Exemplary Info About P&l And Cash Flow Sample

Introduction to fundamental analysis 00:04:07 2.

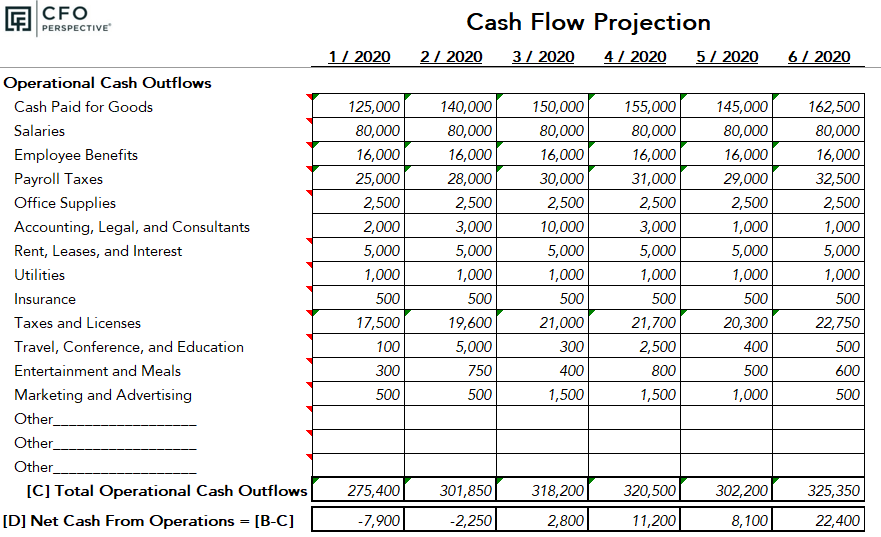

P&l and cash flow. What does it mean? How to read the annual report of a company 00:06:02 4. Your cash flow reveals your business’s liquidity.

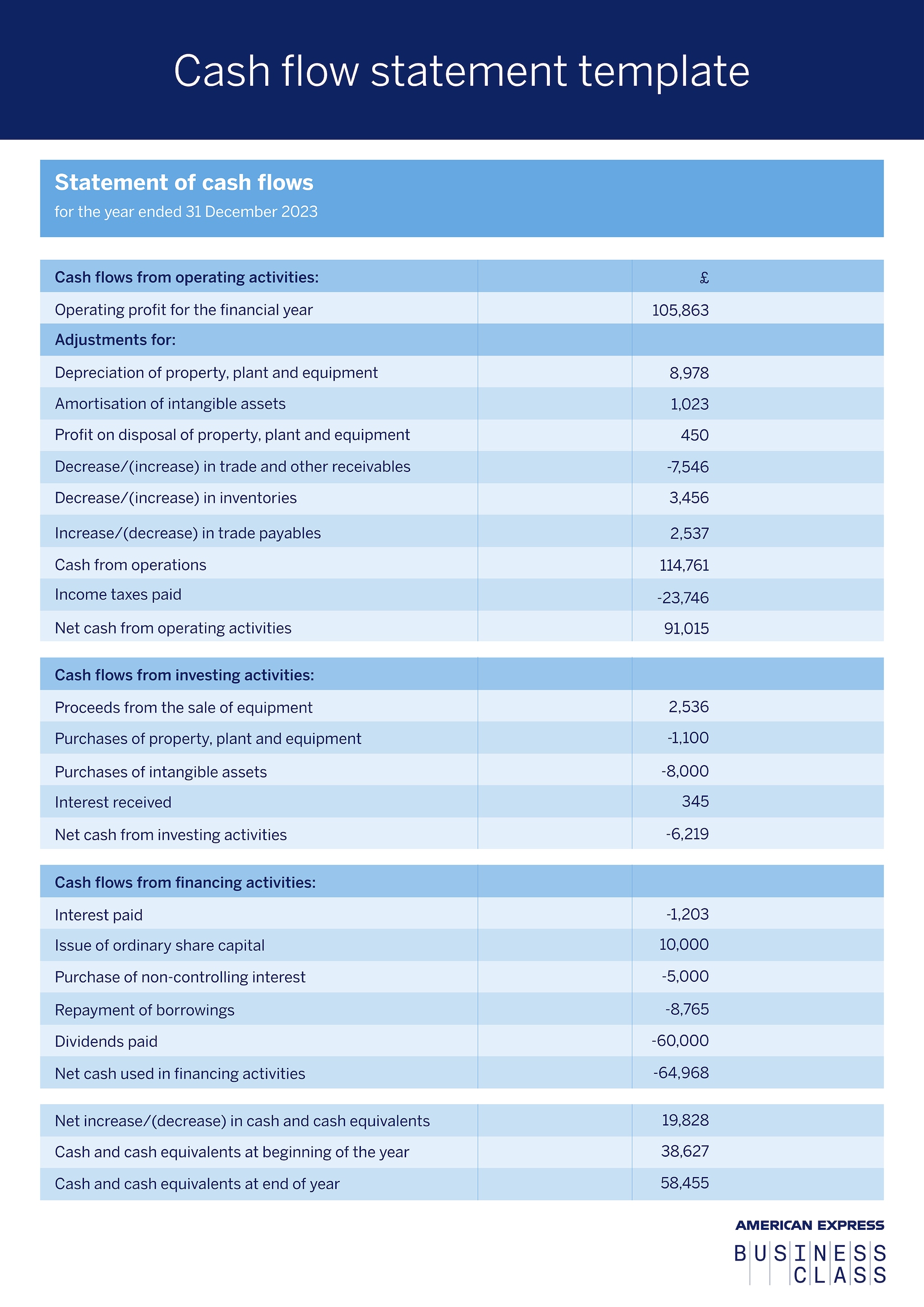

The main difference between a profit and loss statement and a cash flow statement is that a profit and loss statement measures the profitability of the business model while a cash flow statement shows where your money is coming from, where it's going, and how much cash you actually have on hand at a given point in time. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. Revenues and expenses appear based on when cash actually moves into and out of your bank account.

Since the cash flow statement measures sources of cash and its uses, you can see how your cash flow moves throughout the month and year. Profit and loss (p&l) statements are one of the three financial statements used to assess a company’s performance and financial position. The p&l statement shows your profits and losses.

Depreciation flows out of the balance sheet from property plant and equipment (pp&e) onto the income statement as an expense, and then gets added back in the cash flow statement. However, heavy investing can reduce your cash. The difference between cash flow and profit.

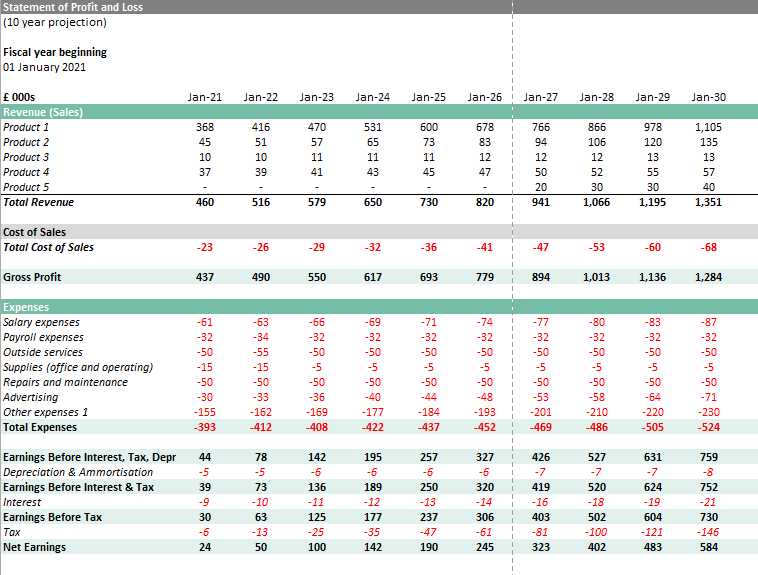

The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. Revenues and variable expenses appear based on the invoice date, not when payments are made or received. Updating your profit and loss statement helps you check in on the health of your business.

Together, alongside the cash flow statement (cfs) and balance sheet ( b/s ), the p&l statement provides a detailed depiction of the financial state of a company. The p&l statement is one of three financial. Mindset of an investor 00:04:21 3.

The connection between balance sheet, p&l statement and cash flow statement zerodha varsity 323k subscribers subscribe subscribed 533 46k views 2 years ago complete guide to fundamental. The p&l and cash flow statements for u.s. Whilst a profit and loss may show that you’re profitable, a cash flow forecast might show that you’re.

Profit and loss statement vs cash flow statement. A p&l budget will show you whether or not you’re profitable but a cash flow forecast will show you how much cash is available to you. One of three main financial statements — along with the balance sheet and the cash flow statement — the p&l includes a business’s revenue, expenses, and net income, among other key financials, for a given accounting period.

For example, growing profits on your p&l statement may provide the cash flow to purchase more assets that appear on your balance sheet. How bench can help. A p&l (profit and loss) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period

A p&l statement provides information about whether a company can. What does p&l mean? Fundamental analysis (video series) 1.

:max_bytes(150000):strip_icc()/AppleCFSInvesto2-6a84aed790a5476abbc3ef04b1718106.jpg)