Sensational Tips About Going Concern Disclosure In Audit Report Example Of Income And Expenditure Account Balance Sheet City

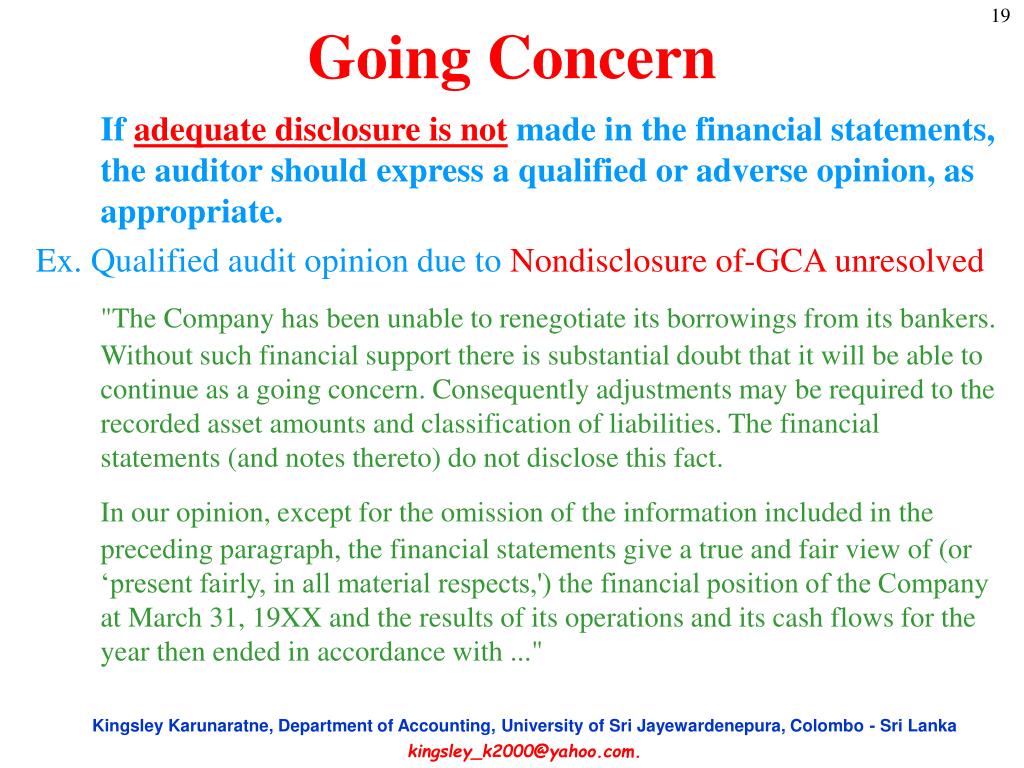

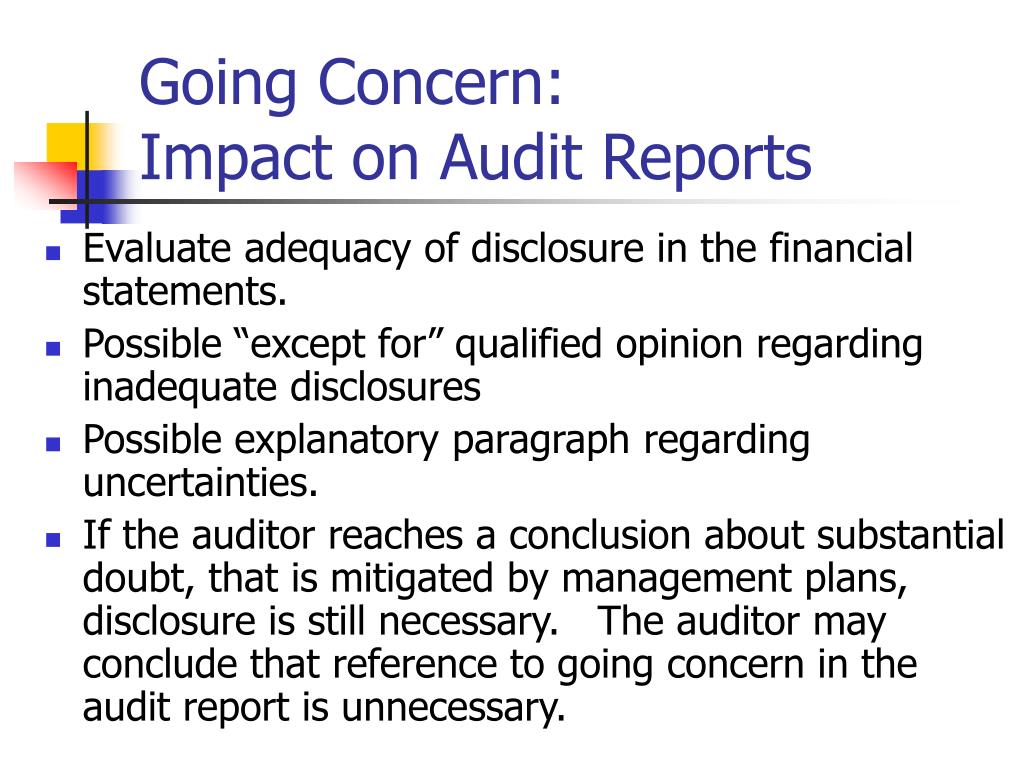

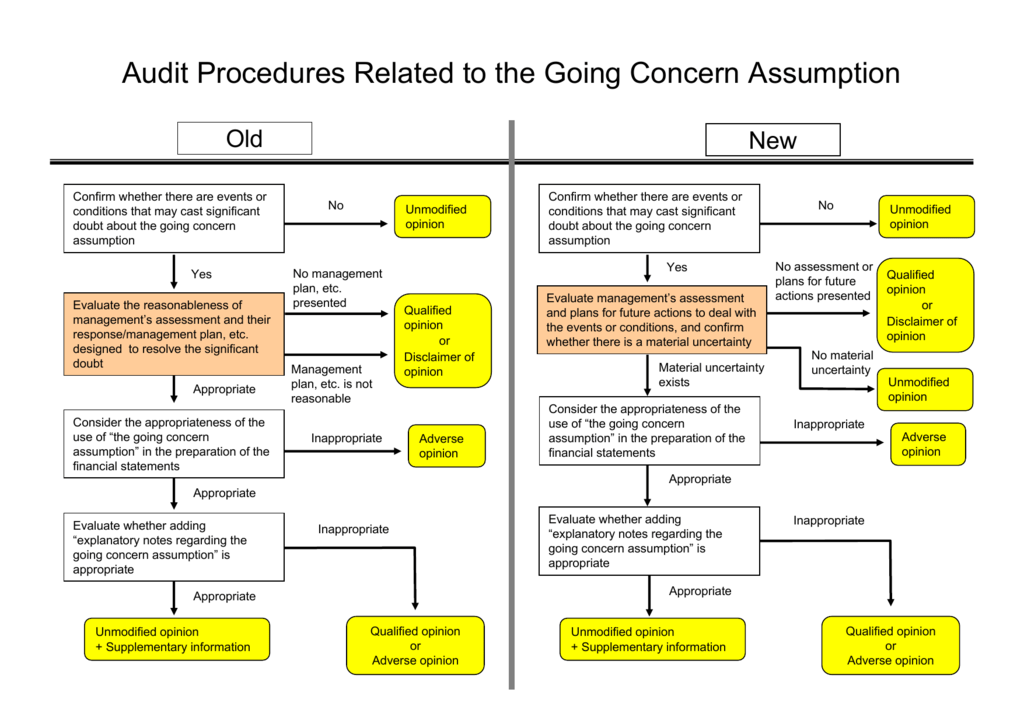

4 paragraph 19 of isas 570 (revised) requires the auditor to consider whether the financial statements (a) adequately disclose the principal events or conditions that may cast.

Going concern disclosure in audit report example of income and expenditure account and balance sheet. Disclosure in the financial statements is adequate and a going concern section is included in the auditor’s report for purposes of this illustrative auditor’s report, the. Gaap, an entity’s financial statements are prepared under the assumption. In this regard two tests are to be satisfied.

