Top Notch Info About Ledger Balance Sheet Bdo Unibank Financial Statements

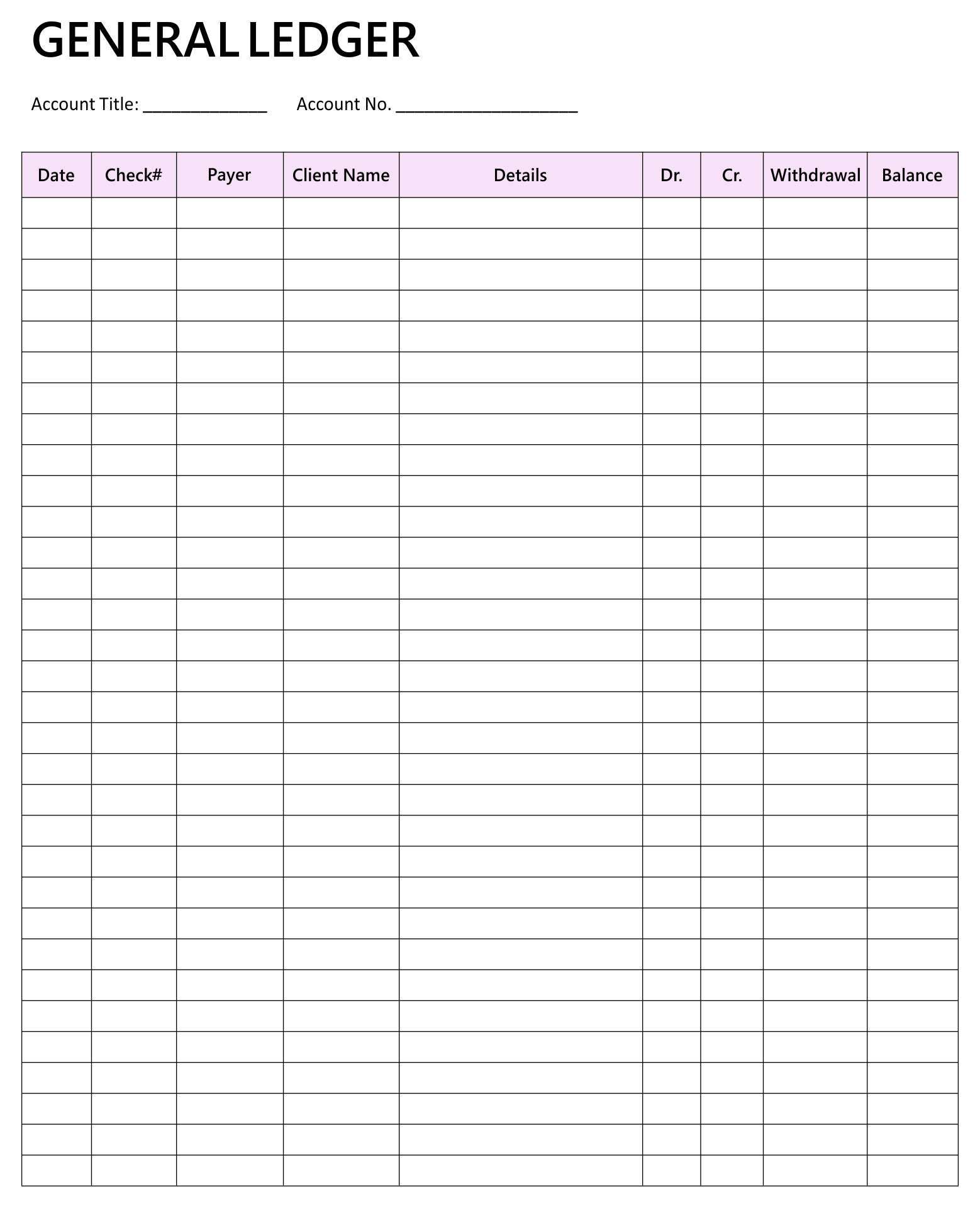

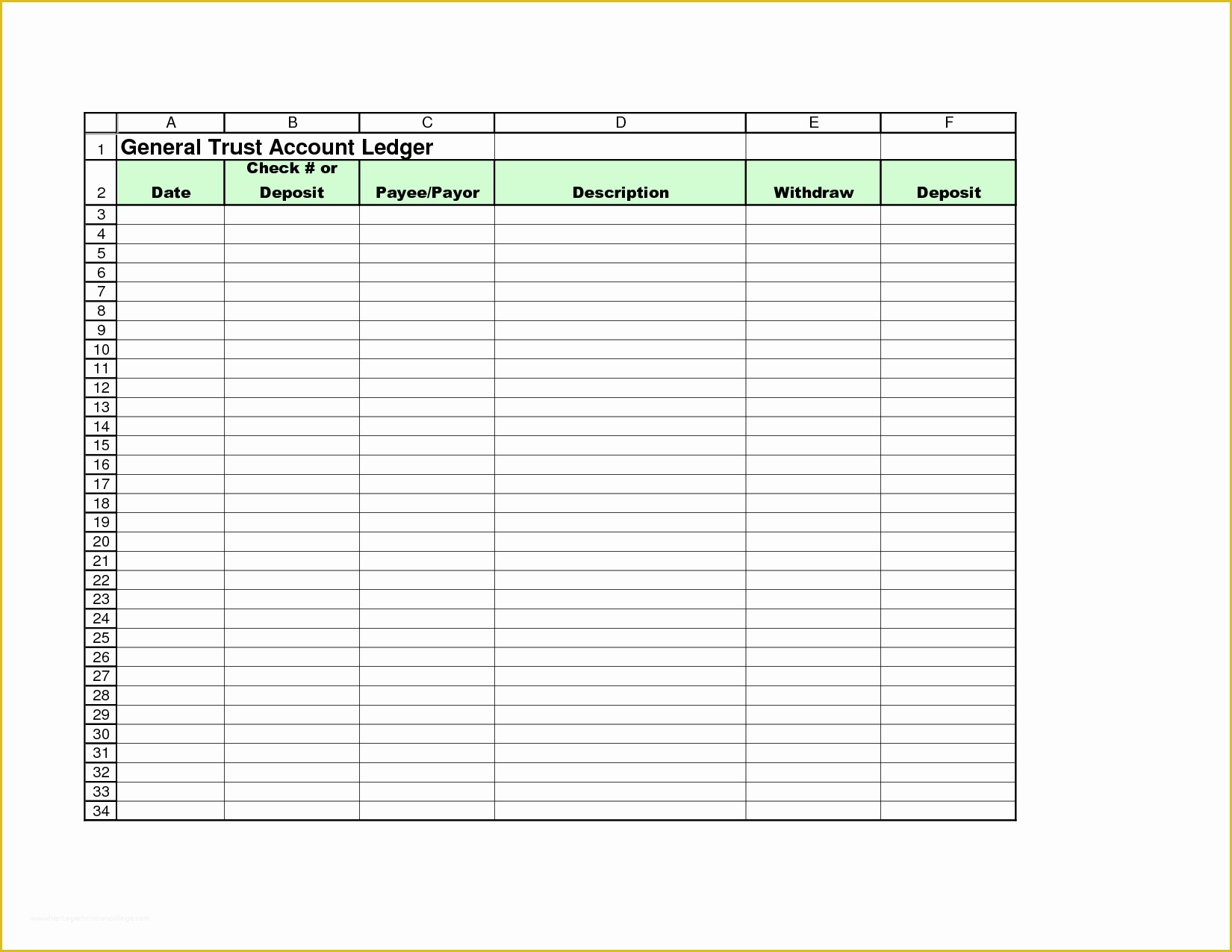

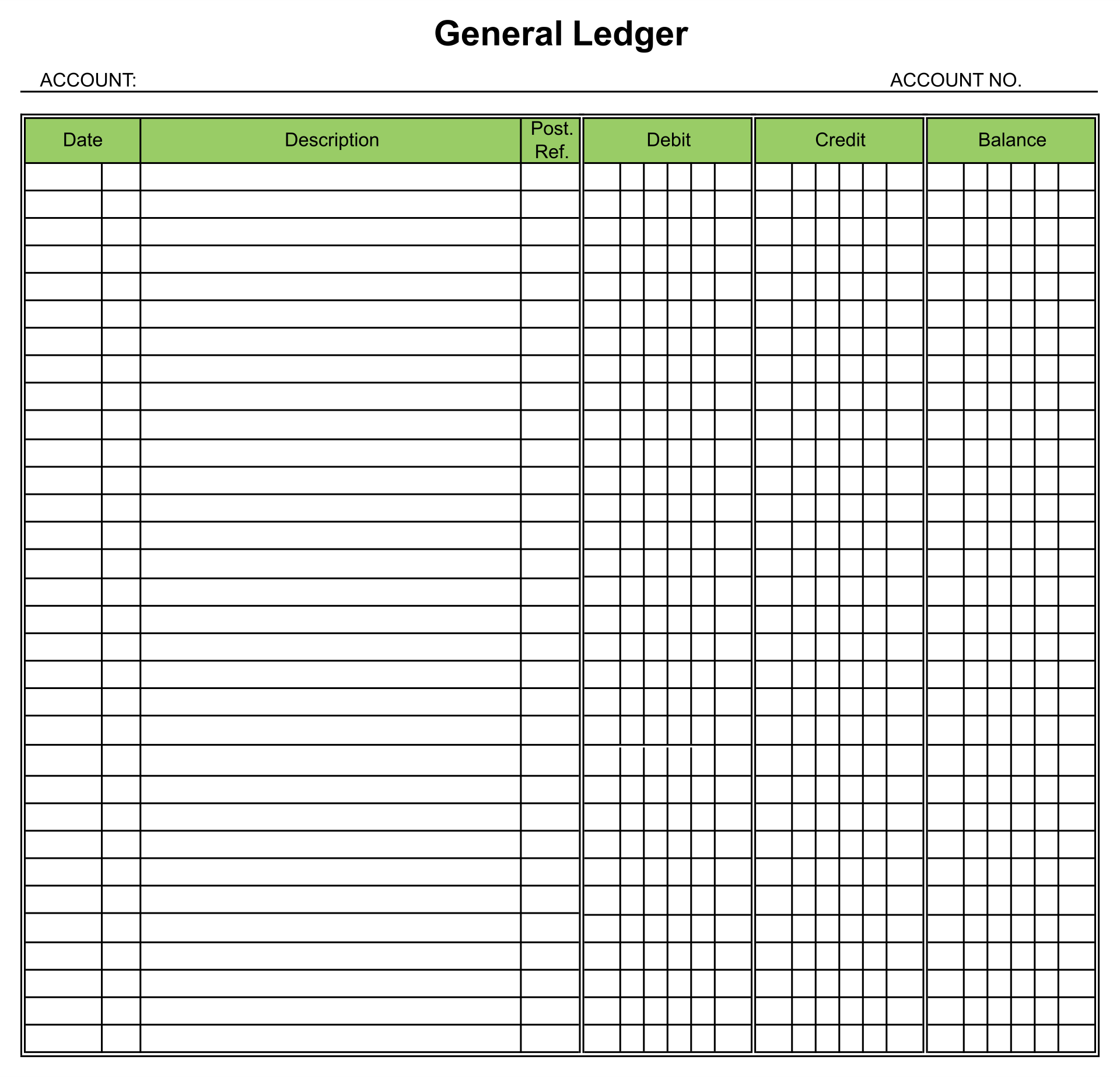

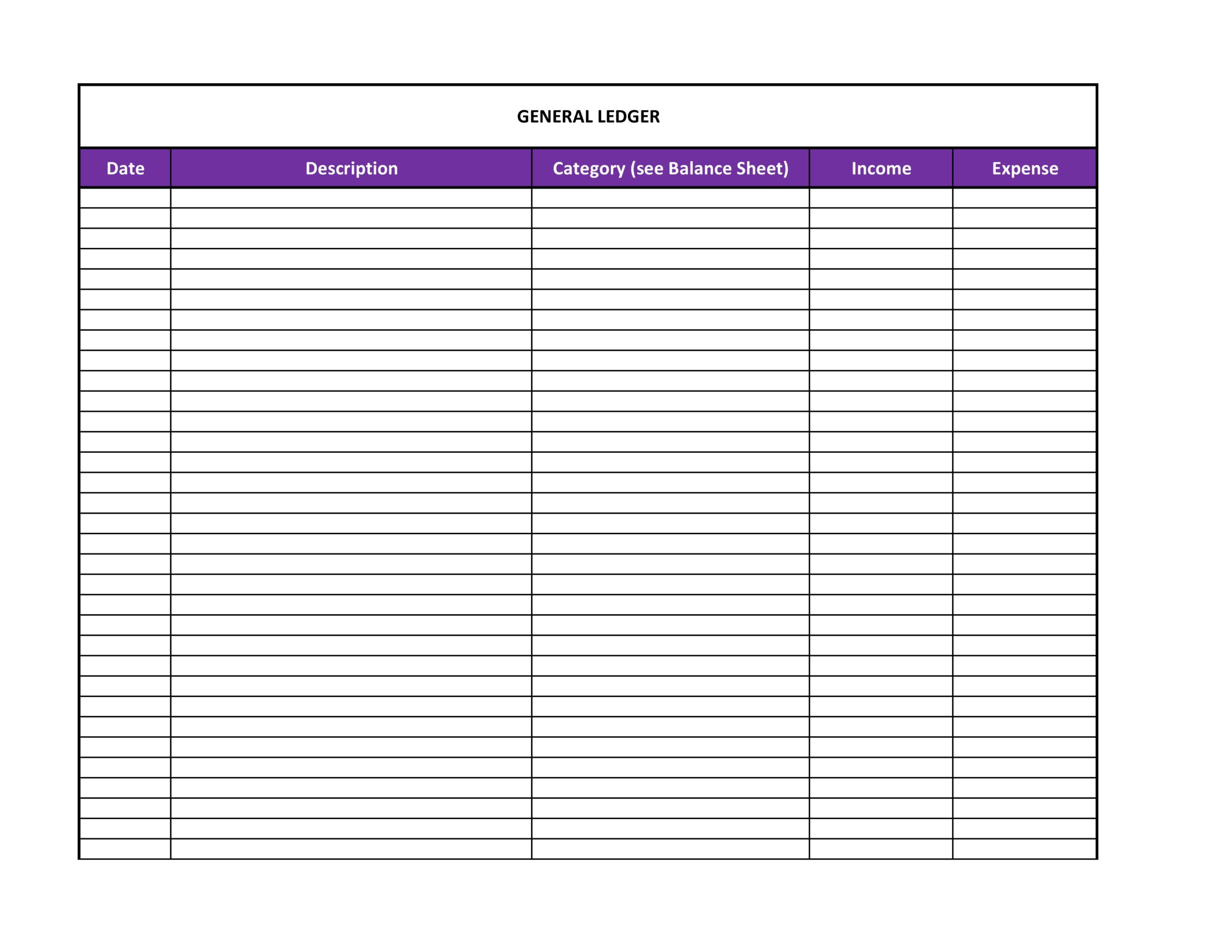

