Best Info About Basic Accounting Ratios Sale Of Equipment Cash Flow

Accounting ratios are an excellent tool to help us determine the financial health.

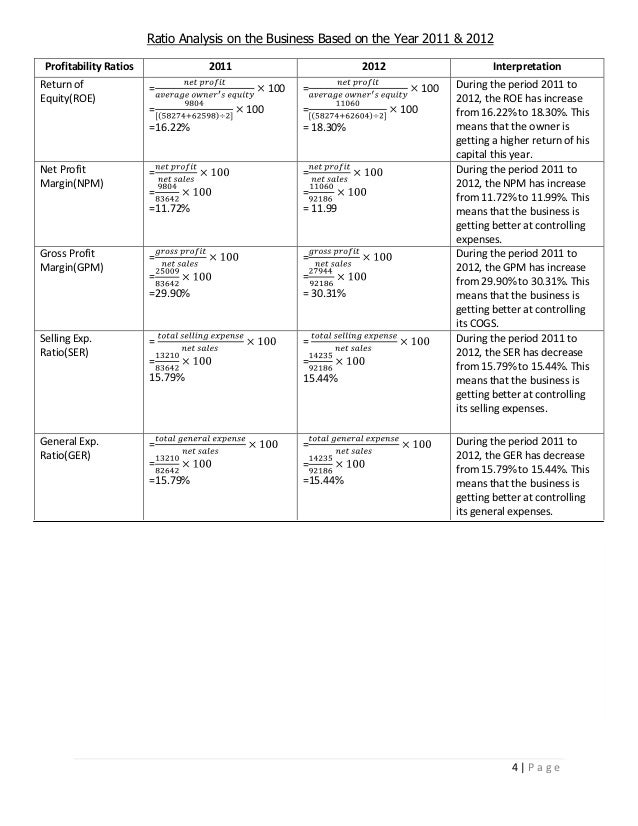

Basic accounting ratios. The best accounting ratios for small businesses to track 1. Accounting ratios, also known as financial ratios, are used to measure the efficiency and profitability of a company based on its financial reports. Financial ratios are often divided up into seven main categories:

The debt ratio measures the relative amount of a company’s assets that are provided from debt: The ratios are a relative measure of two or more values taken from the financial statements of a business and can be expressed as a decimal value such as 0.45 or as a percentage e.g. What are accounting ratios?

