Cool Info About Adjusting Entry For Interest Payable Sole Trader Financial Statements

![[Solved] Help due tonight Interest Payable Accrual Adjustments (pages](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/07/29060811/Accrued-Interest-Journal-Entries.jpg)

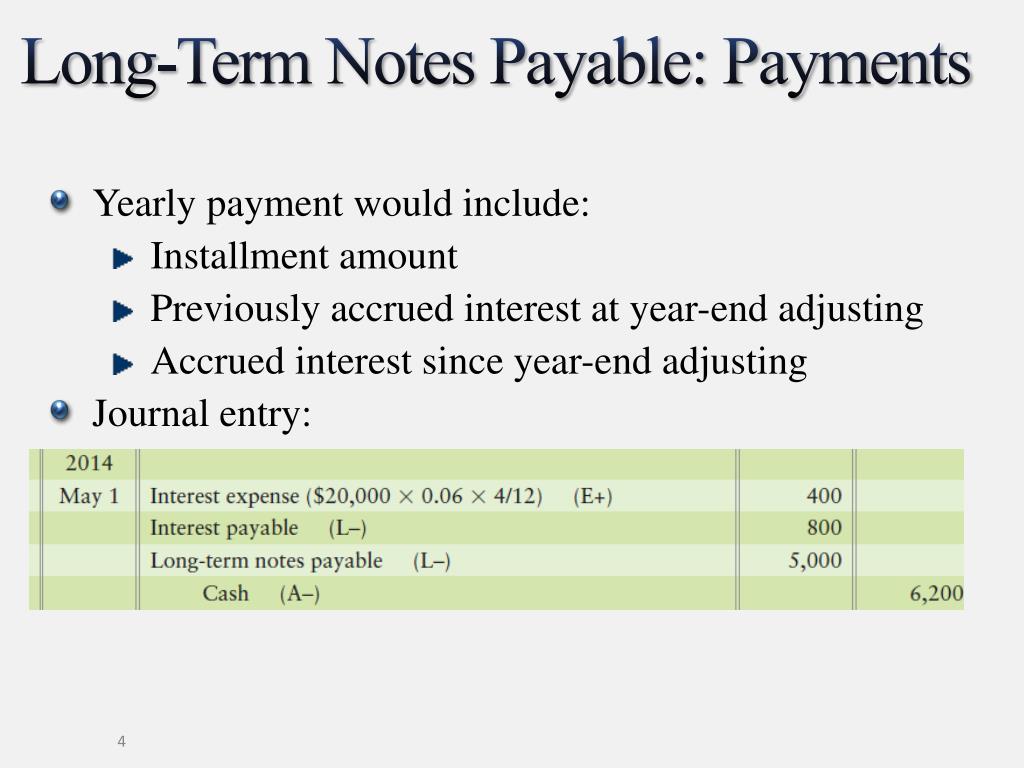

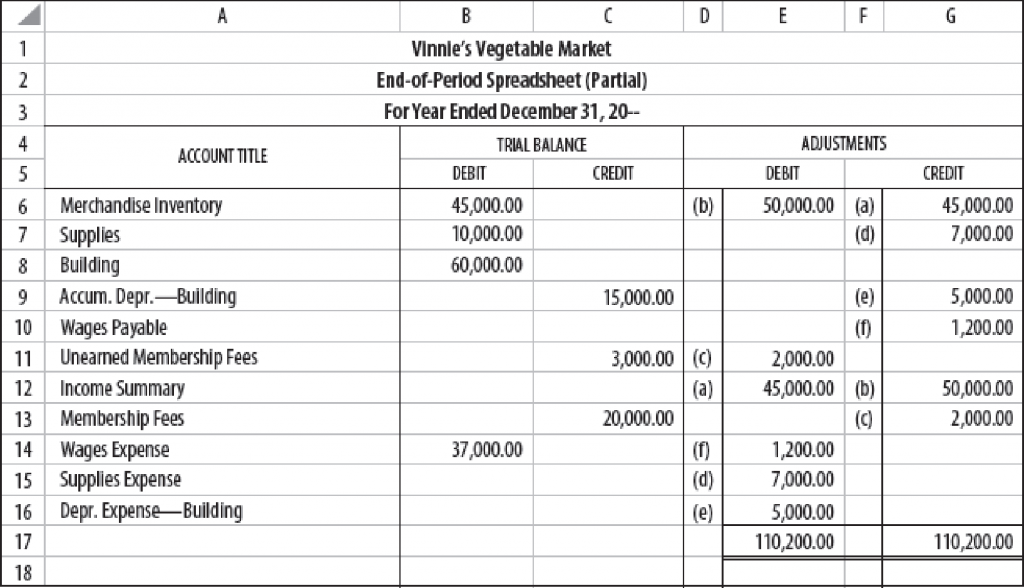

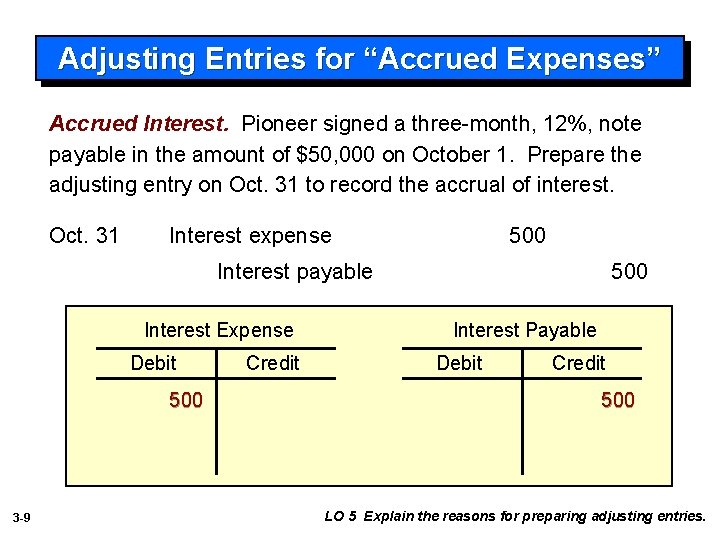

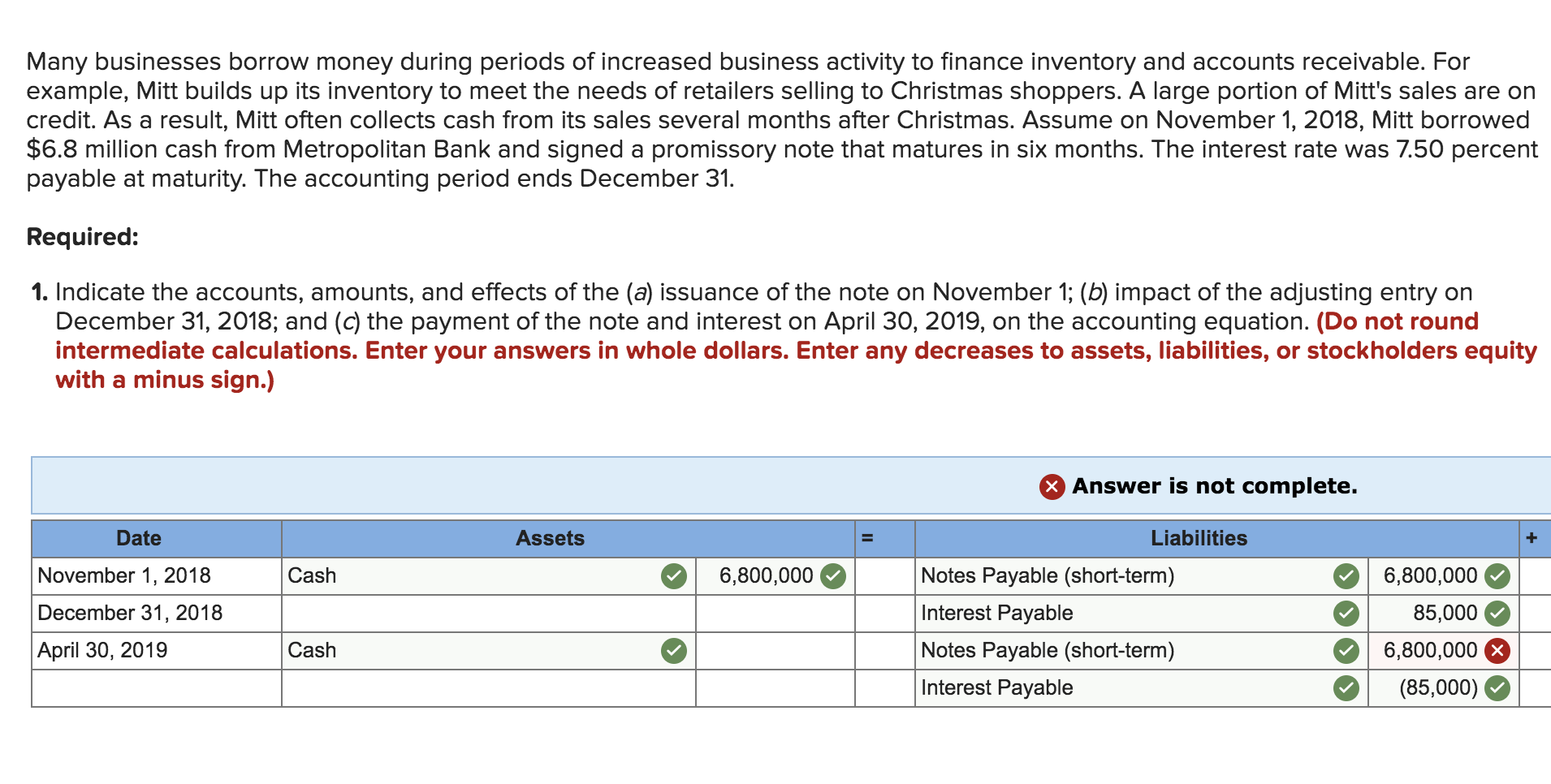

The adjusting entry will debit interest expense and credit interest payable for the amount of interest from december 1 to december 31.

