Awesome Tips About Income Statement Is Used To Impairment Loss On Receivables

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)

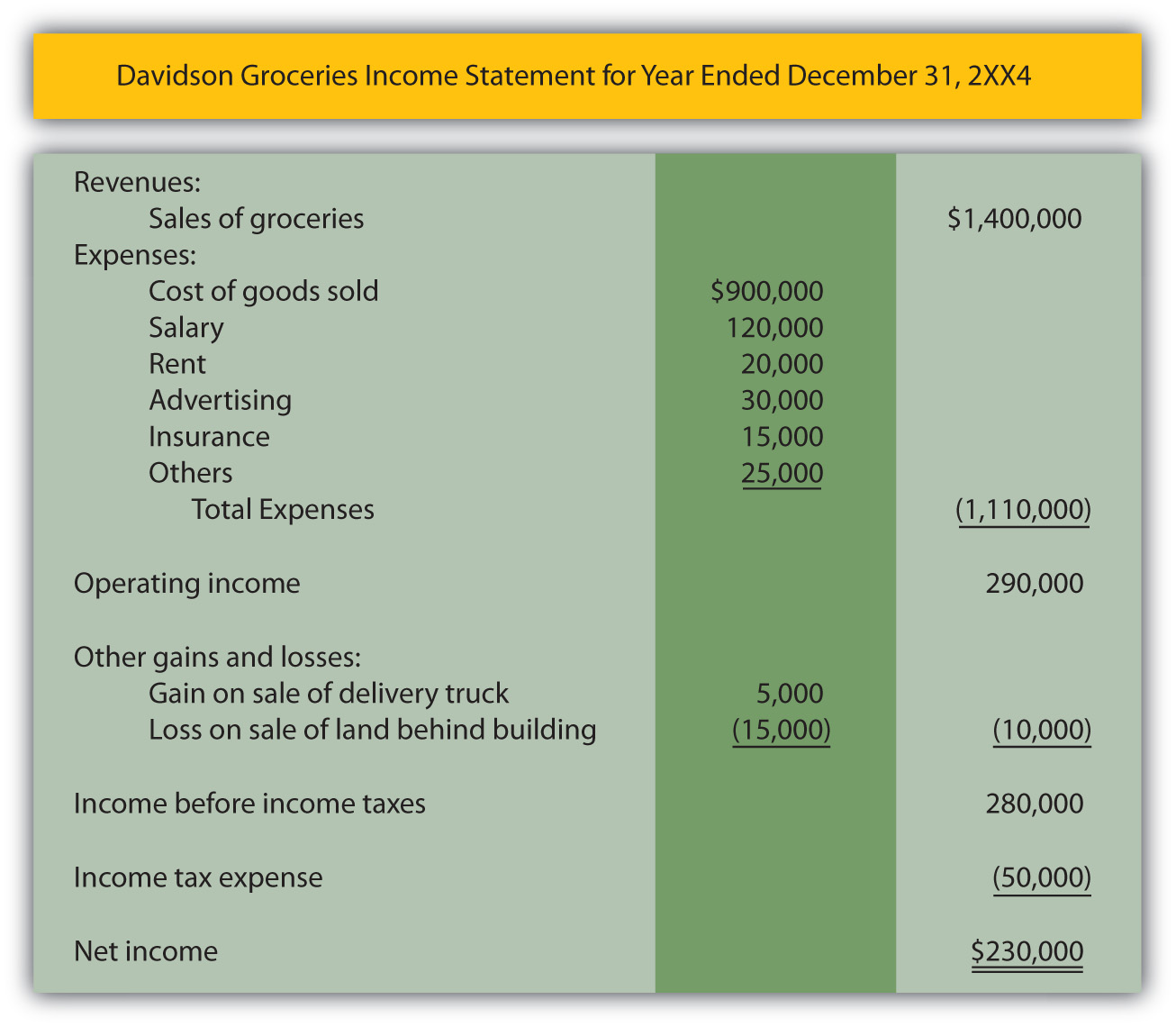

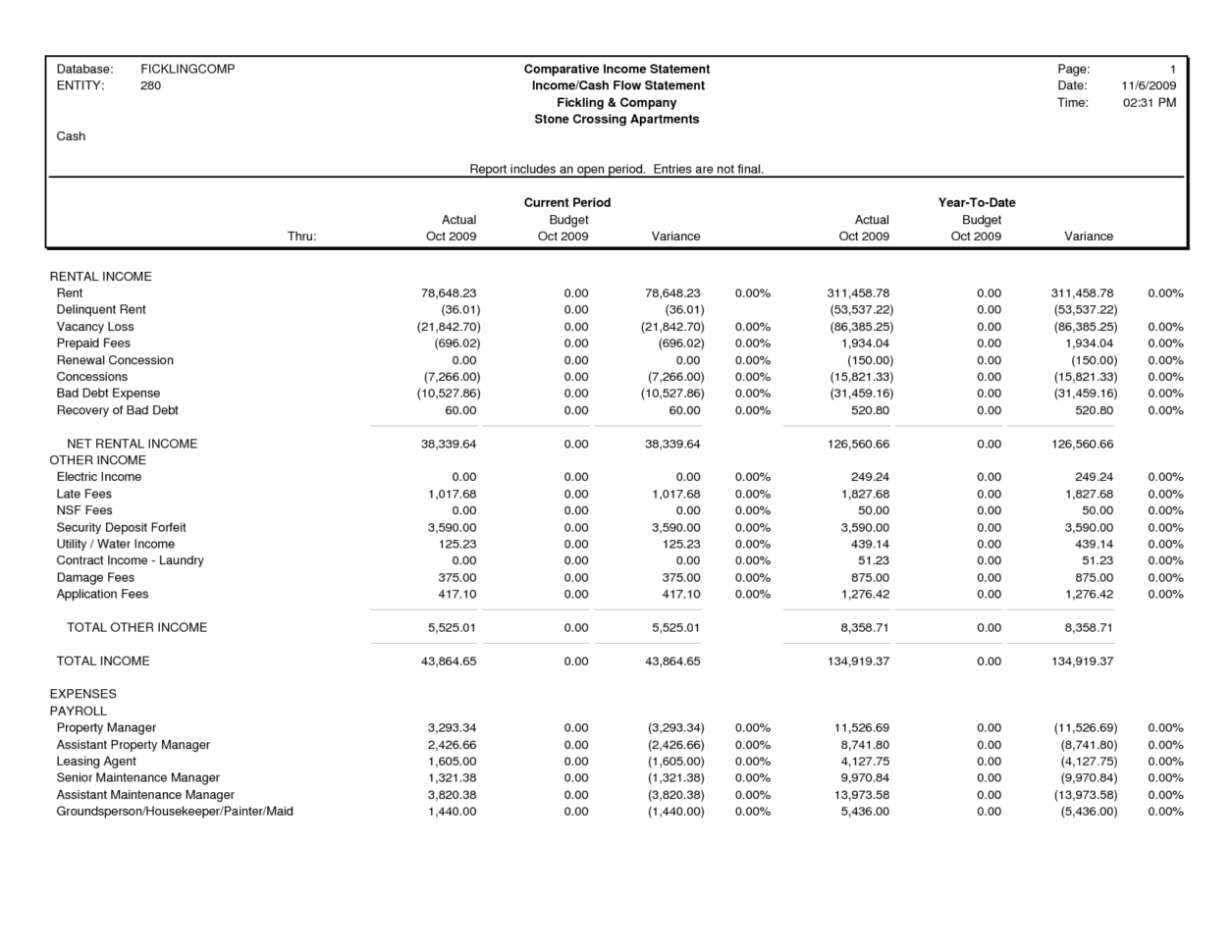