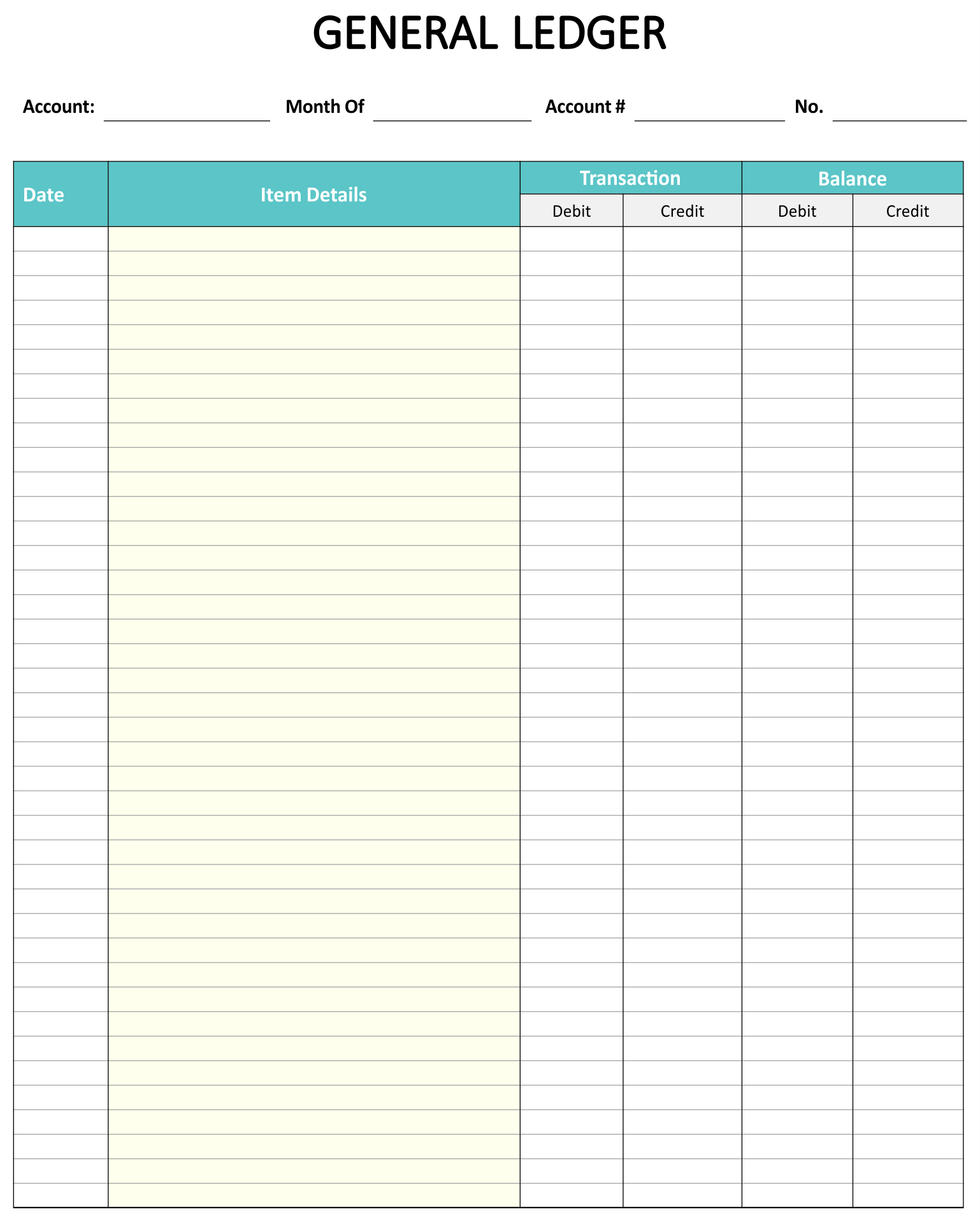

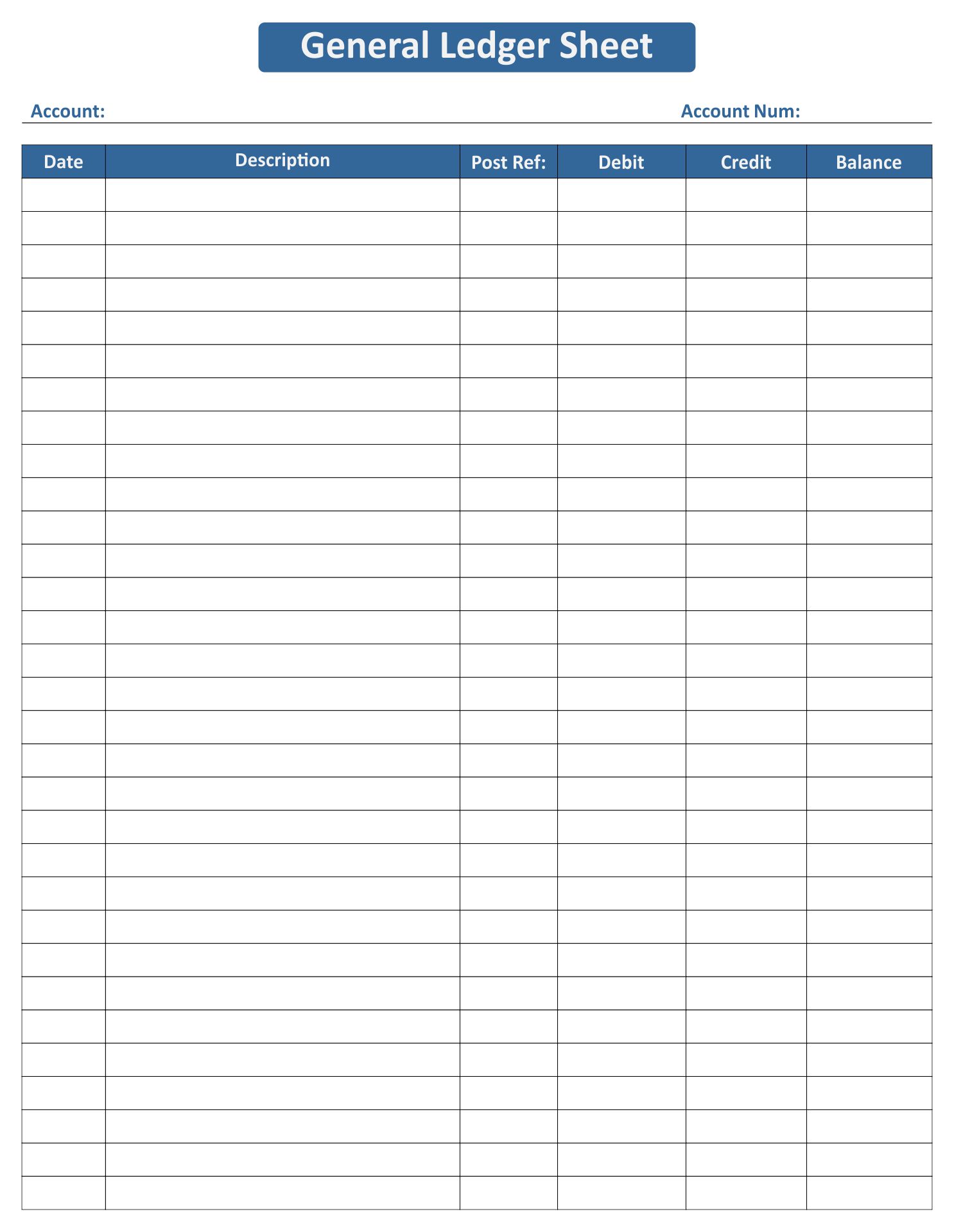

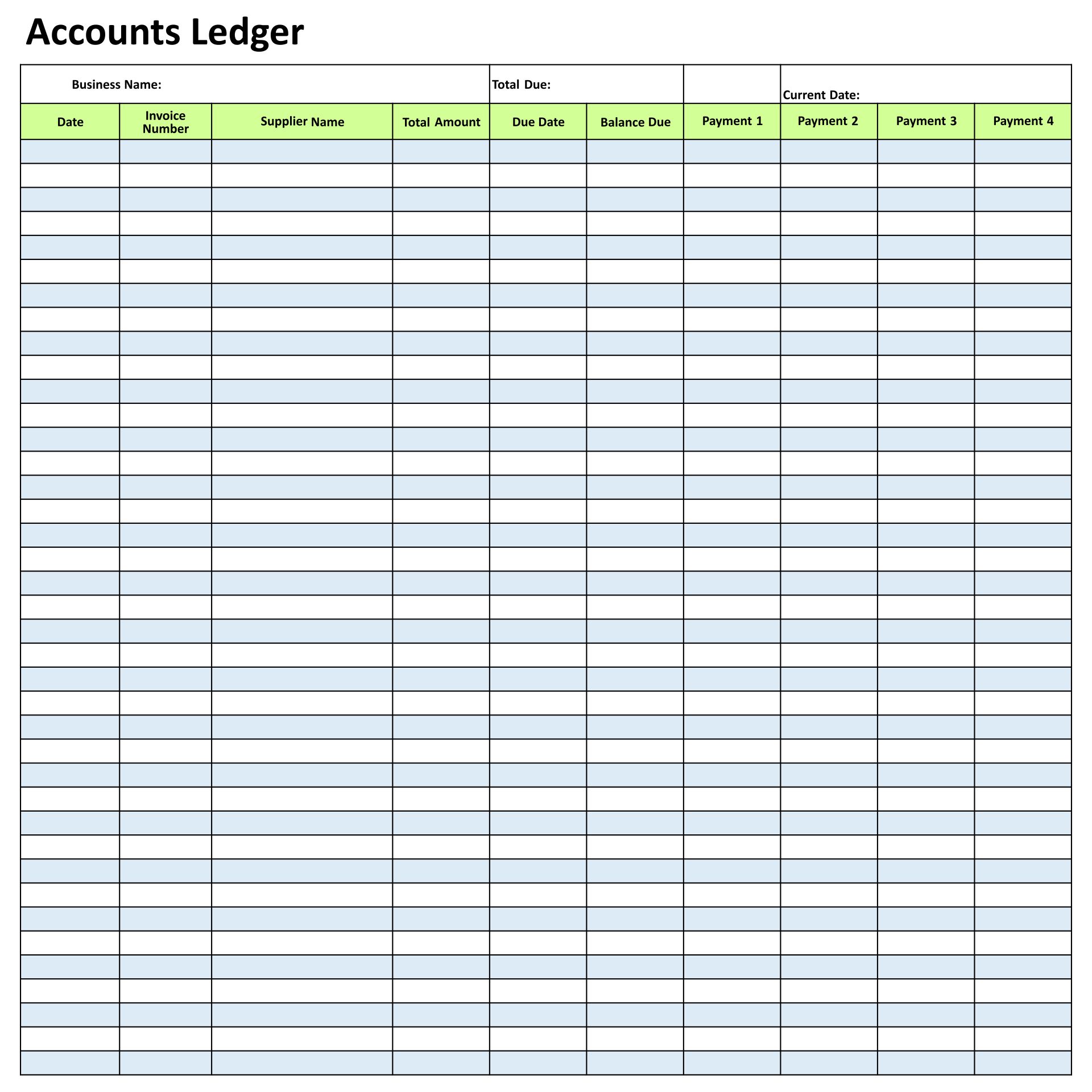