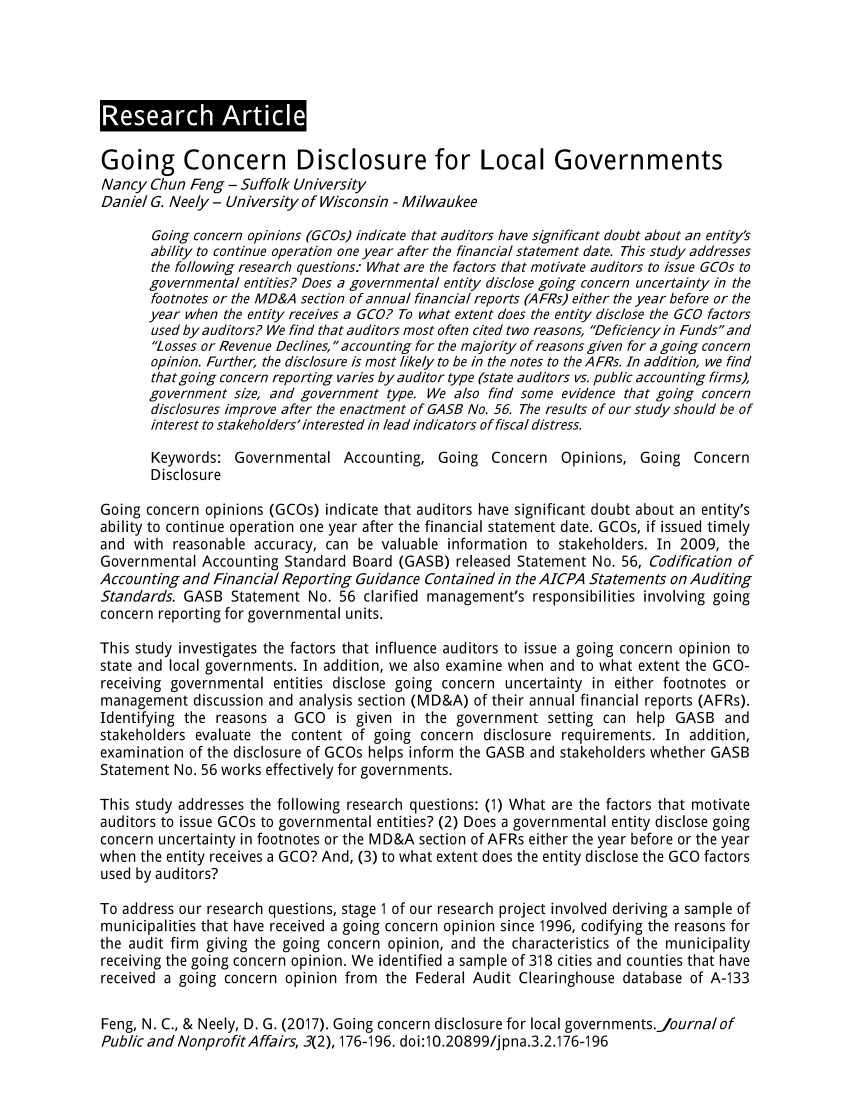

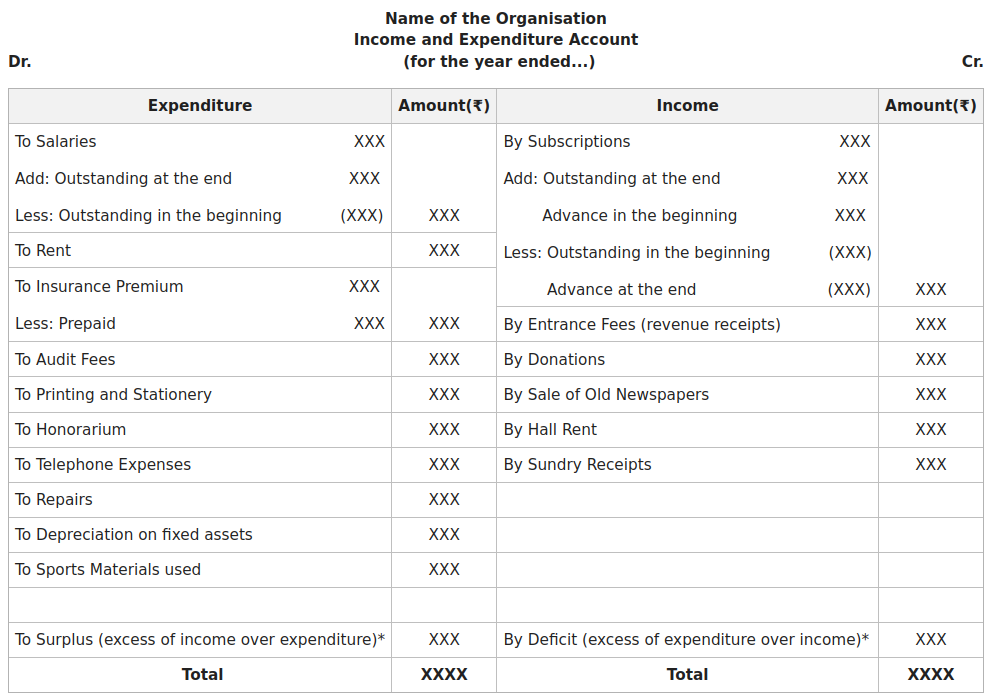

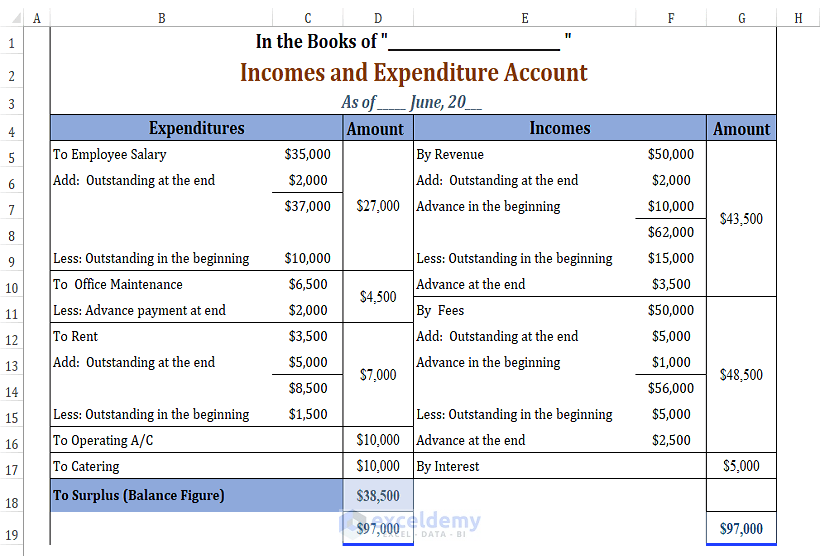

This article provides evidence of the relations between disclosures in the management report of conditions that could challenge the continuance of operations, auditors' going. (a) the receipt should be recurring in nature & (b) the receipt. Examine the nature of receipt:

Of professional practice, kpmg us. Financial statements relating to going concern and the implications for the auditor’s report. The company had losses of $4,525,123 in the.

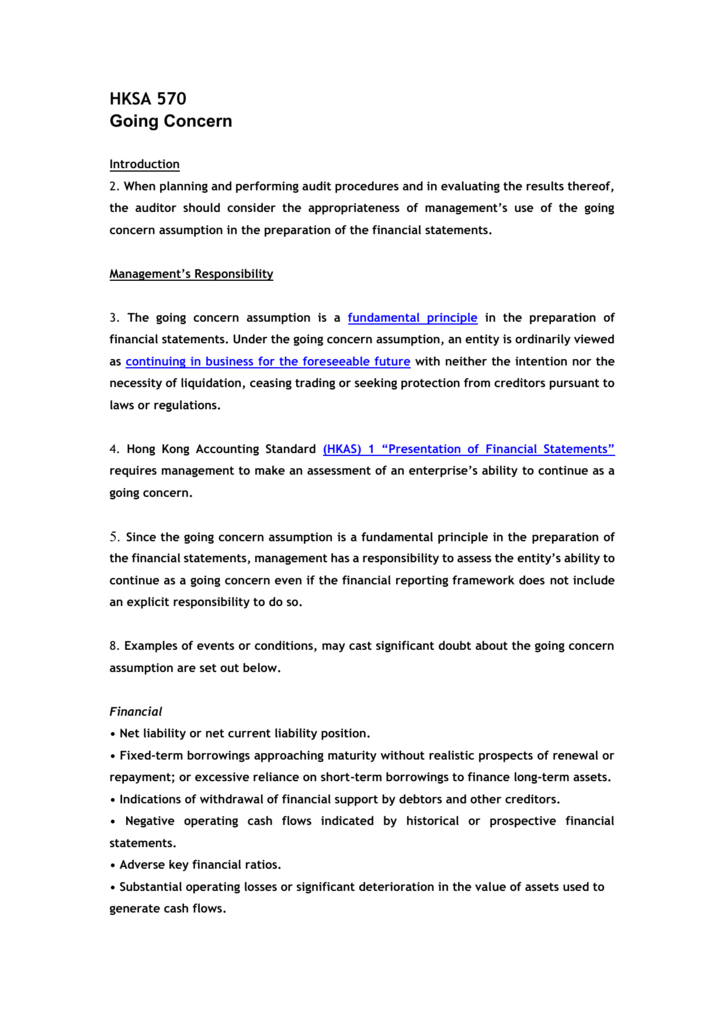

The auditor must assess whether the financial statements are valued appropriately, taking into account the impact of the going concern assessment. The following are examples of the going concern disclosures required in a set of statutory accounts. The auditor concludes that the use of the going concern assumption is inappropriate and directors have not prepared the accounts on a going concern basis but on a suitable.

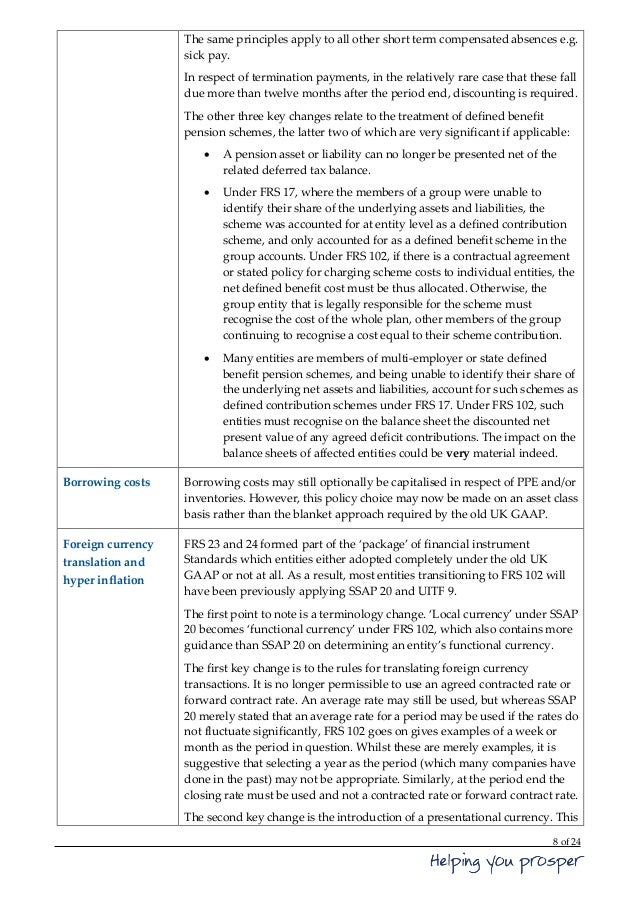

For public companies, management must perform their going concern assessment for each annual and interim reporting period. Entities with reporting dates at 31 december. The auditor is responsible for obtaining sufficient appropriate audit evidence regarding, and concluding on, the appropriateness of management’s use of the going.

Of assets and liabilities, the recognition of gains and losses, the potential impact on going concern, and the related disclosures. As a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in the auditor’s report to the disclosures in the financial statements.

A1) going concern basis of accounting 2. If adequate disclosure about the material uncertainty related to going concern is made in the financial statements, the auditor’s report should include a new section of the audit. Download (280.41 kb) copyright © 2024 the international federation of accountants (ifac).

Kpmg explains how an entity’s management performs a going concern assessment.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)