Brilliant Strategies Of Tips About Nonprofit Audit Report Sample What Are Expenses On An Income Statement

Nonprofit annual report examples & best practices.

Nonprofit audit report sample. Learn how to write and produce affordable nonprofit reports for ngos and charities. Journals that detail the organization’s business transactions and affected accounts ledgers for the fiscal year being audited bank statements and. Irs audit did you know the irs is not the primary reason nonprofits must perform audits?

Enhance your nonprofit annual report with these samples! The guide will also tell you about the role. (a nonprofit organization) (the “foundation”) which comprise the.

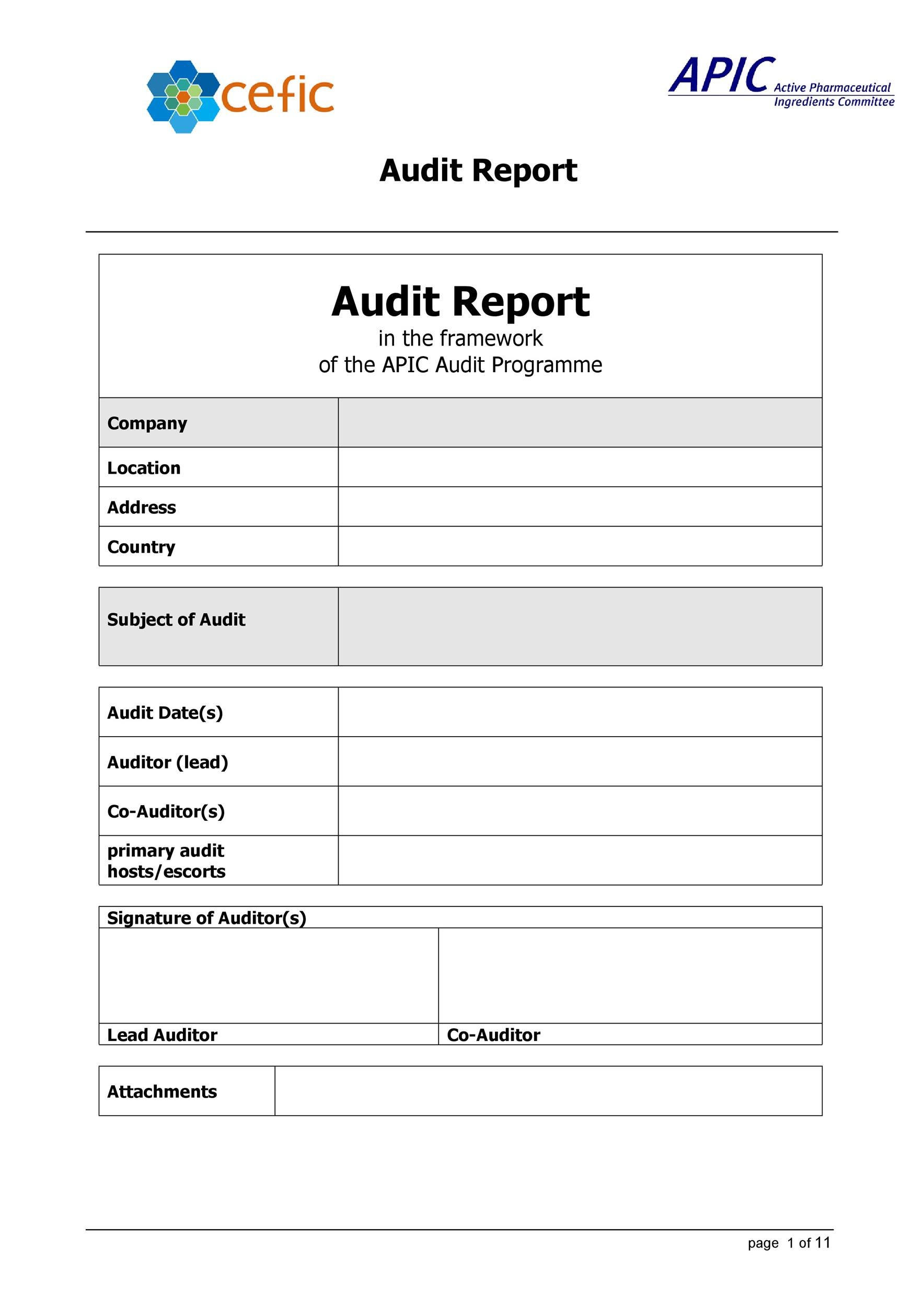

A nonprofit audit is an independent examination of a nonprofit organization’s financial statements and records. While these changes will not affect how you do your accounting, they will affect how future audits are. Report of audit for the fiscal year ended june 30, 20xx

Guiding principles of the audit committee 6 basic roles and responsibilities 11 users of the financial statements 12 the insider’s. Generally, your organization will hire an. The irs will audit your nonprofit if there are discrepancies in your tax.

Contents 4 accountability and independence: The annual audit report for nonprofits is set to change in 2020. Check these 18 best nonprofit annual reports+ great digital & small nonprofit examples.

Pledges and grants receivable, net $ 6,067,593 $ 6,488,386. Compilation, review, audit, and single audit report examples. It can be used to cultivate new relationships.

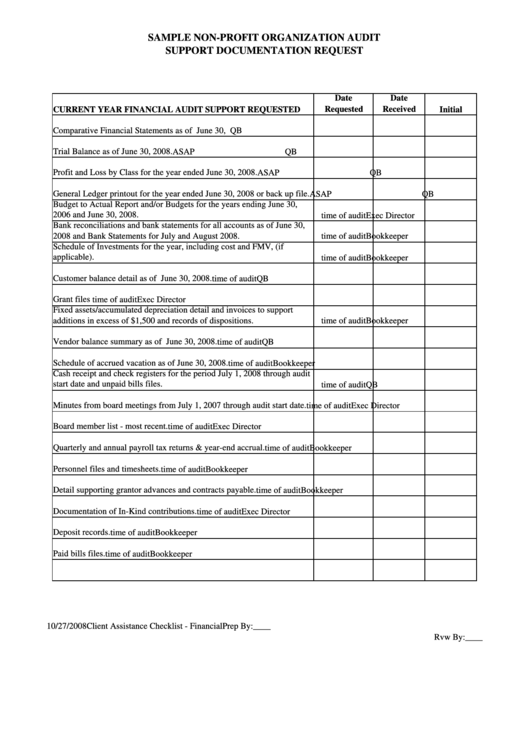

There are cases when you’re required to audit your nonprofit’s finances, but it’s not the irs conducting that audit. Abc school for students with disabilities. Assemble in one location:

This nonprofit audit guide will help you understand what independent audits are, and help you prepare your nonprofit for an audit. (“hope”) (a nonprofit organization), which comprise the consolidated statements of. During the year ended june 30, 2021, first received a pledge totaling approximately $4.6 million.