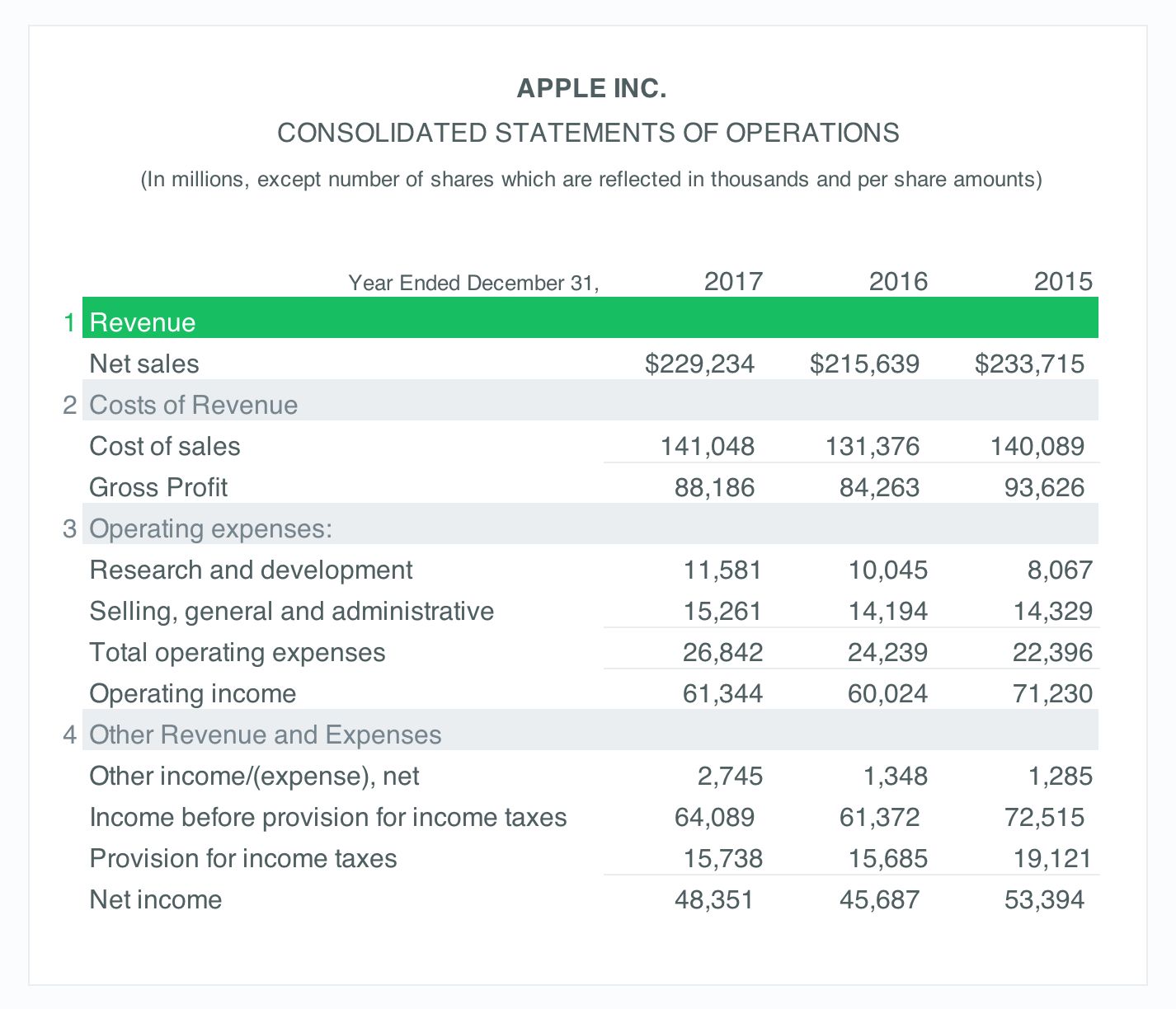

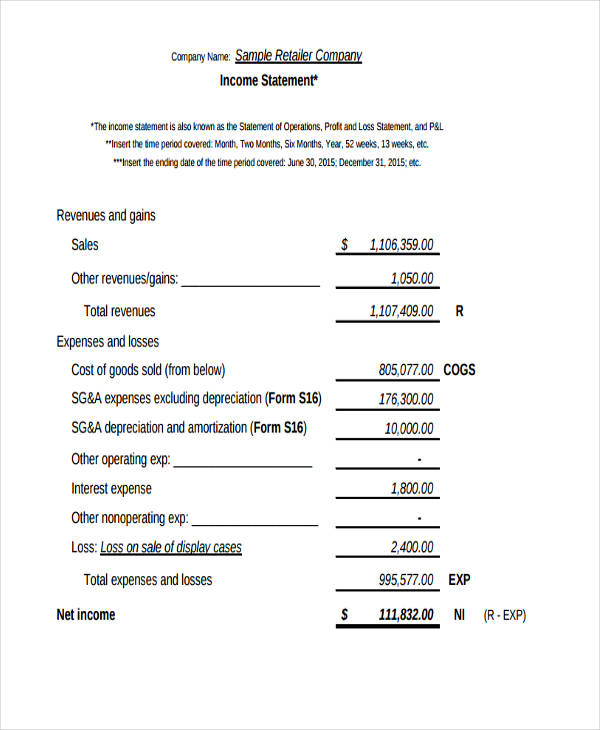

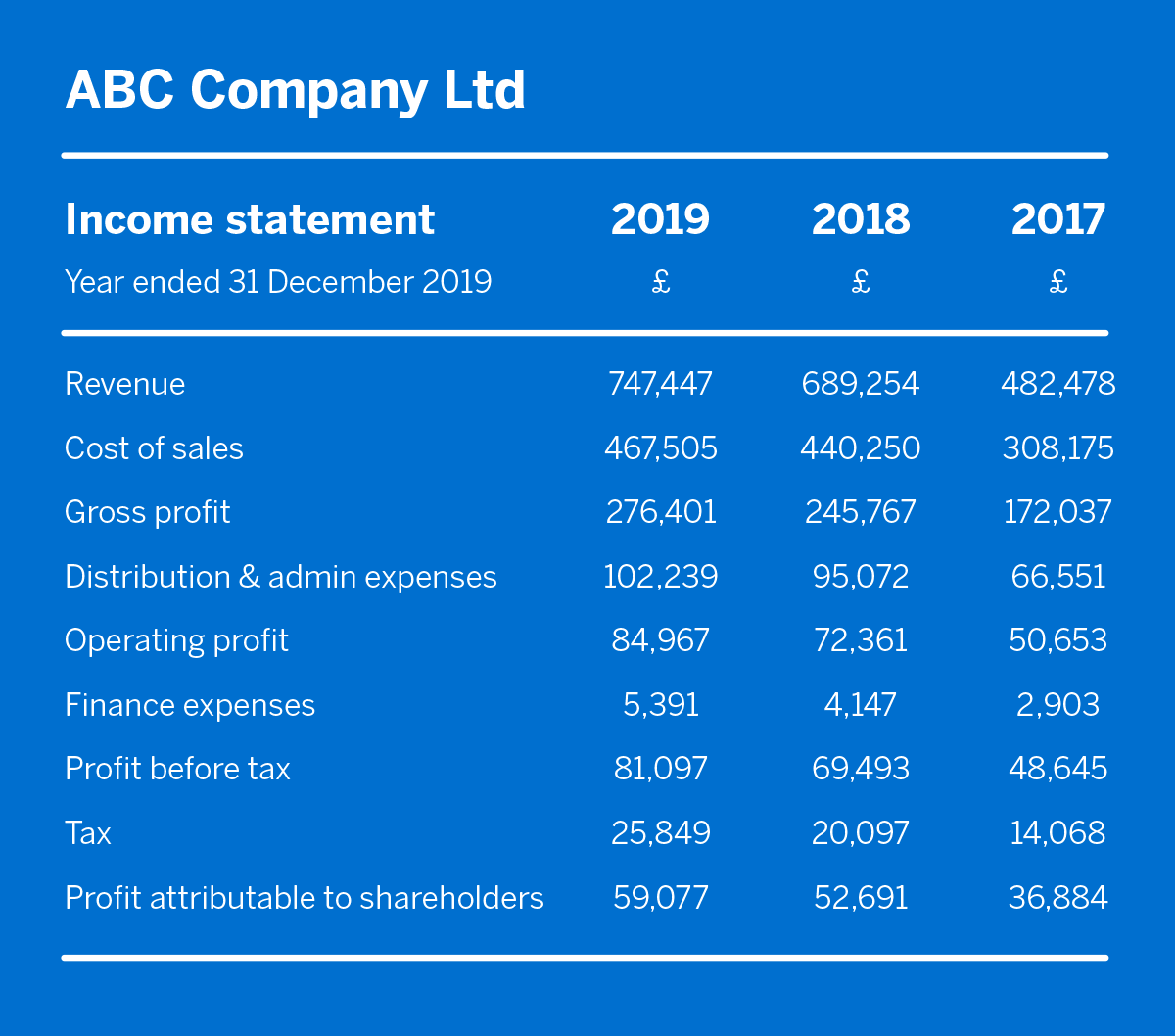

