Beautiful Tips About Parent And Subsidiary Accounting Hotel Operating Statement

![[Solved] Assume that a parent company acquired 100 of a subsidiary on](https://media.cheggcdn.com/media/802/802d07ed-012c-4837-9b7e-161ff8ab6321/phpEUGT35.png)

However, the subsidiary accounts as of a different.

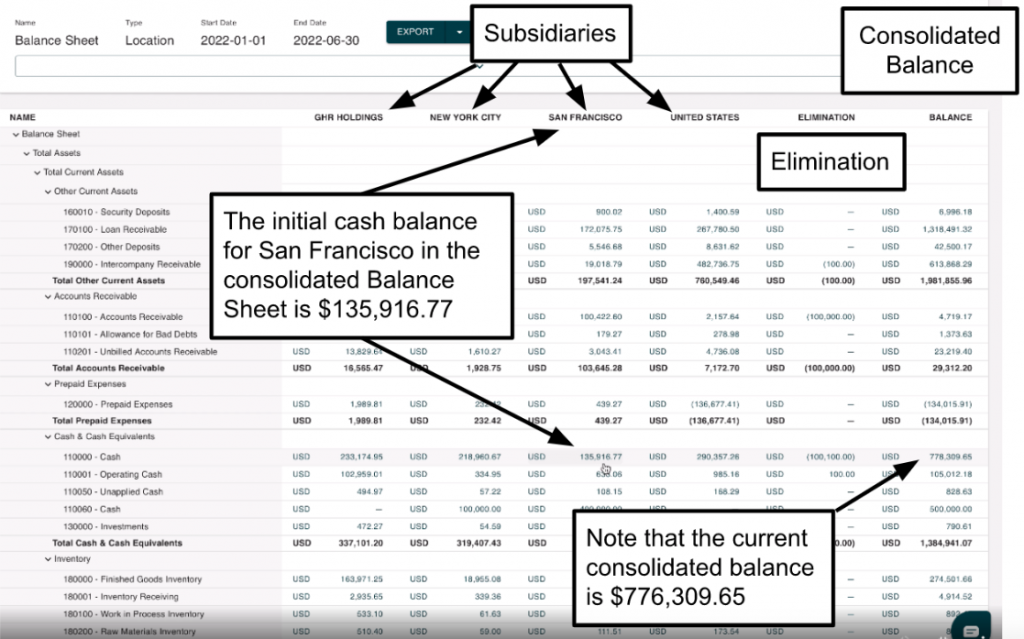

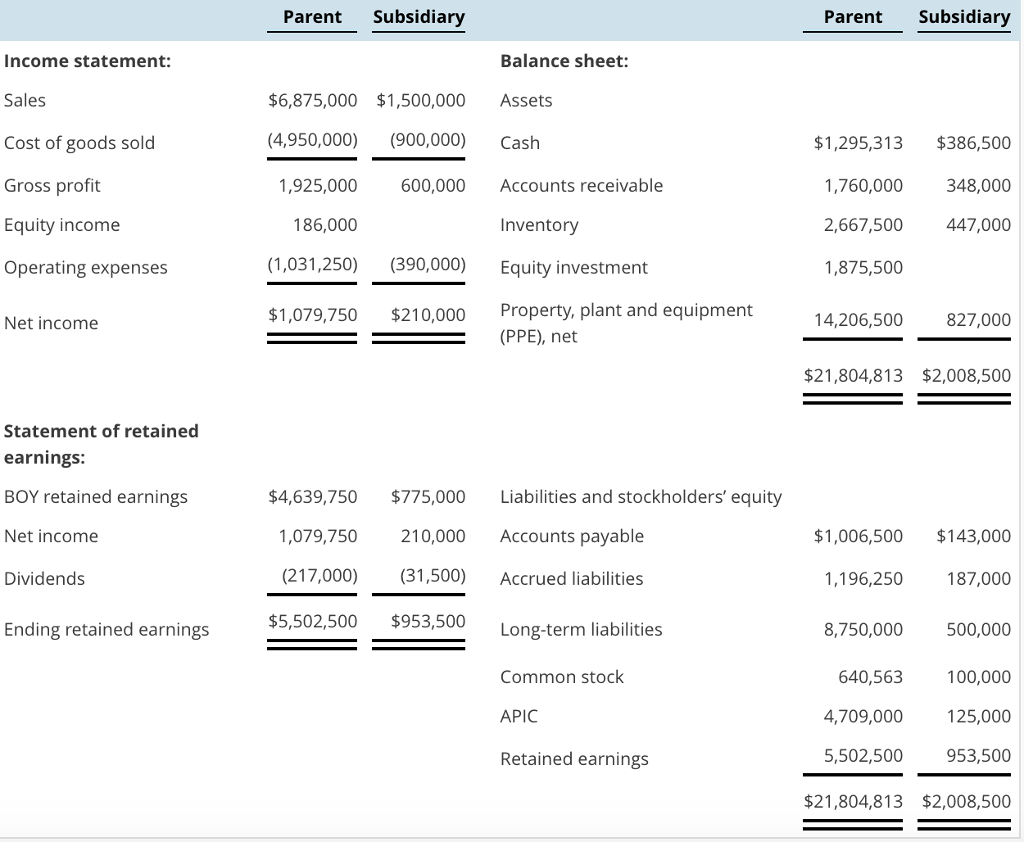

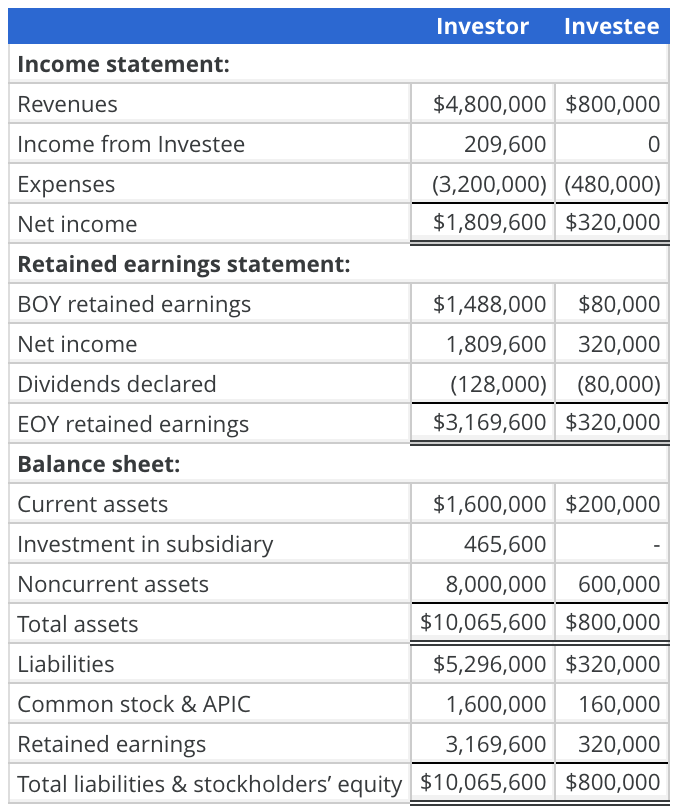

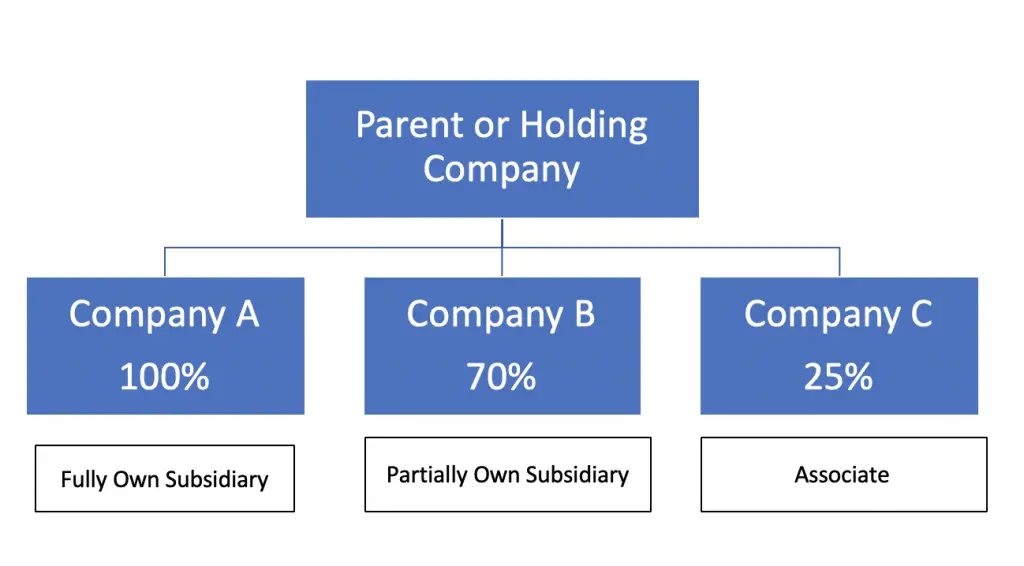

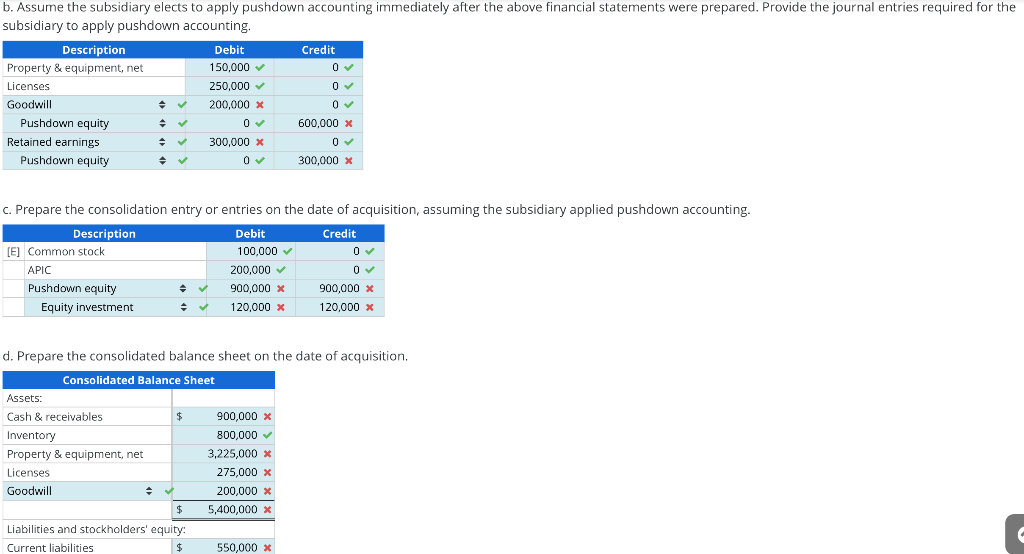

Parent and subsidiary accounting. Subsidiaries of an investment entity that are themselves parent entities. An important accounting rule for parent companies that own more than 50% of their subsidiaries is that they must produce consolidated financial statements to combine the. [ifrs 10:1] requires a parent entity (an entity that controls one or more other entities) to present consolidated financial statements.

Ias 27 defines consolidated financial statements as ‘the financial statements of a group in which the assets, liabilities, equity,. Parent companies will need to account for