Great Tips About Common Size Balance Sheet Formula View 26as Form Of Income Tax

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

Common size % = required item/base item.

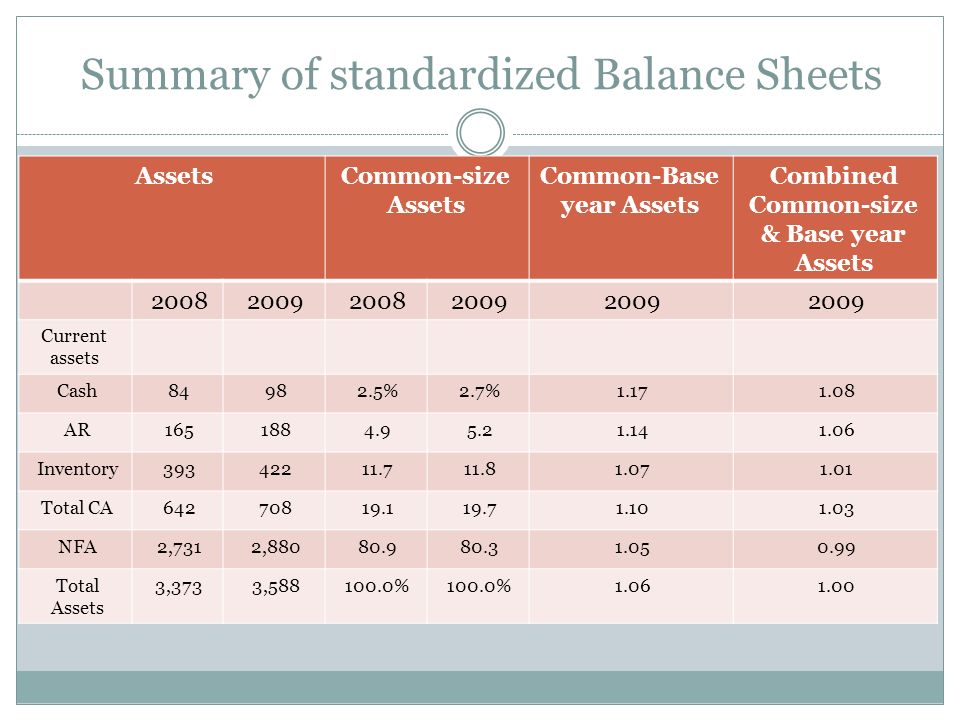

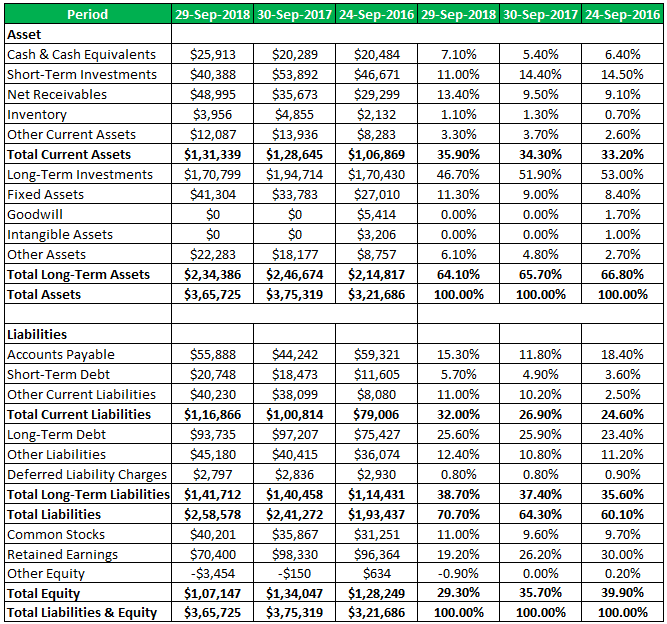

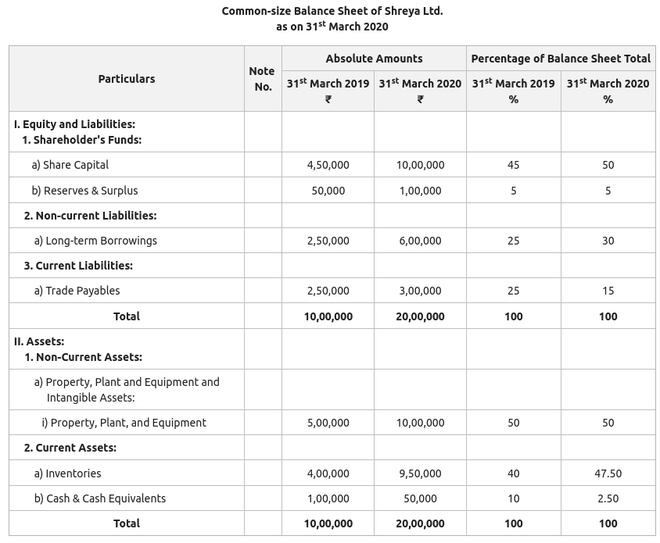

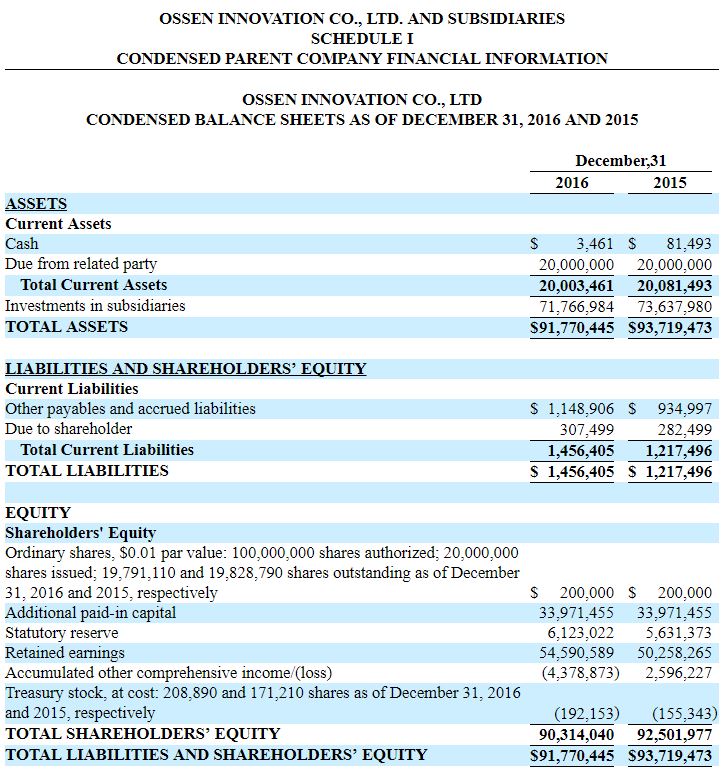

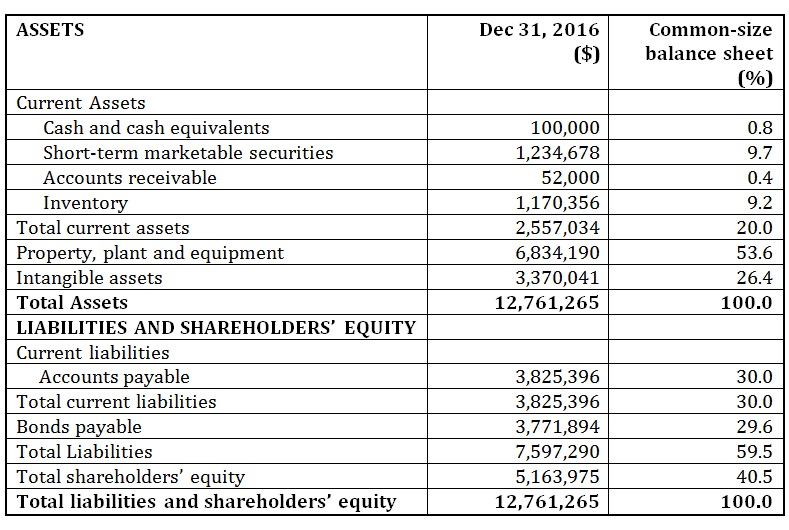

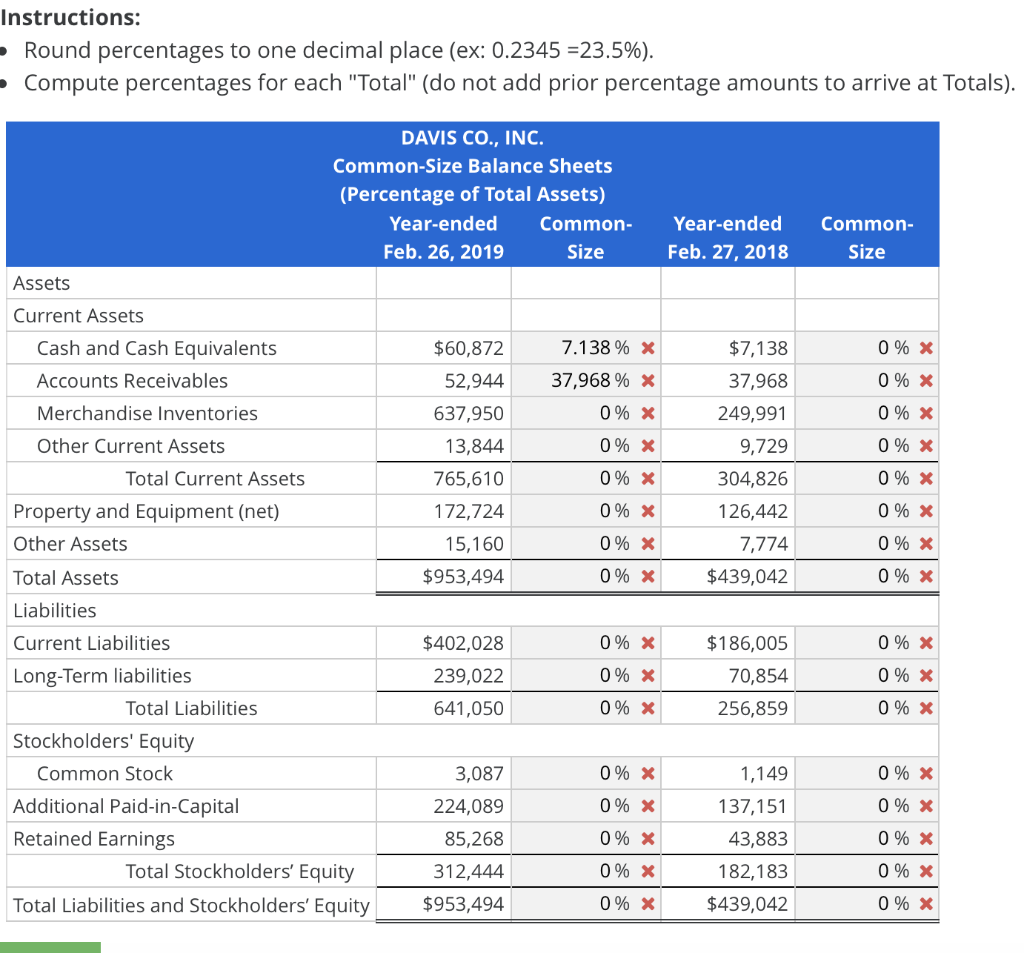

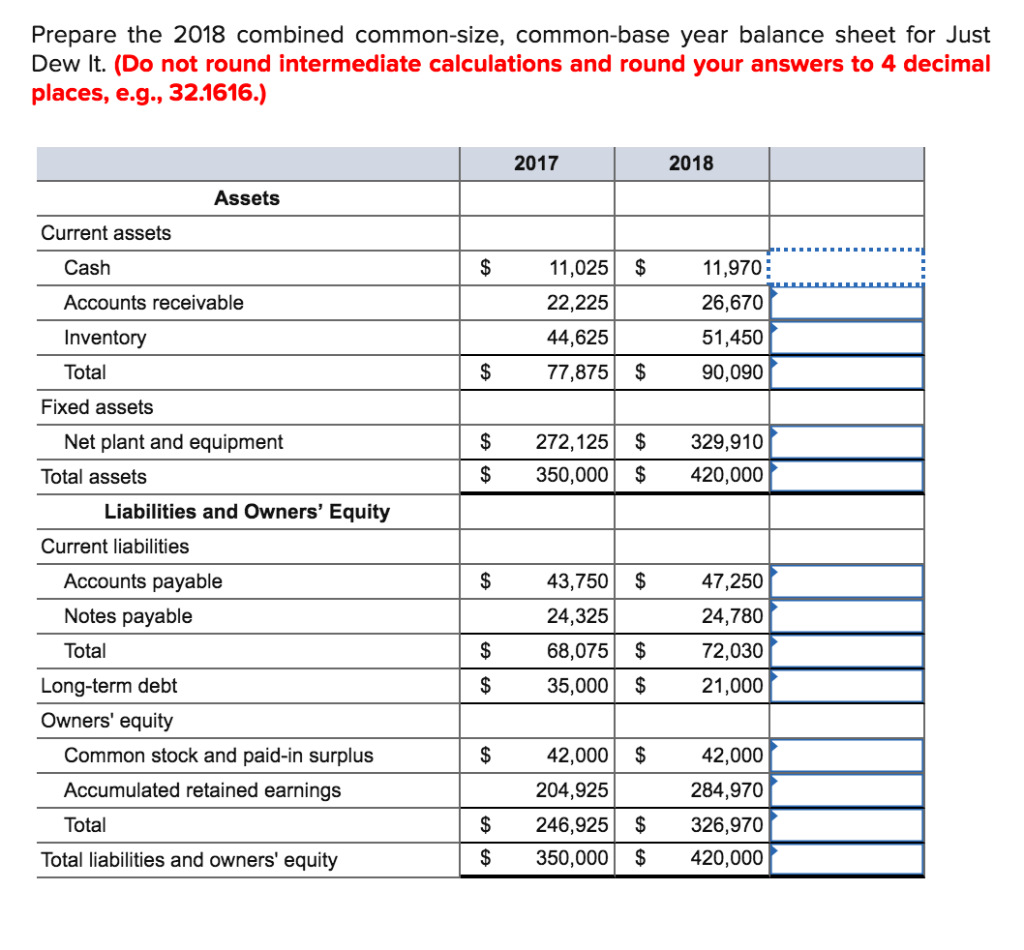

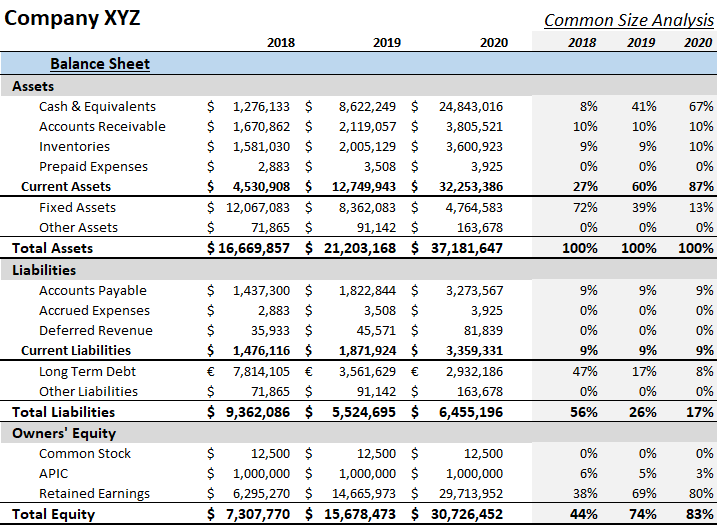

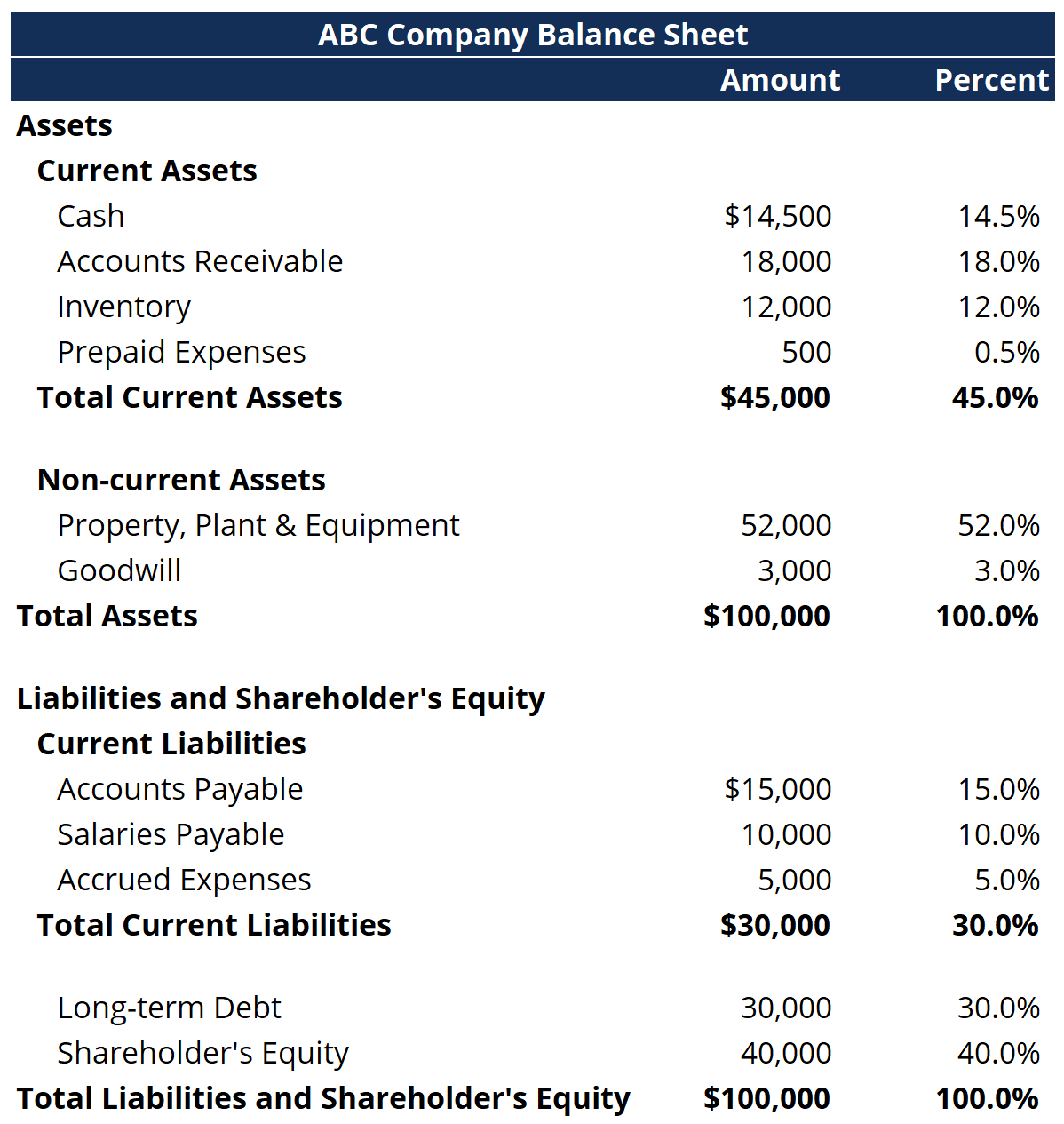

Common size balance sheet formula. Common size balance sheets are used by internal and external analysts and are not a reporting requirement of generally accepted accounting principles. Create a new table in the first step, we will create our output table where we will display the relative percentage. Each line item on the balance sheet is restated as a percentage of.

A common size financial statement lists any entries as a percentage of a base figure. Firstly, create an identical table just like the. For example, if your required item is account receivable and.

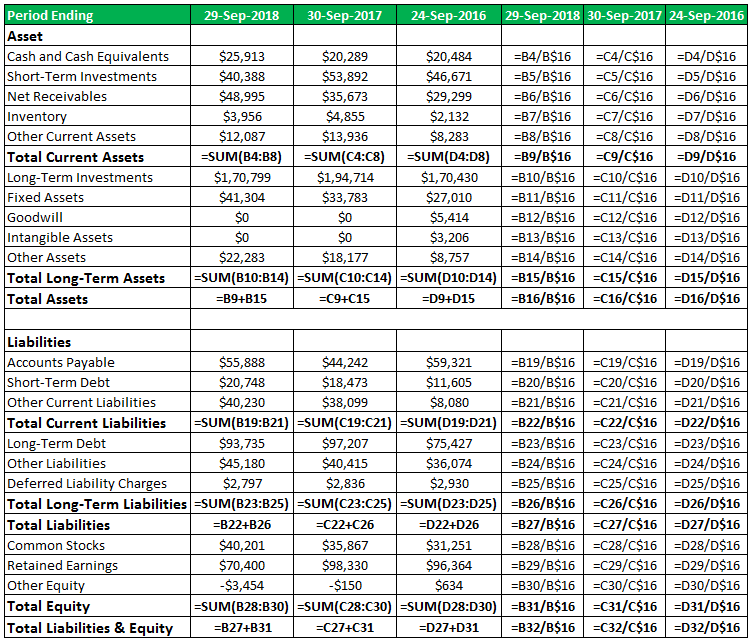

Divide each dollar amount by the total assets and multiply by 100. Sawir (2017:46) dalam analisis common size, setiap total akun disebut juga dengan common base. The formula for calculating the common size statements is as follows:

Formula for common size balance sheet = (line item / total assets)*100 uses of common size balance sheets: What is a common size balance sheet? Learn how to calculate common size financial statements, such as income statement, balance sheet and cash flow statement, by dividing each line item by the total.

As fixed assets age, they begin to lose their value. A statement that shows the percentage relation of each asset/liability to the total assets/total of equity and liabilities,. Helps in building trend lines to discover the.

Common size (%) = (line item / total assets) * 100 example of common size balance sheet let’s consider a hypothetical company xyz corp. This differs compared to traditional financial statements that would use. Common size analysis formula accounting software will typically run a common size financial analysis for you, but it's still a good idea to understand the.

In this case, the percentages are: A common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts.

/GettyImages-172989638-fee6060d1ef74fcbae525500bc96c69a.jpg)

:max_bytes(150000):strip_icc()/Commonsizebalancesheet_final-63f083ed70e64e9da232560ae41429ce.png)