Build A Info About Debit Credit In Balance Sheet Annual Report Notes

Credit balance examples it is generally found in the assets and expenses ledgers;

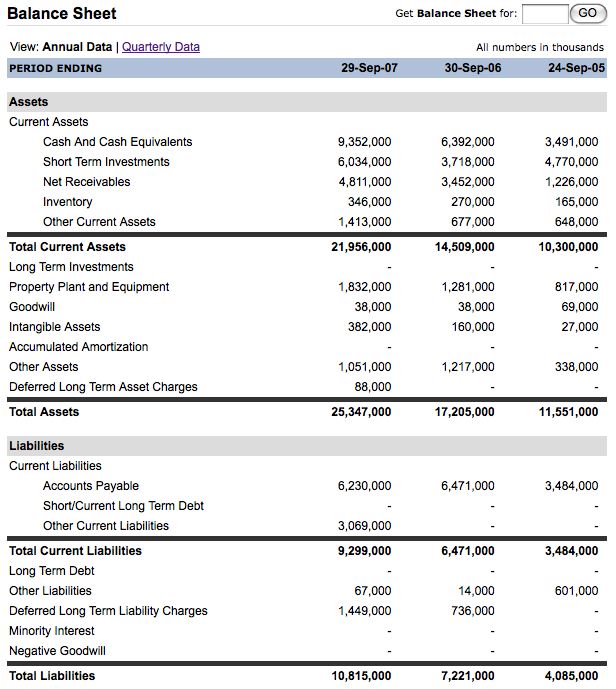

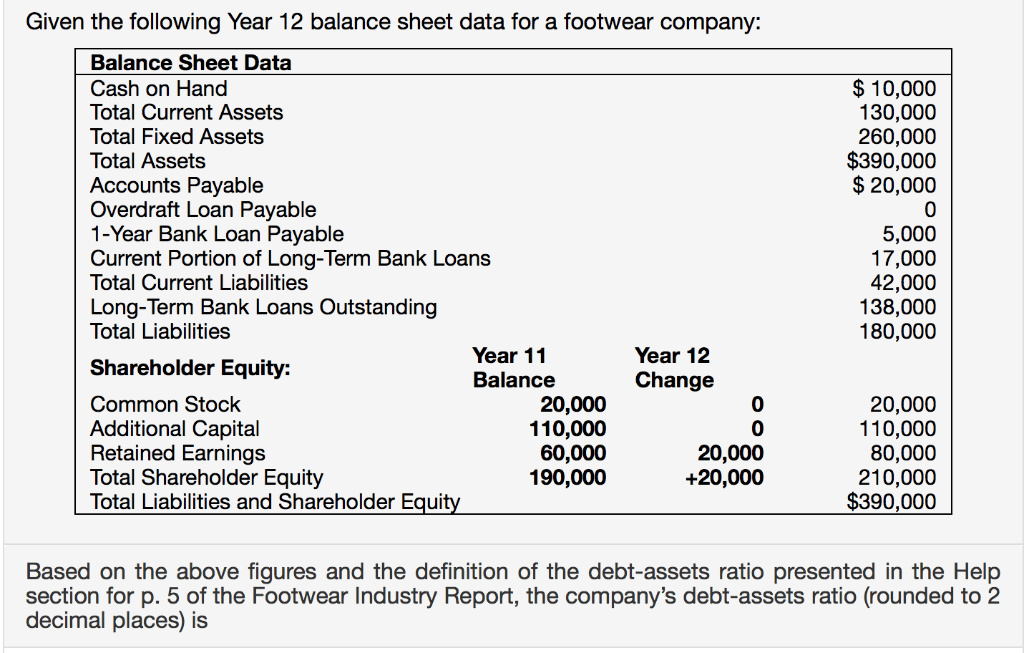

Debit credit in balance sheet. Assets = liabilities + equity What are the five rules of debits and credits? Consider which debit account each.

