Unique Tips About Vat Receivable In Balance Sheet Income Tax On Cash Flow Statement

The vat collected from customers is recorded as a liability on the company's balance sheet until it is remitted to the tax authority.

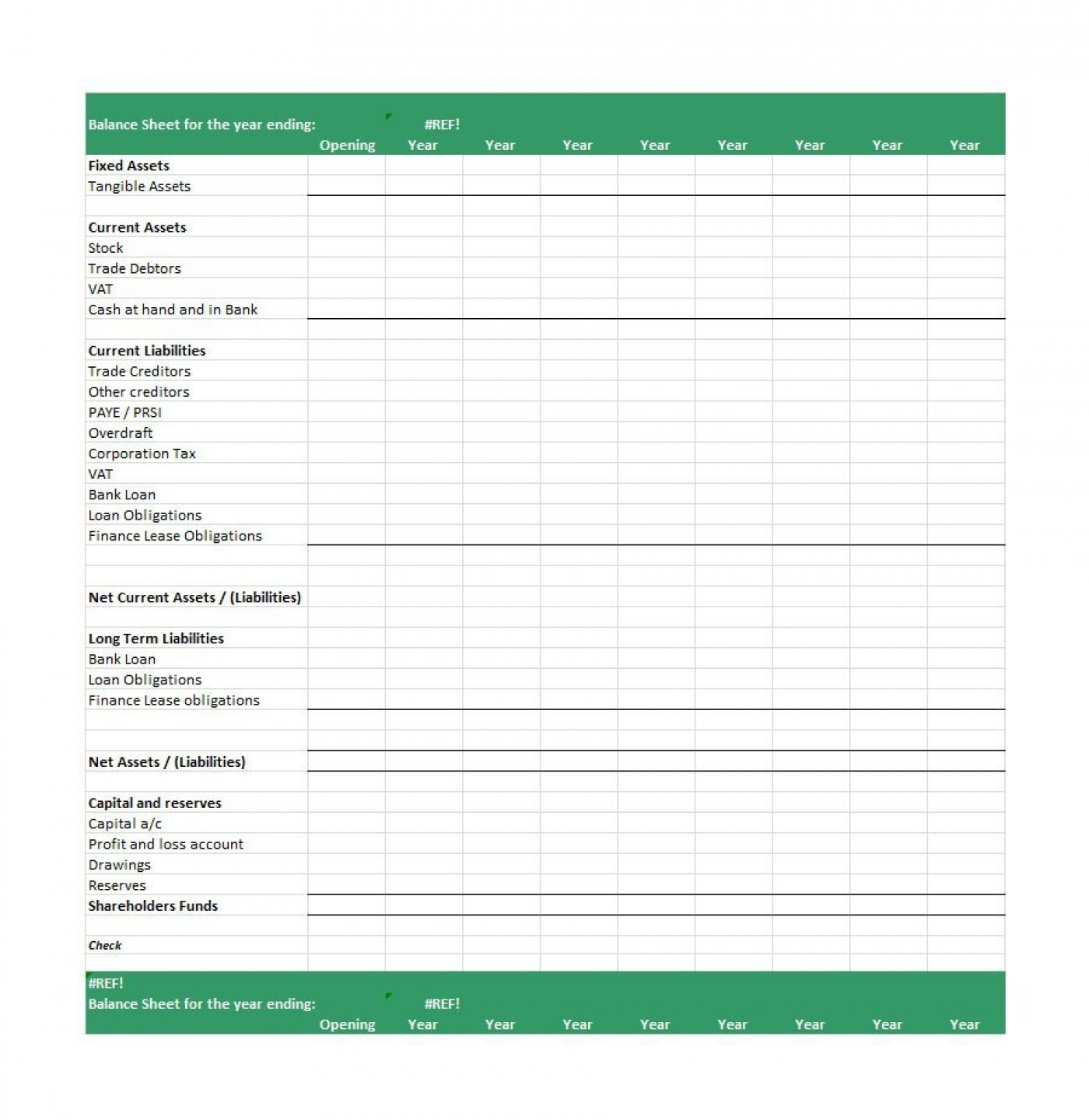

