One Of The Best Info About Estimated Cash Flow Statement Operating Format In Excel

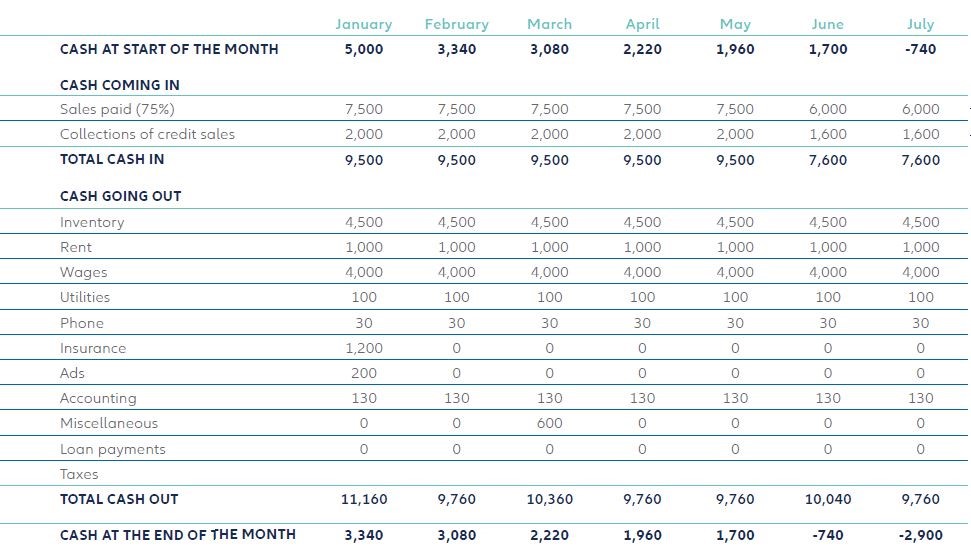

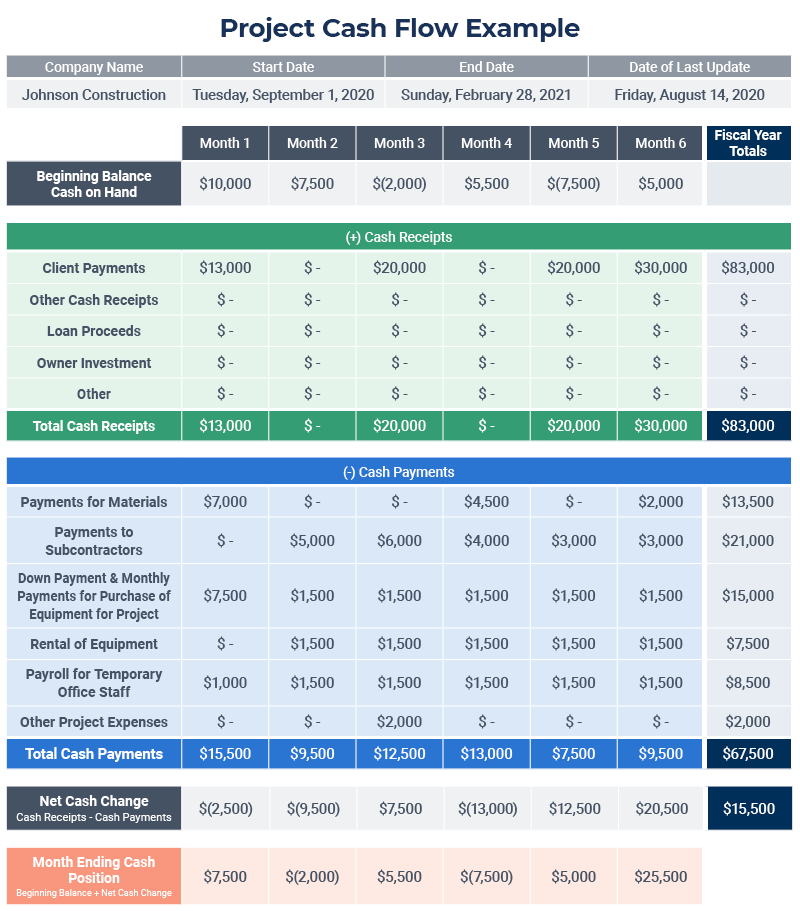

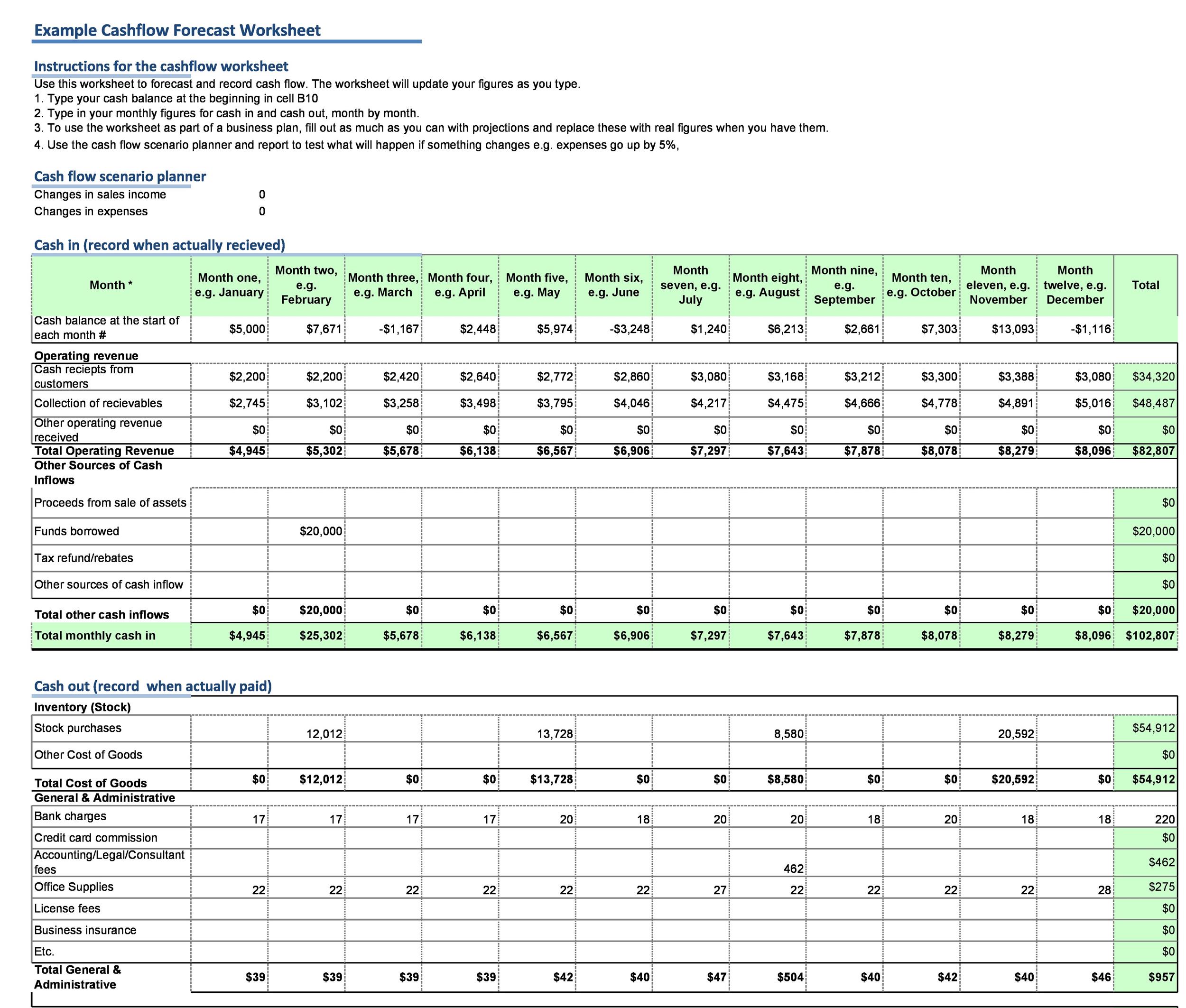

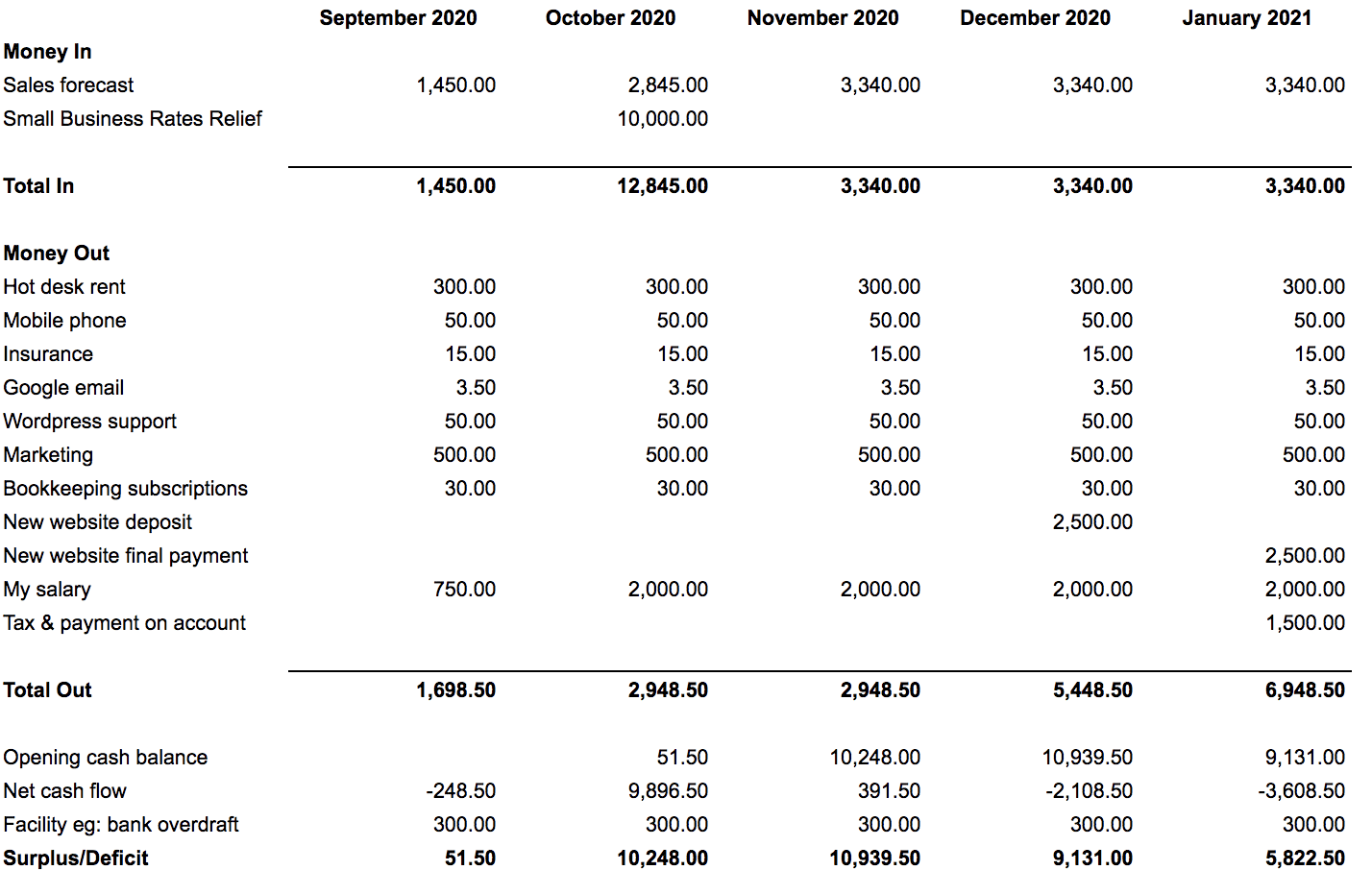

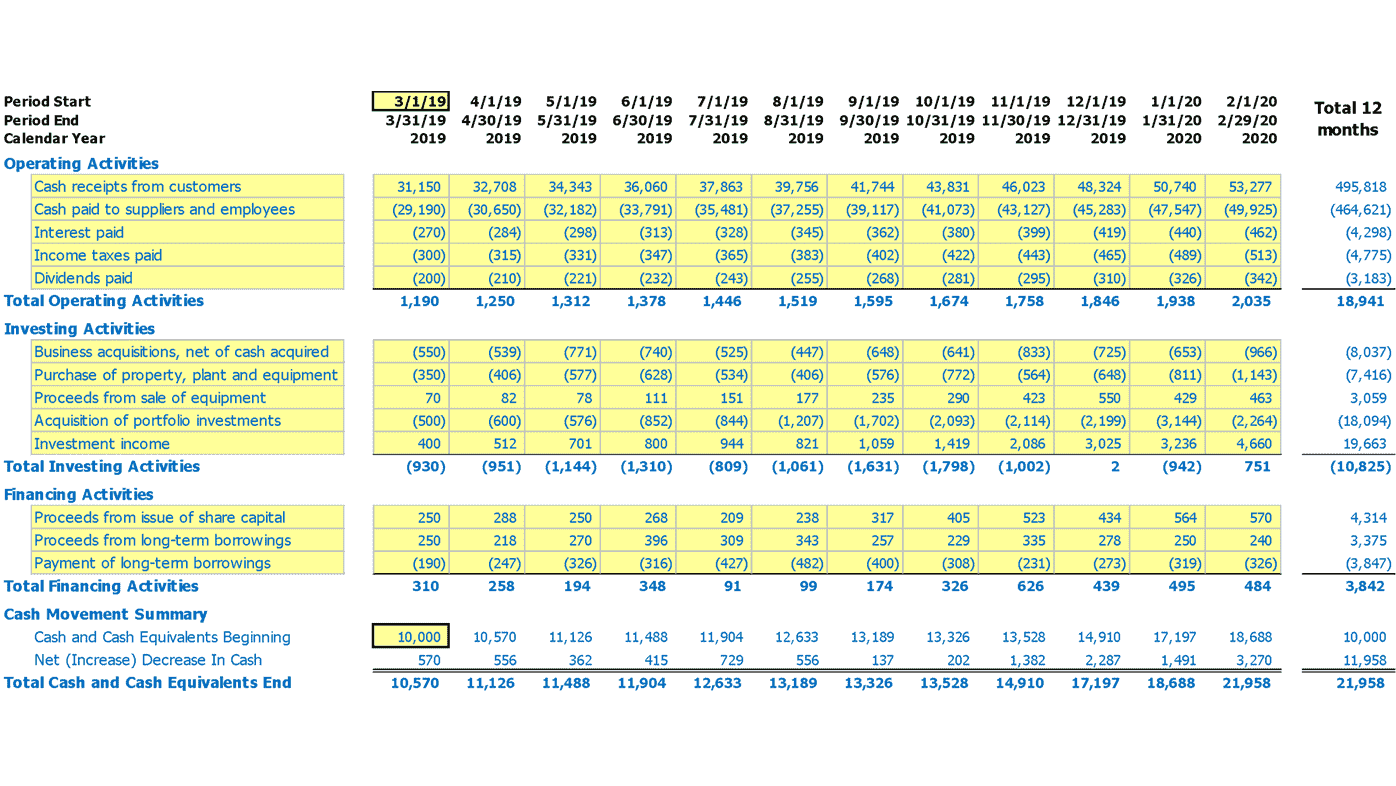

Steps to prepare a projected cash flow statement:

Estimated cash flow statement. The formula for each company will be a little different, but the basic structure always consists of the three same elements: In simple terms, cash flow estimation (or cash flow forecasting) is a