What are debits and credits on the balance sheet? Here the double entries are: The reason for this seeming reversal of the use of debits and credits is caused by the underlying accounting equation upon which the entire structure of accounting transactions are built, which is:

When recording a transaction, every debit entry must have a corresponding credit entry for the same dollar amount, or vice. The balance sheet formula (or accounting equation) determines whether you use a debit vs. A balance sheet is based on the foundational accounting equation of:

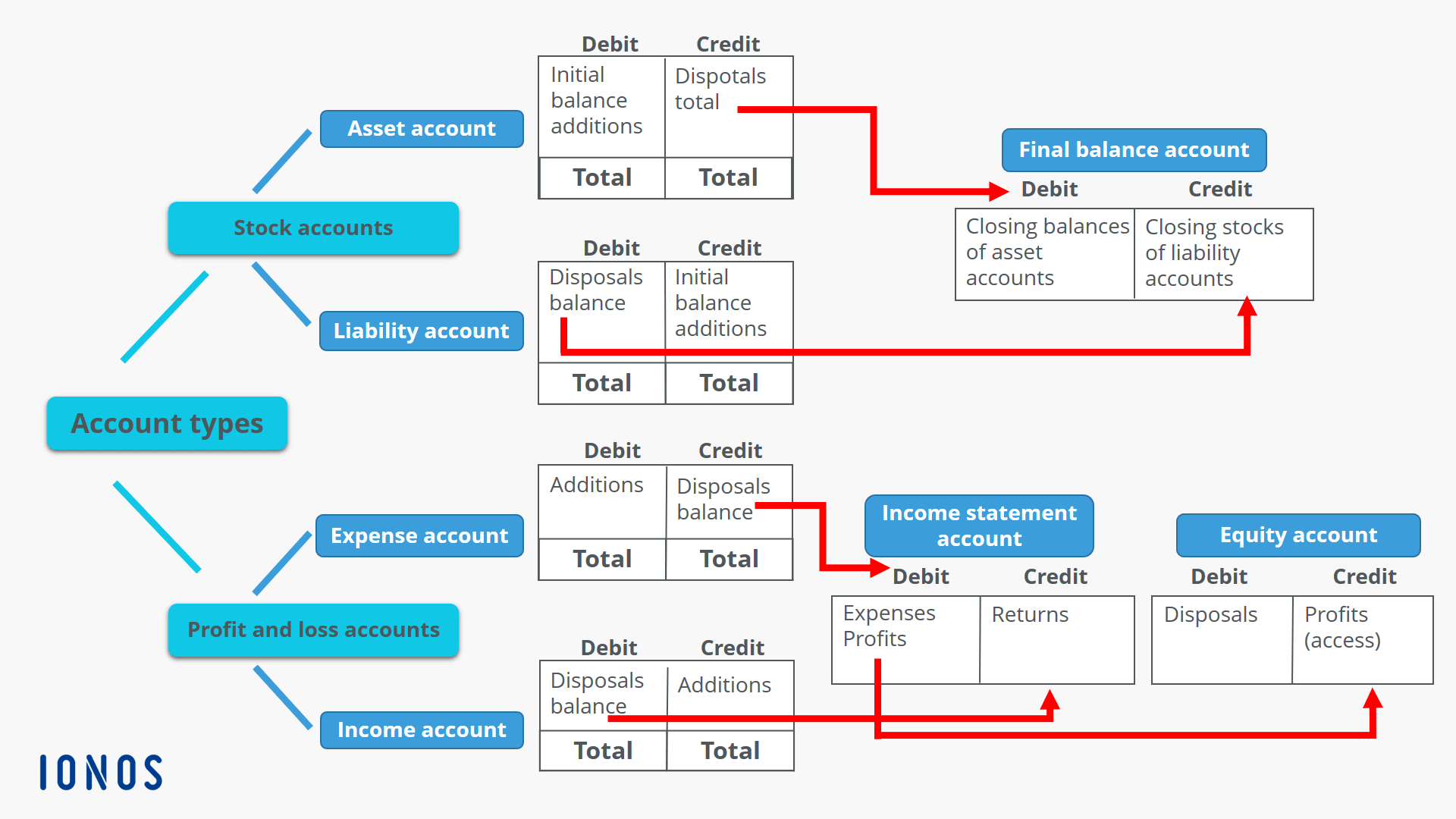

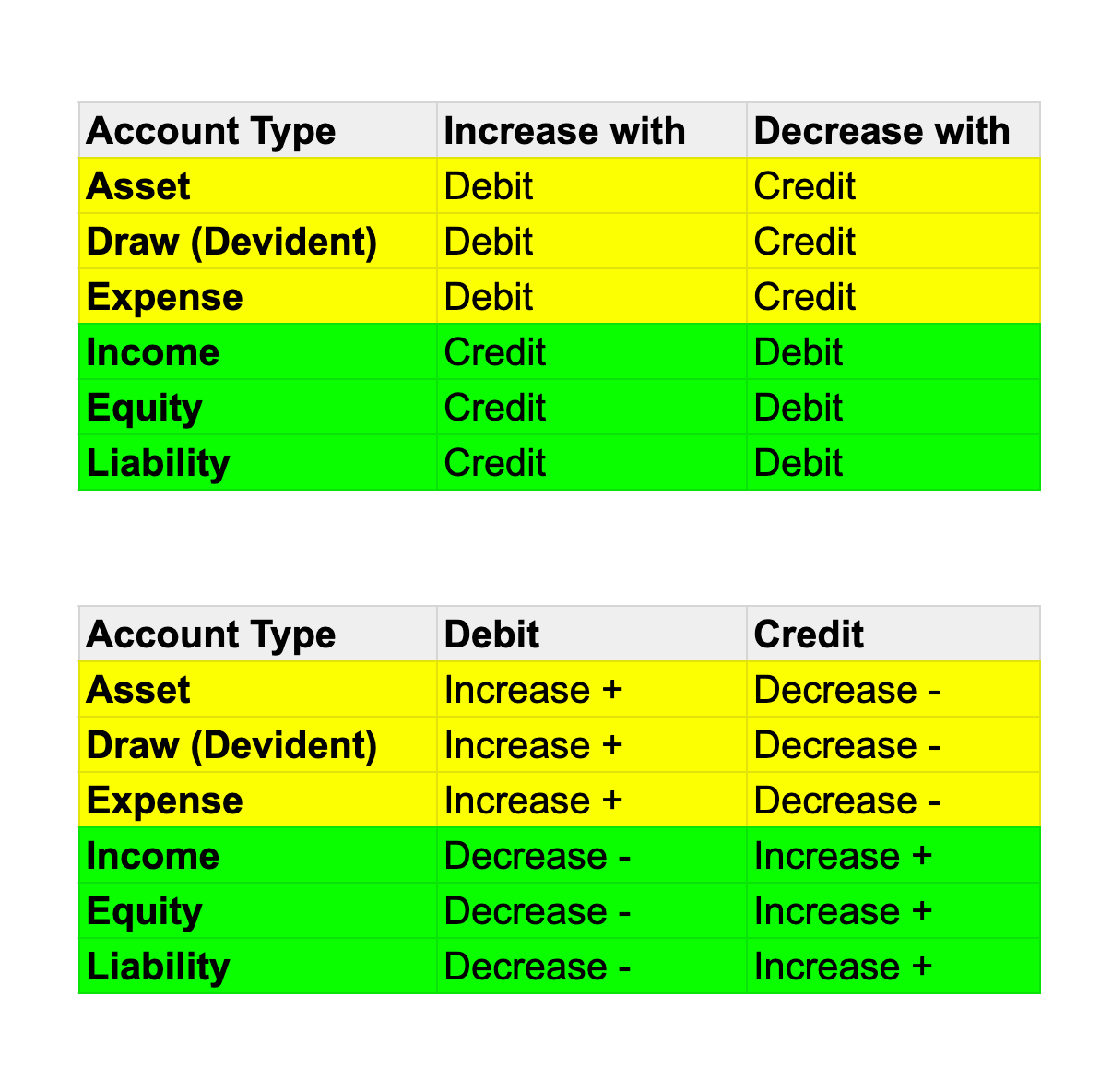

Whether a debit or credit can either increase or decrease an overall account balance is determined by the account type that is receiving the credit or debit transaction. The easiest way to remember the meaning of debit and credit in accounting is as follows: The difference between debit and credit.

