Stunning Tips About Aia Financial Statement Temporary Tax Differences Examples Small Business Cash Flow Template

Explore aia group limited annual results consisting annual report, quarterly business highlights & interim results.

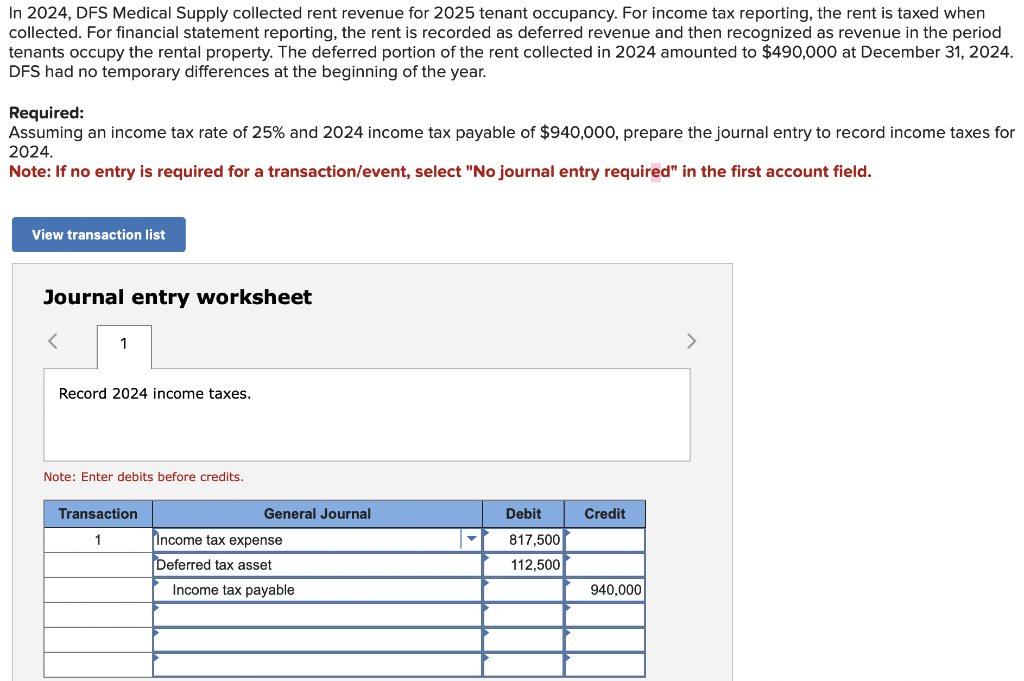

Aia financial statement temporary tax differences examples. Let's consider an example where. (b) the carryforward of unused tax losses; And as deferred revenue is a liability, the.

