Heartwarming Info About Petty Cash Fund In Balance Sheet Pro Forma Forecast

The amount of petty cash will vary by company and may be in the range of $30 to $300.

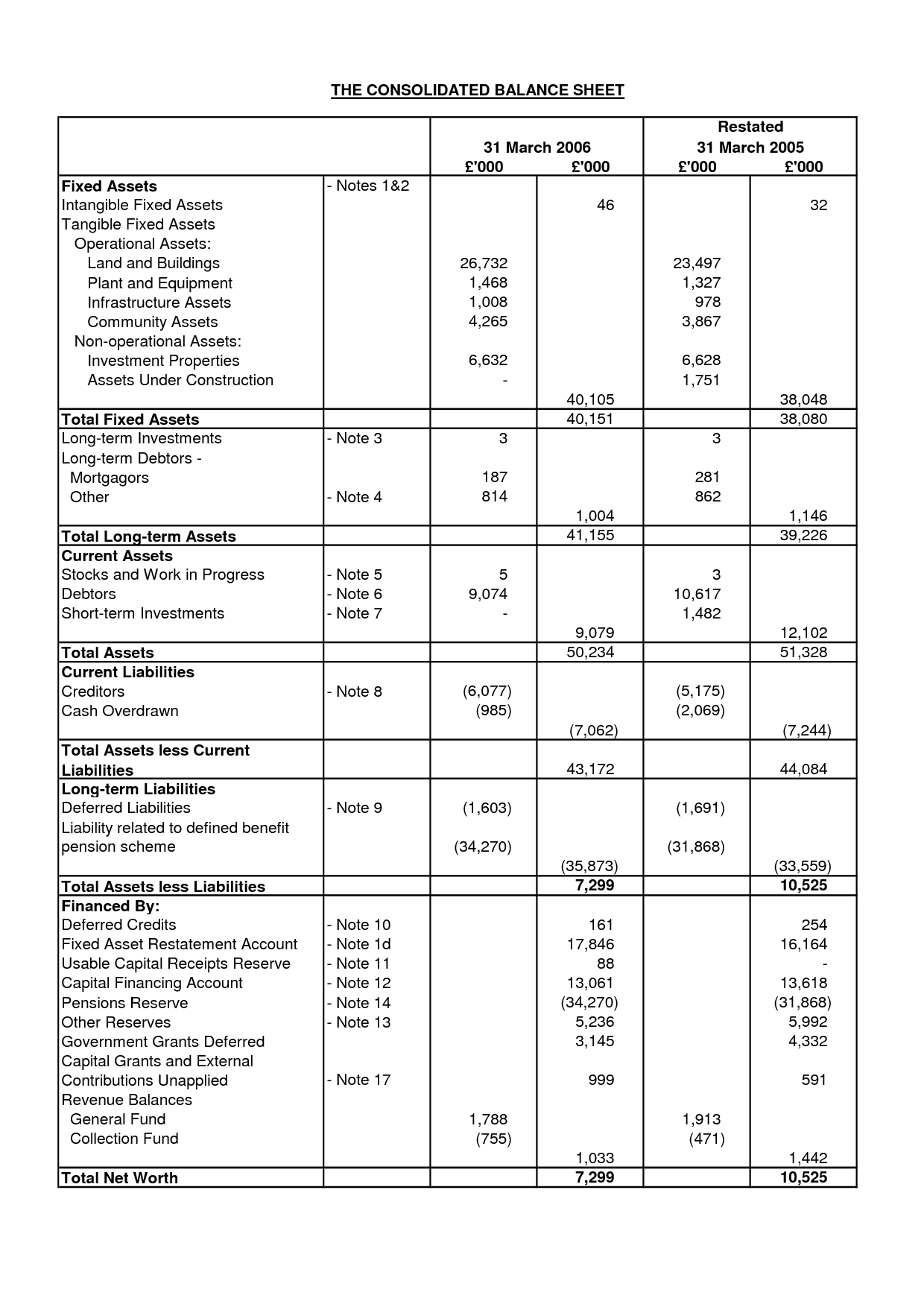

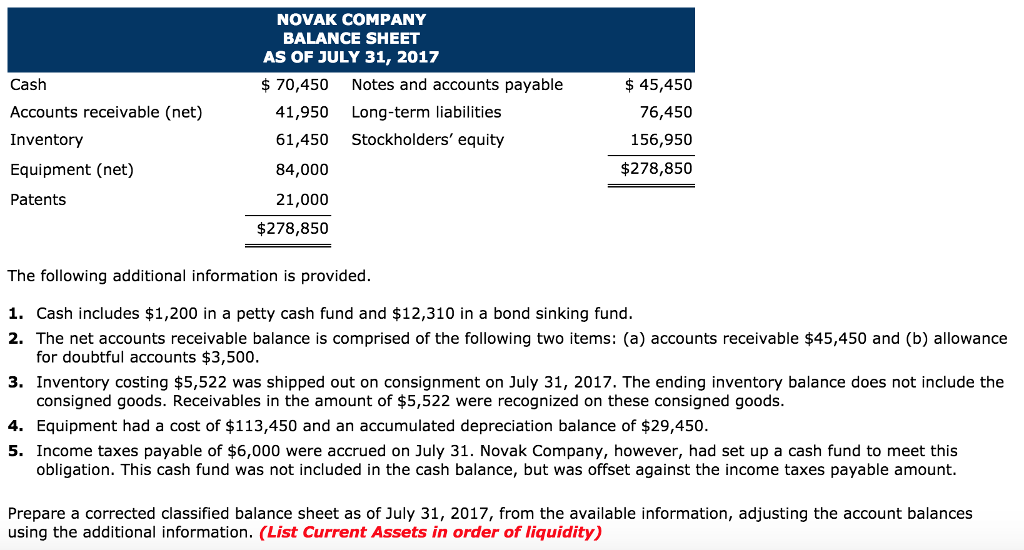

