Outstanding Info About Equation For Operating Income Soc 1 Audit Report

The easiest way to calculate operating income starts with calculating gross income first.

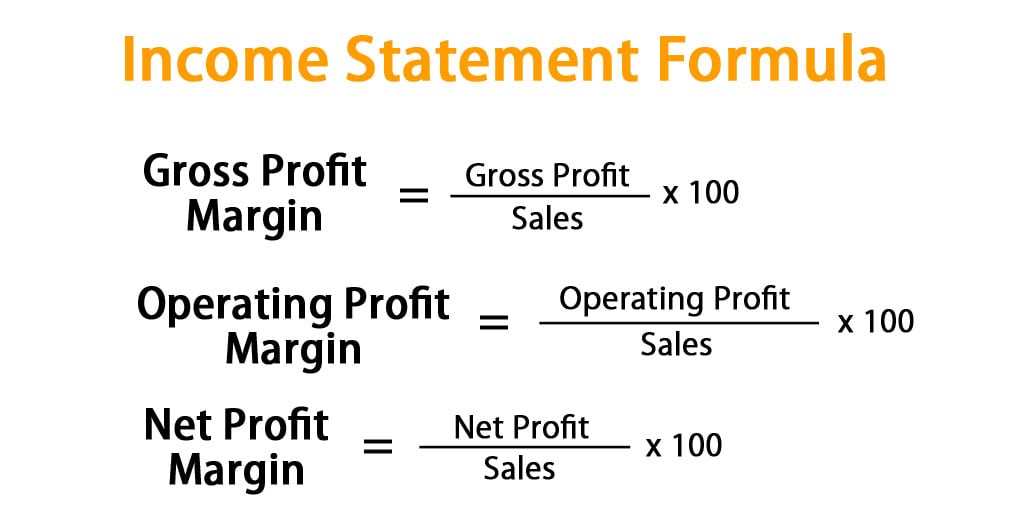

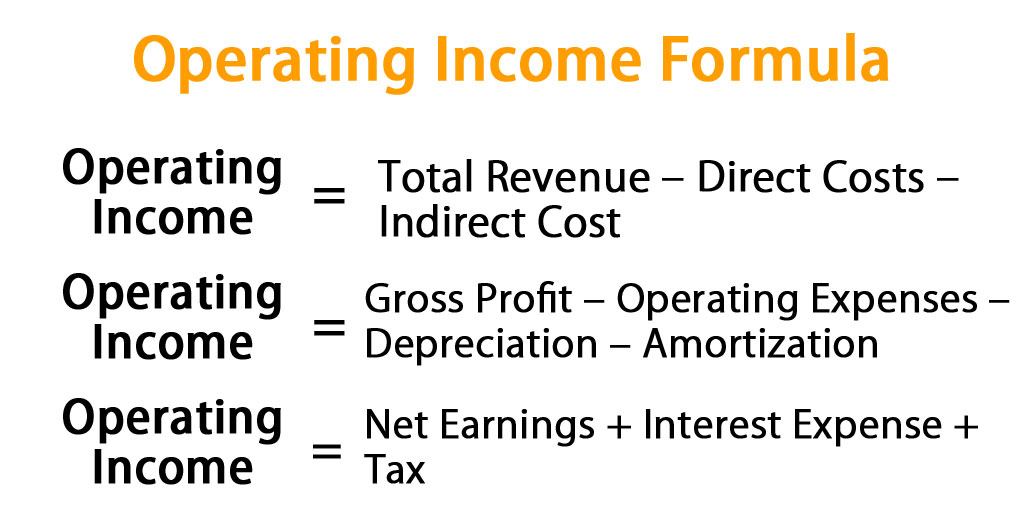

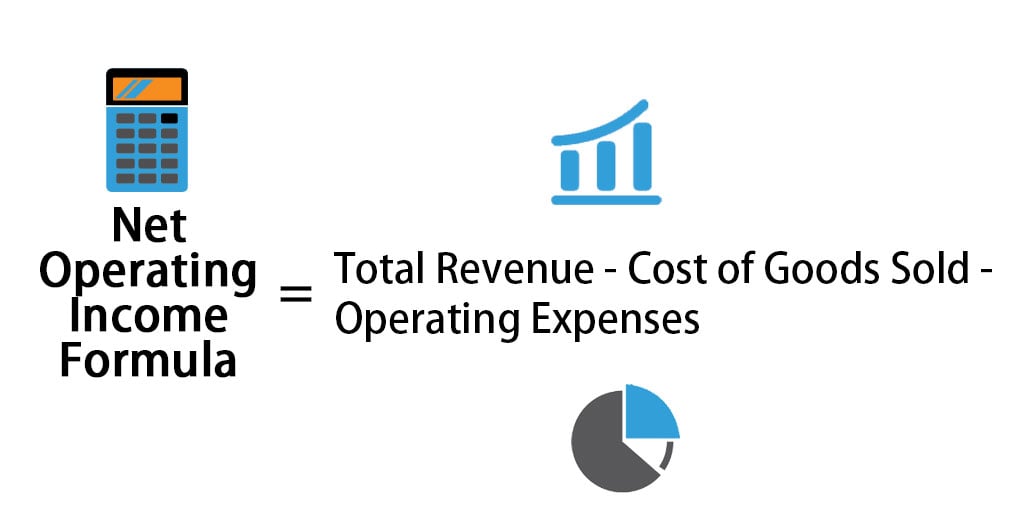

