Glory Tips About Cash In Trial Balance Intangible Assets Under Development Sheet

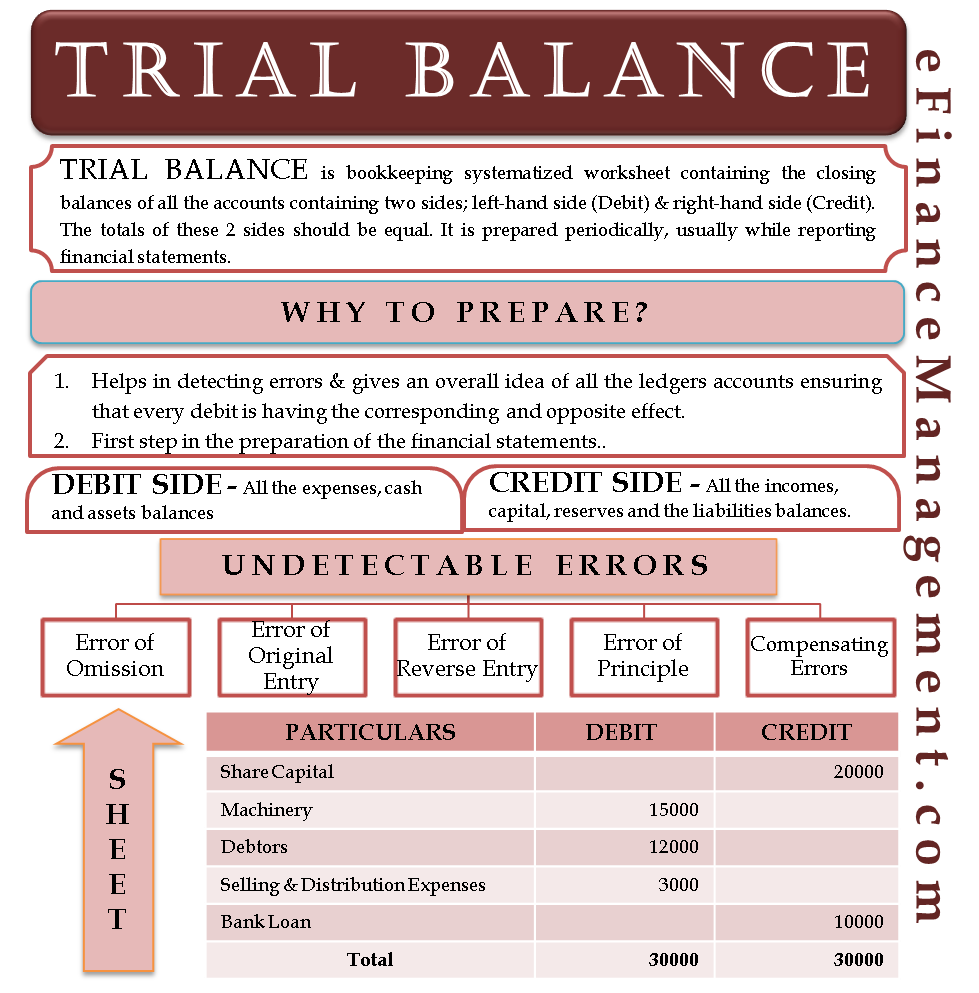

The trial balance is a useful tool that helps accountants check their work.

Cash in trial balance. Engoron attends the trump organization civil fraud trial in new york in november 2023. Balancing in a trial balance. This statement comprises two columns:

The accounts reflected on a trial balance are related to all major accounting items, including assets , liabilities, equity, revenues, expenses , gains, and. The trial balance format is easy to read because of its clean layout. In other words, the total debits must equal the total credits.

A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. A company prepares a trial balance. 6.3 posting of wrong amount.