prediction of how much inflow and outflow of cash a business will have at any given time. Enter your beginning balance for the first month, start your projection with the actual amount of cash your business will have in your bank account.

This is the total amount of money coming into your business; The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a. The expected cash flow is $60,000.

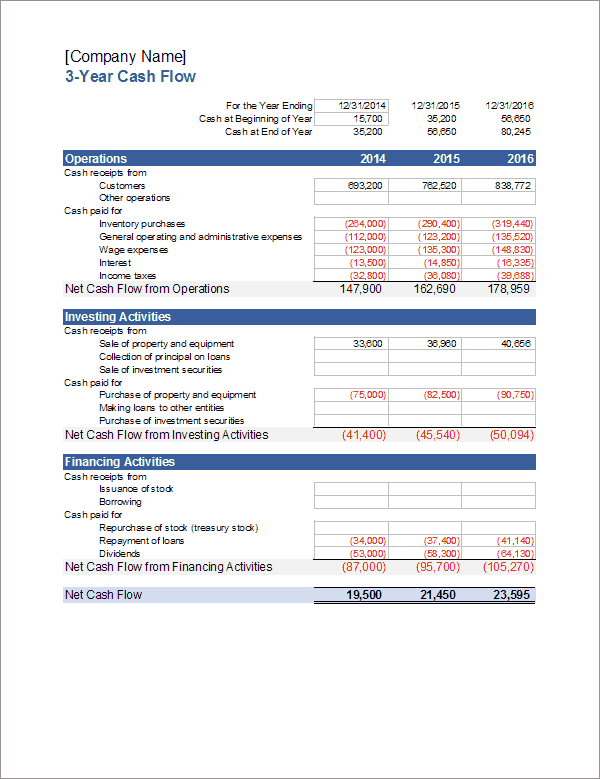

Create columns for operating activities, financing activities, and investing activities. A cash flow projection statement is a financial record that both records a company's current cash flow and estimates cash flow in the future.

This includes money generated from selling. Use the estimated cash inflows and outflows to calculate the net cash flow. 1) ocf begins with net income, 2) adds back any.

Estimate future sales and collections from customers. There are 3 main elements of a cash flow statement: Operating cash flow (or sometimes called “cash from operations”) is a measure of cash generated (or consumed) by a business from its normal operating activities.

1 create a spreadsheet. The cash flow statement is often viewed as the most essential among the financial statements simply because it paints a clear picture of a company’s lifeblood. Open all your bank statements for the month you are.

Projected cash flow, also called a cash flow forecast, is an estimate of the amount of money that an organization expects to gain and spend in a certain time period. This task is crucial as it helps determine whether your business will have a positive or negative cash. The amount actually received may be less than $60,000.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)