Looking Good Tips About Common Stock On Cash Flow Statement Audit Report 2018

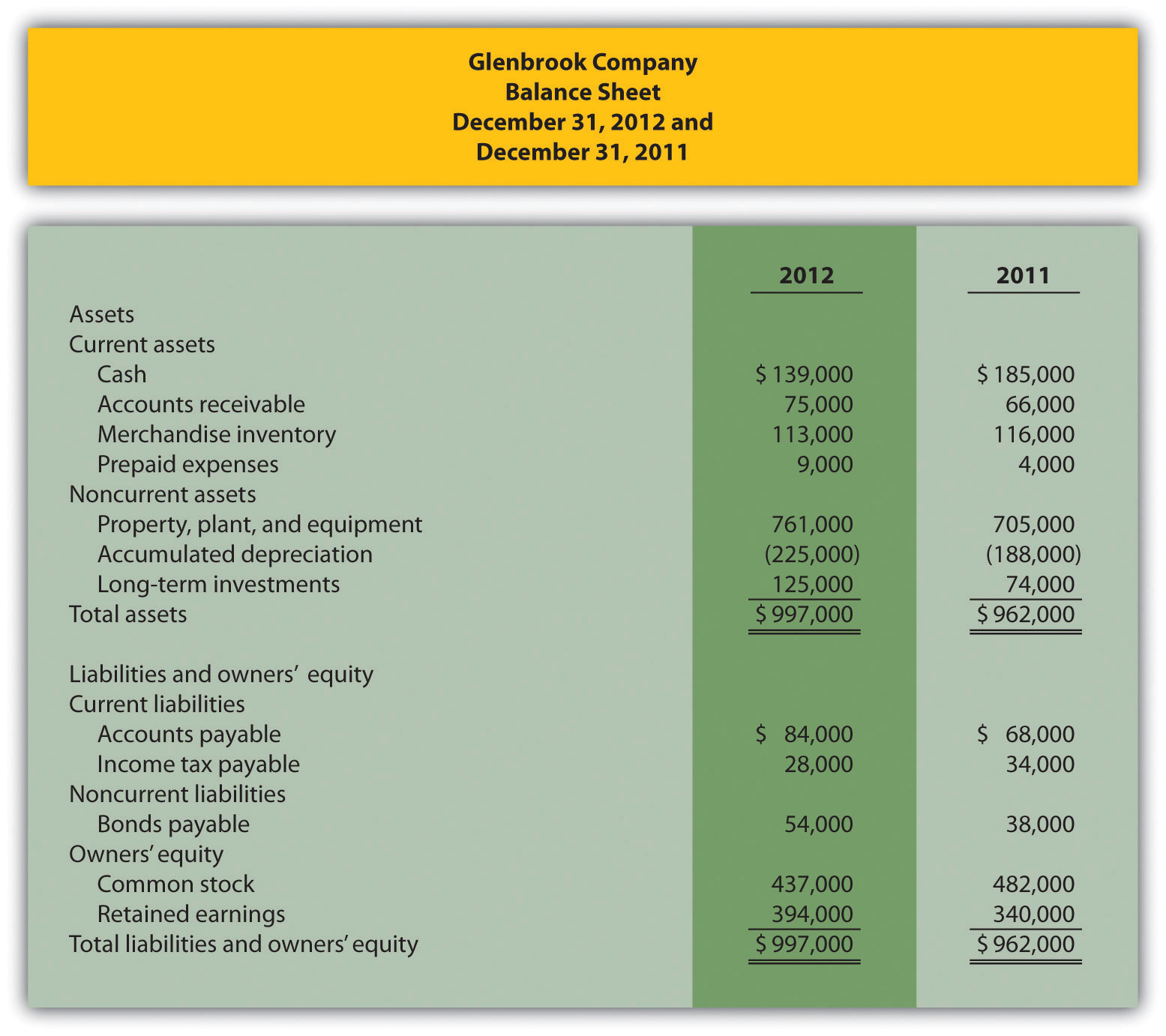

Several accounts frequently appear in the shareholders’ equity section of a balance sheet reported by a corporation.

