Underrated Ideas Of Info About Total Liabilities To Equity Ifrs Statement Of Profit And Loss

It can also be referred to as a statement of net worth.

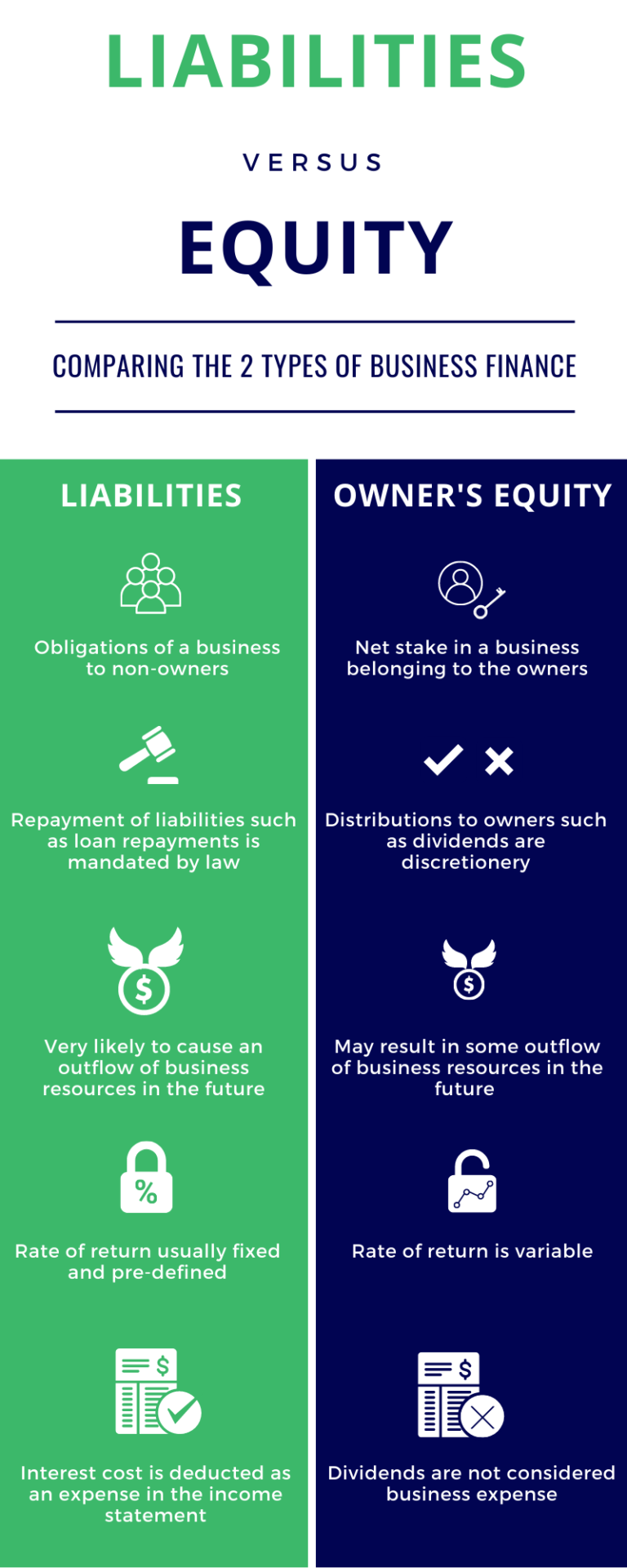

Total liabilities to equity. D/e ratio is an important metric in corporate finance. Equity, also known as owner’s equity, is the difference between the total assets and total liabilities of a business. The optimal d/e ratio varies by industry, but it.

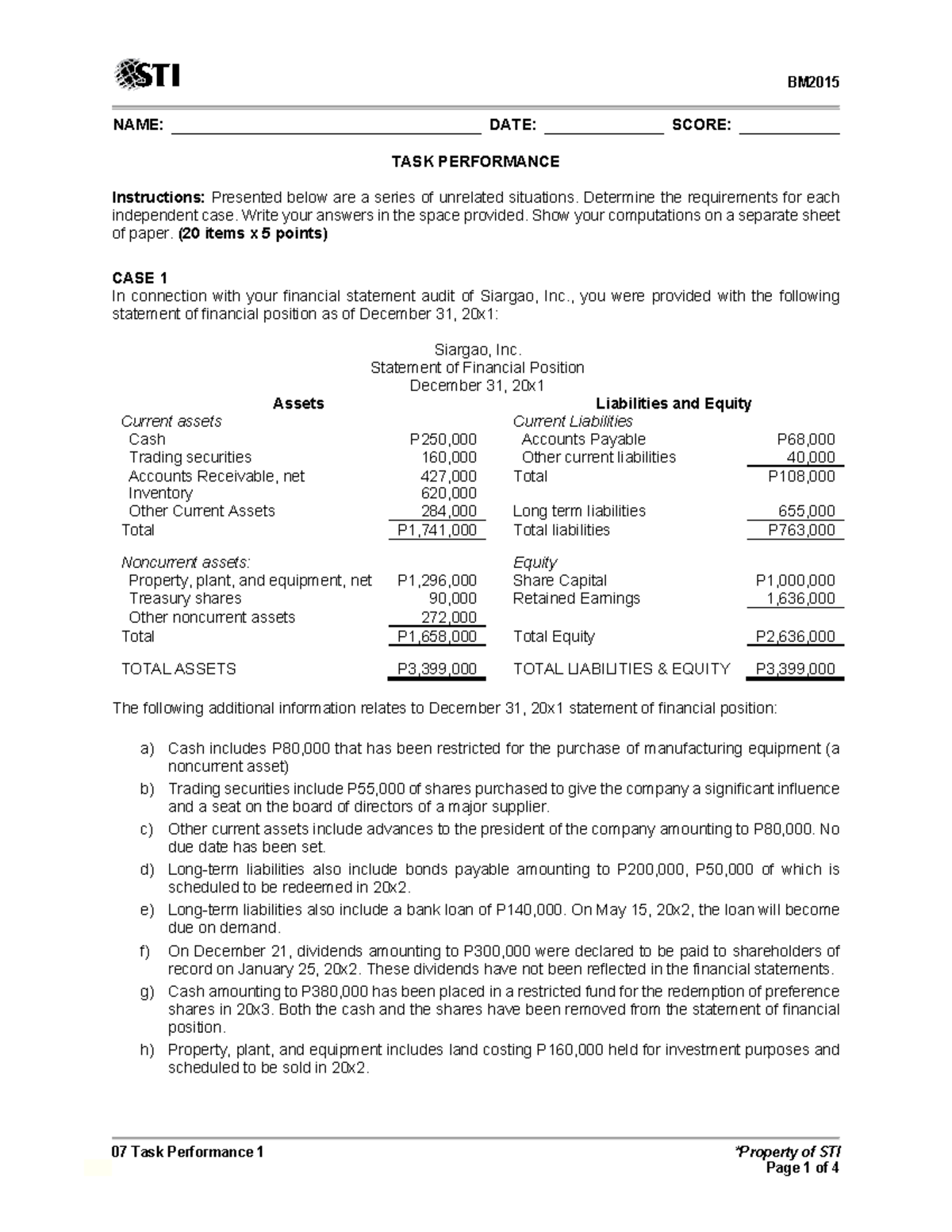

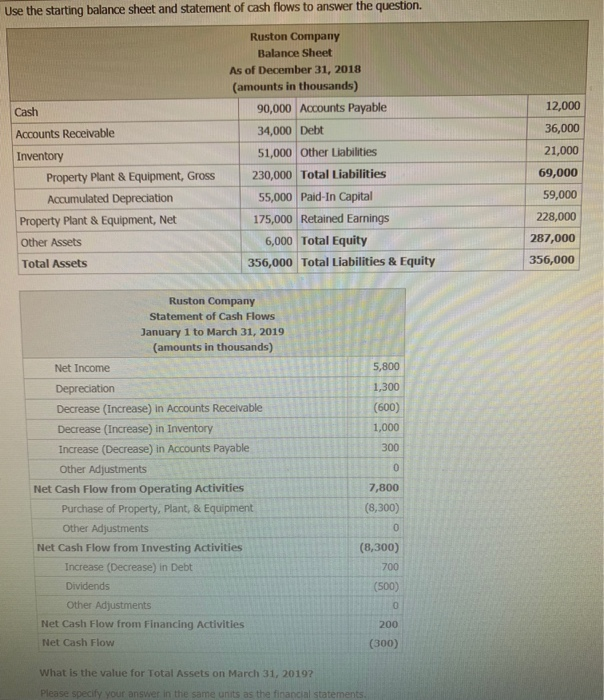

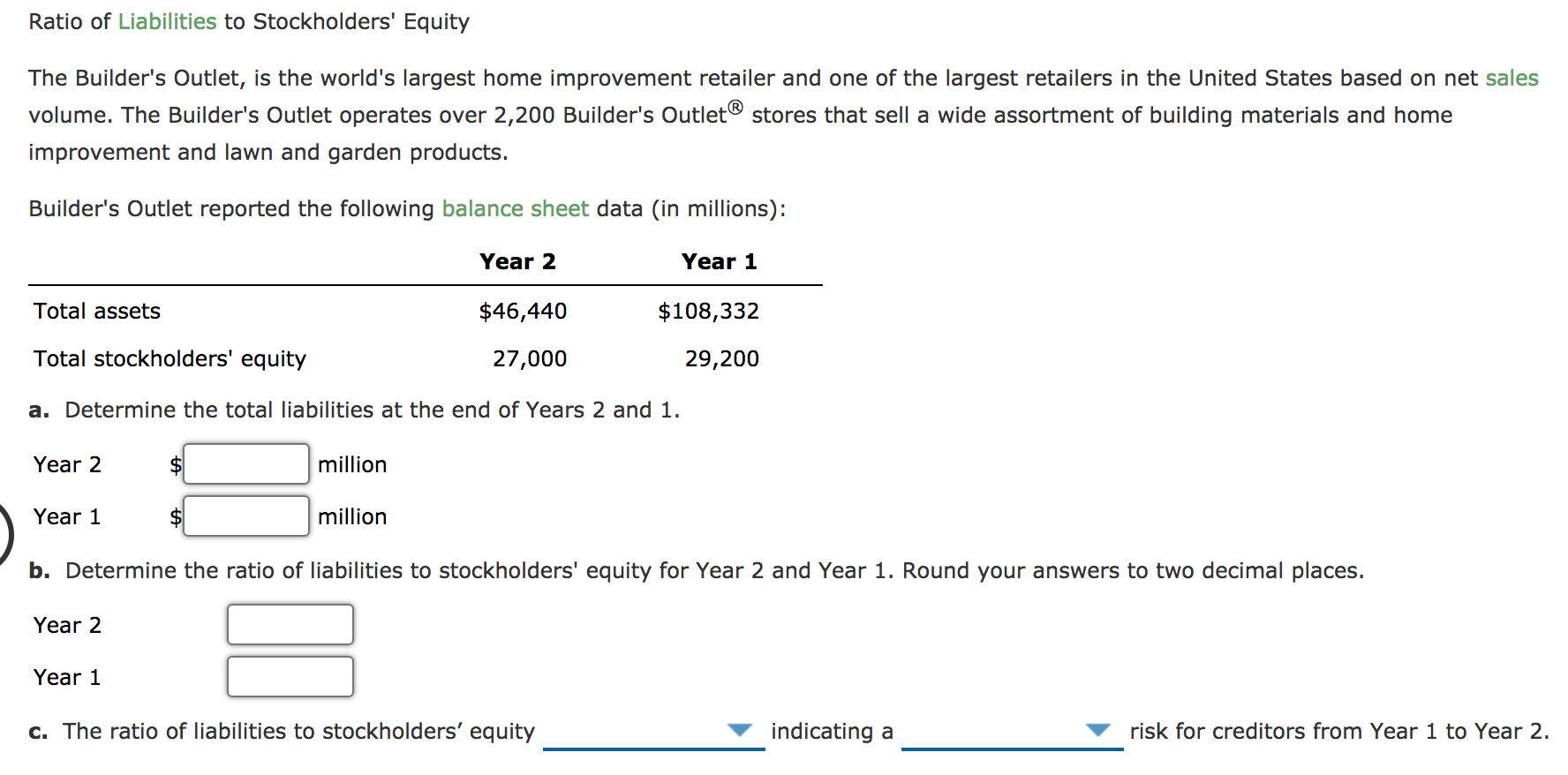