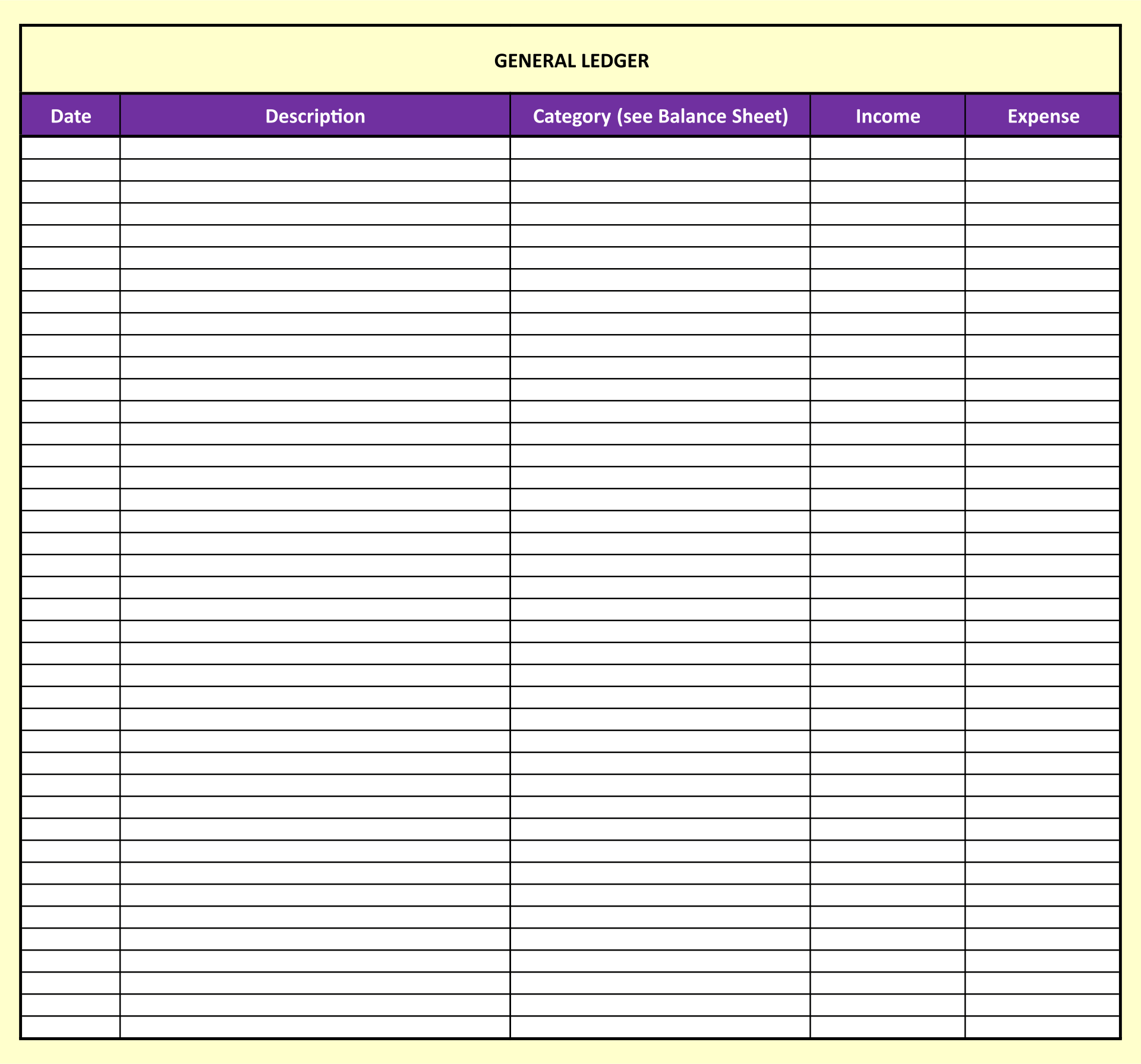

The template also contains specific ledger elements which can be used to record financial transaction.

