One Of The Best Tips About Outstanding Expenses In Profit And Loss Account Garmin Financial Statements

These expenses lead to an increase in liability for a firm.

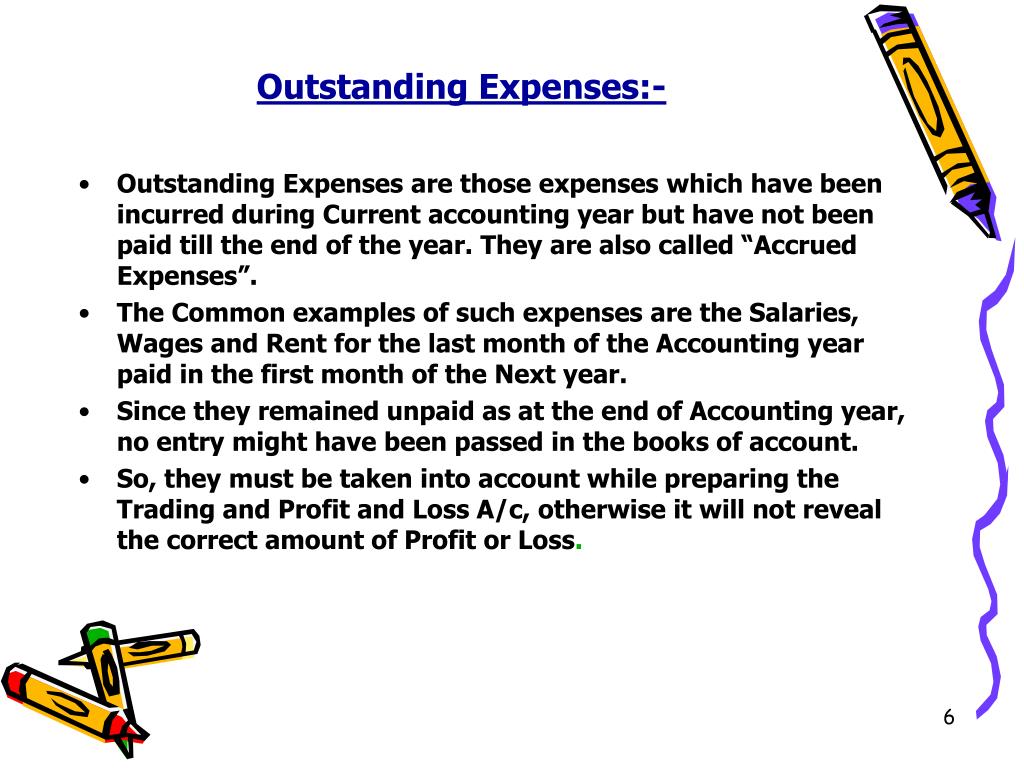

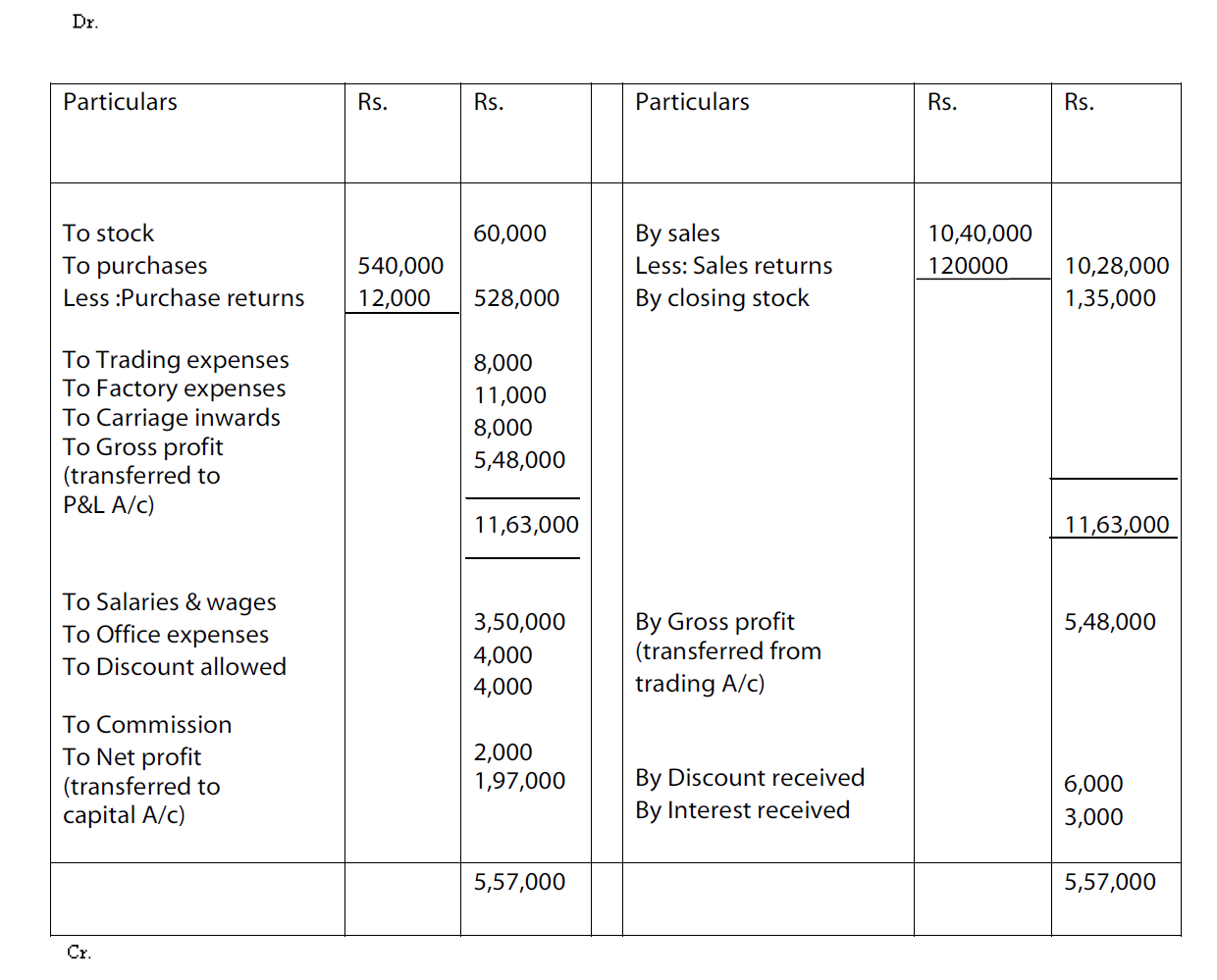

Outstanding expenses in profit and loss account. In the normal course of business, some of the expenses may be paid in advance. Some of the types of these expenses are outstanding wages, outstanding salaries, outstanding interest on loan, etc. Outstanding expenses are reflected on the liability side of the balance sheet and at the time of trading and profit and loss a/c preparation, the outstanding expenses should be added to the particular expenses category to which it belongs.