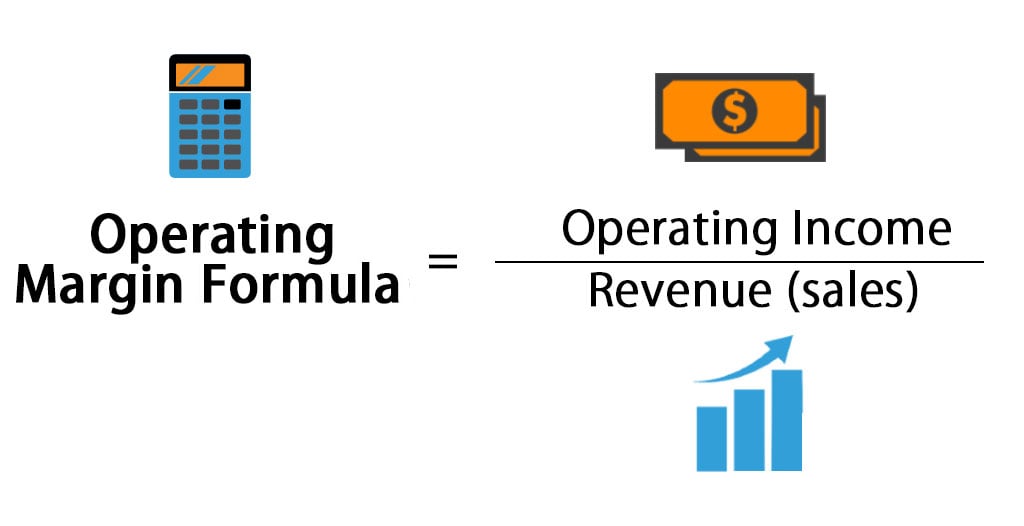

Equation for operating income. Operating expenses include costs such as salaries, rent, utilities, and. The formula for calculating operating income is relatively straightforward: Operating income is calculated by subtracting operating expenses from revenue.

