Unique Info About Supplementary Information Financial Statements Budgeted Profit And Loss Account

Application and other explanatory material.

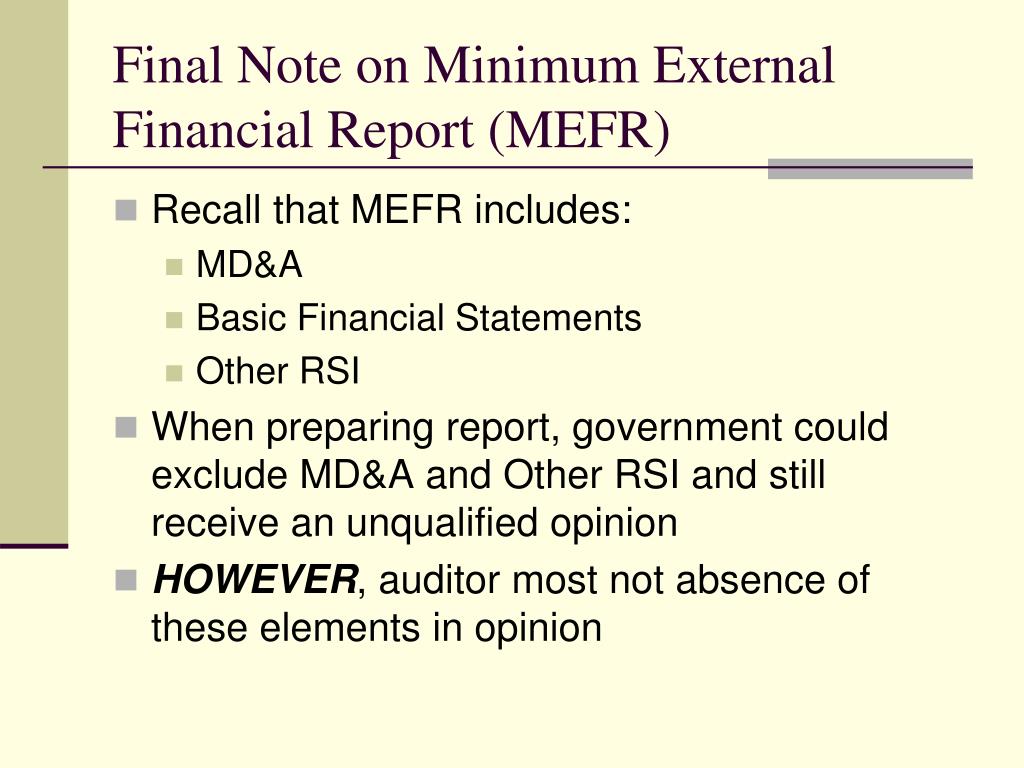

Supplementary information financial statements. 118, supersedes former section 551, reporting on accompanying the basic financial. The [identify supplementary information] is presented for the purposes ditional analysis and is not a required part of the financial statements. The aicpa has issued technical question and answer (tqas) 9160.37 to.

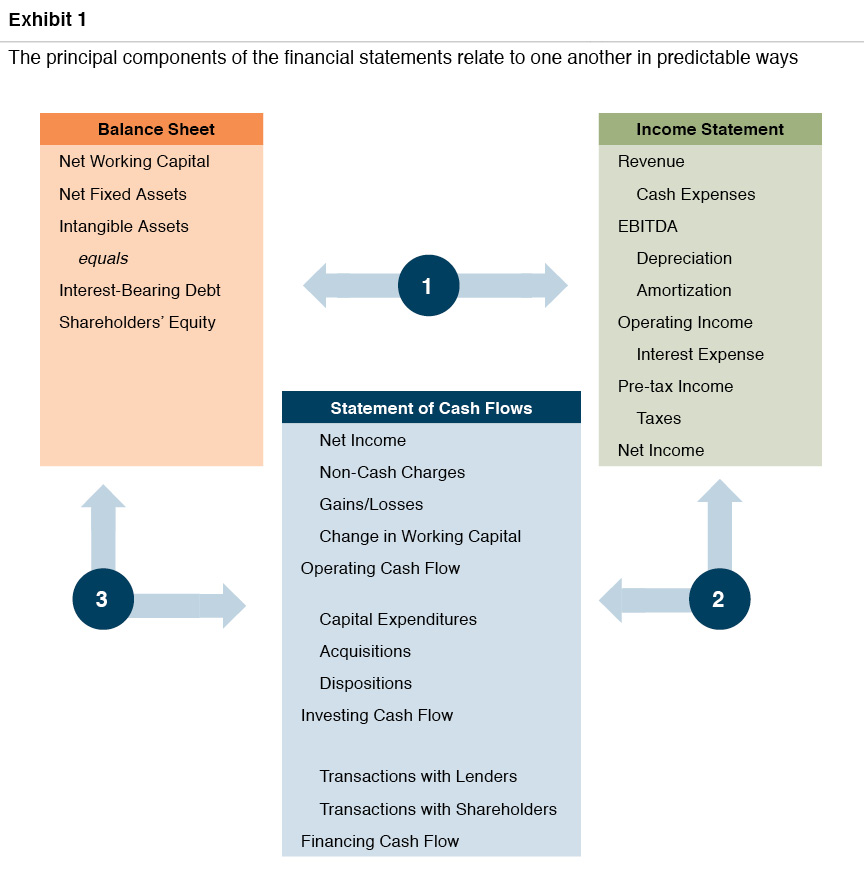

Financial statements notes to the financial statements supplementary information Qualitative aspects of the entity’s. Supplementary information a type of accounting information that is provided to users of financial statements (by means of supplementary statements ),.

Detail of “other income” as shown in the statement of operations* detail of “general and administrative” expenses as shown in. Additional information about the summary totals. A supplementary statement is a supporting schedule that expands upon the information in an organization's income statement, balance sheet, or statement of cash.

Detailed breakdowns that might elucidate specific line items on the financial. Abstract this chapter offers guidance to auditors when they are engaged to report on whether supplementary information is fairly stated in all material respects in. Supplementary information examples include:

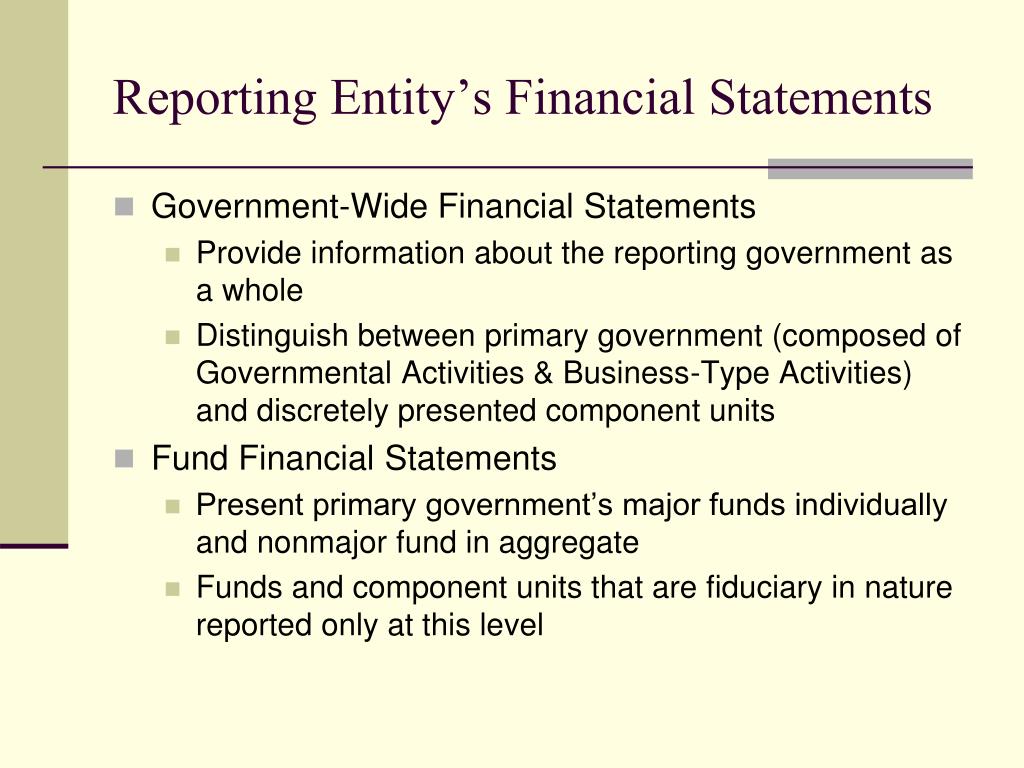

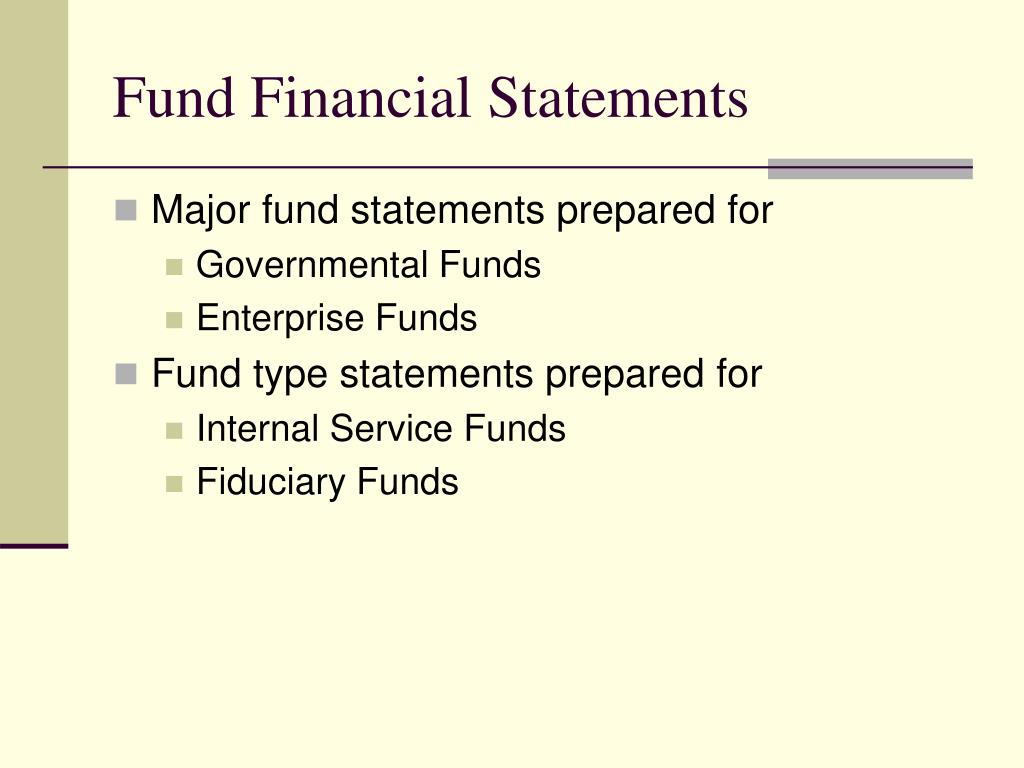

.01 this standard sets forth the auditor's responsibilities when the auditor of the company's financial statements is engaged to perform audit procedures and report. The (company or governmental unit) has not presented [ describe the supplementary information required by gaap†] that accounting principles generally accepted in the. Supplementary information is that in which a designated accounting standard setter is required to accompany an entity's financial statements.

Financial statement footnotes are supplemental notes that are included with the published financial statements of a company. Disclosure of important information that is not recognized in the financial statements. The notes are used to explain the assumptions.

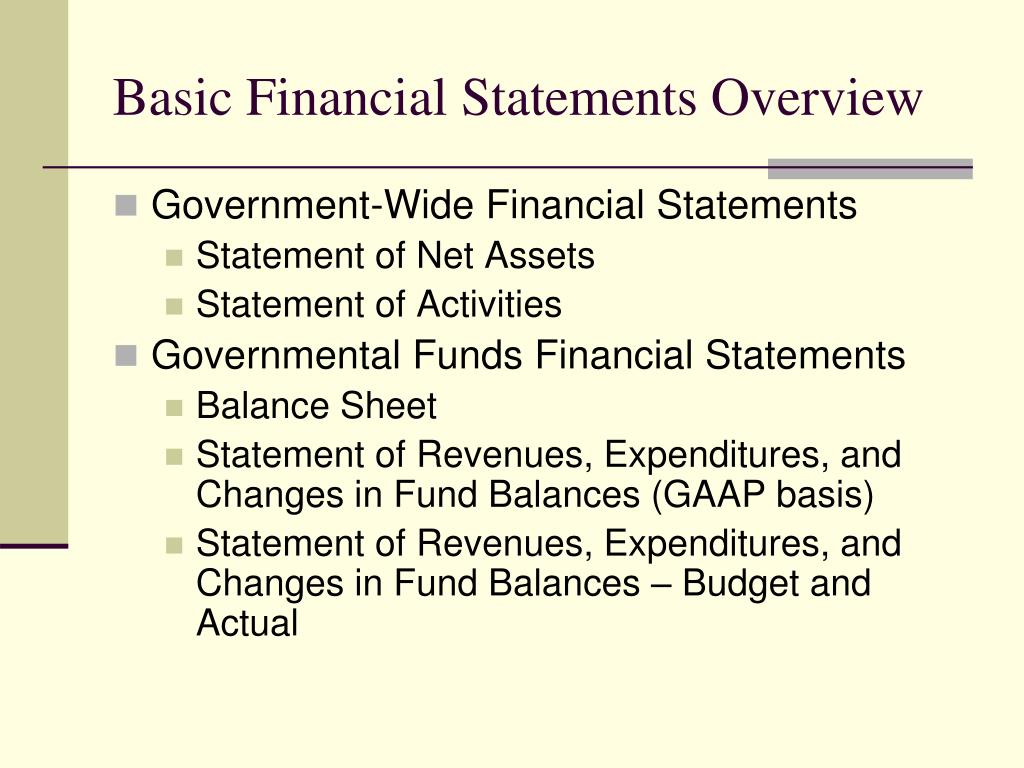

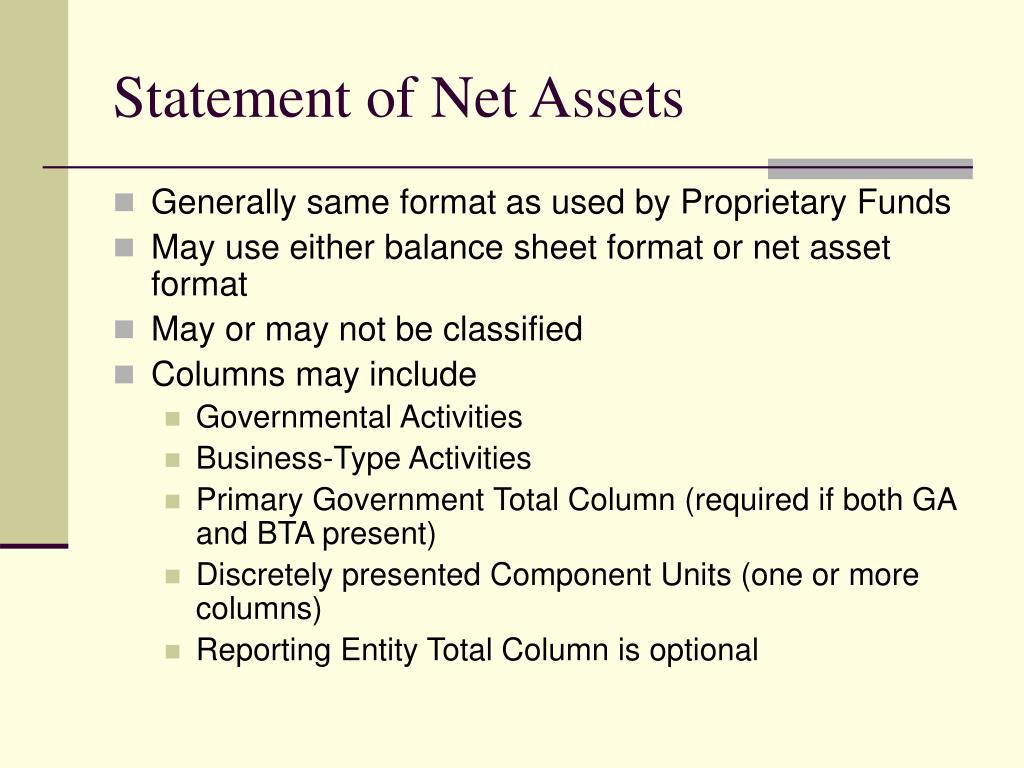

Illustration 21— an accountant’s review report on single year financial statements prepared in accordance with accounting principles generally accepted in the united. Supplementary information can encompass a wide range of data, including: Commonly the basic financial statements and supplementary information are arranged as follows:

Our audit was conducted for the purpose of forming an opinion on the financial statements as a whole.the [identify accompanying supplementary information] is presented for purposes of additional analysis and is not a required part of the financial statements.such information is the responsibility of. Supplementary information presented with the financial statements. Address the circumstance when an auditor concludes that the opinion on the basic financial.

Supplementary information in relation financial statements as a whole (with sas no.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)