Awe-Inspiring Examples Of Info About Verizon Cash Flow Statement Sinopec Financial Statements 2019

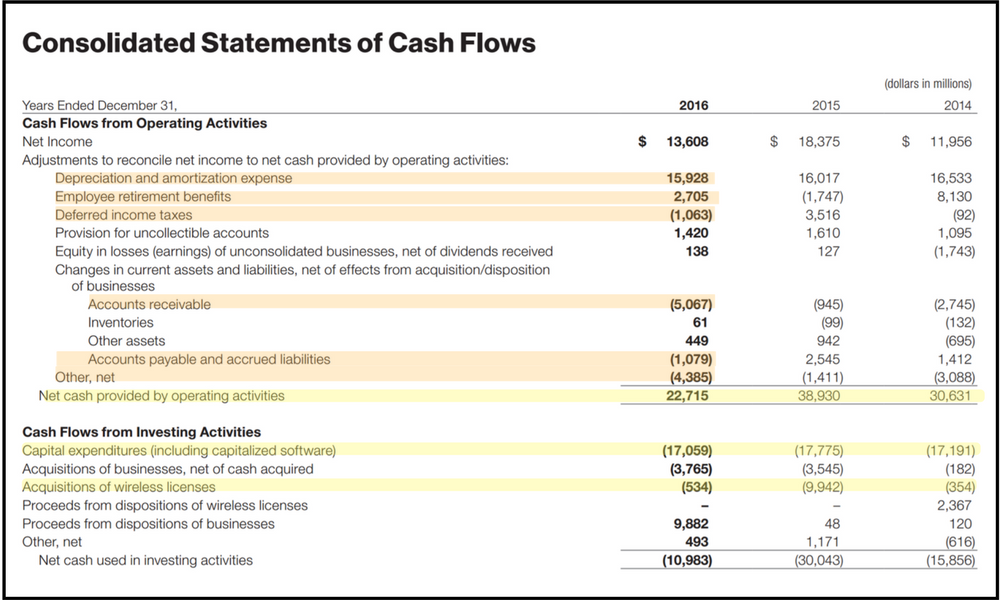