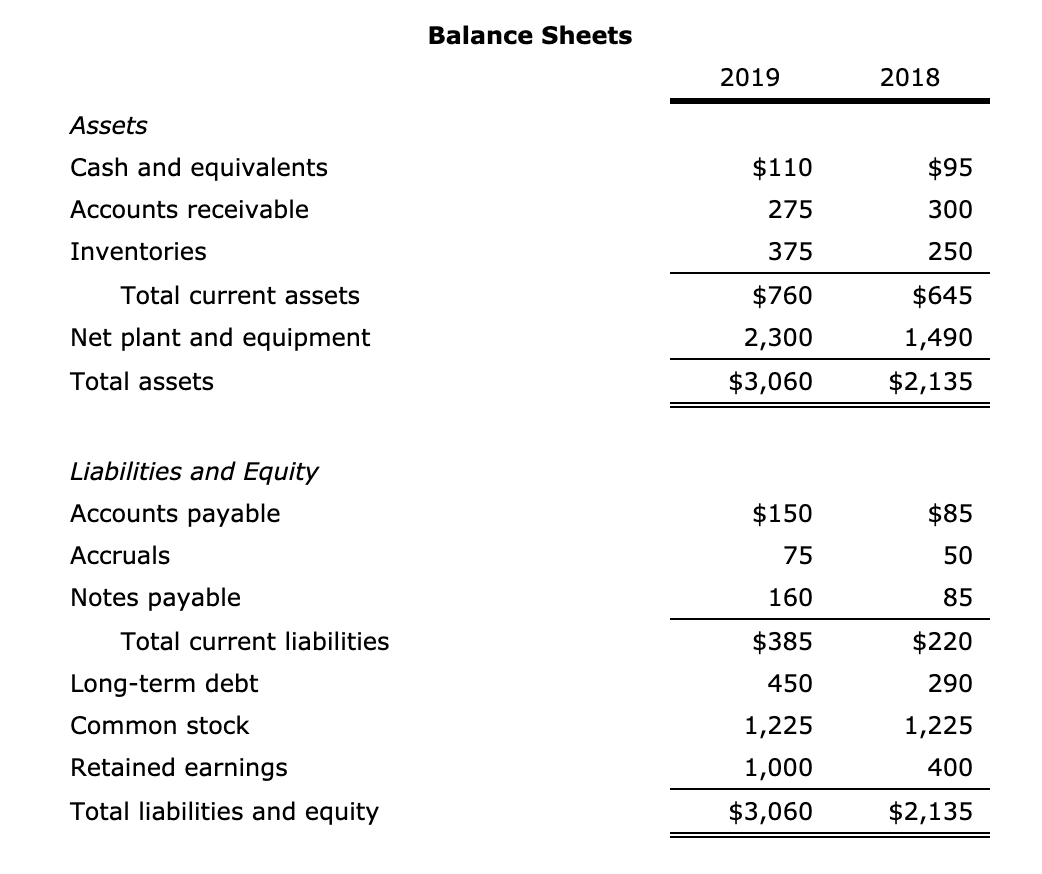

Vat receivable in balance sheet. We must pay the difference and deduct the balance to zero. Vat payable is the liability on the balance sheet. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

