Cool Info About Consolidated Profit And Loss Account Format Mission Statement Of A Bank

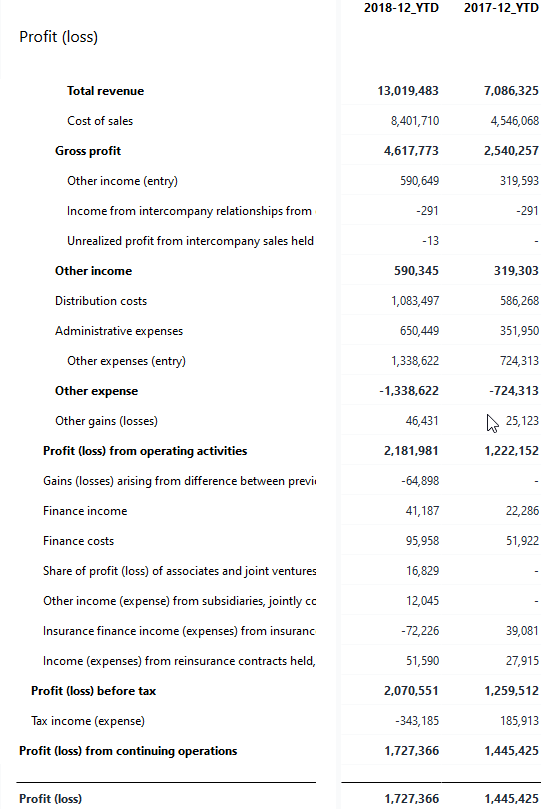

Get hdfc bank latest consolidated profit & loss account, financial statements and hdfc bank detailed profit and loss accounts.

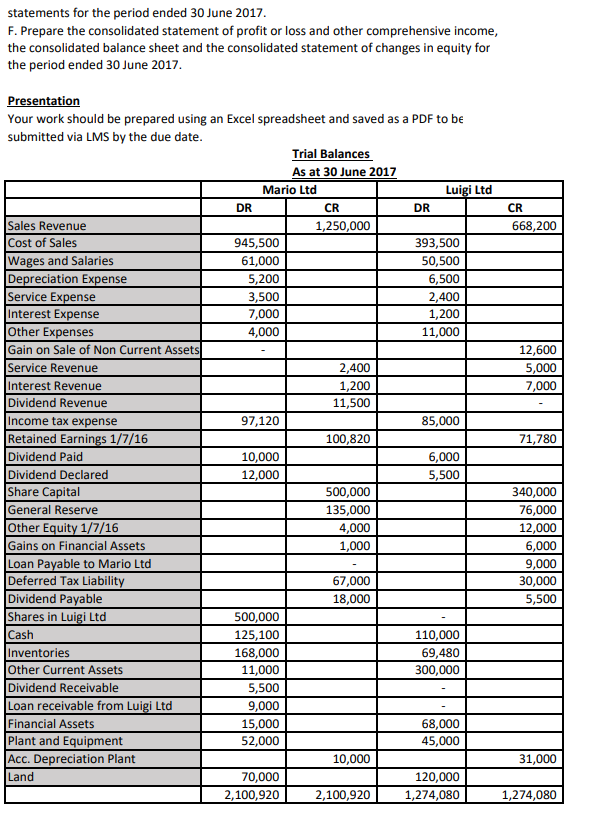

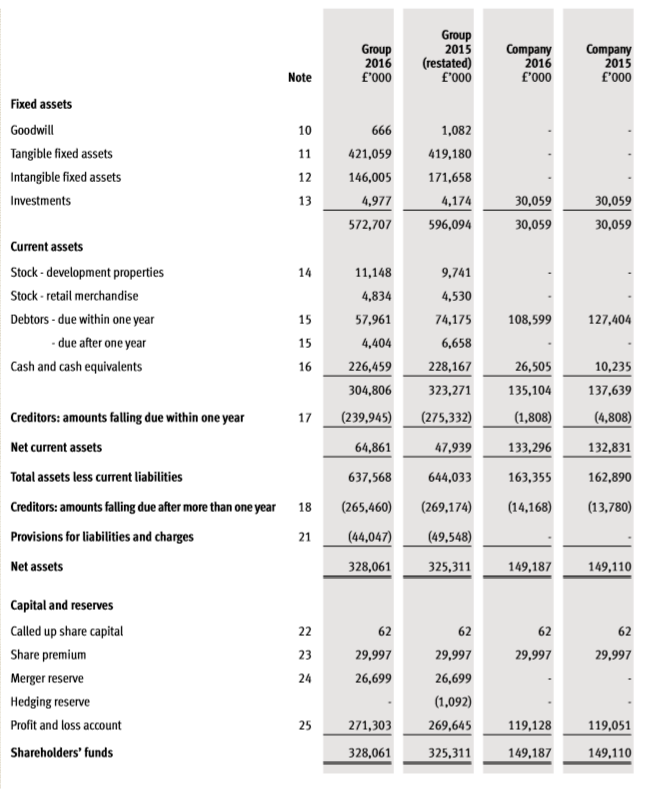

Consolidated profit and loss account format. In addition, the amendments introduced new disclosure On each side there is one column for each company, one column for adjustments and one for total. Cash and bank 10,000 75,000 75,000.

Assets and liabilities when preparing a consolidated statement of financial position, the assets and liabilities of the parent and the subsidiary are added together and then subject to consolidation adjustments. Consolidated financial statements are often referred to as ‘group accounts’. Had the question stem asked for the consolidated cost of sales figure, the answer would be correctly calculated as:

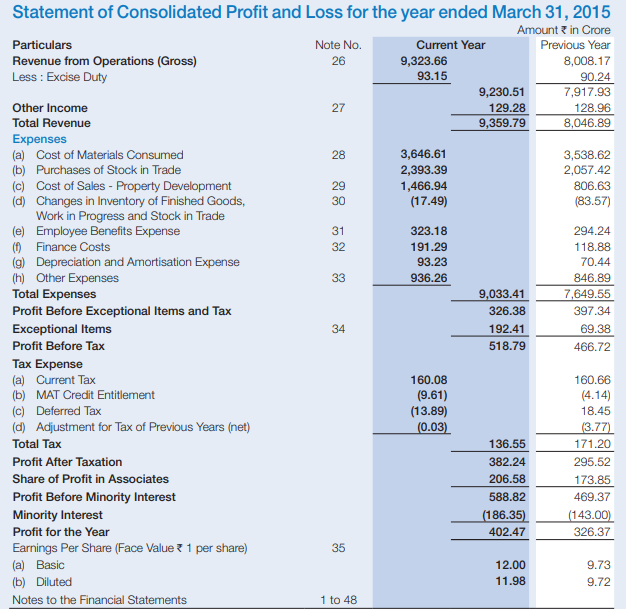

Ias 27 defines consolidated financial statements as ‘the financial statements of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent and its subsidiaries are presented as those of a single economic entity.’. A consolidated financial statement shows the financial data (liabilities, assets, income, equity, expenses, and cash flow) for various subsidiaries owned by one parent company rolled up into a single statement. If the subsidiary is acquired part way through the year all the revenues and expenses of the subsidiary must be time apportioned during the consolidation process.

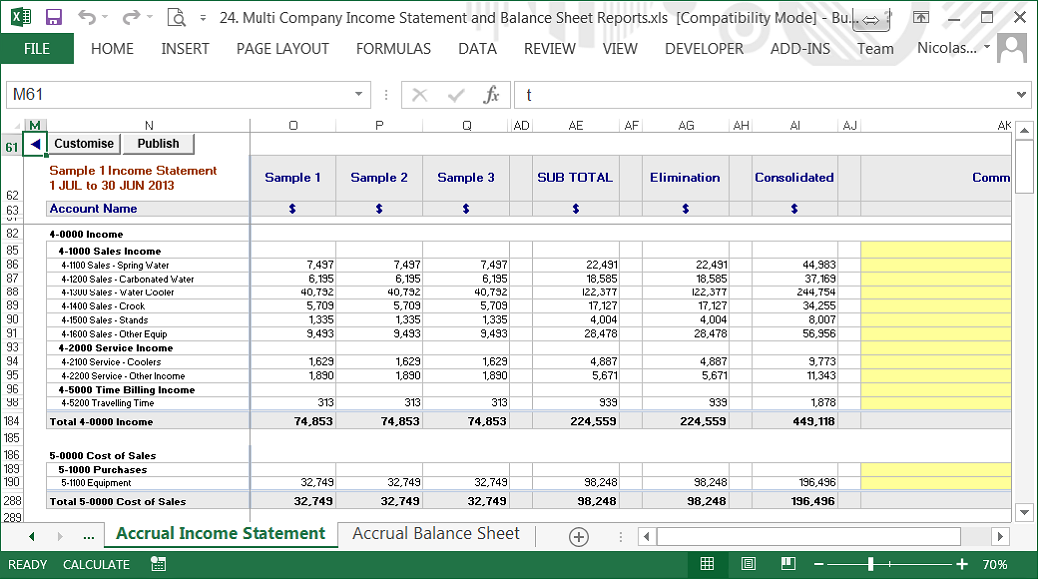

This annual report illustrates the disclosures and format that might be expected for a company that prepares consolidated and separate financial statements in accordance with frs 102 and the companies act 2006. What are consolidated financial statements? A key functionality in this type of report displays subsidiaries or divisions along with intercompany eliminations in the columns.

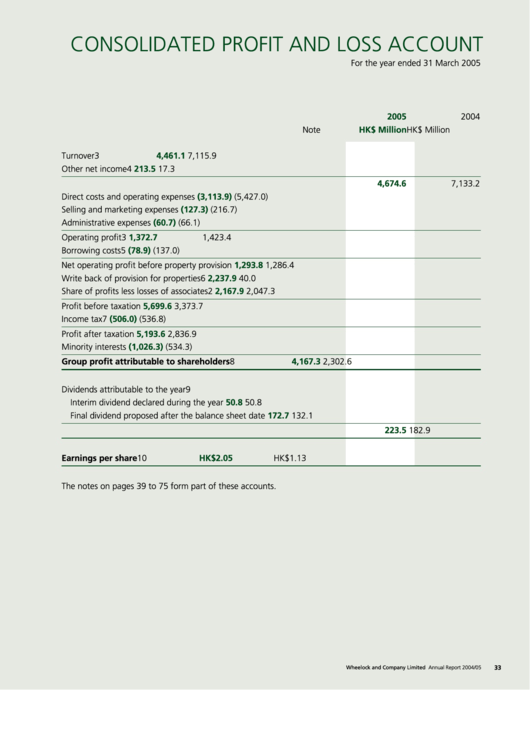

The diagram below shows an example of a typical group structure: In this lesson, we explain what consolidations are and the steps to follow in completing a consolidated statement of profit or loss. Consolidation of profit and loss accounts (with illustrations) article shared by:

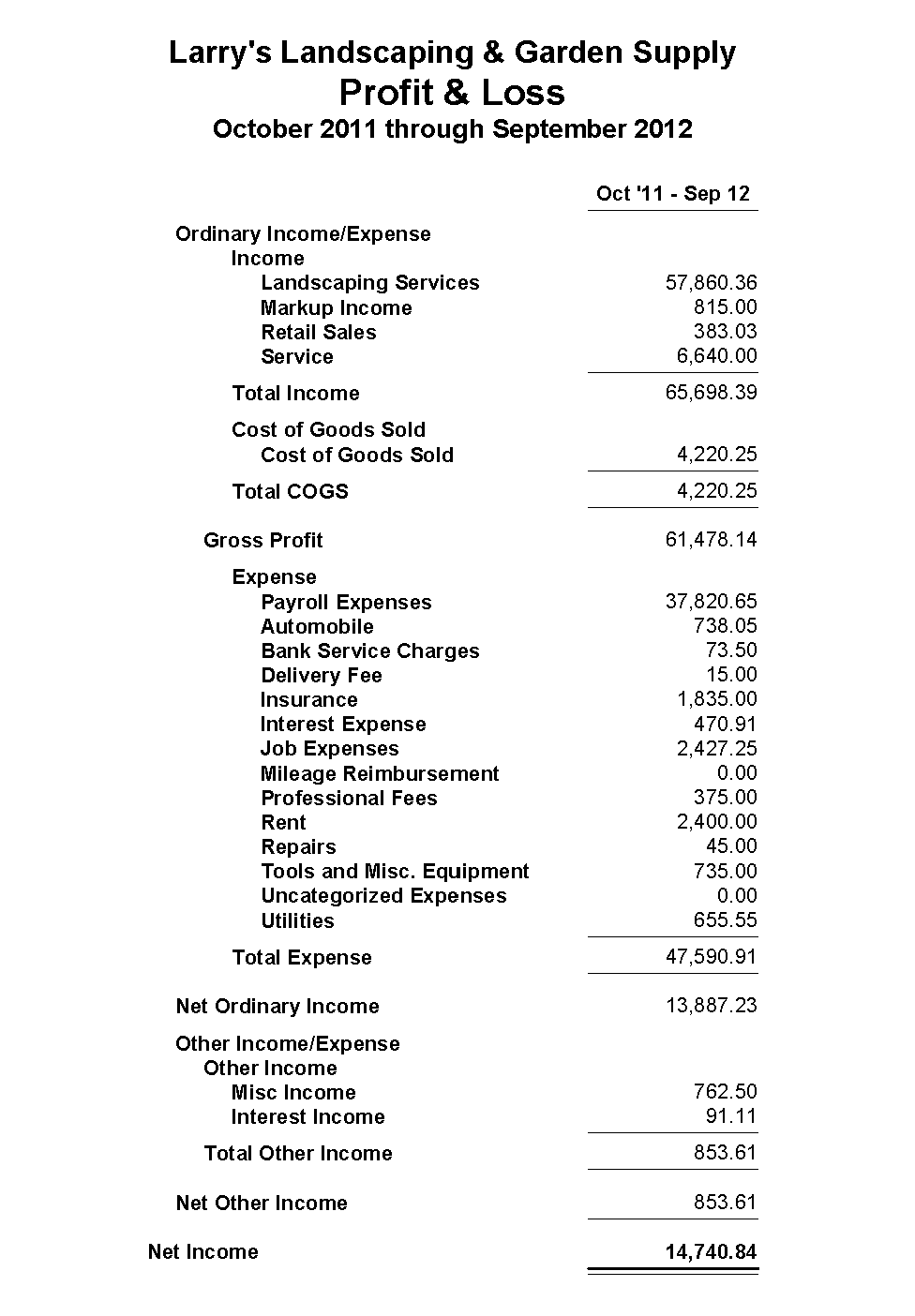

The p&l account is a component of final accounts. Consolidating particular subsidiaries for investment entities. 47k views 3 years ago consolidated financial statements.

Parent company, the directors must prepare group accounts for the year as well as individual accounts unless the company is exempt from the requirement. Get latest consolidated profit & loss account, financial statements and detailed profit and loss accounts. Consolidated financial statements also known as cfs, presents the financial position and results of operations for a parent and one or more subsidiaries as if they were a single company.

The steps for consolidating the income statements are as follows: Format and example of consolidated balance sheet. It is prepared to determine the net profit or net loss of a trader.

It also introduced the requirement that an investment entity measures those subsidiaries at fair value through profit or loss in accordance with ifrs 9 financial instruments in its consolidated and separate financial statements. (1) add together the revenues and expenses of the parent and the subsidiary. The companies act 2006 provides an exemption from preparing consolidated financial statements for a small group.

(ii) revenue incomes and revenue expenditures of holding company and subsidiary companies are recorded. The consolidation of financial statements integrates and combines all of a company's financial accounting functions to create statements that show results in standard balance sheet, income. Therefore, the consolidated revenue is calculated as: