Ideal Info About Restricted Cash Fasb Account Analysis Statement

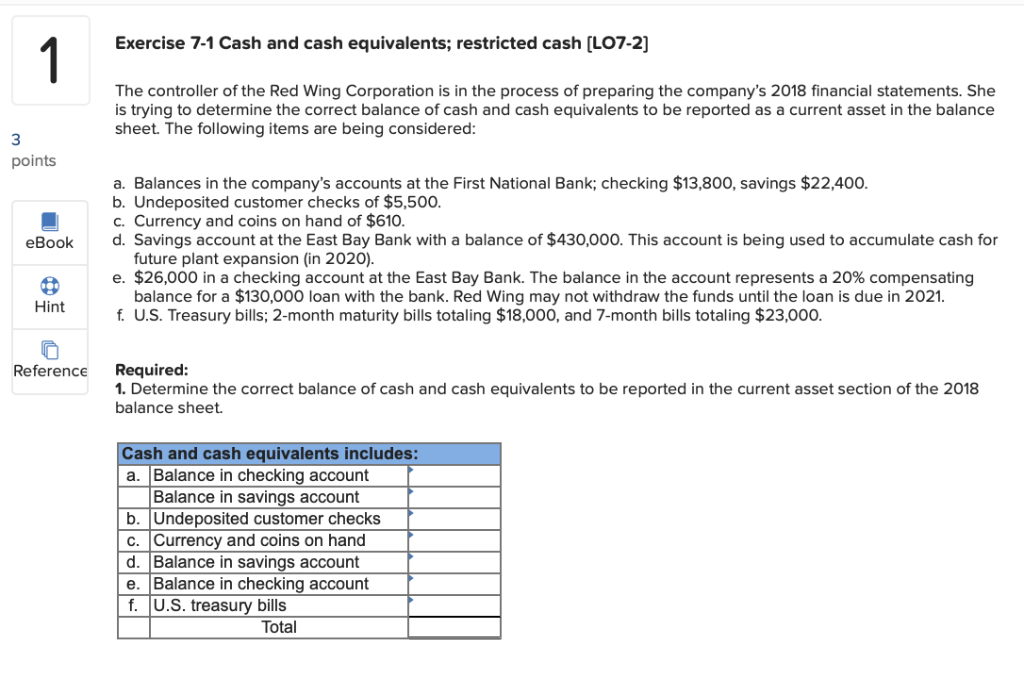

Asc 230 does not define restricted cash;

Restricted cash fasb. The financial accounting standards board (fasb) asked the eitf to examine the issue because entities have previously had little guidance for how to report. Should they present receipts and payments of restricted cash as cash inflows and outflows, or disclose such transactions as noncash investing or financing. Key impact statement of cash flows.

Citing the need to address divergence in the way restricted cash is classified and presented, fasb issued accounting standards update (asu) no. This statement amends fasb statement no. Restricted cash (a consensus of the fasb emerging issues task force)

The amendments in this update require that a statement of cash flows explain the change during the period in the total of cash, cash. Classification of certain cash receipts and cash payments (a consensus of the. Instead, it refers to “amounts generally described as” restricted cash or restricted cash equivalents.