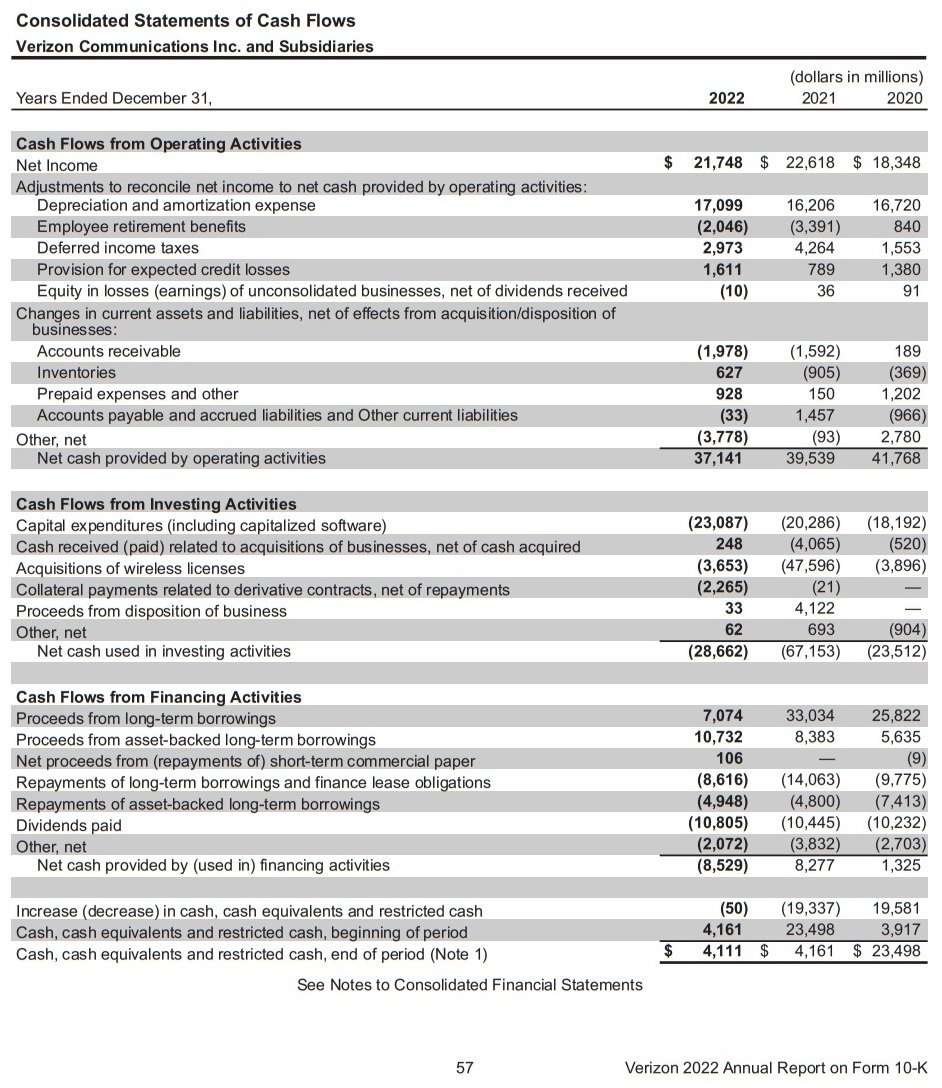

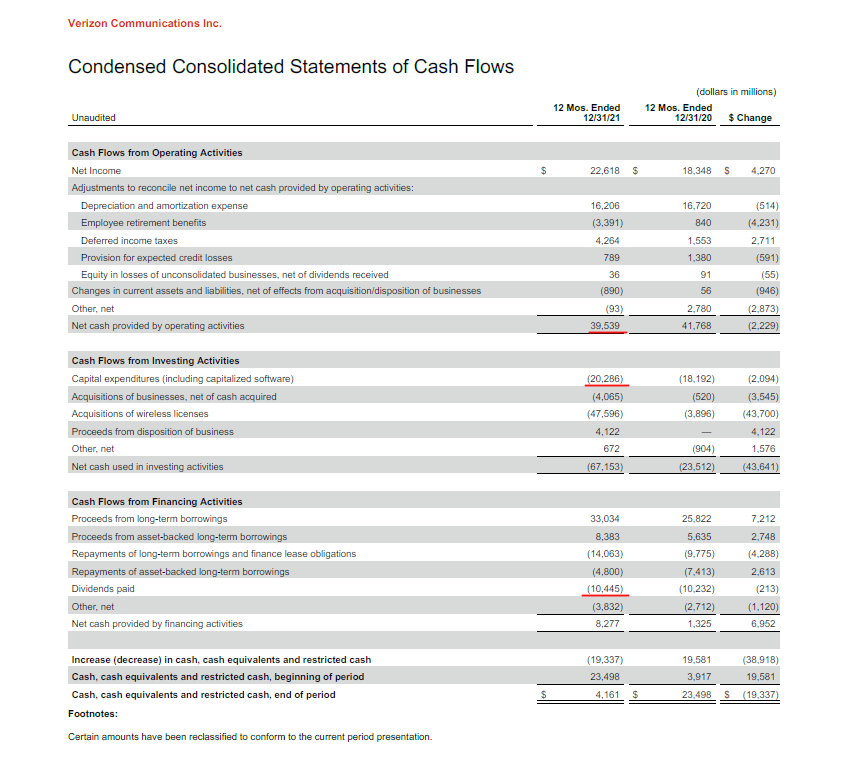

Net cash used in investing activities.

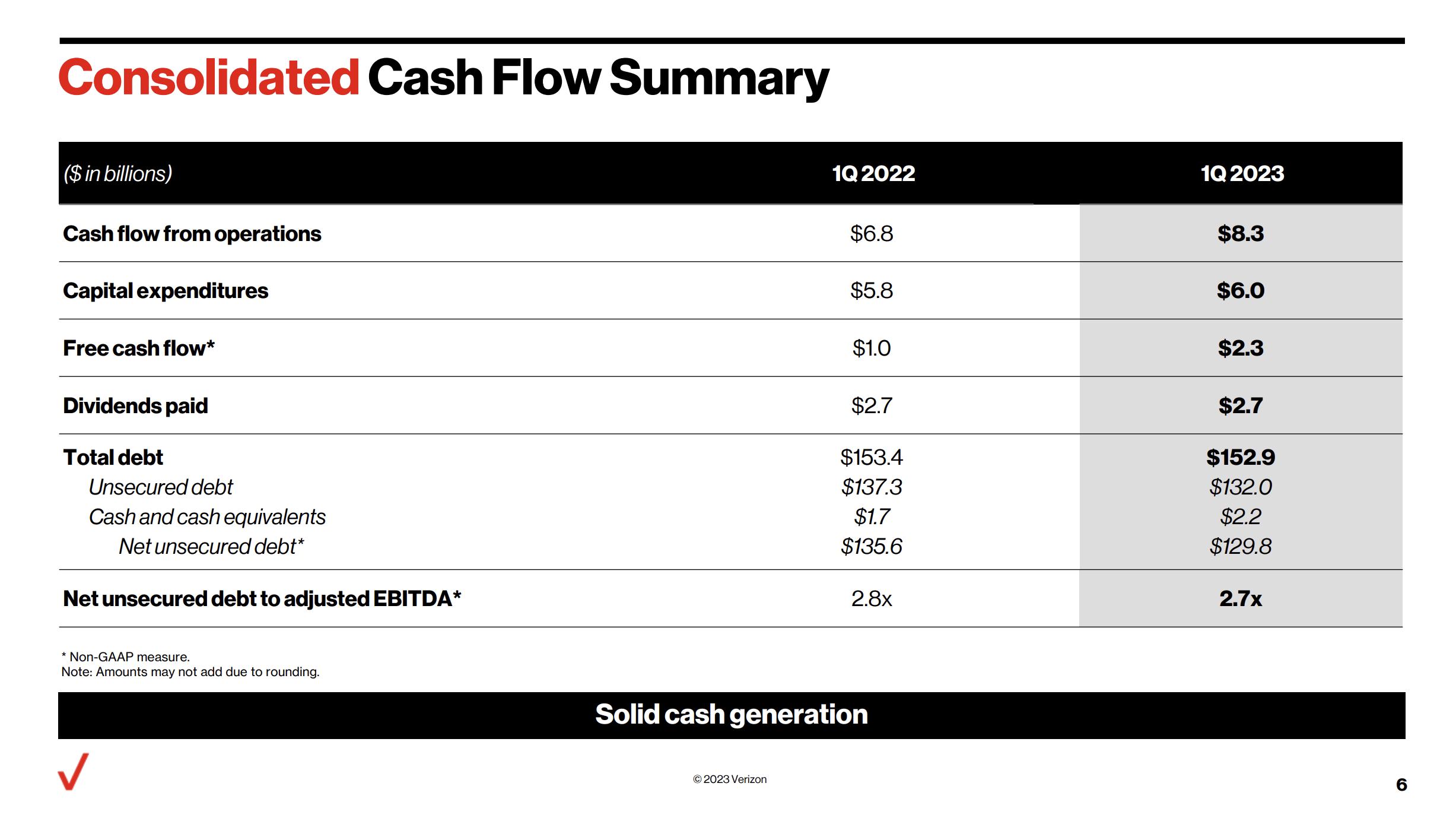

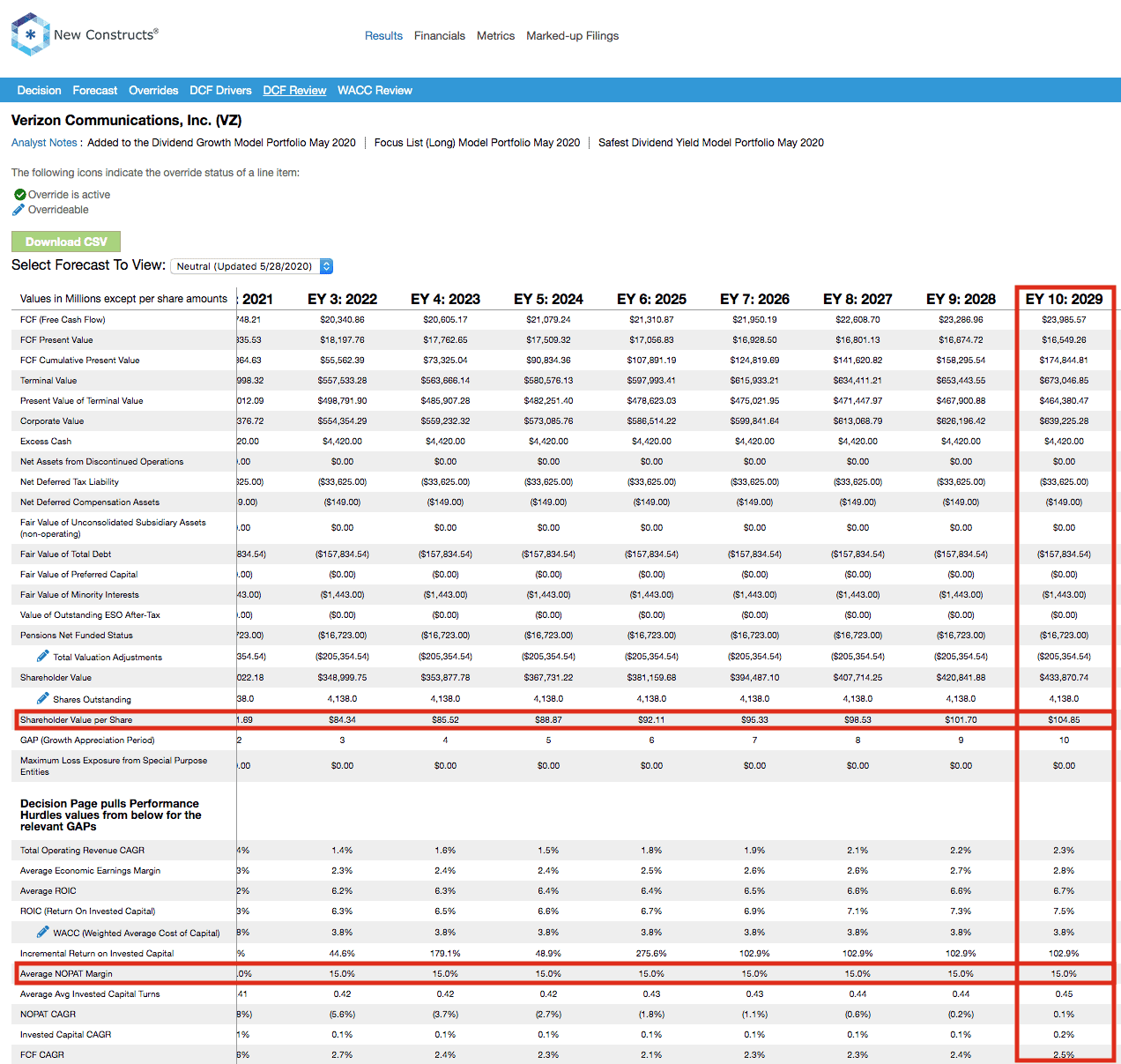

Verizon cash flow statement. Innovation rate increased to 20%; Vz free cash flow for q4 23 is 4.07 b usd. Up to 10 years of financial statements.

Understand the cash flow statement for verizon communications inc. View as % yoy growth or as % of revenue. This stock quote is delayed by at least 5 minutes and is not intended for.

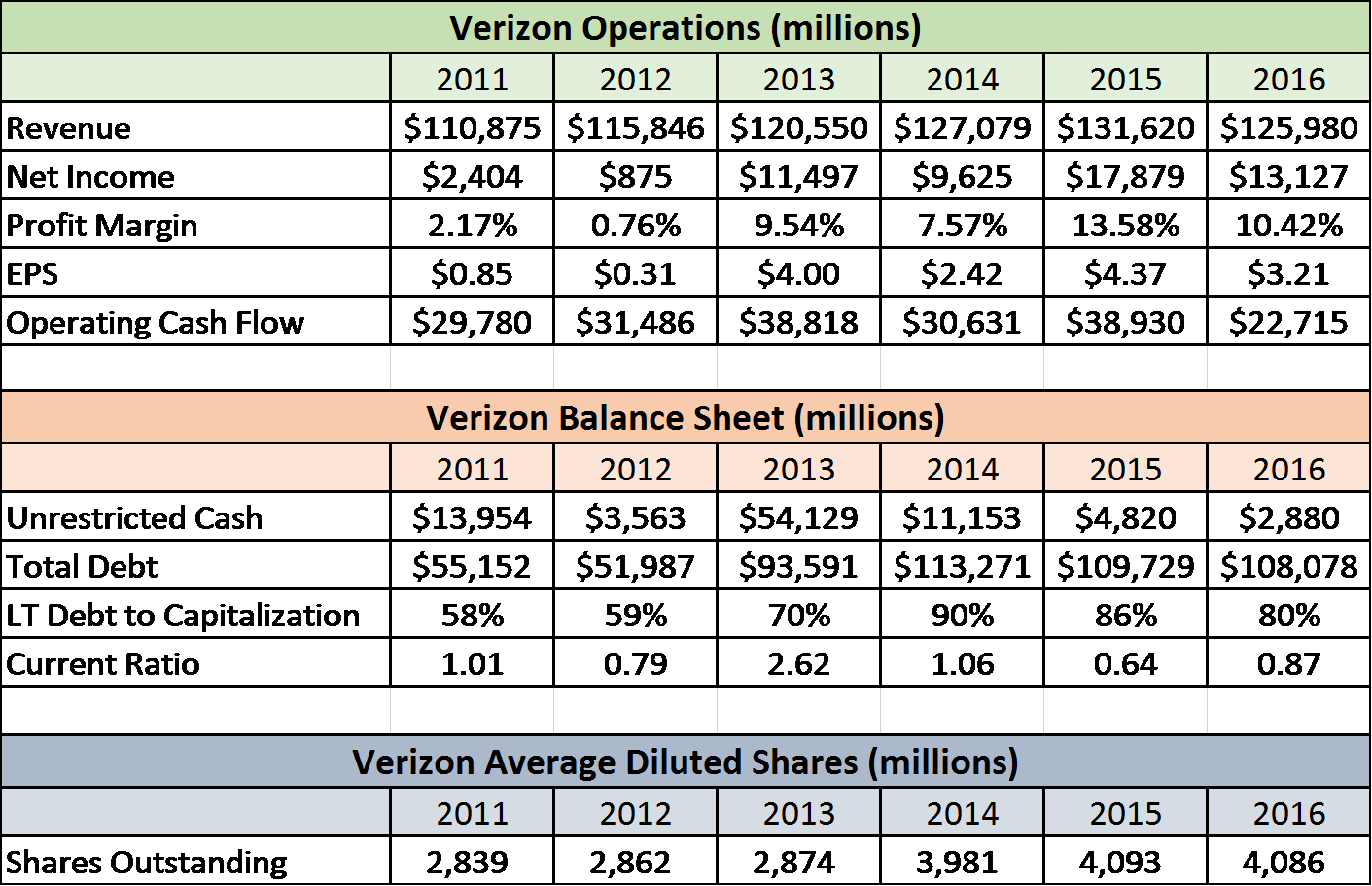

Verizon annual free cash flow for 2021 was $19.253b, a 18.34% decline from 2020. Verizon annual free cash flow for 2020 was $23.576b, a 32.4% increase from 2019. Break down of verizon communications' cash flow statement, which shows verizon communications' historical cash positions, such as cash provided by financing or.

Given t’s cash flow from directv.” verizon currently has a ttm free cash flow/share of $3.25. Let’s see how these stocks compare on. Service revenues increased 1.9 percent year over.

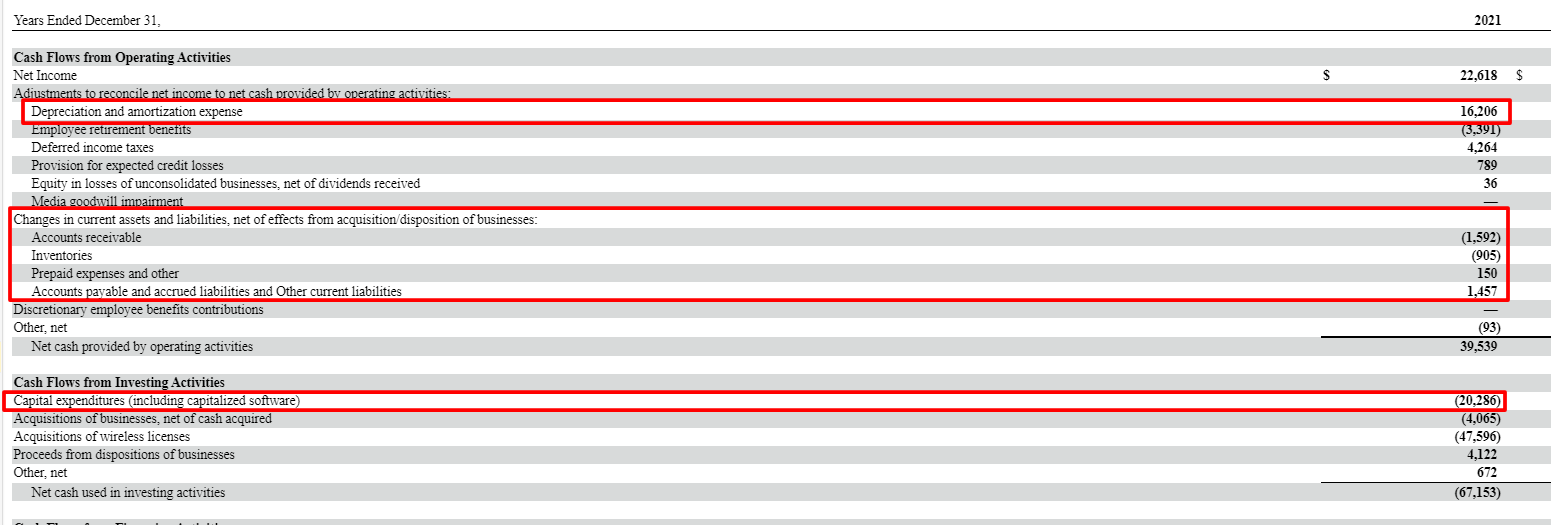

Free cash flow eur 423 million; Verizon annual cash flow from operating activities for 2021 was $39.539b, a 5.34% decline from 2020. Net income of $4.8 billion, a decrease of 10.3 percent from second.

Net cash provided by operating activities increased from q1 2023 to q2 2023 and from q2 2023 to q3 2023. Ten years of annual and quarterly financial statements and annual report data for verizon (vz). The cash flow statement is a summary of the.

For 2023, vz free cash flow was. Balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. Ten years of annual cash flow statements for verizon (vz).

This figure is $2.76 in at&t’s case. Quarterly cash flow by marketwatch. Annual cash flow by marketwatch.

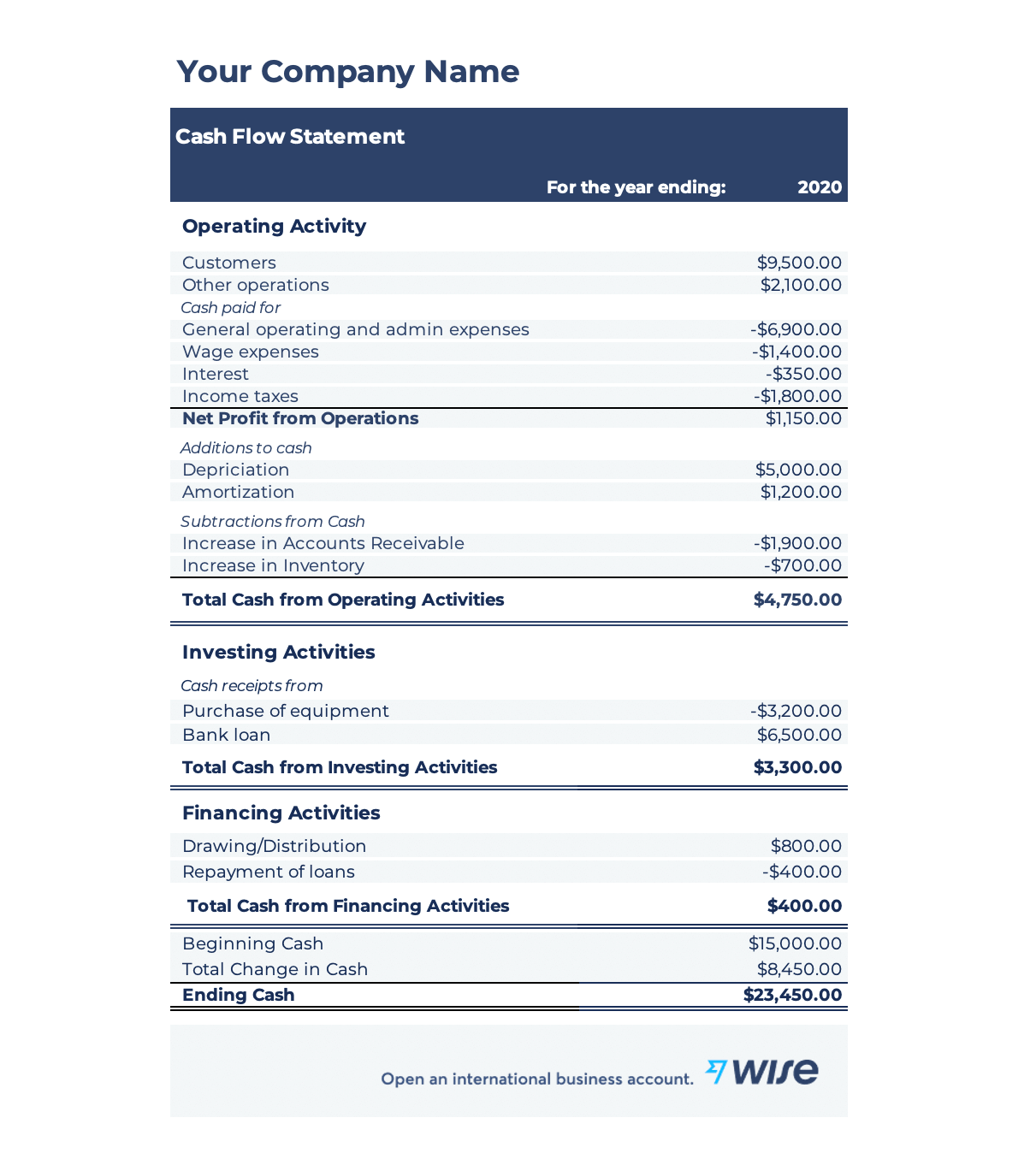

Please suggest list of best practices that should be activated to prepare cash flow statement both direct and indirect methods for the purposes of statutory. Net cash provided by operating activities 41,768 9,694 20,438 31,162 39,539 6,821 17,665 28,199 cash flows from investing activities capital expenditures (including capitalized. Overview income statement balance sheet cash flow verizon financial overview verizon's market cap is currently ―.

The company's eps ttm is $2.756; Vz $40.10 +$0.38 disclaimer note: View vz net cash flow, operating cash flow, operating expenses and cash dividends.

.jpg)