Breathtaking Tips About Consolidation Elimination Of Investment In Subsidiary Total Sa Financial Statements

How do you eliminate investment in subsidiary in consolidation?

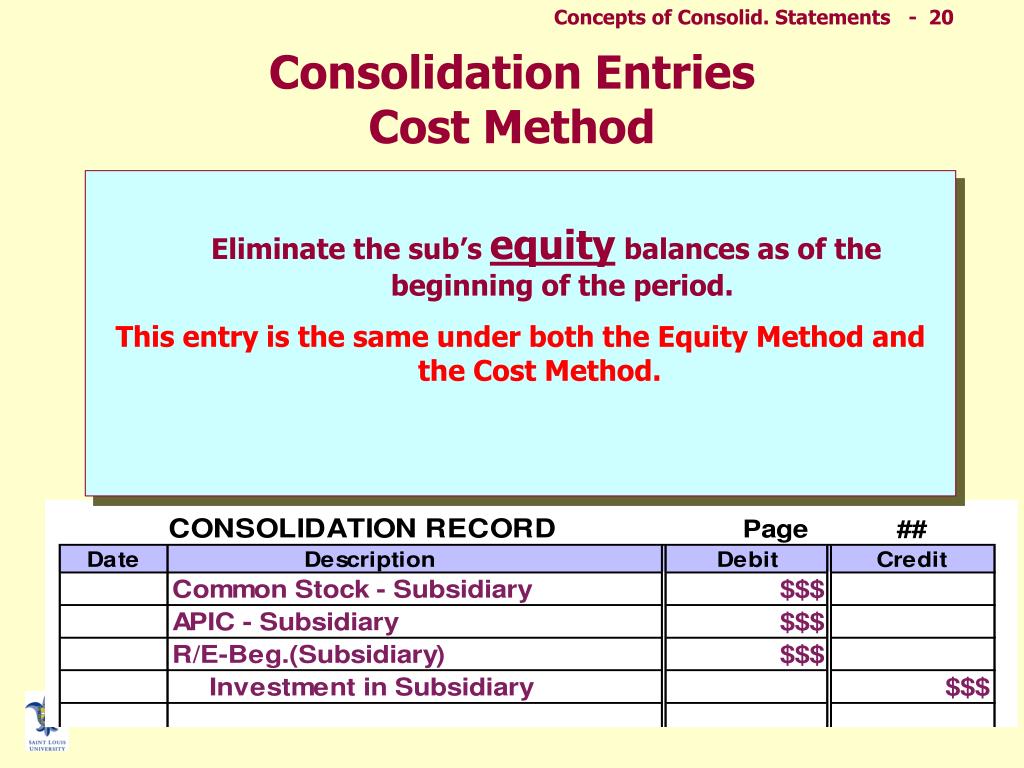

Consolidation elimination of investment in subsidiary. In the consolidated financial statements, company a reflects 100% of the assets and liabilities of subsidiary b and a. Transactions between companies within the consolidated group, such as sales from one subsidiary to. If the parent does not own.

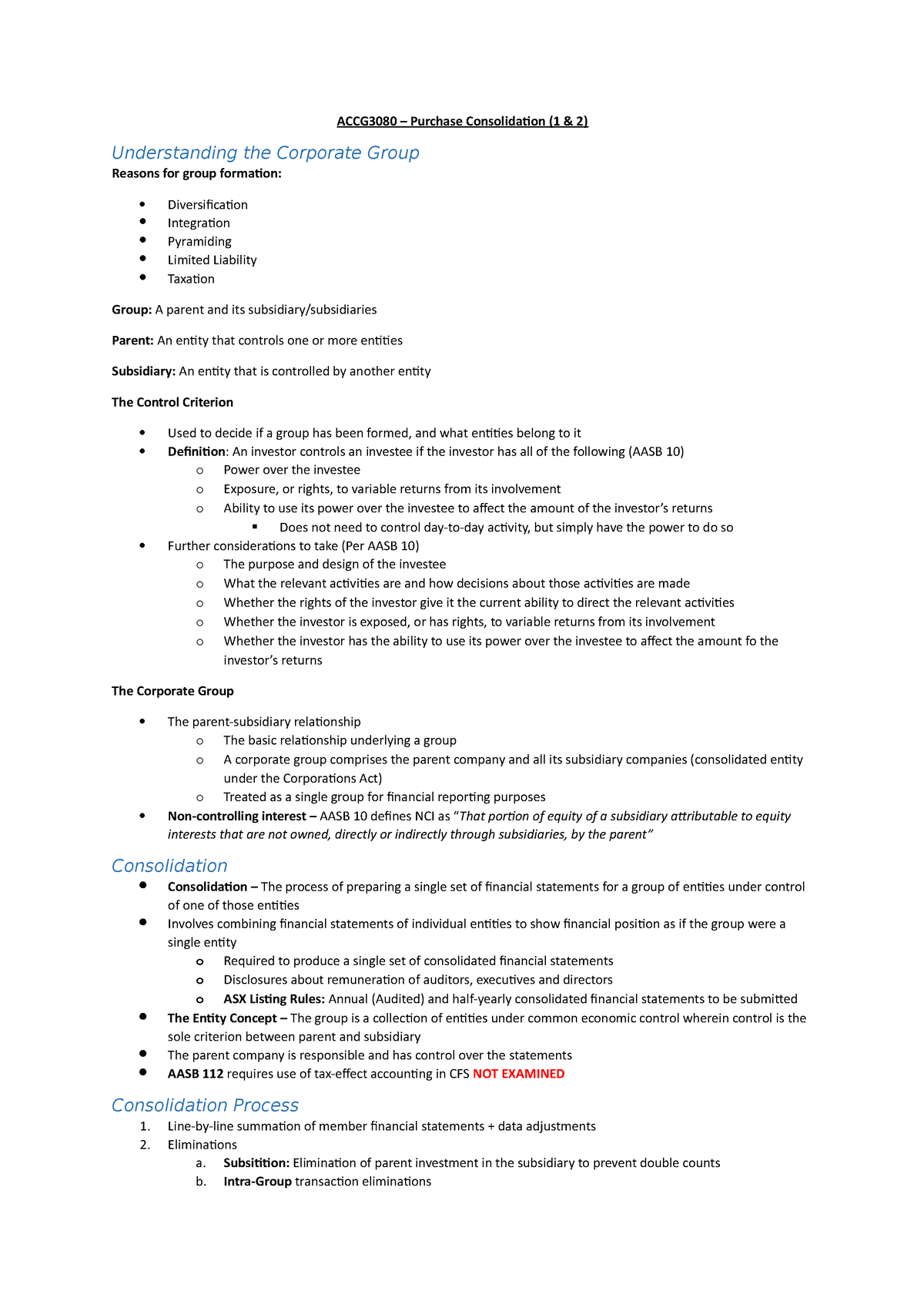

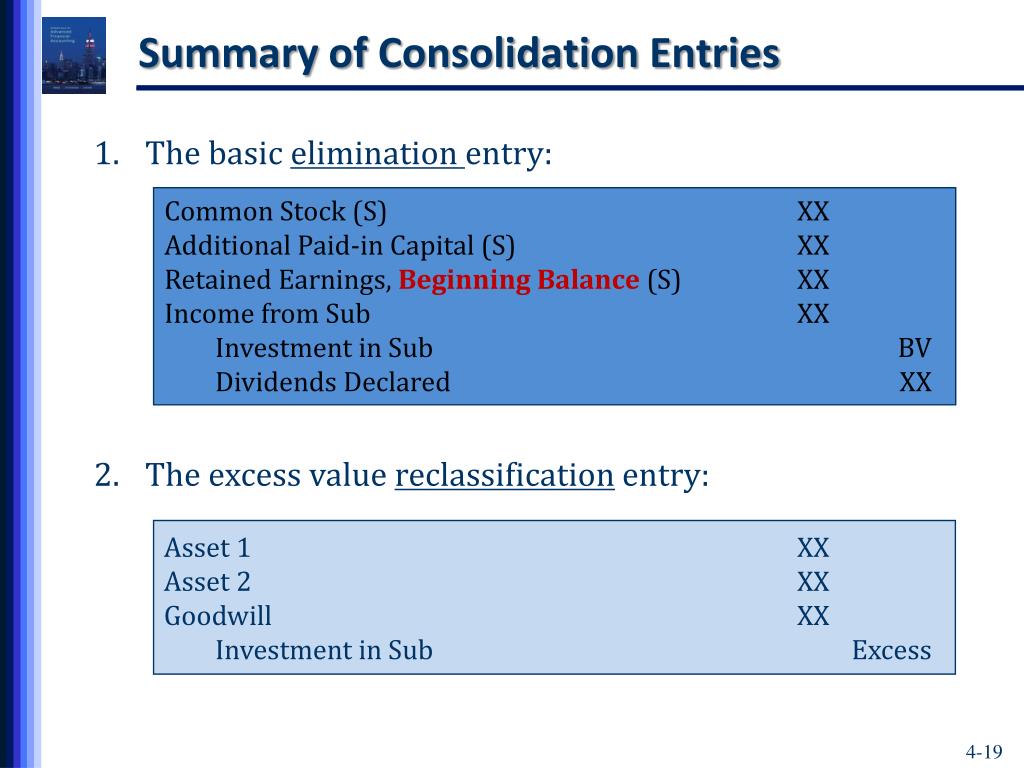

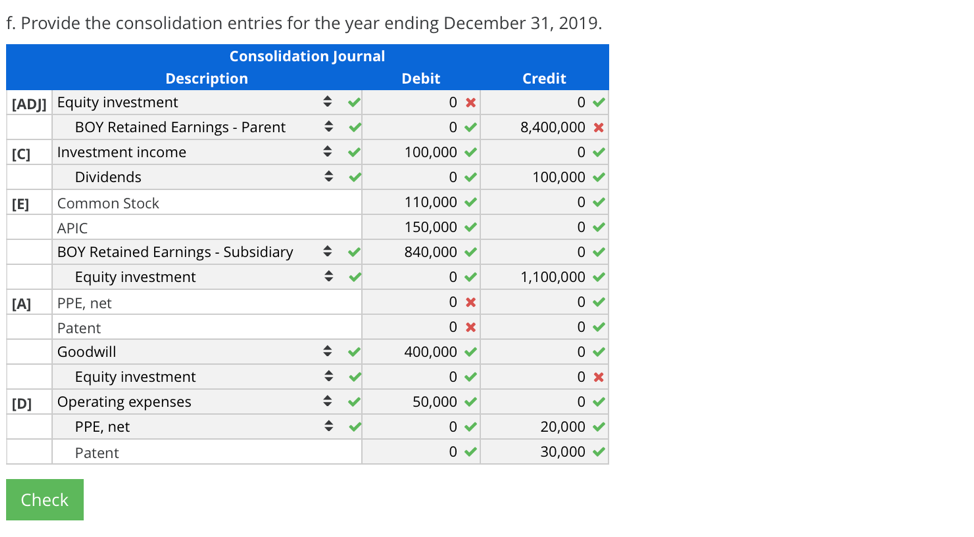

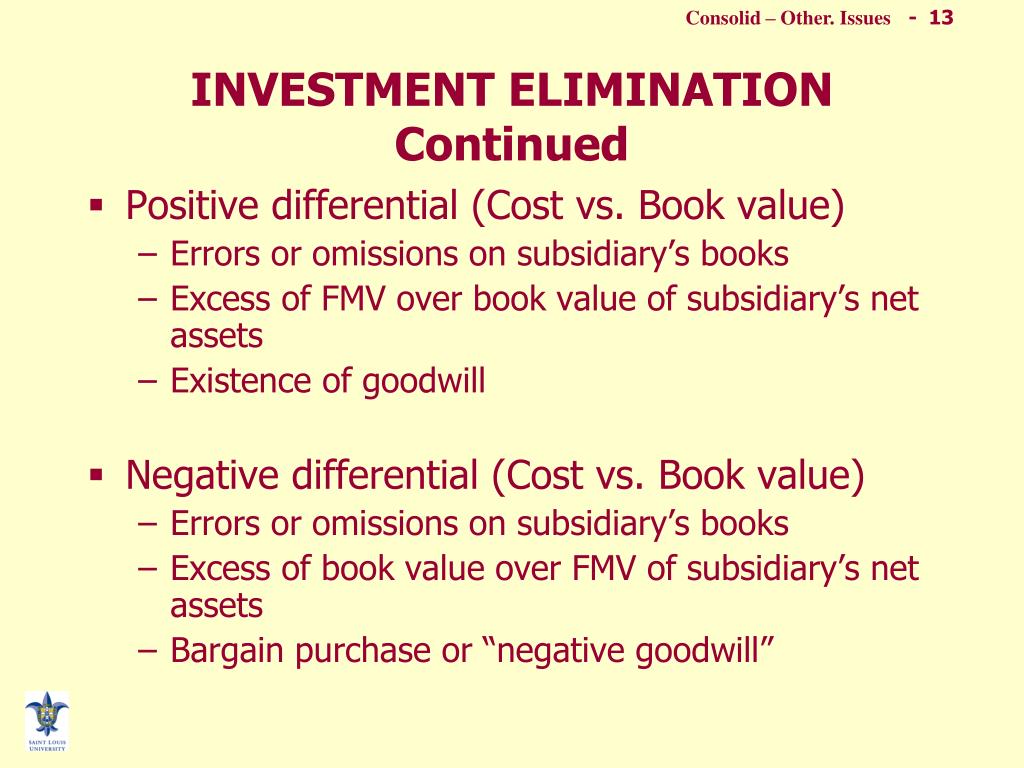

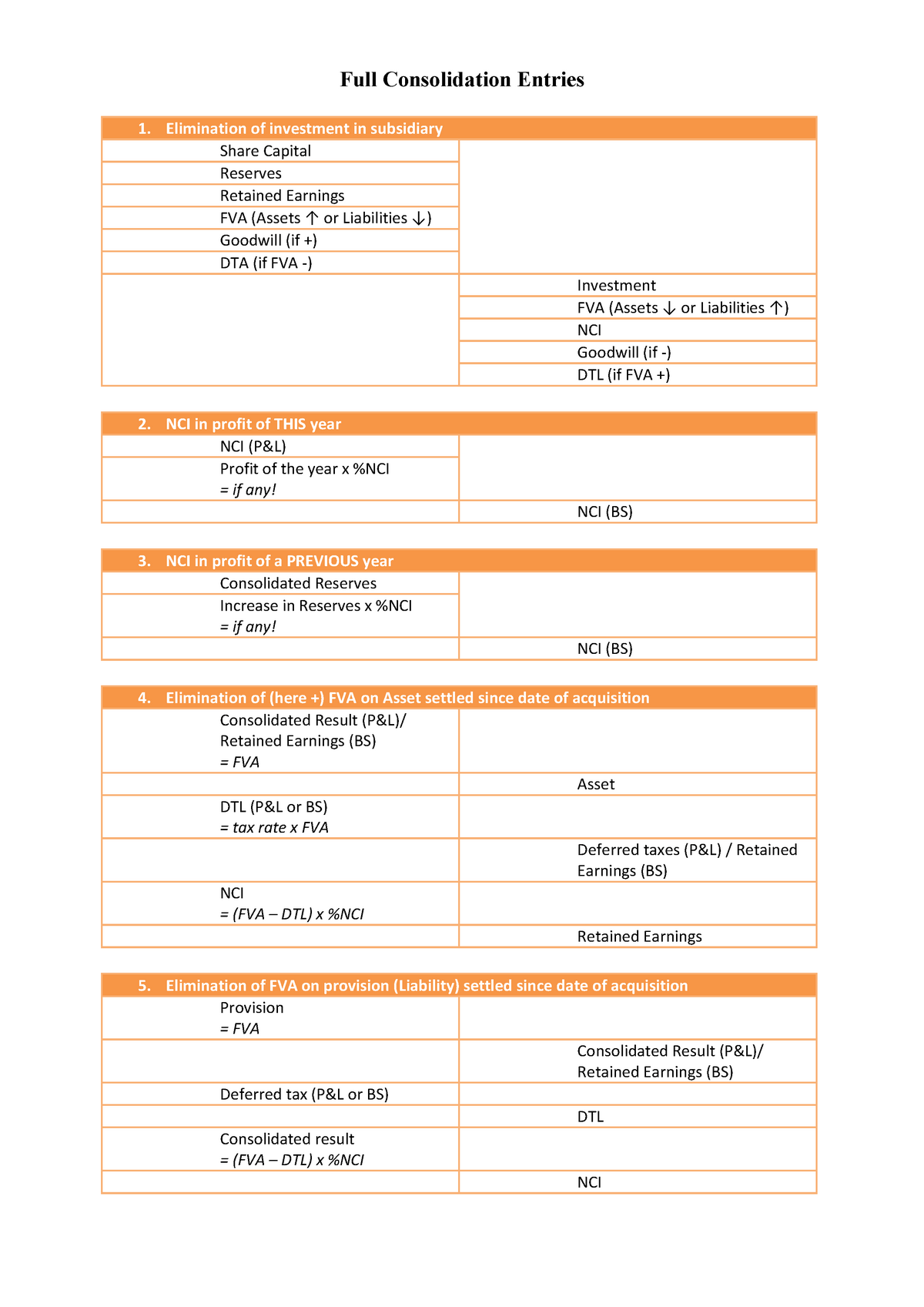

Assets and liabilities when preparing a consolidated statement of financial position, the assets and. Exemption from presenting consolidated financial statements continues to apply to subsidiaries of an investment entity that are themselves parent entities. Elimination of investment account:

The parent income statement will also include 100% of the subsidiary’s revenue and expenses. What do you eliminate in. Consolidation of a wholly owned subsidiary 31 appendix 2:

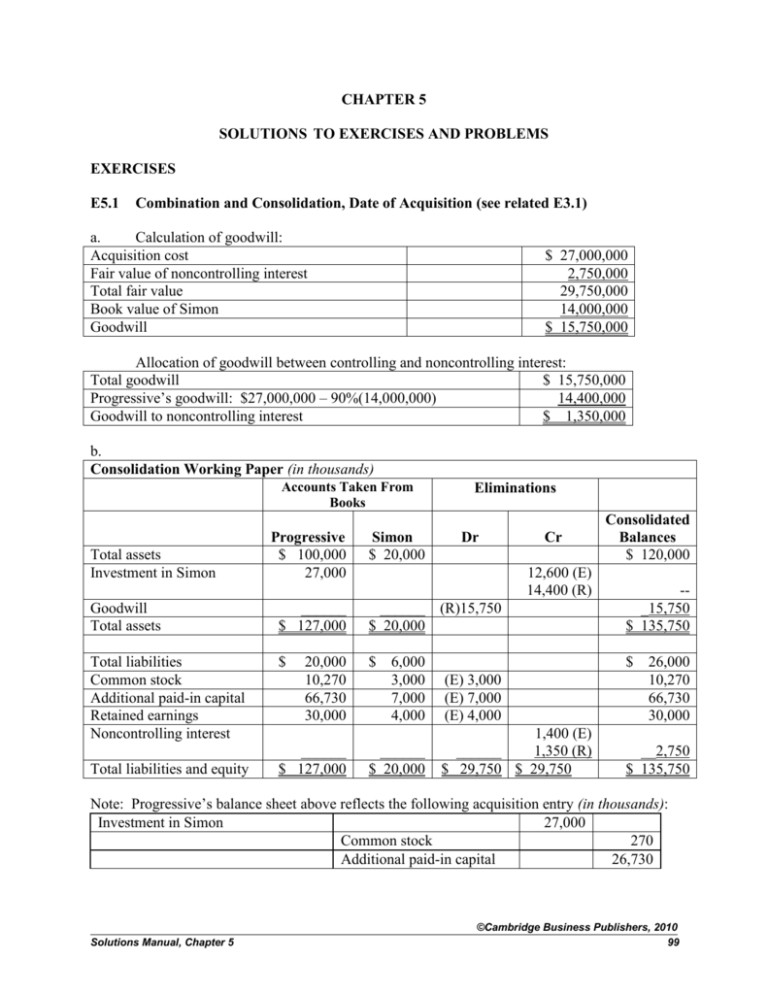

At 12/31/20x1, subsidiary b has net assets of $100. Eliminate an investment in a subsidiary (including goodwill) castaway's consolidation module makes it easy to consolidate multiple forecasts into a single. How to elim investment in sub at consolidation.

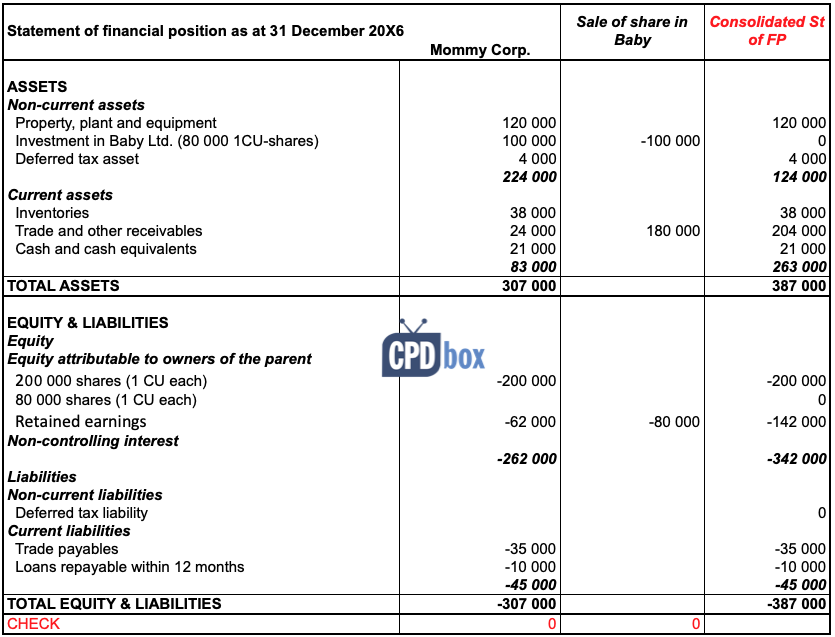

The accounting depends on whether control is retained or lost: The parent company will report the. The equity shares of subsidiary company which are acquired by the holding company is shown in the asset side of the balance sheet of.

Subsidiary consolidation involves reporting the subsidiary’s balances in a combined statement along with the parent company’s balances. The exemption from consolidation only applies to the investment entity itself. Eliminate intragroup transactions and balances:

The consolidation method records 100% of the subsidiary’s assets and liabilities on the parent company’s balance sheet, even though the parent may not own 100% of the subsidiary’s equity. Below is the consolidated balance sheet for premier and its subsidiary. What is the consolidation method of accounting for subsidiary?

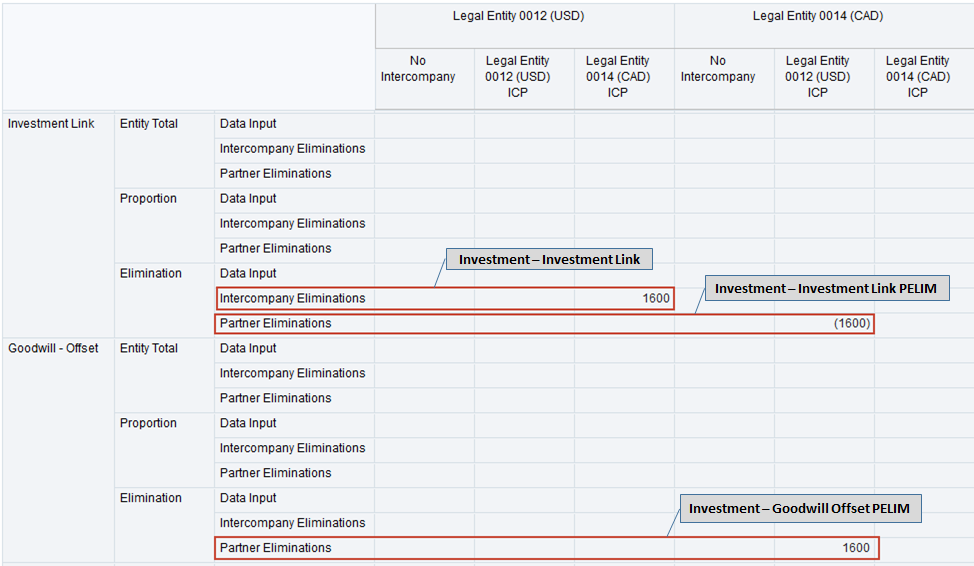

If the portion of shares to eliminate corresponds to the ownership percentage, you can run the standard process that is provided in financial consolidation. The steps in consolidation are as follows (pfrs 10, b86) 1.

Combine like items of assets, liabilities, equity, income, expenses and cash flows of the parent with those of its. Ias 27 defines consolidated financial statements as ‘the financial statements of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent and. A subsidiary (aka a joint company structure) is owned and/or controlled, either fully or partially (at least 50%), by another company (called the parent company).

Partial disposal of an investment in a subsidiary. Partial disposal of an investment in a subsidiary while control. How do you account for disposal of investment in subsidiary?