Spectacular Tips About Are Private Companies Required To Have Audited Financial Statements Free P&l Template

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

See topic 10 for egcs.

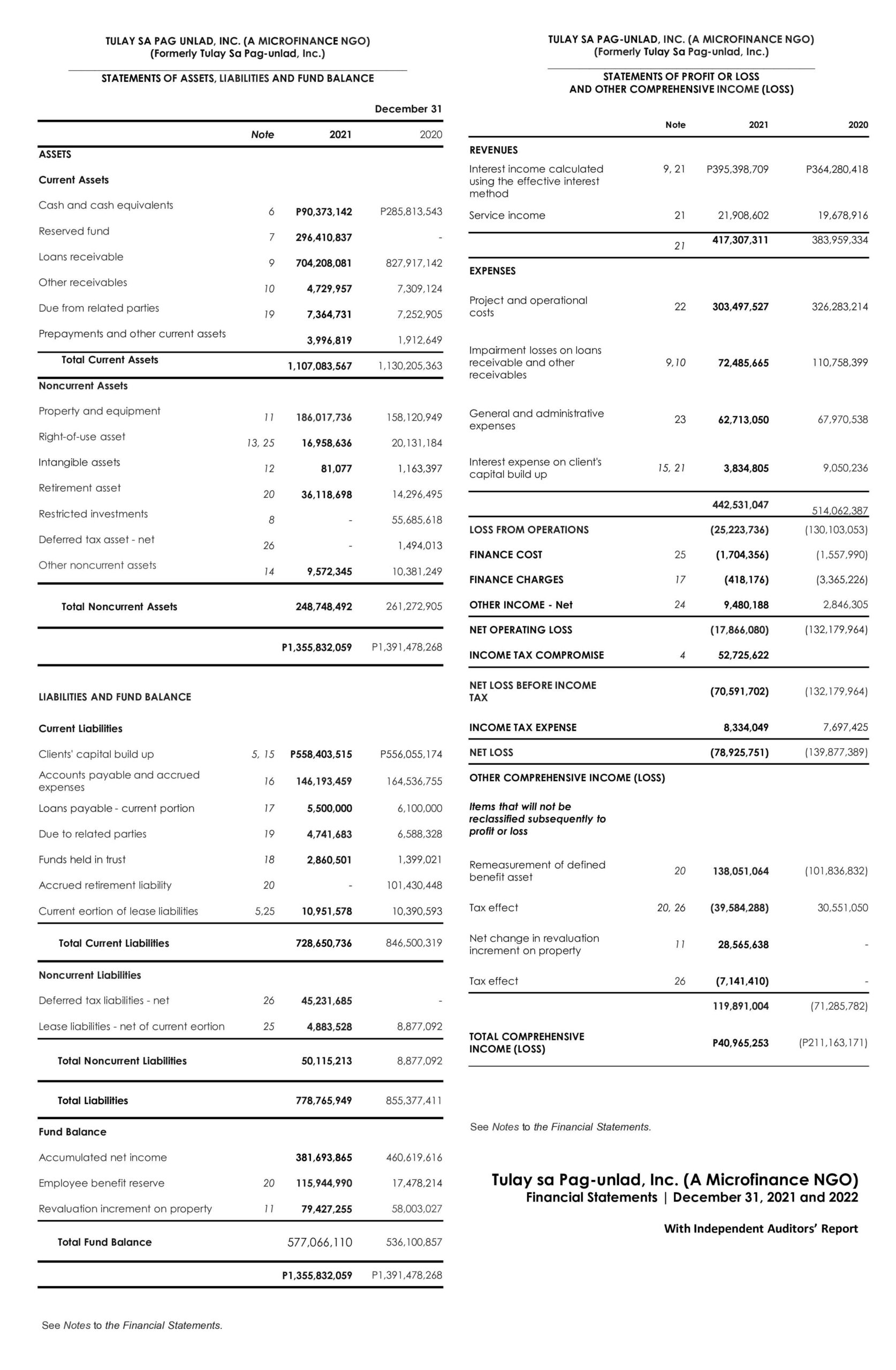

Are private companies required to have audited financial statements. The guidance in asc 250 is applicable to private reporting entities. In the us and canada, for example, private firms are generally. However, many private companies don't issue.

When a new york judge delivers a final ruling in donald j. If you’re one of these types of companies, you’re going to need to prove your financial stability before someone gives you a loan or investment. Based on the minister of trade regulation number 25 in 2020, companies that are required to audit financial statements are companies with the following.