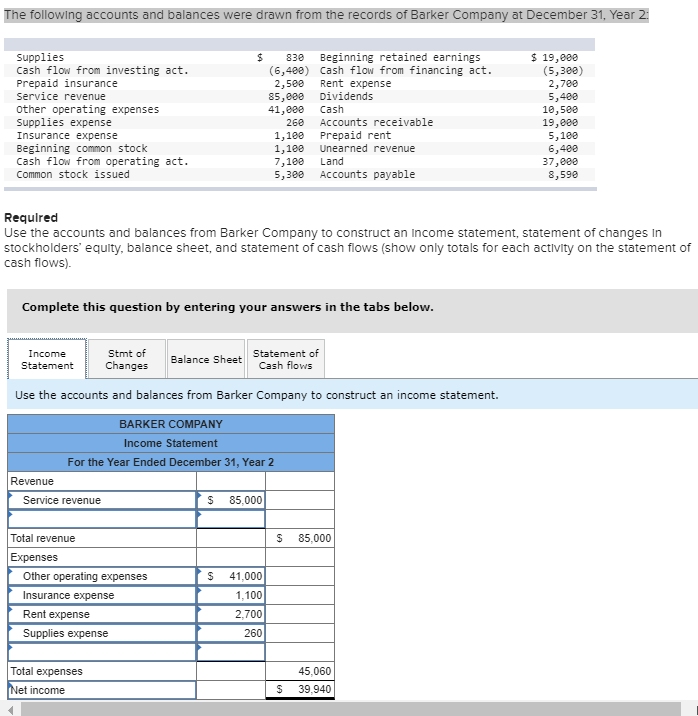

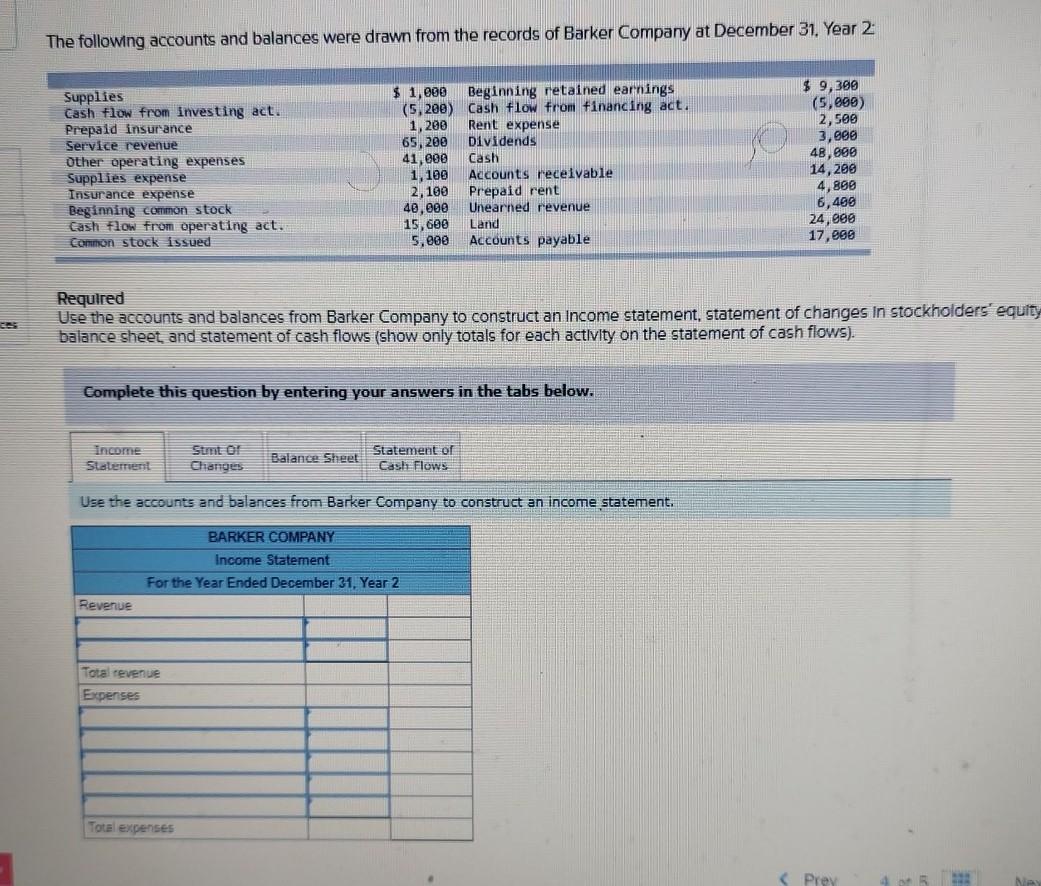

Common stock on cash flow statement. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. The cfs measures how well a. Not all captions are applicable to all reporting entities.

The cash flow statement looks at the inflow and outflow of cash within a company. A firm can be profitable and still not have an adequate flow of cash. The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period.

A company's cash flow is the figure that appears in the cash flow statement as net cash flow (different. What is a cash flow statement? This can create timing differences between profits and cash flows.

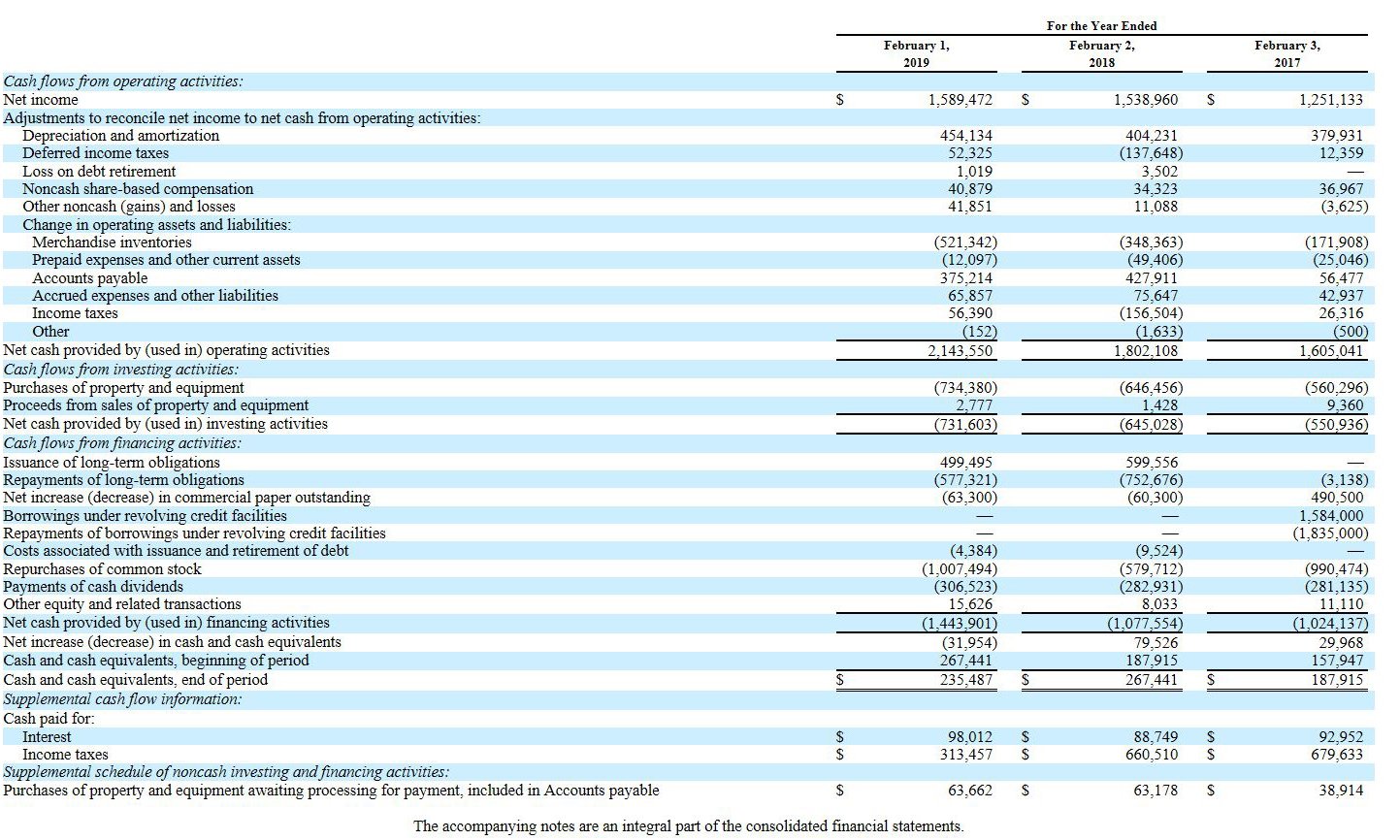

Begin with net income from the income statement. If a company's business operations can generate positive cash flow, negative overall cash flow. The net cash impact of raising capital from equity/debt issuances, net of cash used for share buybacks, and debt repayments — with the outflow from the payout of dividends to.

It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business. The statement of cash flows is prepared by following these steps:. Investopedia / laura porter what is cash flow from investing activities?

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. Cash flow from investing activities (cfi) is one of the sections on the cash flow statement that reports how. Understand the cash flow statement for iron horse acquisitions corp.

Cash flow from financing activities (cff): Upon issuance, common stock is generally recorded at its fair value, which is typically the amount of proceeds received. In example corporation the net increase in cash during the year is $92,000 which is the sum of $262,000 + $ (260,000) + $90,000.

One of the most significant things about cash flow analysis is that it doesn’t consider any growth in the cash flow statement. How issuing common stock can increase cash flows. But past information may not be able to portray the right information about a company for investors interested in investing in the company.

Record the issuance of common stock for a service or for an asset other than cash. How issuing common stock can increase cash flows although issuing common stock often increases cash flows, it doesn't always. Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period.

It reflects certain captions required by asc 230 (bolded), and other common captions. The cash flow statement, also called the statement of cash flows, is a financial statement showing how cash flows in and out of a company over a specific period of time. Revenues and expenses are recorded when they occur, not necessarily when cash moves.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)