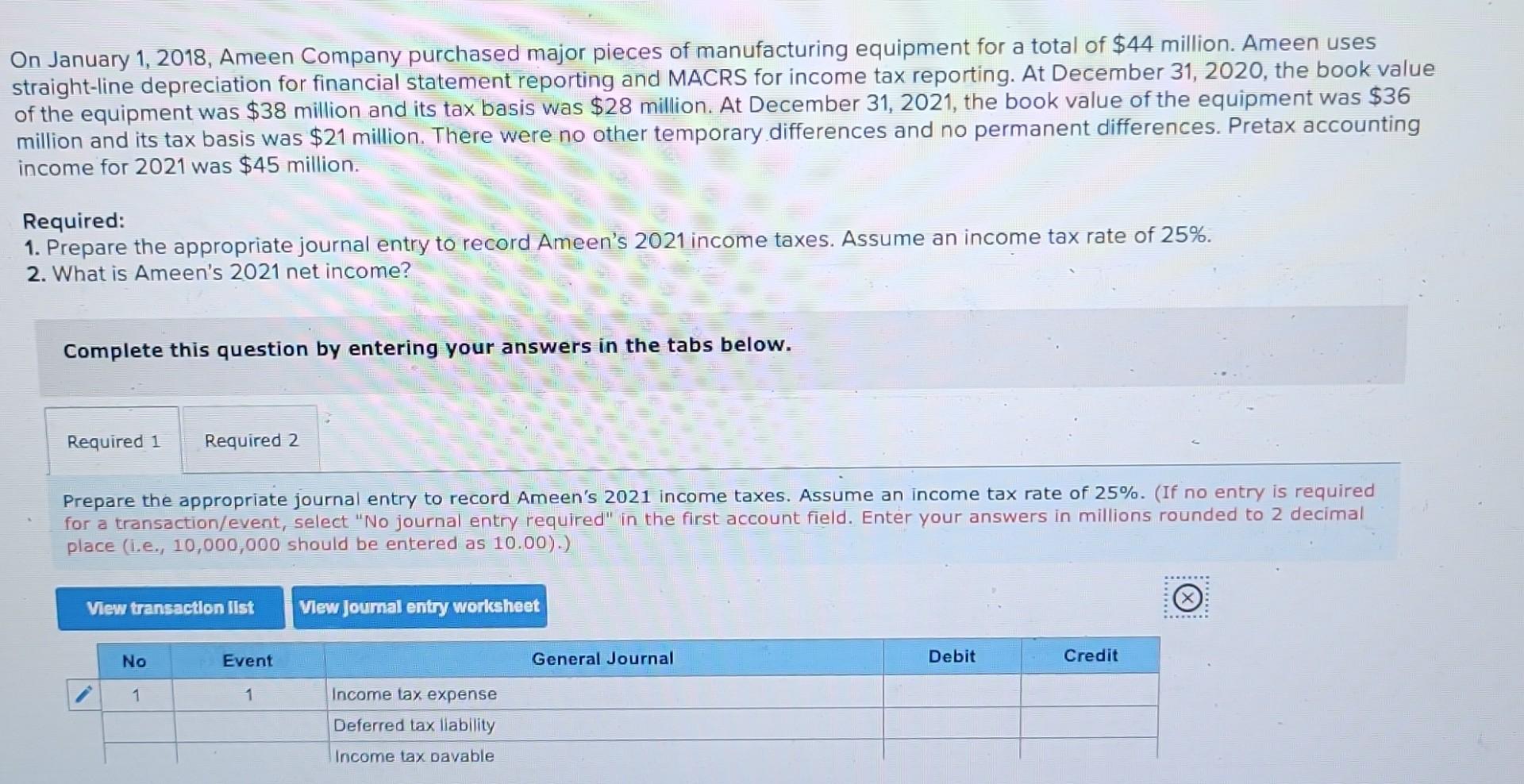

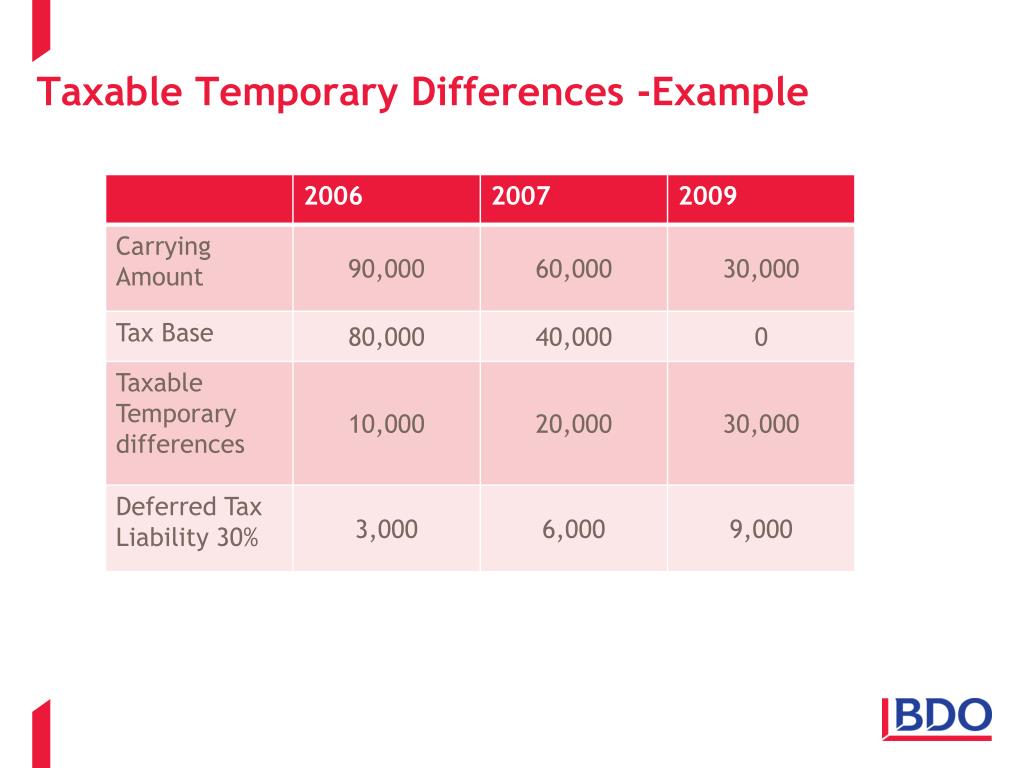

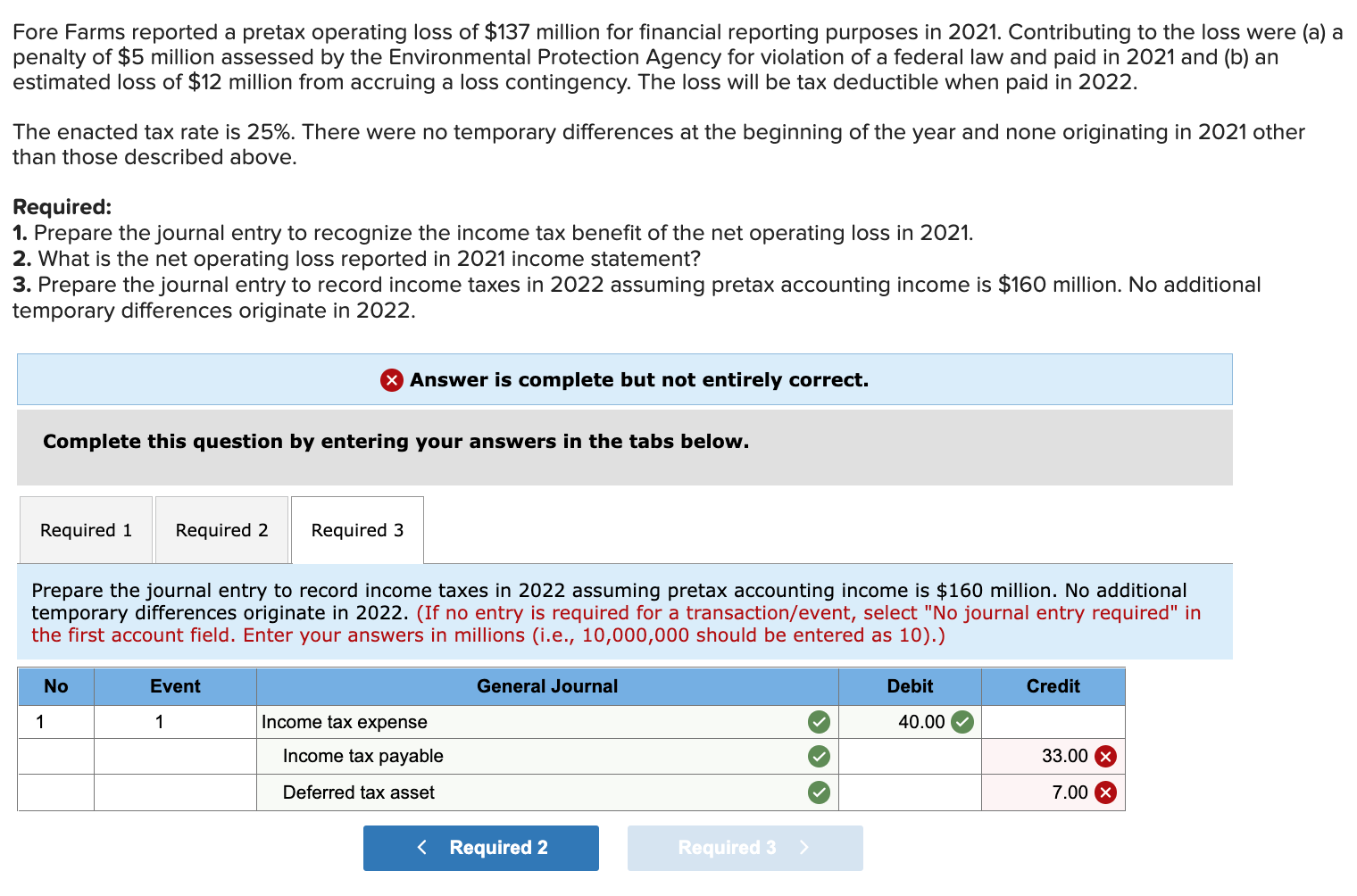

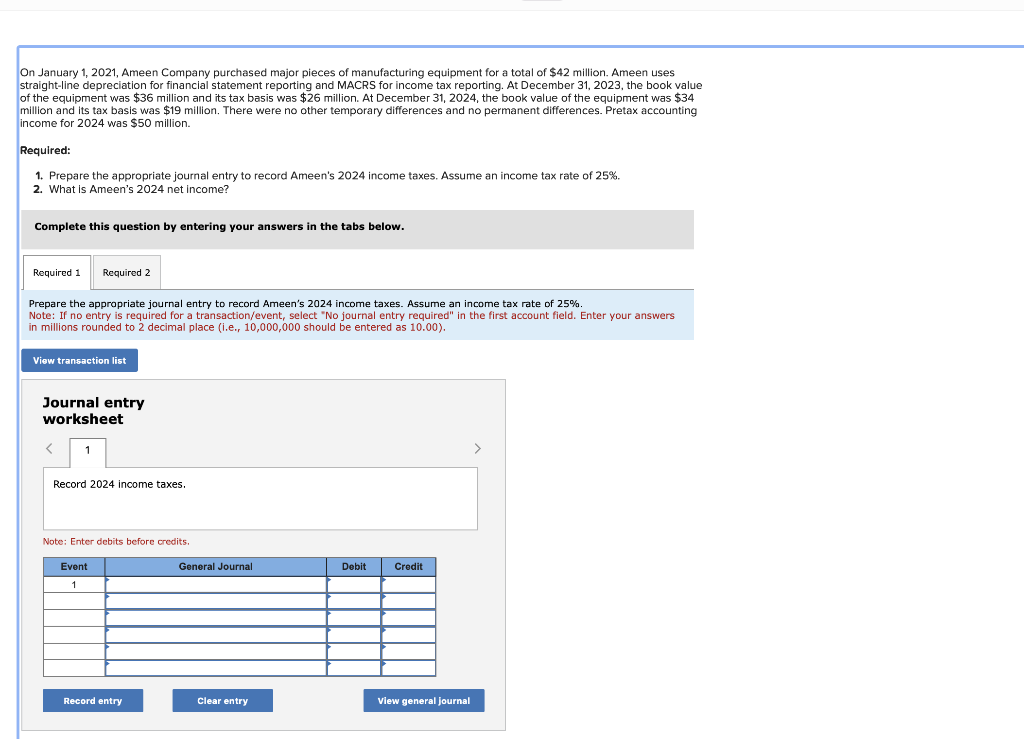

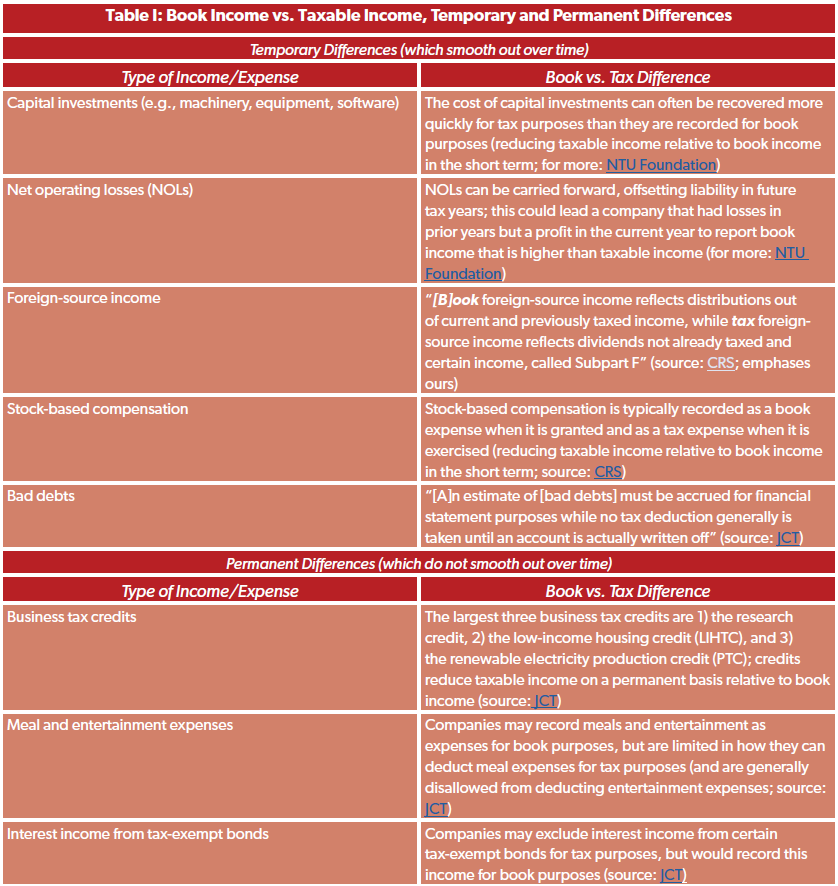

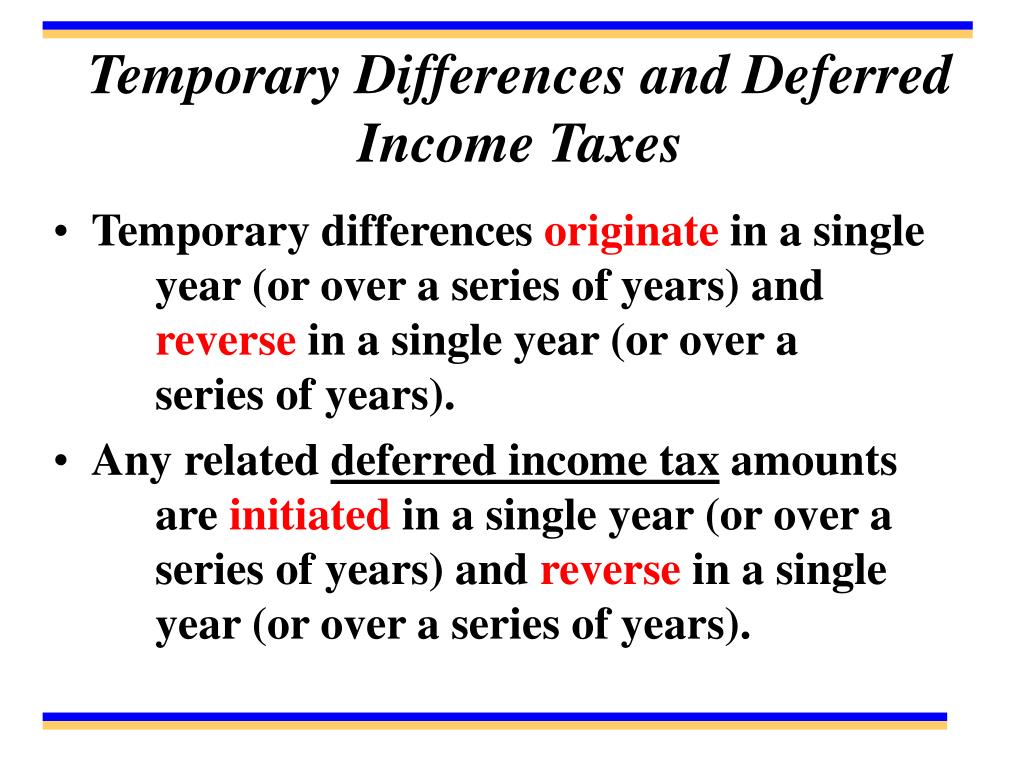

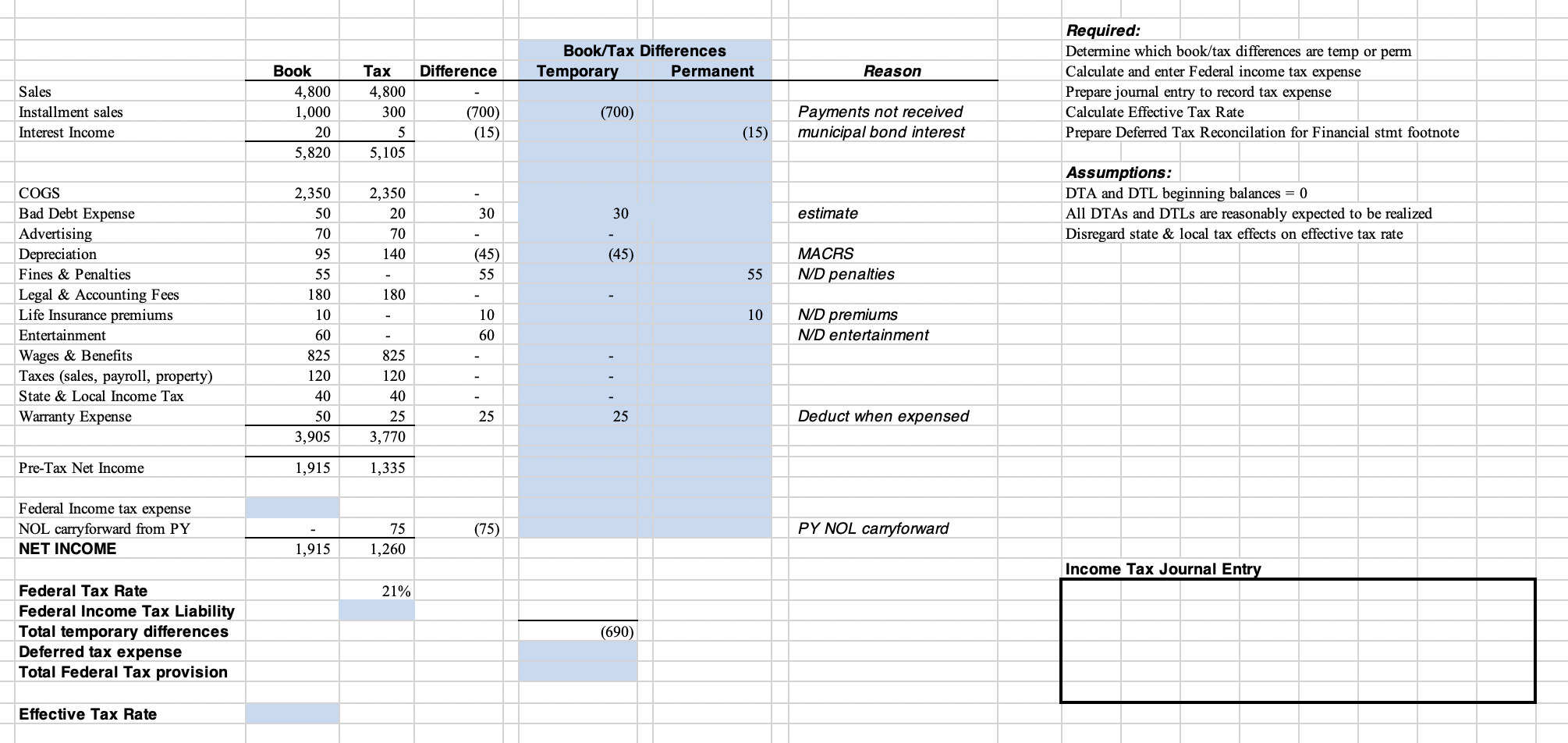

Temporary differences are those items that are reported at different times for book and tax, but at some point in the future, the same cumulative amount will be reported. Temporary differences that will result in taxable amounts in future years when the related asset or liability is recovered or settled are often referred to as taxable temporary. (a) deductible temporary differences;

