Heartwarming Info About Accounting Ratios And Formulas Quickbooks Balance Sheet Example Royal Dutch Shell Financial Statements

A balance sheet, along with an income statement and cash flow.

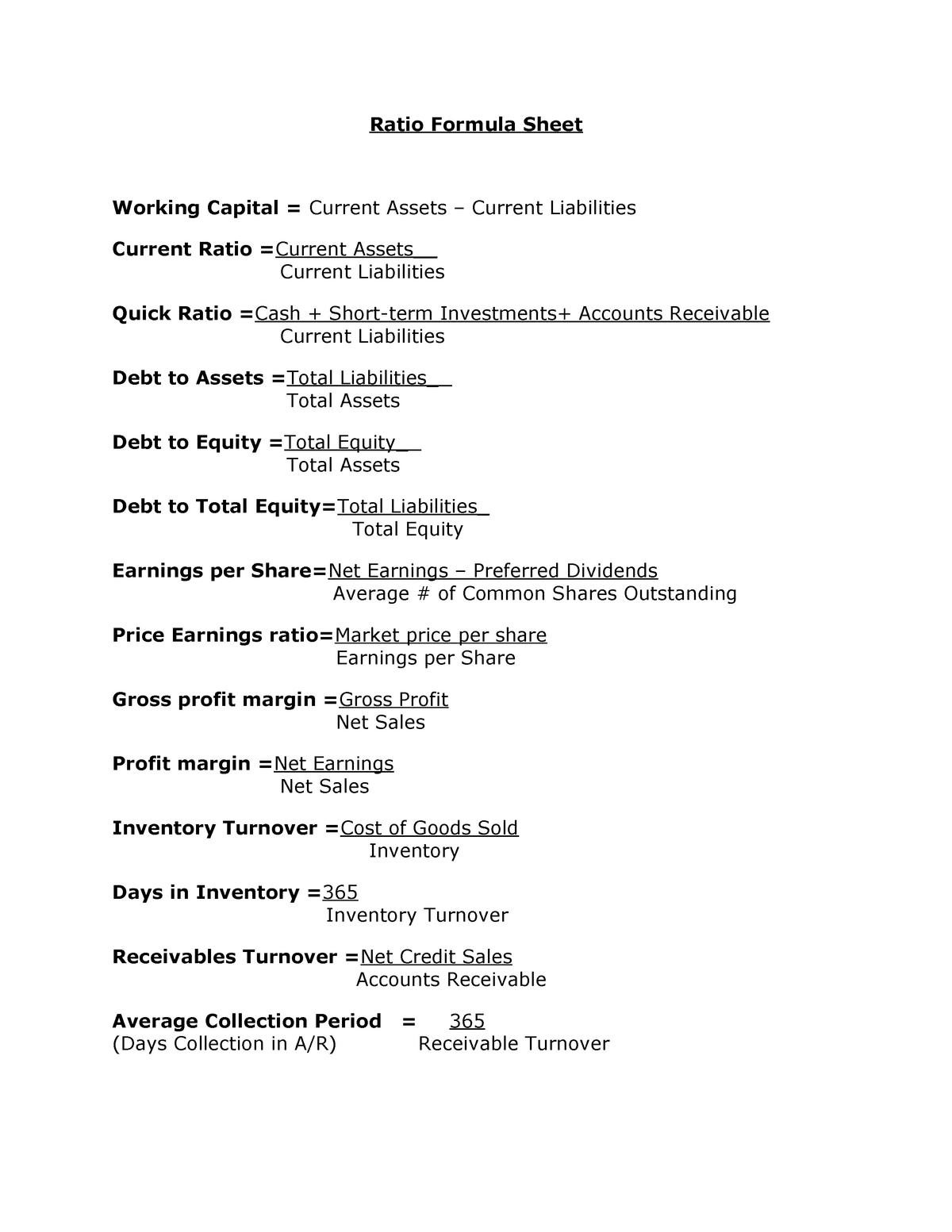

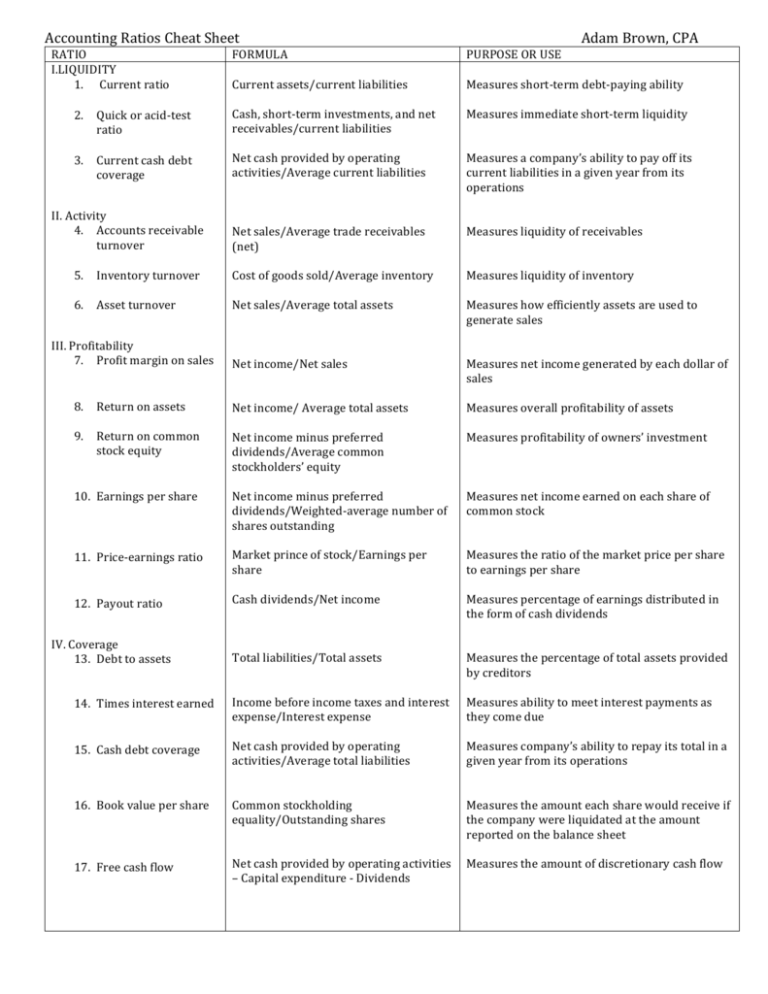

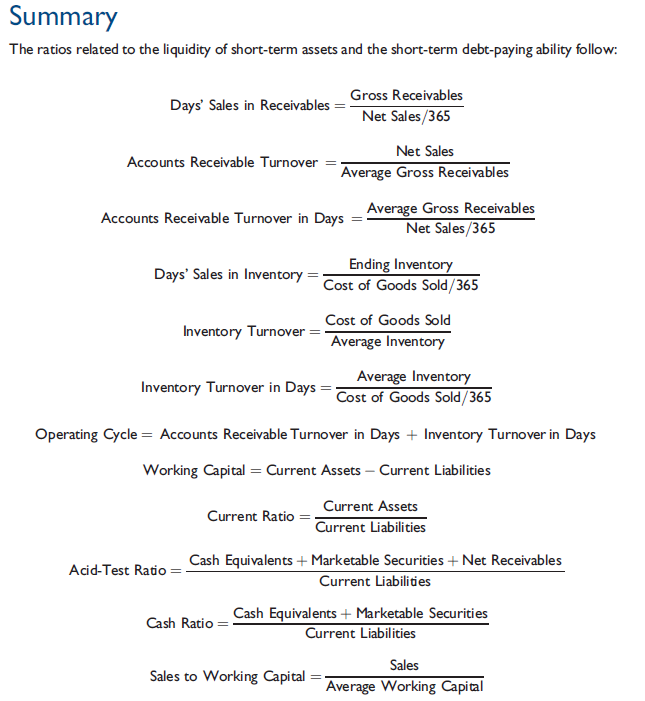