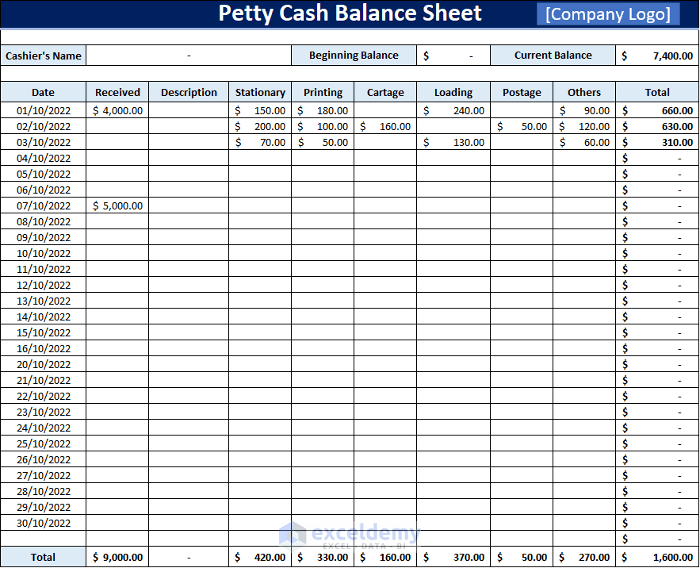

Petty cash fund in balance sheet. The funds will be listed in the balance sheet’s current assets section. Reporting petty cash on the financial statements. Most purchases made with petty cash are unexpected expenses that can.

