Impressive Tips About Income Statement Balance Sheet And Ledgers Financial Statements

Although a balance sheet and income statement may be produced using more detail by modern accounting software like wafeq, this is essentially all that is available.

Income statement balance sheet and. Together, they’re a financial force to reckon with. The balance sheet and the income statement provide distinct yet interconnected perspectives on a company’s financial standing. A balance sheet lists assets and liabilities of the organization as of a specific moment in time, i.e.

Colgate reports it balance sheet. Knowing when to use each is helpful in. The income statement was first since net income (or loss) is a required figure in preparing the balance sheet.

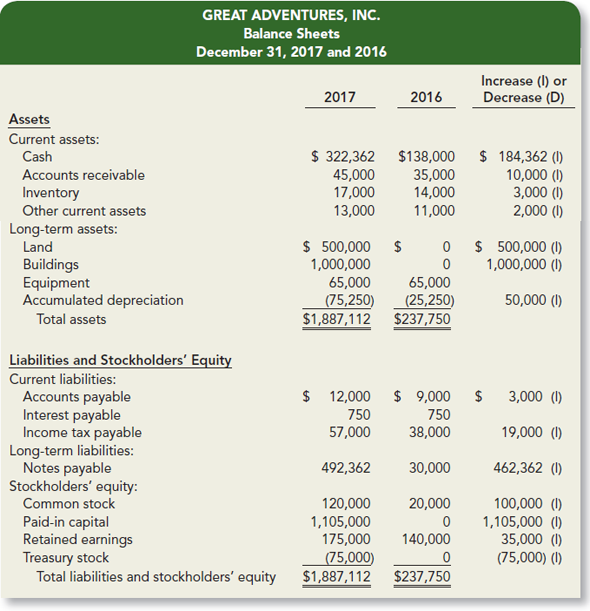

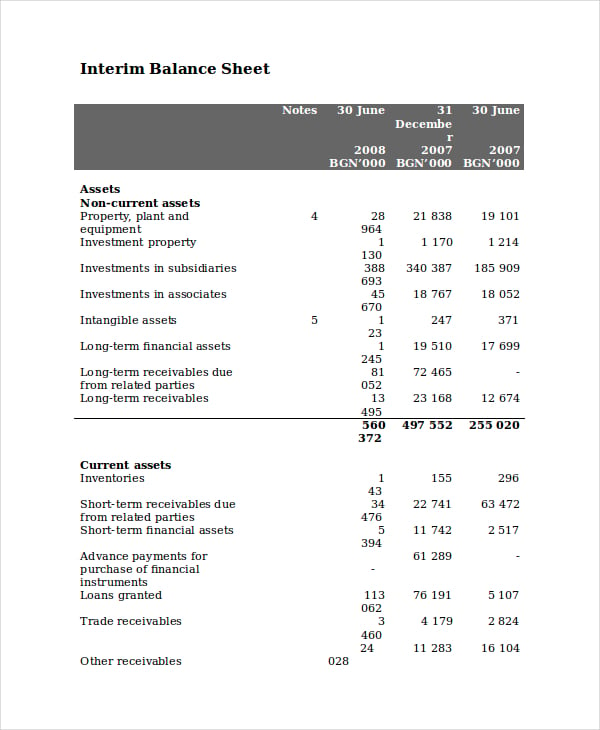

A balance sheet, on the other hand, records assets, liabilities, and equity. The balance sheet presents a snapshot of a company’s assets, liabilities, and equity at a specific point in time, highlighting its financial position. Updated april 24, 2021 reviewed by margaret james fact checked by michael logan companies produce three major financial statements that reflect their business activities and profitability for.

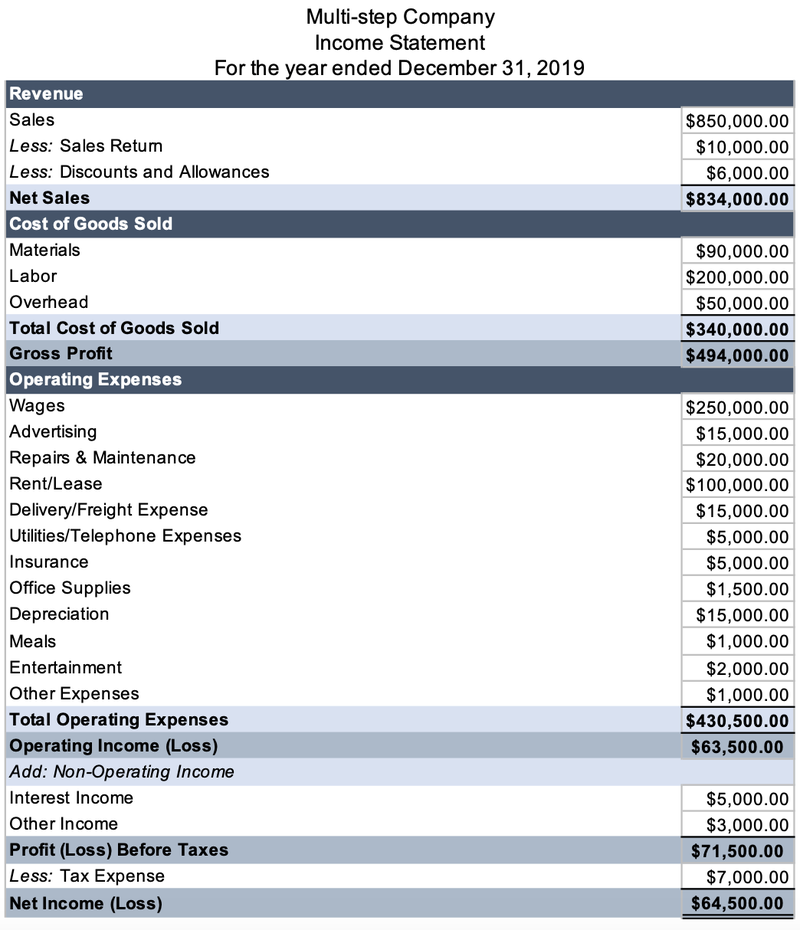

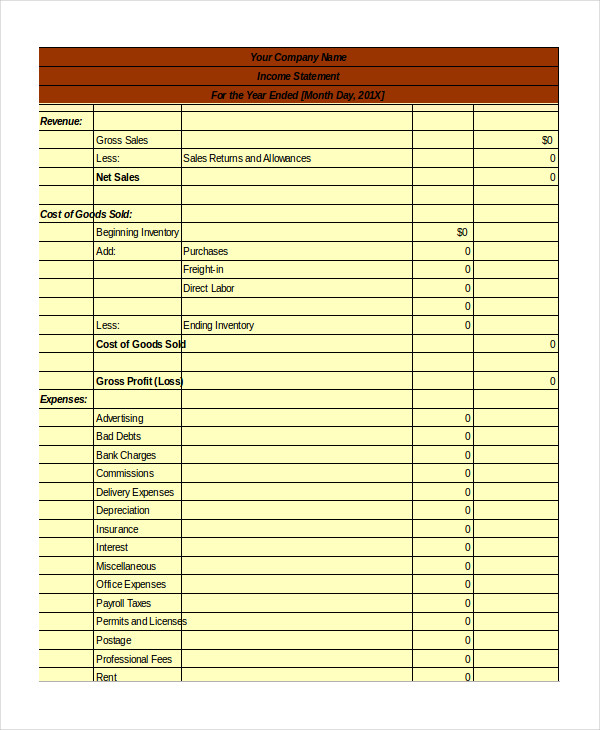

The income statement shows you how profitable your business is over a given time period. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time. Finance and capital markets > unit 5 lesson 2:

Every time a company records a sale or an expense for bookkeeping purposes, both the balance sheet and the income statement are affected by the transaction. An income statement is one of the three major financial statements, along with the balance sheet and the cash flow statement, that report a company’s financial performance over a specific. Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable education (save) repayment.

(1) the income statement, (2) the balance sheet, and (3) the cash flow statement. Balance sheets and income statements are important tools to help you understand the finances and prospects of your business, but the two differ in key ways. The balance sheet and income statement are both part of a suite of financial statements that tell the story of a business’s history.

As fixed assets age, they begin to lose their value. Three core financial statements doing the example with accounts payable growing fair value accounting economics > finance and capital markets > accounting and financial statements > three core financial statements The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

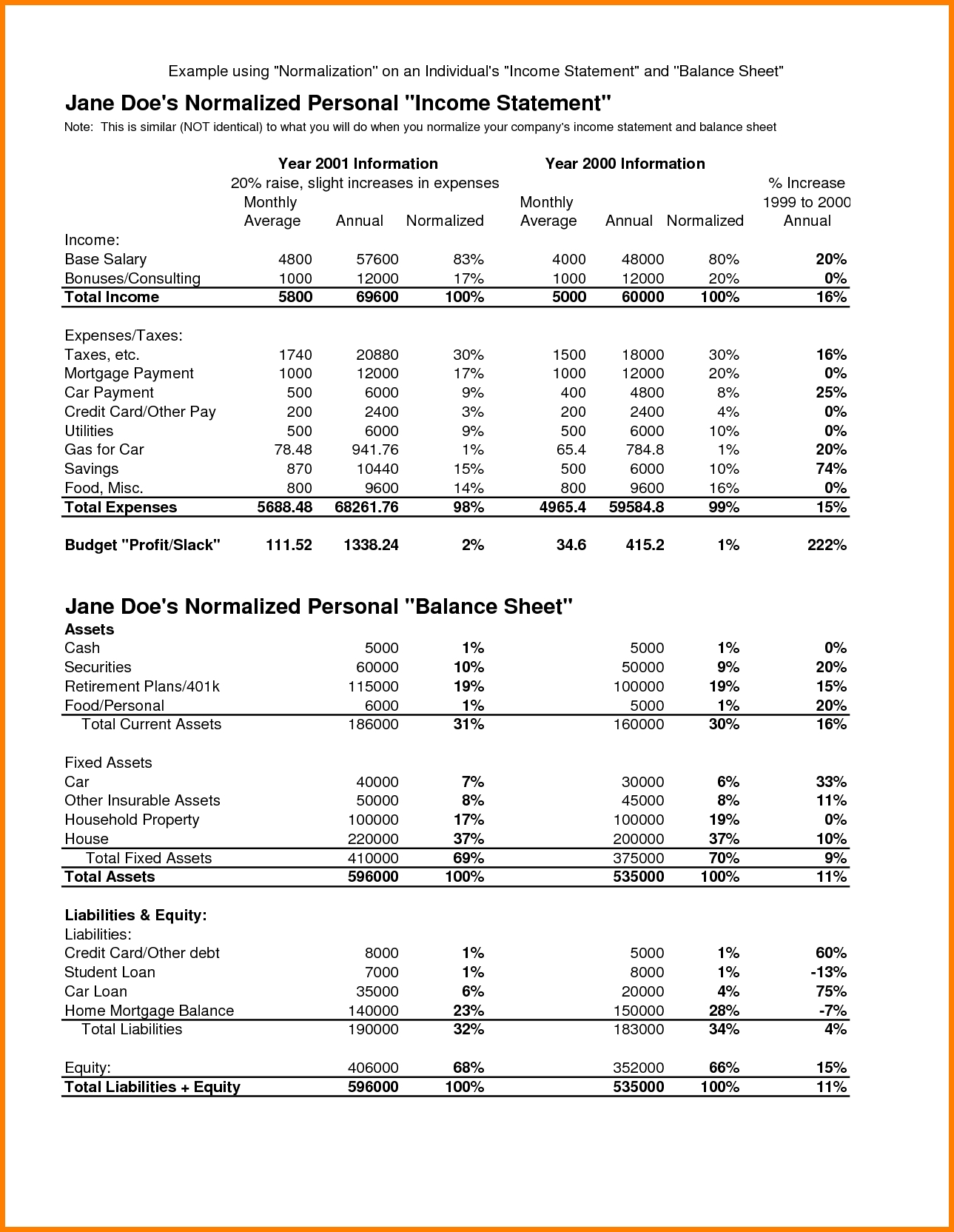

The analysis of the balance sheet and the income statement chapter 8 reformulated the statement of owners’ equity. Reports february 20, 2024 by examining a sample balance sheet and income statement, small businesses can better understand the relationship between the two reports. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

An income statement tallies income and expenses; The income statement vs. Apple’s income statement and balance sheet visit the apple, inc.

In this article, you will learn all the differences that exist between the balance sheet and income statement, including what makes them so important. The three financial statements are: The income statement is prepared for some time.