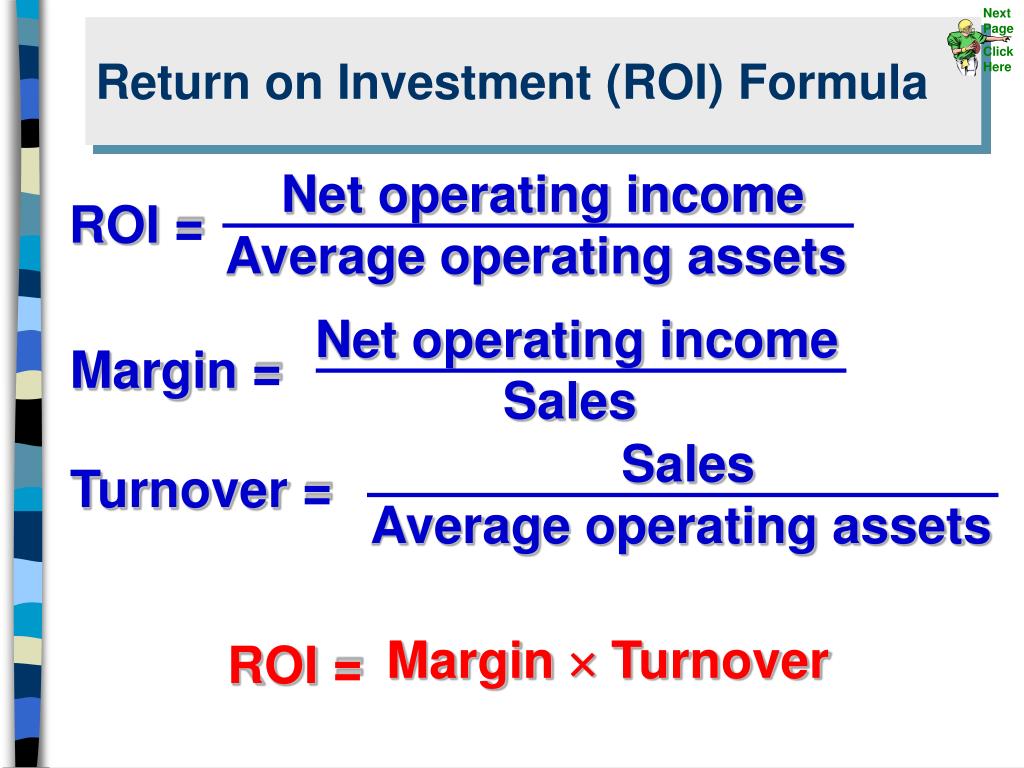

In this equation, operating income is the company's net earnings before deducting interest and taxes. Operating income is an accounting figure that measures the amount of profit realized from a business's operations after deducting operating expenses such. Operating income is calculated by subtracting the total operating expenses from the total gross income.

We can take the example of a. To calculate operating income, you must find the total revenue (gross income), cogs, and the operating expenses on the income statement. The formula can be applied using various metrics from.

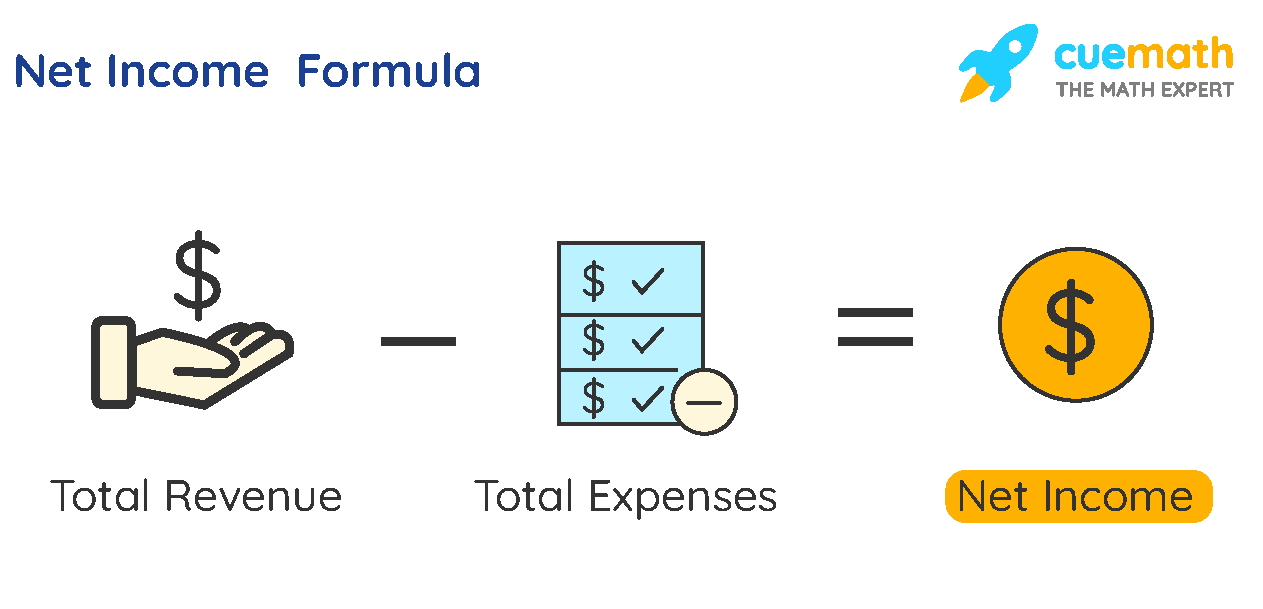

The net operating income (noi) formula calculates a company's income after operating expenses are deducted, but before deducting interest and taxes. The operating income formula is calculated by subtracting operating expenses, depreciation, and amortization from gross income. You may also see this figure mentioned as earnings before.

The operating income amount is calculated by subtracting total operating expenses from total revenue. Operating income formula using an income statement,. The formula to calculate operating income is:

As you can see, there are a few. The first component of the formula, gross profit, represents the revenue generated by a.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)