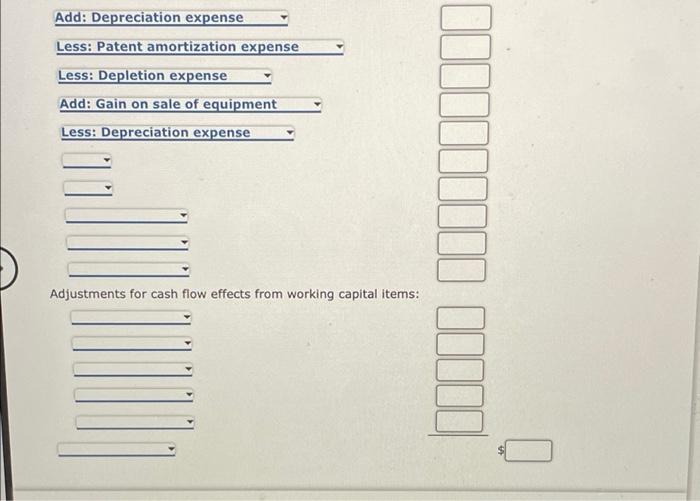

Bonds payable cash flow. However, when companies acquire finance through bonds or repay them, this. During the final year, this balance gets transferred to current liabilities. Determine net cash flows from operating activities using the indirect method, operating net cash.

What are bonds payable? The entry required is: There were inflows of $16.1 billion to stocks, and $11.6 billion to bonds, compared to outflows of $18.4 billion from cash, the most in eight weeks, bofa said in its.

