Supreme Info About Cash Flow Statement Under Direct Method What Counts As Revenue On An Income

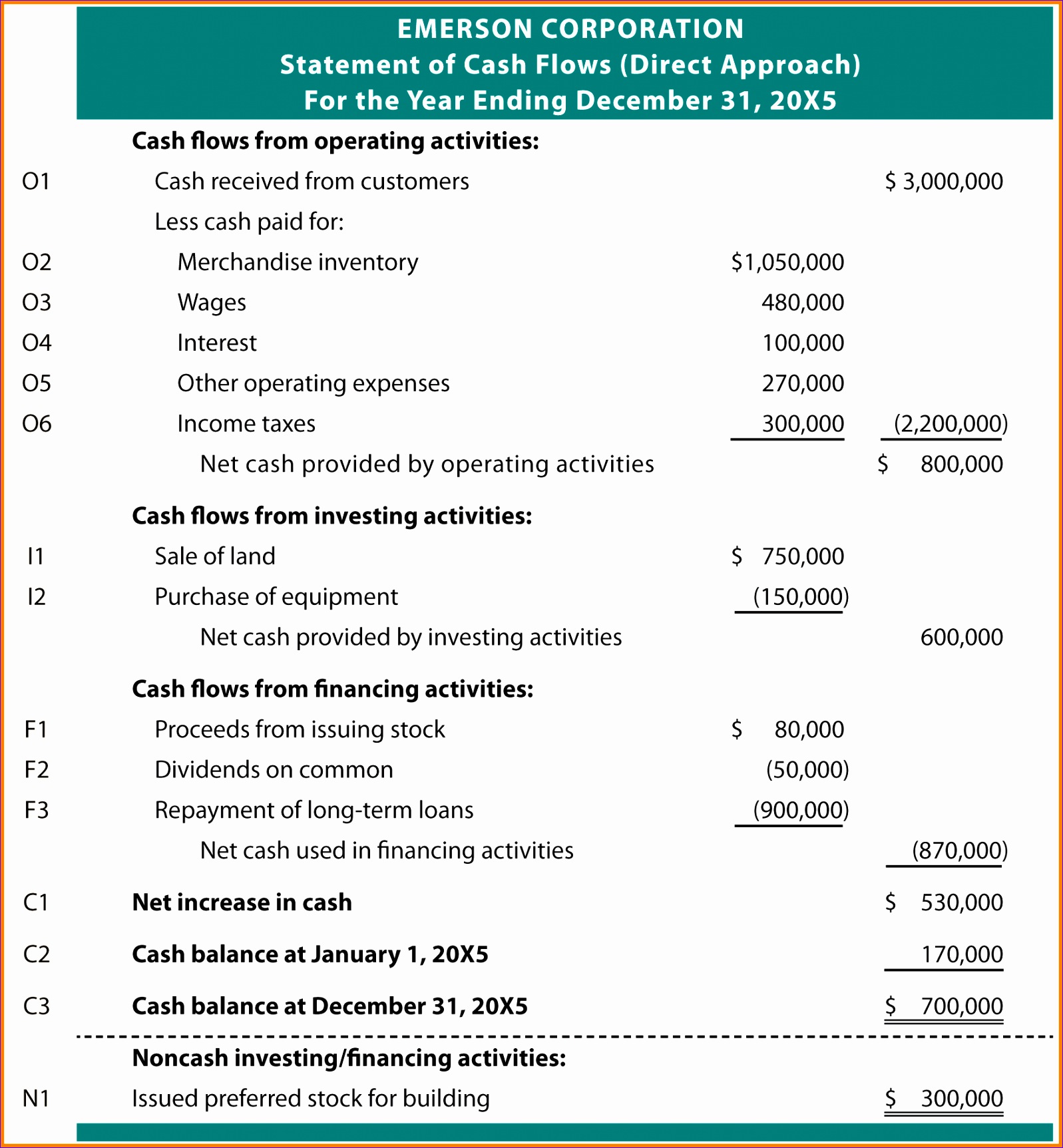

Definition the direct method cash flow, where major classes of gross cash receipts and gross cash payments are disclosed.

Cash flow statement under direct method. The indirect method was discussed earlier in this chapter. Using the direct method the cash flow from operating activities is calculated using cash receipts from sales, interest and dividends, and cash payments for expenses, interest and. The direct method or the indirect method only apply to the cash flow from operations and do not effect the cash flow from investing or cash flow from financing sections of the cash flow statement.

The operating activities, investing activities and financing activities. Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. The direct cash flow method is based on cash accounting principles, not accrual.

The cash flow statement direct method involves a detailed breakdown of operating expenses and income. The cash flow from the operations section of the cash flow statement can be prepared using either the direct method or the indirect method. For instance, assume that sales are stated at $100,000 on an accrual basis.

Under the direct method, the sole section of the cash flow statement which will differ in presentation is that the cash flow from the operations section. The cash flow statement presented using the direct method is easy to read because it lists all of the major operating cash receipts and payments during the period by source. Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements.

A cash flow direct method formula is used to calculate cash inflows and cash outflows when preparing a cash flow statement using the direct method. This method shows a company’s total operating, financing, and investing cash flow over a set period. It is one of two methods a company can apply when presenting its cash flow statement, which reports on three types of activities that generate and use cash in a business — operations, investments and financing.

Direct method of cash flow statement shows the actual cash inflows and cash outflows from operating activities to arrive at the net cash flows from operating activities. It also identifies changes in cash payments and company activity receipts. The first step in preparing the cash flow statement involves the determination of the total cash flows from operating activities.

The method lists every transaction on the company’s cash flow statement. Direct and indirect cash flow statements. Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories.

At a minimum, the following types of operating receipts and disbursements are required in a direct method presentation: The cash flow statement direct method shows all the cash transactions a business completes. Preparing a cash flow statement using the direct method can be as easy as using the indirect method, if the lines that will be displayed are given some forethought and individual receivable and payable accounts.

Cash flow statement classifies all the business activities into three main categories. Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories generally. As mentioned earlier, the only difference when applying the direct method, as opposed to the indirect method, is in the operating activities section;

Most companies operate with accrual accounting practices, meaning that the direct method is not as commonly utilized. Direct method of cash flow statement is how actual cash flow information is retrieved from the segments of a company’s operations and used instead of the accrual accounting values. The direct technique lists the money receipts and payments created during a period for a business’ operations.

/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)