Can’t-Miss Takeaways Of Info About Ifrs 16 Rules Cash Receipts From Customers Formula

[ ifrs 16 para 9 ].

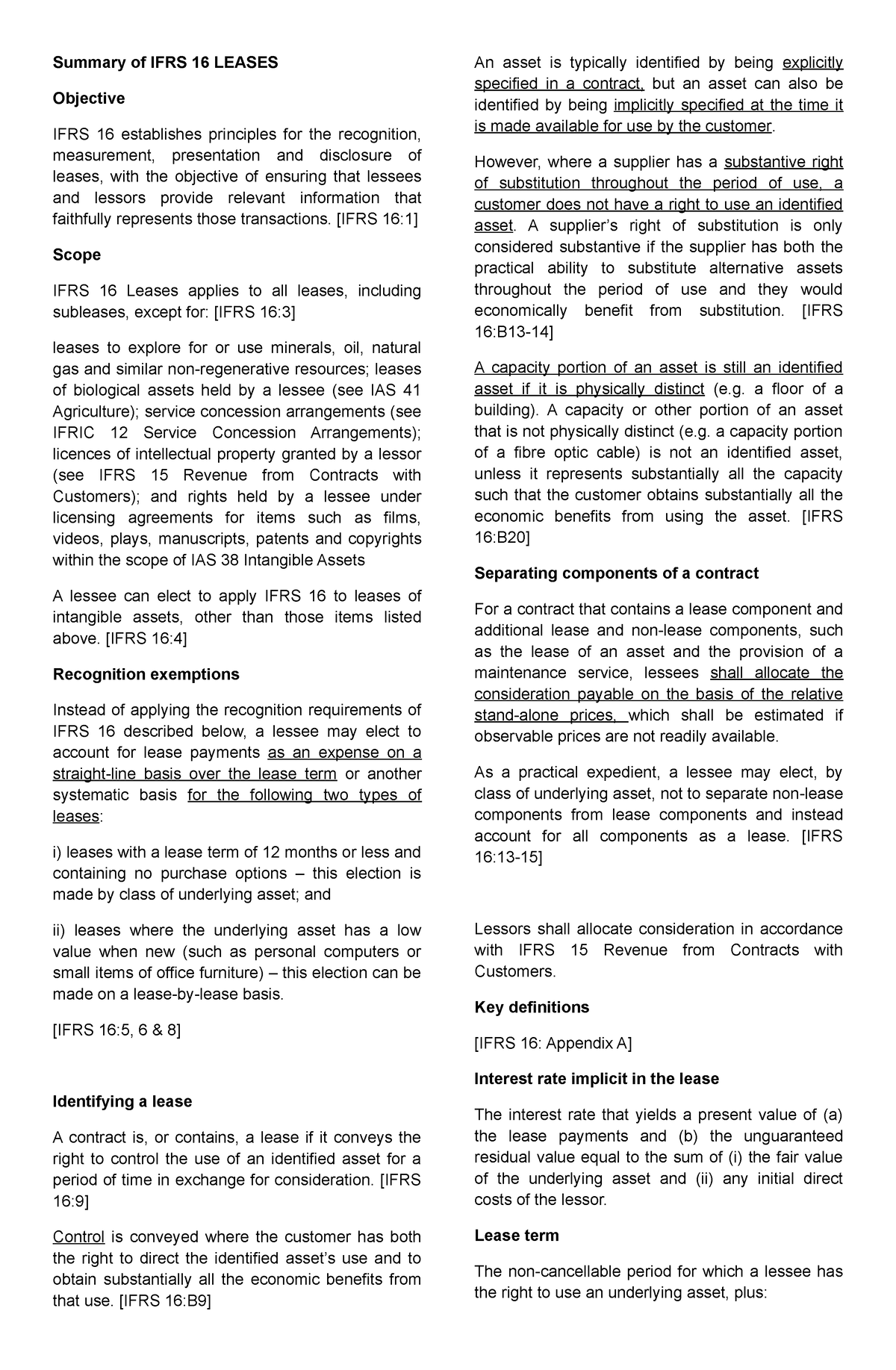

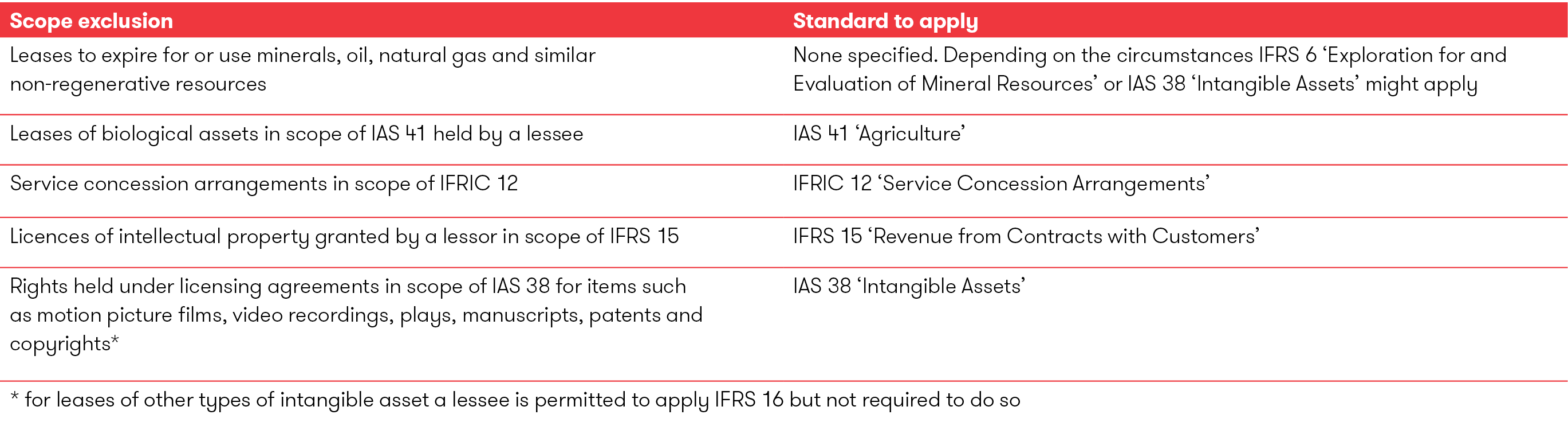

Ifrs 16 rules. Ifrs 16 allows a lessee to elect not to apply the recognition requirements to: Ifrs 16 contains both quantitative and qualitative disclosure requirements. And b) leases for which the underlying asset is of low value.