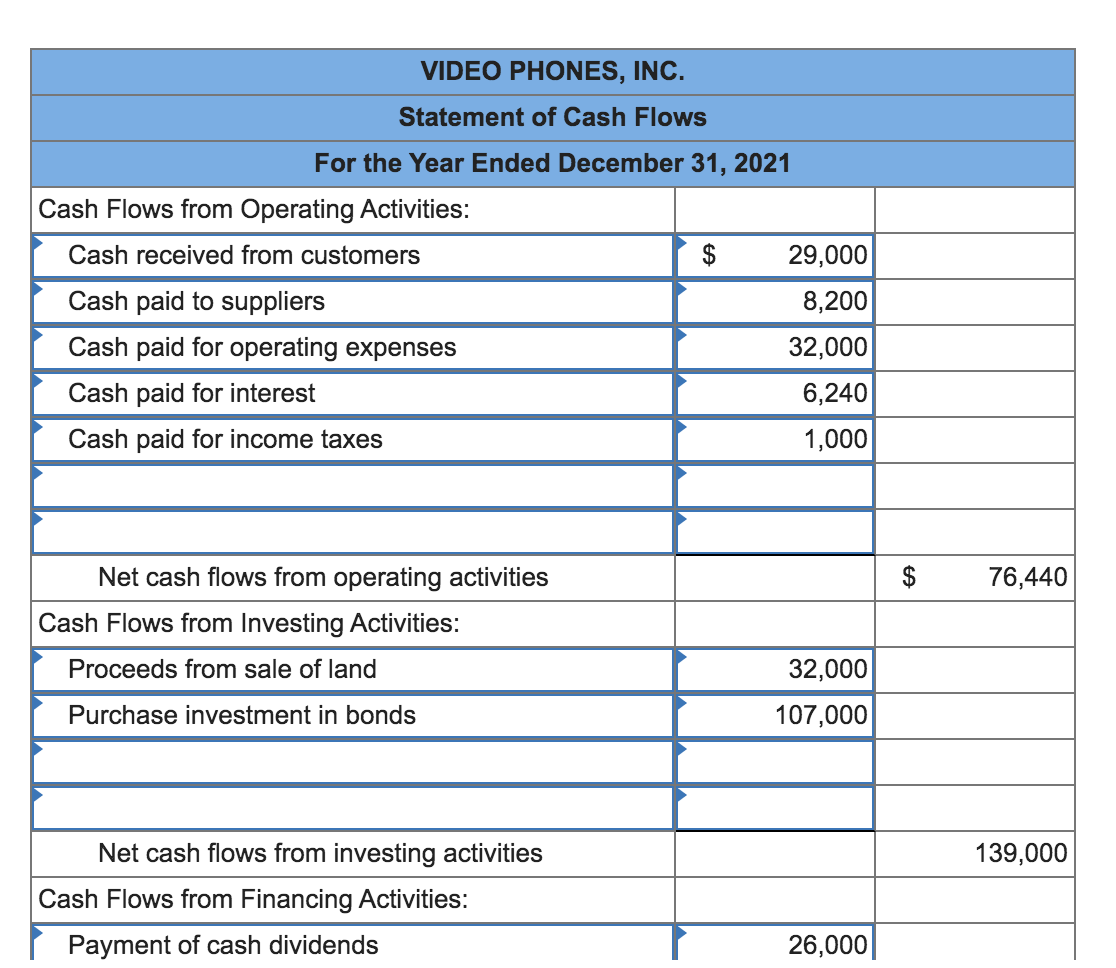

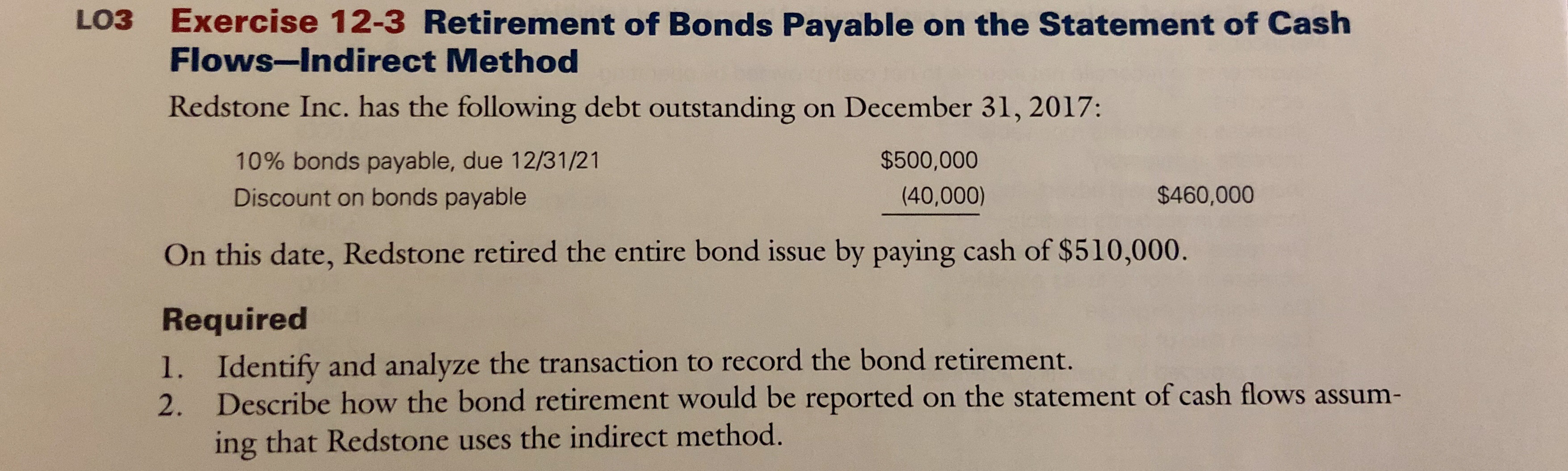

Cash flows from financing activities are cash transactions related to the business raising money from debt or stock, or repaying that. However, it does not impact the company’s cash flow statement. Bonds represent an obligation to repay a principal.

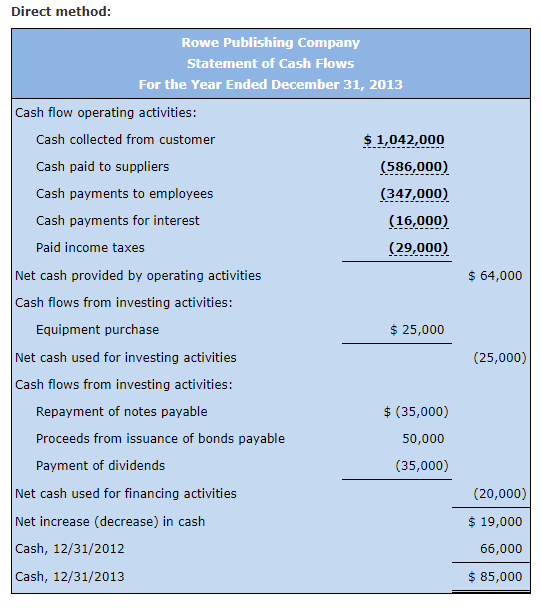

Bonds payable on cash flow statement. Bond issuers will report the related activity in the financing section of the cash flow statement. As such, the act of issuing.

What is cash flow from financing activities? Next, value the final face value payment that you’ll receive at the bond’s. Issuance of bonds (i.e., long term bonds payable), payment of cash dividend to common stockholders, payment of cash dividend to preferred stockholders, purchase.