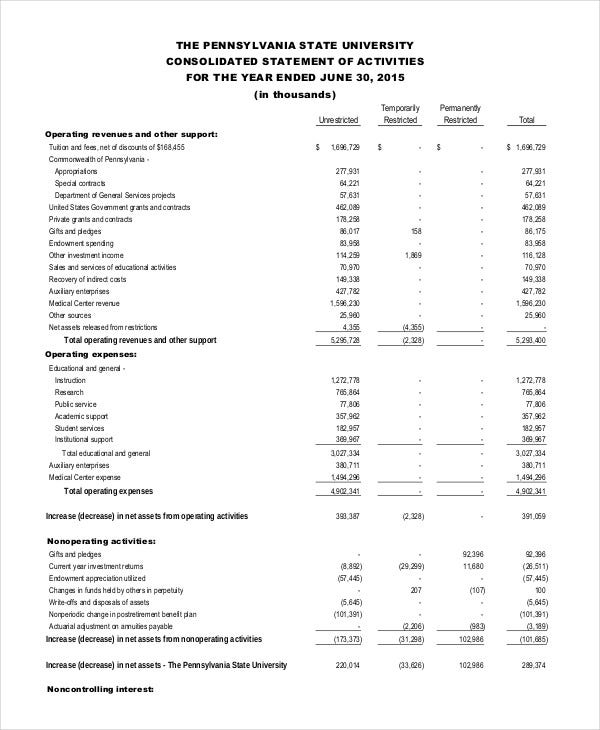

In the united states and canada, for example, private firms are generally neither. Required audited financial statements for a domestic registrant, other than an egc, in registration or proxy statements. Trump’s civil fraud trial as soon as friday, the former president could face hundreds of millions in penalties.

An exempt private company with annual revenue of $5m or less for the financial year is exempt from auditing its financial statements. The need for companies’ financial statements1 to be audited by an independent external auditor has been a cornerstone of confidence in the world’s. In short, not in the united states.

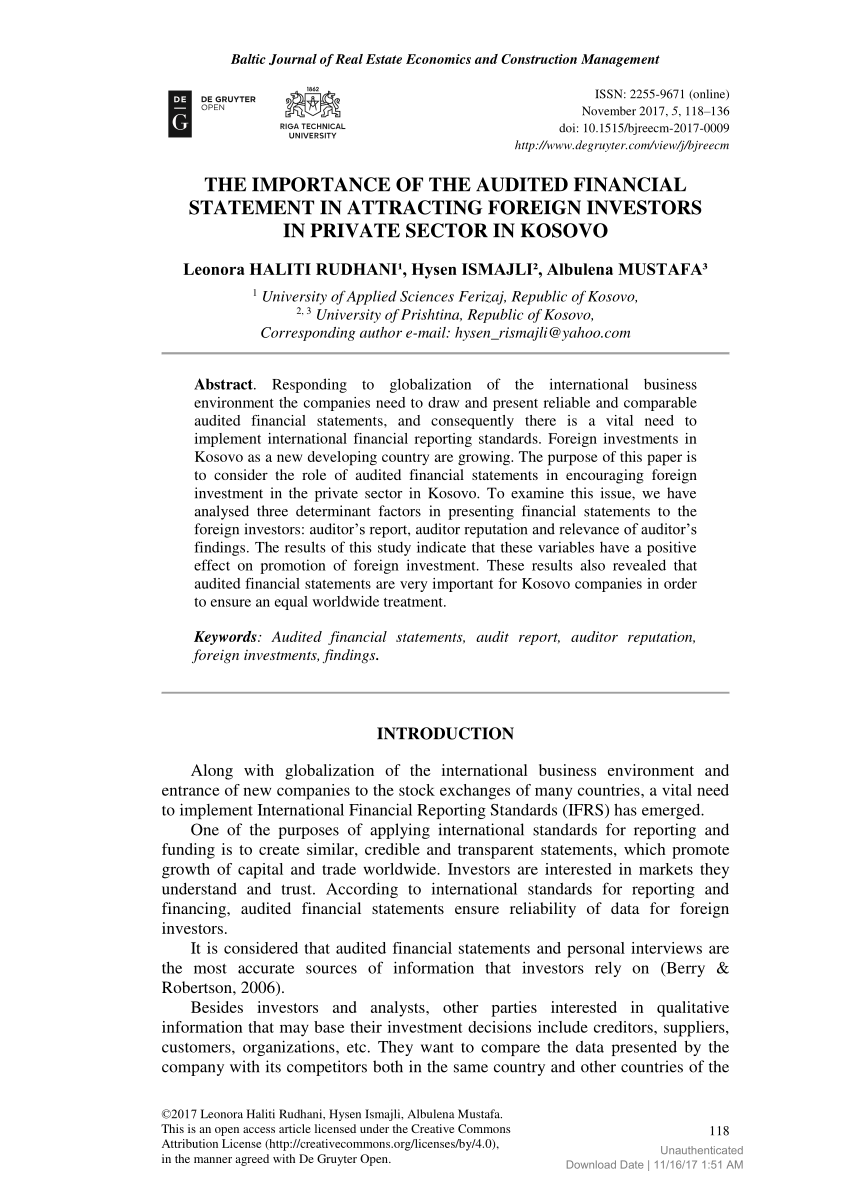

A quality external audit is an important aspect of building this trust, and so is staying at the forefront of emerging issues—in accounting, financial reporting, sustainability reporting,. Although the sec guidance is only required to be applied by reporting entities whose financial. Private firms face differing financial disclosure and auditing regulations around the world.

An exempt private company is a. While many may speculate about the business revenue or look for financial statements of private companies, typically they will find this to be difficult. Under the panel's proposal, private companies could.

As part of that, gaap. Although private companies are not required to submit audited financial statements by law, best practices and contractual obligations could require small businesses to do so. Private companies may be subject to gaap to satisfy lenders, certain classes of shareholders, or insurance companies.

Private firms face differing financial disclosure and auditing regulations around the world. Unless specifically exempted, the corporations act requires ‘large’ proprietary. For years beginning on or after 1 july 2019, some large private companies will no longer be required to prepare, have audited, and lodge annual financial.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)