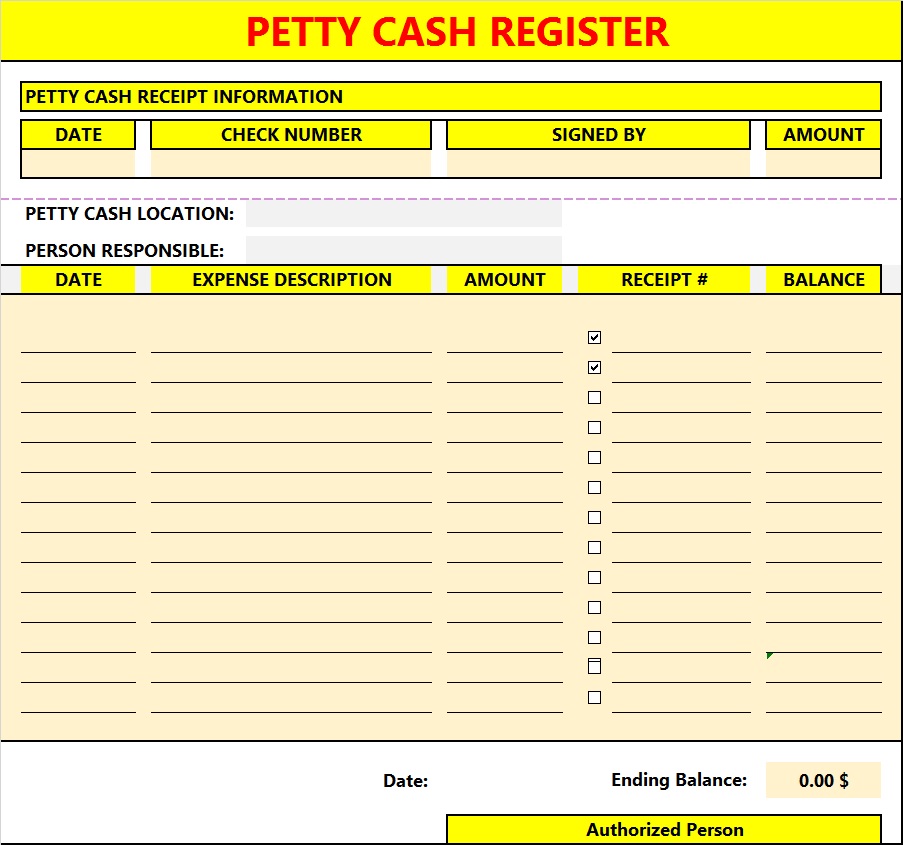

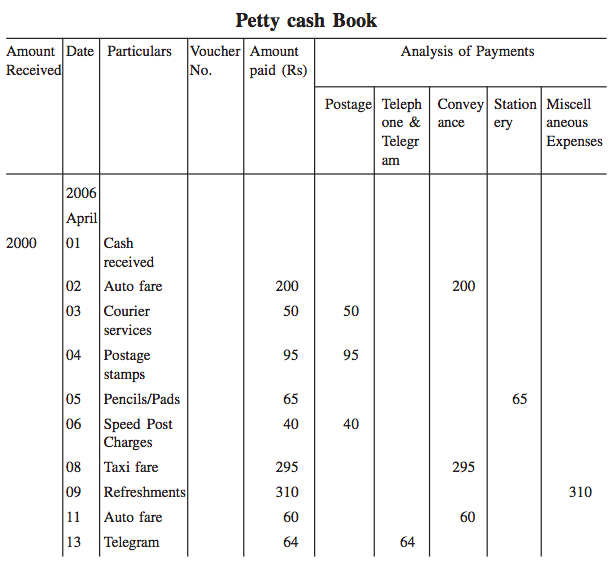

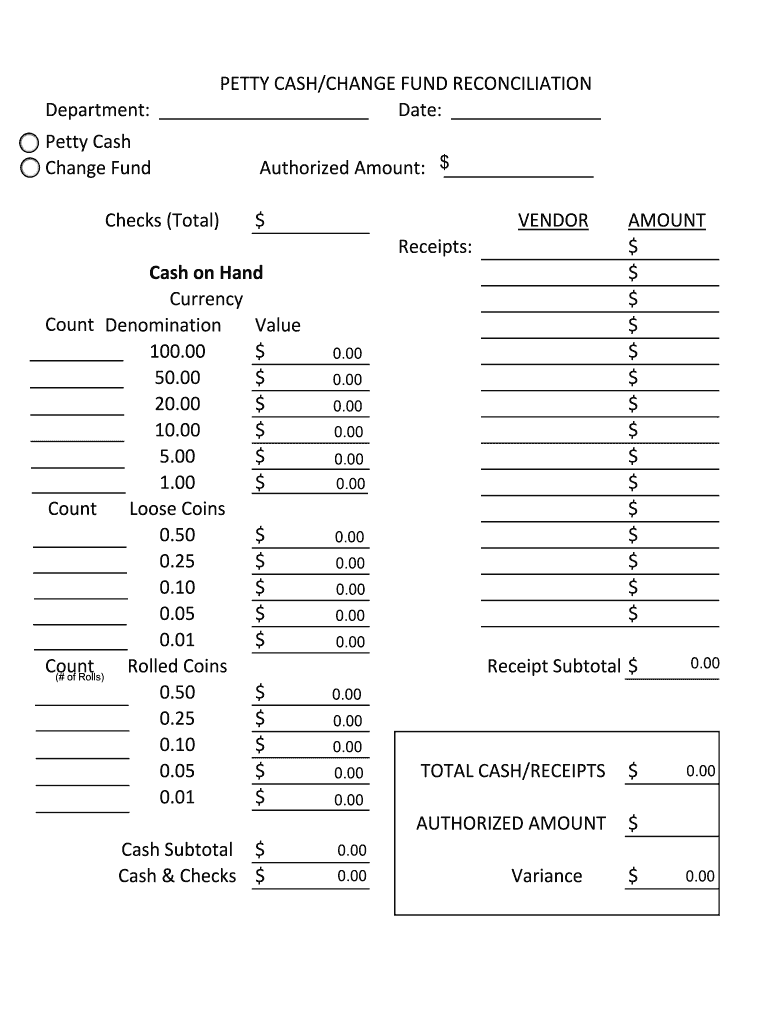

On its balance sheet, the company reports the following: A petty cash balance sheet usually contains minor small payments. Basically a petty cash log template can be easily done in any spreadsheet softwaresuch as microsoft excel wherein you’d create a format with columns to record all the important financial information about petty cash transactions.

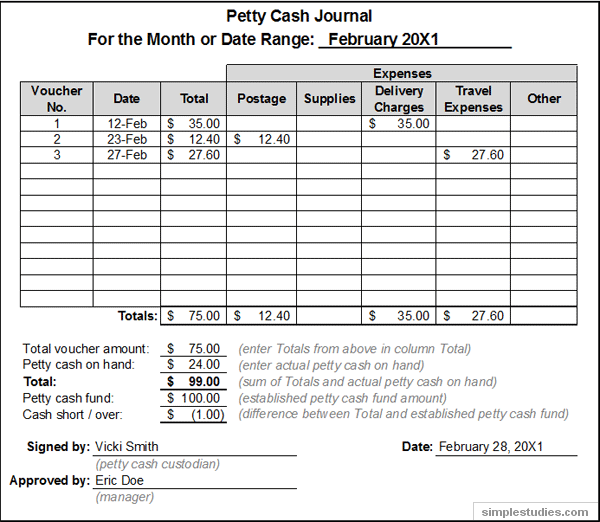

The main common four types are: The custodian should prepare a voucher for each disbursement and staple any source documents (invoices, receipts, etc.) for. This is an asset on the balance sheet of many small businesses.

Petty cash expenses usually range from $50 to $500 but can vary by country and. As this petty cash fund is established, the account titled “petty cash” is created; Petty cash appears within the current assets section of the balance sheet.

However, the petty cash amount might be combined with the balances in the other cash accounts and their total reported as cash or as cash and cash equivalents as the first. Presentation of petty cash account in balance sheet: Petty cash, or petty cash fund, is a small amount of cash your business keeps on hand to pay for smaller business expenses.

It is also known as a petty cash fund. Then, get the total of the amount column to determine total petty cash expenses. Petty cash is the money a business keeps on hand to pay for miscellaneous purchases.

Petty cash is a convenient alternative to writing checks for smaller transactions. This money is used for minor or incidental expenses. Petty cash is the cash amount used to settle small expenditures that companies make from time to time.