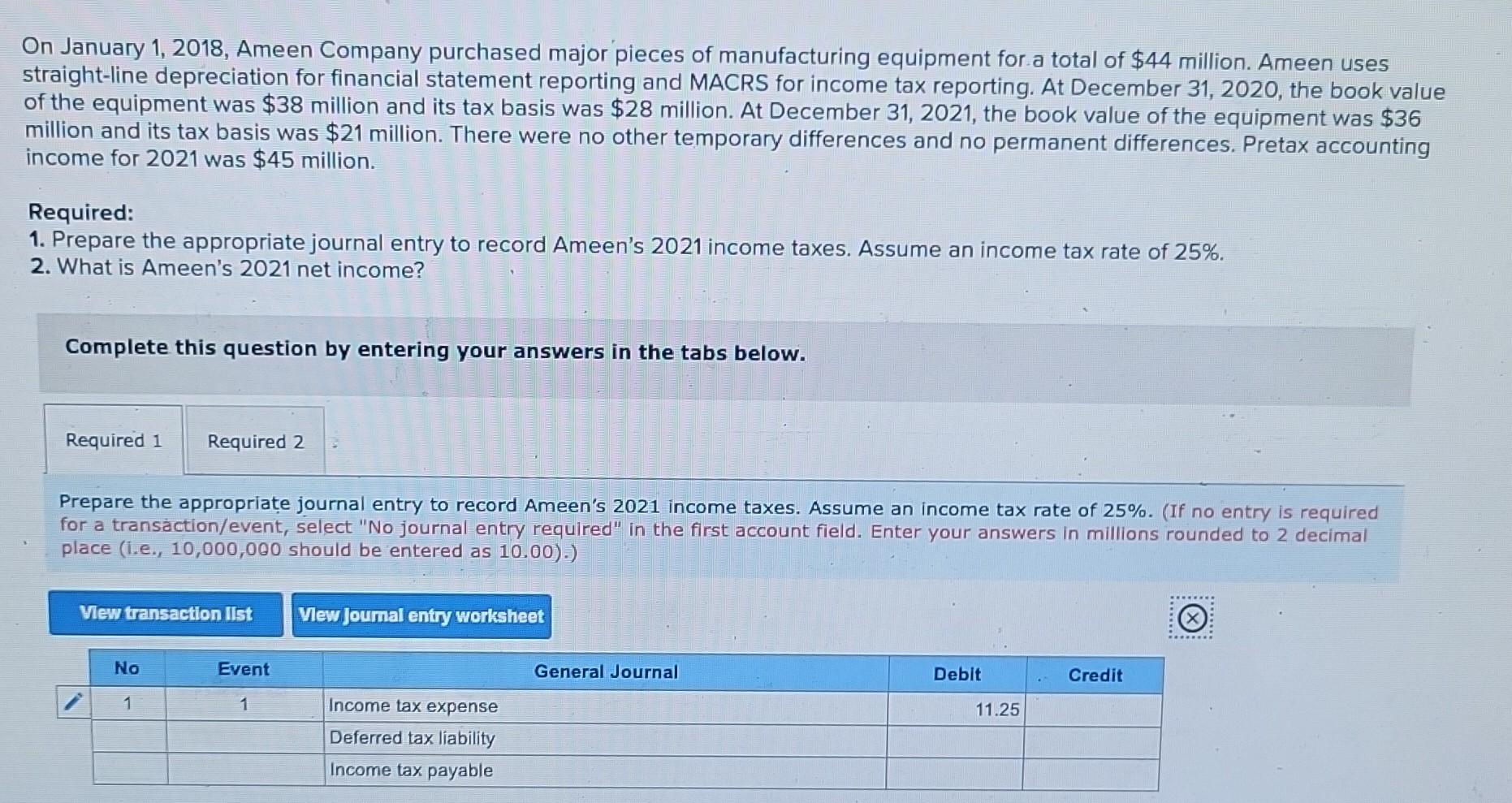

To calculate the net assets of entity b in the consolidated financial statements of entity a, we must calculate the deferred tax on temporary differences. Tax liability or asset, either on initial recognition or subsequently (see example below). Furthermore, an entity does not recognise subsequent.