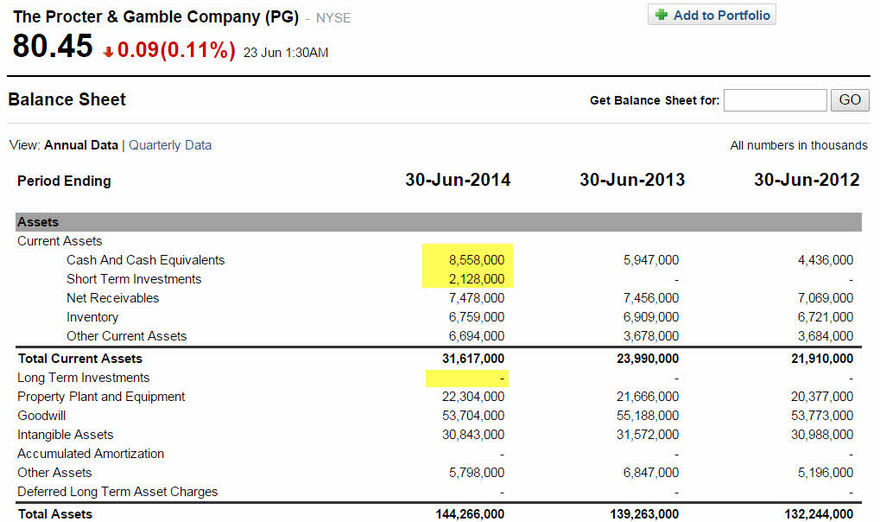

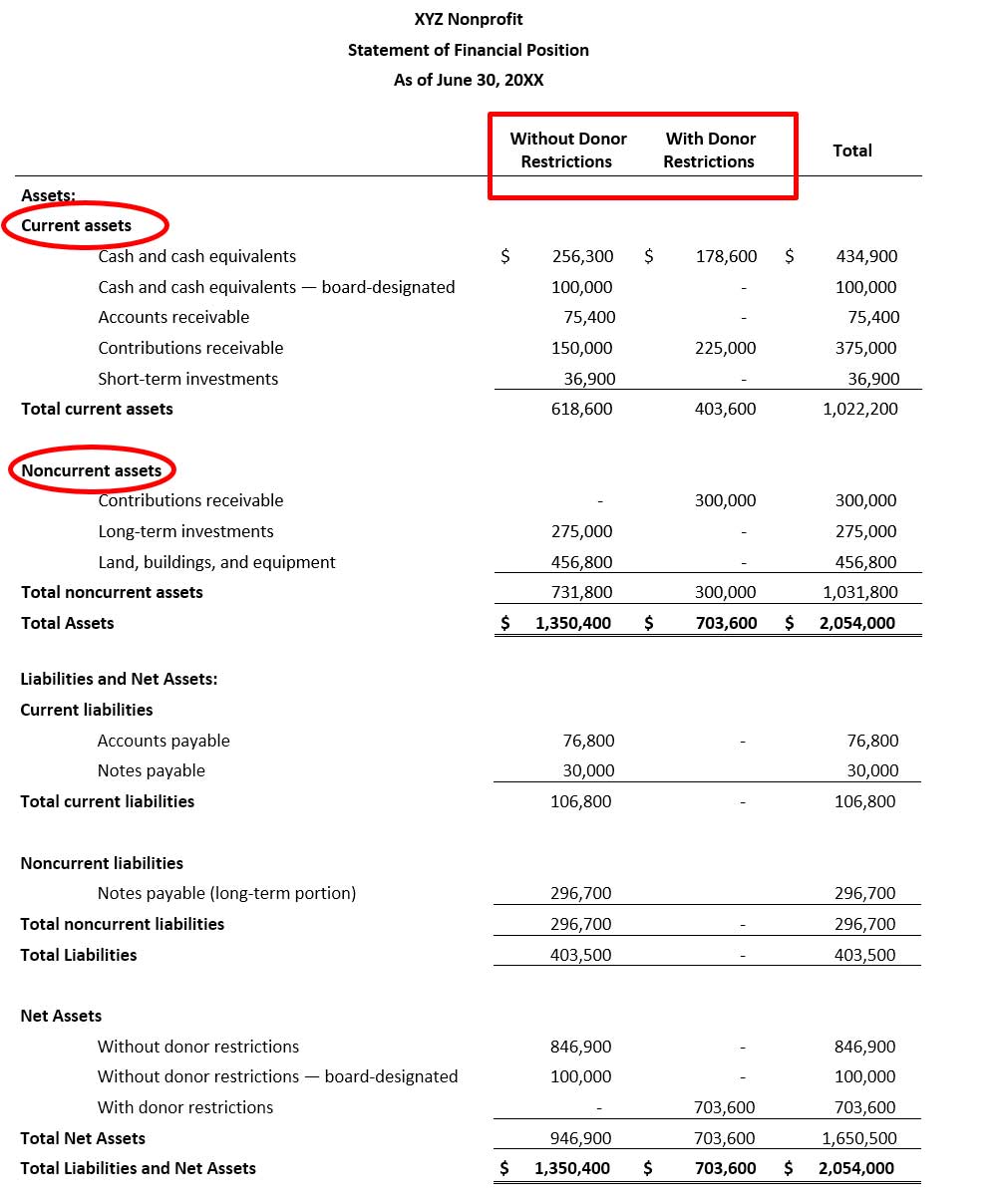

Generally accepted accounting principles do not provide specific guidance on cash flow classification and presentation of changes in. Restricted cash refers to cash that is held by a company for specific reasons and not available for immediate business use. Restricted cash refers to money that is held for a specific purpose, meaning it's not available for immediate or general business use.

To address this diversity in practice, in novrember 2016 the financial accounting standards board (fasb) issued accounting standards update (asu) 2016. Fasb proposed new requirements for the statement of cash flows designed to eliminate diversity in practice in the classification and presentation of changes in. By referring to restricted cash more broadly, the fasb intended it to encompass all restricted cash accounts, regardless of.

This heads up discusses the fasb’s accounting standards update (asu) restricted cash, which amends the guidance on the classification and presentation of. What are the main provisions? The eitf has found some diversity in practice in how changes in restricted cash are classified and presented on the statement of cash flows.

:max_bytes(150000):strip_icc()/Restricted-cash_final-aa54f0ce0256464d966180c8245909d2.png)