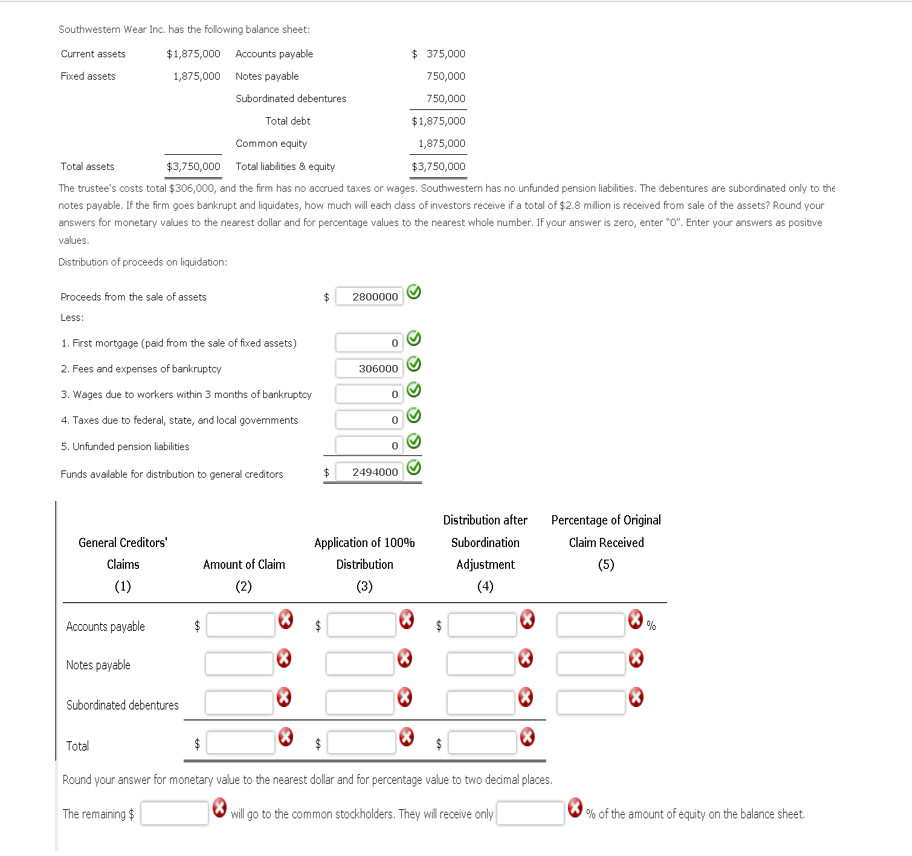

Return on equity 11.05 percent; Locate the total shareholder's equity and add the number to the total liabilities. To determine the debt to equity ratio for company c, we have to calculate the total liabilities and total equity, and then divide the two.

The relationship between d/e and. If a company's total liabilities are $ 10,000,000 and its shareholders' equity is $ 8,000,000,. Debt to equity ratio = total liabilities / shareholders' equity example:

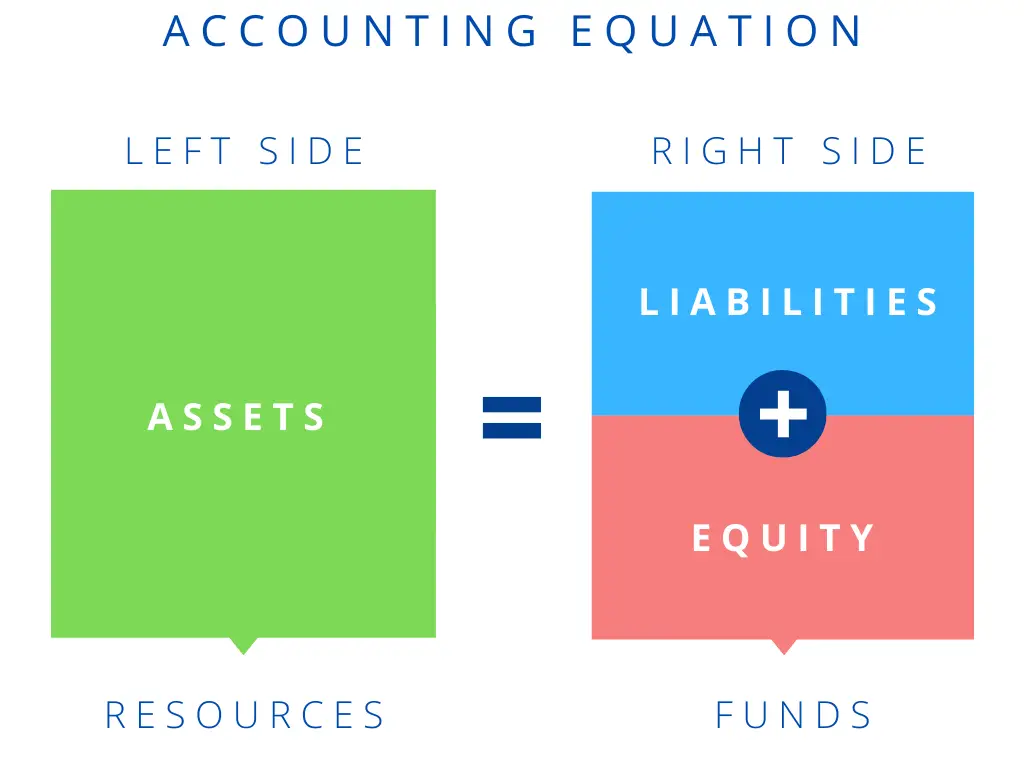

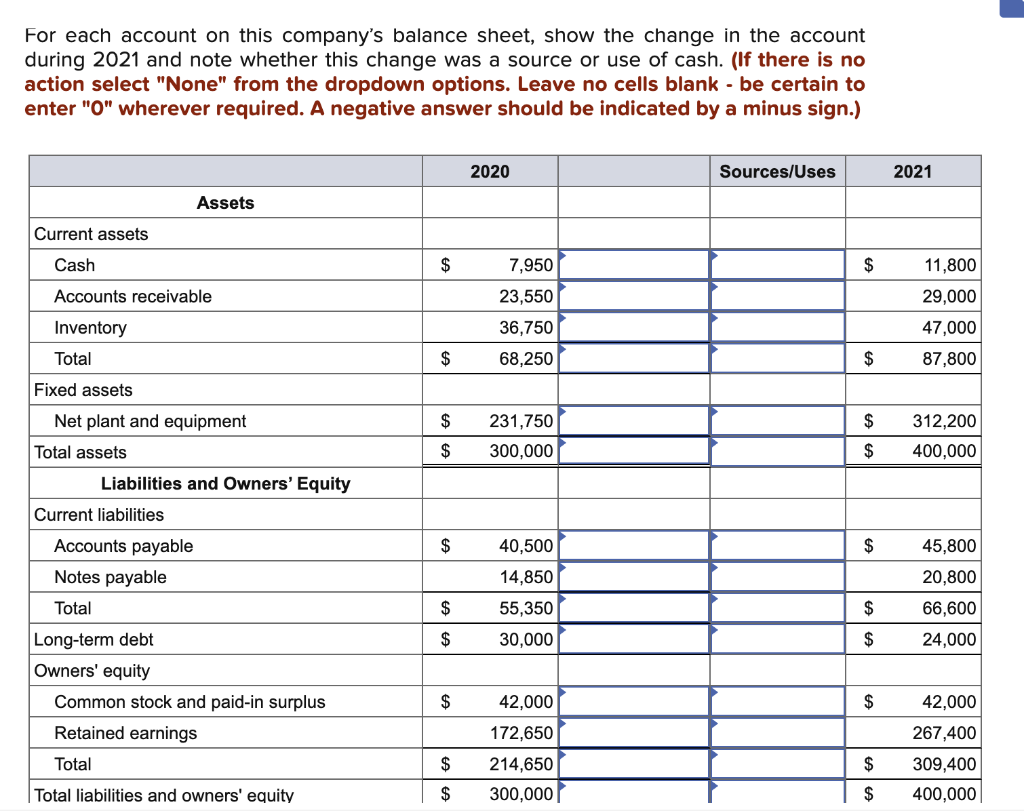

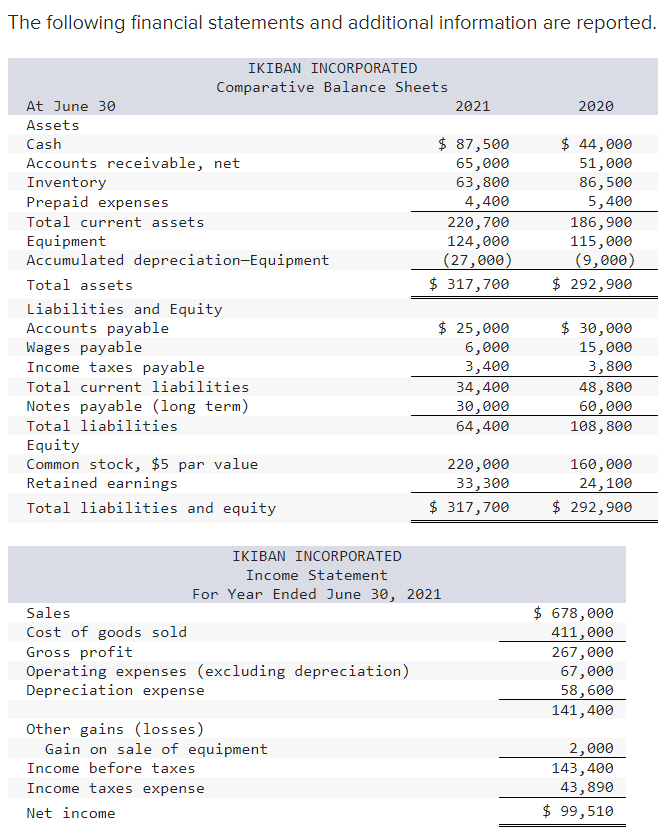

Assets = liabilities + equity accountants call this. Assets can include cash, property, investments,. Total all liabilities, which should be a separate listing on the balance sheet.

D/c = total liabilities / total capital = debt / debt + equity. Let’s take the equation we used above to calculate a company’s equity: After identifying your company’s assets, subtract total liabilities to find total equity.

In this case, the return on equity increased. Total liabilities are the combined debts and obligations that a company. The equity of a company is the net difference between a company's total assets and its total liabilities.

Liquidity ratios leverage ratios efficiency ratios profitability ratios market value ratios uses and users of financial ratio analysis analysis of financial ratios serves two main. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. What are the total liabilities and total equity of a company?

A company's equity, which is also referred to as. The d/e ratio of a company can be calculated by dividing its total liabilities by its total shareholder equity. It is a measure of the degree to which a company is financing its operations with debt rather than.

Total liabilities and total equity: The sum of all assets owned by the company or individual. For example, if a business has total assets worth $100,000 and.

:max_bytes(150000):strip_icc()/latex_ee299ef83f267e92b7d1a82e14f82c14-5c73ffaf46e0fb0001f87d26.jpg)