Spectacular Tips About Non Cash Activities Flow Statement Contribution Margin Income Format

Understanding if fsp corp’s equipment acquisition is a noncash activity requires.

Non cash activities cash flow statement. Cash flow from investing activities (cfi) is one of the sections on the cash flow statement that reports how much cash has been generated or spent from various. By debiting the amount of depreciation in the income statement, net profit falls, but there is. For example, capital items of property,.

Definition and explanation. The main components of the cash flow statement are: Until fsp corp has made a cash payment related to the equipment, the equipment acquisition is a noncash activity that should not be reflected in the statement of cash flows.

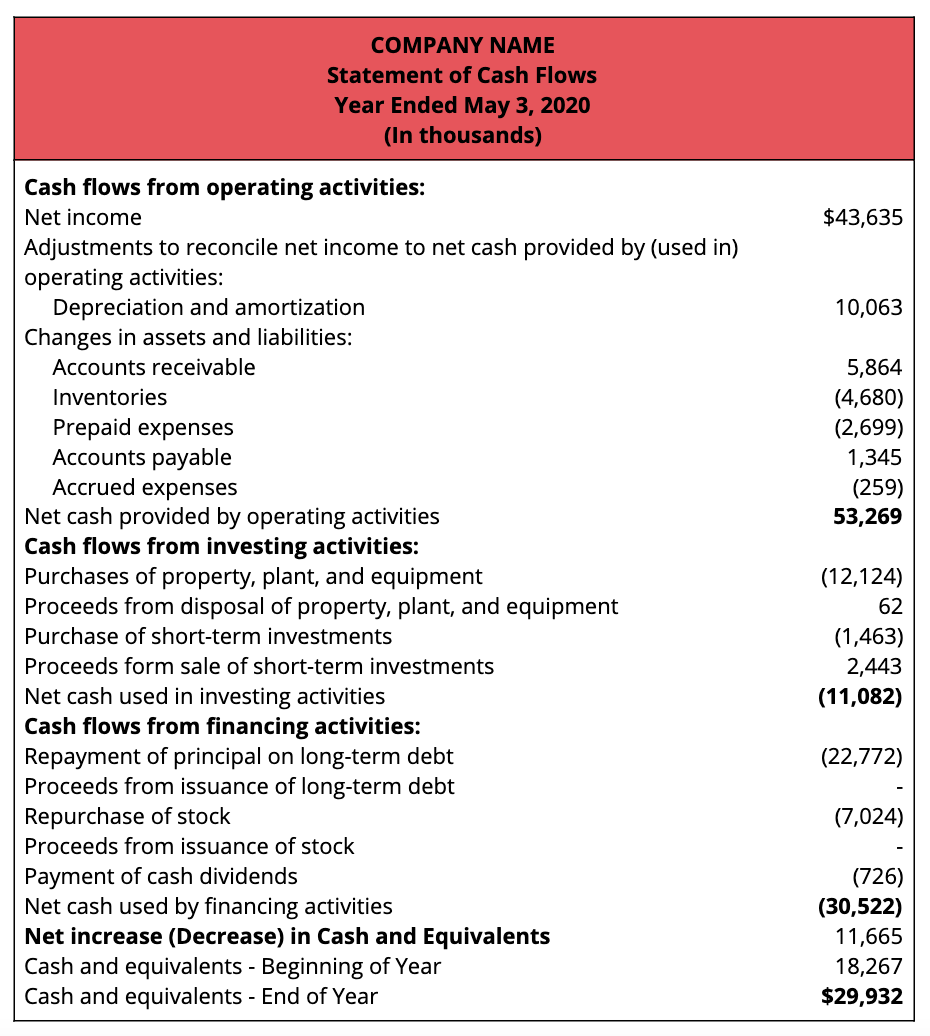

The statement of cash flows reports cash inflows and/or cash outflows in each of three sections: Analysis and income statement presentation. Add back noncash expenses, such as depreciation, amortization, and depletion.

Adjust for changes in current. This would be reported as follows (note: In order to prepare a cash flow statement, we need to understand which items on our income statement and.

Chapter 5 — noncash investing and financing activities. Cash flow from operating activities cash flow from investing activities cash flow from financing activities. Cash flows from operating activities, cash flows from investing.

The $20,000 down payment would be including in the investing section of the statement of cash flows): Reverse the effect of gains and/or losses from investing activities. Presentation of a statement of cash flows operating activities investing activities financing activities reporting cash flows from operating.

Investing and financing activities that do not involve cash are not reported in the cash flow statement since there is no cash flow involved.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)