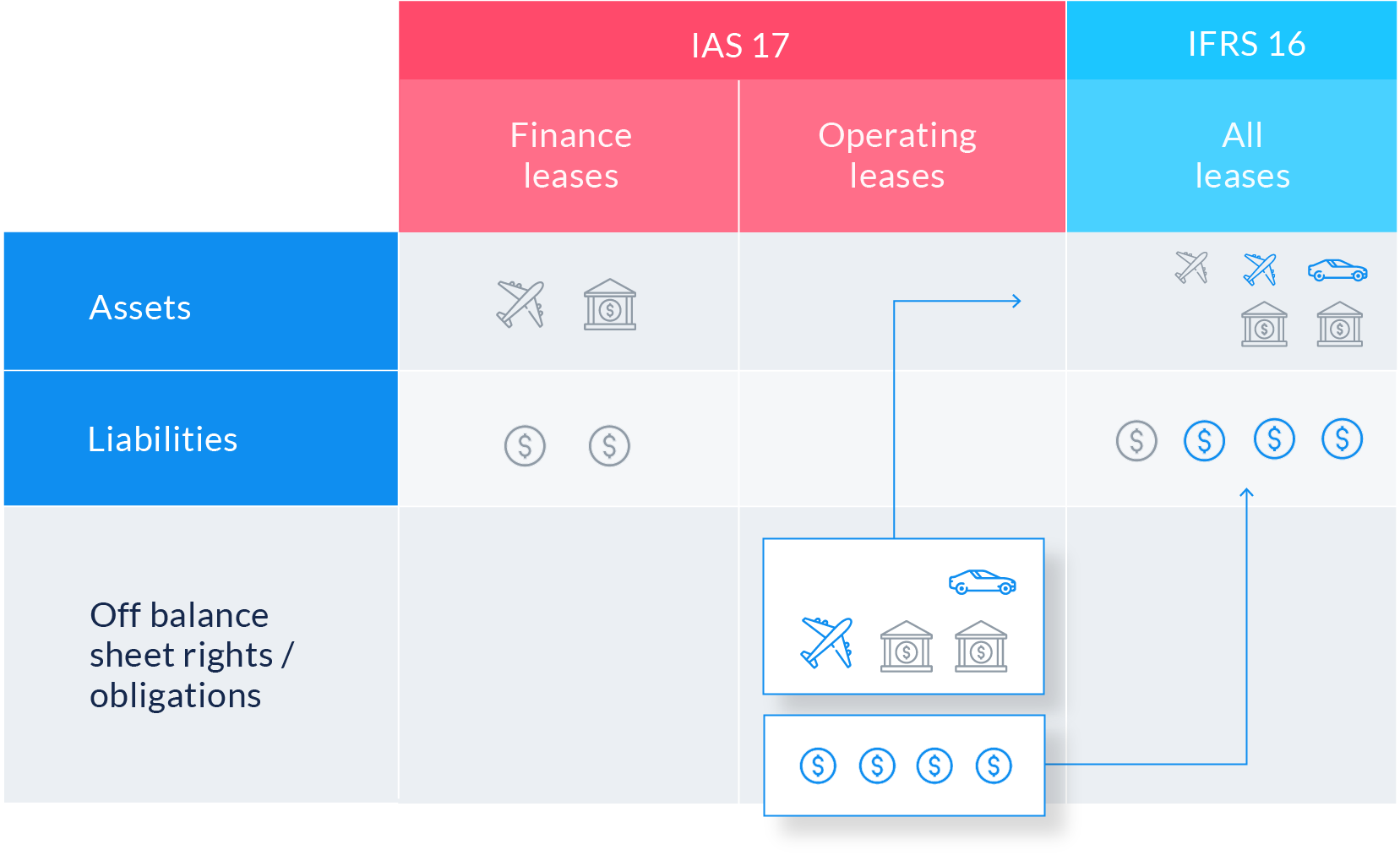

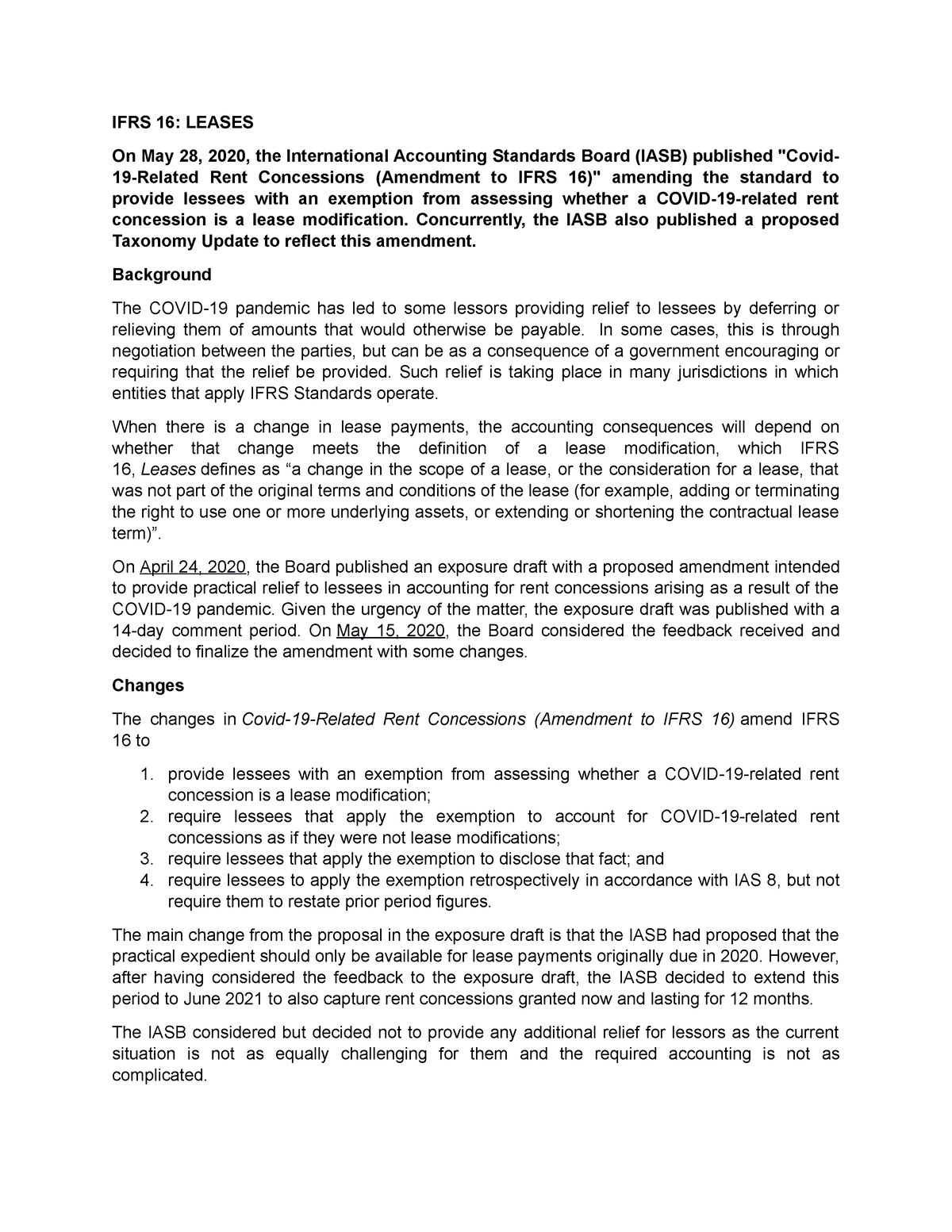

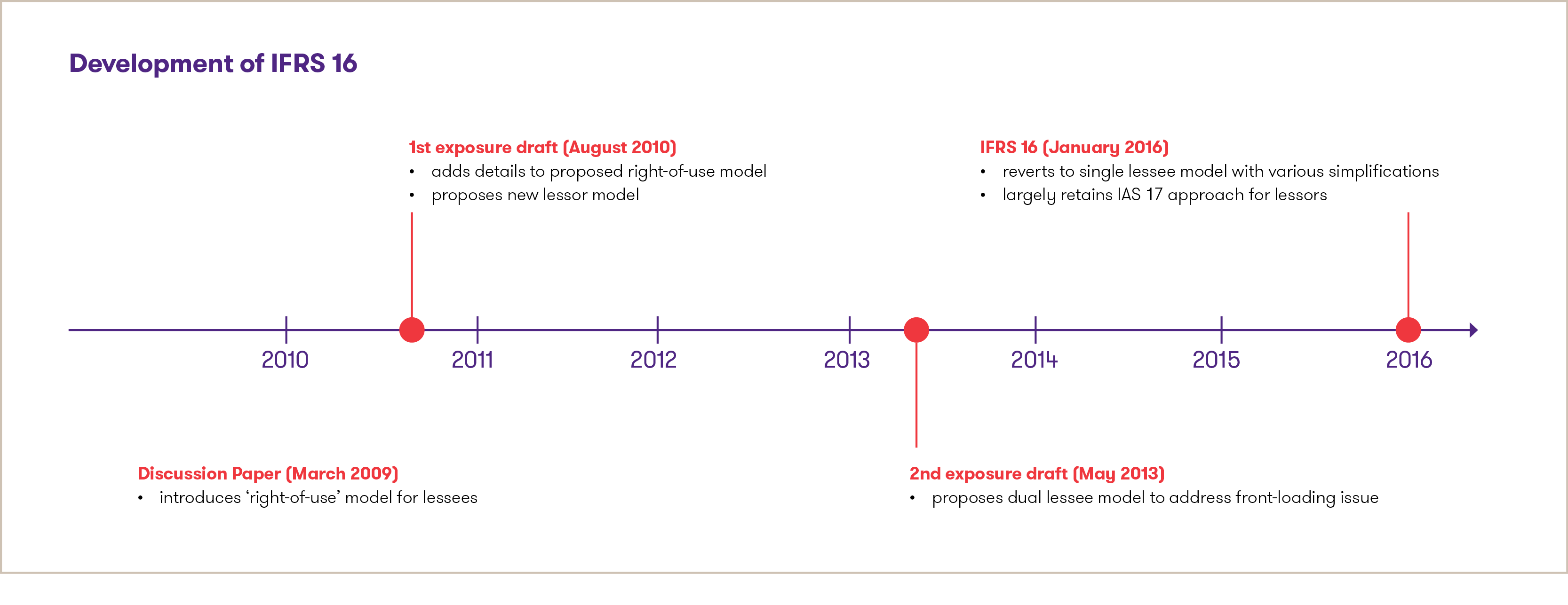

Ifrs 16 specifies how an ifrs reporter will recognise, measure, present and disclose leases. In august 2020 the board issued interest rate benchmark reform―phase 2 which amended requirements in ifrs 9, ias 39, ifrs 7, ifrs 4 and ifrs 16 relating to: It includes the reasons for accepting particular views and rejecting others.

This basis for conclusions summarises the iasb’s considerations in developing ifrs 16. In may 2020, the board issued property, plant and equipment: Individual board members gave greater weight to some factors than to.

Redefines commonly the new requirements accounting for lessees metrics such as the gearing comparability, but may borrowing costs and your business model The cars are owned by supplier. A contract between customer and a freight carrier (supplier) provides customer with the use of 10 rail cars of a particular type for five years.