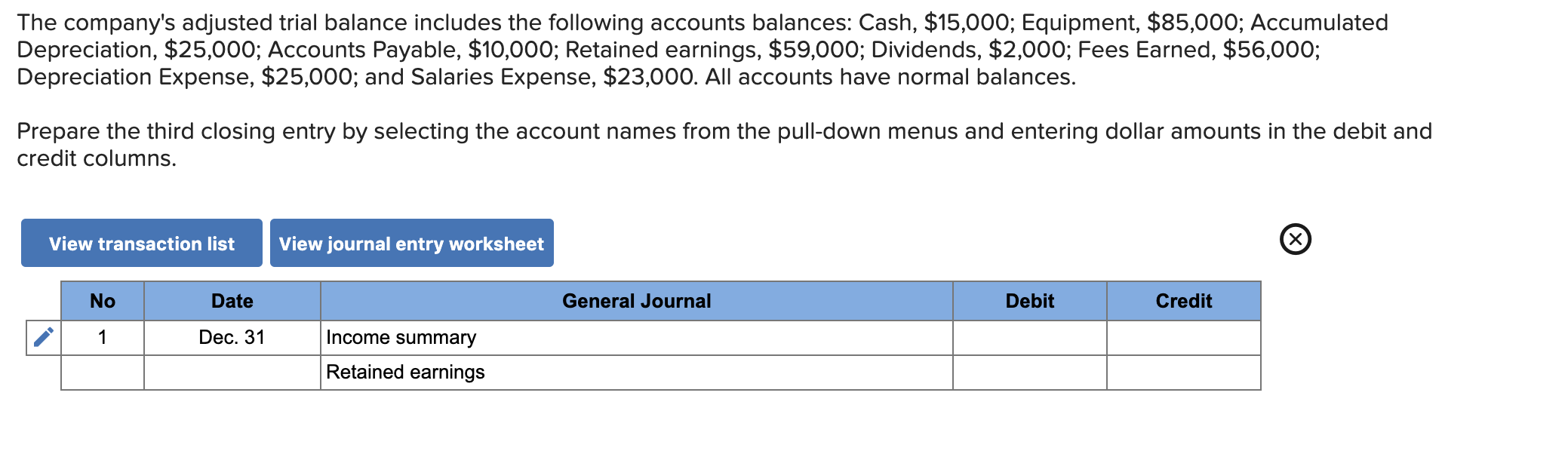

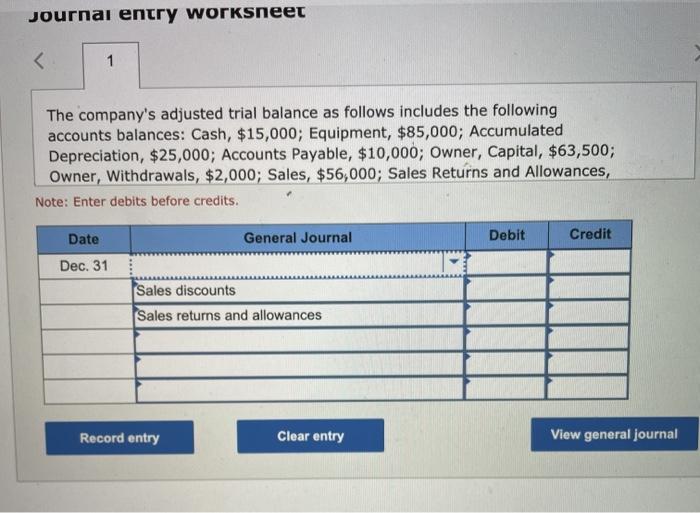

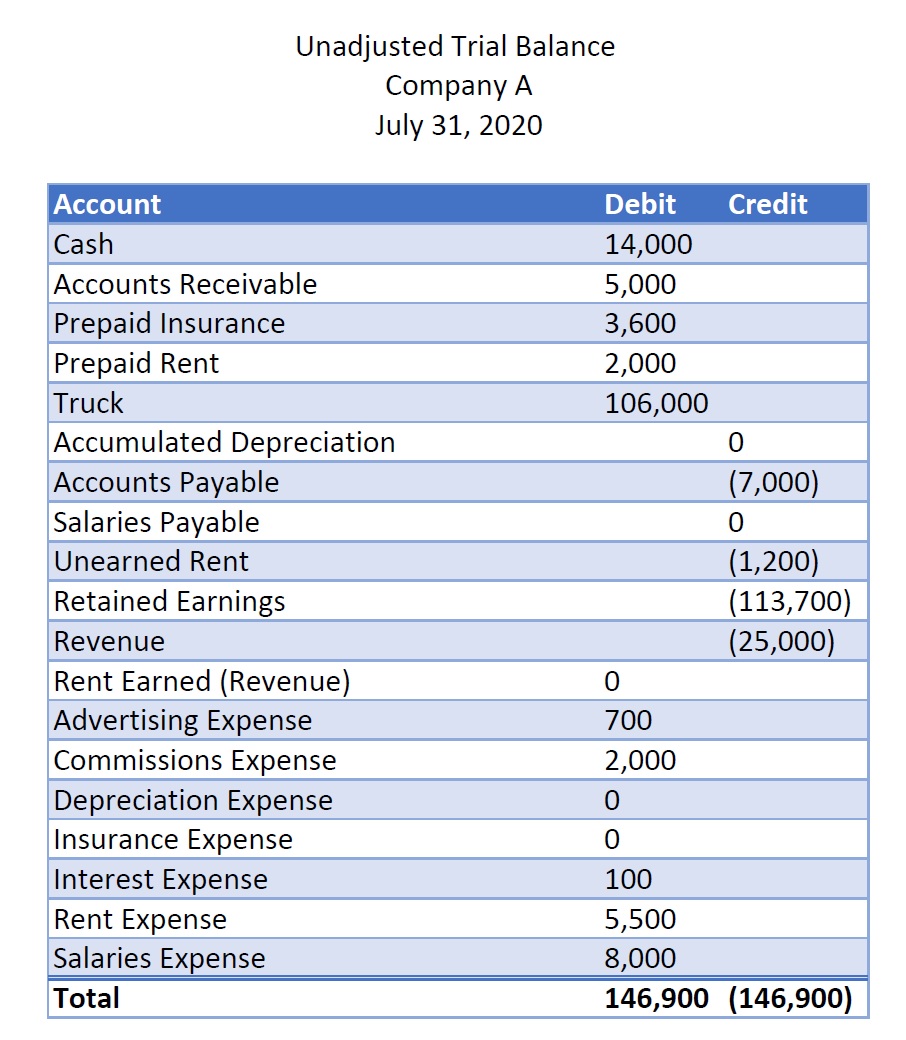

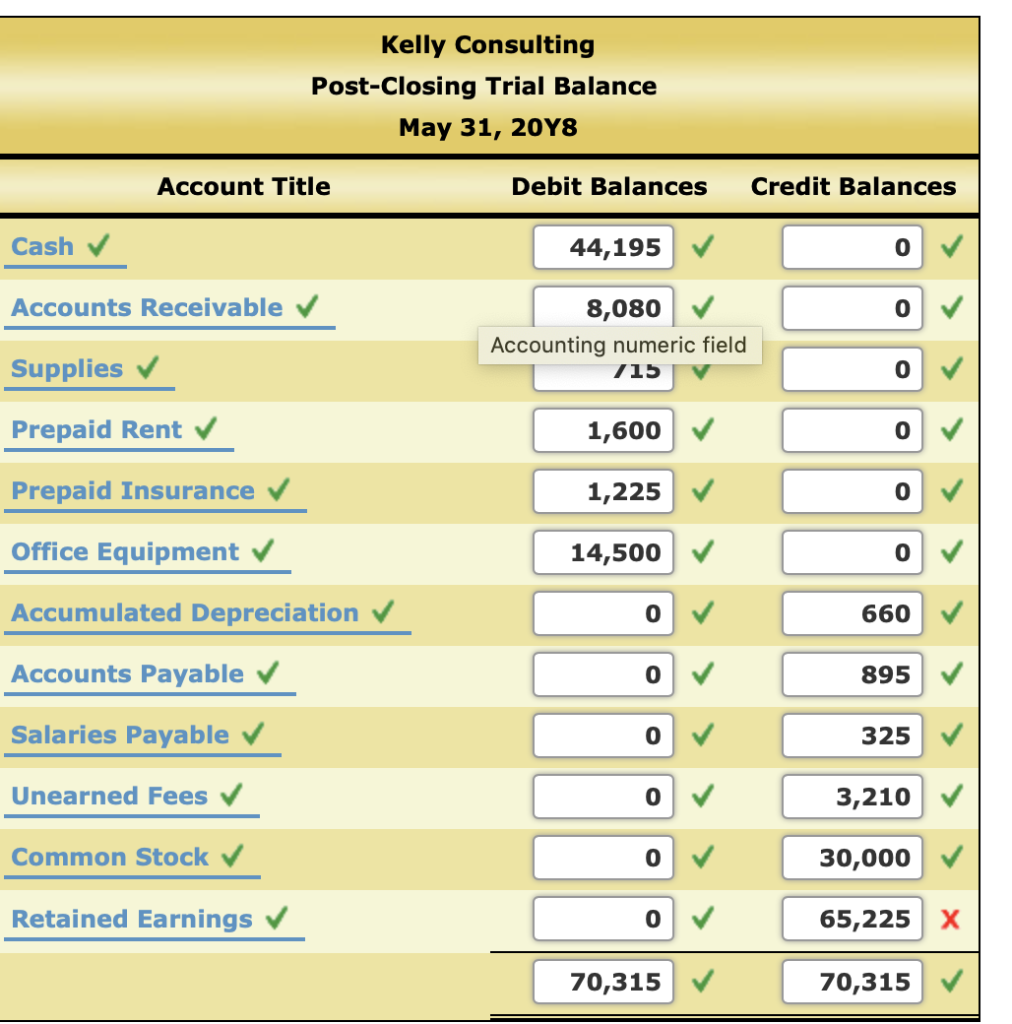

An unadjusted trial balance is created first and used to make adjusted entries, close the books and prepare the final versions of the financial statements. Accounting student accelerator! A trial balance is a financial statement that a business prepares at the end of an accounting period, just before making adjusting entries.

It typically has four columns with the following descriptions: 6 errors disclosed by trial balance. Let us take a look at the steps in the preparation of.

The unadjusted trial balance is the preliminary trial balance report or document that lists all ending balances or totals of accounts to determine if total debits and credit balances for account totals in the general ledger are equal. Account number, name, debit balance, and credit balance. The trial balance includes balance sheet and income statement accounts.

The trial balance is useful for checking the arithmetic accuracy and correctness of the bookkeeping entries. Then we prepare a trial balance to verify that the debit totals equal to the credit totals. 4 example of trial balance preparation.

Best for gas and dining. The rule to prepare trial balance is that the total of the debit balances and credit balances extracted from the ledger must tally. And then we post them in the general ledger.

April 13, 2023 to prepare a trial balance, you need to list the ledger accounts along with their respective debit or credit amounts. A trial balance is a list of all accounts in the general ledger that have nonzero balances. It is prepared at the end of a particular period to indicate the correct nature of the balances of various accounts.

A trial balance simply shows a list of the ledger accounts and their balances. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. The tb does not form part of double entry.