Fantastic Tips About A Trial Balance Prepared After Adjusting Entries Are Posted Petty Cash Excel Sheet Format Building 3 Statement Model

The list and the balances of the.

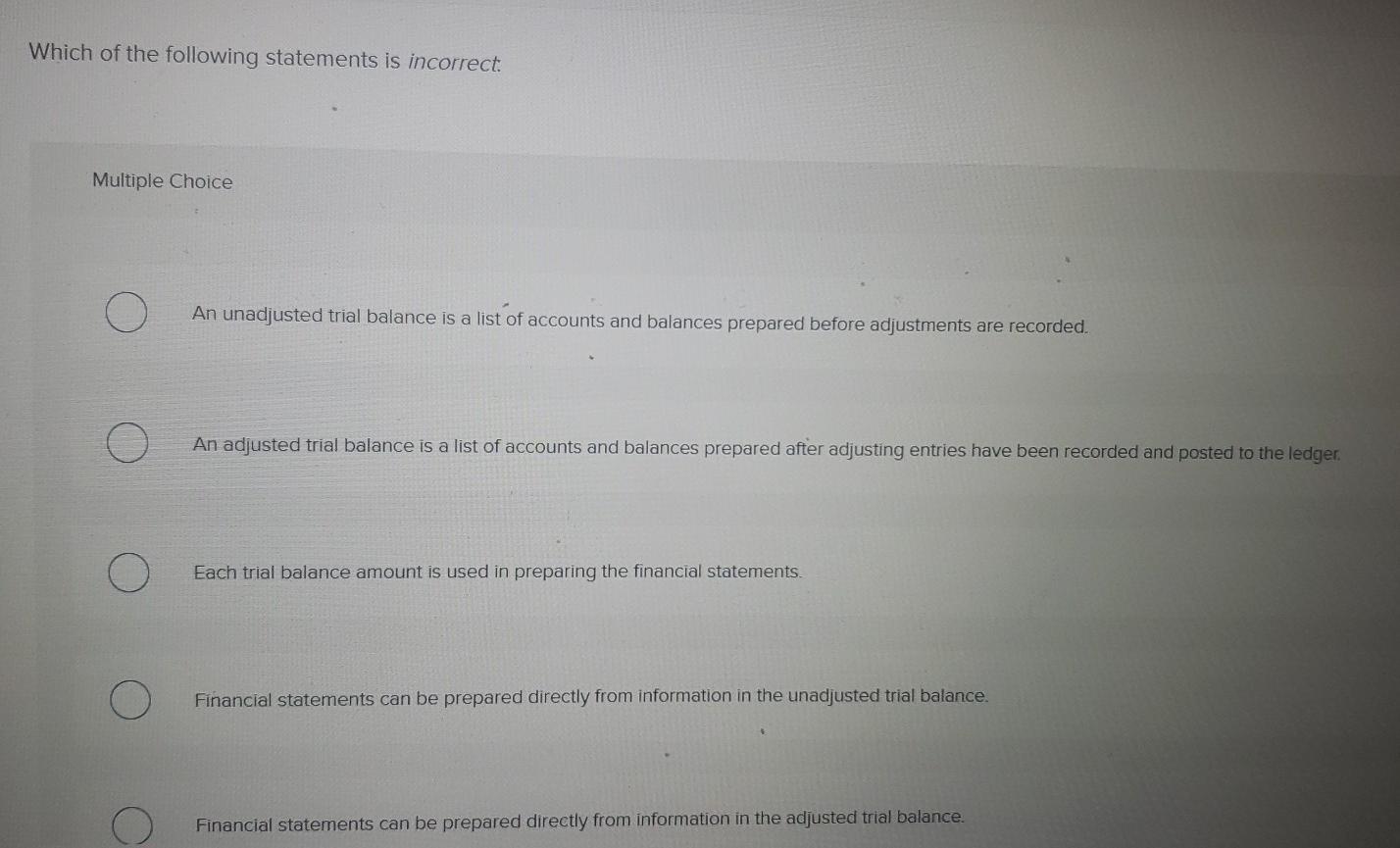

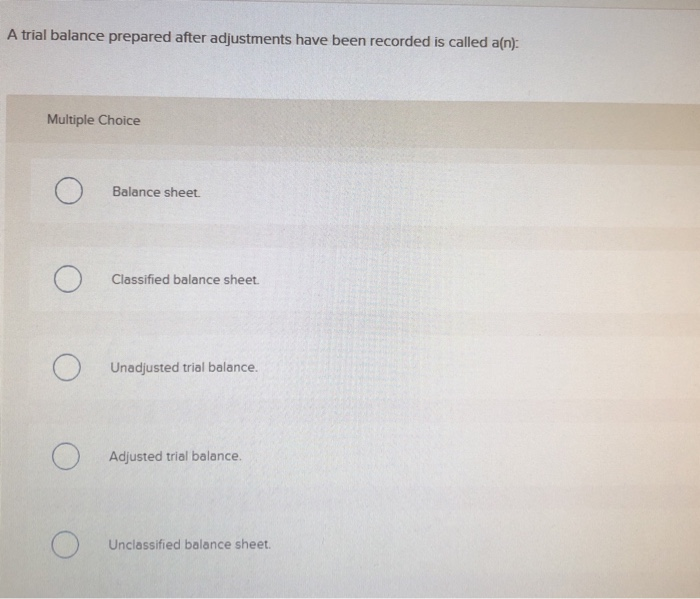

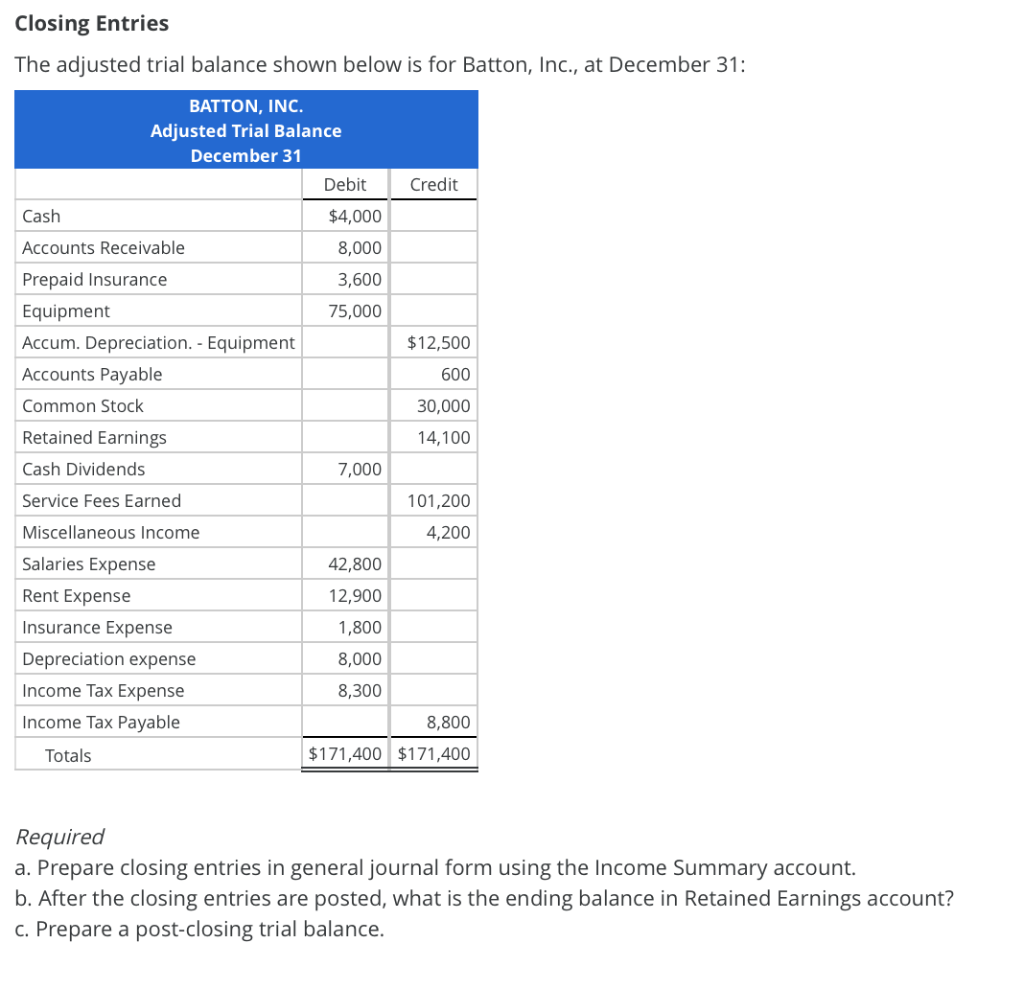

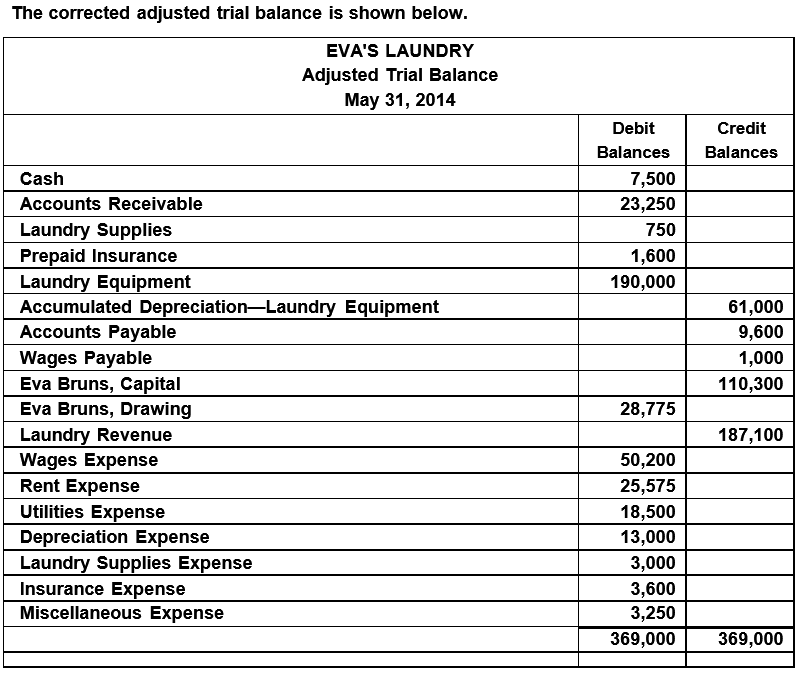

A trial balance prepared after adjusting entries are posted petty cash excel sheet format. List every open ledger account on your chart of accounts by account number. Once the adjusting entries are posted, the adjusted trial balance is prepared to. The intent of adding these entries is to.

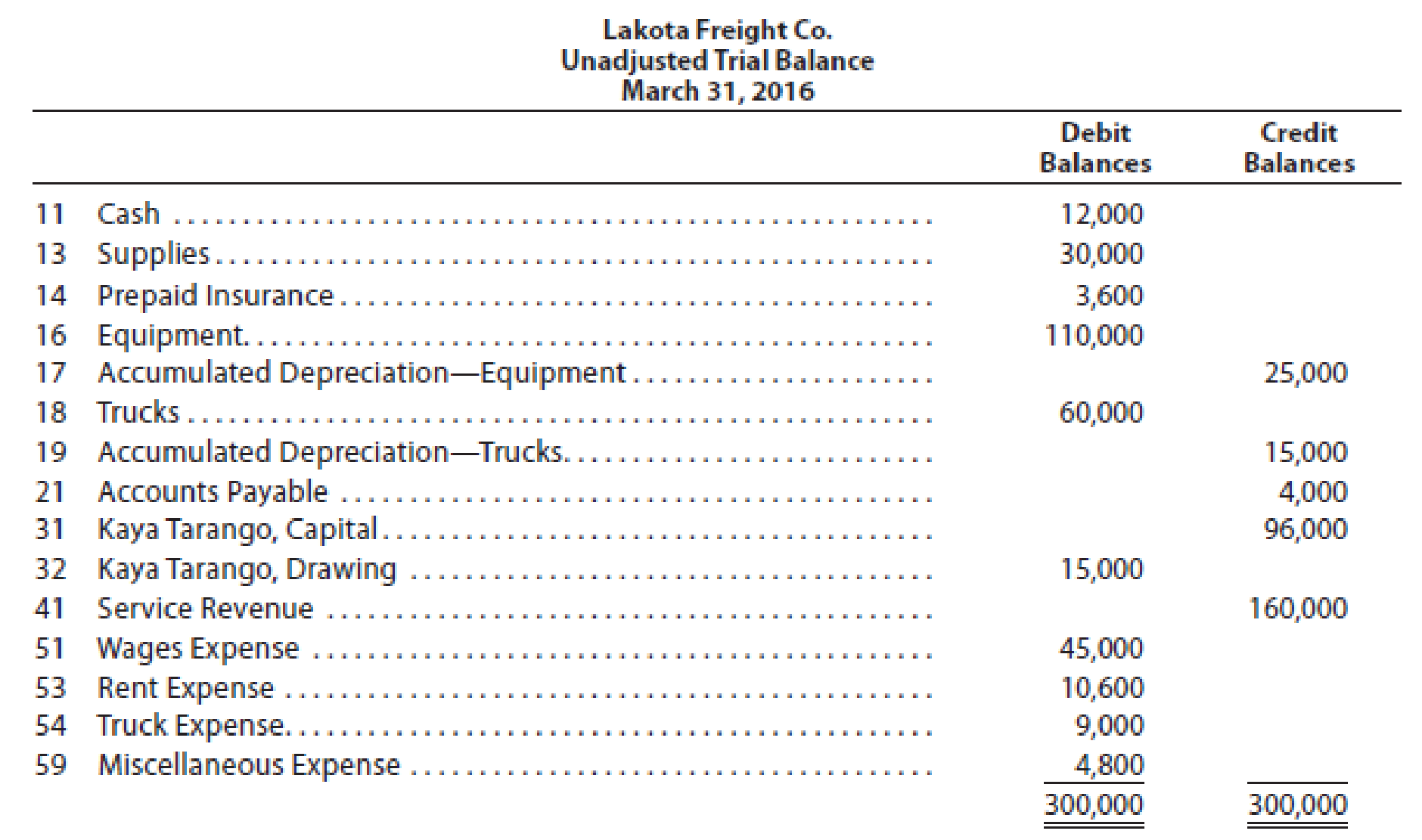

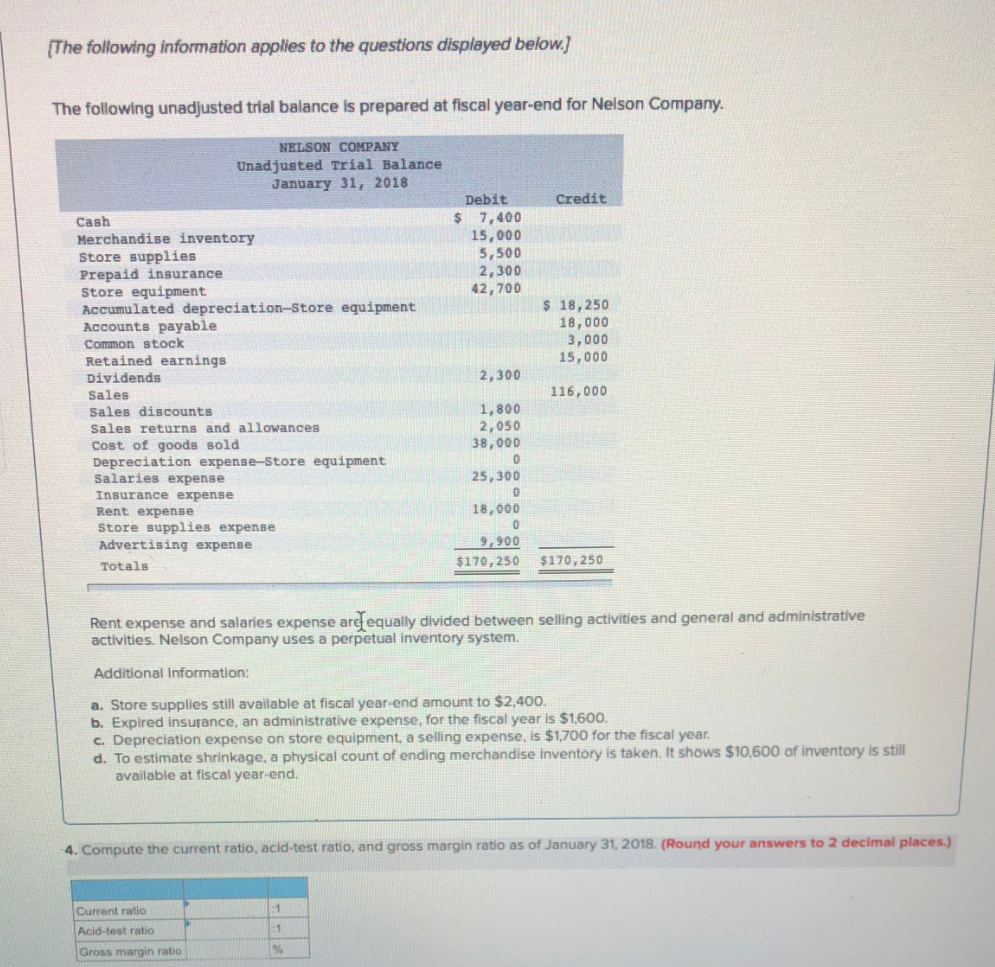

Below is an example of a company’s trial balance: Trial balance has a tabular format that shows details of all ledger balances in one place. A trial balance prepared after adjusting entries are posted adjusting entries journal entries recorded to update general ledger accounts at the end of a fiscal period.

Once the trial balance information is on the worksheet, the next step is to fill in the adjusting information from the posted adjusted journal entries. There are several steps in the accounting cycle that require the preparation of a trial balance: After adjusting journal entries are posted c.

Before the adjusting journal entries are journalized b. *verify that all of the. When is the adjusted trial balance prepared?

You are preparing a trial balance after the closing entries are complete. This trial balance is an important step in the. Steps for preparing a trial balance.

Study with quizlet and memorize flashcards containing terms like a trial balance prepared before adjusting entries are posted. Step 4, preparing an unadjusted trial balance; 441), the amount of inventory on hand at the.

A trial balance prepared after adjusting entries are posted. Start at the top with the checking account balance or whatever is the first account on the trial balance. What is the trial balance format?

The word “post” in this instance. The following section uses the kids learn online (klo) transactions recorded in chapter 2 of the aaa textbook to demonstrate how to record transactions in the journal, post. An adjusted trial balance is a list of all accounts in the general ledger, including adjusting entries, which have nonzero balances.

Step 6, preparing an adjusted. If it’s petty cash, then you should have a petty cash count at the end of. Its purpose is to test the equality between debits and credits after the.

*verify that the debits and credits are in balance. It includes transactions done during the year and the. In addition to error detection, the trial balance is prepared to make the necessary adjusting entries to the general ledger.

![[Solved] Given the following adjusted trial balance Afte](https://media.cheggcdn.com/study/aae/aae6a445-424c-4de8-8b51-33f7b3c5b998/image)