Exemplary Info About The Statement Of Cash Flow Explains Changes In Balance Sheet Cooperative Society

Cash, cash equivalents, and accounts receivable.

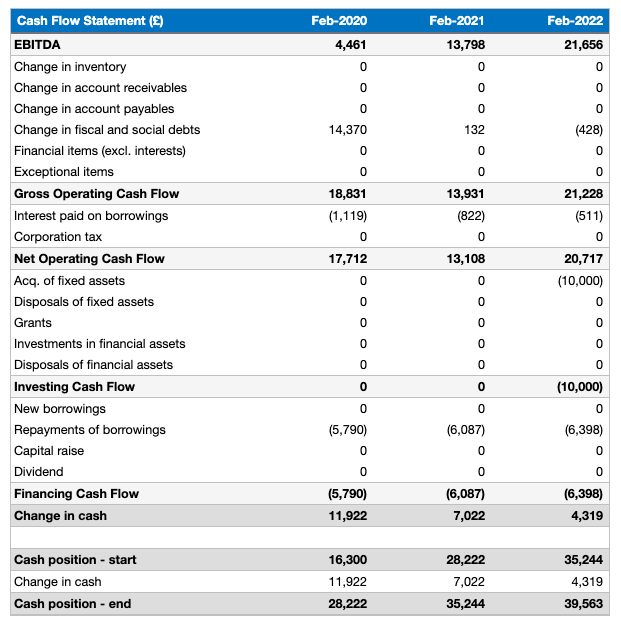

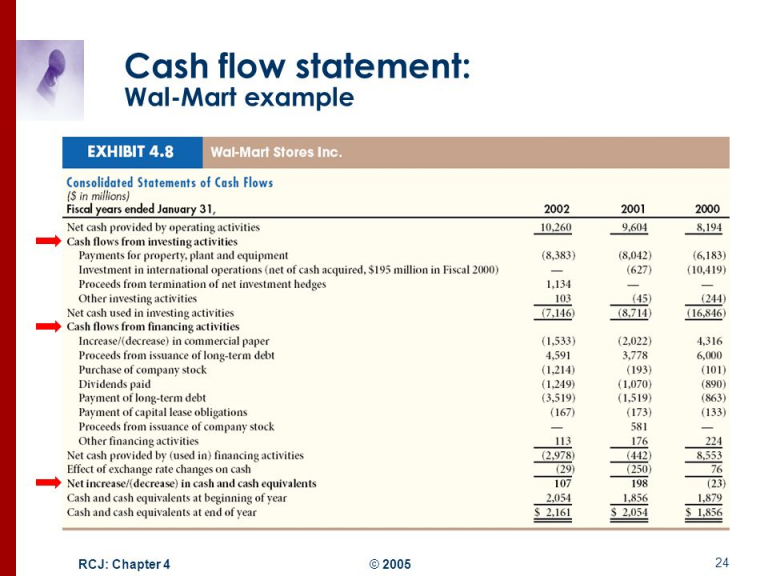

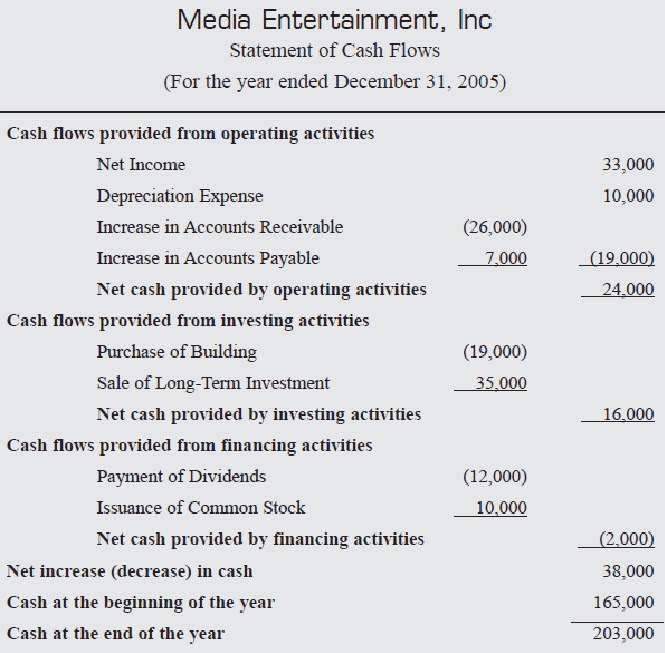

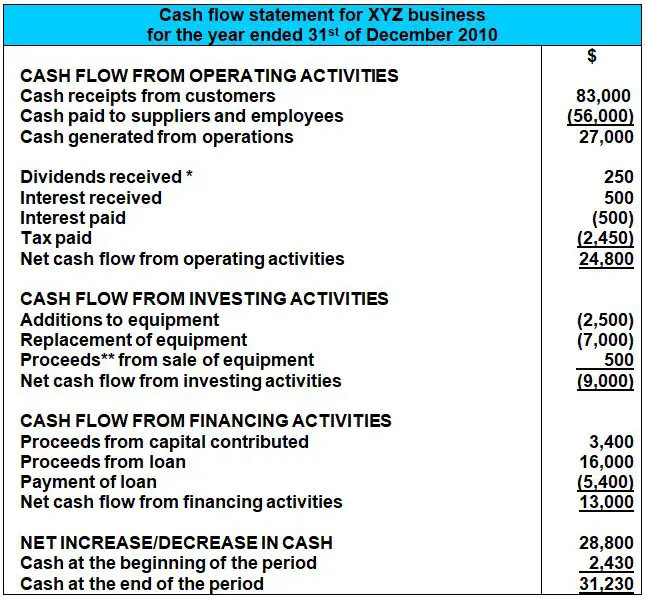

The statement of cash flow explains changes in. Figure 11.5 statement of cash flows for example corporation. Operating activities investing activities financing activities operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses. Cash on hand and cash in the bank.

Operating, investing and financing activities; If there was a $500,000 profit, the statement of cash flow explains why the increase in cash is not also $500,000. The cash flow statement is typically broken into three sections:

The income statement measures a. Here is what we know: It reports the cash receipts (cash inflows) and the cash disbursements (cash outflows) to explain the changes taking place during the year in the cash balance.

We will use these names interchangeably throughout our explanation, practice quiz, and other materials. In this region, the israeli military says it has killed 15 terrorists and located. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

Click the card to flip 👆. The cash flow statement or statement of cash flows measures the sources of a company's cash and its uses of cash over a specific period of time. How the atlantic ocean circulation changes.

The cash flow statement is required for a complete set of financial statements. A cash flow statement is a financial document that reports detailed changes in cash flow over a given period of time. East coast before crossing the atlantic.

The cfs measures how well a. The idf has released an update this morning on its operations on the ground. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company.

The cash flow statement makes adjustments to the information recorded on your income statement, so you see your net cash flow—the precise amount of cash you have on hand for that time period. The total debits of $1,693 less the total credits of $1,570 equal a difference of $123 which reconciles to the decrease in cash calculated in step 2. The purpose of the statement of cash flow is to explain the difference net income and the change in cash over the same period.

Cash flow statements are financial accounting statements that provide a detailed picture of the movement of money through a company — both what comes in and what. Essentially, the cash flow statement is concerned with the. Statement of cash flows is one of the four financial statements which shows the cash movement, cash inflow and cash outflow of the business, and the overall change of cash balance of the company during the accounting period which could be monthly, quarterly, or.

What is a cash flow statement? This article considers the statement of cash flows of which it assumes no prior knowledge. The cash flow statement explains the change in cash by three types of activities:

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)