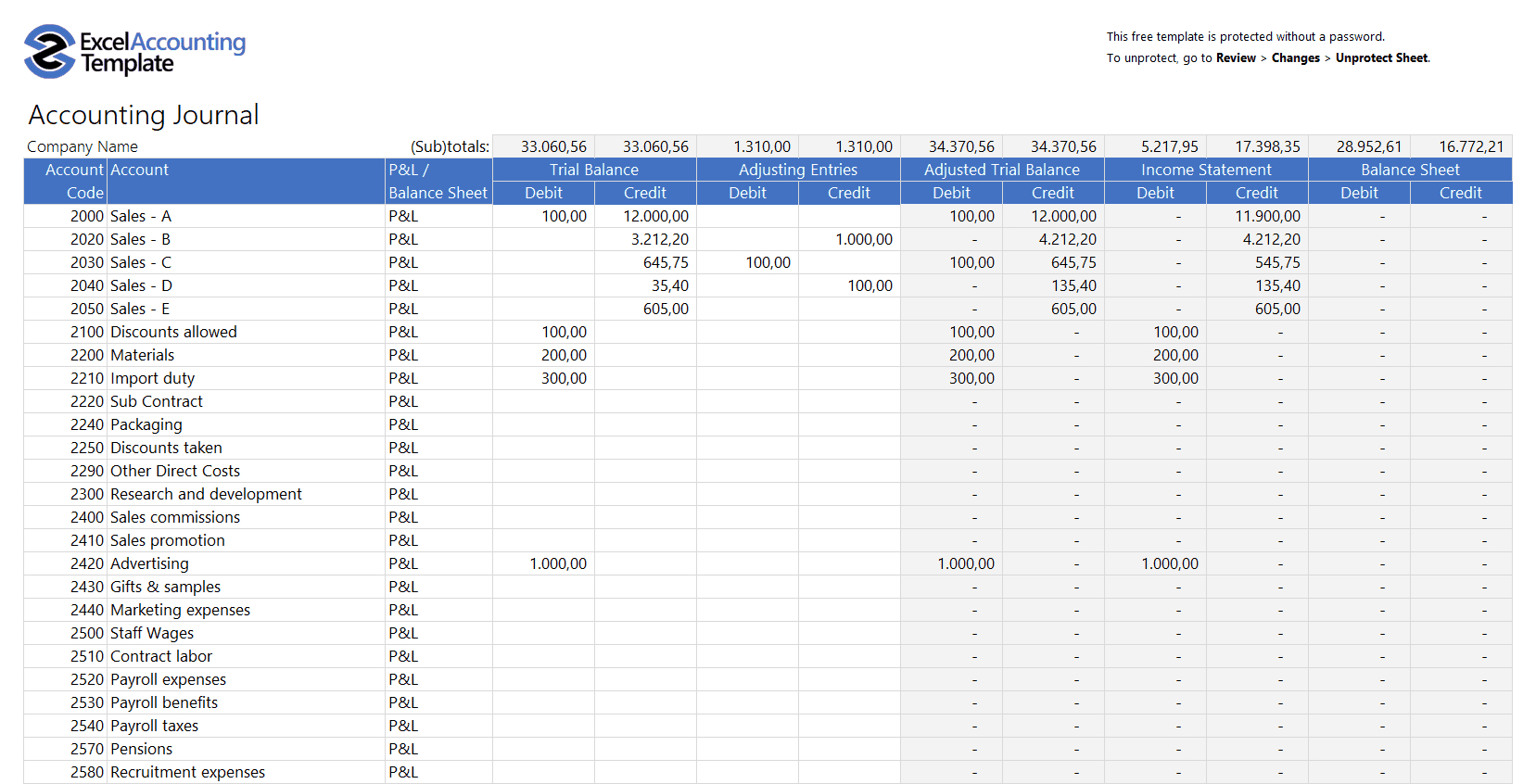

9 subsequent valuation of accounts receivable • receivables are measured at amortized cost in accordance with. If cash is received after revenues are recognized, it's usually recorded as an accounts receivable. Vat stands for value added tax and for those entities that are registered into the scheme they add a percentage (now at 20%) to each sale, in exchange for the capacity to claim.

This fact sheet explains the secretariat’s views on the classification of vat based on the principles in grap 104. For modeling purposes, if the cash is generally received within the same. I am finalizing the accounts of a company to whom at the end of the financial year hmrc was owing tax.