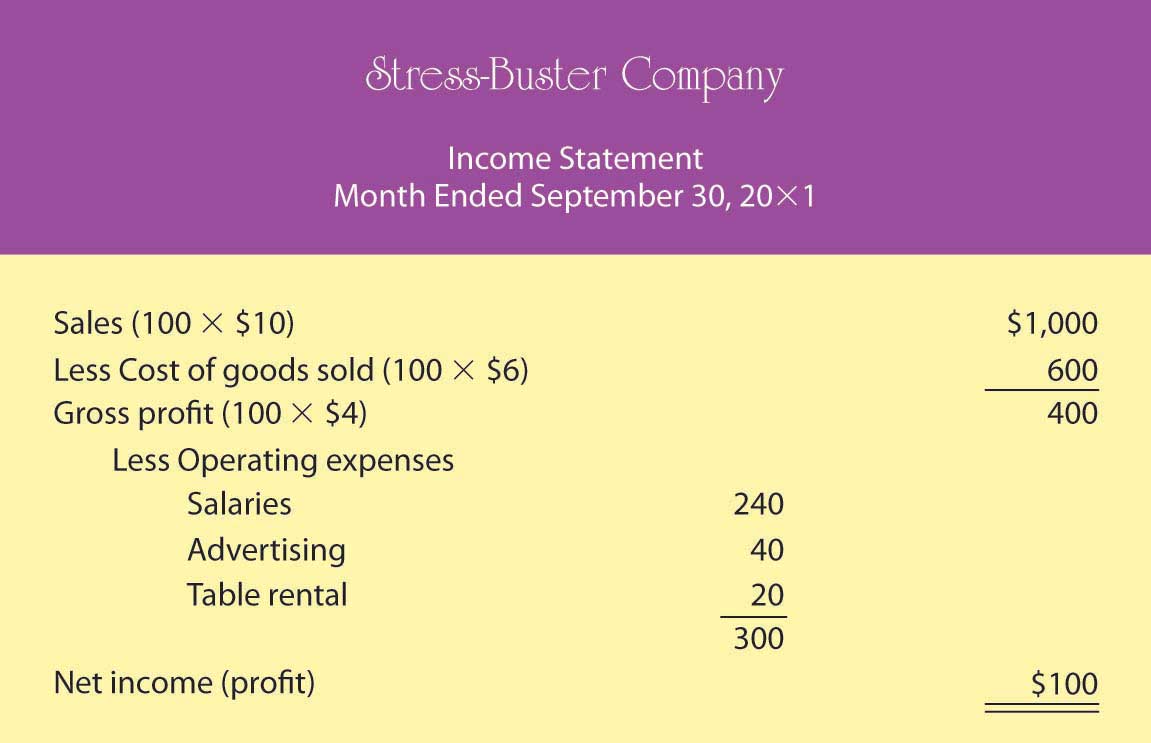

The income statement shows the revenue generated and expenses incurred by a company.