We will now return to the format of the balance sheet and the basic accounting equation: The statement balance is the total amount you. The format of the basic accounting equation can help you understand the normal or expected balances for.

A debit is an accounting entry that results in either an increase in assets or a decrease in liabilities on a company’s balance sheet. Debits increase the value of asset, expense and loss accounts. Debit and credit cards both offer ease of use and protection against unauthorized transactions.

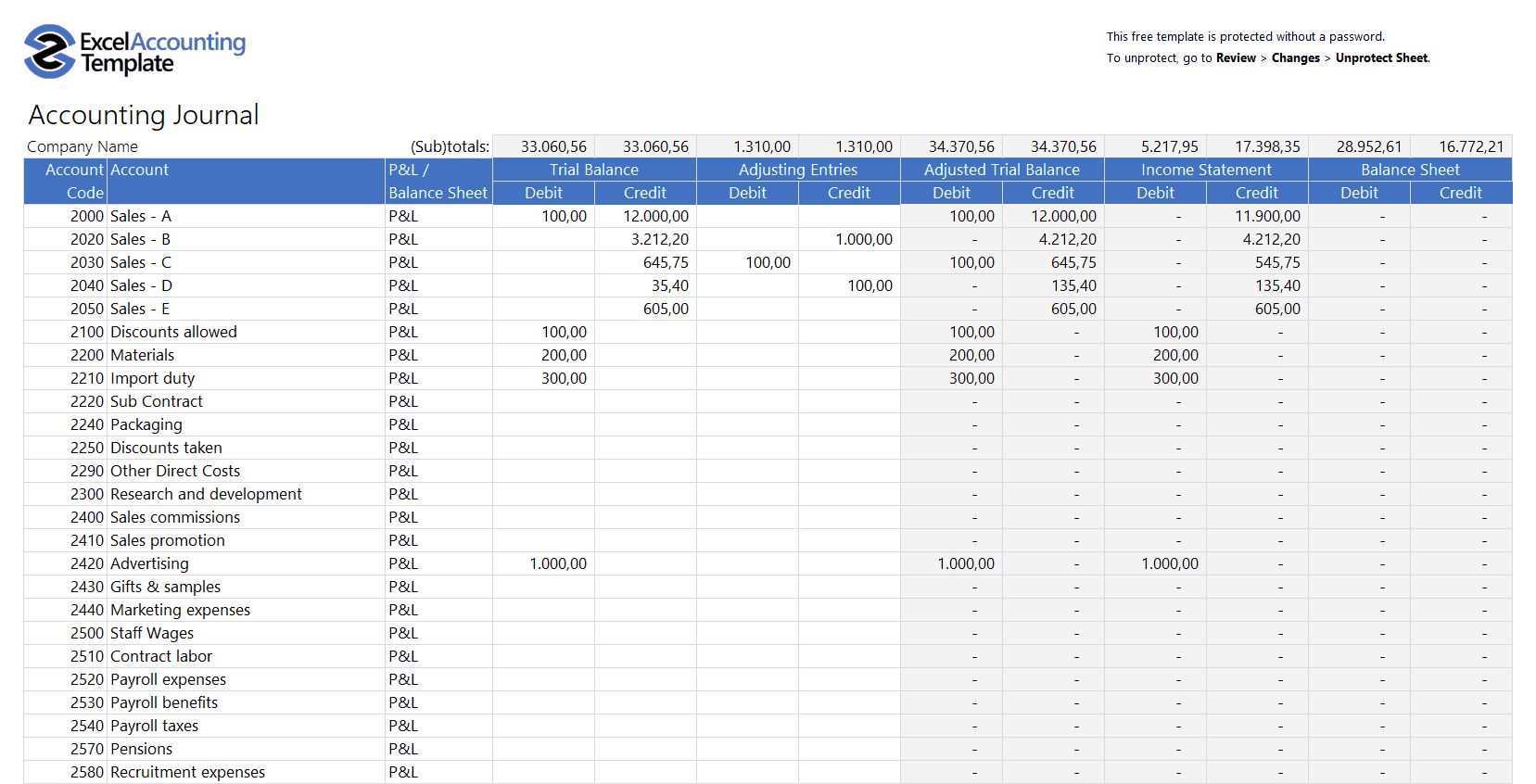

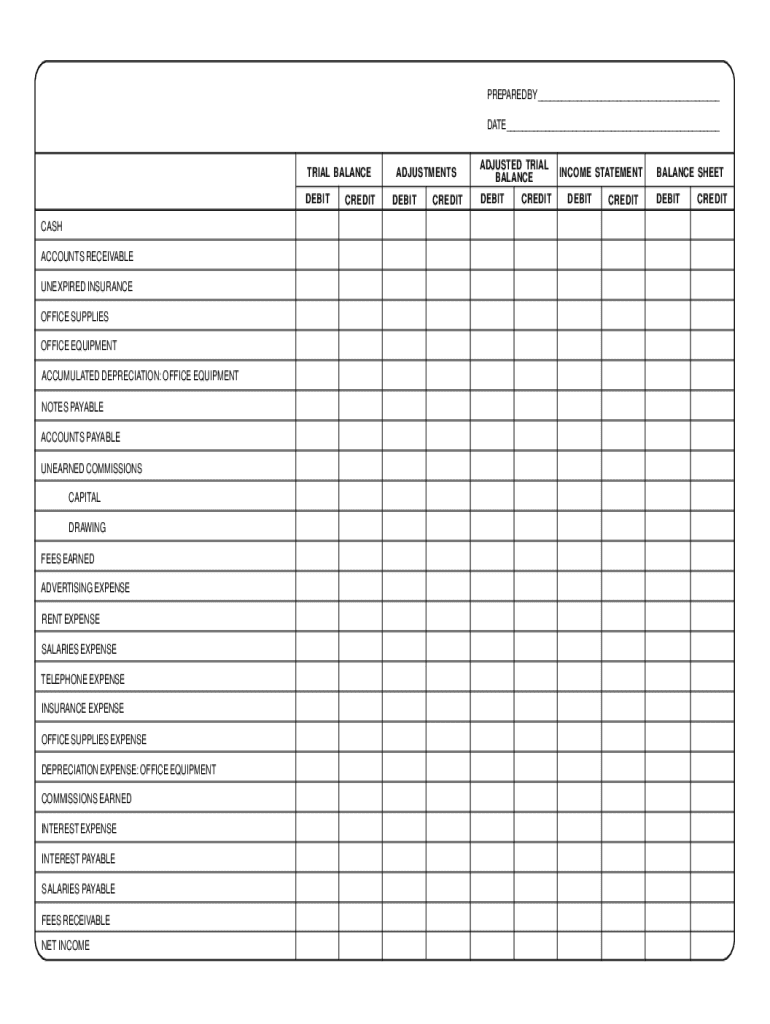

The amount in every transaction must be entered in one account as a debit (left side of the account) and in another account as a credit (right side of the account). Cash account above example shows the debit balance in the cash account (by balance c/d) which is shown on the credit side. To begin, enter all debit accounts on the left side of the balance sheet and all credit accounts on the right.

Debits and credits are terms used by bookkeepers and accountants when recording transactions in the accounting records. Normal debit and credit balances for the accounts. Debits and credits are used in a company’s bookkeeping in order for its books to balance.

In this context, debits and credits represent two sides of a transaction. Before making your next purchase, compare the pros and cons of using a debit vs credit card to determine which is best for your situation. The balance sheet is one of the three basic financial statements that every owner analyses to make financial decisions.

Fact sheets published by the irs in 2023. How to reconcile debits and credits in excel? The same is true for a credit.