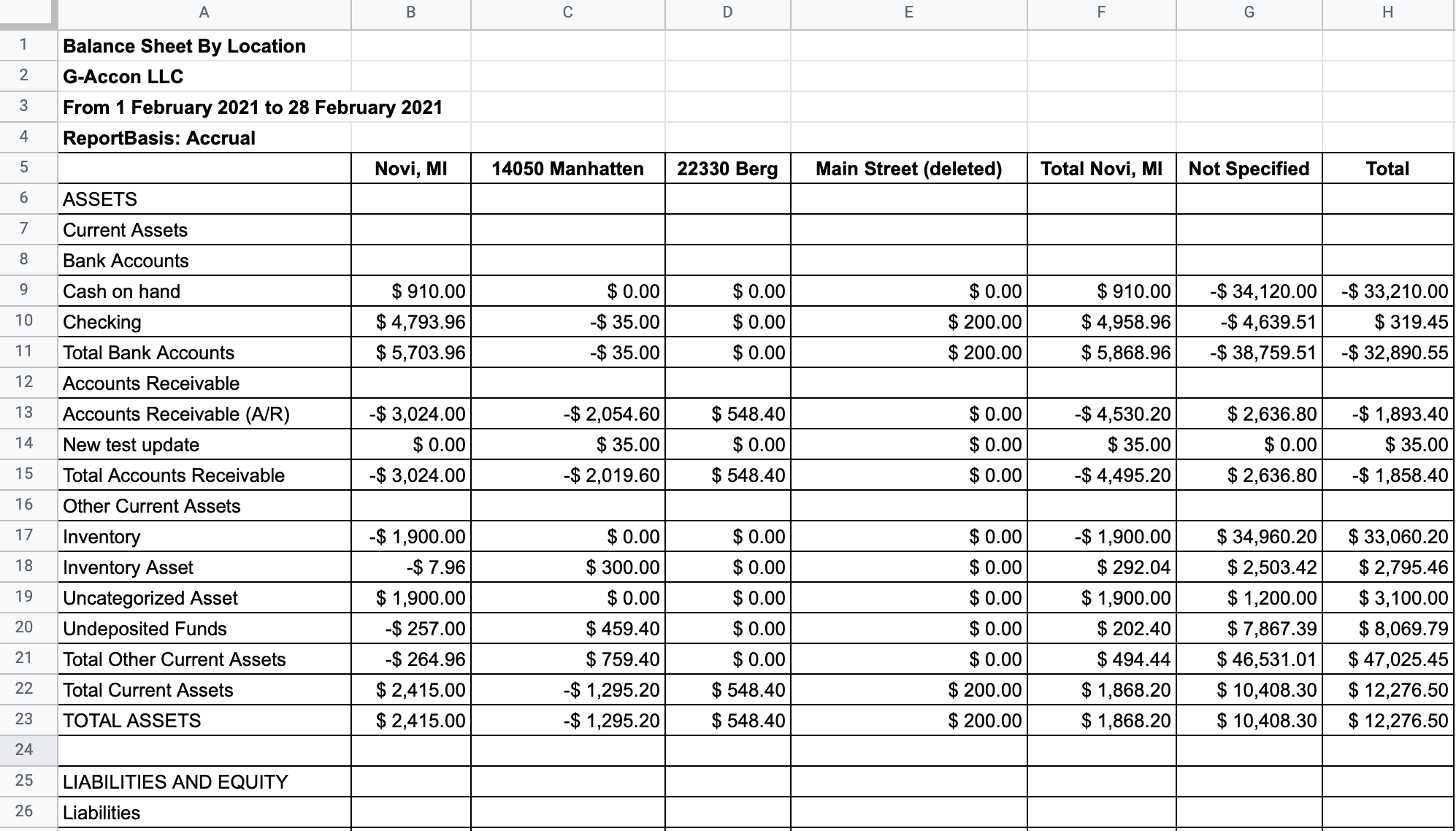

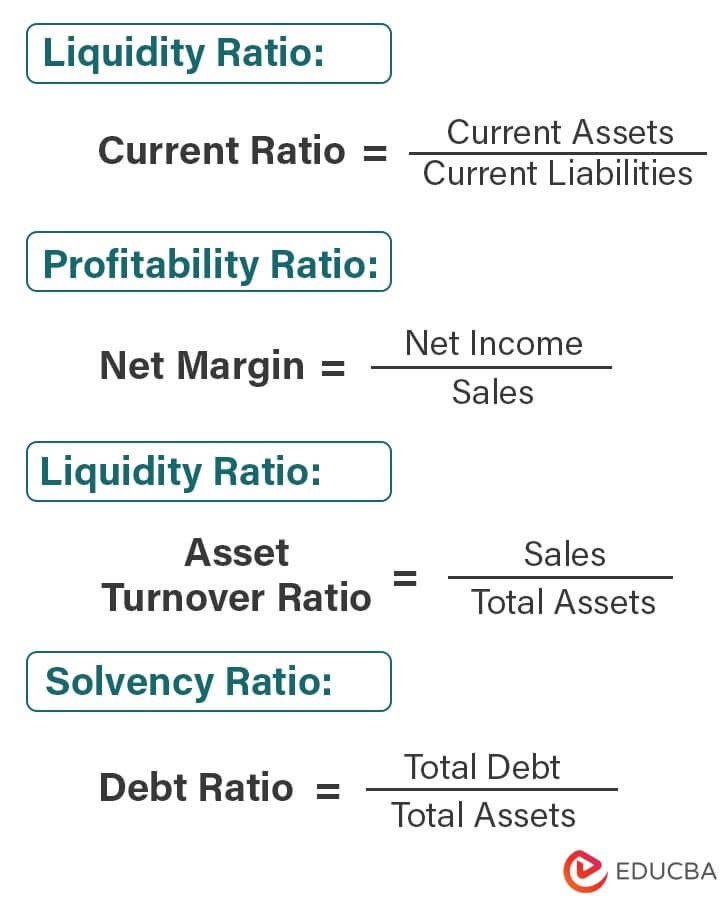

Accounting ratios and formulas quickbooks balance sheet example. Learn how to format your balance sheet through examples and a downloadable template. Gross margin = gross profit / net sales. Quick ratio = quick assets ÷ current liabilities.

