Heartwarming Tips About Treatment Of Provision For Bad Debts Daycare Profit And Loss Statement

However, in any s ubsequent years, you will need to take note of three possible outcomes:

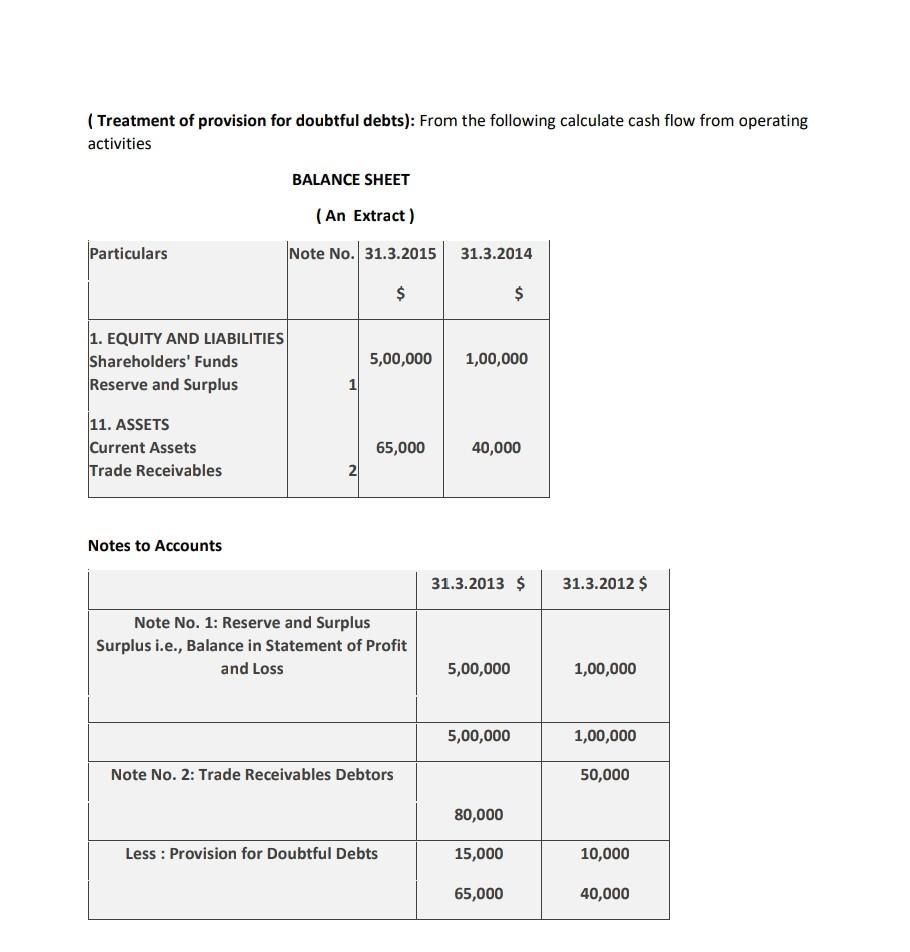

Treatment of provision for bad debts. A provision for a bad debt account holds an amount, in addition to the actual written off bad debts during a year, that will be known to be due and payable in. The process of strategically estimating bad debt that needs to be written off in the future is called bad debt provision. There are several ways to make the.

A bad debt is a receivable that a customer will not pay. The double entry would be: Provision can be made in the following ways:

(provision for bad debts created) accounting for bad debts. If however, we had calculated that the provision should. The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that.

November 08, 2023 what is a bad debt provision? The sharp deterioration took place in the last year after delinquent commercial property debt for the six big banks nearly tripled to $9.3bn. A bad debt provision is a reserve against the future recognition of certain accounts receivable as being uncollectible.

Credit bad provision £100 b/s. Debit bad debt provision expense p+l £100. In simple words, recovery of bad debt is an income and posted to profit & loss a/c as profit.

Debtors should be written off when it can be reasonably assured that the debtor will not pay the sum owed. This article sets out the accounting treatment for the impairment of trade receivables/debtors. Any company that has a policy of selling goods on credit has to deal with the problem of bad debts.

The provision for doubtful debts, which is also referred to as the provision for bad debts or the provision for losses on accounts receivable, is an estimation of the amount of. November 05, 2023 what is the provision for doubtful debts? Bad debts are the debts which are uncollectable or irrecoverable.

The provision for bad debts could refer to the balance sheet account also known as the allowance for bad debts, allowance for doubtful accounts, or allowance for. Subsection 231(1) provides that the vendor may. If provision for bad & doubtful debts is given outside the trial balance:

The provision for bad debts should include an. The provision for bad debts is now, in effect, governed by ias 39,. 1) increase in provision of doubtful debts.

January 07, 2024 what is a bad debt? The provision for doubtful debts is an estimated amount of bad debts that are likely to arise from the accounts receivable that have been given but not yet collected from the. Let’s have a look at the accounting treatment for bad debts.

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)