In this case, the cash account, which includes checking accounts, is decreased,. As this petty cash fund is established, the account titled “petty cash” is created; In this case, the cash account, which includes checking accounts, is decreased,.

Since petty cash is highly liquid, it appears near the top of the balance sheet. The company’s financial statements are mainly of 4 types. This is because line items in the balance sheet are sorted in their order of liquidity.

Examples of these payments are office supplies, cards, flowers, and so forth. As this petty cash fund is established, the account titled “petty cash” is created; Petty cash is also the title of the general ledger current asset account that reports the amount of the company's petty cash.

![40 Petty Cash Log Templates & Forms [Excel, PDF, Word] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2017/08/petty-cash-log-04.jpg?w=320)

![40 Petty Cash Log Templates & Forms [Excel, PDF, Word] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/08/petty-cash-log-16.jpg?w=790)

![40 Petty Cash Log Templates & Forms [Excel, PDF, Word] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/08/petty-cash-log-03.jpg?w=395)

![40 Petty Cash Log Templates & Forms [Excel, PDF, Word] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/08/petty-cash-log-06.jpg?w=395)

![40 Petty Cash Log Templates & Forms [Excel, PDF, Word] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/08/petty-cash-log-05.jpg?w=395)

![40 Petty Cash Log Templates & Forms [Excel, PDF, Word] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2017/08/petty-cash-log-11.jpg)