Example 1—rail cars example 1a: This regulation established the basic rules for the creation of an endorsement mechanism for the adoption of ifrs, the timetable for implementation and a review clause to permit an assessment of the overall approach. An asset can be identified either explicitly or implicitly.

The standard provides a single lessee accounting model, requiring lessees to recognise assets and liabilities for all leases unless the lease term is 12 months or less or the underlying asset has a low value. Ifrs 16 specifies how to recognize, measure, present and disclose leases. Example 12 in ifrs 16 illustrates application of these requirements.

The contract specifies the rail cars; A contract is, or contains, a lease if there is an identified asset and the contract conveys the right to control the use of the identified asset for a period of time in exchange for consideration. Ifrs 16 is effective for annual reporting periods beginning on or after 1 january 2019, with earlier application permitted (as long as ifrs 15 is also applied).

Ifrs 16 leases continues to be a significant project for many local authorities. This basis for conclusions accompanies, but is not part of, ifrs 16. Ifrs 16 leases was issued by the iasb on 13 january 2016 and has a mandatory effective date of 1 january 2019.

The customer has the right to direct how and for what purpose the asset is used throughout its period of use; The iasb has undertaken a number of activities to support consistent application of the standard. Customer determines when, where and which goods are to be transported using the cars.

September 2016 new standard the iasb has published into effect on 1 january or leasing as a means affected by the new standard. However, as per ifrs 16.15, a practical expedient is available for lessees (not lessors). Ifrs 16 does not define the term “low value,” but the basis for conclusions explains that the board had in mind assets of a value of usd 5,000 or less when new.