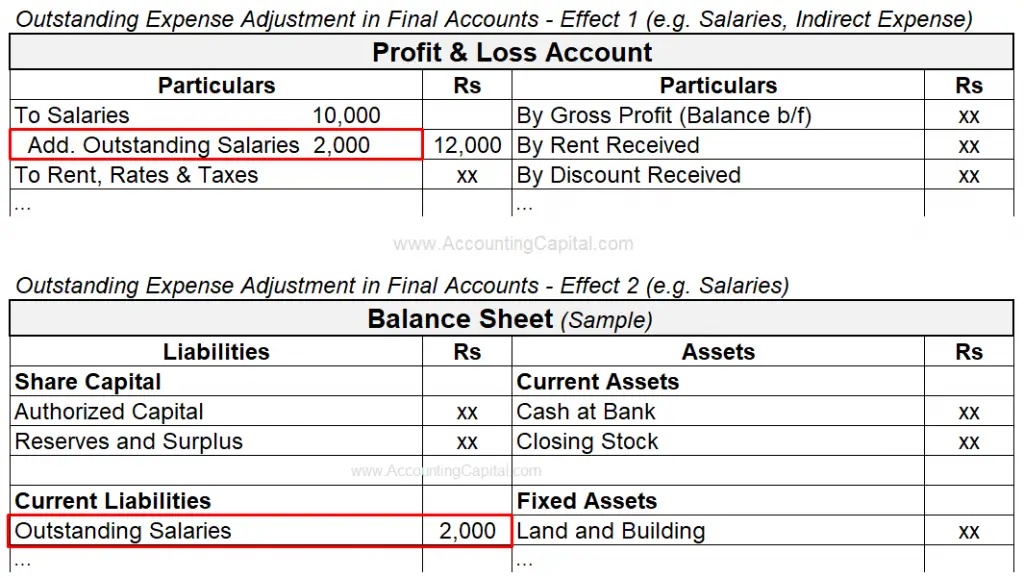

Using the indirect method, calculate net cash flow from operating activities (cfo) from the following information. Outstanding salary of rs 1,000 is added to salary account and is debited to profit and loss account. The statement of profit or loss must include the expenses relating to the period, whether or not they have been paid.