Types of bonds there are many types of bonds with different features for sale in the marketplace. Sources of cash provided by financing activities include: In this section, we will explore the journal entries related to bonds.

To provide clear information about what areas of the business generated and used cash, the statement of cash flows is broken down into three key categories: The entry eliminates the $9,800 book value of the bonds from the accounts by debiting bonds payable for $10,000 and crediting discount on bonds. Bondholders will report all related cash transactions in the investment.

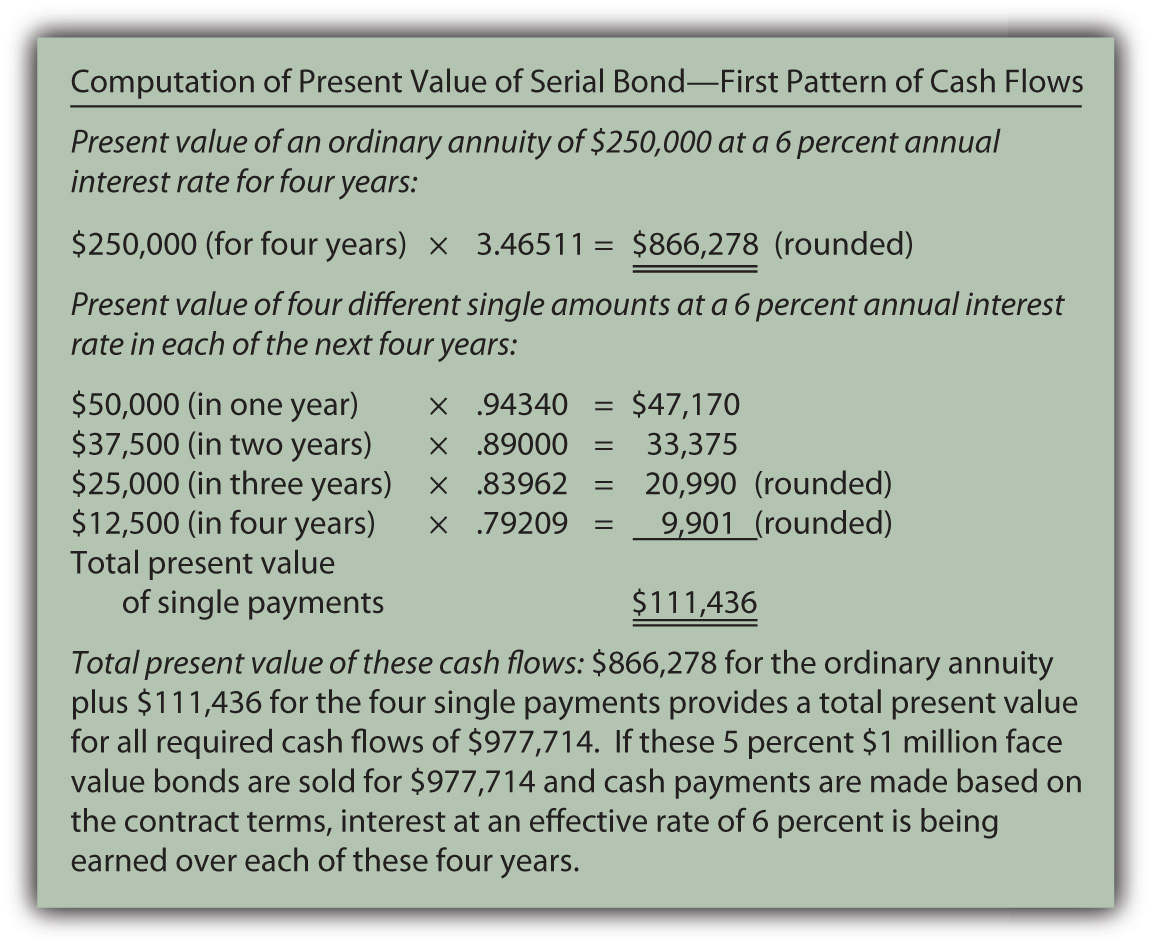

The statement of cash flows is prepared by following these steps: The receipt of cash when the bond. Earlier, we found that cash flows related to a bond include the following:

As a bond issuer, the company is a borrower. Bonds payable are recorded when a company issues bonds to generate cash. Bonds payable are the financial instrument that company uses to issue to get cash from investors.

+ cash flow ÷ (1+r) t. Cash flows from financing activities. The three net cash amounts from the operating, investing, and financing activities are combined into the amount often described as net increase (or decrease) in cash during.