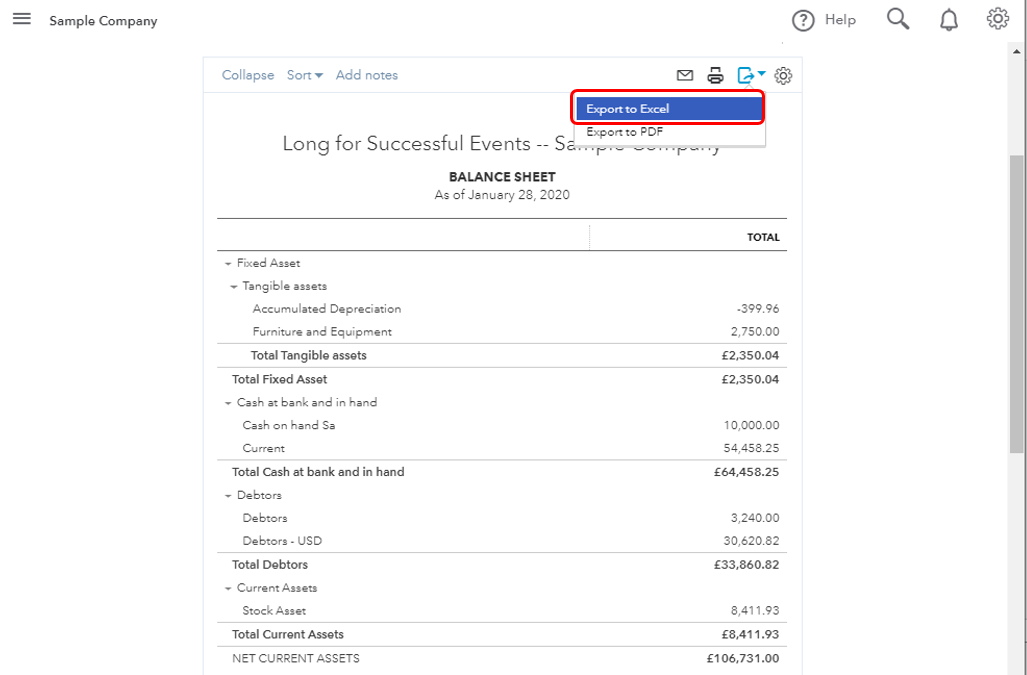

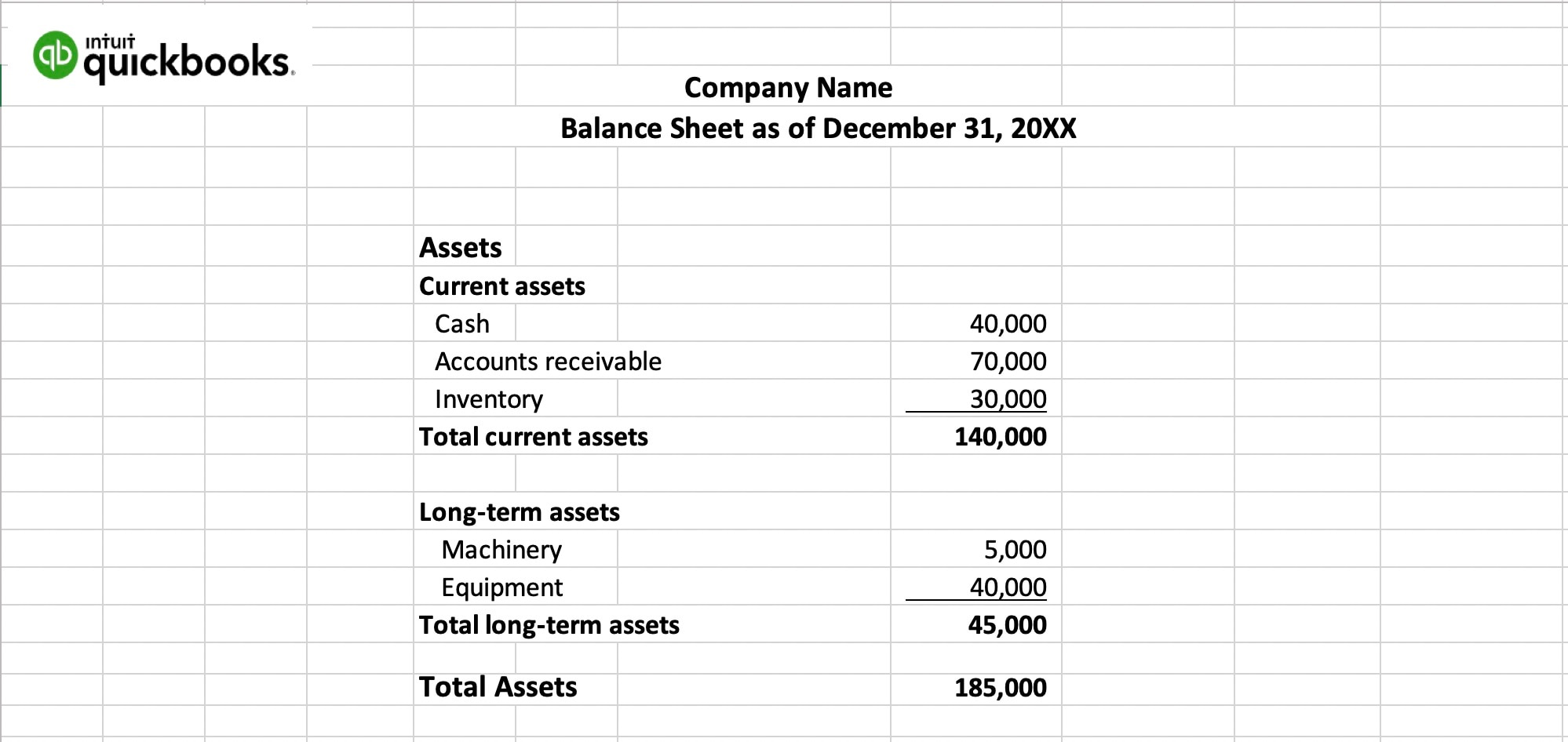

Accounting ratios assist in measuring the efficiency and profitability of a company based on its financial reports. Here’s an example of a company’s balance sheet that your accounting software could produce: The formula is:

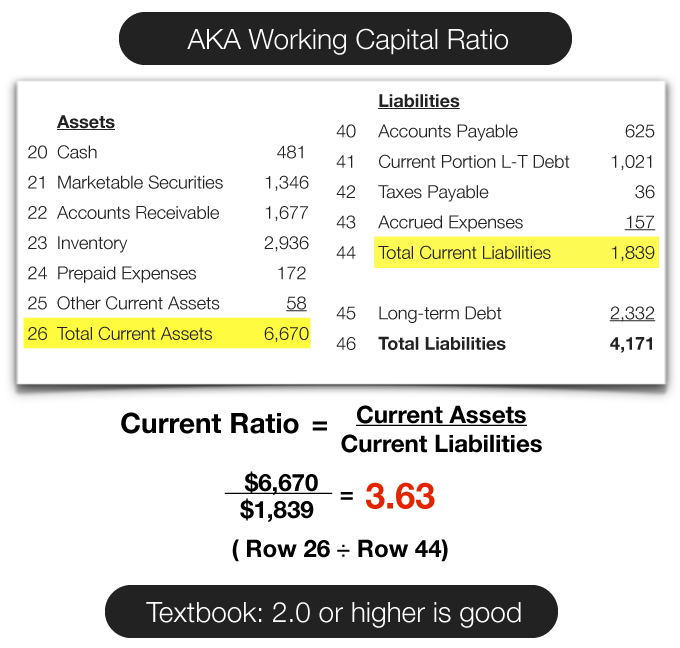

All basic accounting formulas discussed throughout this post highlight. With the balance sheet and income statement in the example above, we can calculate the balance sheet ratios as below: Accounting ratios indicate the company’s performance by comparing various figures from financial statements and the results/performance of the company over the last period,.

Commonly used profitability ratios and formulas. Typically, the accounting ratios are classified based on the purpose for which a particular ratio is calculated. Track company performance determining individual financial ratios per period and tracking the change in their values over time is done to spot trends that may be developing in a.

To get the correct result, you need the average value of assets during the period, not the. The accounting balance sheet formula makes sure your balance sheet stays balanced. In this section, we will discuss five financial ratios which use an amount from the balance sheet and an amount from the income statement.

Balance sheet example. With this balance sheet definition in mind, let’s discuss the different pieces that make up an accurate accounting balance sheet. Return on equity = net income / average shareholder equity.

Also called financial ratios, accounting ratios. Gross profit ratio the gross profit ratio or margin. However, to measure “quick” assets, you only consider your.

To calculate the quick ratio, we need the quick assets and. Types of accounting ratios. Asset turnover ratio = net sales / average total assets.

What are accounting ratios? Specifically, we will discuss the. Assets = liabilities + equity to summarize, we can state that your balance sheet provides a glimpse into the future and the current financial health of your business.

This ratio is similar to the current ratio above.