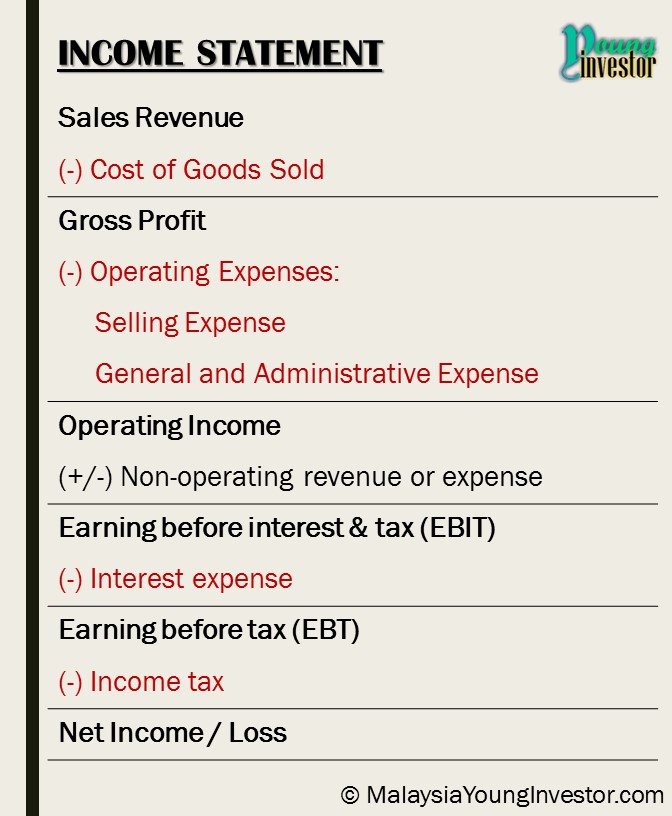

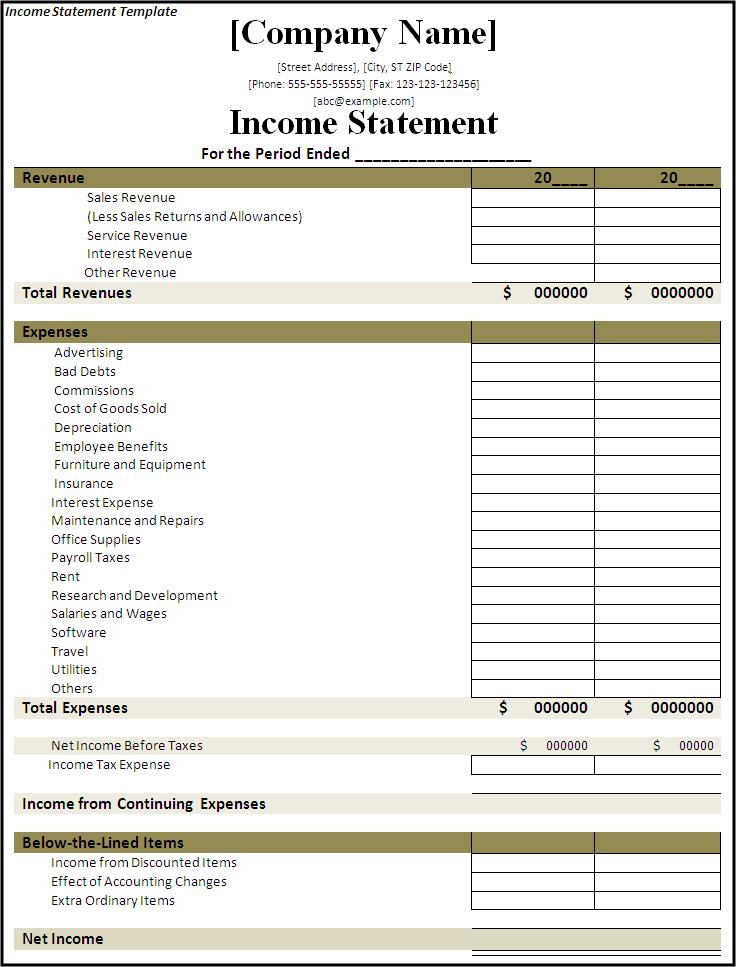

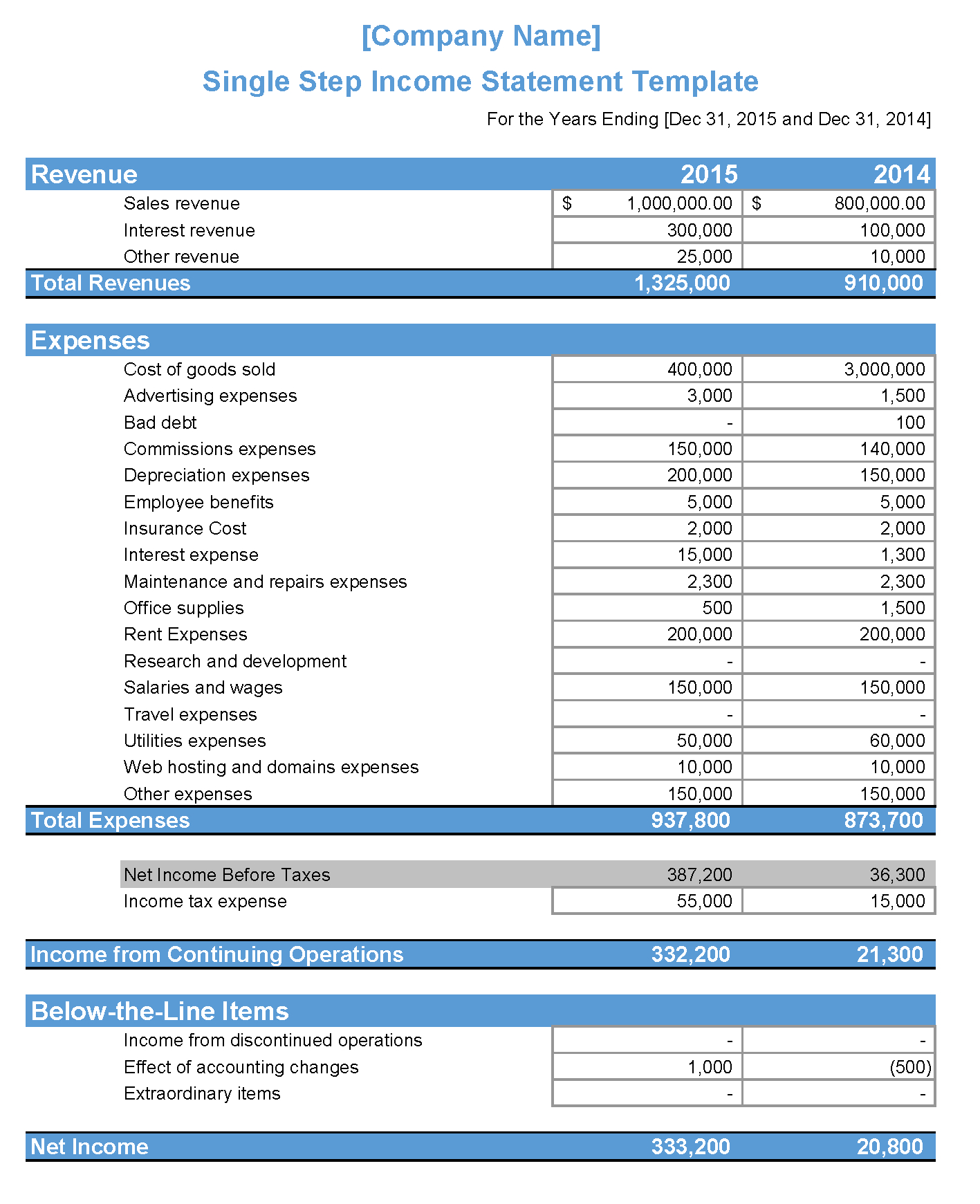

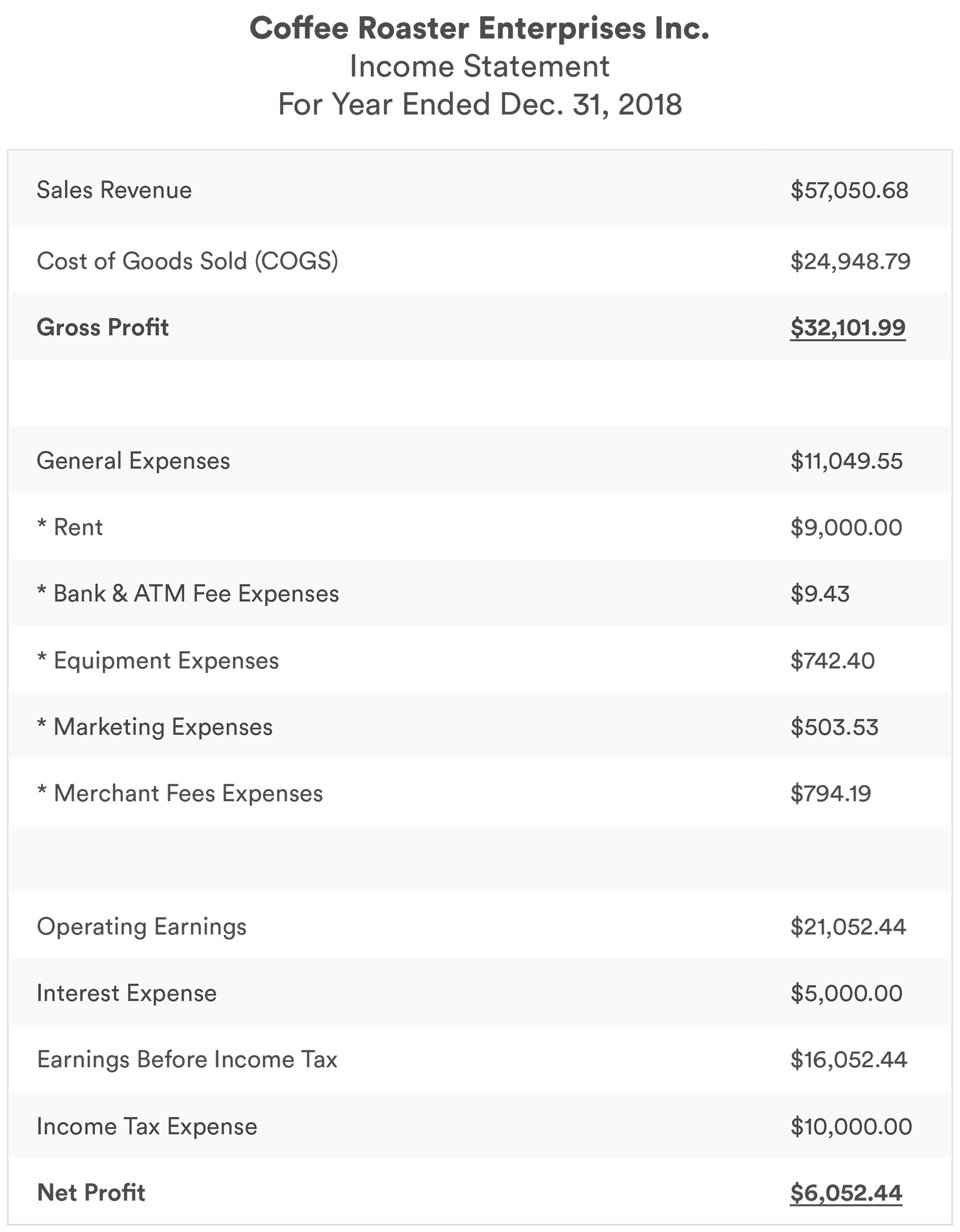

Income statement is used to. An income statement is a financial statement detailing a company’s revenue, expenses, gains, and losses for a specific period of time that is submitted to the securities and exchange commission (sec). The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner. An income statement is a financial statement that shows you the company’s income and expenditures.

It shows your revenue, minus your expenses and losses. The income statement, along with balance sheet and cash flow statement, helps you understand the financial health of your business. The other two key statements.

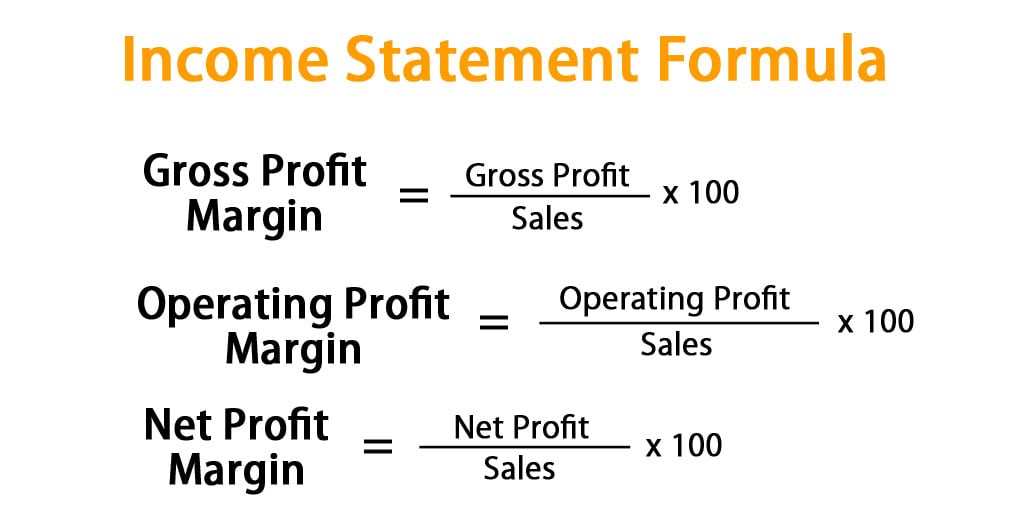

Gross profit represents the income or profit remaining after production costs have been subtracted from revenue. The income statement follows a specific format. When a new york judge delivers a final ruling in donald j.

This calculation shows investors and creditors the overall profitability of the company as well as how efficiently the company is at generating profits from total revenues. Rent prices in the u.s. The most basic income statement components are:

An income statement is a financial report that summarizes the revenues and expenses of a business. The purpose of an income statement is to show a company’s financial performance over a given time period. This document gauges the financial performance of a business in terms of profits or losses for the accounting period.

The income statement is a company’s financial report that shows its profit and loss over a specific period, usually a year. An income statement is a financial document that shows your company’s income and expenses. The difference between the revenue and expenses is the profit for shareholders.

Trump’s civil fraud trial as soon as friday, the former president could face hundreds of millions in penalties and new restrictions on. It provides them with a summary of the performance of the company during a specific period. It’s one of the 3 major financial statements that small businesses prepare to report on their financial performance, along with the balance sheet and the cash flow statement.

In one example, the attorney general's legal team showed that trump's triplex in his eponymously named. An income statement includes a company’s revenue, expenses, gains, losses and profit for a specific accounting period. The income statement most often used by businesses is the accrual basis income statement.

An income statement is a financial document that details the revenue and expenses of a company. The irs said wait times during tax season can average 4 minutes, but you may experience longer wait times on monday and tuesday, the irs said, as well as during presidents day weekend (feb. The term “income statement” refers to one of the three primary financial statements the company uses to summarize its financial performance over the reporting period reporting period a reporting period is a month, quarter, or year during which an organization's financial statements are prepared for external use uniformly across a period of.

Documents shown during trial ranged from spreadsheets to signed financial statements. The income statement, also known as the profit and loss (p&l) statement, is the financial statement that depicts the revenues, expenses and net income generated by an organization over a. The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting.