Heartwarming Tips About Pro Forma Cash Budget Petty Fund In Balance Sheet

A pro forma statement is a prediction, and a budget is a plan.

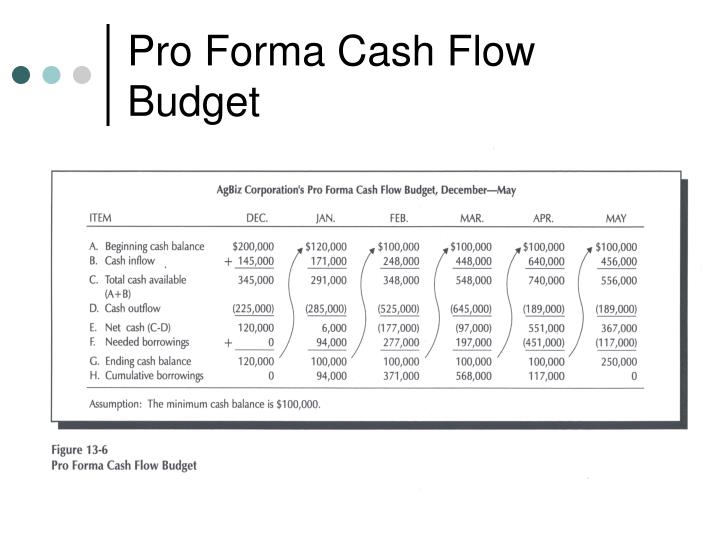

Pro forma cash budget. A pro forma budget is a projected budget based on “what if” scenarios. Pro forma statements can help predict cash flow, analyze risks, and secure funding. A pro forma statement and a cash budget are tools used for planning in companies.

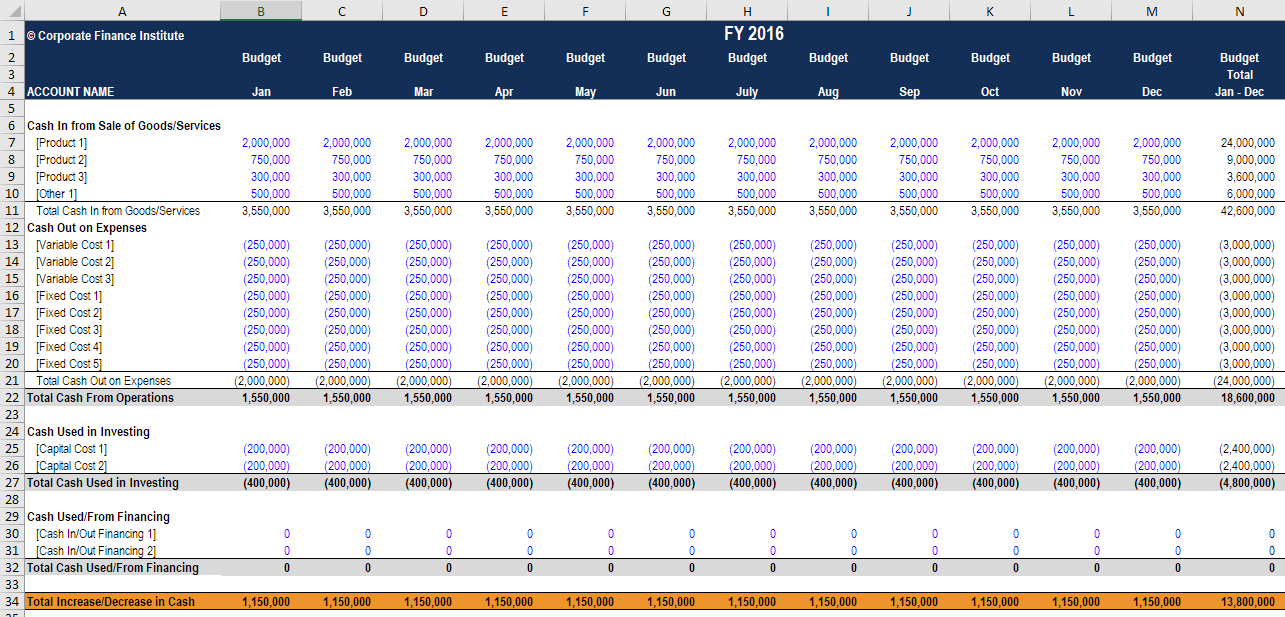

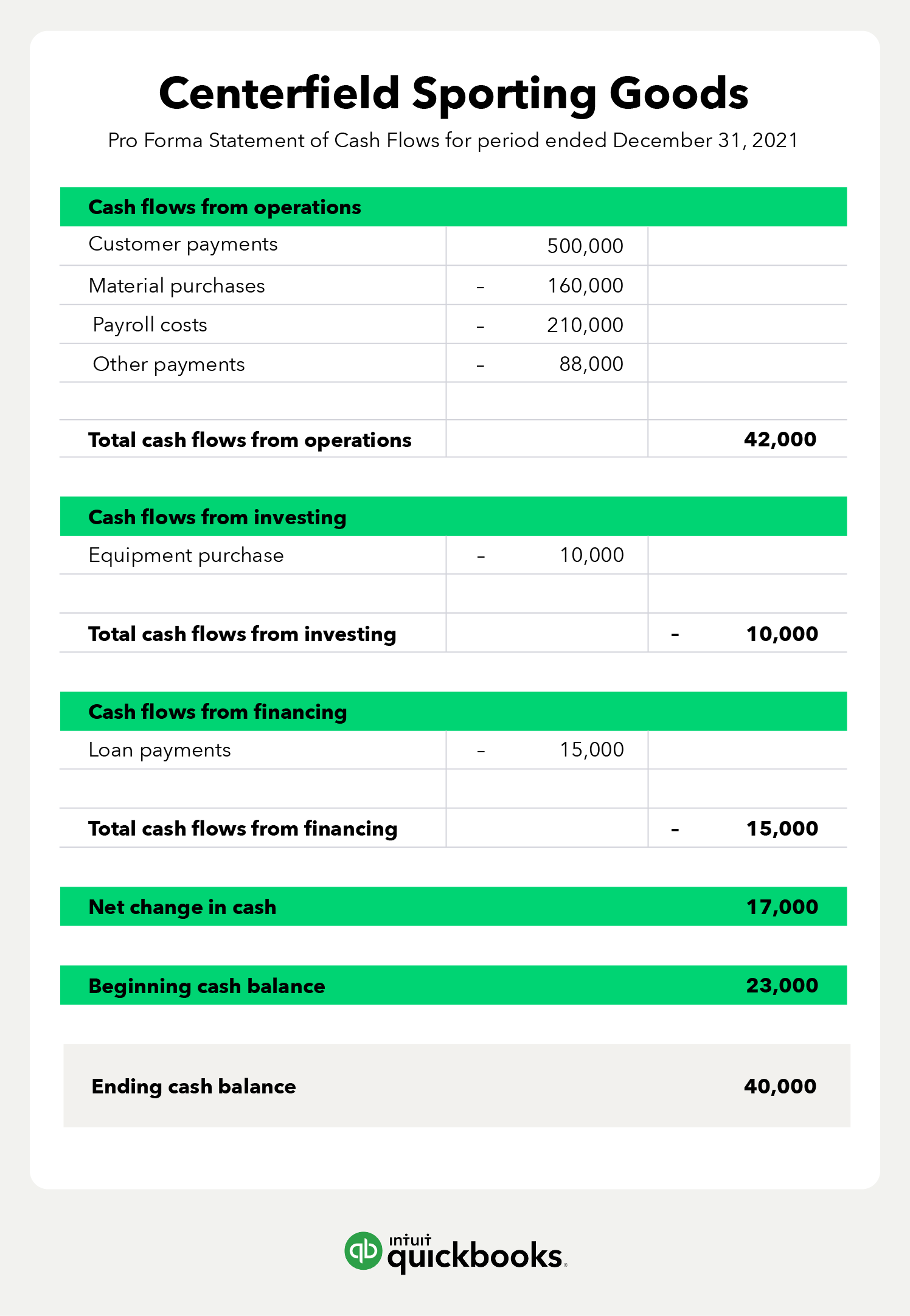

Pro forma statements of cash flow estimate how much cash inflow and outflow is expected in one or more future periods. Updated june 24, 2022 pro forma cash flow statements help companies project their cash inflows and outflows over specified periods. Think of it this way:

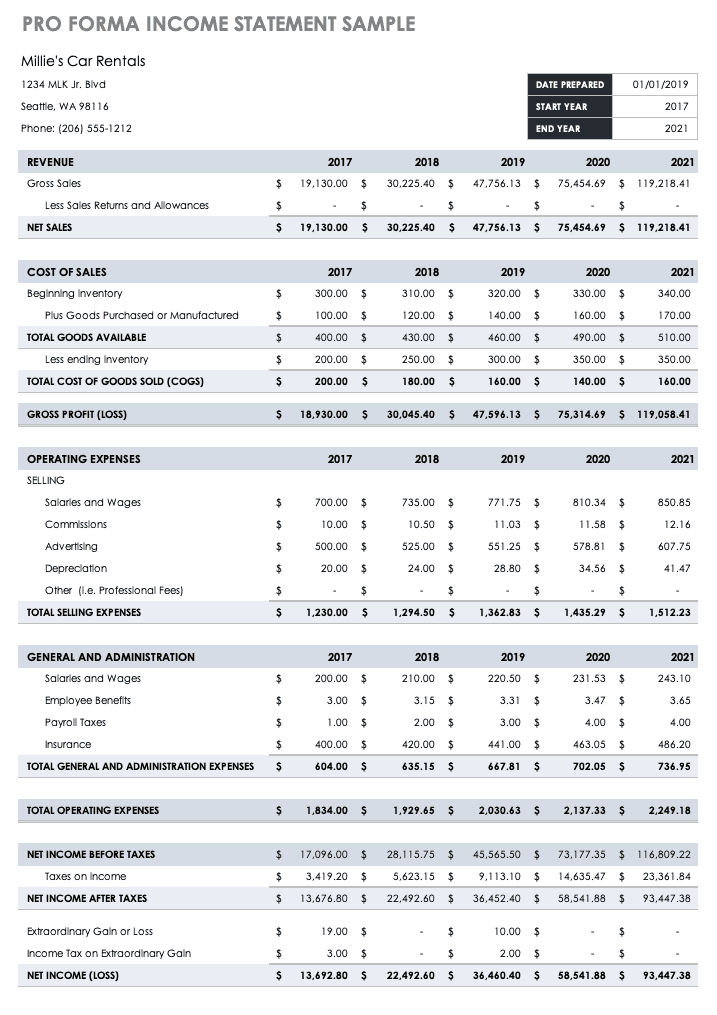

A pro forma financial statement is essentially a budget based on a certain event occurring. Pro forma budgets are used by most businesses and many conscientious individuals. Pro formas look into the future and attempt to forecast anticipated revenues, costs, expenses, profits and cash.

Pro forma, latin for “as a matter of form” or “for the sake of form”, is a method of calculating financial results using certain projections or presumptions. There are three main types of pro forma statements: Basically a pro forma budget forecasts revenues and expenses of a company or business advance in order to carry out a new activity such as paying off.

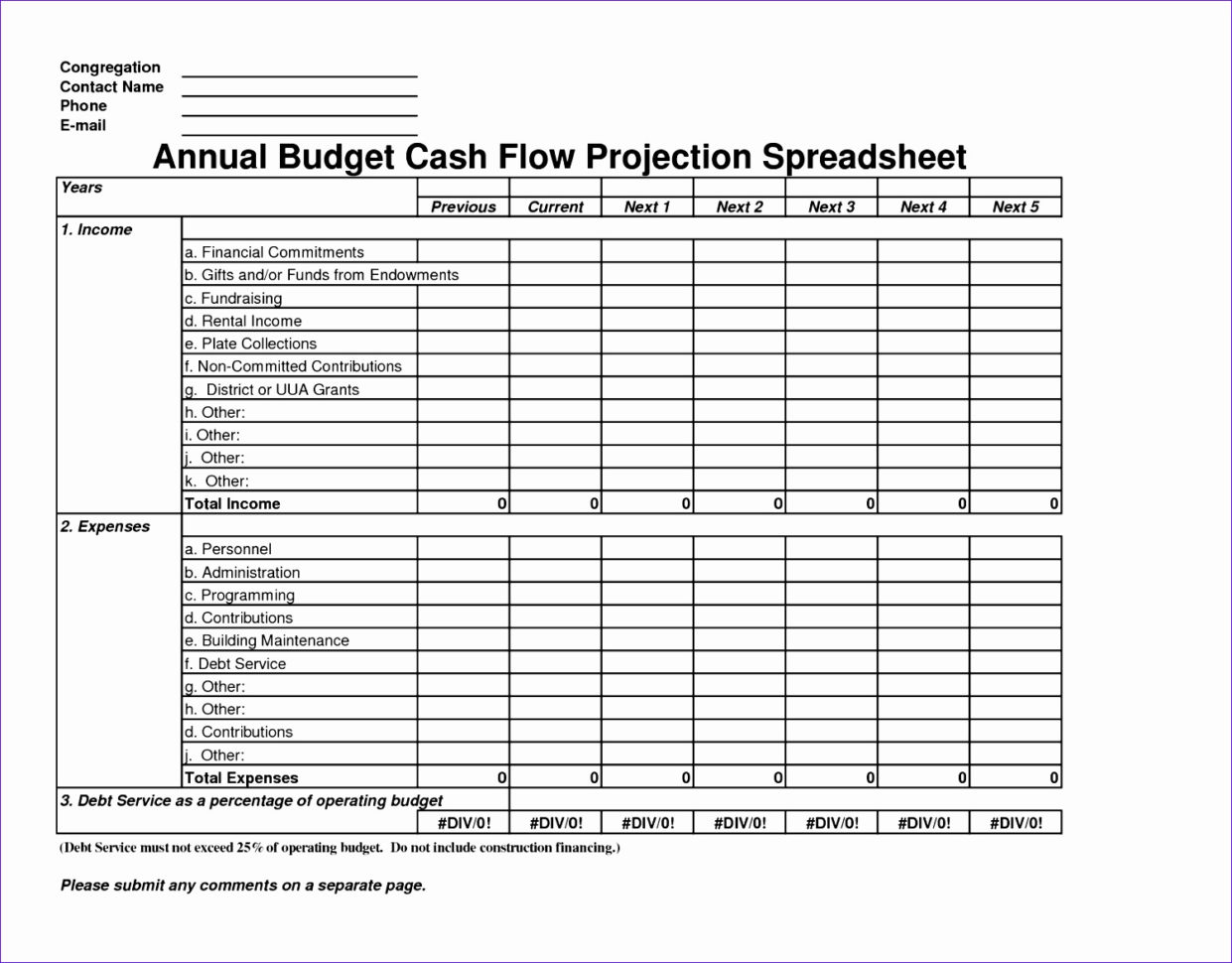

There are four main types of pro forma statements that you can use to manage your cash flows and the financial health. This could be for a weekly, monthly, quarterly, or annual budget. Maybe your company is considering changes to its operating structure.

Often requested by banks, they may. A pro forma cash flow is an estimate of the size of cash inflows and outflows that a business expects in a particular timeframe. What is a pro forma cash flow?

A pro forma cash flow, along with a pro forma income statement and a pro forma balance sheet are the basic financial projections for your business and should be included with. These calculations project the income and outflow for the coming month,. Easily change the data to make.

These projections help businesses plan for. Create pro forma income statements, pro forma balance sheets, and pro forma cash flow statements. Pro forma cash flow is the estimated amount of cash inflows and outflows expected in one or more future periods.

Finally, with the pro forma income statement and balance sheet complete, we can now knock out the cash flow statement. 4 main types of pro forma statements. Your budget may be based on the financial information of your pro forma statements—after all, it makes sense to make plans based on your predictions.

What is the purpose of a pro forma budget? Pro forma cash flow statement. This information may be developed as part of the.