Amazing Tips About Accountant Prepared Financial Statements Bank Balance Is Asset Or Liability

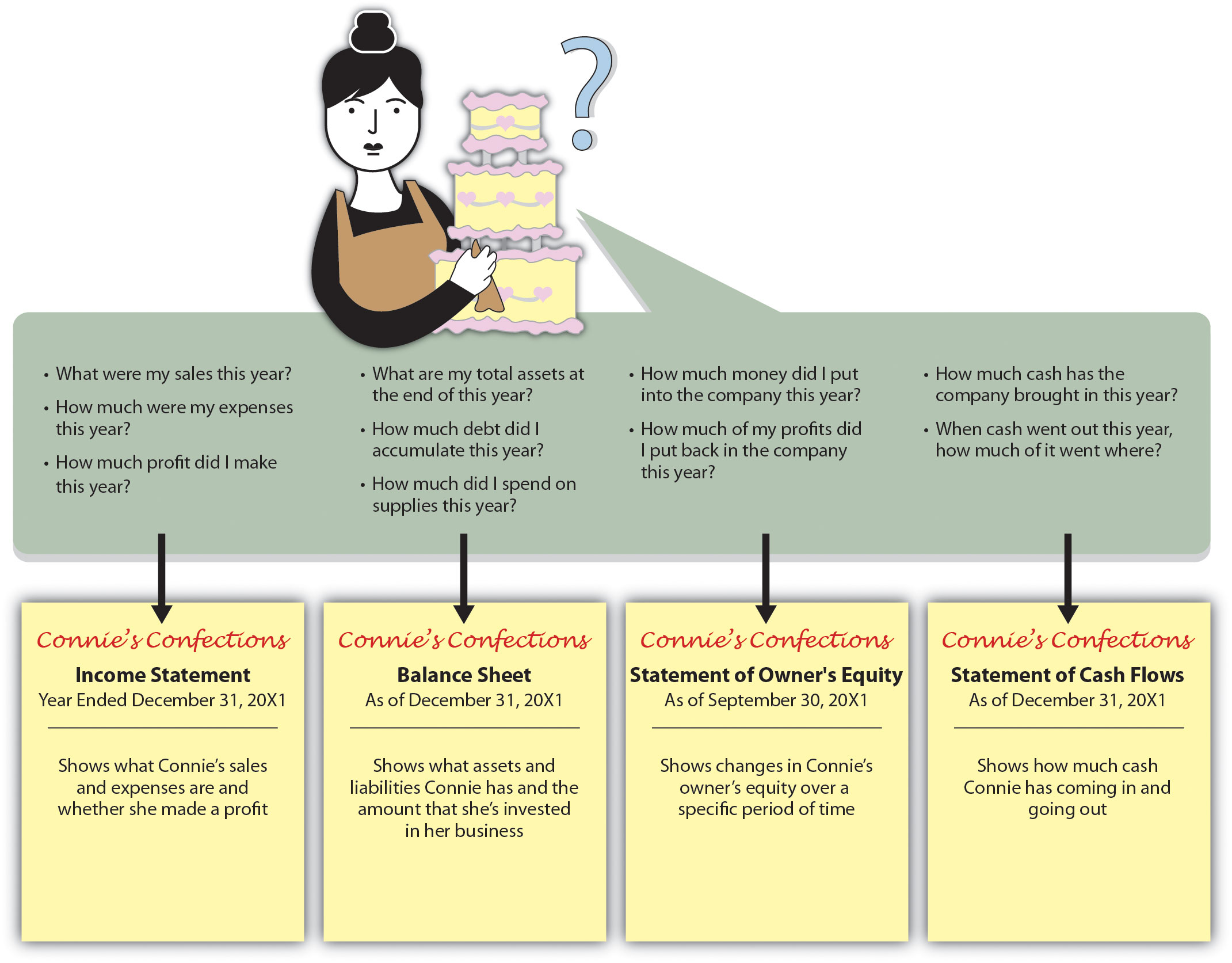

Financial statements are a set of documents that show your company’s financial status at a specific point in time.

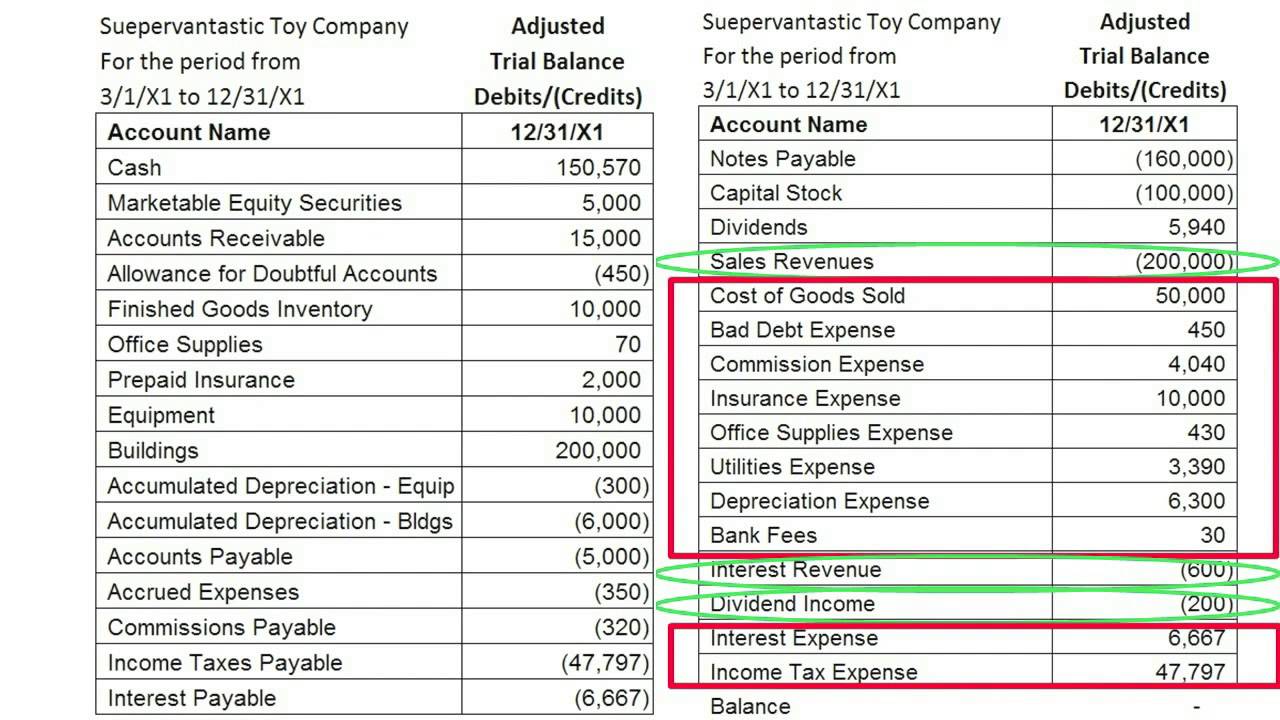

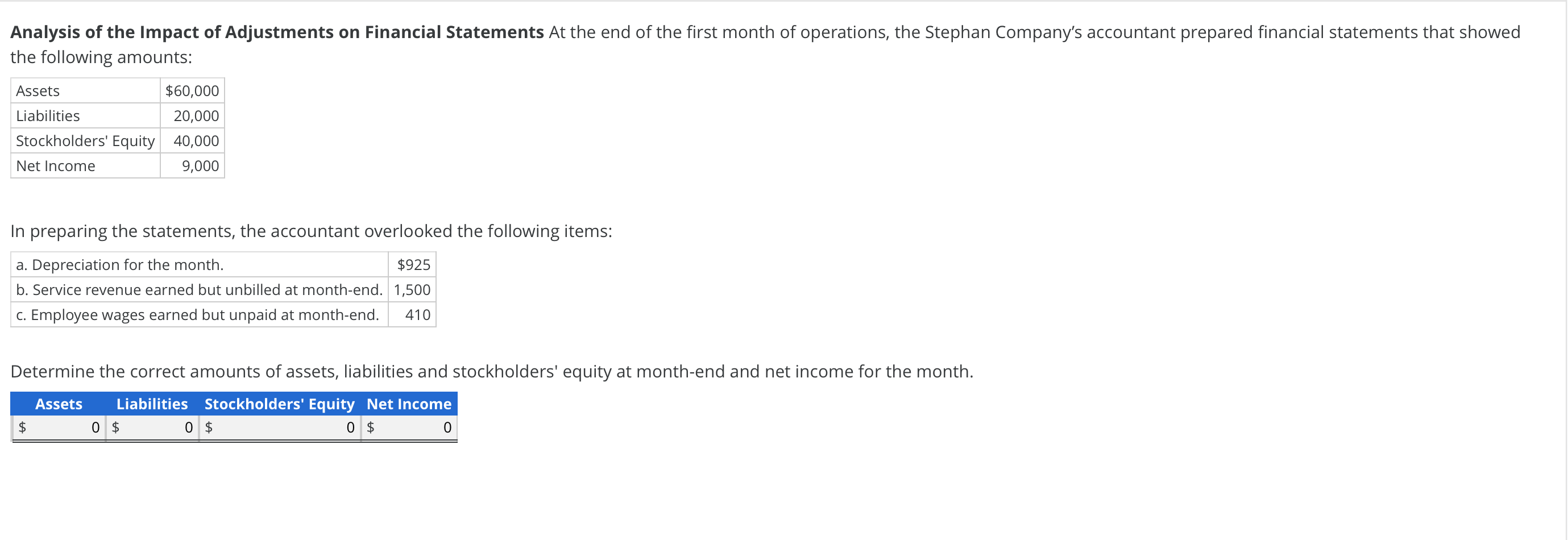

Accountant prepared financial statements. It has not been approved by the auditing and assurance standards board, the accounting standards board or the public sector accounting board. All three are prepared according to international financial reporting standards (ifrs). (1) an income statement, recent standards now require a statement of comprehensive income, (2) a statement of changes in equity, (3) a balance sheet, also known as statement of financial position, (4) a statement of cash flows, and (5) notes to financial statements or supplementary notes.

This section may also be applied, adapted as appropriate in the circumstances, to the preparation of other historical financial information. Often referred to as the “statement of financial condition,” the balance sheet is a snapshot of what you have and what you owe at a given point in time. Meet the team.

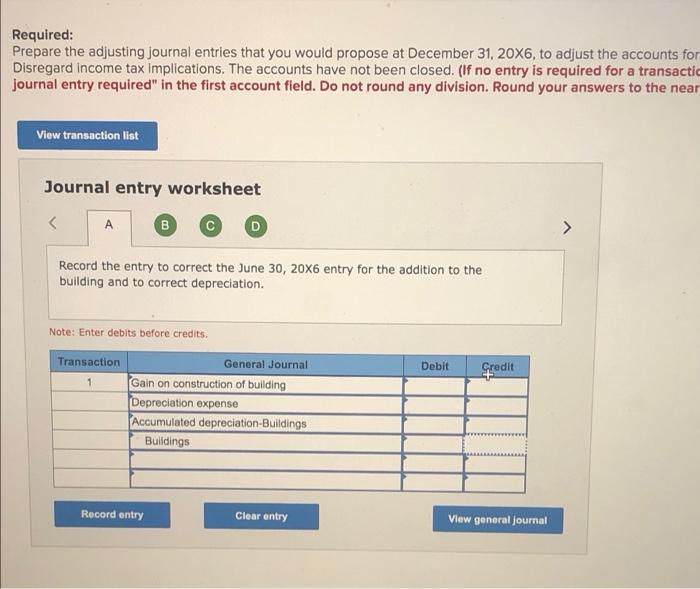

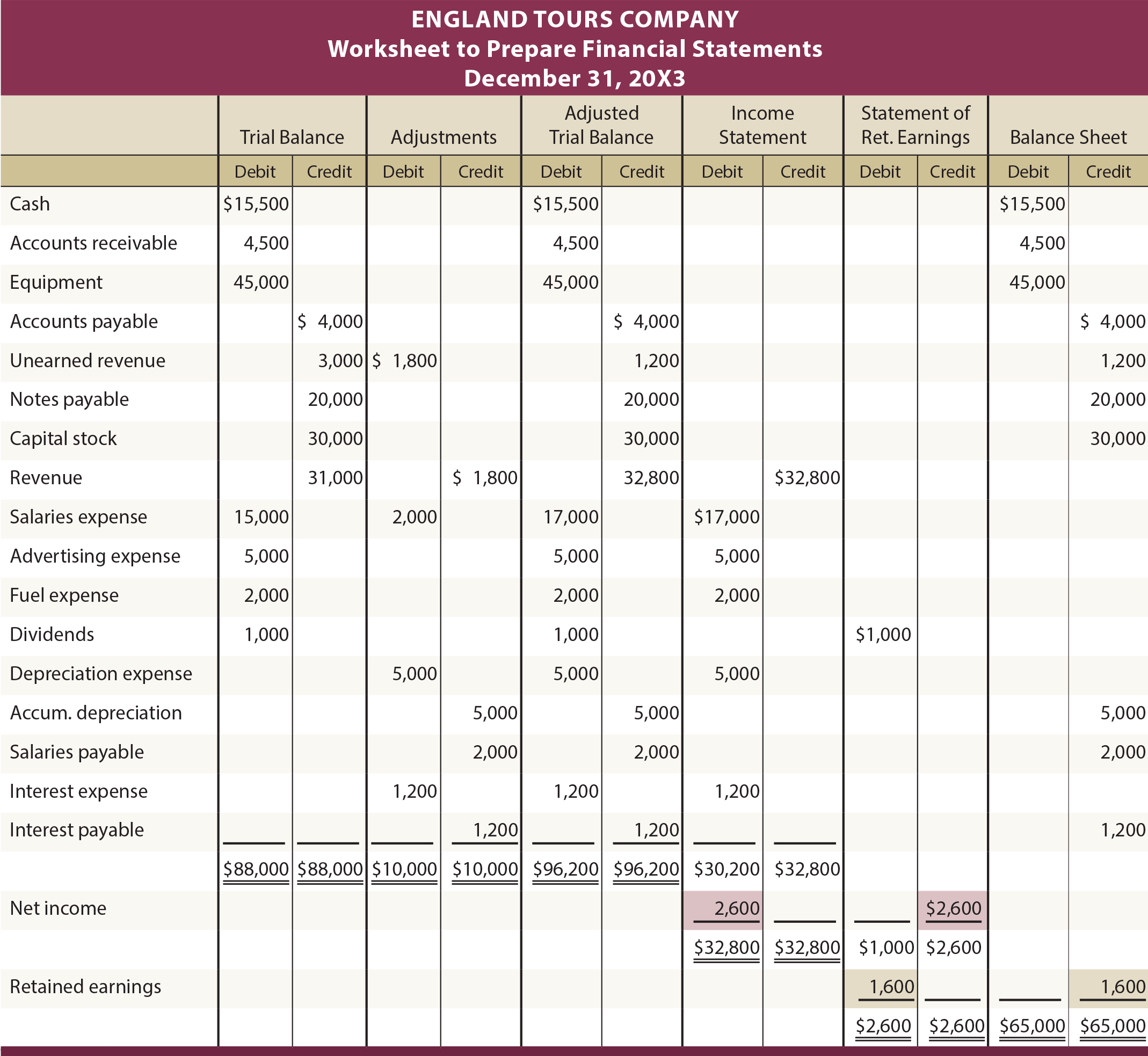

Remember that we have four financial statements to prepare: The following diagram and supporting notes illustrate the basic process of preparing financial statements that will be assessed in the fa1, fa2 and ffa/fa exams from september 2023: An income statement, a statement of retained earnings, a balance sheet, and the statement of cash flows.

Management is responsible for designing, implementing, and maintaining internal control relevant to the preparation and fair presentation of the financial statements. These financial statements were introduced in introduction to financial statements and statement of. To members, the answers might be obvious, but the distinction is often lost in the wider world.

Illustration 1 — an accountant’s compilation report on comparative financial statements prepared in accordance with accounting principles generally accepted in the united states of america. Web.01 this section applies when an accountant in public practice is engaged to prepare financial statements or prospective financial information. Keep in mind that not all accountants are cpas.

Keeping financial statements updated on a regular clip helps businesses develop, prepare for the future, and better identify their capital needs. And is engaged to perform an audit, review, or compilation of financial statements. We produce example financial statements to illustrate the application of the requirements in australian accounting standards (aasbs) and international financial reporting standards (ifrss).

Preparing financial statements is the seventh step in the accounting cycle. For inclusion in written personal financial plans. Financial statement preparation is a crucial aspect of a company's financial management, involving the recording and reporting of its financial transactions and activities.

And what does an auditor do that is different? Financial statements are often audited by government agencies and accountants to ensure. [footnote revised, december 2012, to reflect.

The completed financial statements are then distributed to management, lenders , creditors , and investors , who use them to evaluate the performance, liquidity , and cash flows of a business. Privately held companies can choose to adopt accounting standards for financial enterprises.

Financial statements are written records that convey the financial activities of a company. Management is responsible for the accompanying financial statements of xyz company, which comprise the balance sheets as of december 31,. Statements contain items that are the same as, or similar to, those in financial statements prepared in accord‐ ance with gaap, preparers of full disclosure financial statements prepared when applying the cash‐ or tax‐basis of accounting are.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

/accountant-calculator-accounting-graphs-career-business-1449659-pxhere.com-072d54485e09467292a7fb73fa1761df.jpg)