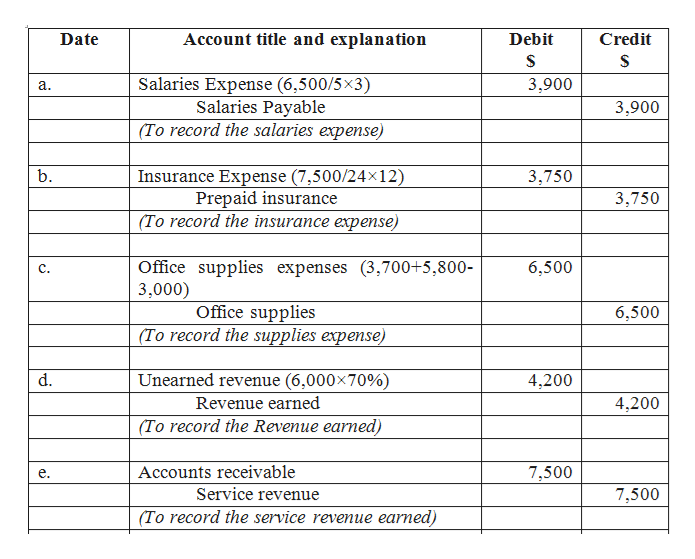

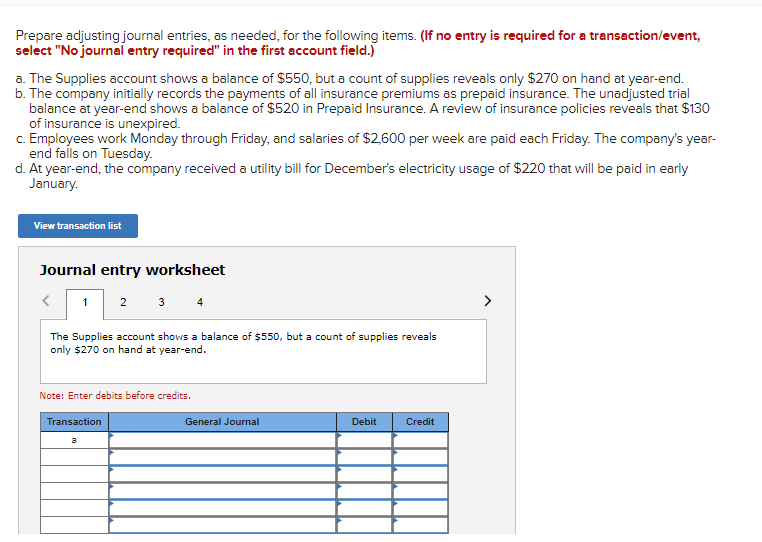

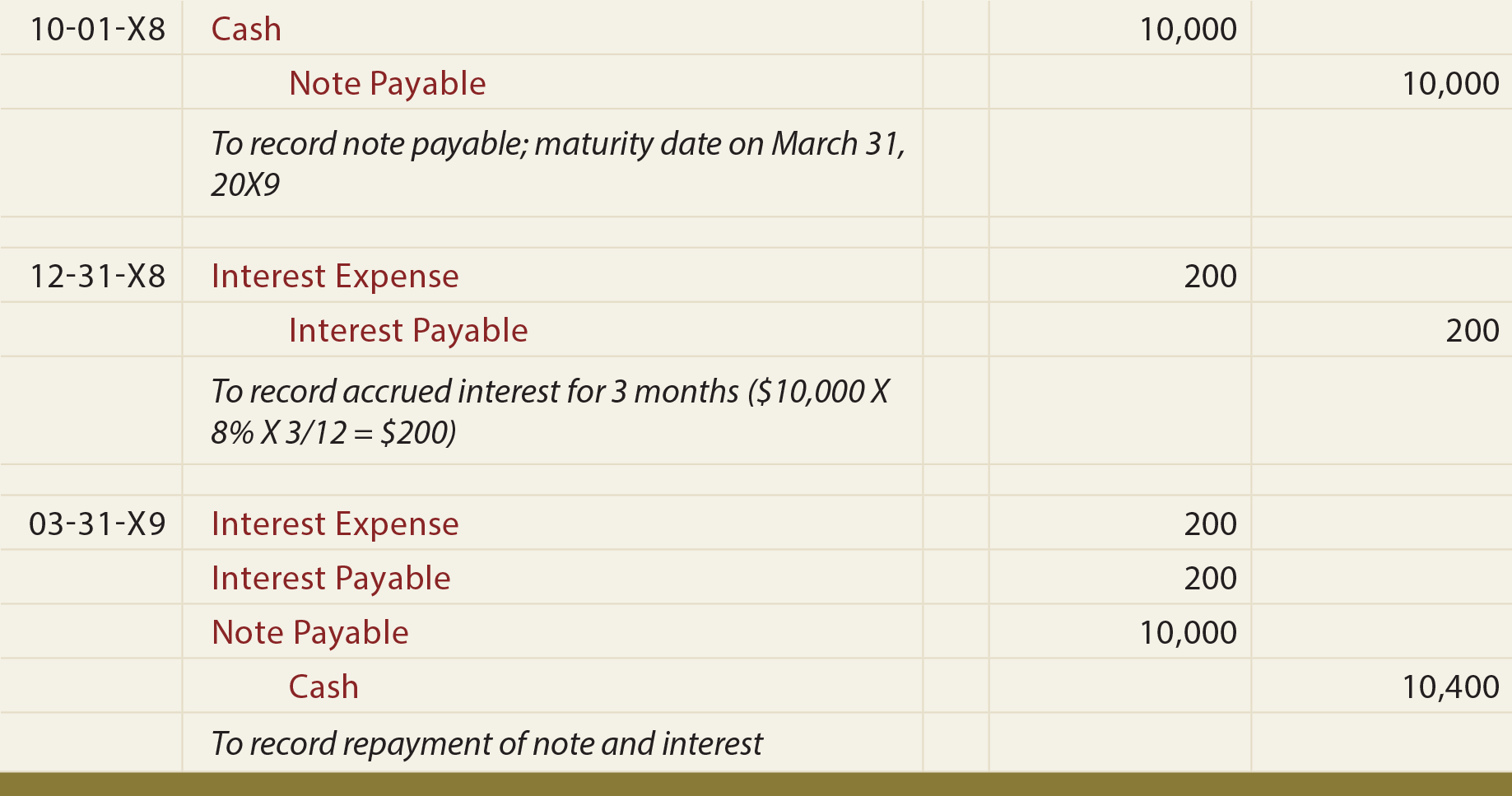

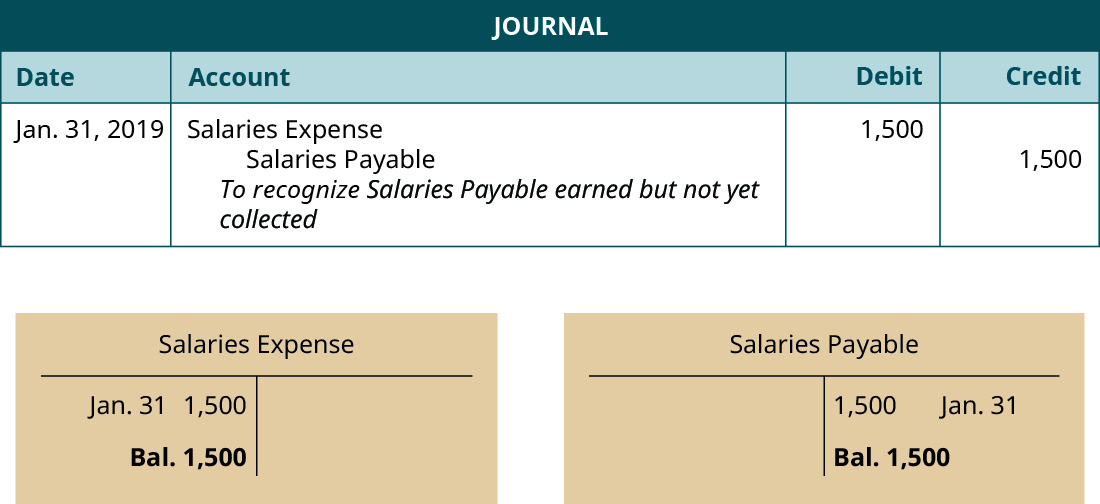

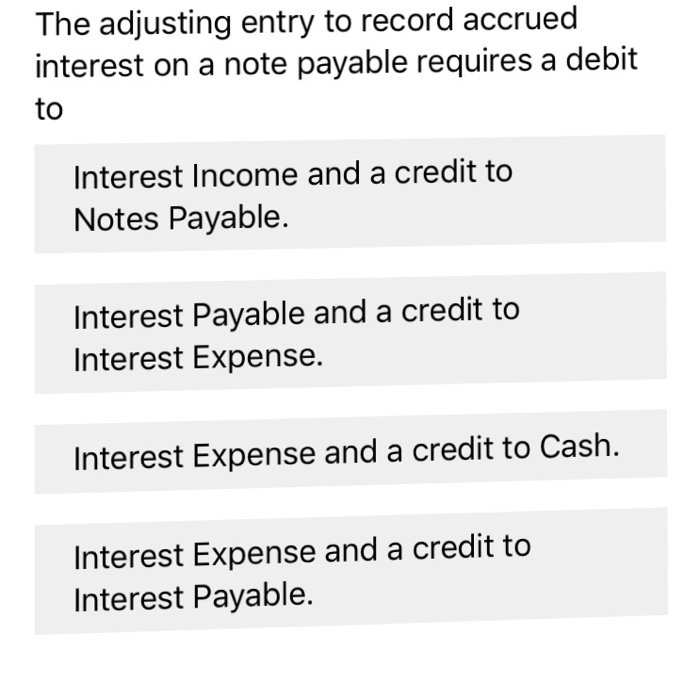

Adjusting entry for interest payable. When you accrue interest as a lender or borrower, you create a journal entry to reflect the interest amount that accrued during an accounting period. What is an adjusting journal entry? The adjusting entry for accrued interest consists of an interest income and a receivable account from the lender’s side, or an interest expense and a payable account from the.