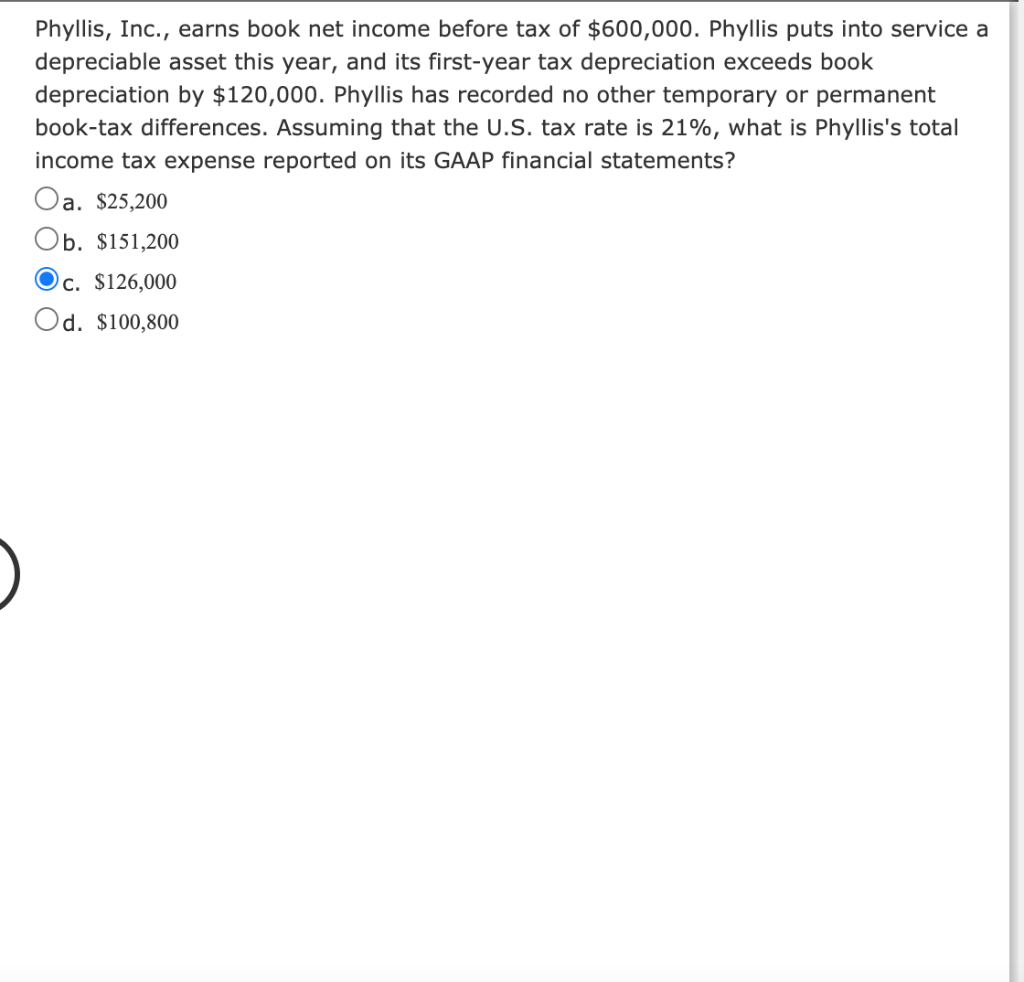

A temporary difference results when a revenue or expense enters book income in one period but affects taxable income in a different period. The permanent and temporary differences in tax accounting result from the differences between financial statements and tax returns. Explain why temporary differences result in deferred tax assets or deferred tax liabilities, while permanent differences do not, and describe the difference in the formation of.

Once the temporary and permanent differences have been analyzed, the deferred tax amounts can be calculated and recorded. Temporary differences are differences between financial accounting and tax accounting rules that cause the pretax accounting income subject to tax to be higher. Tax notices will display total premiums paid during the 2022/23 financial year together with the proportion attributable to benefits deemed to be for insurance against the loss of.

In this case, the deferred revenue in the accounting base is bigger than its tax base. Temporary differences are differences between the carrying amount of an asset or liability and its tax base (for example, for an asset, the tax base is. And (c) the carryforward of unused tax credits.

Most accounting books emphasize this example of a temporary difference: