Out Of This World Tips About Balance Sheet Point In Time Personal Profit And Loss Template

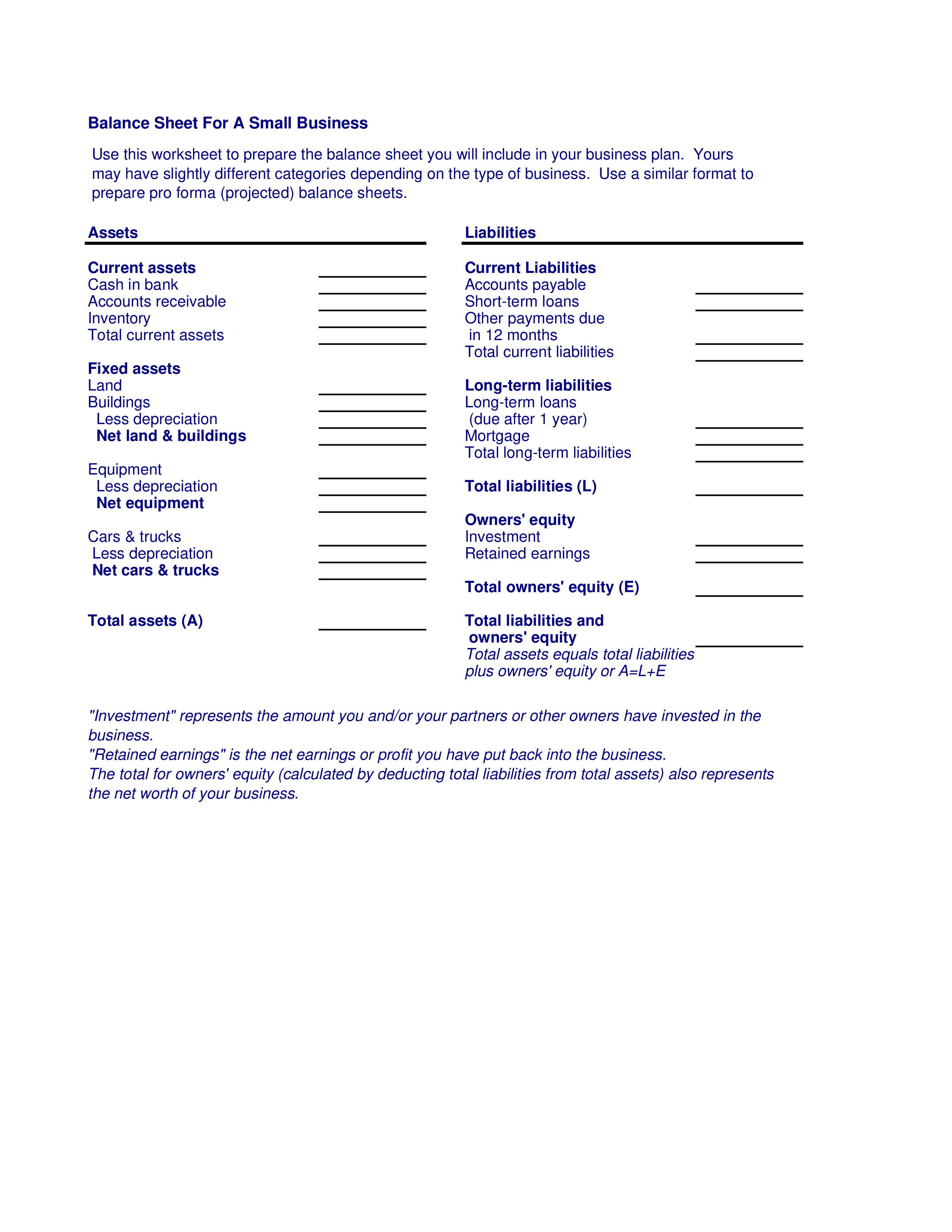

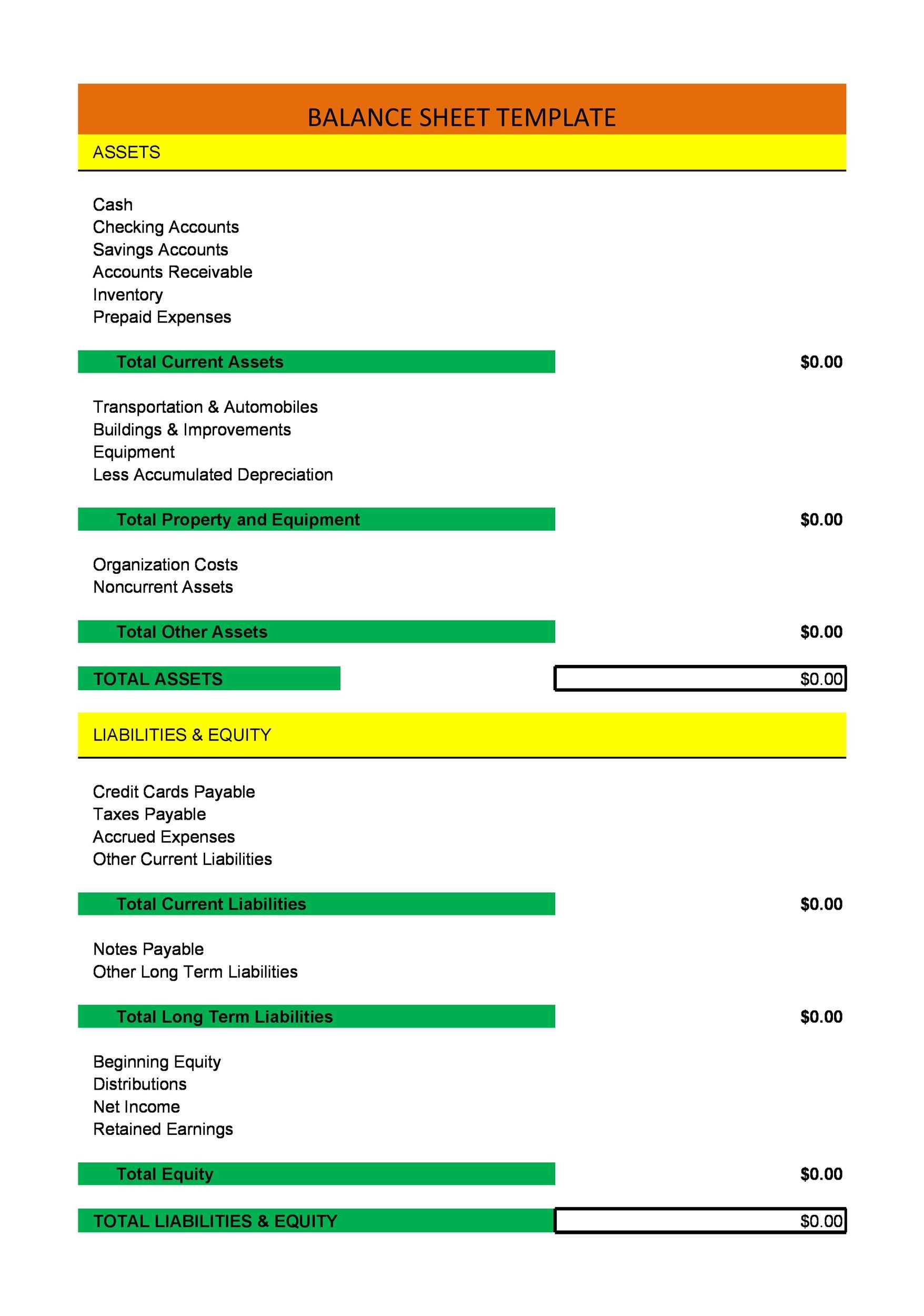

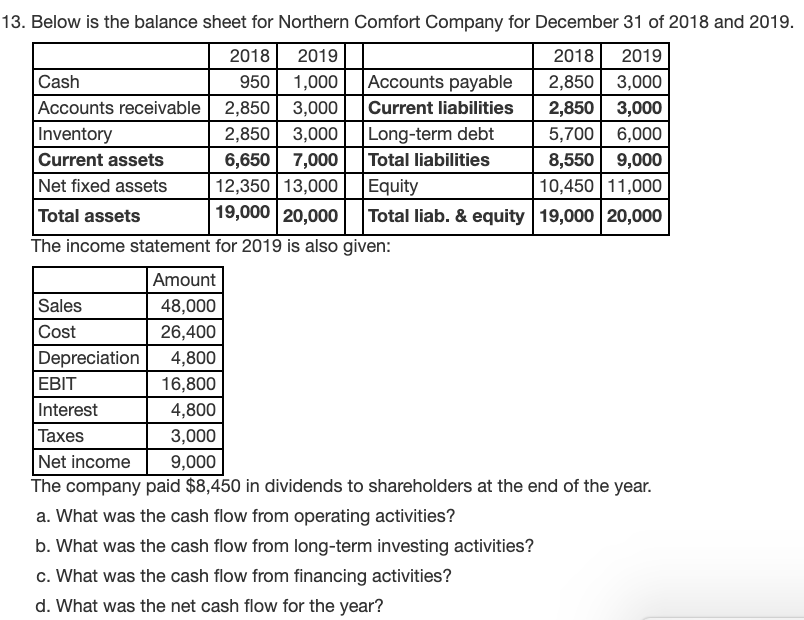

A balance sheet is a financial statement that contains details of a company’s assets or liabilities at a specific point in time.

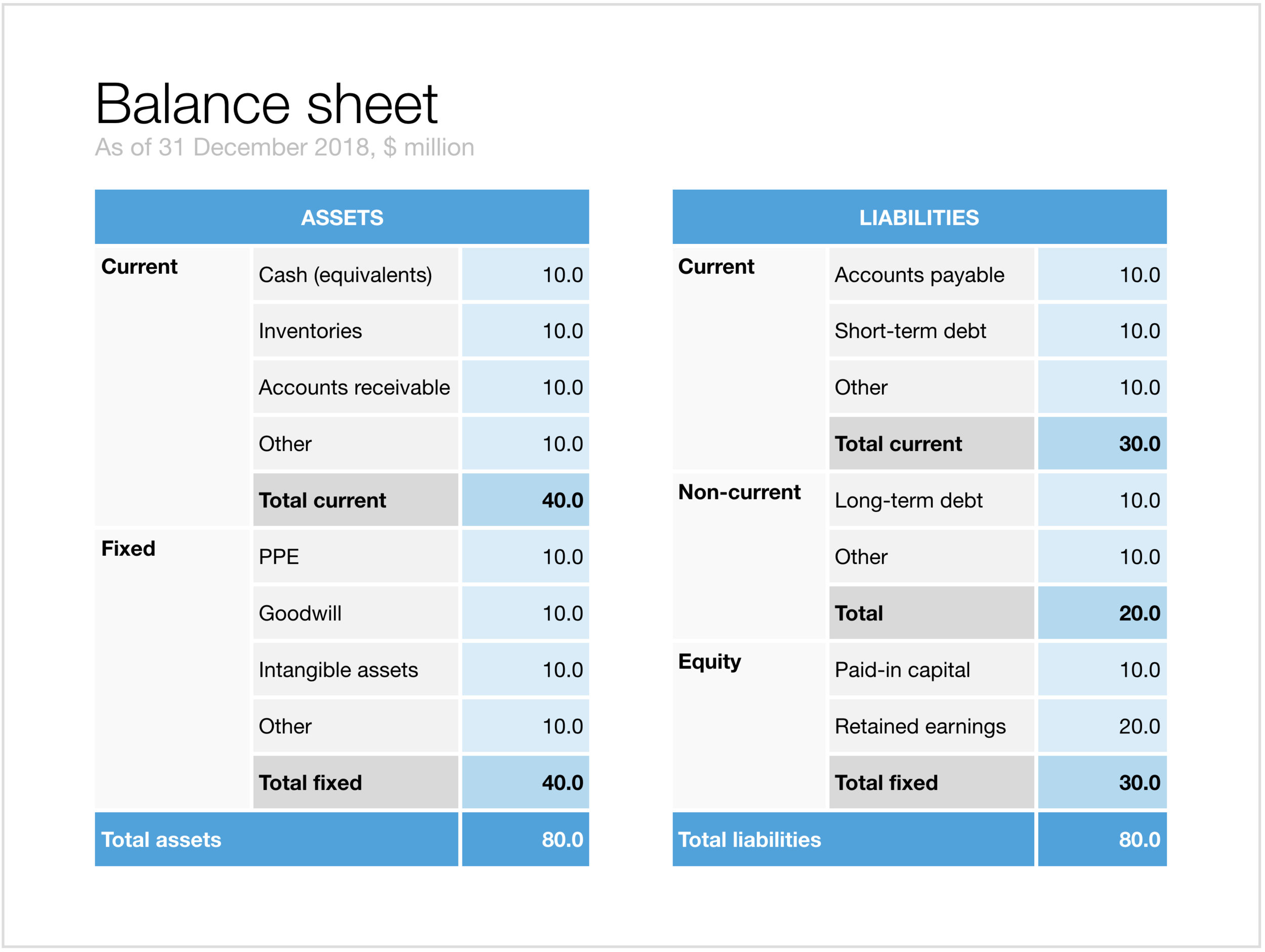

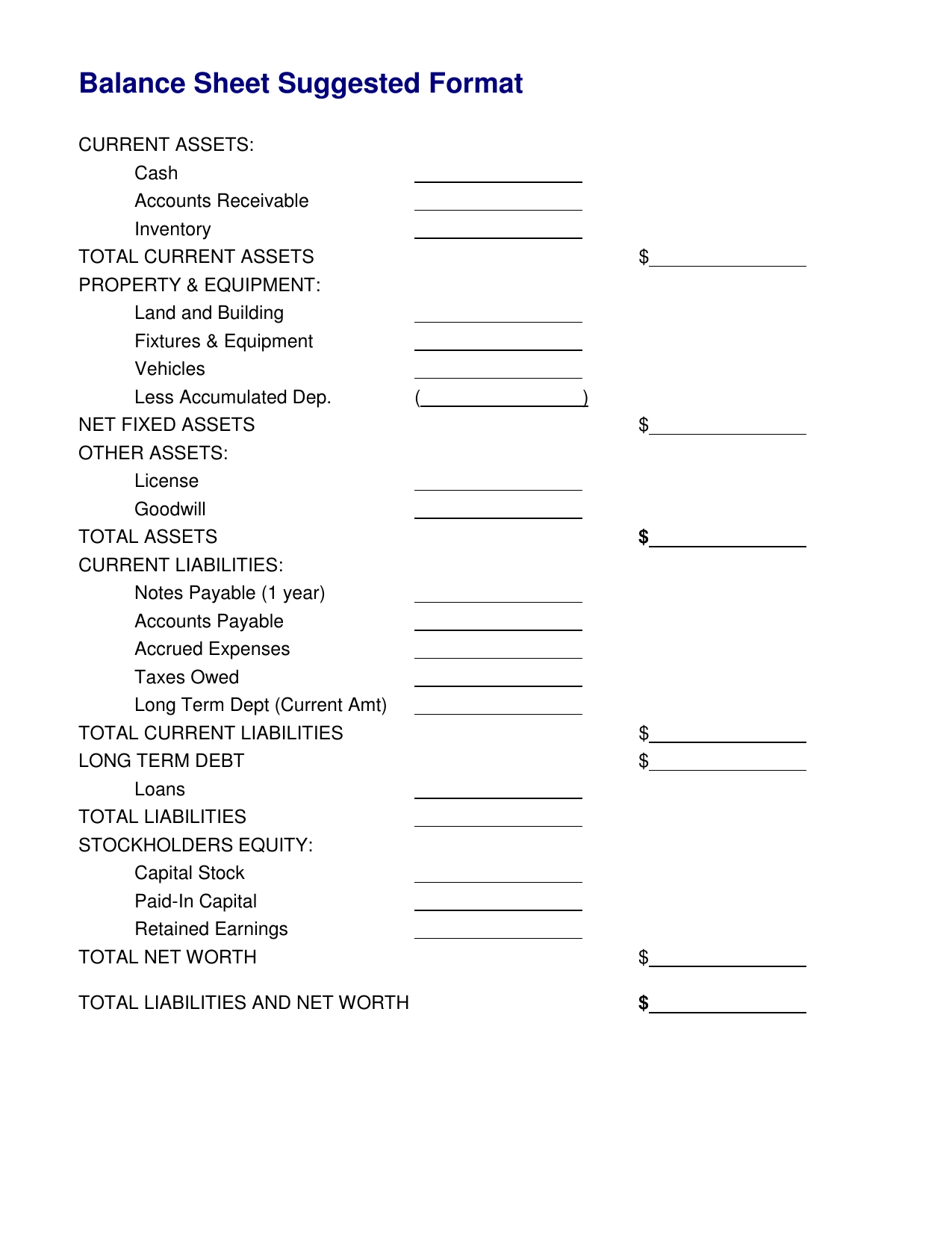

Balance sheet point in time. A balance sheet shows the financial position of the business at a specific point in time. Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity. The balance sheet displays the company’s assets, liabilities, and shareholders’ equity at a point in time.

In other words, the balance sheet illustrates a business's net worth. A balance sheet is a statement of the financial position of a business that lists the assets, liabilities, and owners' equity at a particular point in time. The asset section begins with cash and equivalents, which should equal the balance found at the end of the cash flow statement.

A balance sheet summarizes the assets, liabilities, and capital of a company. A company’s balance sheet is a snapshot of its financial position at a specific point in time. A balance sheet reports a company's assets, liabilities and shareholder equity at a specific point in time.

The balance sheet shows what the company owns, what it owes and the value of the shareholder’s investment in the company. The balance sheet shows the carrying values of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. What is the difference between balance sheet and p&l statement?

Fundamental analysts focus on the balance sheet when considering an investment opportunity. Conceptually, the assets of a company (i.e. ), the balance sheet presents information as of a certain date (at a specific point in time).

It presents a company’s financial position at a specific point in time, showcasing its assets, liabilities, and equity. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. A balance sheet is a comprehensive financial statement that gives a snapshot of a company’s financial standing at a particular moment.

Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable education (save) repayment plan. The two sides of the balance sheet must balance: A balance sheet covers a company’s assets as defined.

Gen z also values authenticity. Gen z looks for trust and authenticity. A balance sheet is a financial statement that shows the relationship between assets, liabilities, and shareholders’ equity of a company at a specific point in time.

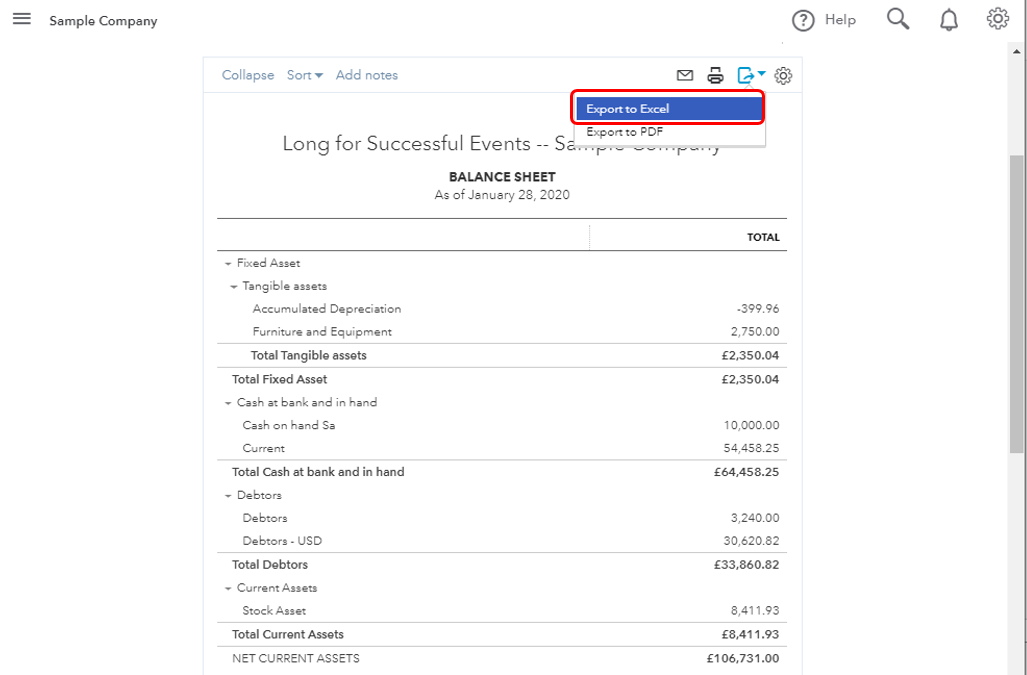

The fed more the doubled the size of its holdings starting in march 2020 to a peak of nearly $9 trillion, using bond purchases to stabilize markets and provide stimulus beyond the near zero. A balance sheet is a type of financial statement. A balance sheet and a profit and loss (p&l) statement serve different purposes and provide distinct financial insights:

Reading a balance sheet is important in determining the financial health of a company. It will allow nickel miners to apply to access a $4 billion fund. The balance sheet lists everything that the company owns (its assets), everything that it owes (its liabilities), and shareholder equity.