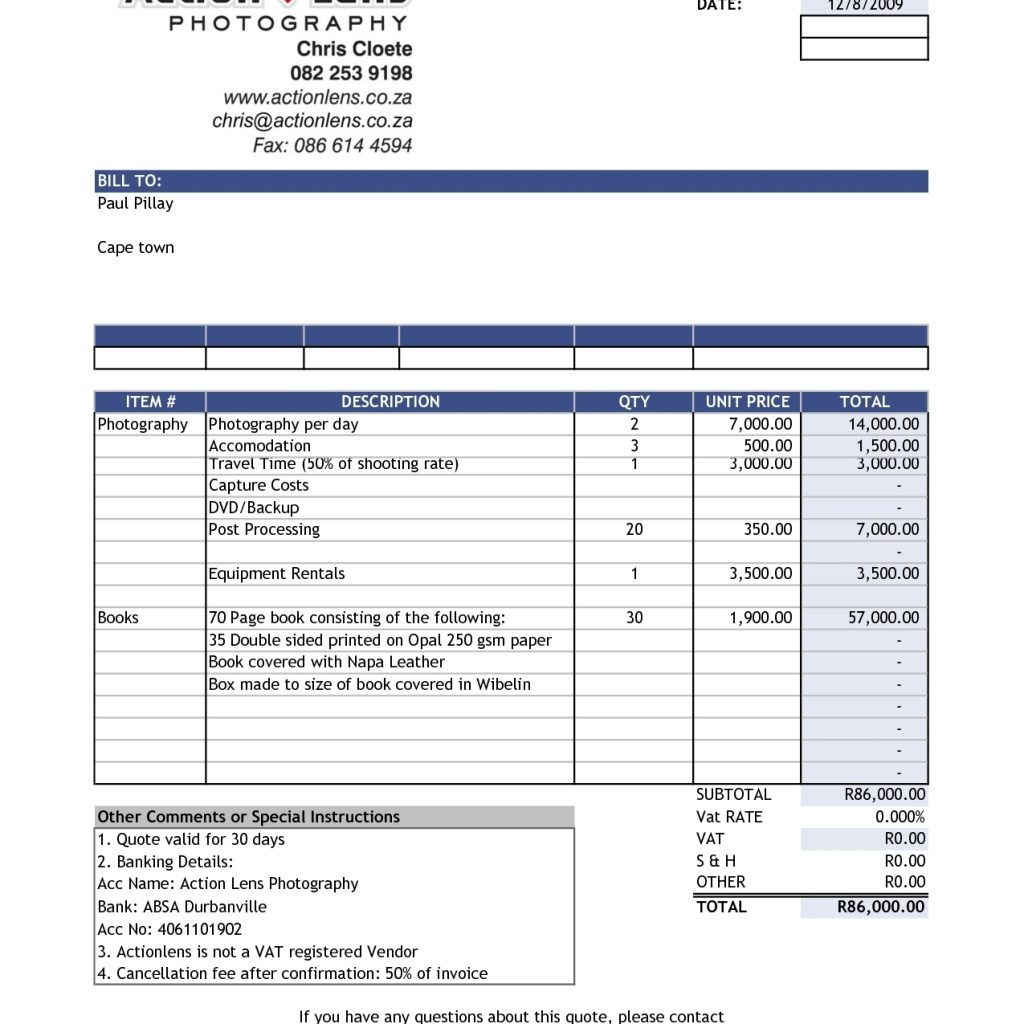

When the company makes a payment to the tax authority, it will impact the vat payable and cash balance. Trade receivables and other receivables in the balance sheet. Vat credit receivable (capital goods)a/c dr.

Value added tax (vat) is an indirect tax which is charged on the supply of taxable goods and rendering of taxable services. If a company has delivered products or. Trade and other receivables are categorized or classified as current assets on the company’s balance.

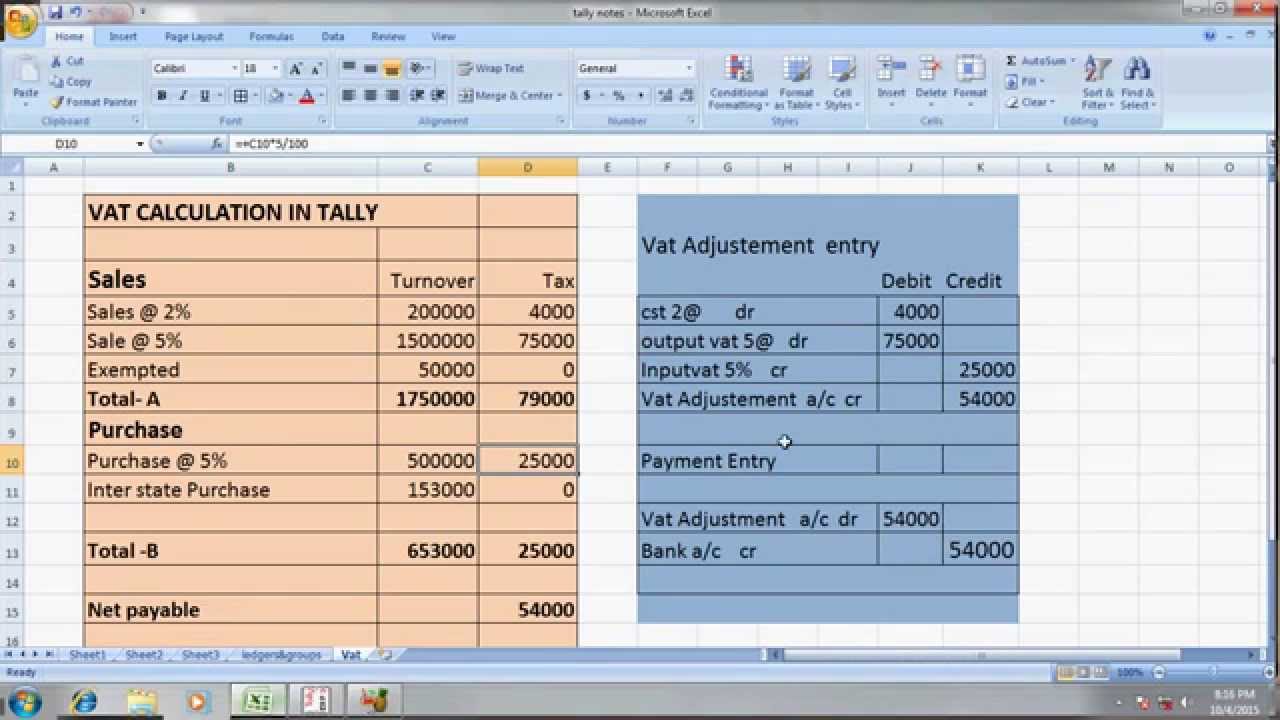

Understanding vat is a step in the right direction for any business with vat obligations. If the vat output > vat input: 1,000 to bank/ creditors 26,000 (being machinery purchased) any balance in the vat credit receivable (capital goods)at the.

It is money owed to a company from the sale of its goods or services to. May 11, 2005 part i: The company will require to calculate the vat pay 1.

Now that you have the amount of vat receivable and vat received then you can calculate how much vat is paid and not refunded during construction. Vat liability is any money owed to hm revenue and. What is value added tax (vat)?

Vat and balance sheet: As fixed assets age, they begin to lose their value. This is because a vat.

Accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. Accounts receivable is one of the most important line items on a company's balance sheet.

:max_bytes(150000):strip_icc()/accounts-receivables-on-the-balance-sheet-357263-final-911167a5515b4facb2d39d25e4e5bf3d.jpg)