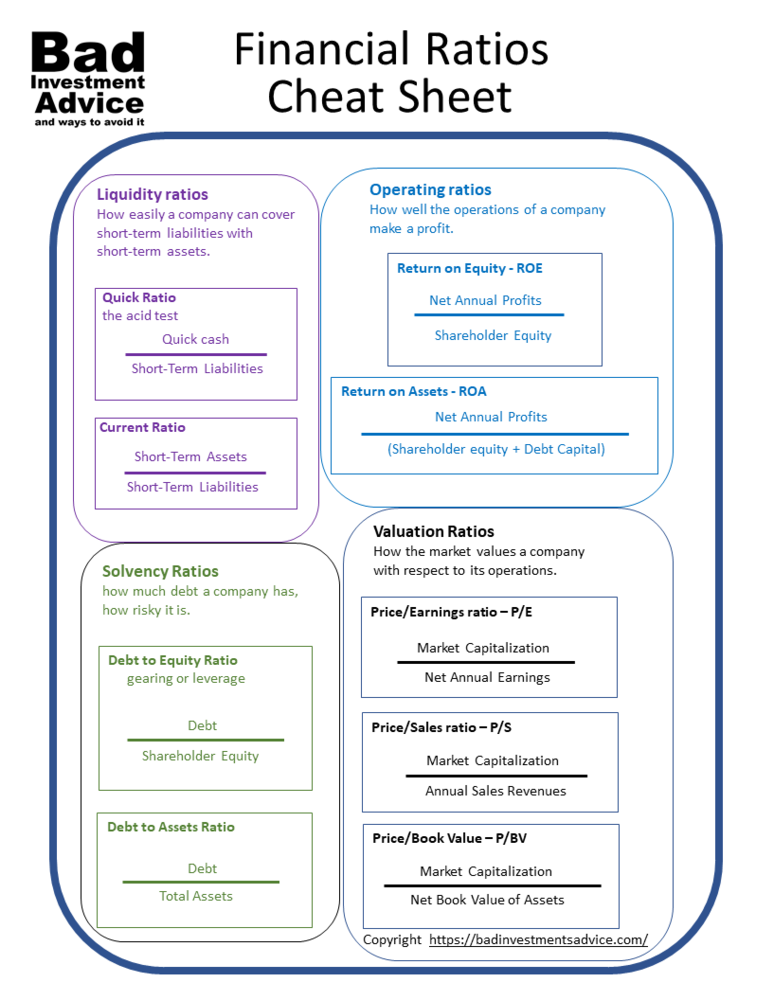

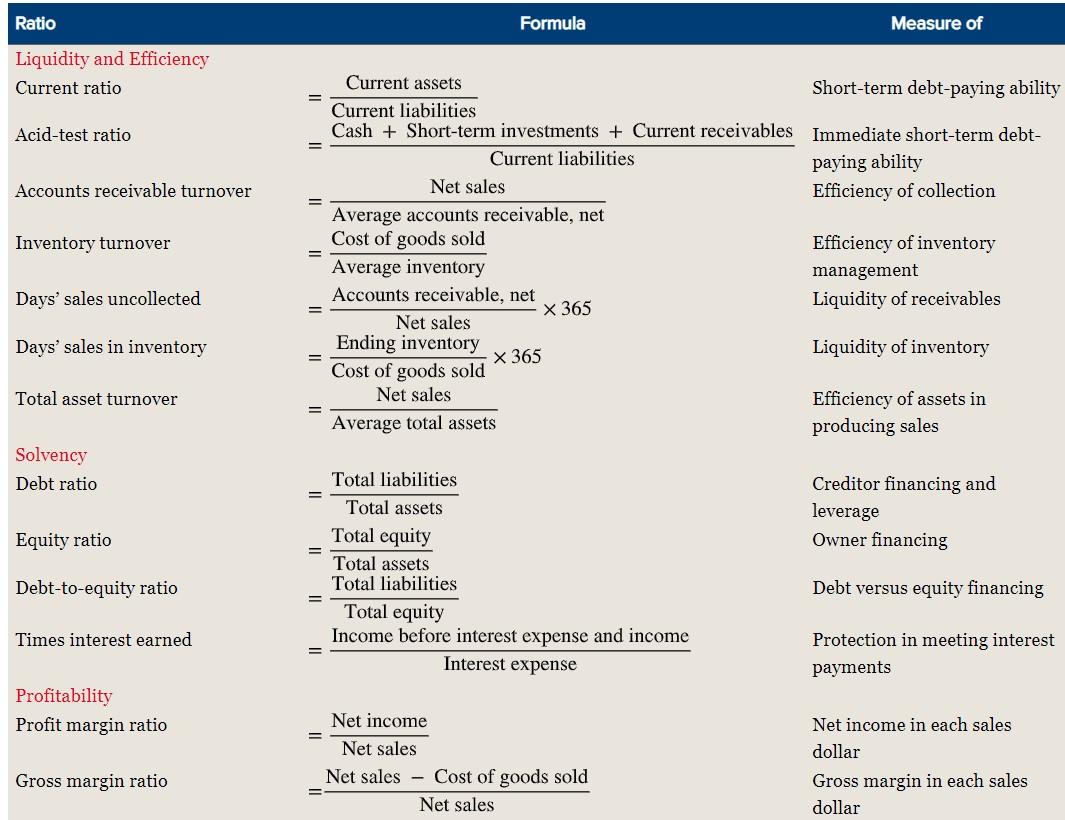

Liquidity ratios, leverage (debt) ratios, efficiency ratios, profitability ratios, and market value ratios. What are accounting ratios? It is an effective business tool that is used by shareholders, creditors, and all kinds of stakeholders to understand the profitability, strength, and financial status of a business.

Accounting ratios, which are also known as financial ratios, are one part of financial statement analysis. Most ratios are best used in. Financial ratios relate or connect two amounts from a company's financial statements (balance sheet, income statement, statement of cash flows, etc.).

Your gross profit margin is one of the most important ratios you can calculate for your. Average stock = (opening stock + closing stock) / 2. Accounting ratio, also known as the financial ratio, is the comparison of two or more financial data which are used to evaluate a business condition.

What are accounting ratios? Liquidity ratios, activity ratios, solvency ratios, and profitability ratios. One of the uses of ratio analysis is to compare a company’s financial performance to similar firms in the industry to understand the company’s position in the market.

Liquidity, profitability, debt, operating performance, cash flow, and investment valuation. There exist many accounting ratios used throughout the industry, divided into subcategories. Leverage ratios measure the amount of capital that comes from debt.

Common leverage ratios include the following: They are indicators of the company's financial health and measure various metrics associated with it, including profitability and liquidity. One can divide financial ratios into six critical areas of analysis:

Accounting ratios are used by businesses to measure profitability and efficiency. Liquidity ratios solvency ratios efficiency ratios profitability ratios market prospect ratios financial leverage ratios coverage ratios receivables turnover ratio asset turnover ratio How to comment on accounting ratios?

There are mainly 4 different types of accounting ratios to perform a financial statement analysis; Accounting ratio is used to describe the relationship between amounts or figures shown in either balance sheet, profit, and loss statement, or any other financial statement document which is part of an accounting organization, thereby aiding financial analysis of the company and depicting its performance level. Accounting ratios are also used to spot and analyze companies in potential financial distress.

/GettyImages-1165045615-3989ced2efa44ab28634ac73786b8121.jpg)