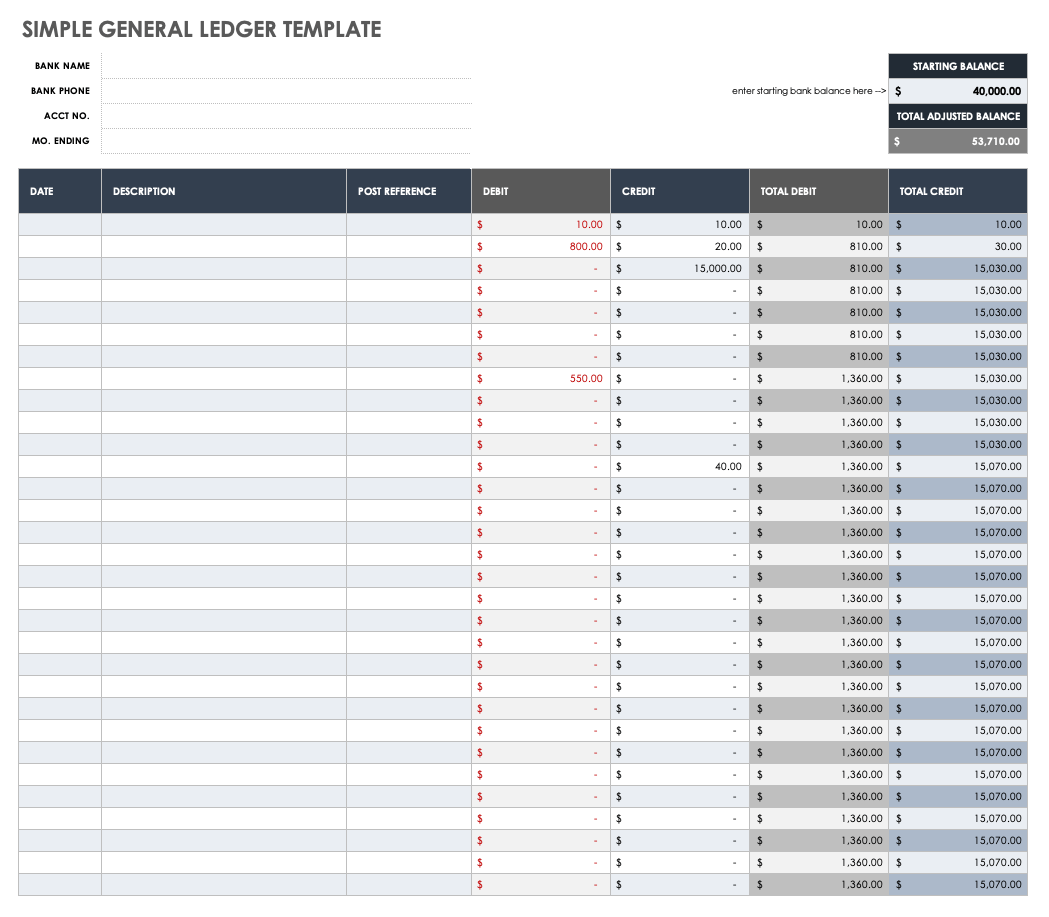

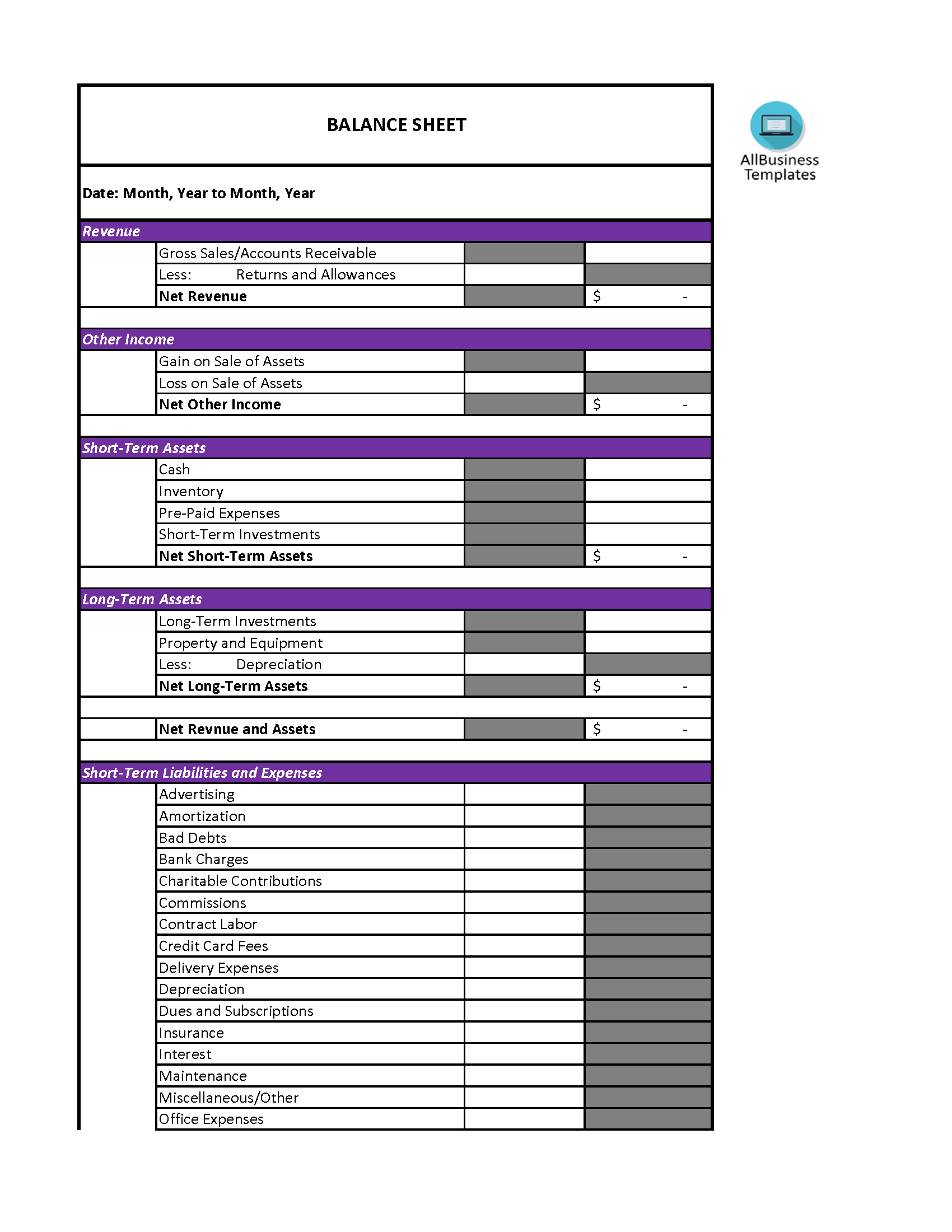

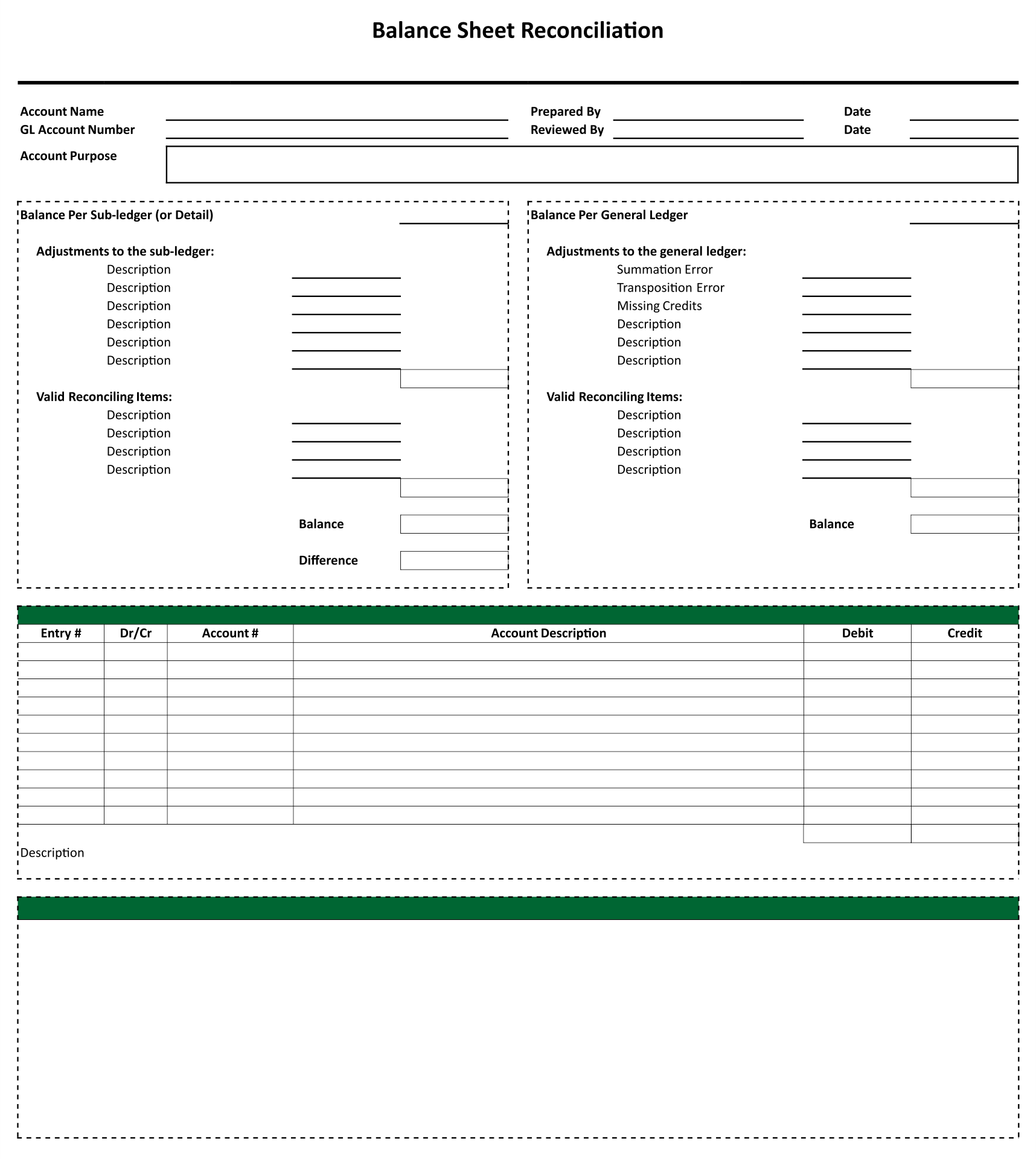

Ledger balance sheet. Companies can maintain ledgers for all types of balance sheet and income statement accounts, including accounts receivable, accounts payable, sales, and payroll. The general ledger includes data from subledgers, such as accounts receivable, accounts payable, fixed assets, cash management, and purchasing, to help you determine whether your company’s assets are sufficient to meet operating costs, or if you need to increase. General ledger accounts encompass all the transaction data needed to produce the income statement, balance sheet, and other financial reports.

The information in the ledger is essential as this will your the basis for making informed decisions. It lists all your financial transactions in separate balance sheet accounts, so that you can easily review your transactions when needed.

