Stunning Tips About Balance Sheet Rec The Reports

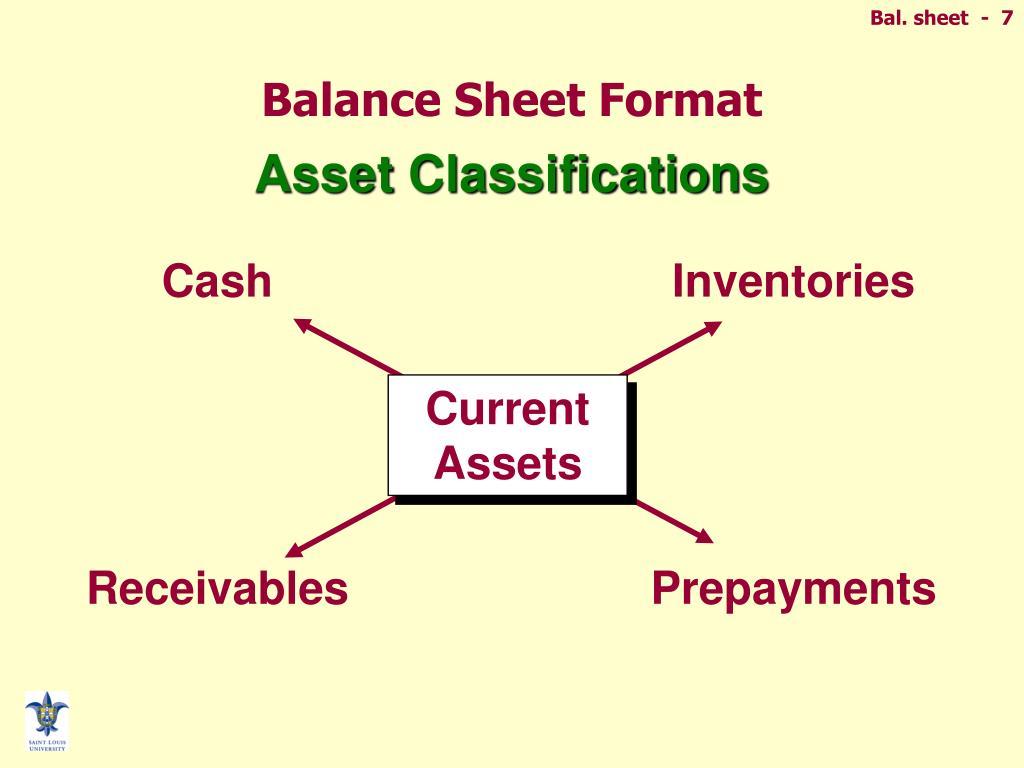

These three balance sheet segments.

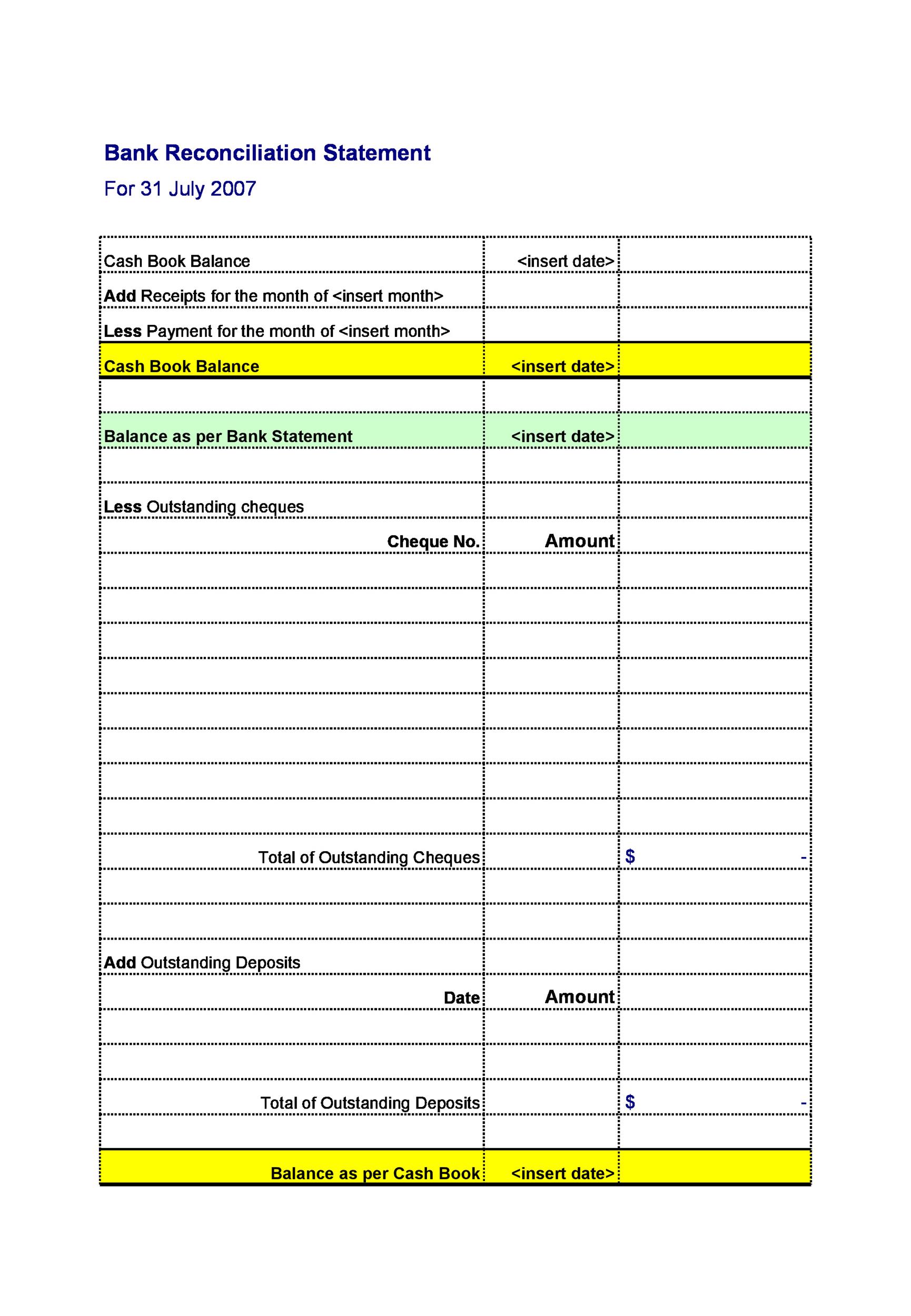

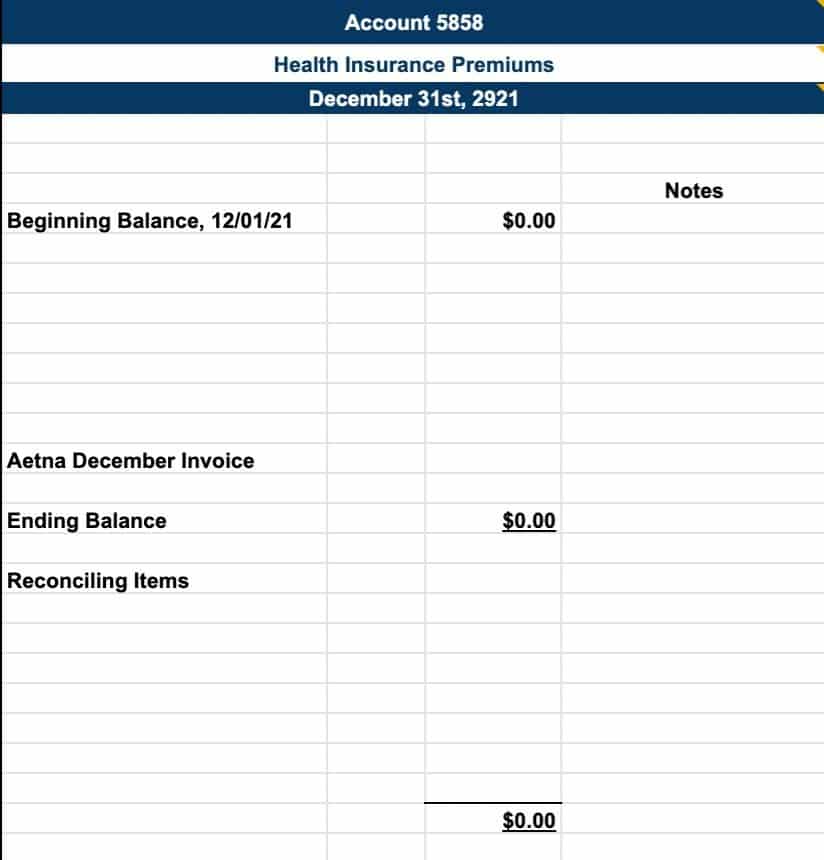

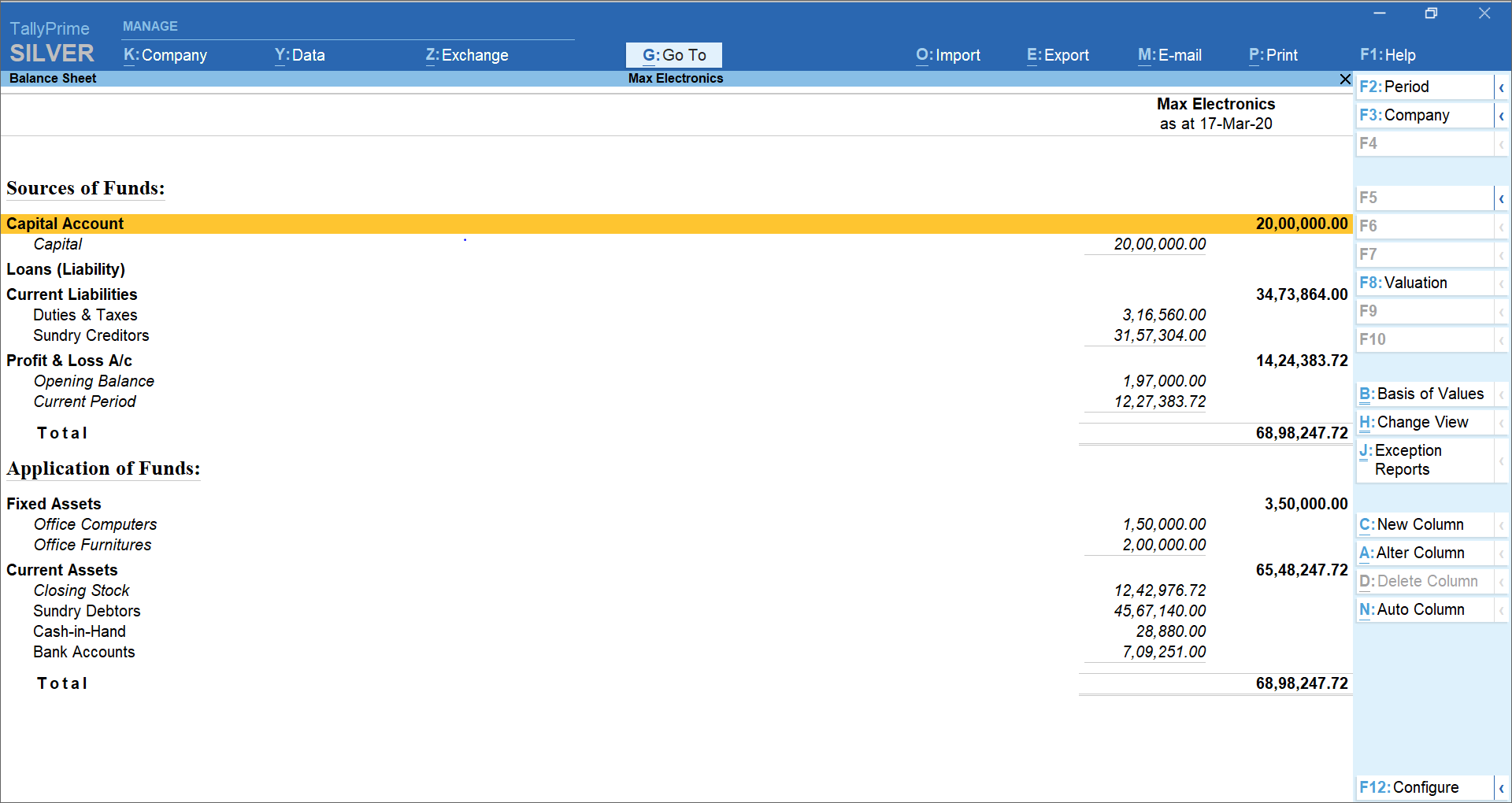

Balance sheet rec. Policymakers said slower qt could ease shift to ample. It is one component of the accounting close cycle. Go to the filters tab and set a date range.

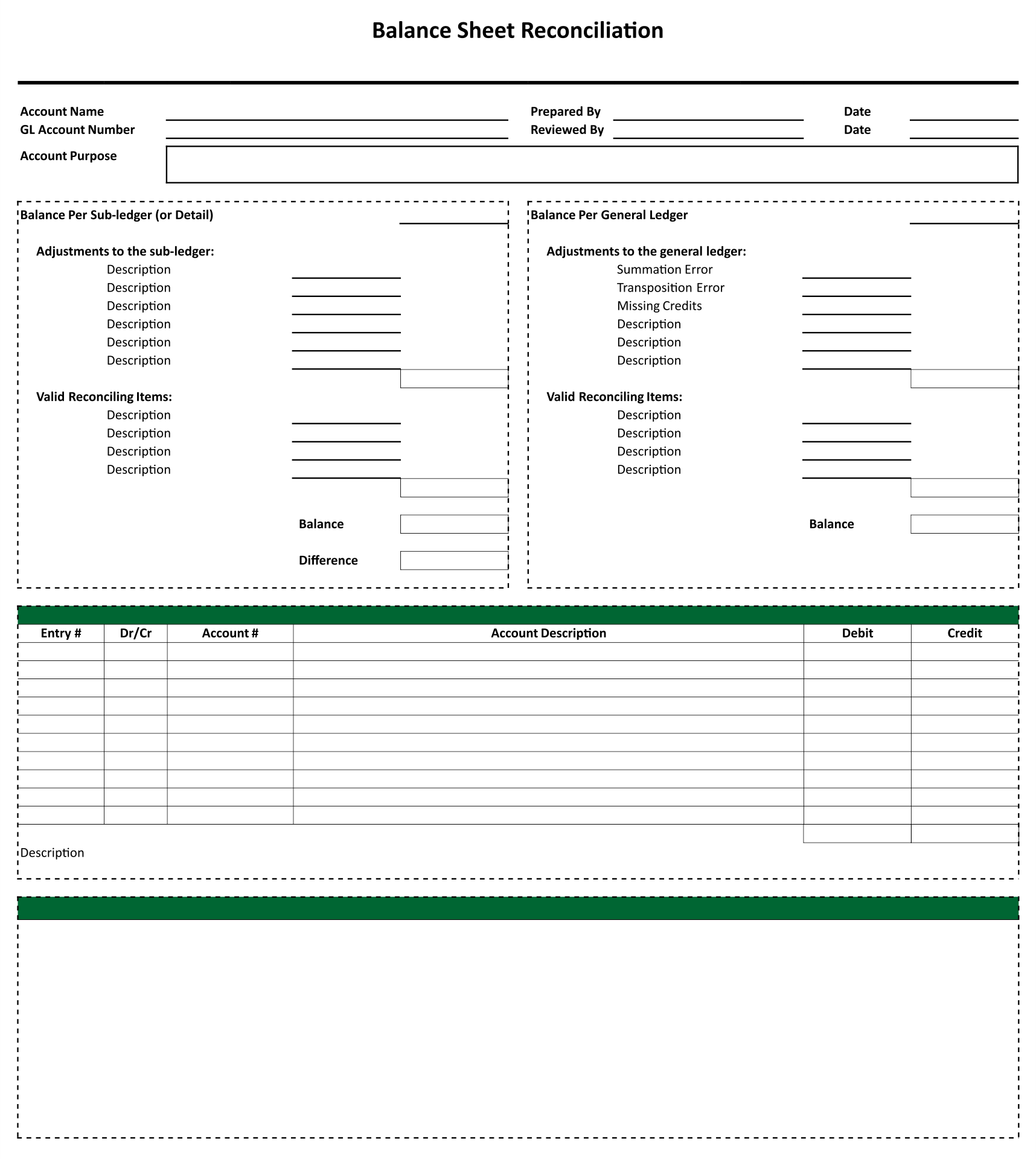

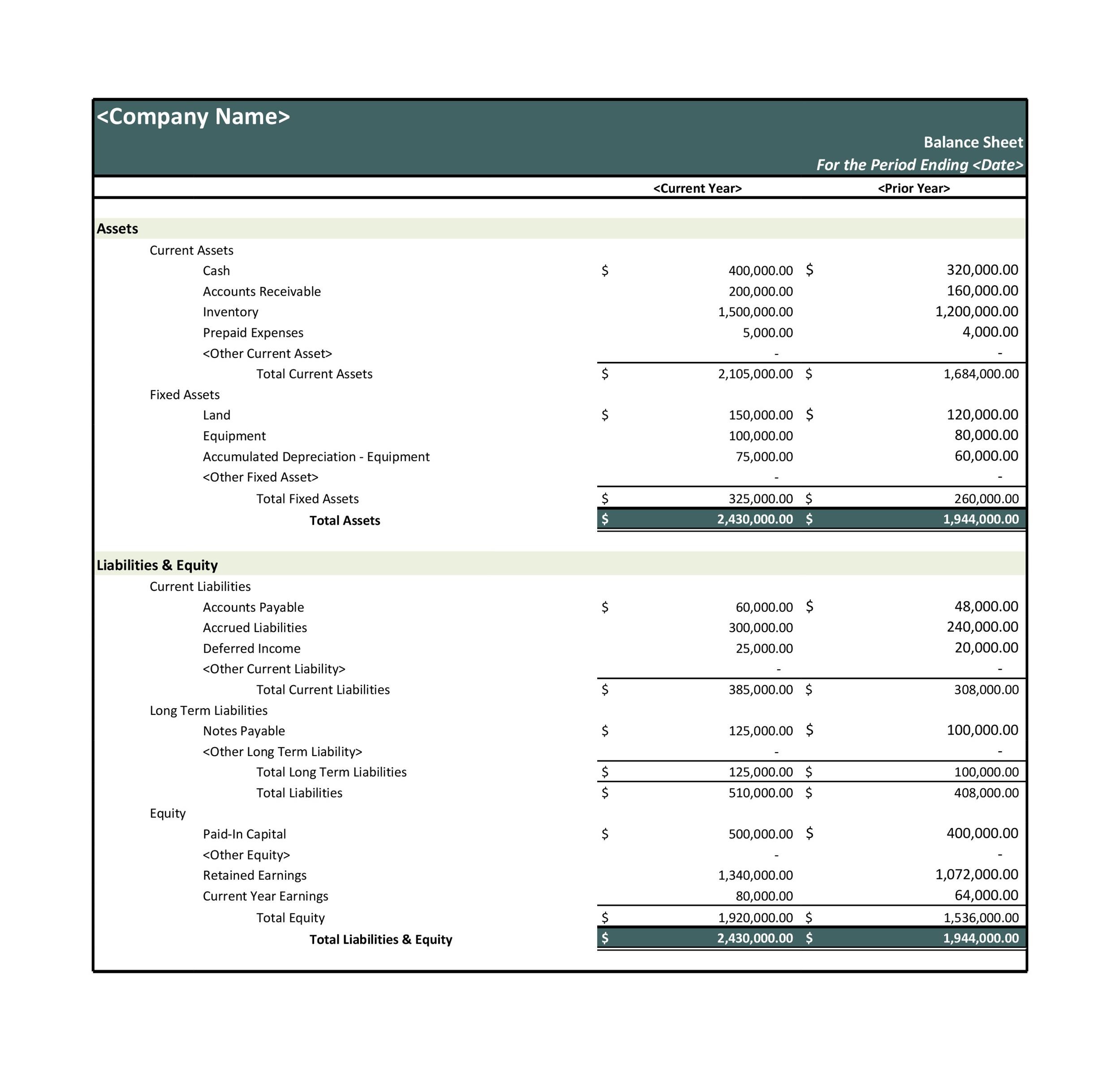

But how do you check that your assets, liabilities, and equity are correct? Efficiency create a faster, more efficient close. This process ensures that all accounts are documented properly before filing every financial year.

Provide the reconciler with appropriate training. Control designed by accountants with a focus on compliance and control, blackline ensures that recs are done right and audits run. This made the older, lower.

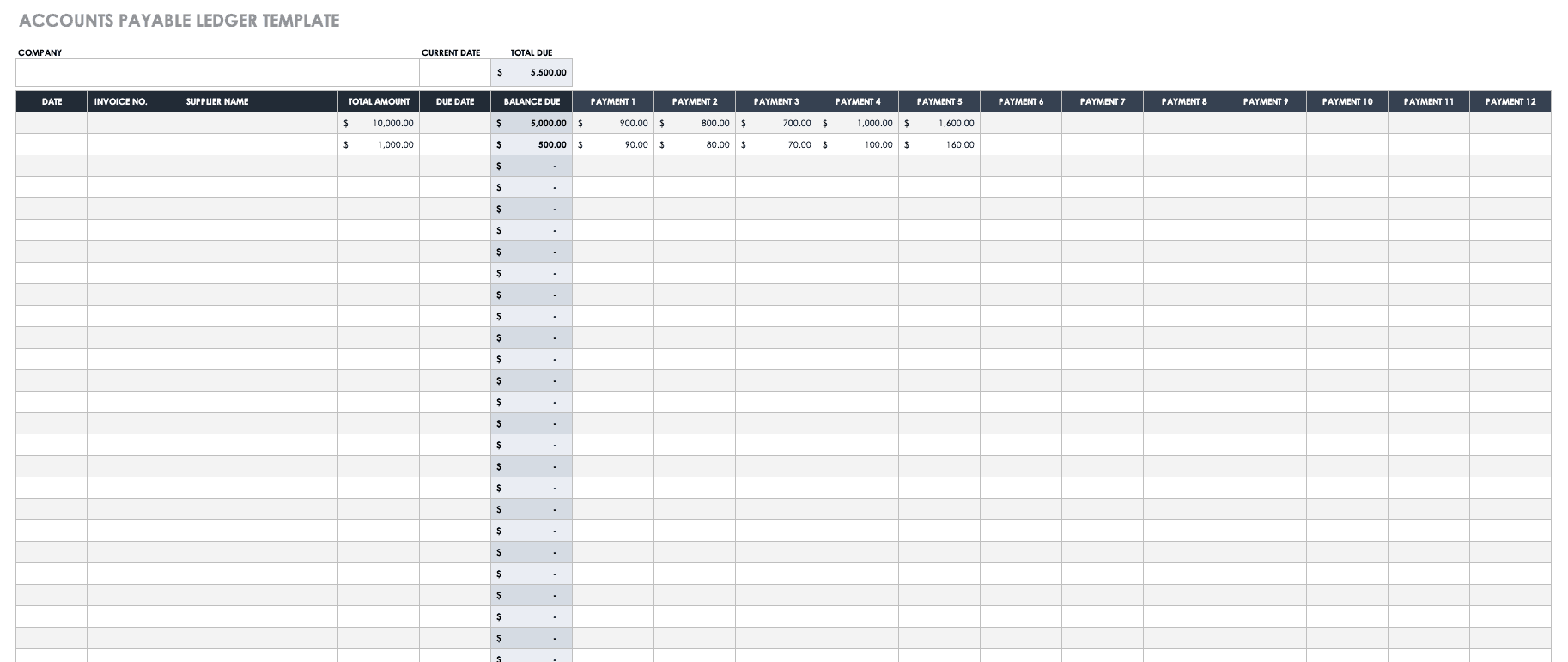

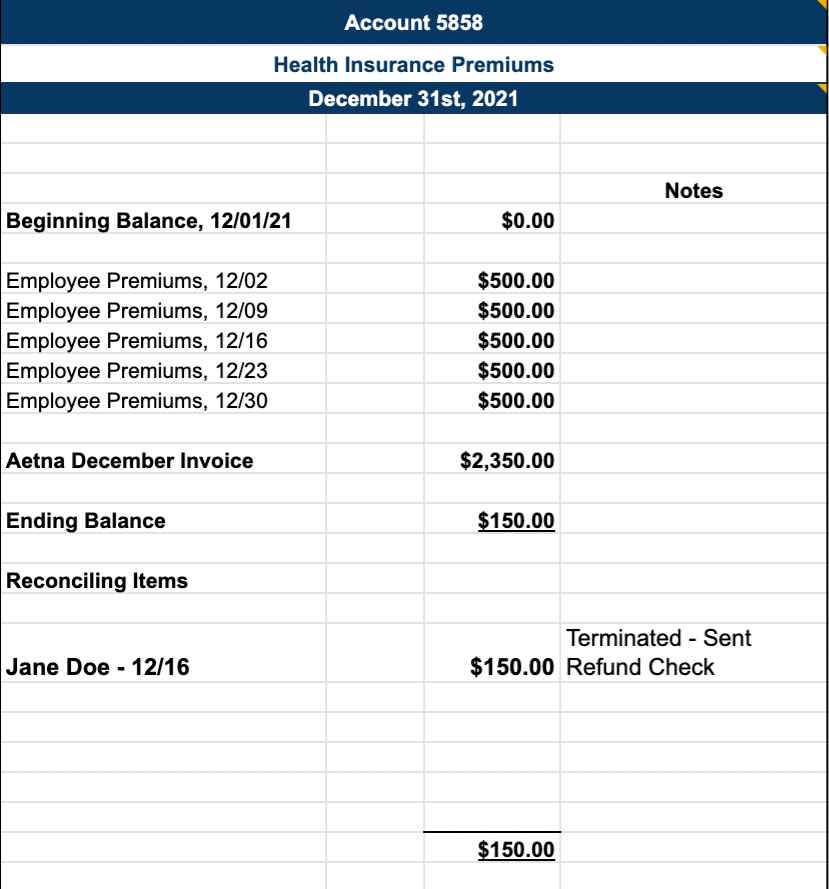

Accountants must reconcile credit card transactions, accounts payable, accounts receivable, payroll, fixed assets, subscriptions, deferred accounts, and other. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. The fed more the doubled the size of its holdings starting in march 2020 to a peak of nearly $9 trillion, using bond purchases to stabilize markets and provide stimulus beyond the near zero.

Get rec latest balance sheet, financial statements and rec detailed profit and loss accounts. Account reconciliation is a critical step and key control for finance and accounting. Click ok and look for the transaction.

The fed has been reducing the size of its holdings since 2022. Assets have declined by about $1.3 trillion since june 2022. Balance sheet reconciliation is the process of closing balances of all individual company accounts that are a part of the company’s balance sheet.

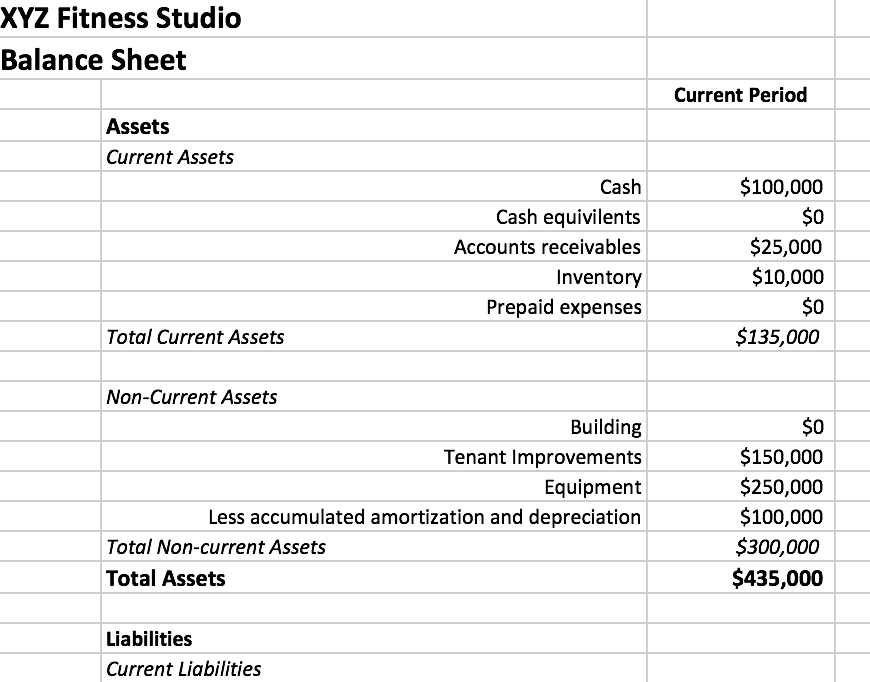

Oct 16, 2023 michael whitmire total assets = total liabilities + total equity. The answer is with balance sheet reconciliations. Risk ranking requires a thorough and balanced analysis of both quantitative and qualitative factors of individual accounts.

This loss takes into account the full release of the provision for financial risks, amounting to €6,620 million, which. At the same time, bank reserve balances — another large liability on the central bank’s balance sheet — are $3.54 trillion, according to the latest data. A common approach to this is risk ranking balance sheet accounts with a designation of high, medium, or low.

Balance sheet reconciliation can be defined as a process of verifying the accuracy of information presented in the balance sheet. Think of it like a guitar: You fix any mistakes and reconcile the balance sheet if a number is wrong or not in the right place.

Ultimately, the risk ranking of the account determines how often the account is reconciled (e.g., monthly. Balance sheet reconciliation is a process where a business or an individual closes all balances of individual accounts as part of their balance sheet. Before the closing process can typically begin, the information in the general ledger is verified against some type of supporting schedule or document.