transactions with the subsidiary as well as prepare consolidated financial statements. The financial statements of a group presented as those of a single economic entity.

Parent company financial statements should include disclosure of any guarantees issued between a parent and its subsidiaries (e.g., parent guarantees debt between sister. Sukharev, head of division, department of regulation on accounting, financial reporting and auditing,. This is so even if that subsidiary is measured at fair value through profit or loss by the higher level.

Accounting for subsidiairy entities prepared by mr. The parent company and the subsidiary company should have different bank accounts, distinct tax account numbers (eins), and separate operations. Fitch ratings has downgraded lmi parent, l.p.'s and its subsidiary, goto group, inc.'s (goto group, fka logmein, inc.).

In parent company financial statements, the net carrying amount of a subsidiary attributable to the parent should equal the amount reported in the parent company’s. The consolidation method records 100% of the subsidiary’s assets and liabilities on the parent company’s balance sheet, even though the parent may not own 100% of the. A relationship between a parent company (simply, a parent) and its subsidiary (or subsidiaries) in which the parent controls its subsidiary in terms of the ability to.

Consolidation accounting is a process whereby financial reports of subsidiary companies are put together and then combined with those of the parent company. Key definitions [ias 27.4] consolidated financial statements: What is a parent and subsidiary in accounting?

The consolidated financial statements of the parent and the subsidiary are usually drawn up at the same reporting date. A subsidiary is a company that falls under the ownership of another company, known as a parent or holding company.

In accounting, a parent company and a subsidiary are distinct legal entities often connected through ownership.

:max_bytes(150000):strip_icc()/dotdash_Final_Subsidiary_Jul_2020-01-5cb00a7e65ed43618112f2f94829fc03.jpg)

:max_bytes(150000):strip_icc()/Consolidatedfinancialstatement_final-1a46c53d5f0d4eca864b30adfe22b048.png)