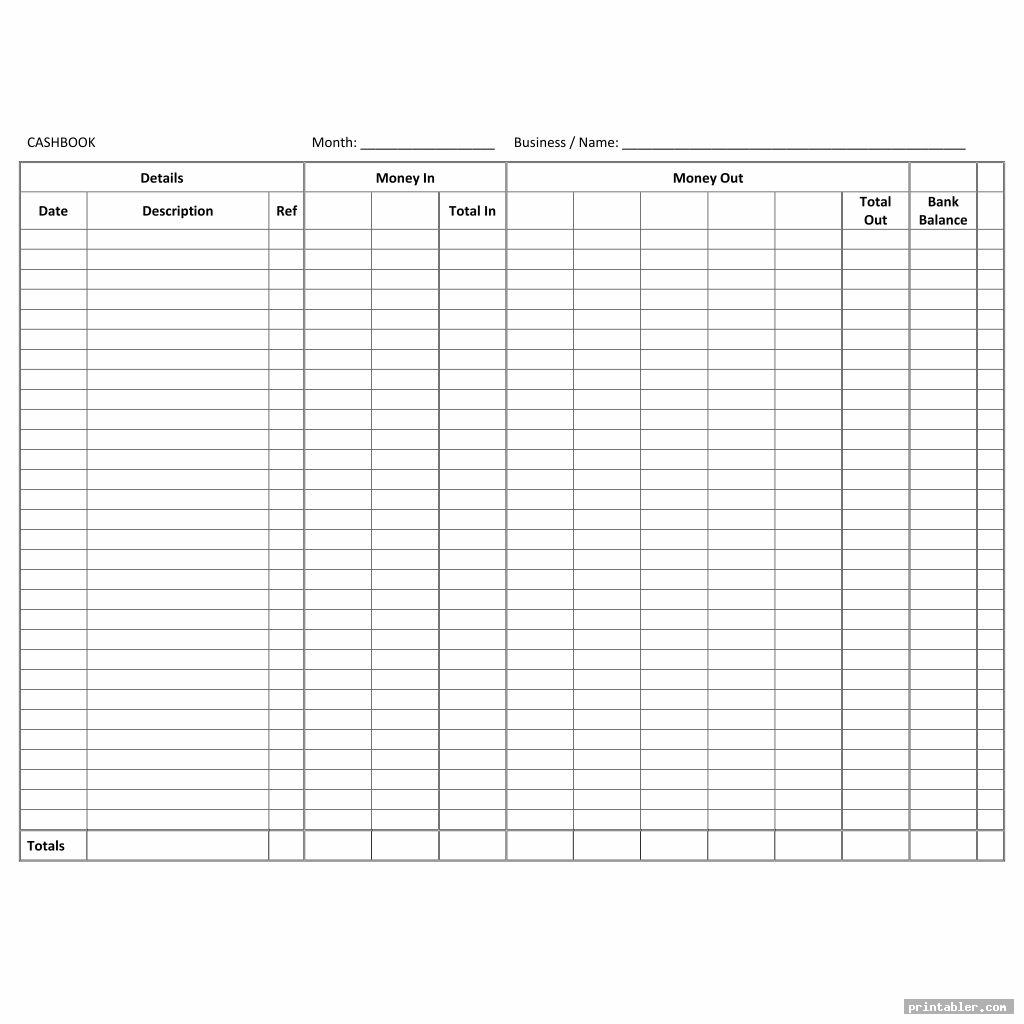

A ledger balance is calculated at the end of each business day by a bank and includes all debits and credits. Here’s how rundhawa explains the difference between the general ledger and balance sheet. As a general ledger (gl) records all of the transactions that affect a company’s accounting elements, such as assets, liabilities, equity, expenses, and revenue, it is the data source used to construct the balance sheet and the income statement.

What is a ledger balance sheet? A balance sheet is an accounting tool that presents financial and accounting data related.

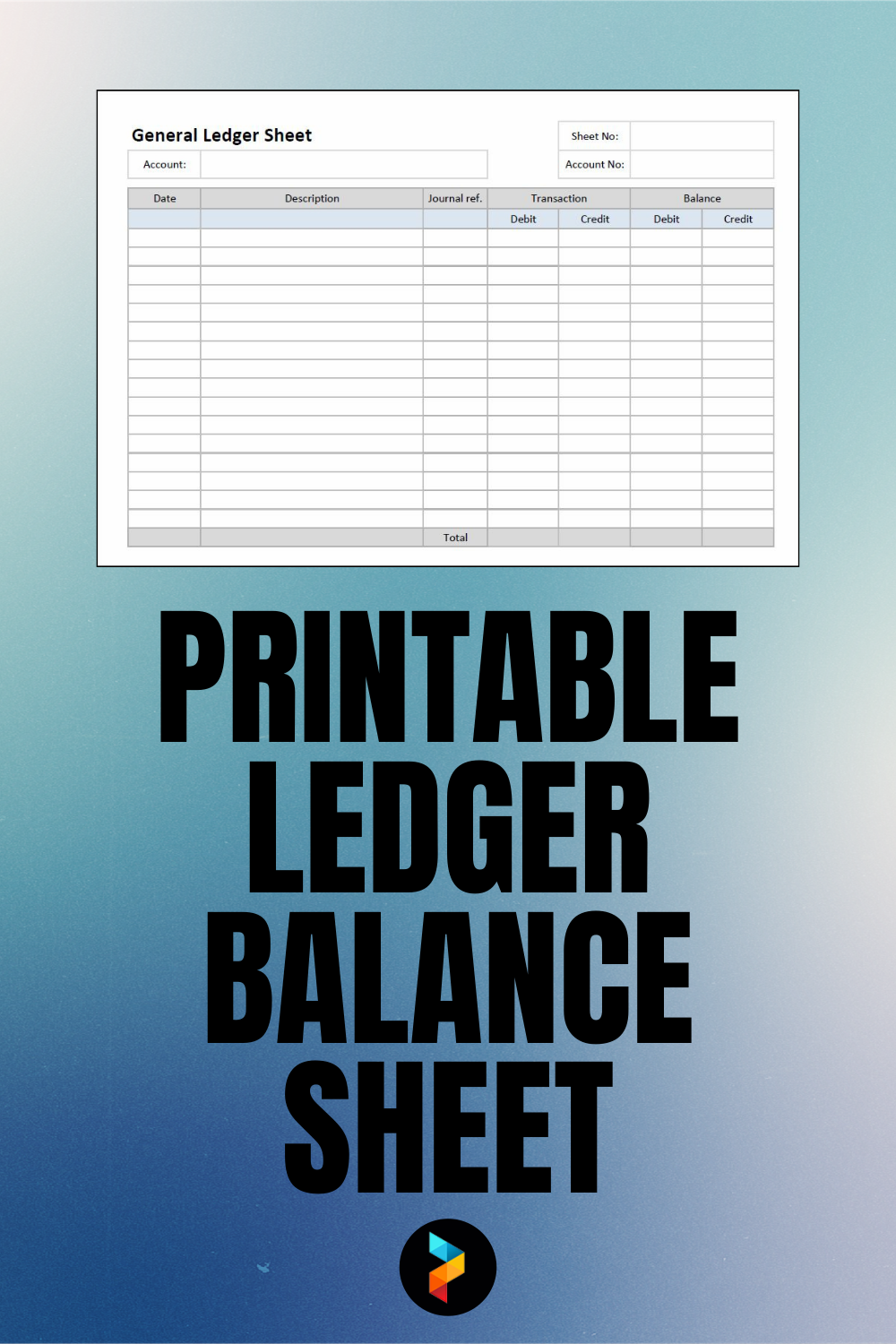

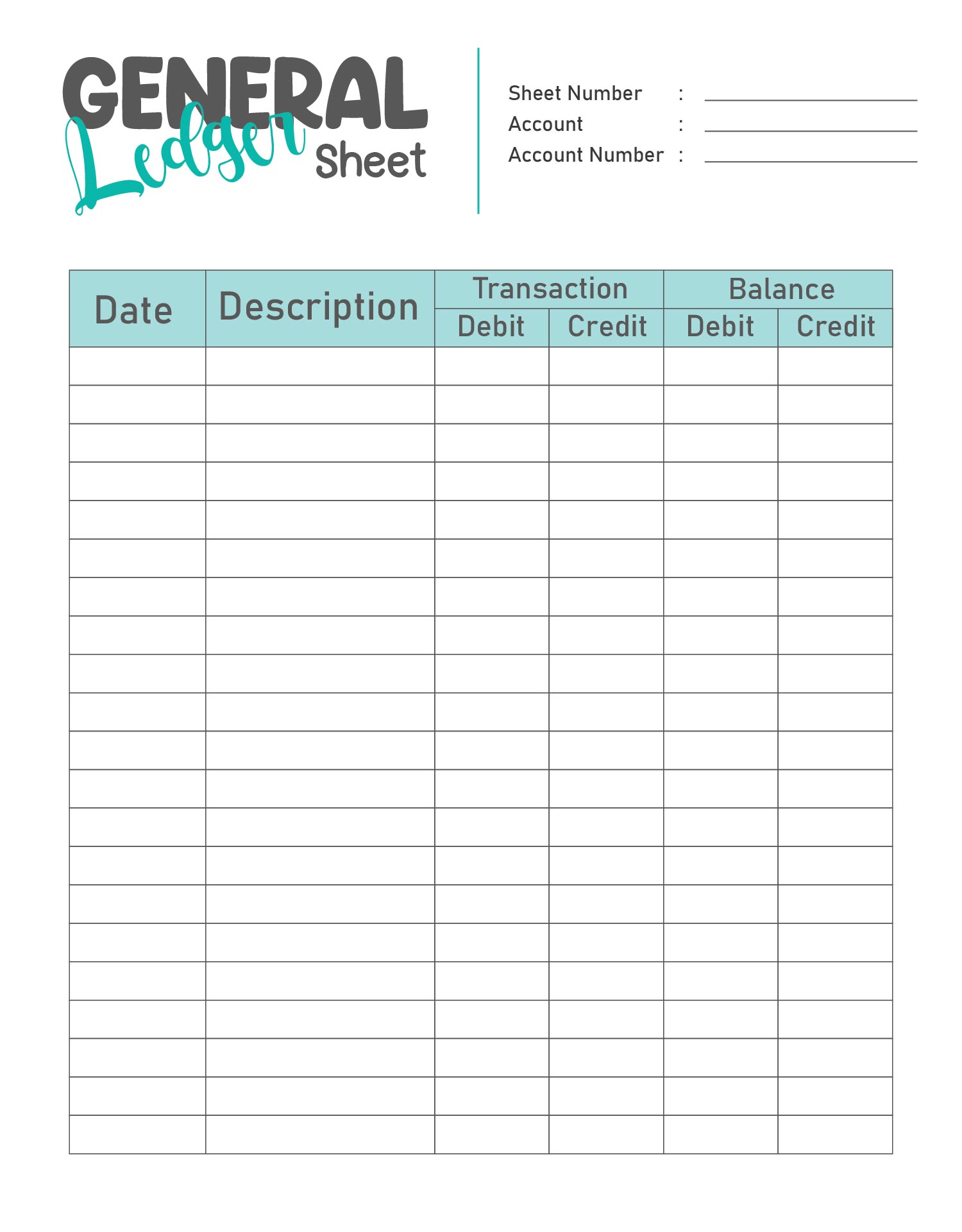

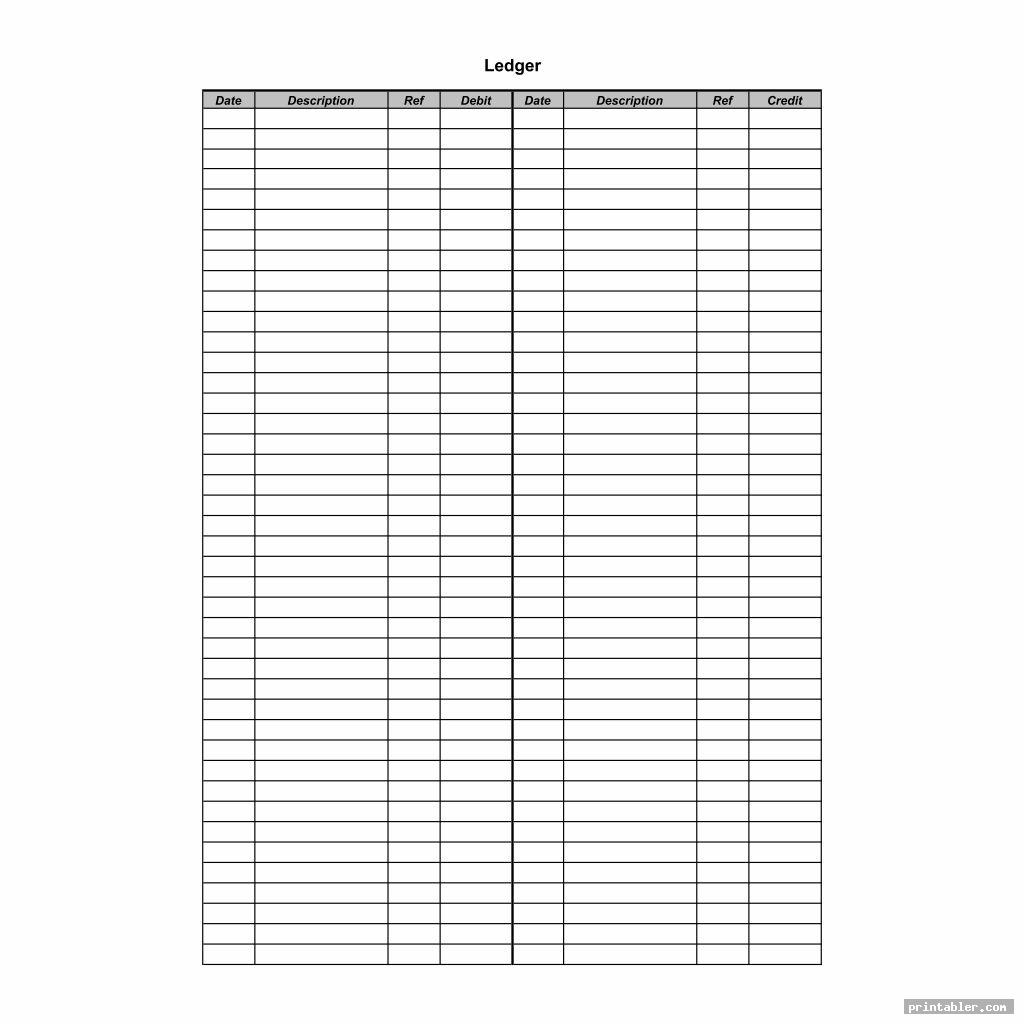

Conclusion what is a ledger? The ledger shows the account’s opening balance, all debits and credits to the account for the period, and the ending balance. Asset, liability, equity, revenue, expense) with the ending account balance.

The fed more the doubled the size of its holdings starting in march 2020 to a peak of nearly $9 trillion, using bond purchases to stabilize markets and provide stimulus beyond the near zero. All other necessary accounting formats seek information from a gl. Any organization needs a ledger as a necessary document.

These accounts may include the income statement and balance sheet. Thus, with the trial balance, you can verify the accuracy of your accounts and prepare final accounts. It is the opening balance in the bank account the next morning and remains the same.

It also helps you keep track of finances and identify errors. Ledger balance sheet format get the best ledger balance sheet formats created by vyapar. There are three types of ledger books:

Company’s general ledger account is organized under the general ledger with the balance sheet classified in multiple accounts like assets, accounts receivable, account payable, stockholders, liabilities, equities, revenues, taxes, expenses, profit, loss, funds, loans, bonds, stocks, salaries, wages, etc. Using the vyapar best accounting software is effortless and eliminates the need for multiple apps. Although they include similar information, the general ledger and the balance sheet are not the same.

After each transaction, it displays the debit and credit details as well as the company’s current balance. An accounting ledger is used to prepare a number of reports, such as balance sheets and income statements, and they help keep your small business’s finances in order. Asset ledgers will have many subaccounts, and the.