This is a common and. We can make the accrued interest expense journal entry by debiting the interest expense account and crediting the interest. *appropriate expense account (such as utilities expense, rent expense, interest expense, etc.) **appropriate liability (utilities payable, rent payable, interest payable, accounts.

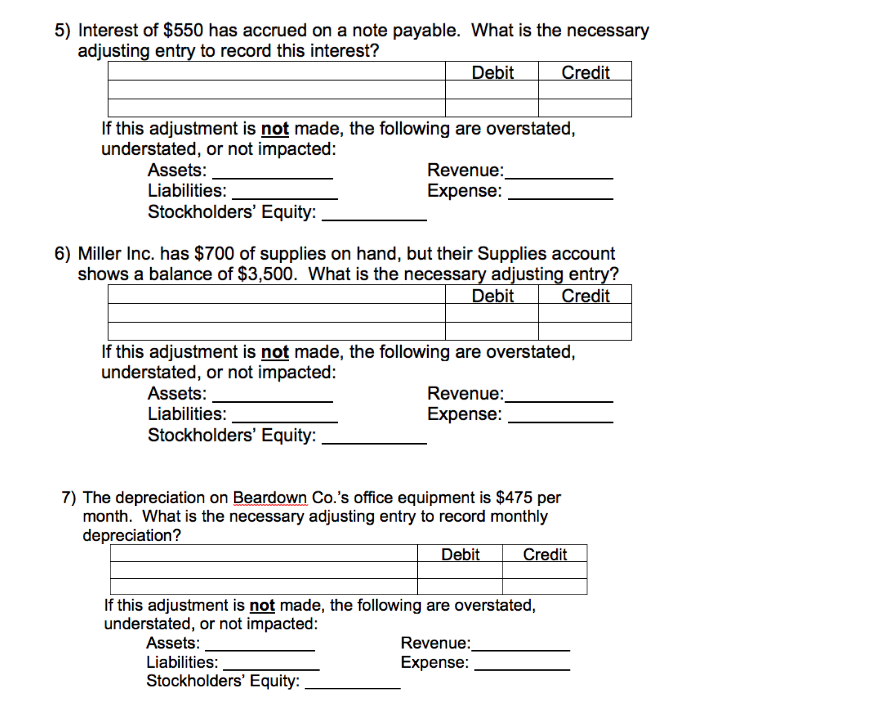

Interest payable is a liability account, shown on a company’s balance sheet, which represents the amount of interest expense that has accrued to date but has not been. An entry must show the amount of interest. An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is.

Adjusting entries are made at the end of an accounting period to account for items that don't get recorded in your daily transactions. The amount of interest recognized as accrued can be calculated by first dividing the number of days until the end of the month by the number of days in the. Divide $3,600 by 12 to get $300 in monthly interest.

Notes payable is a liability account that reports the amount of principal owed as of the balance sheet date. The answer is that the interest amount per month is $66.67. Another situation requiring an adjusting.

$500,000 × 15% × 1/12 = $6,250 The following are the updated ledger balances after posting the adjusting entry. Every adjusting entry will have at least one income statement account and one balance sheet account.

I = ($10,000) (0.08) (1/12). Adjusting entries to accrue the interest expense at the end of november and december 2020: The adjusting entry for an accrued expense updates the wages expense and wages payable balances so they are accurate at the end of the month.

(any interest incurred but not yet paid as of the balance sheet date is reported in a separate. As the notes payable usually comes with the interest payment obligation, the company needs to. Cash will never be in an adjusting entry.

As the amount of interest accumulated throughout the passage of time, the company needs to make the journal entry to account for interest payable at the period end adjusting. Either way, you will need an. Accrued interest expense journal entry.

On december 31 the money on deposit has earned one month’s interest of $600, although the company has not received the interest. To calculate the interest for this example, the equation reads: