Sensational Tips About Statement Of Cash Flows Accounts Payable Walmart Balance Sheet 2019

Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating.

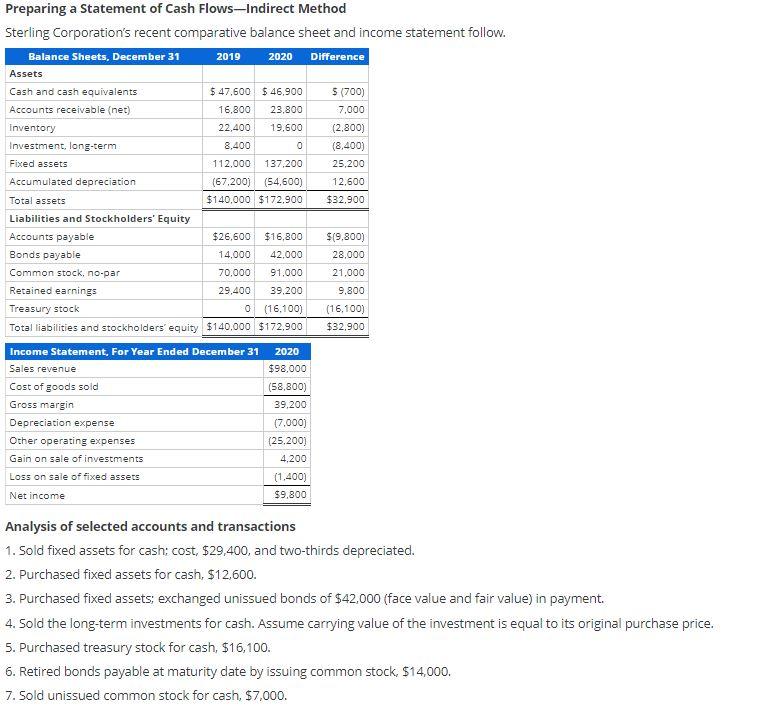

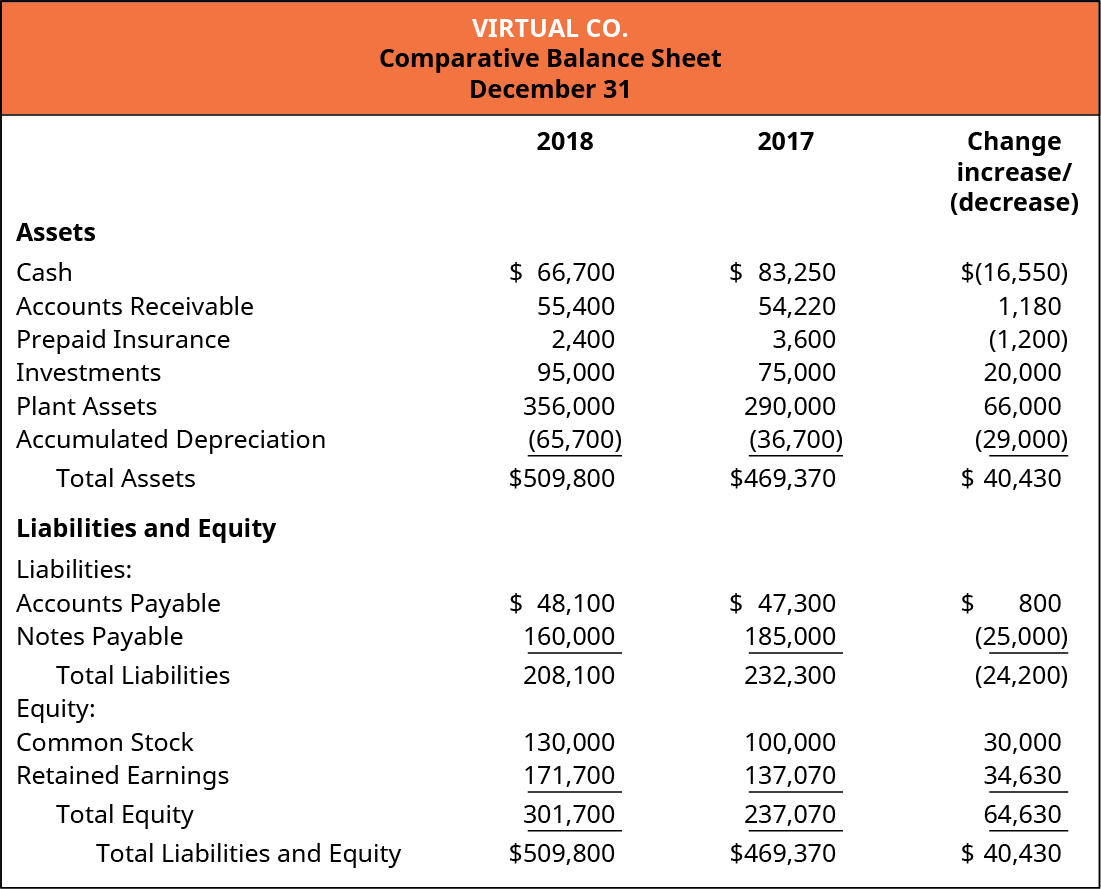

Statement of cash flows accounts payable. Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows: However, if more recent information is available, such as the previous month's accounts payable information, then use it instead. Accounts payable is also recorded in the cash flow statement since it involves transferring money from the company in the near future to the vendors' bank accounts.

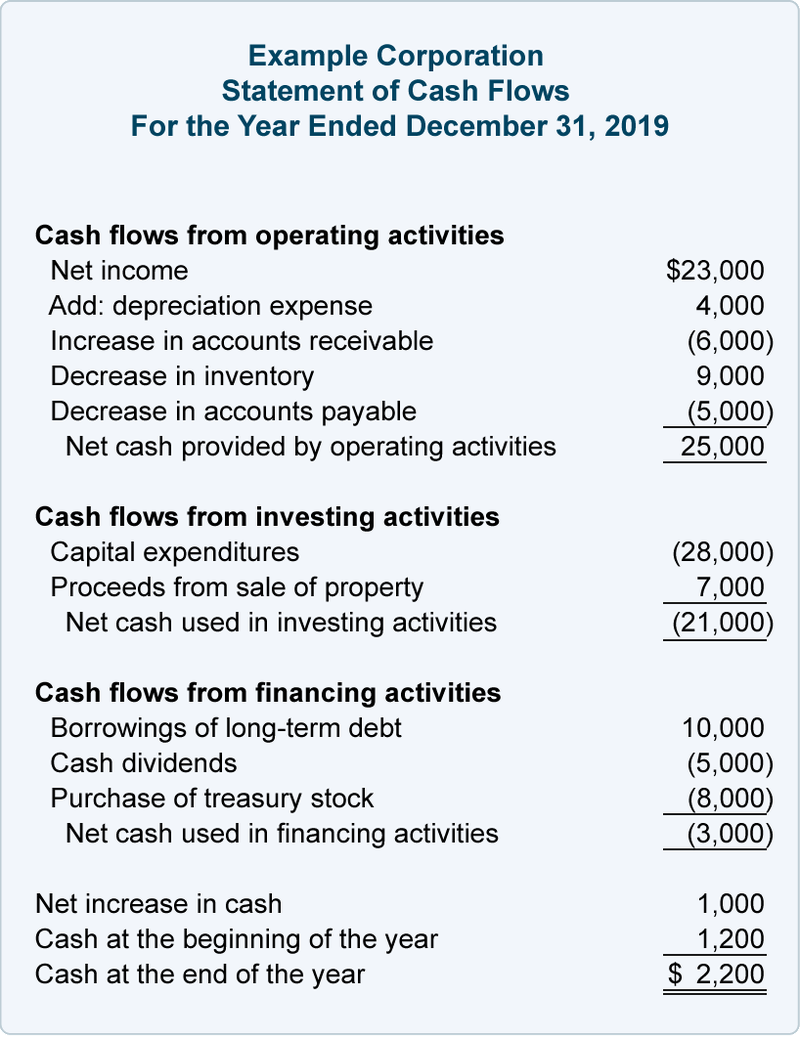

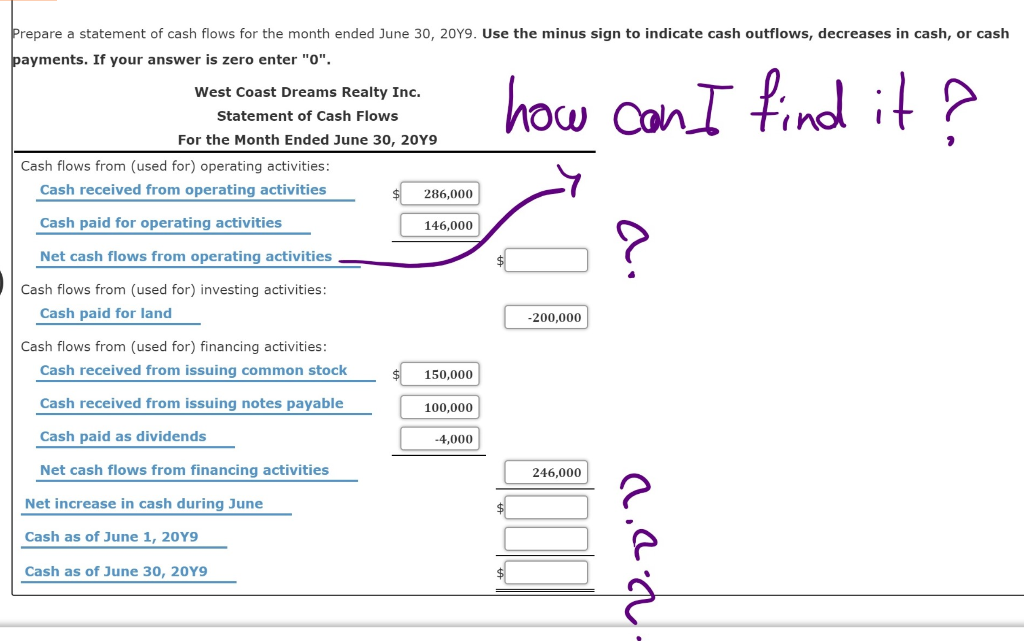

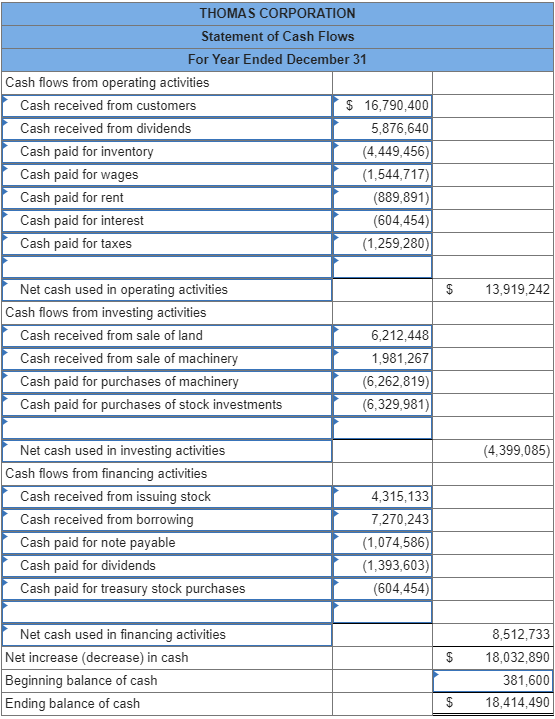

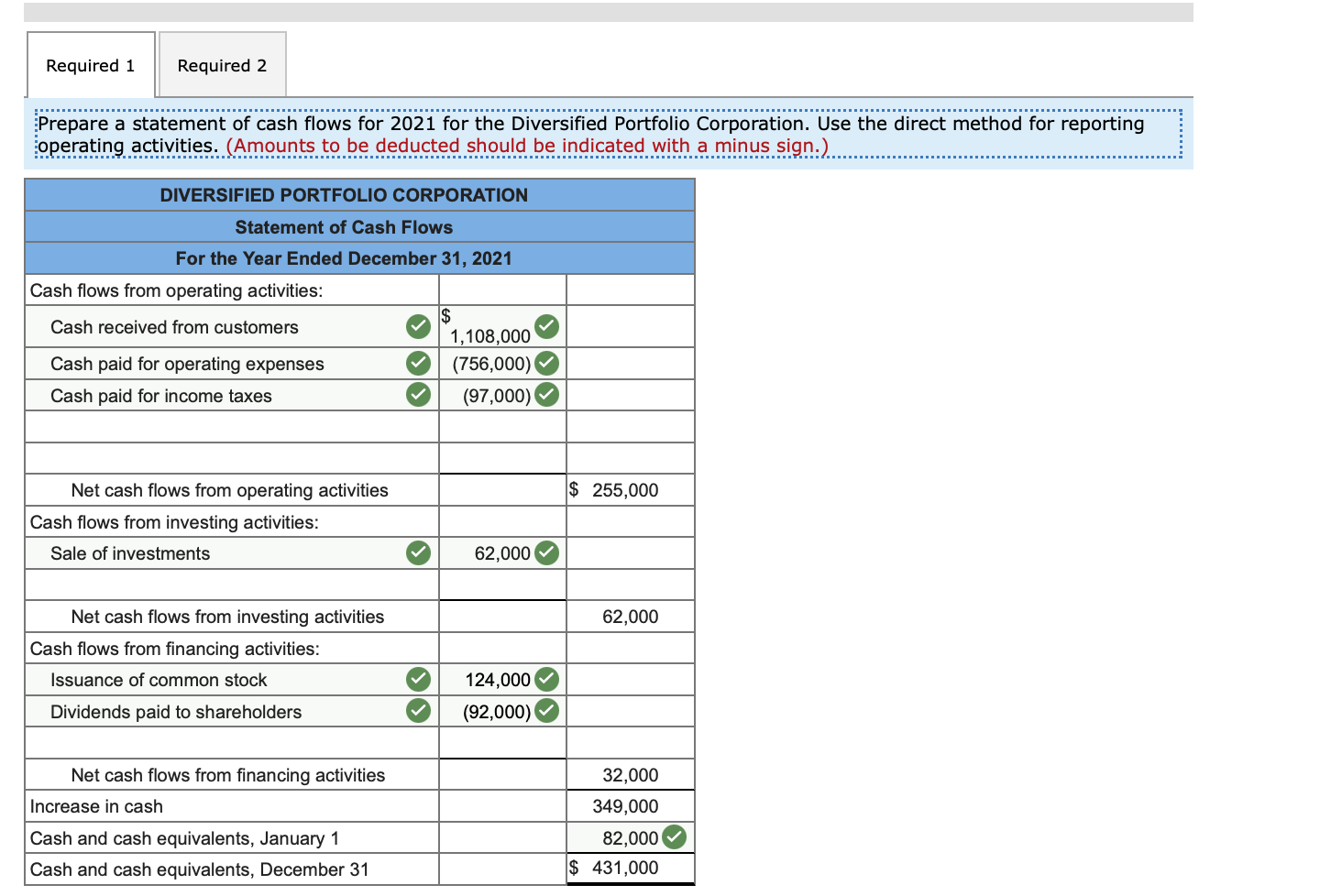

The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business. To provide clear information about what areas of the business generated and used cash, the statement of cash flows is broken down into three key categories: It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business.

The account is used for recording the amount of money owed by the company’s suppliers to the company. What is a cash flow statement? Begin with net income from the income statement.

Therefore, when a company does not pay its creditors and suppliers, it is keeping cash. Example of direct cash flows: Treatment of account payable in the statement of cash flow:

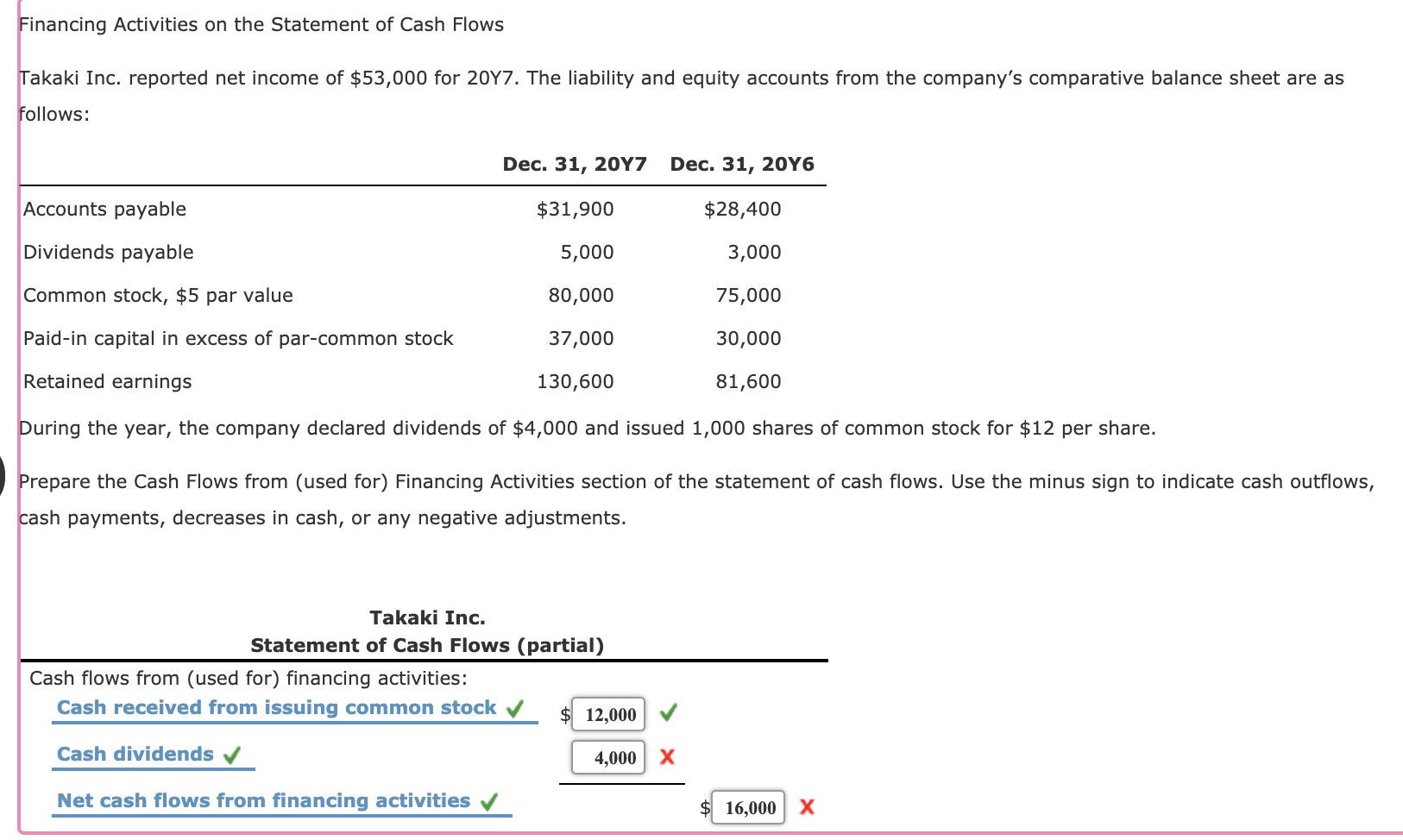

In normal routine, the account is considered as the current liability of the company as it. The preferred shares and contributed surplus accounts had no changes to report. A cash flow statement summarizes a company's cash inflows and outflows.

Accounts payable accounts payable increase means that our cash outflow is less than our expense amount, so we need to add back. Always pay your bills on time, but do not pay them before they are actually due. Increase in accounts payable:

The cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a period. The statement of cash flows is prepared by following these steps: Why does an increase in accounts payable appear as an addition on the statement of cash flows?

Purchase of property, plant, and equipment (580) proceeds from sale of equipment: Often used interchangeably with the term, “statement of cash flows,” the cash flow statement tracks the real inflows and outflows of cash from operating, investing and financing activities. The basic rule is as follows:

Thus, an increase in the accounts payable will increase the cash flow. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. The scf reports the cash inflows and cash outflows that occurred during the same time interval as the income statement.

The cfs measures how well a. A cash flow statement tells you how much cash is entering and leaving your business in a given period. The starting cash balance is necessary when leveraging the.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)