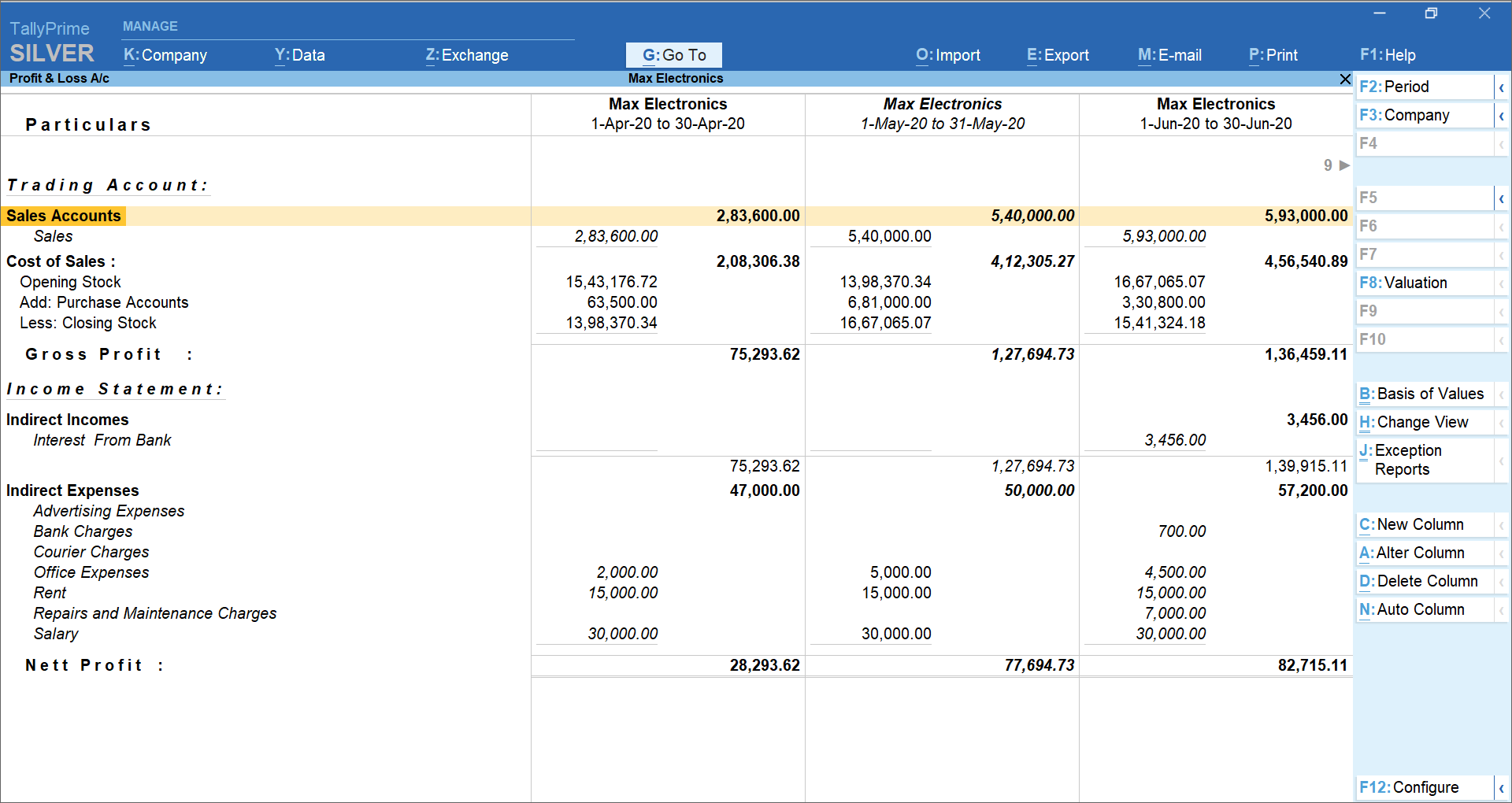

What is profit & loss statement? While preparing the trading and profit and loss a/c we need to add the amount of outstanding expense to that particular expense. Suppose a company paid rs 10,000 in salaries during the year and evaluates outstanding salaries at rs 2,000 at the end, showing the adjustment of.

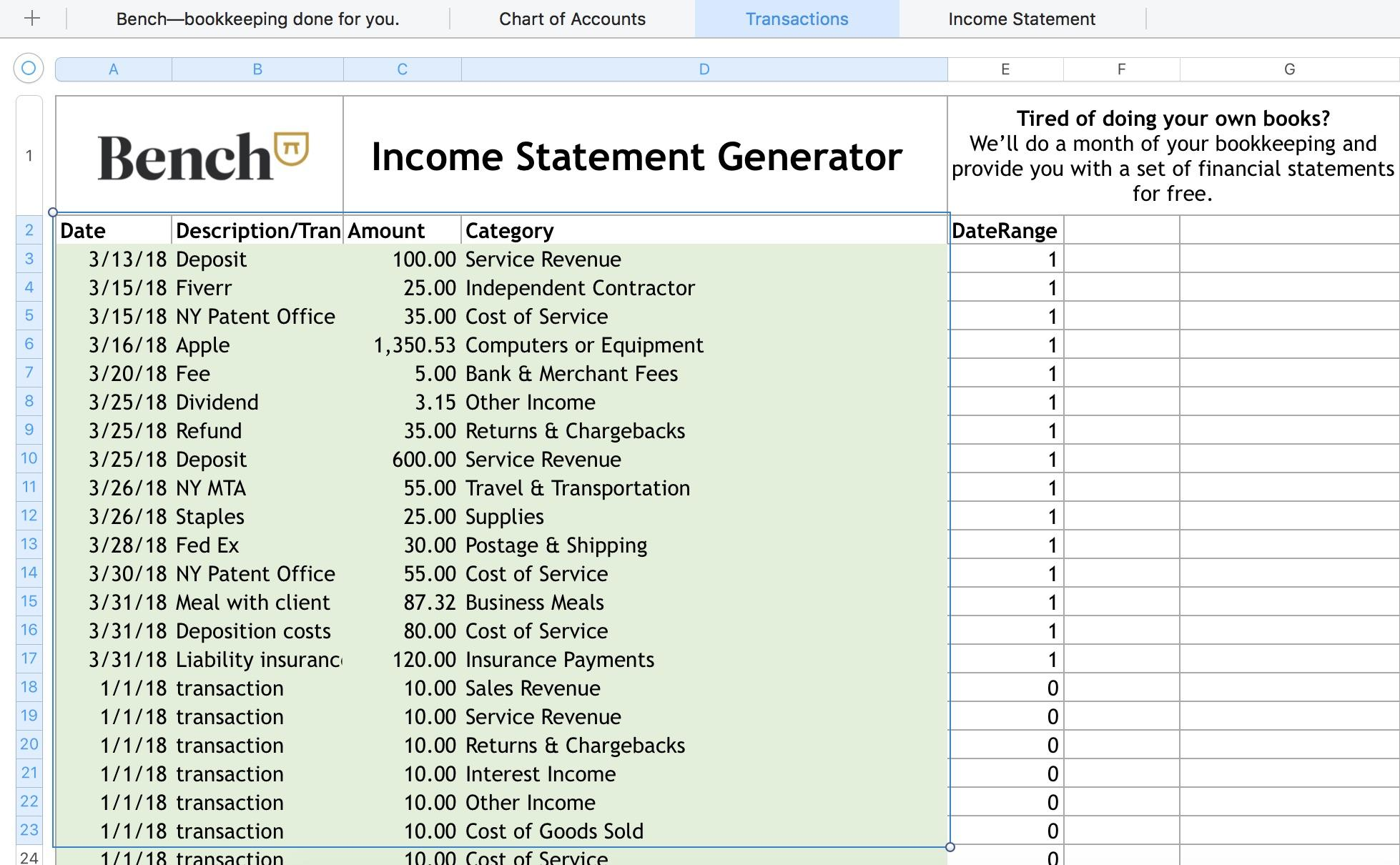

Such expenses that are due in the current accounting year but will be paid in the next accounting year are recorded as. This can be illustrated with a sample question. The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period.

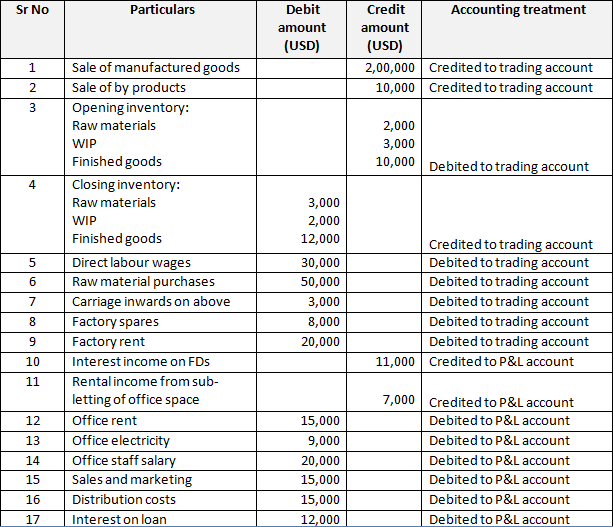

Only indirect expenses are shown in this account. The p&l statement is one of three financial. Outstanding expenses in profit and loss account.

The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. Profit and loss account is made to ascertain annual profit or loss of business. Treatment of outstanding expenses in financial statements/final accounts trading & profit and loss a/c show on the dr.

If one understands the word “expense”, there will be no difficulty in deciding which items in the trial balance will be shown in the profit and loss account. At the time of preparation of the profit and loss account, there may be that some expenses are outstanding while a few others are prepaid. These outstanding expenses are related to a given accounting period that is not paid in the same accounting period.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. Profit & loss account is also known as p&l a/c, profit & loss statement, income statement or income and expense statement. All “expenses” apart from those that have already been taken to the trading account will appear in the profit and loss account.

These expenses are connected to an accounting period in which they have not been paid. The outstanding expenses are certain expenses that are incurred but not paid. Outstanding salary is a liability and shown in balance sheet (liability).

Outstanding expenses are the ones that have been incurred but have not been paid yet. The figures in the trial balance will usually be the amounts paid in the period, and they need adjusting for outstanding amounts and amounts paid which relate to other periods to obtain the correct charge in the statement of. Therefore, this item will be added.

![17+ Profit And Loss Template EDITABLE Download [Word, PDF]](https://www.opensourcetext.org/wp-content/uploads/2020/07/pal-6.jpg)