Brilliant Tips About Sundry Expenses In Balance Sheet Partnership Income Statement

Sundry expenses are miscellaneous expenditures that are not frequently incurred.

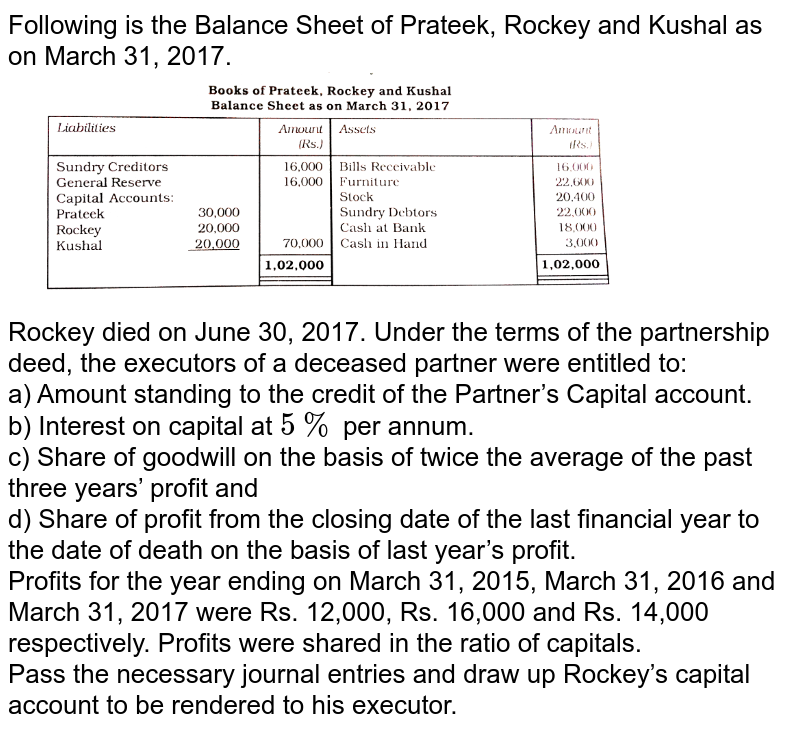

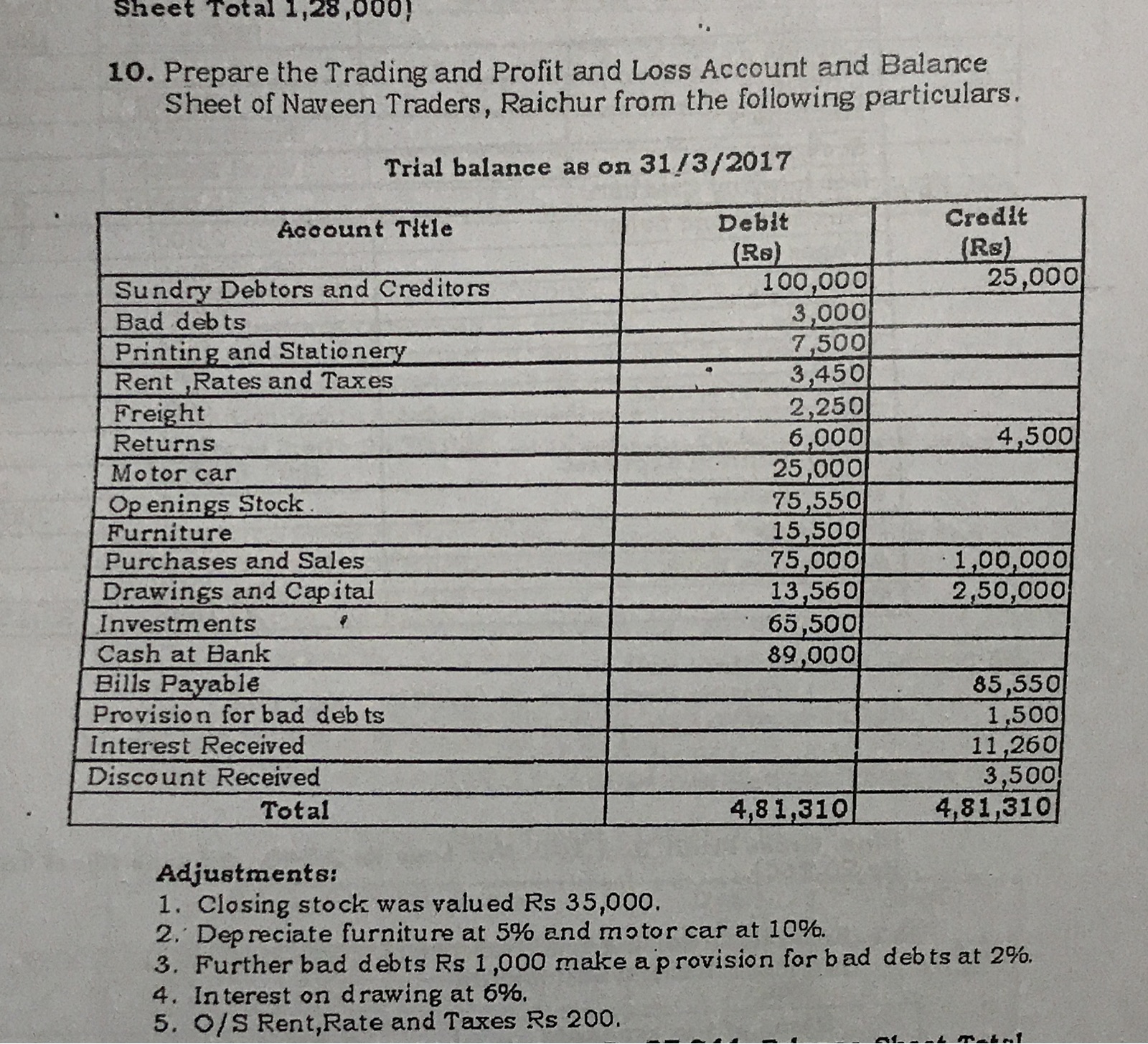

Sundry expenses in balance sheet. Sundry debtors or accounts receivable are considered a fixed asset in the business. In accounting and bookkeeping, sundry expenses are expenses that are small in amount and rare in. Larger businesses may need to create a separate.

In 2015, muilenburg replaced mcnerney in the pilot’s seat, and continued the strong focus on lowering costs and delivering big shareholder returns. But, when added together, they can pile up to make a significant expense that can affect your tax liabilities and even your net worth. In the world of business, it refers to many similar items combined under one head.

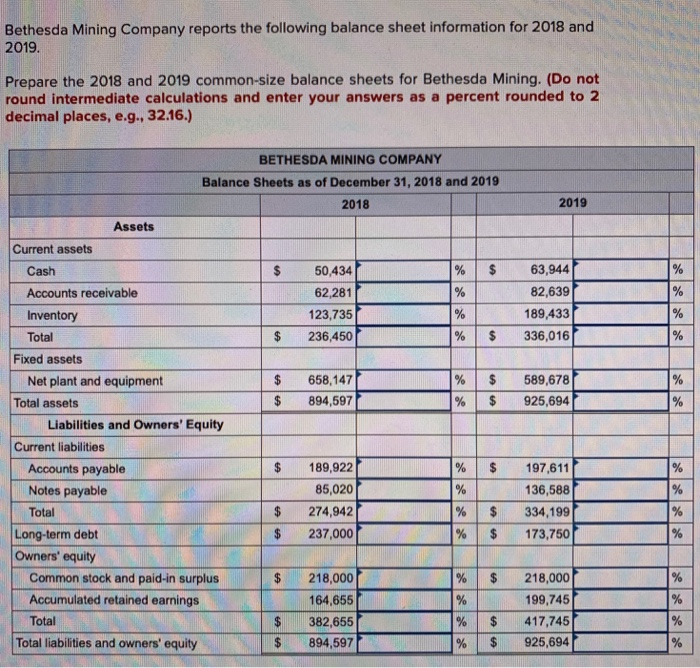

On the income statement or balance sheet, sundry income may also be listed as miscellaneous income or other operating income. They might include expenses for items. Bad debts can be shown as a deduction from debtors on the.

A group of such individuals or entities is called sundry. In a balance sheet, you can find the recording of sundry creditors done under the 'liabilities' head, but sundry debtors are recorded in the 'assets' heading. Sundry expenses meaning while discussing debtors, it’s worth mentioning sundry expenses.

Sundry expenses refer to miscellaneous small costs typically incurred by a business but not categorised under main expense categories. Sundry expenses encompass the smaller, irregular expenses that may not be attributable to a specific cost account that you have set up within your accounting. Typically, sundry debtors arise from core business activities,.

Easy to classify under regular expense accounts : Sundry expenses, or sundries, include all the small, irregular, and infrequent expenses that can’t fit into any other expense category. Individual sundry expenses can seem unimportant or insignificant on your balance sheet.

Meaning creditors are individuals or companies to whom you owe money for goods or services purchased on credit. On a balance sheet or income statement, sundry income might be listed as miscellaneous income or operating income. This is mainly because the money associated with sundry debtors belongs to.

A sundry account is a handy way to record various business expenses, particularly if your company does not already have a separate account for petty cash or. These expenses are recorded within an.

You can view sundry revenues or operating income in your balance sheet or profit and loss account. Sundry expenses examples sundry expenses vs. The sundry expense journal entry must display a credit to the bank account or cash to balance the ledger entry.

Sundry income or sundry expenses are also known as other or. General expenses why is it important to register sundry. October 12, 2023 what are sundry expenses?